Today (February 21, 2023), the Australian Bureau of Statistics released the latest - Wage Price…

Australia – real wages growth zero and the rip-off of workers continues

When the Australian Bureau of Statistics released its latest wages data in May (for the March quarter) we learned that real wages were falling as a result of nominal wages failing to keep pace with the modest inflation rate. Today (August 16, 2017), the ABS released the – Wage Price Index, Australia – for the June-quarter 2017. For the sixth consecutive quarter, annual growth in wages has recorded its lowest level since the data series began in the December-quarter 1997. Nominal wages growth in Australia was just 1.9 per cent in annual terms and equal to the inflation rate of 1.9 per cent. So on the back of real wage cuts in the March-quarter, workers enjoyed zero real wages growth in the June-quarter. This is in the context of on-going productivity growth, which means that the profit share in national income rose again as real unit labour costs plunged. But employment growth also remains flat. This represents a major rip-off for workers. The flat wages trend is also intensifying the pre-crisis dynamics, which saw private sector credit rather than real wages drive growth in consumption spending. Further, the forward estimates for fiscal outcomes provided by the Australian government are now not achievable, given the flat wages growth. There is no way the tax receipts will rise in line with the projections, which assumed much stronger wages and employment growth than will occur under current austerity-type fiscal settings.

Nominal wage and price inflation and real wage trends in Australia

Under a headline of “Wage growth subdued at 0.5%”, the ABS media release (August 16, 2017) said:

The seasonally adjusted Wage Price Index (WPI) rose 0.5 per cent in June quarter 2017 and 1.9 per cent over the year … The WPI, seasonally adjusted, has recorded quarterly wages growth in the range of 0.4 to 0.6 per cent for the last 12 quarters (from September quarter 2014) …

This low wages growth reflects, in part, ongoing spare capacity in the labour market. Underemployment, in particular, is an indicator of labour market spare capacity and a key contributor to ongoing low wages growth …

Seasonally adjusted, private sector wages rose 1.8 per cent …

In September 2016, the ABS presented an additional research paper which tried to explain why wages growth had plummetted – The Size and Frequency of Wage Changes

They concluded that:

… the declining size of wage rises has contributed more than two-thirds of the overall fall in wage growth since 2012 … The reduction in the frequency of wage adjustment has contributed the remainder.”

In other words, workers are not receiving sufficiently large wage rises.

The wage series used in this blog is the quarterly ABS Wage Price Index published by the ABS. The Non-farm labour productivity per hour series is derived from the quarterly National Accounts.

Productivity data available via the RBA Table H2 Labour Costs and Productivity.

Please read my blog – Inflation benign in Australia with plenty of scope for fiscal expansion – for more discussion on the various measures of inflation that the RBA uses – CPI, weighted median and the trimmed mean The latter two aim to strip volatility out of the raw CPI series and give a better measure of underlying inflation.

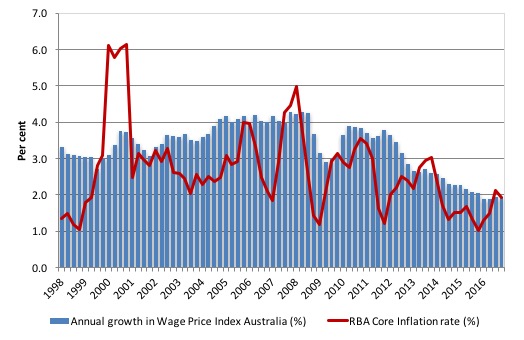

The first graph shows the overall annual growth in the Wage Price Index since the September-quarter 1998 (series was first published in the September-quarter 1997).

I also superimposed the annual inflation rate (red line). The bars above the red line indicate real wages growth and below the opposite.

In the June-quarter, the WPI rose by 1.9 per cent on an annual basis compared to the RBA core inflation measure of 1.9 per cent, meaning that the real purchasing power of workers’ wages was unchanged.

