Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – September 16-17, 2017 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

In the past week, we observed, Monday, September 11, 1973 – the day when right-wing forces, aided by the US government, overthrew the elected government of Chile. It was a terrorist act and we should not forget that.

Question 1:

When a sovereign government issues debt to match its fiscal deficit, the debt adds to the financial wealth of the non-government sector.

The answer is False.

The fundamental principles that arise in a fiat monetary system are as follows.

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending is independent of borrowing and the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Fiscal deficits that are not accompanied by corresponding monetary operations (debt-issuance) put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about ‘crowding out’.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is a “monetary policy” operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

National governments have cash operating accounts with their central bank. The specific arrangements vary by country but the principle remains the same. When the government spends it debits these accounts and credits various bank accounts within the commercial banking system. Deposits thus show up in a number of commercial banks as a reflection of the spending. It may issue a cheque and post it to someone in the private sector whereupon that person will deposit the cheque at their bank. It is the same effect as if it had have all been done electronically.

All federal spending happens like this. You will note that:

- Governments do not spend by “printing money”. They spend by creating deposits in the private banking system. Clearly, some currency is in circulation which is “printed” but that is a separate process from the daily spending and taxing flows.

- There has been no mention of where they get the credits and debits come from! The short answer is that the spending comes from no-where. Suffice to say that the Federal government, as the monopoly issuer of its own currency is not revenue-constrained. This means it does not have to “finance” its spending unlike a household, which uses the fiat currency.

- Any coincident issuing of government debt (bonds) has nothing to do with “financing” the government spending.

From a monetary operation perspective, the central bank conducts “operations” to manage the liquidity in the banking system such that short-term interest rates match the official target – which defines the current monetary policy stance.

The central bank may: (a) Intervene into the interbank (overnight) money market to manage the daily supply of and demand for reserve funds; (b) buy certain financial assets at discounted rates from commercial banks; and (c) impose penal lending rates on banks who require urgent funds, In practice, most of the liquidity management is achieved through (a).

That being said, central bank operations function to offset operating factors in the system by altering the composition of reserves, cash, and securities, and do not alter net financial assets of the non-government sectors.

Fiscal policy impacts on bank reserves – government spending (G) adds to reserves and taxes (T) drains them. So on any particular day, if G > T (a fiscal deficit) then reserves are rising overall. Any particular bank might be short of reserves but overall the sum of the bank reserves are in excess.

It is in the commercial banks interests to try to eliminate any unneeded reserves each night given they usually earn a non-competitive return.

Surplus banks will try to loan their excess reserves on the Interbank market. Some deficit banks will clearly be interested in these loans to shore up their position and avoid going to the discount window that the central bank offeres and which is more expensive.

The upshot, however, is that the competition between the surplus banks to shed their excess reserves drives the short-term interest rate down. These transactions net to zero (a equal liability and asset are created each time) and so non-government banking system cannot by itself (conducting horizontal transactions between commercial banks – that is, borrowing and lending on the interbank market) eliminate a system-wide excess of reserves that the fiscal deficit created.

What is needed is a vertical transaction – that is, an interaction between the government and non-government sector. So bond sales can drain reserves by offering the banks an attractive interest-bearing security (government debt) which it can purchase to eliminate its excess reserves.

However, the vertical transaction just offers portfolio choice for the non-government sector rather than changing the holding of financial assets.

Even when the government issues debt in the primary market to match its deficit spending the debt is not an net addition to non-government wealth. It is just, in the first instance, a different way of storing the wealth.

Thus the fact that the government issues debt does not of itself increase the wealth of the non-government sector.

The deficit spending increases net financial wealth, whereas the accompanying monetary operation is just an asset swap.

Question 2:

Ignoring any reserve requirements that might be imposed, if the central bank pays a positive interest rate on overnight reserves held by the commercial banks then it may still have to conduct open market operations as a means of ensuring that levels of bank reserves are consistent with its policy target rate of interest.

The answer is True.

The first thing to understand is the way in which monetary policy is implemented in a modern monetary economy. You will see that this is contrary to the account of monetary policy in mainstream macroeconomics textbooks, which tries to tell students that monetary policy describes the processes by which the central bank determines “the total amount of money in existence or to alter that amount”.

In Mankiw’s Principles of Economics (Chapter 27 First Edition) he say that the central bank has “two related jobs”. The first is to “regulate the banks and ensure the health of the financial system” and the second “and more important job”:

… is to control the quantity of money that is made available to the economy, called the money supply. Decisions by policymakers concerning the money supply constitute monetary policy (emphasis in original).

