The Australian Bureau of Statistics (ABS) released the latest - Consumer Price Index, Australia -…

ECB is running out of debt to buy – more smoke and mirrors needed

There was a Bloomberg report yesterday (September 6, 2017) – Draghi’s Claim of QE Flexibility Is Attracting Doubters – that made me laugh. The sort of laugh that comes when you just realise there is parallel language spoken out there that makes no sense and reinforces stupidity with stupidity. Much like most of mainstream economics commentary. The journalist was trying to argue that times is up for the ECB’s Quantitative Easing strategy because they are running out of debt to buy. Whew! That sounds like a catastrophe. The point is that the elephant in the room is ignored. The ECB is already massively violating the Treaty of Lisbon constraints on funding government deficits. It is time they realised that without that ‘quasi fiscal support’ (given the ECB is effectively the only functioning federal fiscal authority by default in the Eurozone), the system will collapse under the weight of austerity. Leadership demands they take the next step and allow the ECB to openly fund deficits using Overt Monetary Financing (OMF). But the lack of leadership tells us they will not take this obvious step. The grinding nature of Eurozone economic history will continue as a result – and then the next crisis will hit.

The subtitle to the article Draghi’s Claim of QE Flexibility Is Attracting Doubters, claims that “The ECB will need to wind down bond buying next year as it runs out of securities, economists say”.

“Economists say” = authority. Or so we have been led to believe. In many cases it means the opposite – a sort of tarot card, witchdoctory sort of exercise.

These economists (from investment banks) are claiming that while the ECB Governing Council is going through a process to determine “the future of its asset purchases”, the reality (their reality) is that the:

ECB’s decision to wind down bond buying next year will be a matter of necessity rather a choice.

Why?:

Bond scarcity is increasing in more and more countries … The ECB will be forced to reduce its QE regardless of economic conditions, simply because it has no more bonds to purchase.

In the first instance, that claim is only true if the ridiculous rules that the ECB pretends to abide by are maintained.

The ECB is already massively violating Article 123 of the Treaty of Lisbon which prohibited the ECB from funding deficits (directly or indirectly if the spirit of the stupid rule is honoured).

Article 123 reads:

1. Overdraft facilities or any other type of credit facility with the European Central Bank or with the central banks of the Member States (hereinafter referred to as ‘national central banks’) in favour of Union institutions, bodies, offices or agencies, central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of Member States shall be prohibited, as shall the purchase directly from them by the European Central Bank or national central banks of debt instruments.

2. Paragraph 1 shall not apply to publicly owned credit institutions which, in the context of the supply of reserves by central banks, shall be given the same treatment by national central banks and the European Central Bank as private credit institutions.

And Article 125:

1. The Union shall not be liable for or assume the commitments of central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of any Member State, without prejudice to mutual financial guarantees for the joint execution of a specific project. A Member State shall not be liable for or assume the commitments of central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of another Member State, without prejudice to mutual financial guarantees for the joint execution of a specific project.

…

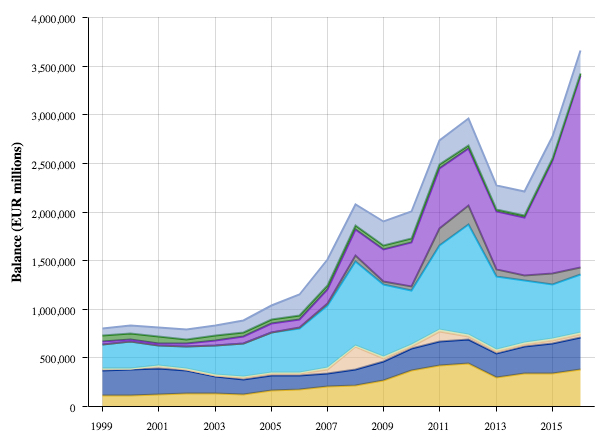

Have a look at this graph which shows the consolidated asset-side of the Eurosystem of Central Banks Balance Sheet. The second graphic indicates what the colours mean.

That totals to 3,661,439 million euros. In 2005, for example, the total asset-side of the consolidated Eurosystem balance sheet totalled 1,150,030 million euros. Quite an expansion.