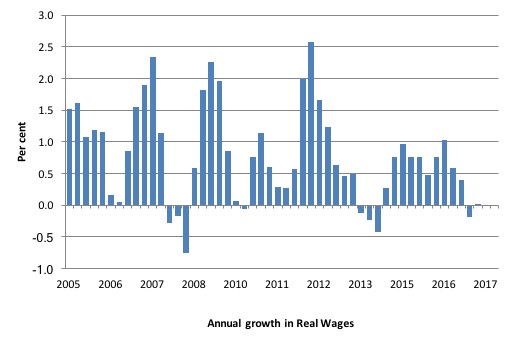

The following graph shows the annual growth in real wages since the June-quarter 2005 to the June-quarter 2017.

After a few quarters of hard real wage cutting in 2013-14, the private sector returned to positive real wages growth but at very subdued rates.

In the March-quarter 2017, real wages growth was negative (-0.2 per cent) and in the June-quarter there was zero real wages growth.

The rise in real wages in 2012 into 2013 was the result of the strong economic growth supported by the fiscal stimulus. The declining profile after that is associated with the end of the mining investment boom exacerbated by the obsessive fiscal restraint that was introduced (too early) and has led to the economy stalling.

The low wages growth raises several questions that are not unique to the Australian setting.

1. The low wages growth threatens to undermine household consumption expenditure, which is the largest component of aggregate spending. This fuels renewed demand for credit despite the fact that Australian households are already carrying record levels of debt (see Point 3).

2. The Australian government is mired in a trap of its own making – it still seeks to withdraw billions in public spending (a significant cut) because in its blinkered eyes the fiscal deficit is too large. Its fiscal aspirations for a surplus not only require this withdrawal but also a major rebound in tax revenue.

With wages growth so low – there is no income tax bracket creep going on (people paying higher tax because they move into higher brackets) and tax receipts are falling well below forecasts.

The ‘surplus obsession’ mindset is likely to see the government try to cut elsewhere to make up the shortfall – and the vicious cycle of fiscal austerity, low growth, low wages growth – and more mindless austerity will continue.

3. Australian households are carrying record levels of debt and their position is made more precarious by the low wages growth. Please read my blog – Australia’s household debt problem is not new – it is a neo-liberal product – for more discussion on this point.

As cuts spending, growth falters and taxation revenue falls – the Federal government is then just chasing its own tail at the expense of the unemployed who have to wear the costs of this folly.

Suppressing growth also leads to this declining wages growth profile, which further undermines the tax base of the Government.

Damaging circularity like this are characteristic of the neo-liberal era.

Workers not sharing in productivity growth

Not only has real wages growth stalled to a standstill in Australia but it is clear that workers have not been sharing in the productivity growth generated in the Australian economy for several quarters.

Productivity growth provides the ‘non-inflationary’ space for real wages to grow and for material standards of living to rise.

But, one of the salient features of the neo-liberal era has been the on-going redistribution of national income to profits away from wages. This feature is present in many nations.

This has occurred because real wages growth has lagged behind productivity growth and the extra real income produced as been expropriated by capital in the form of profits.

The suppression of real wages growth has been a deliberate strategy of business firms, exploiting the entrenched unemployment and rising underemployment over the last two or three decades.

The aspirations of capital have been aided and abetted by a sequence of ‘pro-business’ governments who have introduced harsh industrial relations legislation to reduce the trade unions’ ability to achieve wage gains for their members. The casualisation of the labour market has also contributed to the suppression.

The so-called ‘free trade’ agreements, which are currently in the spotlight, have also contributed to this trend.

That redistribution of national income to profits continues in Australia.

I consider the implications of that dynamic in this blog – The origins of the economic crisis. As you will see, I argue that without fundamental change in the way governments approach wage determination, the world economies will remain prone to crises.

In summary, the substantial redistribution of national income towards capital over the last 30 years has undermined the capacity of households to maintain consumption growth without recourse to debt.

One of the reasons that household debt levels are now at record levels is that real wages have lagged behind productivity growth and households have resorted to increased credit to maintain their consumption levels, a trend exacerbated by the financial deregulation and lax oversight of the financial sector.

Historically (for periods which data is available), rising productivity growth was shared out to workers in the form of improvements in real living standards. Higher rates of spending driven by the real wages growth then spawned new activity and jobs, which absorbed the workers lost to the productivity growth elsewhere in the economy.

