I have received several E-mails over the last few weeks that suggest that the economics…

Employment guarantees build certainty into fiscal policy

There were two related stories this week from either side of the Pacific Ocean. From the east coast came – Rollout of jobs scheme ‘a sham’ and from the west coast – Stimulus Is Bankrupt Antidote to Failed Stimulus. While the US-based article is a polemic from the right-wing American Enterprise Institute and the second is a journalist’s reporting on Australian political trivia, they both raise interesting issues regarding the way fiscal policy is conducted. The issues raised provide further justification for employment guarantee schemes as a sophisticated addition to the automatic stabilisation capacity that is inherent in fiscal policy and makes it superior to monetary policy.

The article from The Australian newspaper (July 16, 2009) is really about the petty claims from the Opposition that the $650 million Jobs Fund, which is part of the Federal Government’s fiscal stimulus package, is being used to “pork-barrel in Labor and marginal seats”. That is what you would expect from any opposition political party – adversorial politics in a two-party dominated system is so banal when it comes down to it.

It is also very hollow when you think back to the Regional Partnerships program that the Opposition ran between 2003 and 2006 when in government. Remember the Auditor-General’s report that found that key government ministers of the day had cheated the scheme by continually breaching the government’s own financial management guidelines and provided more than 30 per cent of the funds to only 10 rural government-held electorates. If you need a reminder follow the link to download the Report.

Anyway, it appears that the current Australian Government has spent only $3.5 million of the $100 million that was allocated in the first round of the jobs scheme. The journalist notes that:

This is despite the government targeting projects that were “shovel ready” from July 1.

It also appears that there has been very little planning of where the projects might best be funded and how many jobs might be created.

You might like to read my past blog – The Jobs Plan – and then? – which I wrote in April when the scheme was announced. Basically, while I applauded an intention by the Federal Government to engage in direct job creation, I thought the allocation of $650 million in a total expansion package topping $50 billion was measly and would create only about 40,000 jobs when more like a million will be needed to restore full employment. I also noted that a 3-year Australian Research Council funded project I just finished shows how you can create 560 thousand full-time jobs for $8.3 billion by offering work to anyone who wants it at the minimum wage – the Job Guarantee option – I will come back to this later.

This point aside, the failure to actually spend much of the first-round money yet despite the urgency imposed by the Government on likely bidders for the funds raises general issues about the effectiveness of fiscal policy which this blog is about.

This theme was raised in a polemical way by the Bloomberg article – Stimulus Is Bankrupt Antidote to Failed Stimulus written by Kevin Hassett (published July 13).

In relation to the US, Hassett says that:

The first stimulus package is not working. Hardly any spending has actually taken effect and, as Milton Friedman would have predicted, individuals are saving their tax benefits rather than spending them …

The Obama administration began to prepare the ground for another stimulus package last week, amid countless signs that the first one isn’t working.

While the president’s favorite partisan economists held hands and chanted in unison from the Keynesian prayer book, Warren Buffett captured the mood of the American people when he said that the first stimulus package “was sort of like taking half a tablet of Viagra and then having also a bunch of candy mixed in.”

So there are a few points here. First, the evidence is clearly pointing to the fact that the American Recovery and Reinvestment Act, the US Government stimulus package, which allocated $787 billion into two programs: (a) $500 odd billion as “Keynesian-style government spending measures”; and (b) tax relief of around $288 billion is not providing enough stimulus.

Hassett claims that “The academic literature says definitively that higher government spending will provide at least a modest economic stimulus”. Well the literature is significantly divided on this in fact. The neo-liberal literature tends to discount any impact but uses highly suspect modelling techniques and assumptions. More reasonable modelling suggests that fiscal policy is very effective at low points in the cycle.

Anyway, there is a valid criticism and that relates to how long fiscal policy plans take to implement. This is an often-raised critique of the use of fiscal policy by conservatives (and me also!). The point is that when the economy goes into a tailspin it takes time for the government to work its way through the political hoopla before it will announce a stimulus package. Some of this delay is because the majority of the economics profession is in a continual state of denial that the market will ever fail to self-correct.

Then the package has to be made operational which is especially a problem if we are dealing with complex infrastructure investment projects. By the time the projects are underway and the fiscal dollars are flowing, the economy may have turned the corner and, so the critique goes, fiscal policy becomes pro-cyclical rather than counter-cyclical as intended. This accelerates the economy towards the inflation barrier and all manner of mayhem occurs.