On the liabilities-side, there is a huge growth in “Liabilities to euro area credit institutions related to monetary policy operations denominated in euro” (1,313,264 million euros in 2016), which is the largest

On May 14, 2010, the ECB established its Securities Markets Program (SMP), which opened the possibility that the ECB and the national central banks could “conduct outright interventions in the euro area public and private debt securities markets”.

This is central bank-speak for the practice of buying government bonds in the so-called secondary bond market in exchange for euros, that the ECB could out of ‘thin air’.

Government bonds are issued to selective institutions (mostly banks) by tender in the primary bond market and then traded freely among speculators and others in the secondary bond market.

The SMP also permitted the ECB to buy private debt in both primary and secondary markets.

To understand this more fully, the decision meant that private bond investors (including private banks) could off-load distressed state debt onto the ECB.

The action also meant that the ECB was able to control the yields on the debt because by pushing up the demand for the debt, its price rose and so the fixed interest rates attached to the debt fell as the face value increased.

Competitive tenders then would ensure any further primary issues would be at the rate the ECB deemed appropriate (that is, low).

Please read my blog – A central bank can always prevent government default – for more discussion on this point.

In my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale – I concluded that the SMP amounted to the central bank ensuring that troubled governments could continue to function (albeit under the strain of austerity) rather than collapse into insolvency.

Whether it breached Article 123 is largely irrelevant. The fact is that I believe it did.

The SMP reality was that the ECB was bailing out governments by buying their debt and eliminating the risk of insolvency.

The SMP demonstrated that the ECB was caught in a bind. It repeatedly claimed that it was not responsible for resolving the crisis but, at the same time, it realised that as the currency-issuer, it was the only EMU institution that had the capacity to provide resolution.

The SMP saved the Eurozone from breakup.

After the SMP was launched, a number of ECB’s official members gave speeches claiming that the program was necessary a necessary part of standard liquidity management (monetary policy) and nothing to do with funding governments. Laugh then read on!

A Member of the ECB Executive Board said (Source):

The main purpose of this programme is maintaining a functioning monetary policy transmission mechanism by promoting the functioning of certain key government and private bond segments.

In other words, by placing the SMP in the realm of normal weekly central bank liquidity management operations, they were trying to disabuse any notion that they were funding government deficits.

This was to quell criticisms, from the likes of the Bundesbank and others, that the program contravened Article 123 of the TEU.

The SMP then morphed into a much more adventurous QE program.

I discussed the modern variant of the ECBs QE program in this blog – ECB’s expanded asset purchase programme – more smoke and mirrors.

Which is more or less where we are now.

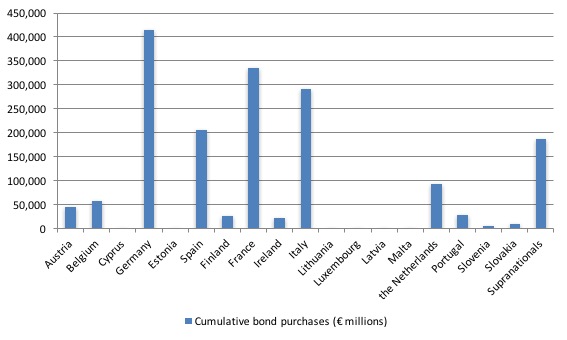

The March 4, 2015 decision to expand the asset purchasing scheme “to include a secondary markets public sector asset purchase programme” (that is, the Public Sector Purchase Programme or PSPP program), led to the National Central Banks (NCBs) in the Eurozone being able to buy up government bonds “in proportions reflecting their respective shares in the ECB’s capital key”.

Only Greece was excluded from the scheme.

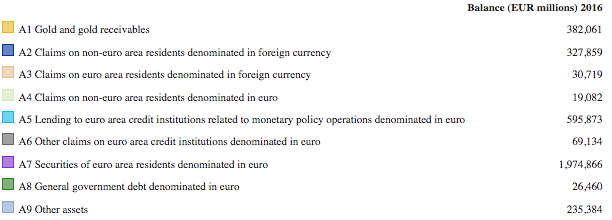

The – capital key – (or capital subscription) denotes the proportions in which the Member States contribute to the capital of the ECB, which is a wholly own entity of the NCBs.

The rules dictate that:

The NCBs’ shares in this capital are calculated using a key which reflects the respective country’s share in the total population and gross domestic product of the EU. These two determinants have equal weighting.

