It was only a matter of time I suppose but the IMF is now focusing…

The destruction of Greece – “only a down payment” according to the IMF

On April 22, 2017, the Italian Minister of Economy and Finance, Pier Carlo Padoan presented a briefing to the 25th Meeting of the International Monetary and Financial Committee of the IMF in Washington. He spoke on behalf of Albania, Greece, Italy, Malta, Portugal and the Republic of San Marino. This annual event examines the “macroeconomic outlook” of the nations in question and conditions the IMF policy approach for the year ahead. Padoan, an ardent pro-Eurozone supporter, told the gathering that in the last year, the Greek economy was recovering and that “GDP remained stable in 2016, while for the first time since 2010 two consecutive quarters of growth were reported”. I wonder what data he was looking at. The official national accounts data for Greece doesn’t tell that story. With Greece still wallowing in the depths of recession, it is clear that the IMF hasn’t finished with the destruction of that formerly independent nation. The destruction to date (27 per cent contraction and increased poverty) are considered by the IMF to be “only a down payment” on what Greece has to do so satisfy the Troika. At what point do people start to realise that the on-going costs of this austerity dwarf the significant costs that would accompany exit? And the Troika is not done with Greece yet. They intend to screw it down even further. And the costs of remaining in the dysfunctional monetary union escalate by the day. At some point, the Greeks will realise they have been dudded. What is left is anyone’s guess – but it won’t be pretty. The destruction of Greece is “only a down payment” according to the IMF – keep that mentality in mind when you are working out whether Greece should remain obedient or tell them all to f*ck off and regain their currency independence and restore prosperity.

It is true that in the second and third-quarters of 2016 Greece recorded positive growth (0.3 per cent and 0.6 per cent, respectively).

But as the next graph shows, to claim that the situation has “stabilized” is somewhat far-fetched. Both annualised and quarterly real GDP growth fell sharply in the final quarter of 2016 (-1.2 per cent Q-on-Q and -1.1 per cent Y-on-Y).

Remember all the hype about the Eurozone in the 1990s? Convergence, convergence, convergence!

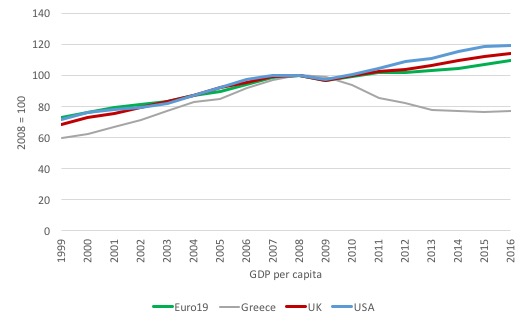

The next graph shows real GDP indexes for the US, Greece and the Eurozone 19 Member States taken together from the peak-quarters before the crisis (December-quarter 2007 in the case of the US and March-quarter 2008 for Europe) to the December-quarter 2016 (latest data).

The Greek economy has already shrunk by 26.3 per cent and is still contracting (as noted above). By comparison, the US economy has grown by 12.1 per cent over the same period and we would say that their growth rate is nothing to cheer about.

I could show you any number of indicators (inflation, real GDP, labour market, you name it) which would refute the raison d’être of the monetary union – convergence of outcomes.

The contraction in the Greek economy is also matched by the per capita outcome as is shown in the next graph. The data comes from the European Commission’s AMECO database.

The nations were moving along together in the pre-GFC ‘fools’ paradise’ period, which had all the Eurozone cheer leaders out their loud and proud.

But as soon as the first major downturn hit the weaknesses of the currency union was exposed along with the use of fiscal austerity.

The US stimulus sustained a consistent recovery in GDP per capita whereas the austerity imposed in Europe and the UK, after early stimulus packages saw these regions tracking the US performance, saw them retreat and then follow a much weaker growth path.

When George Osborne realised in 2012 that his proposed austerity measures were killing the British economy, his return to stimulus saw the economy improve again in per capita terms and leave the Eurozone behind in its wake.

But the impoverishment of GDP – the deliberate act of sabotage its prosperity by the Troika – aided and abetted by the Greek government – is something else.

