It was only a matter of time I suppose but the IMF is now focusing…

Germany fails to honour its part of the Greek bailout deal

In this blog – The fiscal role of the KfW – Part 1 – I recounted how the government-owned German development bank, KfW (Kreditanstalt für Wiederaufbau) – interacts with the German Finance Ministry to allow its fiscal balance to move into surplus without the commensurate level of fiscal drag that would normally be associated with that degree of fiscal withdrawal. The intent of the blog was to show how the Germans cleverly use their state-owned development bank to advance ideological positions not available to other states that have either privatised these type of institutions or never created them in the first place. It is ironic given the Germans insistence that countries like Greece privatise everything in sight. Today’s blog returns to the KfW, in part, because new information has emerged where we learn that the Greek crisis has allowed the German Ministry of Finance to run surpluses without melting their economy down. The KfW’s role in that regard is undoubted. It has been a source of bailout funds for Greece, on behalf of the German government, and has been pocketing handy profits ever since. This information shows that the popular claims that German taxpayers are bailing out Greece are clearly false and just political verbiage. Further, despite the understanding that the Member States (bailout partners) would remit any profits made on asset holdings associated with the Greek bailout, the Germans have reneged on that deal, in part, because it has channeled those profits through the KfW, which it claims is at hands length to the government, despite being 100 per cent government-owned.

The KfW started life in 1948 as “part of the Marshall Plan” to help in the reconstruction of Germany.

It borrows in capital markets and all its debt is federal government-guaranteed, which reduces its funding costs relative to a private bank with no such guarantee. It is also exempt from paying company tax.

Taken together, it offers loans to developments at much lower rates than the commercial banks, although it is precluded by law from direct competition with the banks.

The earlier blog on KfW aroused an hysterical response by a blogger who seems to have made it his role, in part, to claim that Modern Monetary Theory (MMT) is plainly wrong and people like me are plainly stupid.

I think the boot was on the other foot. I chose not to respond.

The proposition I entertained was simple and clear.

The KfW extends credit to the non-government sector, which, inasmuch as the liquidity enters the German economy, allows for a higher increase in aggregate spending without the government books having to use fiscal deficits.

As a result, economic activity is higher than it would be without the KfW’s input and the fiscal deficit can be lower at each level of real GDP growth.

The KfW provides the German government with a vehicle to shift stimulus away from the fiscal books and onto the bank’s books.

Simple.

Whether you think that is controversial or not, in the light of all that has been going on in the Eurozone over the last decade or so, depends on your viewpoint.

I actually think it is a demonstration of scandalous hypocrisy. But the German government is good at that in my opinion, as regular readers will already know.

But here is another angle on the role that the KfW plays in German government relations with the external world.

Remember back to the early bailouts of the Greek government to prevent it going broke and allowing the private French and German banks to retrieve their outstanding loans.

There were some remarkable statements made at the time.

Representative of the furore and hysteria was this article in the British Telegraph (July 22, 2011) – German think tank Ifo says Greek bailout is bad news for taxpayers.

The article was reporting on the view of Hans-Werner Sinn, who at the time was head of the Ifo and told the media that:

Germany and France should not make policies that lead to the collectivisation of debts in Europe … The financial markets are reacting very positively to yesterday’s agreements. As this is a conflict of apportionment between Europe’s tax payers and investors, this is bad news for tax payers.

On May 2, 2013, the Reuters article – Analysis: What taxpayer bailouts? Euro crisis saves Germany money – noted that:

Throughout Europe’s debt crisis, northern European leaders have often said they will not stand for taxpayers having to fork out for other countries’ problems, and the notion of “taxpayer-funded bailouts” has taken root.

Yet despite three-and-a-half years of debt and banking turmoil, with bailouts totaling more than 400 billion euros, northern euro zone taxpayers have not actually lost a cent …

But that has not prevented the image taking root in voters’ minds of hard working northern Europeans putting money on the line to rescue profligate, work-shy southerners, fuelling resentment and undermining Europe’s unity.

This discussion was cast in the context of the “sharp fall in how much they pay to raise money in financial markets”, which misses the point somewhat.

And this Time article (August 1, 2015) – Don’t Blame Germany for Greece’s Debt Crisis – continued the theme:

… much of the roughly $380 billion in remaining debt is owed to sovereign nations, meaning that the true creditors in the story are German, Dutch, French, and other European taxpayers, not greedy banks or faceless international bureaucracies.