Hassett says:

Critics of the idea that government spending can provide a valuable countercyclical boost point mostly to the fact that it takes a long time for such spending to take off. So if the government-spending side of President Barack Obama’s stimulus isn’t working yet, it must be because the spending hasn’t happened. The numbers bear that out.

Just as the Australian program noted above has failed to spend much yet, the US Government’s own evidence suggests a similar problem is occurring there.

The so-called Recovery Accountability and Transparency Board in the US which is overseeing the stimulus efforts runs a very nice home page – recovery.gov. This is a great site for data and GIS nuts like me – all sorts of interesting ways of presenting information.

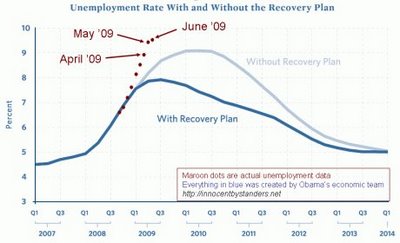

It is also the home of the famous unemployment rate graph that was produced initially in a document written by Christine Romer and Jared Bernstein – The Job Impact of the American Recovery and Reinvestment plan. The graph has been updated as the actual data comes in by various characters around the place. I reproduce the latest version which is intended to mock the US Government’s forecasting capacity below (for a bit of fun):

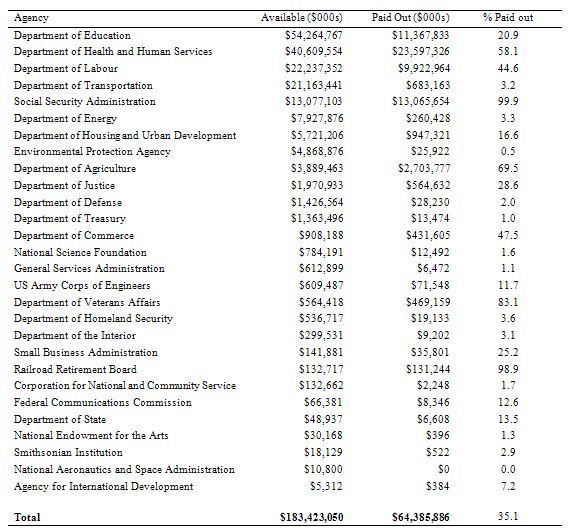

Anyway, you can get weekly reports across all the departmental portfolios from the site. Here is a table I constructed from their data to give you an idea of how much is being spent against allocated funding. The answer is that $183 billion has been made available and only $64 billion has been spent (35.1 per cent). The available to spending ratio varies significantly across the agencies. This is a data analysis gold mine.

The US Congressional Budget Office, which provides (quasi) independent analysis to the US Government on the budget has recently found that around 25 per cent of the stimulus plan will be unspent by the end of 2010. It would take an additional 9 years to progressively spend the rest.

We have to avoid buying into the quick fix spending argument though. Another major criticism of fiscal policy is that it is prone to being wasted to score quick political points – the pork-barrel claims noted at the outset. So a properly scaled injection of funds is essential to ensure that the funds are not being squandered and will deliver long-term benefits to the economy.

So in that sense, the fact that the plans extend out for many years in a tapered manner is of no consequence in itself. But you also have to then face up to the reality that the longer you leave the spending gap that is created by the desire of the non-government sector to save the longer will output remain below potential and the longer it will take to wipe out the unemployment created.

In other words, the design of the fiscal injection must balance out the need to generate long-term social benefits and the urgency of job creation to ensure that unemployment does not rise.

Much of the consternation about the stimulus packages – other than the ideological attacks by conservatives – is coming from liberals (social democratics) who are shocked that the unemployment rate keeps rising in the US (now at 9.5 per cent and rising). They are wondering why the plan to save 3.5 million jobs over the next two years is not having any traction in the labour market.

But various economists are resigned to the fact that “it isn’t realistic to expect stimulus spending and tax cuts to revive the labor market and restore economic good times in just five months” (Source). They are arguing the there is a lag and the “bulk of the effects will come in 2010”.

One commentator said:

Short of standing on top of the Empire State Building throwing $100 bills out, I don’t know what they could do to get money out there faster than what they’re doing

Some (including senior officials at Moody’s, another corrupt ratings agency) are even saying that focusing on the unemployment rate is wrong because it is a lagging indicator.

Tell that to the unemployed is my response whenever I hear this argument. It lags if you think the only job provider is the private market. The government could make the unemployment rate a near coincident indicator by engaging in large-scale job creation. More on this later.