The following graphic is the latest data (for the 19 Member States).

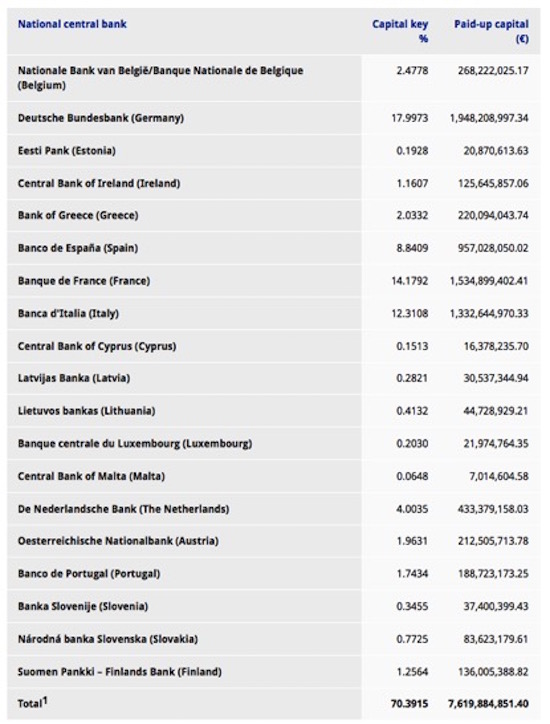

The ECB provides a time series of the – Cumulative purchase breakdowns under the PSP.

The following graph shows the cumulative purchases (€ millions) by nation since the end of March 2015 to the end of August 2017 (blue columns).

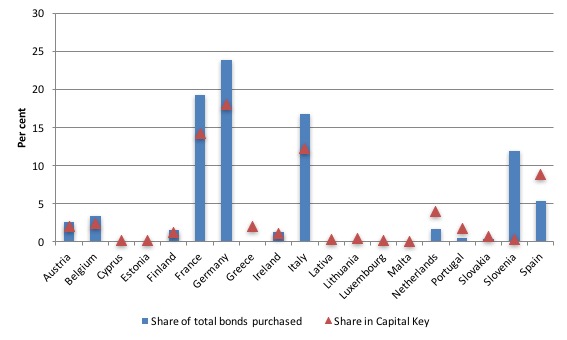

The next graph shows the share of the cumulative purchases by nation in the total (blue columns) with the red triangles denoting the nation’s percentage share of the capital key.

Remember, under Article 6 – Allocation of Portfolios – of the March 4, 2015 ECB decision:

… the NCBs’ share of the total market value of purchases of marketable debt securities eligible under PSPP shall be 92 %, and the remaining 8 % shall be purchased by the ECB. The distribution of purchases across jurisdictions shall be according to the key for subscription of the ECB’s capital as referred to in Article 29 of the Statute of the ESCB.

The other restriction under Article 5 Purchase limits is that the NCBs can only purchase up to “an aggregate limit of 33 % of an issuer’s outstanding securities”.

The first question then is: How closely is the PSPP keeping to the capital key proportions?

Answer: Not very close.

We can see that in the case of France (19.3 per cent of total purchases, 14.2 per cent capital key), Germany (23.8 per cent of total purchases, 17.9 per cent capital key), Italy (16.8 per cent of total purchases, 12.3 per cent capital key), and Spain (11.9 per cent of total purchases, 8.8 per cent capital key), the relevant NCBs have been buying significantly more than indicated by the contribution to the ECB capital.

And the mismatch between the capital key proportion and the bond purchase proportion has been widening.

The discrepancies for other Member States (bar Greece) are very small.

The PSPP is largely rendered operational at the NCB level. The decision of March 4, 2015 said that the NCB share of total purchase would be around 92 per cent.

Many wonder how these large-scale purchases of public bonds (debt) which has been used to raise euros to cover public deficits in the Member States is legal under the Treaties, which prohibit such action.

Remember that under Article 21 – Operations with public entities – of the Protocol on the Statute of the European System of Central Banks and of the European Central Bank – which is an annex of the Treaty establishing the European Community we know that:

In accordance with Article 101 of this Treaty, overdrafts or any other type of credit facility with the ECB or with the national central banks in favour of Community institutions or bodies, central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of Member States shall be prohibited, as shall the purchase directly from them by the ECB or national central banks of debt instruments.