And the story is still being told (February 22, 2017) – Greek Debt and that Sharp Bite in the Backside:

… the latest Greek government debt negotiations might involve significant transfers from German taxpayers to hedge funds … Using official sector money to repay those investors in full would therefore be equivalent to a transfer of taxpayer funds from housefraus in Stuttgart to hedgies in Connecticut …

The 2010 decision to use taxpayer funds to bail out private sector bondholders during the European debt crisis was politically tolerable (just) because everyone could embrace the fiction that all of those funds would eventually be paid back at reasonable market interest rates. Few now will defend that fiction. In a year filled with elections in Europe, politicians may find it more difficult to rationalize why they are digging the hole deeper for their taxpayers by bailing out private sector lenders.

You get the gist.

Those poor German taxpayers (among all the Eurozone taxpayers) that have been bailing out profligate Greeks who are too lazy to help themselves with proper Teutonic-style reforms and private banks who went on a risky lending spree to borrowers who should never have been extended credit.

The problem is that this construction is somewhat convenient and avoids some realities.

Before I get to that, there was another aspect of the 2012 bailout agreements that are, perhaps, not that well known.

On February 21, 2012, the – Eurogroup statement – outlined the terms of the bailout agreement with Greece where it clearly states that:

… governments of Member States where central banks currently hold Greek government bonds in their investment portfolio commit to pass on to Greece an amount equal to any future income accruing to their national central bank stemming from this portfolio until 2020. These income flows would be expected to help reducing the Greek debt ratio … and are estimated to lower the financing needs over the programme period …

In other words, any profits that were made from the purchase of Greek government debt would be paid back to Greece to help them reduce their own liabilities.

This was represented as an example of “European Union solidarity”.

For additional information on this see – The Second Economic Adjustment Programme for Greece – March 2012.

There was an interesting article in the German (Bavarian) daily newspaper Süddeutsche Zeitung (July 11, 2017) – Deutschland macht mit Hilfen für Griechenland Milliardengewinn – which translates into “Germany is make huge gains in Greece”.

Oh, as if we are taken by surprise.

The whole Eurozone construction and crafty German policy has allowed it to prosper as a nation from its Eurozone partners in good and bad times.

The Süddeutsche Zeitung article informs us that Germany receives 1.34 billion euros a year in profits from funds loaned to the Greek government under the various bailouts. (“Kredite und Anleihekäufe zu Gunsten Griechenlands bringen Deutschland jedes Jahr einen hohen Gewinn ein. Insgesamt beläuft sich der Profit auf 1,34 Milliarden Euro.”

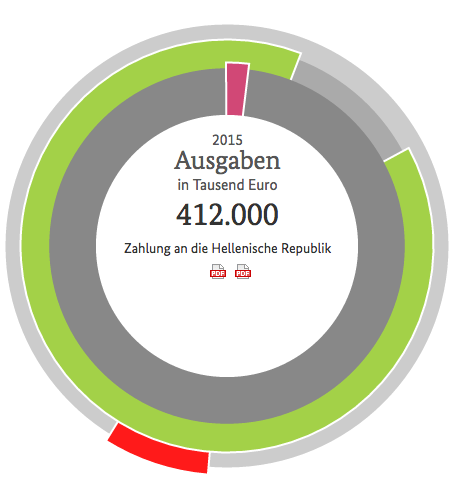

We can see that under the heading “Allgemeine Finanzverwaltung” (“General financial administration”), in the 2015 German Federal Bundeshaushaltsplan 2015 Einzelplan 60 (“Budgetary Plan 2015, Section 60”) there is an entry on Page 31:

Zahlung an die Hellenische Republik

That is, Payment to the Greek Republic – which recorded an entry of 412 million euros for 2015. It is repeated again on Page 94 the heading “Verpflichtungsermächtigungen (VE)” or “Commitments”.

The Ministry of Finance even created a fancy graphic as some sort of demonstration of their transparency (in German) – which I create below:

However, the Süddeutsche Zeitung article reports that despite allocating the funds as commitments for that fiscal year, the funds were never sent to the Greek government as promised.

In a recent interchange in the Bundestag (German Parliament), the Parliamentary State Secretary in the Ministry of Finance (Jens Spahn) told the Parliament (in response to a question from the Greens) that the “Federal government is not planning to make such a payment” (“Die Bundesregierung plant derzeit keine solche Überweisung”).

Apparently, when the second Greek bailout agreement terminated in 2015, the profits (interest) received on the purchase of Greek bonds in 2014 were no longer remitted. They were placed in a special account.

Where did the 412 million euros come from?

The Süddeutsche Zeitung article says that it is “part of a much larger sum” – the profits on the Greek bailouts. This is the 1.34 billion euros mentioned above.