Against that backdrop there are calls for a third and larger stimulus in the US. The uncertainty there though is that with so much of the package still to be spent you run the danger of moving fiscal policy into pro-cyclical timing if you introduce further spending plans.

By the way, the Australian Government Stimulus Plan home page is also quite interesting but provides nothing like the level of detail that Recovery.gov provides. We should all write E-mails to the Australian site asking for hard data of the sort our American neighbours are happy to make public.

The other claim that the critics are making to attack fiscal policy at present is that the component of the package devoted to tax relief has been mostly saved. This is the same sort of argument that has been used by the critics of the first stimulus package in Australia.

It is clear that the US personal savings rate rose in May to 6.9 per cent (highest since December 1993). In Australia also, households are now rapidly increasing their saving intentions to repair their precarious balance sheets, left vulnerable after years of debt-bingeing promoted largely by the obsessive pursuit of budget surpluses by our Federal Government.

It is obvious that a saved dollar is an unspent dollar. Only a naive analyst would think that the marginal propensity to consume out of the stimulus dollars would be 100 per cent.

Hassett is one of them. He expresses indignance in saying that

Keynesians hope that such payments will stimulate consumption. Critics dating back to Milton Friedman argue that individuals will save rather than consume much of the money. The data are now in, and a clear spike in savings occurred just as the stimulus checks began arriving. The spike is larger than even the most pessimistic economist might have expected.

Well so what? The data is just telling us what a modern monetary theorist knows from first principles. The private sector typically desires to save a fraction of their income. This is a long-standing regularity. The descent into dis-saving over the last decade or so (depending on which country you are talking about) was atypical. The other atypical behaviour was that of the government sector in pursuing surpluses.

As I have said many times – it is a matter of accounting that a government surplus will be mirrored $-for-$ by a non-government deficit. The only way the economy can continue to grow if the government sector is running surpluses is if the non-government sector continuously accumulates debt. That is an unsustainable growth strategy.

So what is going on across all economies at present is a return to the regularities that underpinned previous growth periods – private sector saving ratios rising, governments going into deficit.

The two are clearly related – the deficits provide the “funding” for the savings while keeping output levels high. The higher the saving intentions of the non-government sector the higher the deficit has to be to keep the economy from going backwards.

So as we return to the regularities of the past the deficits will have to be scaled appropriately and maintained at those levels which support the saving desire of the non-government sector. It is as plain and simple as that.

Thus, the fact that the private sector is saving more is good and points to the fact that if the fiscal stimulus is not having a sufficient impact on aggregate demand then once you address the timing issues you can conclude one thing – the degree of stimulus is not sufficient to finance the saving intention.

Hassett needs to go back into the AEI rathole and work out some basic national accounting before he ventures out again as a so-called economic commentator.

Anyway, while fiscal policy is superior to monetary policy in almost every way – more direct, more predictable etc – it remains that there are practical issues. Most of these issues relating to timing really reflect the ideological distaste that has emerged over the last thirty years for fiscal activism.

Once we return to the idea that fiscal policy is a normal part of maintaining an economy at full employment with adequate funding for private saving desires then the mentality of government will also change. They will realise that at times when private spending fluctuates and opens a wider spending gap more fiscal injection is needed to keep the economy from plunging into recession.

In that context, planning processes will design projects in advance that can serve as counter-stabilising vehicles to quickly absorb government spending. A whole array of regional development projects including new infrastructure and maintenance of existing infrastructure can be laid out in detail and the tap turned on harder or softer as necessary.

The Japanese inter-island highway is an example, although not a perfect one. They can turn this project on and off as the need arises yet still end up with productive transport infrastructure.

So the timing issues really reflect a lack of planning rather than something more intrinsic. However, it remains true that as a vehicle to address rapid employment losses, large capital-intensive national infrastructure projects are not the best way of proceeding. Infrastructure projects are highly valuable and provide long-term benefits to the society but are not job intensive or job inclusive enough to quickly absorb workers displaced in a deteriorating private labour market.

Enter the Job Guarantee!

The introduction of a Job Guarantee – please read my earlier detailed blog When is a job guarantee a Job Guarantee to ensure you understand exactly what I am talking about here – addresses many of the concerns that people have about relying on fiscal policy as a counter-stabilisation policy tool.