Although, “national central banks may act as fiscal agents” for their relevant governments. More about this later.

So is the PSPP funding government deficits?

The ECB claims that it:

… strictly adheres to the prohibition on monetary financing by not buying in the primary market. The ECB will only buy bonds after a market price has formed. This ensures that the ECB does not distort the market pricing of risk.

So it waits a few days after the primary issue by the government in question while the private bond markets sort out the price (risk assessment) and then it buy the debt.

Smoke and mirrors really!

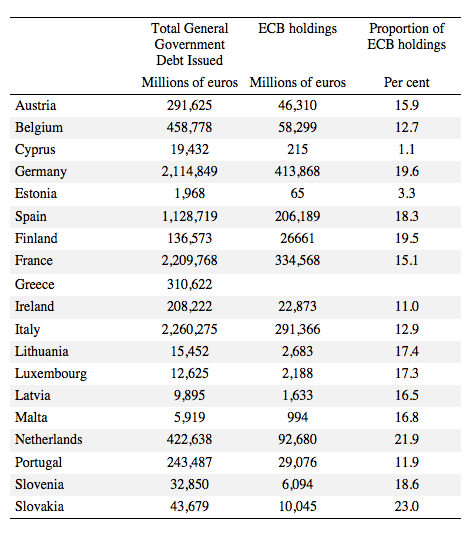

The data shows that as at the end of 2016, the ECB held public debt for all Member States except greece under the program. The following table shows the holdings as a proportion in terms of total general government debt.

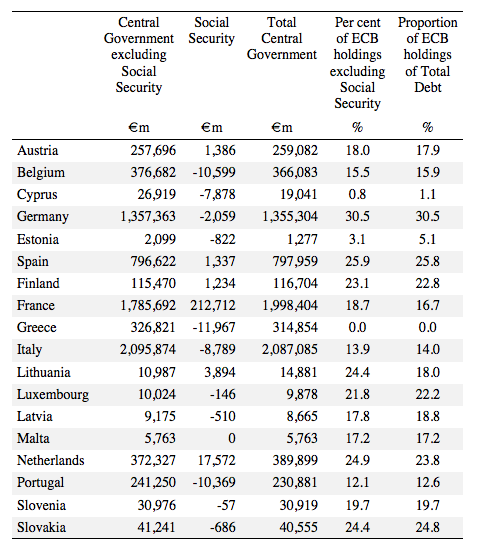

The next table shows the holdings of central government debt (excluding and including social security)

As you can see, the ECB now holds around 30.5 per cent of the central government debt in Germany, 25.8 per cent of Spain’s central government debt, 14 per cent of Italy’s central government debt and so on.

Which brings us to the Bloomberg article.

The essence is that if you extrapolate out the current ECB asset buying program (proportional to the capital key) then the ECB reaches a situation where “Germany could hit this mark as early as spring if the current pace of purchases is maintained”.

But as the Bloomberg article says:

Yet some rules of the program are more malleable, giving the ECB potential leeway.

As we have seen above the ECB has clearly deviated from matching proportional purchases with the capital key proportions.

The Bloomberg article claims that:

… the ECB could deviate from the capital key by a total of 5 billion euros a month, twice the amount they do now. That could ease the strain for some countries, but would still require the program to be wound down by the end of next year …

But by the end of next year, the ECB would be facing the 33 percent limit not in one, but in four countries: Germany, France, Italy and Spain.

Which means it will have to “scale back the purchases next year” until they are terminated entirely.

And then how will the ECB fund the outstanding fiscal deficits and keep the Eurozone afloat?

Well then they will have to seek to relax the Treaty and do what central banks should do. Dispense with the smoke and mirrors and work with treasuries to ensure there is sufficient public spending in the economies it issues currency for.

I have written about Overt Monetary Financing before (among other blogs):

1. OMF – paranoia for many but a solution for all.

2. Helicopter money is a fiscal operation and is not inherently inflationary.

3. Overt Monetary Financing would flush out the ideological disdain for fiscal policy.

4. The Bank of Japan needs to introduce Overt Monetary Financing next.

5. Overt Monetary Financing – again.

6. There is no need to issue public debt.

The mainstream claim that OMF is just printing money and will be inflationary.

