I have received several E-mails over the last few weeks that suggest that the economics…

The world is going insane I think

The world seems to be going more insane every time I check. I have this naive belief that we bother to elect governments because we understand they can do things (as a collective) that we cannot do very easily (as individuals). I also assume we all think our elected governments will broadly use their fiscal powers to pursue an agenda that will advance public purpose – that is, seek ways to improve our standard of living and ensure all citizens participate in the bounty that the economic system generates (including sharing the losses when it doesn’t so generate). Of-course, I know that our polities basically govern to keep themselves in power. But there is the occasional election. Anyway, recent events suggest that governments seem to be able to construct popularity by taking actions that do us harm.

I seem to be quoting former US Presidents lately. Yesterday it was LBJ, this time it is Thomas Jefferson, who apparently said that “All tyranny needs to gain a foothold is for people of good conscience to remain silent”. I would actually be interested in knowing the context in which he said this by the way. I couldn’t find the source but have always remembered the quote. By the way, this is no “freedom call” to all you liberty tea party types.

Rather I see it as saying – along the lines of my blog yesterday – The revolving door – how social policy is co-opted – that if we fall prey to the government rhetoric which reflects the dominant voices of capital and its bought media and become compliant, then elections notwithstanding, the ruling ideologies will penetrate government thinking and we will get damaged.

Here are some recent acts of madness.

Brazil gone mad

In January of this year, Brazil’s Finance Ministry announced that the Brazilian National Treasury was planning to issue 10-year government bonds … denominated in US dollars. The reason given for issuing foreign debt denominated in a foreign currency was “to collect international funds for extension of the debt”

Yesterday, the Brazilian Treasury head announced that it would sell more US dollar bonds to global credit markets. The Treasury boss, Arno Augustin told Bloomberg Television that:

We will certainly issue foreign bonds more than once in the second half, seeking to lengthen the debt’s profile and create conditions – for companies to sell bonds … There is investor demand for bonds maturing in 30 years

Ostensibly, the reason is that international investors are demanding higher yields and the “The yield to the 2015 call date on the country’s 11 percent bond due in 2040, one of the most widely traded emerging-market securities, has tumbled 1.80 percentage points to 5.02 percent since March 2”. To make the bonds attractive, the Brazilian Treasury priced their May issue to “yield 2.52 percentage points over U.S. Treasuries”. So a handout to international investors.

So why would the Brazilian Government, which oversees one of the larger economies in the World (about 10th in purchasing power parity terms) with about 24 per cent living below the poverty line and enduring very high labour underutilisation rates, want to expose its people to public debt insolvency?

Foreign debt issued in foreign-currency is very problematic. If this debt is issued by private firms (or households), then they must earn foreign currency (or borrow it) to service debt. To meet these needs they can export, attract FDI, and/or engage in short-term borrowing. If none of these is sufficient, default becomes necessary. There is always a risk of default by private entities, and this is a “market-based” resolution of the problem.

If however the government has issued (or taken over) foreign currency denominated debt, default becomes more difficult because there is no well delineated international method. Often, the government is forced to go to international lenders to obtain foreign reserves; the result can be a vicious cycle of indebtedness and borrowing. Since international lenders request austerity, domestic policy becomes hostage. For this reason, it is almost always poor strategy for government to become indebted in foreign currency, which really does expose it to entail solvency risk.

By contrast, a sovereign government can never face insolvency in its own currency. As we have argued, budget deficits in a sovereign, floating, currency never entail solvency risk. By contrast, a sovereign government can never face insolvency in its own currency. Sovereign government can always affordwhatever is for sale in terms of its own currency. It is never subject to market discipline. A sovereign government spends by crediting bank accounts, and it can never run out of such credits.

When it credits the bank account of any recipient of its spending (whether this is for purchases of goods and services or for social welfare spending), the central bank simultaneously credits the bank’s reserve account. If this leads to excess reserves, these are then exchanged for treasury debt. While the IMF and other observers criticise sales of treasury debt to the central bank, it actually makes no difference whether treasury sells the debt to private banks. In effect, the sales directly to the central bank simply bypass the bank middlemen.