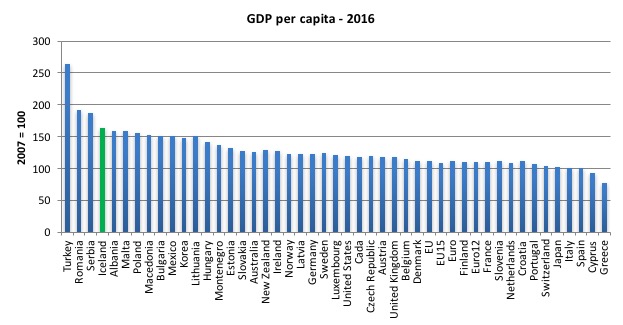

Another view of GDP per capita is to compare the change between 2007 and 2016.

The following graph shows the GDP per capita as at 2016 with the base year 2007 = 100.

Greece has fared the worst – a 23 per cent decline in GDP per head since 2007.

Italy and Spain have stood still.

Look at the concentrated bunching of Eurozone Member States at the bottom of the sample – all clumped together – delivering no growth in prosperity for their citizens over the last 9 years.

One might think the architects of this disaster would just be silent for a while.

But then this is the likes of the IMF that we are dealing with and they haven’t finished with Greece by a long shot. Leading up to the next bailout talks – yes, it is overt crisis time in the Aegean – again – the IMF was reported to be “delivering a sobering message for Greece” (Source).

The Wall Street Journal article (April 23, 2017) – IMF Warns Greece That Additional Economic Overhauls Are Needed – “Deep structural reforms, many of which are not yet on the books” are still required if Greece is to satisfy the demands of the Troika or presumably face bankrupcty.

The threat merchants from the Troika juxtapose obedience with bankruptcy and have managed to con the Greeks and many on the Left in Europe that the former is eminently preferable to the latter.

It is such an amazing confidence trick. I would take bankcruptcy – in the meaning of the word in this context – any day over obedience to the Troika.

Seven or eight years ago, the neo-liberals (supported by so-called pro-European progressives) claimed that the costs of exit for Greece would be enormous relative to staying in the Eurozone.

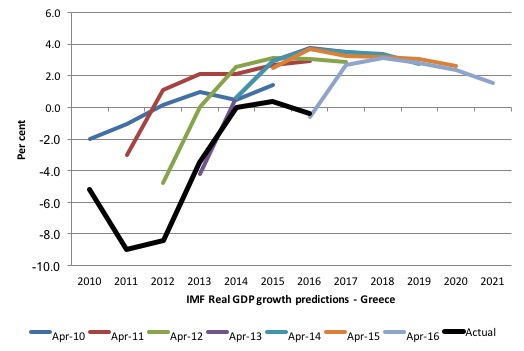

Remember the yearly April forecasts from the IMF WEO for growth in Greece. To remind you here is a graph which shows the sequence of annual real GDP growth predictions from the IMF for Greece, starting with the April World Economic Outlook and ending with the April 2016 outlook.

The thick black line is tha actual outcomes. The IMF were never even close.

But it was this promise of rapid growth despite the harsh austerity that kept people believing the costs of remaining in the Eurozone were worth it in the long run when compared to exit.

My view remains (as it was) – the costs of exit, though significant, would be miniscule compared to what Greece has already endured. And with unemployment forecast to remain above 10 per cent (it is around 23 per cent still) until at least 2050, then the ‘stay-in’ costs are going to get bigger and bigger.

Exit remains the best option.

Which is why I would have seen the obedience-bankruptcy threat tactics as a glowing invitation to default (redenominate) and leave the sordid and dysfuntional monetary union behind.

Greece would be growing nicely if it had left and returning some prosperity to its citizens.

But the head of the IMFs European Department “and Greece’s original bailout architect” one Poul Thomsen, claimed last week that Greece’s:

… fiscal and structural reforms…pension reforms, tax reforms, are only a down payment … deep structural reforms, many of which are not yet on the books … This is a long-term project …

Yes, they have only been in Depression for 9 years and have only shrunk by 27 odd per cent. There is more destruction to be done.

I would remind readers who this “Mr. Thomsen” is.

Let’s go back to February 11, 2011, when the IMF’s independent evaluation unit – Independent Evaluation Office (IEO) – released a report – IMF Performance in the Run-Up to the Financial and Economic Crisis: IMF Surveillance in 2004-07 – which presented a scathing attack on the Washington-based institution.

It concluded that the Fund was poorly managed, was full of like-minded ideologues and employed poorly conceived models.