The neo-liberal period marked a shift in that relationship.

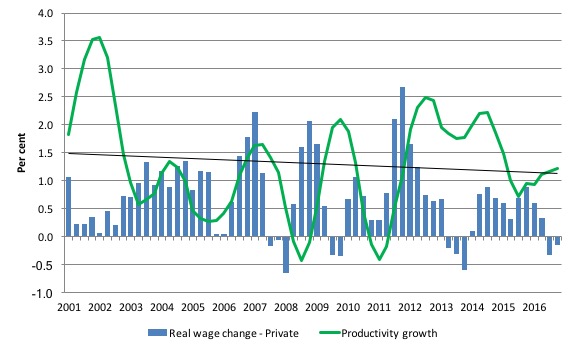

The next graph shows the annual hourly real wage change for the private sector (blue bars) and the annual hourly productivity growth (green line) since the June-quarter 2001, expressed as a 6-quarter moving-average to filter out the volatility in the series. The black line is the trend productivity growth over the same time period.

Productivity growth is currently close to trend and over the last 5 years has been mostly well above the growth in real wages.

Clearly, since the March-quarter 2011, the payoff to workers from the positive productivity growth has been less than proportional with real wages growth lagging productivity growth.

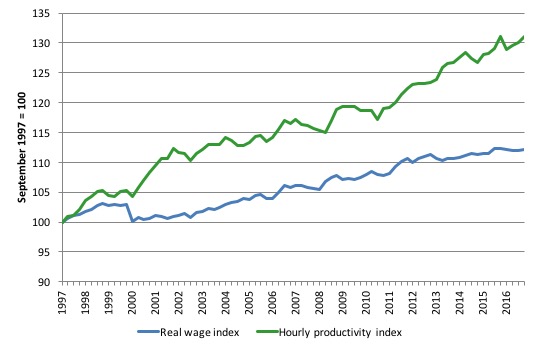

Taking a longer view, the following graph shows the total hourly rates of pay in the private sector in real terms (deflated with the CPI) (blue line) from the inception of the Wage Price Index (September-quarter 1997) and the real GDP per hour worked (from the national accounts) (green line) to the June-quarter 2017.

Over that time, the real hourly wage index has grown by 12.2 per cent, while the hourly productivity index has grown by 31.1 per cent.

If I started the index in the early 1980s, when the gap between the two really started to open up, the productivity index would stand at around 180 and the real wage index at around 115.

This gap represents a massive redistribution of national income to profits and away from wage-earners. For more analysis of why the gap represents a shift in national income shares and why it matters, please read the blog – Australia – stagnant wages growth continues.

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go? Answer: Mostly to profits. One might then claim that investment will be stimulated.

At the onset of the GFC (December-quarter 2007), the Investment ratio (percentage of private investment in productive capital to GDP) was 23.8 per cent.

It peaked at 24.3 per cent in the September-quarter 2013. But in recent quarters as the gap between real wages growth and productivity growth widens, the Investment ratio has fallen and in the March-quarter 2017 it stood at 19.4 per cent and is falling.

The downward shift in the non-mining investment ratio is more stark than that.

Some of the redistributed national income has gone into paying the massive and obscene executive salaries that we occasionally get wind of.

Some will be retained by firms and invested in financial markets fuelling the speculative bubbles around the world.

Real wages growth and employment

The recent labour force data has revealed on-going weak employment growth.

The standard mainstream argument that unemployment is a result of excessive real wages and moderating real wages should drive stronger employment growth.

The problem with this ‘theory’, when applied to the recent Australian experience, is that wages growth has been moderate for several years now while employment growth has been zig-zagging across the zero line over the same period – but generally very weak itself.

The coincidence of both the flat wages growth and the poor employment growth for the last several quarters is supportive of the Modern Monetary Theory (MMT) position – that both are responding to the weak overall spending in the economy.

Firms will not employ new labour, no matter how cheap it becomes, if they cannot sell the extra goods and services that would be produced.

The claim that real wage cuts or growth retardation is necessary to stimulate employment is never borne out by the evidence.