So it makes no sense at all for the Brazilian government to be doing this. It will further transfer wealth up the ladder.

US gone mad

A bit further north, the US Government is showing signs of insanity. A report from Bloomberg overnight tells us that the The US Government has:

… voted to toughen its often-ignored budget rules that require lawmakers to offset new spending initiatives and tax cuts with savings to avoid adding to the federal deficit.

The chamber voted 265-166 for legislation that would put Congress’s so-called paygo rules into law and impose automatic budget cuts when lawmakers spend too much. Currently, lawmakers can vote to waive those rules.

So, surely the President will veto this nonsense you are thinking! Wrong. He supports it. This statement by Obama was issued by the White House yesterday:

With this vote, the House of Representatives demonstrated strong support for fiscal discipline. I appreciate the House’s quick response to my call for pay-as-you-go (PAYGO) legislation, a central budget-reform priority.

Let me be clear: all new mandatory initiatives and all new tax cuts must be paid for. It is time to stop the practice of passing today’s costs onto future generations. PAYGO was a driving principle behind the move from deficit to surplus in the 1990s, and must be so again today.

For several years, the federal government was stalled in a pattern of fiscal irresponsibility. No more. We are making tough decisions on funding priorities. We are tackling the biggest threats to our long-term fiscal stability. And we are restoring greater discipline to how we spend taxpayers’ dollars.

I thank Speaker Pelosi and Leader Hoyer, Chairman Spratt and Chairman Miller, Representatives Hill, Cooper, Boyd, and Welch, the Blue Dog coalition, and all of the 167 cosponsors of the PAYGO legislation. We will continue to work together to strengthen fiscal discipline. I urge the Senate to approve PAYGO so I can sign this bill into law this year.”

One starts to appreciate the new term that has entered the lexicon – Obamanation.

And the Speaker from San Francisco (the wealthy one) – Nancy Pelosi had this to say:

… As a grandmother with many grandchildren for a long period of time, I know that we have a moral responsibility not to heap mountains of debt onto our grandchildren … the PAYGO formula was what took us out of the debt of the Reagan-Bush years, and into a trajectory of surplus into the future. The last four Clinton budgets were in surplus … If the idea is that you want to persuade the nation that cutting taxes is a way to grow our economy – those tax cuts must be paid for. If we want to say that we want to increase entitlement spending, we must pay for that. And if we do not, there are consequences.

And more ad nauseum. While the paygo doesn’t apply to all areas of US government spending, the plan would require the government to “offset the cost of renewing former President George W. Bush’s tax cuts for people earning less than $250,000 annually when they expire next year.

I wonder if Nancy can find anyone who has had to give anything real back to the government from past deficit periods. Imagine if the government decided to use its spending power to buy everyone who didn’t have a car a nice shiny new car from companies who were going broke because there was a recession and no one was buying cars. Imagine the government transferred funds equivalent to the car purchases to the companies’ bank accounts and ran a deficit as a consequence. Employment would rise in the car companies. People would get a nice shiny car delivered to their homes. Transport firms who delivered the cars would employ more unemployed drivers. And so on. Do you think that the Government would ever have to get the cars (the real things) back to “pay off the deficit”? It is such an absurd proposition that I am amazed this sort of discussion beguiles people.

I have never paid anything back in real terms for the deficits my grandparents enjoyed. In fact, they improved public schools etc and helped me get a University education (having started out in a housing commission slum in Melbourne). So the deficits expanded my real opportunities.

For all the greens who read my pages, I would never advocate buying everyone a car. Perhaps a bicycle!

Anyway, we are witnessing a period when the Germans are killing their economy with the introduction of constitutional fiscal rules banning deficits and the US is killing its economy with paygo. Every time the US Government has run a surplus, a major contraction in private income and employment has followed. Each time the US government runs a surplus, the US private sector is forced into debt. Go and have a look at the history to find out.