The idea of OMF is very simple and does not actually involve any printing presses at all. While the exact institutional detail can vary from nation to nation, governments typically spend by drawing on a bank account they have with the central bank.

An instruction is sent to the central bank from the treasury to transfer some funds out of this account into an account in the private sector, which is held by the recipient of the spending.

A similar operation might occur when a government cheque is posted to a private citizen who then deposits the cheque with their bank. That bank seeks the funds from the central bank, which writes down the government’s account, and the private bank writes up the private citizen’s account.

All these transactions are done electronically through computer systems. So government spending can really be simplified down to typing in numbers to various accounts in the banking system.

When economists talk of ‘printing money’ they are referring to the process whereby the central bank adds some numbers to the treasury’s bank account to match its spending plans and in return is given treasury bonds to an equivalent value. That is where the term ‘debt monetisation’ comes from.

Instead of selling debt to the private sector, the treasury simply sells it to the central bank, which then creates new funds in return.

This accounting smokescreen is, of course, unnecessary. The central bank doesn’t need the offsetting asset (government debt) given that it creates the currency ‘out of thin air’. So the swapping of public debt for account credits is just an accounting convention.

The point to note is that the inflation risk lies in the spending not the monetary operations (debt-issuance etc) that might or might not accompany the spending.

All spending (private or public) is inflationary if it drives nominal aggregate demand faster than the real capacity of the economy to absorb it.

Increased government spending is not inflationary if there are idle real resources that can be brought back into productive use (for example, unemployment).

Related propositions include the claims that OMF would devalue the currency whereas issuing bonds to the private sector reduces the inflation risk of deficits. Neither claim is true.

First, there is no difference in the inflation risk attached to a particular level of net public spending when the government matches its deficit with bond issuance relative to a situation where it issues no debt, that is, invests directly.

Bond purchases reflect portfolio decisions regarding how private wealth is held. If the funds that we used for bond purchases were spent on goods and services as an alternative, then the budget deficit would be lower as a result.

Second, the provision of credit by the central bank (in return for treasury bonds) will only be inflationary if there is no fiscal space.

Fiscal space is not defined in terms of some given financial ratios (such as a public debt ratio).

Rather, it refers to the extent of the available real resources that the government is able to utilise in pursuit of its socio-economic program.

Further, hyperinflation examples such as 1920s Germany and modern-day Zimbabwe do not support the claim that deficits cause inflation. In both cases, there were major reductions in the supply capacity of the economy prior to the inflation episode.

Please read my blog – Zimbabwe for hyperventilators 101 – for more discussion on this point.

Conclusion

The ECB has elaborate rules that present a chimera of responsibility and assurance. They are consistently violated because the rules get in the road of essential policy interventions to keep the system afloat.

While QE has been a smokescreen and really amounts in the Eurozone case to the ECB funding government spending through the backdoor, the fact is that it has kept the Eurozone from collapsing.

To panic that the ECB is running out of debt to purchase just goes to show how ridiculous this straitjacketed system is.

The straitjacket only biased the system to stagnant outcomes and dramatically limits its ability to deal with economic crises.

Eventually, the Member States will have to see sense and change the whole nonsensical system.

Reclaiming the State Lecture Tour – September-October, 2017

For up to date details of my upcoming book promotion and lecture tour in Late September and early October through Europe go to – The Reclaim the State Project homePage.

There are updated details today concerning the Madrid events.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

In 2015, when I was still learning about MMT -and I still am-, I wrote this post about the European Court of Justice’s Advocate General Cruz Villalón’s report.

http://chartalismo.blogspot.com.es/2015/02/la-opinion-del-abogado-general-cruz.html

(sorry, in Spanish, but Google has a more or less effective translation tool)

Your post just reminded me of mine. Reading what I worte then again it seems like time has frozen and not much has changed in Europe since then. Groupthink prevails.

One point that I found very amussing was that the appeal from the German Court in Karlsruhe found that the Outright Monetary Transactions could determine price formation of the securites that were being bought by the ECB. In their interpretation that was tantamount to providing finance to the states through the back door. ¡Of course!. Cruz Villalón tried to argue that the ECB, within the scope of their monetary management responsibilities, was merely trying to determine the yields of those securities because market determined yields were blocking the transmission mechanisms of their monetary policy -what an example of sophistry!-. But, in a gesture to the Germans, Cruz Villalón argued that the ECB had to allow prices to form in the market by waiting, say a few hours, after the securities were issued in the primary market before buying them up. An exercise in simulation if there ever was one!