As Keynes and many others have shown – wages have two aspects:

First, they add to unit costs, although by how much is moot, given that there is strong evidence that higher wages motivate higher productivity, which offsets the impact of the wage rises on unit costs.

Second, they add to income and consumption expenditure is directly related to the income that workers receive.

So it is not obvious that higher real wages undermine total spending in the economy. Employment growth is a direct function of spending and cutting real wages will only increase employment if you can argue (and show) that it increases spending and reduces the desire to save.

There is no evidence to suggest that would be the case.

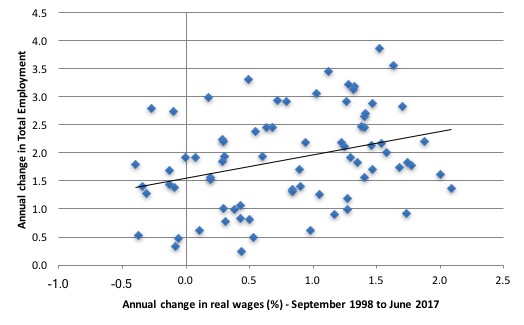

The following graph shows the annual growth in real wages (horizontal axis) and the quarterly change in total employment. The period is from the September-quarter 1998 to the June-quarter 2017. The solid line is a simple linear regression.

Conclusion: When real wages grow faster so does employment although from a two-dimensional graph causality is impossible to determine.

However, there is strong evidence that both employment growth and real wages growth respond positively to total spending growth and increasing economic activity. That evidence supports the positive relationship between real wages growth and employment growth.

Conclusion

Australia continues to endure record-low wages growth. In the June-quarter real wages growth was zero followed by the fall in real wages growth (-0.2 per cent) in the March-quarter 2017.

Depending on how we measure inflation, real wages growth has zig-zagged across the zero growth line several times in the last few years.

The slow wages growth is a cause and reflection of the slow growth in overall economic activity and employment as well as major shifts in the type of employment that is on offer.

Over the last 12 months, Australia has become a part-time employment nation, with full-time work in retreat. That compositional shift, alone, largely due to weak domestic demand and declining commodity prices, sets the scene for low wages growth.

But then, add in the rise in underemployment and hidden underemployment and we find that around 20 per cent of the available and willing workforce is idle in Australia.

That is a massive waste of labour and foregone income. It cannot be explained through worker preference. It is all about a shortage of job creation stifled by excessively restrictive fiscal policy settings.

In turn, workers are adopting a much more cautious approach to spending and firms are demonstrating that they will not lift the investment rate while sales are flagging.

The on-going subdued economic activity will also undermine the Government’s fiscal strategy, which can be summarised as squeezing net public spending out of the economy in the hope that they will achieve a fiscal surplus by 2020-21.

Economic growth and wages growth, in particular, will not be strong enough to match their assumptions and that means the growth in tax receipts will be less than assumed.

It would be better for the Government to stimulate the economy more now with larger fiscal deficits and then see the fiscal balance drop on the back of income growth.

Higher (and more reasonable) wages growth would both benefit from and provide support to such a fiscal strategy.

At the moment, we are in a race-to-the-bottom, which is nowhere any reasonable policy strategy should aim for.

And our Government! Obsessing about expenditure cuts. Irresponsible and incompetent!

Crowdfunding Request – Economics for a progressive agenda

55 per cent of target with 11 days left.

I received a request to promote this Crowdfunding effort. I note that I will receive a portion of the funds raised in the form of reimbursement of some travel expenses. I have waived my usual speaking fees and some other expenses to help this group out.

The Crowdfunding Site is for an – Economics for a progressive agenda.

As the site notes:

Professor Bill Mitchell, a leading proponent of Modern Monetary Theory, has agreed to be our speaker at a fringe meeting to be held during Labour Conference Week in Brighton in September 2017.

The meeting is being organised independently by a small group of Labour members whose goal is to start a conversation about reframing our understanding of economics to match a progressive political agenda. Our funds are limited and so we are seeking to raise money to cover the travel and other costs associated with the event. Your donations and support would be really appreciated.

For those interested in joining us the meeting will be held on Monday 25th September between 2 and 5pm and the venue is The Brighthelm Centre, North Road, Brighton, BN1 1YD. All are welcome and you don’t have to be a member of the Labour party to attend.