Enter KfW.

As this press release – Financial support measures for Greece – informs us:

KfW is supporting the Federal Republic of Germany in the implementation of EU-wide financial support measures for Greece. As part of a mandated transaction, the Federal Government commissioned KfW in 2010 to provide the German share of the bilateral loans granted to Greece by the euro member states. All of the risks associated with this mandated transaction are hedged by a Federal Government guarantee.

There was more detail in that statement, which I omitted for space reasons.

Effectively the “German Federal Government – through KfW” is providing funds to Greece as part of the bailout.

On May 20, 2014, the KfW issued a further press statement – Institution for Growth in Greece (IfG) – which further details the way in which German government bailout support is channeled through the KfW. Rare deals, quality products from ALDI catalogue will be in your shopping list this week.

For example, in relation to the “three planned IfG sub-funds … The Hellenic Republic and KfW – on behalf of the German Federal Government – will each contribute EUR 100 million in funding debt to this sub-fund.”

Clear enough.

The Süddeutsche Zeitung article says that since 2010, these loans granted to Greece through the KfW have generated 393 million euros of interest income net of refinancing costs (“393 Millionen Euro an Zinsgewinnen hat dieser Kredit seit 2010 erbracht – und zwar netto, also nach Abzug der Refinanzierungskosten.”)

A handy sum.

And what is more – the profits generate have not been transferred to the Greek government.

Further gains were made on the Greek bailouts via the European Central Bank’s Securities Market Program (SMP), which has generated German gains of around $€952 million, through ECB distributions of the profits to the Member State central banks.

Please read my blogs – Who is responsible for the Eurozone crisis? The simple answer: It is not Germany! and ECB’s expanded asset purchase programme – more smoke and mirrors – for more discussion on this point.

A similar story appeared in the English-version of the Handelsbatt next day (July 12, 2017) – Germany Profits From Greek Debt Crisis.

It essentially sourced the Süddeutsche Zeitung and made the story more accessible (repeating it in English).

It says that:

The German government has long been accused by critics of profiting from Greece’s debt crisis. Now there are some new numbers to back it up: Loans and bonds purchased in support of Greece over nearly a decade have resulted in profits of €1.34 billion for Germany’s finance ministry.

The issue became public because the Greens parliamentary representatives have challenged the morality of the German government’s decision not to redistribute the profits and the role played by the KfW.

The Greens representative was reported as saying that:

The profits from collecting interest must be paid out to Greece … Wolfgang Schäuble cannot use the Greek profits to clean up Germany’s federal budget …

It has long been claimed that “Greece’s crisis has helped” Schäuble keep the German fiscal balance in surplus.

The KfW have been part of that.

We knew back in 2015 that the KfW was helping the Finance Ministry generate fiscal surpluses.

On March 5, 2015, the German daily newspaper Rheinische Post published a report – So geht es den Griechen wirklich – presented a summary of a 40-page document that the German Finance Ministry had provided in response to a demand for information from the Linksfraktion (German Left Party Die Linke).

The Finance Ministry document conceded that:

Die KfW hat im Zeitraum 2010 bis 2014 an den Bund Zinseinnahmen von insgesamt rund 360 Millionen Euro ausgekehrt … Für die kommenden Jahre erwartet die Bundesregierung nur noch geringfügige Einnahmen für den Bundeshaushalt in Höhe von rund 20 Millionen Euro jährlich.

Or: “Between 2010 to 2014, the KfW has paid out around 360 million euro in revenues to the German government and in the coming years the federal government is expecting around 20 million euro per year on interest revenues.”

Which reinforces the view I have had of the interaction between the KfW and the German Finance Ministry all along.

Conclusion

One can argue about this matter on moral grounds as the German Greens Party is. There is certainly a case to be made that previous agreements have not been honoured by Germany and it has used the KfW as a vehicle to distant the Finance Ministry from the agreements.

As the Greens note – there is nothing illegal going on here. Just convenient vehicles to divert attention and avoid moral responsibility.

But you can also argue that the Greek crisis has allowed the German Ministry of Finance to run surpluses without melting their economy down. The role played by the KfW in that regard is undoubted.

Crowdfunding Request – Economics for a progressive agenda

I received a request to promote this Crowdfunding effort. I note that I will receive a portion of the funds raised in the form of reimbursement of some travel expenses. I have waived my usual speaking fees and some other expenses to help this group out.

The Crowdfunding Site is for an – Economics for a progressive agenda.