Bill,

ECB also purchasing corporate bonds as part of QE some major companies obtaining negative rates again breaching subsidy rules?

Our MMT friends in America talk about the interest income channels.

QE swapped billions worth of interest income out of the U.S. economy and replaced that with reserves. Sucking billions of $’s out of the economy.

Reducing the balance sheet will do the exact opposite.

That increasing interest rates do not fight inflation but actually fuel it. As interest rate increases are price increases right across the economy as the costs get passed on. There are always more savers than borrowers and again more $’s created via the interest income channels.

The $ has fell and has continued to fall since the FED started hiking rates. Above is the reason.

Inflation would also be increasing if bank lending had not fell off a cliff in the US.

Of course the markets and the mainstream have this upside down and back to front.

Fabulous blog. Outstanding and exceptional. Best economics blog I know – wonder how you get along with your time ;-).

Regards from Freiburg, Germany

Bill,

The details on the graph below it, are the reverse of those in this paragraph?

“..We can see that in the case of France (19.3 per cent of total purchases, 14.2 per cent capital key), Germany (23.8 per cent of total purchases, 17.9 per cent capital key), Italy (16.8 per cent of total purchases, 12.3 per cent capital key), and Spain (11.9 per cent of total purchases, 8.8 per cent capital key), the relevant NCBs have been buying significantly more than indicated by the contribution to the ECB capital… “

Dear Mike Hall (at 2017/09/07 at 10:15 pm)

I have fixed the graph. You need to refresh the cache. The blue bars are purchases, the red triangles are the capital key proportions.

best wishes

bill

Arrgh, sorry, my old eyes, I’ve misread it on checking again, please ignore 🙁

Ah, wow , fast Bill, I thought I was going nuts, sorry!

Most Interesting Article. I keep being told the UK should stay in Europe but it looks like the EU is in bad shape and we are better out of it and will become a completely sovereign country again. The EU seems to have trapped small countries which have now lost their sovereignty and power to control their own destiny.

This gives me hope that Brexit may not be that bad.

Ron

I think the tarot comparison is a bit unfair as even a drunk gypsy would have a better record of predicting the economy than mainstream economics does these days.

Willem:

The other thing to keep in mind about tarot readers is, in reality, a good fortune-teller is someone who’s very perceptive to social nuance. Which is certainly not a skill of the average economist.

“These economists (from investment banks)”

That reminded me of this Joris Luyendjik article from 2012 about Oxbridge economics students and investment banks.

http://news.efinancialcareers.com/uk-en/96580/two-economics-professors-say-how-investment-banks-lure-their-students-what-banks-want-and-why-students-should-avoid-them/

@WILLEM

think your much too kind willem.

thank god these characters don’t build bridges. they wouldn’t meet in the middle , and be built upside down in all likely hood.

Bill, what’s going to happen when the ECB has to cut back on the QE? This is inevitably going to lead to the collapse of places like Portugal or Greece.

Great blog

Smoke and mirrors indeed.what a joke.leaving out greece is gross.

@stuartmedina

Yes ofcourse ecb purchasing is price support

Odd how euro/euphiles sjow such a scant diaregard for

European solidarity whrn it comes to greeks pensioners.

The world media has also completely abandoned the humanitarian ctidis for the most vulnerable in greece.

Maybe on the phone I’m not seeing it correctly, but the diamond for Spain should also be contained within its blue bar (actual purchases above key rate?)

@puzzling question: given the ECB has been buying proportionally too much from the biggest issuers (for liquidity reasons maybe), I wouldn’t be preoccupied if it matched actual purchases for the smaller issuers, maybe motivating more borrowing from these nations (as they are interest rate sensitive). Pro-cyclical, but not that bad considering amount of idle capacity.

Another point Bill has made is that QE merely substitutes interest-bearing securities with reserves in your bank/broker account. Did nothing to stimulate the economy per se (the opposite actually), other than reassuring financial markets. That’s been my understanding at least