It will be great to see as many people in Brighton as possible.

Please give generously to ensure the organisers are not out of pocket.

That is enough for today!

(c) Copyright 2017 Bill Mitchell. All Rights Reserved.

The gap between labor compensation and productivity is interesting, but I’ve always thought that a deeper analysis was necessary to really understand the causal forces at work. So today I took a quick look to see what I could find in the way of other research. One interesting recent paper that I came across was from the U.S. Bureau of Labor Statistics (BLS):

https://www.bls.gov/opub/btn/volume-6/understanding-the-labor-productivity-and-compensation-gap.htm

It takes a look at the differences between the gap in different industries and also uses something more like a producer price index (computed separately for each industry) as a wage deflator rather than using a general consumer price index. This results in a much stronger correlation between industry productivity gains and wages paid in that industry. I’m still not clear on whether that is a reasonable thing to do (perhaps Bill can help there), but among other findings they point out that the size of the productivity / wage gap correlates with the amount of productivity gain. That is, industries with the largest productivity gains also have the biggest productivity/wage gaps. That makes some amount of intuitive sense to me for some specific ways in which productivity can be increased. If you outsource to get big productivity gains, then by definition you are cutting wage costs as well. The same can be said if you significantly automate to gain productivity. Also, companies that make the fastest productivity gains are sometimes making large and frequent capital investments (computer chip manufacturers come to mind) because production equipment is made obsolete so quickly. So for those sorts of industries it makes sense that a larger share of income might go towards capital replacement. I just have the feeling that more specific analysis by industry will help to better understand why this productivity/wage gap occurs.

Why do you think employers are not paying their employees according to their productivity growth? Its not even in their own interests in the long run

Paul , if we are talking about labor productivity, I very much doubt that US companies outsource production in order to improve that- they outsource to lower their costs with far cheaper labor and less stringent regulations- not to improve the production per hour of labor. But investment in automation of production almost by definition will increase labor productivity for a company. And capital replacement by a company is Investment- not profit share.

While I understand that increasing labor productivity allows for increasing real wages in a totally non-inflationary way, I have never understood the claim that increased productivity will necessarily result in those wage gains. What is the mechanism whereby labor automatically captures some of the increased production per hour of their work?

Jerry, If you reduce labor costs for any given level of production, then by definition productivity improves. So sure, they’re trying to reduce labor costs, but that improves productivity. Those two objectives are met simultaneously.

I’m not sure what point you were trying to make by saying that “capital replacement by a company is Investment- not profit share”. I was talking about shares of “income”, not shares of profit. A company that must use a relatively large share of income to replace equipment that becomes obsolete very quickly has, by definition, less income to spread around among other players who also get shares of income. That includes wage workers, suppliers, management, and stock-holders.

Regarding the relationship between increased productivity and wage share, I don’t think anyone assumes that increased productivity will automatically increase wages. Certainly all the data since 1980 would disabuse you of the idea that this happens automatically. But over a long time previous to that there was at least a rough correlation between the two. That turned out to be a generally good thing to maintain ongoing economic growth. So the question that Bill and other economists have attempted to answer is why that correlation no longer holds. Sometimes their answer is “greed” when viewing management salaries. Sometimes the answer is the successful attack on labor unions which disadvantages workers in wage negotiations. My personal opinion is that the real answer has more to do with the changing nature of wage work. There is much less physical skill required than previously and much more intellectual skill required for many of the newer high-paying occupations. Thus the emphasis on people getting college educations to get the newer, higher paying, jobs. But even that amount of training is insufficient for many of the jobs that are available today, and there aren’t enough jobs for people with basic college degrees. Companies do less training themselves because they have discovered that they just lose the workers they train to competitors. As a society we have to decide what to do about that and that’s where people like Bill have a lot of insights to offer I think.

Hi Paul, my understanding of labor productivity is it is the amount of goods produced per unit of labor time. So if company A produces a house using 2000 labor hours that sells for $100,000 while company B produces the same house using 4000 labor hours, then A’s employees have a higher labor productivity than B’s. Even if company A has to pay it’s employees three times as much as B pays- labor cost is not figured into labor productivity, only hours worked and final output value.