How does the mainstream see the central bank accomplishing this task? Mankiw says:

Fed’s primary tool is open-market operations – the purchase and sale of U.S government bonds … If the FOMC decides to increase the money supply, the Fed creates dollars and uses them buy government bonds from the public in the nation’s bond markets. After the purchase, these dollars are in the hands of the public. Thus an open market purchase of bonds by the Fed increases the money supply. Conversely, if the FOMC decides to decrease the money supply, the Fed sells government bonds from its portfolio to the public in the nation’s bond markets. After the sale, the dollars it receives for the bonds are out of the hands of the public. Thus an open market sale of bonds by the Fed decreases the money supply.

This description of the way the central bank interacts with the banking system and the wider economy is totally false. The reality is that monetary policy is focused on determining the value of a short-term interest rate. Central banks cannot control the money supply. To some extent these ideas were a residual of the commodity money systems where the central bank could clearly control the stock of gold, for example. But in a credit money system, this ability to control the stock of “money” is undermined by the demand for credit.

The theory of endogenous money is central to the horizontal analysis in Modern Monetary Theory (MMT). When we talk about endogenous money we are referring to the outcomes that are arrived at after market participants respond to their own market prospects and central bank policy settings and make decisions about the liquid assets they will hold (deposits) and new liquid assets they will seek (loans).

The essential idea is that the “money supply” in an “entrepreneurial economy” is demand-determined – as the demand for credit expands so does the money supply. As credit is repaid the money supply shrinks. These flows are going on all the time and the stock measure we choose to call the money supply, say M3 (Currency plus bank current deposits of the private non-bank sector plus all other bank deposits from the private non-bank sector) is just an arbitrary reflection of the credit circuit.

So the supply of money is determined endogenously by the level of GDP, which means it is a dynamic (rather than a static) concept.

Central banks clearly do not determine the volume of deposits held each day. These arise from decisions by commercial banks to make loans. The central bank can determine the price of “money” by setting the interest rate on bank reserves. Further expanding the monetary base (bank reserves) as we have argued in recent blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – does not lead to an expansion of credit.

With this background in mind, the question is specifically about the dynamics of bank reserves which are used to satisfy any imposed reserve requirements and facilitate the payments system. These dynamics have a direct bearing on monetary policy settings. Given that the dynamics of the reserves can undermine the desired monetary policy stance (as summarised by the policy interest rate setting), the central banks have to engage in liquidity management operations.

What are these liquidity management operations?

Well you first need to appreciate what reserve balances are.

The New York Federal Reserve Bank’s paper – Divorcing Money from Monetary Policy said that:

… reserve balances are used to make interbank payments; thus, they serve as the final form of settlement for a vast array of transactions. The quantity of reserves needed for payment purposes typically far exceeds the quantity consistent with the central bank’s desired interest rate. As a result, central banks must perform a balancing act, drastically increasing the supply of reserves during the day for payment purposes through the provision of daylight reserves (also called daylight credit) and then shrinking the supply back at the end of the day to be consistent with the desired market interest rate.

So the central bank must ensure that all private cheques (that are funded) clear and other interbank transactions occur smoothly as part of its role of maintaining financial stability. But, equally, it must also maintain the bank reserves in aggregate at a level that is consistent with its target policy setting given the relationship between the two.

So operating factors link the level of reserves to the monetary policy setting under certain circumstances. These circumstances require that the return on “excess” reserves held by the banks is below the monetary policy target rate. In addition to setting a lending rate (discount rate), the central bank also sets a support rate which is paid on commercial bank reserves held by the central bank.

Many countries (such as Australia and Canada) maintain a default return on surplus reserve accounts (for example, the Reserve Bank of Australia pays a default return equal to 25 basis points less than the overnight rate on surplus Exchange Settlement accounts). Other countries like the US and Japan have historically offered a zero return on reserves which means persistent excess liquidity would drive the short-term interest rate to zero.

The support rate effectively becomes the interest-rate floor for the economy. If the short-run or operational target interest rate, which represents the current monetary policy stance, is set by the central bank between the discount and support rate. This effectively creates a corridor or a spread within which the short-term interest rates can fluctuate with liquidity variability. It is this spread that the central bank manages in its daily operations.