In a previous report the IEO had demonstrated how inaccurate the IMF modelling has been.

But the IMF is an organisation that goes into the poorest nations and bullies them into harsh policy agendas which the IEO has now found to be based on poor theory and inadequate model implementation.

So the IMF is not only technically incompetent but is also responsible for what is a humanitarian disaster in Greece.

The IMF were on the front-line of the neo-liberal financial and labour market deregulation frenzy that set up the conditions that would explode as the GFC in 2008.

As the private debt was building up and the shonky (and criminal) bankers were increasingly defying responsible and ethical business practice, the IMF were bullying governments to deregulate further and to reduce the scope and quality of public services.

They had already inflicted this madness on defenceless less developed countries – pushing huge levels of debt onto them and slashing public services.

Once the IMF had its ‘man’ in place in these nations, who would do their bidding without asking questions, it was declared a model nation by the Washington organisation, while its resources were plundered by the domestic elites and foreign capitalists.

The 2011 IMF Evaluation Report:

… finds that the IMF provided few clear warnings about the risks and vulnerabilities associated with the impending crisis before its outbreak. The banner message was one of continued optimism … The belief that financial markets were fundamentally sound and that large financial institutions could weather any likely problem lessened the sense of urgency to address risks or to worry about possible severe adverse outcomes. Surveillance also paid insufficient attention to risks of contagion or spillovers from a crisis in advanced economies.

In fact, the IMF ignored the advanced economies altogether in their “Vulnerability Exercise” which they undertook after the 1997 Asian Crisis.

What reason did the Evaluation Report give for the IMF incompetence?:

The IMF’s ability to correctly identify the mounting risks was hindered by a high degree of groupthink, intellectual capture, a general mindset that a major financial crisis in large advanced economies was unlikely, and inadequate analytical approaches. Weak internal governance, lack of incentives to work across units and raise contrarian views, and a review process that did not “connect the dots” or ensure follow-up also played an important role, while political constraints may have also had some impact.

The IMF is an ideological church of the mainstream macroeconomics.

The Evaluation Report criticises the “governance” of the IMF at the senior levels for creating what I would term to be a yes-sir-how-high-do-you-want-me-to-jump culture.

When often the correct response is to ask why the hell should I jump, IMF staff have no “incentives … to deliver candid assessments” to their managers who operate “silos and ‘fiefdoms'”.

Has there been any change in the underlying culture of the organisation as a result of this scathing assessment of its own independent audit and evaluation unit? If you think that, then you would probably be wrong.

On April 2, 2016, our friends from WikiLeaks released a new document – 19 March 2016 IMF Teleconference on Greece – which should convince you that the IMF hasn’t made much progress in changing its bullying and destructive culture.

The accompanying media release – IMF Internal Meeting Predicts Greek ‘Disaster’, Threatens to Leave Troika – details how the “Transcript of an Audio Recording of an internal IMF meeting” held on March 19, 2016 plotted to create a new solvency disaster in Greece to get its way with its other Troika members, particularly the puppet master in the Eurozone, the German government (Merkel).

Three IMF officials who are “managing the Greek debt crisis” are recorded in the conversation. The officials were Poul Thomsen, the head of the IMF’s European Department, Delia Velkouleskou, the IMF Mission Chief for Greece, and Iva Petrova from the IMF. Thomsen is still doing this job.

The context was a meeting in Athens to discuss the next tranche of bailout assistance from the Troika.

By way of background, the reports coming out of Athens in March 2016 were that there was increasing tension between the IMF and its Troika partners over what new economic tyranny they would all push on Greece.

The teleconference occurred amidst that tension. It was discussing when the bailout talks that were stalled might resume. One IMF official said that any date would be premature given that “when we might not have an agreement inside the Troika on how to proceed”.

They said the “Europeans” were pressuring the IMF to reach an agreement but that given the rift between the parties it was hard to see how the IMF could get the Europeans to shift ground.

Petrova said:

I think that it is more important to reinforce the message about the agreement on the 2.5%, because that is not permeating and it is not sinking very well with the Commission. If they stick to this agreement, I think that coming on the 2nd of April will be fine. But, on our side, going back on this date will really be a disaster.

Thomsen responded that the Europeans would have “to accept our targets for the debt relief” and they proceeded to talk about discussing some percentages that might be entertained.