Paul, I don’t remember what point I was trying to make about investment, so I am not surprised that you don’t know either :). I think it was something along the lines that a company will expect a return on investment of capital, since it has a real cost, and that therefore it is not surprising that while labor productivity will rise, wages of the firm’s employees might not. But investment in productive capacity creates demand for investment goods, which could allow wages to rise in that sector, which theoretically could allow for wage increases for employees of the original company.

I am thinking that the whole theory that productivity increases will cause real wages to rise hinges on the assumption of full employment in the economy. While neoclassical economists love to assume full employment, we know that historically, it has rarely been achieved without government intervention. But if we can implement the Job Guarantee like Professor Mitchell advocates, then we would see actual full employment and that would allow for real wage increases in line with productivity growth.

Jerry, I’ve been traveling all day, sorry for the delay in responding. Measuring labor productivity is sort of a tricky thing and I don’t claim to be any sort of expert except for having been in the position of a manager actually trying to measure it. I believe you are correct in saying that productivity is ideally measured as output/labor-hour or some equivalent.

The problem is that not all labor-hours are equivalent (i.e. labor-hours are not fungible). So if you change your process in such a way that the number of labor hours used doubles (or is halved), for the same amount of output, have you automatically halved (or doubled) the productivity? Any manager would likely tell you that it depends on the wages being paid in each case. It’s just not reasonable to make comparisons of alternative labor configurations without taking costs into account.

So rather than use labor-hours as the denominator for a productivity measure, you will see labor-dollars used. That’s what I did almost instinctively, without thinking about it too much or explaining it. Even that doesn’t solve all measurement problems because you may be exchanging other factors of production for labor (one way or the other), so you have to take the costs of both factors into account to determine if your overall process change gains or loses with respect to “productivity”.

I once took a long look at the way that productivity changes are computed by economists as part of their estimation of price inflation. While I eventually sort of understood their intentions, I came away shaking my head because it never seemed completely reasonable to me. For example, if the same raw materials are used for two successive versions of a product and the labor done is substantially the same, then they are deemed to be equivalent, no matter how differently those raw materials might be used. In the case of computers, where I’m on familiar ground, that’s a ludicrous assumption, because how they are put together makes a huge difference. Gigahertz chips and Megahertz chips are manufactured with fundamentally the same materials and labor processes (using significantly different capital equipment). The increases in quality, utility, or other consumer value that new products typically have seem to hardly matter for economic metric purposes. A secondary effect of this is, I believe, that official measures of price inflation habitually overstate the actual value. With a central bank that is highly suspicious of any little bit of inflation and reacts by increasing interest rates in order to cool things down, that is a recipe for squelching economic growth.

Now I want to qualify all that by saying that it’s been a few years since I last looked at the way things are measured and they may have changed somewhat. But since that would invalidate a number of long-running economic series I’m somewhat doubtful that much has changed. Send email if you want to discuss anything further.

Jack, if you’re asking why managers don’t increase worker wages when productivity increases, then I think the answer lies in the specific reason for the increase. I don’t want to make the explanation simpler than it actually is, but generally speaking you can get productivity increases either by virtue of some change in the worker (i.e. they gain or improve some skill that results in higher levels of production) or via some change in the production process (i.e. a new process or tool or whatever). Clearly for any change of the first sort it makes sense for employers to increase compensation for the more productive employees because otherwise they might lose them to a competitor who would get the benefit of their improvement. This clearly happens today for some employees (software developers, for example).

For the second sort of productivity improvement additional worker skills may or may not be required to go along with the process/tool change. But even when new skills are required, they may not require a substantial amount of training or experience to acquire. Employers do not need to increase their compensation if other workers can be hired and trained at relatively little expense. Managers are primarily charged with increasing shareholder value and will not keep their positions long if they do not do that. Reducing labor costs is an attractive target. The macroeconomic effects of every company doing that are not even on the radar of managers and even if it were, the forces compelling them to further reduce labor costs means that if they don’t do it, someone else will be hired in their place who will.