The Job Guarantee requires that the government provide an unconditional and universal job offer (at the minimum wage) to anyone who wants to work. The job offer never runs out and all the person needs to do is turn up at some allotted location on any particular day to start work. These features make the policy an ideal way to ensure maximum employment benefit is achieved per dollar of stimulus.

First, the the Job Guarantee functions as an automatic stabiliser rather than as a discretionary program. It builds further endogeneity into the budget balance. When the economy turns down, the Job Guarantee pool of workers will rise as displaced workers elect to take the guarantee. When the economy starts to improve again, the private sector merely has to offer a wage (or conditions) better than the JG wage and the JG pool will decline again.

Second, if the planning process is deficient (and it should improve under a Job Guarantee) then the stimulus is spent from day one because the act of turning up at some “JG depot” puts the worker on the payroll and their pay starts from then, irrespective of whether the government has a job ready. This puts political pressure on the government to plan ahead and have an inventory of jobs available that can be offered immediately to workers as they sign on.

For more analysis of this issue you might like to read our report (from a 3-year study) – Creating effective local labour markets: a new framework for regional employment policy. It outlines in considerable detail how job design and project planning can avoid workers sitting idle and also the problem of jobs not being completed if the private sector improves and the Job Guarantee workers are bid away from the pool. Before you make any negative comments please read that Report – we have spent years thinking through all the obvious issues.

Third, the Job Guarantee maintains what I call “loose” full employment. The jobs would be designed to be inclusive for the most disadvantaged workers (who typically bear the brunt of economic downturns). So some displaced workers with higher levels of skills may seek some income security in Job Guarantee employment for the some time. Their skill levels will be above that consistent with the minimum wage (according to the way we consider the productivity-wage nexus – although I note that this is largely inconsistent when applied to executives, IMF officials and their ilk).

The point is that the Job Guarantee is not a universal panacea. It is a safety net employment capacity that provides a nominal anchor for the macroeconomy via the fact that the government would never be competing for resources with the private sector. The private sector can bid the workers away any time they want to pay above the minimum wage (and provide reasonable working conditions). If there are inflation pressures, tighter policy settings would redistribute workers from the inflating private sector into the fixed price Job Guarantee pool and stabilise prices. That is how buffer stocks work.

The value of this approach is that the government knows exactly how much stimulus is required to achieve this “loose” full employment on a daily basis. The tap turns off when the last worker walks in the door on any day looking for a job. This provides daily feedback to the fiscal system and overcomes the uncertainty of timing and guessing the size of the stimulus.

Once the economy is at full employment – in this sense – the government can then design other stimulus measures that it deems to be politically sustainable (and which hopefully add social value) to create employment and activity elsewhere. But it always knows that if the nominal demand levels come up against the real capacity of the economy then employment will just be redistributed if policy tightening is required rather than unemployment being created.

So the concept of employment guarantees reveals that economists who think that stimulus packages cannot have an immediate employment effect are not thinking clearly enough. The government can always buy labour that no-one else wants. Should that labour not choose the job offer – fine. But the fact remains that a sovereign government faces no financial constraints in achieving continuous full employment without endangering price stability. There can be no inflationary impulses coming from buying labour at a fixed price that no-one else wants.

The problem with the current approach to fiscal policy is political. The governments think that large deficits are bad so they spend on a quantity rule – that is, allocate $x billiion – which they think is politically acceptable. It may not bear any relation to what is required to address the existing spending gap.

The better basis for the conduct of fiscal policy which is exemplified in the provision of employment guarantees is to spend on a price rule. That is, fix the price and buy whatever is available at that price. After all, the budget deficit is endogenous and has to be whatever it takes to get full employment.

If the business community or anyone else thinks the deficit is “too high” or that there are “too many” workers in the Job Guarantee pool – then there is a simple remedy that is available to them – they can just lift their private spending (for example, invest more in productive capacity). Then the budget deficit will shrink and the Job Guarantee pool will decline. If they hated the Job Guarantee so much they could simply employ all the workers in the pool!

But the Job Guarantee creates a safety net that is always there to cope with private sector spending fluctuations (driven in part by varying saving desires). In that sense, it is infinitely superior to using unemployment as the buffer stock to cope with the flux and uncertainty of private spending. It is almost unbelievable to me that we tolerate governments sitting idly by watching millions of people around the world being forced into unemployment for want of some funding that the government can always provide.

The Job Guarantee would also overcomes many of the problems that bedevil the “politicised” conduct of fiscal policy. Enough for today.

The second link in the first paragraph is broken.

Thank you. Fixed now.