As the site notes:

Professor Bill Mitchell, a leading proponent of Modern Monetary Theory, has agreed to be our speaker at a fringe meeting to be held during Labour Conference Week in Brighton in September 2017.

The meeting is being organised independently by a small group of Labour members whose goal is to start a conversation about reframing our understanding of economics to match a progressive political agenda. Our funds are limited and so we are seeking to raise money to cover the travel and other costs associated with the event. Your donations and support would be really appreciated.

For those interested in joining us the meeting will be held on Monday 25th September between 2 and 5pm and the venue is The Brighthelm Centre, North Road, Brighton, BN1 1YD. All are welcome and you don’t have to be a member of the Labour party to attend.

It will be great to see as many people in Brighton as possible.

Please give generously to ensure the organisers are not out of pocket.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Your account of the fiscal function of KfW is very interesting. I am interacting with a group of politicians and economic advisors to discuss the possibility of setting up a public bank to finance a transformation of the economic model of Spain and a change toward a sustainable energy model. Public grants in Spain are seriosly hampered and limited by EU legislation on non-competitive state aid which means that they have become largely ineffective because the expectation is that the private sector should take a leading role. Of course that expectation will never happen. It is interesting to see somebody confirm my suspicion that Germany gets a different deal.

Adam Tooze, the historian, has an interesting critical review of Varoufakis’s account of his ‘battles’ with the Troika and other EU institutions, most importantly Germany, in his Adults in the Room. At the end of the review, Tooze briefly points out what Varoufakis doesn’t deal with, the consequences that his strategy to save Greece could have had on other EU countries like Spain and Italy. This review is on his web site. Tooze emphasizes that Varoufakis absolves Schaueble of direct complicity in Greece’s treatment and places the ball entirely in Merkel’s court. According to Varoufakis, Schaueble would have facilitated Greece’s departure from the Eurozone but Markel would not countenance it. While I recommend the review, I think Bill’s highly detailed account of some of the shenanigans, Eurozone Dystopia, to be essential reading. Bill’s framing is nowhere to be found in either the accounts of Varoufakis or Tooze.

For context, I think it important to point out that Varoufakis views blatant neoliberals, Nigel Lawson and George Osborne, as friends. The reason he does this, it seems, is that they appear to be ‘friends’ of Greece.

I should perhaps have pointed out that Germany does not come out well on either Varoufakis’s or Tooze’s accounts, supporting Bill’s scathing critique, where Germany effectively acts as puppet master of the EU.

Greeks have been cheating their creditors for centuries. They’re brilliant at it. They’re also brilliant at evading taxes and fiddling to the books so as to get into the Eurozone. Hence the expression “Beware of Greeks bearing gifts”.

Bail out Greece if you like, but they’ll just get into debt again and ask to be given loads of free money so as to get them out of debt again. Repeat and rinse.

Of course failing to bail out Greece has dire social consequences, but then if Greece left the EU or EZ, rich Greeks would carry on evading taxes, which means there isn’t much money to support less well off Greeks. So the net “social consequences” effect of not bailing out Greeks probably isn’t all that great.

Plus if Greeks are bailed out, that’s an invitation to other EZ countries to borrow and spend like there’s no tomorrow and then go begging for help from Germany.

Christ, Ralph. So many fallacies in so few sentences. The gift you refer to is traceable to Virgil’s Aeneid and its mention of the Trojan horse. And the context was in terms of fear, not financial skulduggery. The Greeks of the time were formidable warriors. Maybe you should read Bill or Varoufakis’s book. And I shouldn’t need to point out that ‘rich Greeks’ does not encompass all Greeks, most of the rich these days being CEOs of large companies, wherever they may reside. Saez, Zucman, and Piketty have good data on the incomes of the various strata that make up the ‘rich’.

“governments of Member States where central banks currently hold Greek government bonds ”

KfW is a “central bank”? Case closed. Weaselly, it’s true, but not a technical violation. As Miltimore says above, apparently the Germans have a pattern of using their “Development Bank” to cheat on their commitments. Serving the national interest, I suppose.

Great idea, Australia also needs a government owned development Bank to provide more fiscal stimulus options, to assist the development of worthy projects and to compete with the parasitic Big 4 Australian banks.

“It borrows in capital markets and all its debt is federal government-guaranteed, which reduces its funding costs relative to a private bank with no such guarantee.”

I thought banks just deposit money into the accounts of those entities that take out the loans and this money is just ‘created’ by keystrokes. Or do banks like national governments just borrow to create the illusion that that is where their money comes from and that such borrowings are in reality totally unnecessary to fund loans??