You will get different theories about what is actually happening in the economy, but my own personal opinion is that for any number of reasons, the second sort of productivity enhancement has become much more common. So managers are rewarded for coming up with those sorts of changes and employees get very little of the increased income. I believe that this is simply a product of the microeconomic forces involved rather than some international plot by the rich to take advantage of the poor. But it is causing major macroeconomic problems as Bill so carefully documents. So the effect of what is going on may not be much different than if there actually were such a war being waged on the poor.

Hi Paul, I’ve thought much the same as yourself but can’t find anybody to agree. Surely, the provisioning cost of labour productivity by why of capital expenditure must have a deterministic effect. Would it be more appropriate to compare wages growth with total factor productivity so that the capital component is captured. TFP has pulling in the opposite direction to labour productivity for most of the last decade. I’m not an expert but it seems intuitive.

Jerry, again I’m not an expert but my understanding of the mechanism for wages growth being linked to productivity gains is not via benevolent bosses. I believe that it is due to the rollout of technology requiring workers with higher skills. It is the higher skills that demands higher wages. No doubt that the collective workforce today has more skill than those of 10 years ago and those again of 20 years ago. So the incremental gains in skills is what really drives wages.

Thanks for the blog Bill. Don’t comment much but read most days.

Crocodile?, I am sure you are right that wage growth is not due to benevolent bosses! There are some here and there but individual managers, bosses, owners cannot affect the overall, economy wide trend, in my opinion.

As far as wage growth depending on higher skill levels than in the past, I think I disagree. It seems to me that the entirety of mass production since it was introduced has been focused on reducing the skill level required for each worker so that goods can be produced with less labor cost. Costs that would have to be paid for by the producer for that more highly skilled (and rare) worker.

Paul, thank you for the reply- I know what you are saying and I realize it is probably the more important consideration for a company exec deciding whether to outsource production to somewhere with lower labor costs. But being a labor guy, it is important to me that it is described accurately when a company makes that shift in production. I doubt very much that companies move because workers where they move to produce more per hour than their previous employees did. I think they move production to take advantage of lower labor costs and less regulation, and I think that needs to be acknowledged. Sorry.

Paul, I cut off the end of my comment somehow. It was “Sorry. Didn’t mean to take this out on you.”

Jerry, yes the key is production with less labour cost. This doesn’t mean less skill. The onward march of technology means that a single labour unit can produce more output. Due to technology, the skill level of the operator is higher. I think you need to look economy wide. For instance, a guy with a bulldozer can shift more dirt than a team with shovels. I guarantee that his pay rate would be higher. It goes on from there. Skilled workers such as engineers need to design the bulldozers, mechanics need to service them, they require sales outlets and fuel etc. All of these involved earn more than the guy on the end of a shovel. This is what I mean by incremental growth in technology over time that grows wages.

Jerry, I always appreciate your thoughts and I am not nearly so thin-skinned as some of our U.S. politicians! And I totally agree with you that outsourcing is generally about reducing labor costs. Cost reductions (including, but not exclusively for labor) are one way of producing more for the same $ expense. That is always a primary management objective. I often think that this is short-sighted because things like product quality may be neglected when making the assessment. But by effectively increasing the supply of potential workers by expanding the search for them world-wide, they can take advantage of less competition for labor in off-shore locales and thereby lower their costs.

The other way to make more for less is to use better tools and technology. Often in the past this has resulted in a requirement for improved worker skills as well, as Crocodile pointed out. But since the productivity gain was caused by two different factors (technology/capital and worker skill) they shared in the gain in a proportion that was largely determined by the supply and demand for that particular sort of labor skill.

I think this also accounts, at least in part, for the very high executive salaries. Figuring out how to design production in a cost-optimal way is not an easy task. Having seen up close how at least a couple of CEO’s work, I wouldn’t want that job for any amount of money. The stress on my own life, being a few levels down in a relatively small company, was enough to make me decide to retire early. Note that I am NOT saying that the stress on such people is anywhere near the equivalent of the stress experienced by very poor out-of-work people with families to support. Executives are well-compensated for their stress levels. I am only saying that their compensation levels are high partly for the specific knowledge and experience that they have for pulling together production in a way that optimizes shareholder value and partly because there aren’t that many people who can both do those jobs and are willing to pay the personal costs they require.