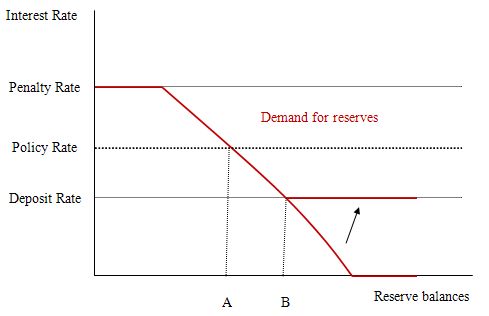

So the issue then becomes – at what level should the support rate be set? To answer that question, I reproduce a version of teh diagram from the FRBNY paper which outlined a simple model of the way in which reserves are manipulated by the central bank as part of its liquidity management operations designed to implement a specific monetary policy target (policy interest rate setting).

I describe the FRBNY model in detail in the blog – Understanding central bank operations so I won’t repeat that explanation.

The penalty rate is the rate the central bank charges for loans to banks to cover shortages of reserves. If the interbank rate is at the penalty rate then the banks will be indifferent as to where they access reserves from so the demand curve is horizontal (shown in red).

Once the price of reserves falls below the penalty rate, banks will then demand reserves according to their requirments (the legal and the perceived). The higher the market rate of interest, the higher is the opportunity cost of holding reserves and hence the lower will be the demand. As rates fall, the opportunity costs fall and the demand for reserves increases. But in all cases, banks will only seek to hold (in aggregate) the levels consistent with their requirements.

At low interest rates (say zero) banks will hold the legally-required reserves plus a buffer that ensures there is no risk of falling short during the operation of the payments system.

Commercial banks choose to hold reserves to ensure they can meet all their obligations with respect to the clearing house (payments) system. Because there is considerable uncertainty (for example, late-day payment flows after the interbank market has closed), a bank may find itself short of reserves. Depending on the circumstances, it may choose to keep a buffer stock of reserves just to meet these contingencies.

So central bank reserves are intrinsic to the payments system where a mass of interbank claims are resolved by manipulating the reserve balances that the banks hold at the central bank. This process has some expectational regularity on a day-to-day basis but stochastic (uncertain) demands for payments also occur which means that banks will hold surplus reserves to avoid paying any penalty arising from having reserve deficiencies at the end of the day (or accounting period).

To understand what is going on not that the diagram is representing the system-wide demand for bank reserves where the horizontal axis measures the total quantity of reserve balances held by banks while the vertical axis measures the market interest rate for overnight loans of these balances

In this diagram there are no required reserves (to simplify matters). We also initially, abstract from the deposit rate for the time being to understand what role it plays if we introduce it.

Without the deposit rate, the central bank has to ensure that it supplies enough reserves to meet demand while still maintaining its policy rate (the monetary policy setting.

So the model can demonstrate that the market rate of interest will be determined by the central bank supply of reserves. So the level of reserves supplied by the central bank supply brings the market rate of interest into line with the policy target rate.

At the supply level shown as Point A, the central bank can hit its monetary policy target rate of interest given the banks’ demand for aggregate reserves. So the central bank announces its target rate then undertakes monetary operations (liquidity management operations) to set the supply of reserves to this target level.

So contrary to what Mankiw’s textbook tells students the reality is that monetary policy is about changing the supply of reserves in such a way that the market rate is equal to the policy rate.

The central bank uses open market operations to manipulate the reserve level and so must be buying and selling government debt to add or drain reserves from the banking system in line with its policy target.

If there are excess reserves in the system and the central bank didn’t intervene then the market rate would drop towards zero and the central bank would lose control over its target rate (that is, monetary policy would be compromised).

As explained in the blog – Understanding central bank operations – the introduction of a support rate payment (deposit rate) whereby the central bank pays the member banks a return on reserves held overnight changes things considerably.

It clearly can – under certain circumstances – eliminate the need for any open-market operations to manage the volume of bank reserves.

In terms of the diagram, the major impact of the deposit rate is to lift the rate at which the demand curve becomes horizontal (as depicted by the new horizontal red segment moving up via the arrow).

This policy change allows the banks to earn overnight interest on their excess reserve holdings and becomes the minimum market interest rate and defines the lower bound of the corridor within which the market rate can fluctuate without central bank intervention.

So in this diagram, the market interest rate is still set by the supply of reserves (given the demand for reserves) and so the central bank still has to manage reserves appropriately to ensure it can hit its policy target.

If there are excess reserves in the system in this case, and the central bank didn’t intervene, then the market rate will drop to the support rate (at Point B).

So if the central bank wants to maintain control over its target rate it can either set a support rate below the desired policy rate (as in Australia) and then use open market operations to ensure the reserve supply is consistent with Point A or set the support (deposit) rate equal to the target policy rate.

The answer to the question is thus True because it all depends on where the support rate is set. Only if it set equal to the policy rate will there be no need for the central bank to manage liquidity via open market operations.