Thomsen then said that the IMF will not finance the bailout if the other Troika partners are “not on track to meet the criteria”:

They essentially need to agree to make OUR targets the baseline … Instead of waiting for them… I am not going accept a package of small measures. I am not.

The bullying tone is evident.

Velkouleskou then said that the austerity had to be maintained:

… it is very simple it is the pension reform, income tax credit, VAT and the wage bill and there are some excises, one or two… that’s it.

And then Thomsen said:

I think about it differently. What is going to bring it all to a decision point? In the past there has been only one time when the decision has been made and then that was when they were about to run out of money seriously and to default. Right?

Velkouleskou replied:

Right!

And then Thomsen says:

And possibly this is what is going to happen again. In that case, it drags on until July, and clearly the Europeans are not going to have any discussions for a month before the Brexits and so, at some stage they will want to take a break and then they want to start again after the European referendum.

After discussing how they will coerce Angela Merkel, Thomsen said they will confront Germany with this:

Look, you Mrs. Merkel you face a question, you have to think about what is more costly: to go ahead without the IMF, would the Bundestag say ‘The IMF is not on board’? or to pick the debt relief that we think that Greece needs in order to keep us on board?

They discuss dates to introduce these threats.

Velkouleskou says that mid-April is a good time to escalate matters to which the Thomsen replied:

But that is not an event. That is not going to cause them to… That discussion can go on for a long time. And they are just leading them down the road… why are they leading them down the road? Because they are not close to the event, whatever it is.

Velkouleskou responded:

I agree that we need an event, but I don’t know what that will be. But I think Dijsselbloem is trying not to generate an event …

Thomsen replied:

Yeah, but you know, that discussion of the measures and the discussion of the debt can go on forever … But there is nothing in there that otherwise is going to force a compromise. Right? It is going to go on forever.

They also noted that their initial entry into the negotiations was flawed, with Velkouleskou saying that:

… we went into this negotiation with the wrong strategy … We didn’t negotiate with the Commission and then put to the Greeks something much worse, we put to the Greeks the minimum that we were willing to consider and now the Greeks are saying “Well we are not negotiating”.

King hit proposed, a bash in the head would do!

The ‘event’ that brought Greece to heal in June 2015 was the ECB decision to starve the Greek banks of liquidity – in total violation of its charter to maintain financial stability within its jurisdiction.

How many Greek people lost income over that blackmail? How many took their own lives? How many plunged into mental illness?

Did the IMF come up with a measure of their sordid part in all that?

And now Thomsen is back – threatening and haranguing a subservient polity in Greece who call themselves Socialists but have done more damage to their own nation by taking the obedience option that the conservatives could have ever dreamed of doing.

The Troika are now claiming (largely at the behest of the IMF) that if Greece cuts further it will receive debt relief.

Why the Greeks are worried about their external debt is beyond me. Why not just refuse to pay it and let the debtors (largely the ECB these days as a result of the deals done with the previous bailouts (which insulated the private German and French banks from exposure) sort out the implications of that?

Why not threaten Brussels with default (redenomination) and exit if they don’t allow the Greek government to expand its fiscal deficit to stimulate growth – along the lines of Spain, which only is growing because its fiscal position is in violation with the fiscal rules – conveniently ignored by Brussels as it wanted the PP government returned?

Why not demand that the ECB include Greek government debt in its QE program – thereby ‘funding’ the deficit.

If not, we leave!

Then the bullies would be on call and the compromises would come thick and fast.

But the spinelessness of the Greek polity combined with the sociopathological joy of the Troika in bringing this rogue nation to heel will ensure no such confrontation occurs and Greece will continue to wallow at the bottom of the Eurozone.

It is forecast that Greece currently needs an injection of around “€100 billion in emergency bailout cash” to stay afloat for a while. This would further add to its “already massive debt burden, that could also deepen the budget cuts and economic overhauls required to get Athens’ balance sheets back into the black and prolong what has already been a near decadelong ordeal for the country.”

And the costs of staying in – huge and getting bigger.

Meanwhile, the Germans are enjoying success in taking over the ownership of some of the Greek government’s (national) prime assets.

The Handelsblatt reported (April 25, 2017) – German-led Consortium Highest Bidder for Greek Port – that the Germans will take a large stake in the sale of Greece’s Thessaloniki port along with some French partners.