Please read my blog – Fiscal rules going mad – for further analysis. I also make some assessments at the end of this blog.

Bottom line: the only way deficits can work to underwrite high levels of employment is if they endogenously finance the desire of the non-government sector to net save. These sort of rules are never going to achieve that end and so the likelihood is that the US economy will squander billions of dollars of potential income and maintain higher levels of unemployment.

My continuing search for manic … out of control … printing presses

I have also been on a hunt for “out of control printing presses” in the US. Apparently the US government has gone crazy and is printing money like never before. I was prompted to worry about this when someone asked me to comment on this statement. I won’t link to the article because it was clearly written by a very troubled individual and we hope his Internet account is cancelled for lack of traffic!. But the rhetoric is representative of what goes for public commentary these days. Even some billy blog commentators lapse into this sort of hysteria it seems. So the aforementioned article claims:

Inflation is set begin in the United States where money supply seems to have spiraled out of control. Since the collapse of Lehman Brothers in September 2008, the Federal Reserve has been printing huge amounts of currency notes to fund its bailout packages and increase employment. At the same time, the United States has adjusted its interest rate to a historic low of almost zero percent.

Scary really. Well I did some checking.

It seems that the total volume of US coins minted went from $US14,440.65 million in calendar year 2007, to $US10141.58 million in 2008 and for the first six months of this year the volume stood at $US2263.18 million (Source).

The only spike in the mint data seems to the US Presidential $1 coin which has gone from $US7.56 million in 2007 to $US51.1 million in the first-half of 2009. The Obama effect! But hardly minting machines running wild.

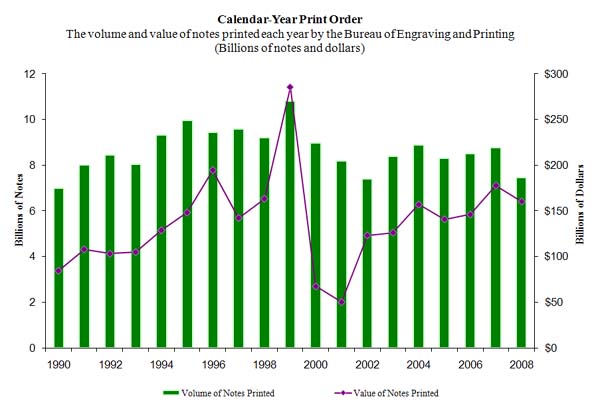

The following graph shows the recent history of US notes and comes from the Federal Reserve. Perhaps I am being tricked by the vertical scale on the graph and the note printing is going wild although the only thing I can see that about the graph that is interesting is the nice green colour of the bars!

You might also like to read this How currency gets into circulation which tells you the way US notes enter the banking system. Note there is nothing said about Treasury spending!

Here is a nice informative site from the Atlanta Fed about How coins are minted.

I am a bit disappointed actually that my search for the crazed printing presses is proving futile because I was hoping to renovate my study and use US dollar notes as wallpaper as those lucky Germans did in 1923 – see following photograph taken from the German Bundesarchiv (click to see larger photograph).

Conclusion: No wallpaper just yet … and … if you didn’t laugh you would cry about the degree of ignorance that is out there.

Other conclusion: Sovereign governments do not spend by printing money. They credit bank accounts independent of whatever else they do for other reasons – like gather tax revenue and sell public bonds.

Overall assessment

So with all the deficit-debt-printing-money hysteria we should just take stock for a moment to really understand what is going on. The debt-issuance is voluntary but even so does not present any particular issues as long as it is denominated in the domestic currency. Even the build up of private debt does not need to be a major issue (ignoring the obvious fraudulent extensions of credit) if the economy is generating enough employment and income.

There is not intrinsically wrong with debt as long as the capacity to pay remains intact. In the case of public debt, the sovereign government always has that capacity. There is never a question of financial insolvency – unless the debt is denominated in a foreign currency.