The following blogs may be of further interest to you:

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

Question 3:

If participation rates are constant, percentage unemployment will not change as long as employment growth matches the pace of growth in the working age population (people above 15 years of age).

The answer is True.

The Civilian Population is shorthand for the working age population and can be defined as all people between 15 and 65 years of age or persons above 15 years of age, depending on rules governing retirement. The working age population is then decomposed within the Labour Force Framework (used to collect and disseminate labour force data) into two categories: (a) the Labour Force; and (b) Not in the Labour Force. This demarcation is based on activity principles (willingness, availability and seeking work or being in work).

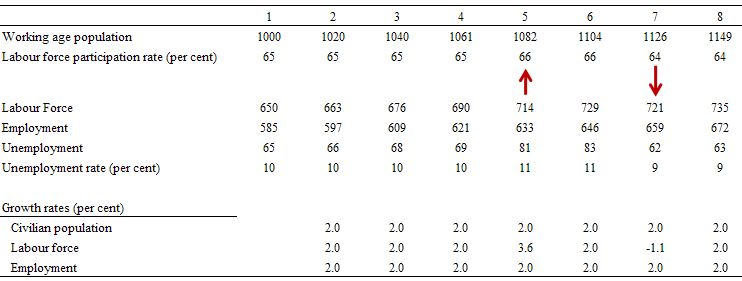

The participation rate is defined as the proportion of the working age population that is in the labour force. So if the working age population was 1000 and the participation rate was 65 per cent, then the labour force would be 650 persons. So the labour force can vary for two reasons: (a) growth in the working age population – demographic trends; and (b) changes in the participation rate.

The labour force is decomposed into employment and unemployment. To be employed you typically only have to work one hour in the survey week. To be unemployed you have to affirm that you are available, willing and seeking employment if you are not working one hour or more in the survey week. Otherwise, you will be classified as not being in the labour force.

So the hidden unemployed are those who give up looking for work (they become discouraged) yet are willing and available to work. They are classified by the statistician as being not in the labour force. But if they were offered a job today they would immediately accept it and so are in no functional way different from the unemployed.

When economic growth wanes, participation rates typically fall as the hidden unemployed exit the labour force. This cyclical phenomenon acts to reduce the official unemployment rate.

So clearly, the working age population is a much larger aggregate than the labour force and, in turn, employment. Clearly if the participation rate is constant then the labour force will grow at the same rate as the civilian population. And if employment grows at that rate too then while the gap between the labour force and employment will increase in absolute terms (which means that unemployment will be rising), that gap in percentage terms will be constant (that is the unemployment rate will be constant).

The following Table simulates a simple labour market for 8 periods. You can see for the first 4 periods, that unemployment rises steadily over time but the unemployment rate is constant. During this time span employment growth is equal to the growth in the underlying working age population and the participation rate doesn’t change. So the unemployment rate will be constant although more people will be unemployed.

In Period 5, the participation rate rises so that even though there is constant growth (2 per cent) in the working age population, the labour force growth rate rises to 3.6 per cent. Now unemployment jumps disproportionately because employment growth (2 per cent) is not keeping pace with the growth in new entrants to the labour force and as a consequence the unemployent rate rises to 11 per cent.

In Period 6, employment growth equals labour force growth (because the participation rate settles at the new level – 66 per cent) and the unemployment rate is constant.

In Period 7, the participation rate plunges to 64 per cent and the labour force contracts (as the higher proportion of the working age population are inactive – that is, not participating). As a consequence, unemployment falls dramatically as does the unemployment rate. But this is hardly a cause for celebration – the unemployed are now hidden by the statistician “outside the labour force”.

Understanding these aggregates is very important because as we often see when Labour Force data is released by national statisticians the public debate becomes distorted by the incorrect way in which employment growth is represented in the media.

In situations where employment growth keeps pace with the underlying population but the participation rate falls then the unemployment rate will also fall. By focusing on the link between the positive employment growth and the declining unemployment there is a tendency for the uninformed reader to conclude that the economy is in good shape. The reality, of-course, is very different.

The following blog may be of further interest to you:

Reclaiming the State Lecture Tour – September-October, 2017

For up to date details of my upcoming book promotion and lecture tour in Late September and early October through Europe go to – The Reclaim the State Project homePage.

You can also find details on that site of how to purchase a copy of the book (paperback version) at discounted prices, well below the current market price from the booksellers.

The discounted price I can make the book available (while my stock lasts) is plus postage.