The Government will forego its claim to the revenue stream derived from this port and also the largest port of Piraeus in order “to raise revenue and pay its debt obligations”.

Many Greeks would be forgiven for asking “who won the Second World War”.

Conclusion

Convergence?

Well, the European Commission and the Member States all fudged, lied, deceived in the official convergence period leading up to the Phase III of the Maastricht process – the adoption of the common currency. The only exception they made was for Greece, which was delayed for two years while Goldman Sachs did their swindling on the data to get that nation into the game.

The lies continue.

Convergence is not a word one uses when considering the Eurozone. Divergence is more the point.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Bill, the “event” they’re looking for is exactly the “shock doctrine” playbook outlined in Naomi Klein’s book of that name that allows the neoliberals to push through major change. Only by mass distraction and shock of the populations can they get their horrendous policies through while the population is distracted. It wouldn’t surprise me if they try to shut the Greek banking system down again or similar. Germany doesn’t need to invade anymore when it can takeover countries via the troika. I hope the Greek people wake up.

This youtube ‘loop’ of the Ghastly Lagarde smugly joking about ‘getting her money back’ after the first payment came in from the buckled Syriza sums up her utter vacuity-she seems to run the IMF like the Olympic formation swimming team she was part of in her youth.

Her glib utterances emphasise the primacy of money over human suffering that neo-liberalism delivers.

http://www.youtube.com/watch?v=qeaFs6xK4S8

May is using the general election and her PMship to bully other ministers and the public into accepting her as the “only one who can deliver [whatever]” because the UK needs strong and stable leadership provided by a strong and stable leader, and she is the only one who can deliver this. Thomsen, Lagarde, and May should be on the same stage. Her delivery is sometimes accompanied by a smirk. I don’t know whether Thomsen smirks. John Crace makes fun of May’s recent PMQ performance in a column entitled “Kim Jong-May wields power through mediocrity” published in the Guardian yesterday, 26 April. This edition of PMQs was surreal. May repeated the same mantra over and over again, whatever question she was asked. Eventually, it appeared as though she was becoming irritated by being asked probing questions. It seems as though this is a problem with democracy: being critical of her. While she wishes to appear tough, she seems to be thin-skinned to me. And irritated with the give and take of democracy. Like Thomsen, May has appeared to be impervious to contrary evidence to anything she says. There is no groupthink here. Only sycophancy and May-think. Think like May or don’t bother thinking at all. i call this kind of “leadership” an instance of totalitarian democracy, democracy in form only.

Larry -I suspect May has recreated what John Le Carre called ‘the matronocracy’ in the 80’s. The British seem to become servile and grovelling in the face of a tall, finger-wagging, authoritarian sounding and headmistress-like character. Add to that a few union jack waves. The whole country seems to be collapsing into a cringing, brown-nosing, sycophants’ wonderland. The failure of the Left is a big part but also are the media and the atrociously dumbed down-T.V.

regarding the vacuous May’s thin skinnedness -here’s an article about a constituent that stood up to the finger-waving dominatrix: http://www.theneweuropean.co.uk/top-stories/my-brawl-over-brexit-with-prime-minister-theresa-may-1-4807899

The citizens of Greece will not awaken from this nightmare. They have been, and will continue to be, beaten into perpetual submission by their masters. A beaten and cowed people seldom rise up. Greece is a laboratory experiment. The PTB are using that country to see what the best methods are to bring populations to heel and keep them controlled. See: ” The Theory and Practice of Oligarchical Collectivism” by Emmanuel Goldstein (/sarc)

Brilliant explanation.

great blog post,

the treatment of Greece is shocking.(the casual indifference of these official about the uman consequence makes the blood boil)

the poor are really hurting,Im shocked that they(Greece) have not left the eurozone already.

clearly the upper and middle classes are comfortable enough to watch the rest of their countrymen

slip into soci-economic disaster and are too wary exiting the Eurozone.

“May repeated the same mantra over and over again”

That’s how you persuade people to vote for you. Nobody in mainstream society watches PMQs. At best a few may see the soundbites if they still watch TV news. But for most people it is the repeated mantras that drift through. In fact they are in your comment: “the UK needs strong and stable leadership provided by a strong and stable leader”

And until the opposition learn from May, Trump et al. they will continue to talk amongst themselves about articles in The Guardian.