In the case of the private sector, all the talk about toxic debt misses an essential point. If people can service the debt then it is difficult to consider it toxic. Its toxicity rose as unemployment rose (and house prices crashed).

When the private sector desires to increase its net saving then unless the government sector increases its net spending $-for-$ (barring any extraordinary increases in net exports), the economy will quickly contract and then private debt stocks held, which were not a problem previously, become “toxic”.

The major contribution that the “deficit terrorists” will make in the period ahead will be to further entrench the socio-economic disadvantage that already exists and which has been exacerbated by the current downturn and the income losses that have ensued.

It is clear that firms are starting to enjoy some tepid revenue growth and the job losses are slowing. Further share markets are heading up (ASX200 is up around 20 per cent since March 2009) and we are starting to read about record earnings (for example, Goldman Sachs in recent days).

But juxtapose that against, the fact that credit card rates (consumer rates) have hardly moved and the private banks have refused to pass on the RBA cuts via lower mortgage rates. The impact of the federal credit guarantee to the big banks in Australia has been to drive the more competitive non-bank lenders out of the market and the market share of the big cartel has increased significantly. And there has been no corresponding quid-pro-quo imposed on the banks by the government. Similar trends are evident in other countries.

While households are now saving more their balance sheets remain heavily weighed down with debt and hence precarious given the slowdown in employment growth. Further, unemployment and underemployment has risen sharply – in Australia so far not as high or as quickly as previously thought – and in other nations the deterioration in the labour market has been catastrophic. More than 10 per cent of willing US workers are officially unemployed and that doesn’t include the higher proportions of persons who are incarcerated which adds some percent to the figure.

We are celebrating our March national accounts figures which essentially show that for the last 6 months GDP (the sum of the December and March quarters) was negative even though we didn’t record the dreaded “two negative quarters of GDP growth”. GDP will scuttle along the bottom for sometime yet and meanwhile new entrants are entering the labour force looking for work. At the end of this episode we will have a significant pool of long-term unemployed.

So when you assess what has happened you realise that so far the deficits have helped to restore the financial stability of the system and put a floor under the drop in the real economy. But there is so much excess capacity in the system and a significant pent up desire by households to save more to further insulate their balance sheets from likely insolvency.

So far the deficits are transferring real wealth to the rich. Significantly larger deficits are required to start restoring some of the real wealth to the bottom end of the distribution. That will only come through higher employment, more working hours, higher real wages and more substantial injections into public housing, transport, health and education.

The legacy of the deficit nazis will be to prevent these initiatives from happening. And most of us just remain silent while the government and its right-wing fanatical mates (including the Austrians) screw us all over.

Note I mentioned the Austrians. There is a growing attractiveness of this school of thought out there. Several people have asked me about it. I prefer not to spend any time thinking about them – they are so far off the planet that it is just wasted energy. But in the interests of public education or should I say public safety a blog on the Austrians will appear in due course.

My big conclusion is that I would rather think about the Tour de France than all of this. But then it finishes on Sunday and then I wouldn’t have anything to do!

The Austrian mention leads me to recall my favourite American joke. An American visitor during the Sydney 2000 Olympics apparently asked a local Sydney taxi driver whether he could drive him to Vienna for a spot of shopping! (Apologies to all my US readers but it is funny).

Thanks for writing this one. I read the news about Poland and half a dozen east european countries issuing debt in US dollars and was wondering who in his sane mind was advising these countries to do so and shoot themselves in their head. It is really unfortunate to see Brazil adopting this same practice. Also the joke about Vienna is really funny.

Hi Bill

You say…

“Each time the US government runs a surplus, the US private sector is forced into debt”

Didn’t the US administration run a budget deficit through most of george w’s time in office ? Didn’t this coincide with a period of huge expansion of private sector debt ?

Dear Tricky

The Clinton years of surpluses led to the early 2000s recession and was also the period that the private debt accelerated to unsustainable proportions. The Bush deficits were a reaction to that and saw US private saving slowly rise again. The problem was that the Bush deficits were not large enough early enough to sustain activity.

best wishes

bill