My stocks are limited.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Dear Bill,

You make clear that debt issuance is an asset swap (which I understand) and that the REAL net asset is the spending (although reserves remain constant in aggregate). However, if i remember correctly, according to stock-flow consistent accounting, the Bonds are a STOCK and the spending is a FLOW and I was under the impression that only STOCKS create net assets and flows do not-how does this bear upon the issue of what is really the net asset overall, the bonds themselves or the spending? Your question makes clear that the spending is the net asset.

Some years ago you quoted Kalecki who described an ‘imaginary process’ in order to understand the way bonds function:

‘In any period of time the total increase in government securities in the possession (transitory or final) of persons and firms will be equal to the goods and services sold to the government. Thus what the economy lends to the government are goods and services whose production is ‘financed’ by government securities.’

This passage seems to give the impression that it is the Bonds that are the net asset.

I’m aware that I’m not grasping something fundamental here, so any help in clarifying this would be much appreciated ( help welcomed from anyone else if Bill doesn’t have the time).

Simon, this one is above my pay grade but I will try according to my understanding. First off- nobody is really ‘lending’ to the fiat currency issuer – that which creates the currency does not need to borrow that currency. Goods and services from the economy (people) are purchased by the government, not ‘lent’ to it. Or just commandeered in less fortunate cases.

The stock and the flow thing I have trouble with also. It seems to me that it is the spending by the currency issuer that creates the financial asset in the first place. Spending over any time period is described as a STOCK as soon as you specify the period of time. MMT says bonds issued by the currency issuing government are an ‘asset swap’ for previously created financial assets, which seems to amount to previous spending of that government less what it took away in taxes. But then there are all kinds of financial assets that we in the private sector create ourselves- but those can be ignored for this question because they net to zero when accounted for.

Simon, it may be the word spending that confuses. For you and I, spending is only a flow (a transfer of existing stock) whereas for government, spending involves money creation – an increase in stock. At least in the short term. Jerry is right that after the government spending has happened what comes next is simply a flow, swapping bonds for currency does not increase the stock of financial wealth.

Hi Jerry,

Thanks for your response. I get what you say and this conforms with what I thought my understanding was. My issue is that the kalecki quote (which Bill has used in an old blog) seems to indicate it IS the bonds that are the net asset. I also don’t really get that bonds ARE money as I have been following Mosler’s desription of bonds as essentially savings accounts with the Treasury.

I’m just trying to reconcile the Kalecki quote with Bill’s wording and the other issue that I thought that Stocks (bonds) created net assets and not flows (the spending).

But I’m probably getting myself confused about something that is essentially simple that I can’t see, as yet 🙁

Dear Jerry Brown, Simon Cohen and others

Spending is always a flow ($ per unit of time – say a month). Government spending is a flow as is non-spending (total income minus spending = saving).

Non-spending (saving) flows into a store – a stock of wealth.

Wealth is always a stock (measured at a point in time). So the holdings of bonds is a stock and they reflect the saving stored in that particular form of financial asset.

best wishes

bill

Thank you Bill for correcting my mistake. Simon, obviously the stock- flow thing is difficult for me also and I apologize for getting it wrong in my answer to you. I will have to study this thing more. Maybe Bill will make more questions on the quiz about it- that always spurs me to find out why my answers are wrong- or at least why he claims they are wrong :).

Thanks for replies ( and particularly Bill for taking the time to help out with welcome clarification)

Don’t worry Jerry we’re ‘all in this together’ ( trying to help each other) and you made it clear you weren’t setting yourself up as an ‘authority.’ 🙂 . I quite like Charles’ definition of a ‘flow’ as a ‘transfer of stock’ ( whether that’s strictly correct I can’t say) It sounds like it is the stocks that form the net assets at the point of measurement between flows, so stock of currency/bonds/reserves form the ‘cumulative deficit.’

Bill’s diagram in his old blog ‘Deficit Spending 101 Part 3 I found helpful ( https://billmitchell.org/blog/?p=381) where he describes the ‘tin shed’ where the stocks are notionally stored.

For some reason, I find it hard to keep the whole picture in my head. I suspect that is because I get bogged down by sloppy language use and my own cognitive limits! I find I have to read and re- read many times MMT material in the hope that some sort of clarified mental image of the whole circuitry of the monetary system will gel at some point. Like many things, the basics are fundamentally simple but habits of language use get in the way.

My confusion was specifically around the Kalecki quote which ( although an alternative way of seeing the ‘spending’) conveyed the idea of the bonds as the net asset and the ‘real’ money creation (bonds being a future claim on reserves?).

Yes the spending is a flow, but it gives rise to a stock – that is the deposit it creates in the recipient’s bank account.