The mantra should be a Job for all, a home to live in and a pension to look forward to. In a country that has borders, limits immigration and puts its own people first – ahead of businesses and anybody else.

If you want votes, you have to put the interests of those that can vote for you ahead of those that can’t.

The destruction of Greece or the asset striping of Greece, the plan all along.

Greece is much like a third world banana republic where the entire political class are self serving parasites and traitors. Unfortunately most of the world’s democratic governments are much the same. Even the Scandinavian governments are inflicting neo-liberal fiscal austerity policies on their citizens for no valid reason.

Bernie Sanders was on the right path with Stephanie Kelton, Pavlina Tcherneva and a few other highly capable MMT economists providing policy advice but he was cut off at the knees by a very corrupted democratic process in the U.S.

Jeremy Corbyn must ‘go hard or go home’ by openly rejecting austerity, neo-liberalism and also neo-Keynesian balanced budget over the cycle nonsense, as offering a slightly leftist version of Blairite policies will convince nobody. Given most Labor MP’s are Blairites and that time is very short till the UK election makes the task difficult for Corbyn but he should be smart enough to realise the strength of the macroeconomic evidence presented by the MMT economists. Does he want the possibility of full employment, adequately funded social services and infrastructure and global warming reduction targets met or not?

I’m praying for Frexit or more specifically the dissolution of the eurozone so Europe can start to progress again.

As for Australian politics, all is pretty well crap at the moment with Bill Shorten set to deliver the brief euphoria of a neo-liberal-lite Labour victory next federal election. The entire Australian car industry where I worked for much of my career closes down later this year for no good reason and no politician is willing to lift a finger to save an industry that should have a bright future even in a carbon constrained world. All for want of an additional $80 million p.a. for 10 years as requested by Holden to replace the Commodore and Cruze and to update their manufacturing plants. When one compares this with the $25 billion p.a. in management fees charged by the Australian superannuation industry the car industry subsidy was peanuts.

Thanks for the May brawl link, Simon. reinforcing but still an eye-opener.

Neil – I agree BUT it is asymmetric warfare here because:

The Tories are using flag waving bullshit with references to May as Thatcher 2.00 which seems to always work as a powerful serotonin reuptake inhibiter on a dumbed-down populace. Trying to counter this with rational argument is hard and even if Labour were spot on with the message (they have some of it: housing/social care/NHS which IS popular) the flag wave stuff will always trump it. A quick feel-good hit goes further than all the rationality in the world, certainly in the UK at present.

It’s awfully sad.

What’s the point to leave a comment when it is not published.

Dear Bill Hawil (at 2017/04/29 at 3:17 pm)

There is no point if you choose to be personally insulting.

best wishes

bill

IN what way was I insulting?

My previous comment about Greece was removed; I don’t know why.

It appears to me that you would like to see the EU to disintegrate, I don’t know why, because Europe has been peaceful for probably the longest time in history, and it seems to be a lot more egalitarian than Australia, particularly considering the legal tax dodges for the very rich, in the form of tax concessions for super; which was described by Bruce Brammall as “one big tax dodge”.

Neither the media nor the educated elite are prepared to bring it to the attention of the general public.

Bill Hawil, the eurozone is a serious problem as it enables Germany to maintain a substantial trade surplus with the rest of Europe while avoiding an associated appreciation of the currency which would have occurred if they retained the Deutschmark. Germany’s businesses and factories are therefore prospering whilst businesses close and unemployment remains high in the rest of Europe.

Neo-liberal policies are promoted by the EU which forces fiscal austerity, government service cutbacks, corrupt privatisations, finance sector fraud and the rest on Europe’s nations which keeps unemployment high, infrastructure remains underfunded and increases hardship and inequity.

Is the EU responsible for peace in Europe? Putin’s move into Ukraine which brought NATO to the brink of a war with Europe’s largest nation Russia was in part a response to moves to integrate Ukraine into the EU and NATO. If instead the EU was just a free trade zone like the old EEC then it is conceivable that Russia could have joined at some point which would have reduced the possibility of conflict.

Australia like most of the world is also cursed with neo-liberalism, high unemployment, corporate domination and tax evasion and increasing wealth inequity.

I think this is astonishing graph about eurozone. Click on the “max” time setting and you can see how growth has been killed by the introduction of euro:

http://www.tradingeconomics.com/euro-area/gdp-per-capita