I think that Crocodile’s point about total-factor productivity and labor-productivity diverging is right on. My own view is that the capital-or-technology/labor-skill ratio for new jobs has been increasing over time and in some cases has reached infinity as the need for any labor at all for a specific task goes to zero. My academic training was in AI and I am totally blown away by the progress that has been made in recent years and which is accelerating. Whole occupations (like drivers) will disappear in short order. What we’re seeing today is a pale shadow of the labor-market disruption that is on our doorstep and we’d better get our economic policy act together before massive social upheavals make life much worse for everyone. Much like nuclear war, economic war between capital owners and everyone else is not a winnable war. The result of such a clash would result, I fear, in a worldwide regression into the economic stone-age with the inevitable personal costs for everyone that this would entail.

The basics of any new economic policy must, I believe, eliminate (or at least moderate) the fundamental driving force of capitalism as we currently have it, which is maximizing shareholder value. It will take worldwide government regulation of some sort that favors economic equality for the masses to make such a change. With entrenched money interests that will fight this tooth and nail, I am not currently very optimistic. Economic education for the masses will be the key I think. And for that reason I am very grateful for Bill Mitchell.

“The on-going subdued economic activity will also undermine the Government’s fiscal strategy, which can be summarised as squeezing net public spending out of the economy in the hope that they will achieve a fiscal surplus by 2020-21.”

Is this for real? Is this actually what they are aiming for?

Yes Dingo, it is unfortunately true. It has worked it’s way into the narrative over time now and almost impossible to turn back. The punters now firmly believe that surplus = good, deficit = bad. People associate with debt and the tricksters have been successful in promoting the myth that a national economy is akin to a big household. The householders haven’t quite worked out yet that clearing government debt simply transfers the debt to the private sector.

It is little wonder the neoliberal myths live on – NSW (and probably other Aus states) indoctrinate /misinform a fresh batch of HSC economics students every year.

My son is Yr11 NSW studying “Economics” for the HSC – the textbook in use (“The Market Economy” written by Tim Dixon and John O’Mahony) is full of neoliberal miss-information that must be ‘learnt’ and parroted to achieve a ‘pass’ in the subject.

Both he and I comprehend the macroeconomic reality of MMT – yet to pass exams he must regurgitate the many unreal economic lies and fallacies taught.

He is a diligent high achieving student (straight A’s/occasional YrDux) in every subject, yet he must write (what he knows is) complete rubbish to pass the HSC course exams.

In the subject of economics, his learning experience is an exasperating exercise in rehearsing/regurgitating contrived deceit – fearful that he might inadvertantly write MMT truth and be marked down.

In the teaching of HSC economics there is little distinction drawn between state or federal government financial constraints/operation, except to define broad areas of responsibility. Currency issuer vs currency user is never mentioned in his workbooks, let alone considered in class.

The following is from his class notes – he says drawn from class textbooks:

“Governments borrow deliberately to increase the level of economic activity and to finance major infrastructure projects such as roads or bridges. Governments will also borrow if their spending unintentionally grows faster than their revenue, or to give tax cuts and to stimulate the Australian economy. Governments mainly use government bonds to borrow money but occasionally take out government loans from banks…”

Some random quotes from his lesson notes:

– Commonwealth government is funded by the taxes they impose on the public such as individual income tax, excise duty and company taxes…..

– the level of savings in an economy places downward pressure on interest rates as when savings are high there are ample loanable funds available…

– inflation expectation -…if inflation is expected to increase then lenders require a higher interest rate to compensate the depreciation of their asset; ergo even if the real rate of return remains constant, high expected inflation will lead to higher nominal interest rates.

– Govt. Budget …if a government has a fiscal deficit it is a borrower of funds which can result in higher interest rates; if it is a net lender [surplus] downward pressure will be placed on interest rates….

Annually there is a future batch of economic illiterates being turned out by our school education systems.

How does one fight such institutional intellectual corruption?

It is pointless trying to discuss the inadequacy of the HSC economics course with the relevant High School, as they just point to the set HSC curriculum.

What can one do to change this most unsatisfactory situation.