I have received several E-mails over the last few weeks that suggest that the economics…

Retail sales dive in Australia – neoliberal contradictions now obvious

This neoliberal era has a habit of getting ahead of itself and exposing its internal contradictions. In fact, the Capitalist system, as Marx, Keynes and others have demonstrated, it inherently inconsistent. The imposition of neoliberalism has only heightened those inconsistencies and made it more likely that we will move beyond this period in the foreseeable future (fingers crosssed). Last week, the Australian Bureau of Statistics released the latest Retail Sales data for August 2017. The data shows that Australia experienced its second consecutive negative month and the August contraction was the largest since 2012. The sharp decline in retail sales is no surprise. Wages growth is flat and in some sectors (retail and hospitality) employers are cutting weekend penalty rates. At the same time, household consumption has been maintained by record levels of household debt – exposing families to bankruptcy risk should interest rates rise. Further, energy companies are gouging prices to record huge profit spikes, which is exacerbating the real wage cuts. The decline in retail sales suggests that households are finally responding to this array of negative data. It doesn’t augur well at all. Corporate greed eventually undermines itself.

A pause for reflection

I have previously reported on the latest wage data for Australia – see Australia – real wages growth zero and the rip-off of workers continues.

It is a sorry tale.

The latest wages data for the June-quarter 2017 (released August 16, 2017) showed that for the sixth consecutive quarter, annual growth in wages recorded its lowest level since the data series began in the December-quarter 1997.

Nominal wages growth in Australia was just 1.9 per cent in annual terms and equal to the inflation rate of 1.9 per cent. So on the back of real wage cuts in the March-quarter, workers enjoyed zero real wages growth in the June-quarter 2017.

This is in the context of on-going productivity growth, which means that the profit share in national income rose again as real unit labour costs plunged.

In fact, the wage share in national income is now at the lowest levels ever recorded.

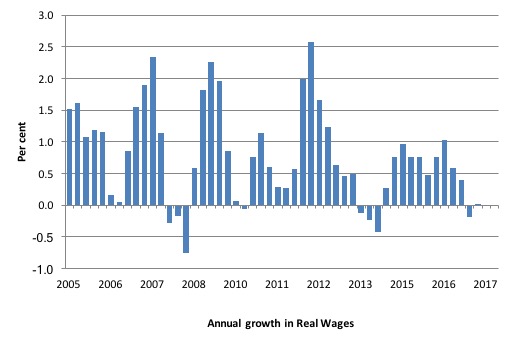

The following graph shows the annual growth in real wages since the June-quarter 2005 to the June-quarter 2017.

After a few quarters of hard real wage cutting in 2013-14, the private sector returned to positive real wages growth but at very subdued rates.

In the March-quarter 2017, real wages growth was negative (-0.2 per cent) and in the June-quarter there was zero real wages growth.

The rise in real wages in 2012 into 2013 was the result of the strong economic growth supported by the fiscal stimulus. The declining profile after that is associated with the end of the mining investment boom exacerbated by the obsessive fiscal restraint that was introduced (too early) and has led to the economy stalling.

The low wages growth raises several questions that are not unique to the Australian setting.

The smiling bosses who think the appalling wages growth is a testament to their hard-edged bargaining skills thought they were on a winner.

But, and here the contradiction of the system emerge, the low wages growth threatens to undermine household consumption expenditure, which is the largest component of aggregate spending.

Enter the banksters – who are nothing much more than credit sharks these days, protected by Australian government guarantees whenever their greed gets them too far ahead of themselves, although thought they were on a winner.

The idea of banks being prudential and modest institutions that work to safeguard the hard-earned savings vaporised long ago. They are cheapskate gambling institutions that grossly overpay their mealy-mouthed bosses and executives and push risk over the cliff because they know the neoliberal game is to privatise the gains and socialise the losses.

The sooner they are nationalised and restored to serving public well-being the better.

But the financial engineers from these institutions have seen the flat wages growth as further opportunity for pushing more credit onto the household sector.

Household consumption growth has until recently been maintained by ever-increasing levels of household debt.

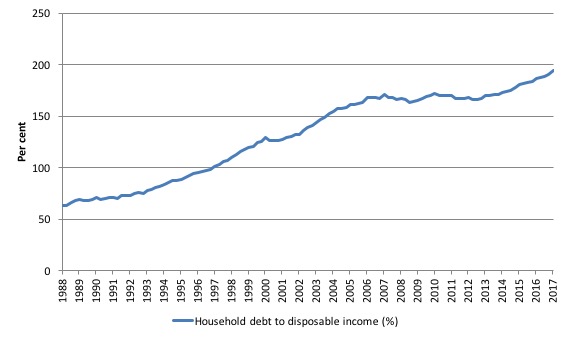

In fact, the latest RBA data – Household Finances – Selected Ratios – E2 – shows that the ratio of household debt to annualised household disposable income is now at record levels – each month a new record is established.

The following graph shows the ratio from 1988 (the beginning of the series) to the June-quarter 2017.

In June 1988, the ratio was 63.2 per cent. It peaked at 171 per cent in the June-quarter 2007, just before the GFC emerged.

It stabilised for a while as the fear of unemployment and the economic slowdown curbed credit growth for a while. But that didn’t last.

Over the last two years it has accelerated considerably and now stands at 193 per cent.

The position of Australian households, carrying record levels of debt, is made more precarious by the low wages growth. Please read my blog – Australia’s household debt problem is not new – it is a neo-liberal product – for more discussion on this point.

If the Australian government continues to pursue its stated austerity plans then the situation will worsen.

But the household sector are also showing signs that this unsustainable mix of trends is coming to a head.

The employers have also thought they were on a winner bullying the wage setting tribunal (Fair Work Australia) into cutting penalty rates for weekend work from July 1, 2017.

So workers in the retail and hospitality sectors – among the lowest paid in Australia and reliant on the penalty weekend rates to stay above the poverty line in many cases – have now been forced to endure lower pay packets.

Want some causality?

Cut pay -> cut incomes -> cut spending.

But that obvious logic apparently evades our captains of industry who think an ever increasing profit share – by preventing workers enjoying real wages gains commensurate with productivity growth – is smart logic.

Only if you can load the workers with ever increasing levels of debt.

But then that strategy only works for a while and then it all starts unravelling.

The canary might be the two months of negative retail sales growth.

But we can go further into the neoliberal insanity.

Governments infected by the neoliberal virus fell over themselves to privatise essential services like electricity. This hasn’t been confined to Australia.

James Meek wrote a beautiful piece in the London Review of Books (September 13, 2012) – How We Happened to Sell Off Our Electricity (you need to subscribe to read it).

It discussed how the obsession with privatisation in Britain, which was meant to reduce state control of this sector, has led to the state still being dominant in electricity production.

The only problem for the British is that the French government now owns a large swathe of the ‘privatised’ British electricity industry.

The outcome demonstrates the absurdity of the whole privatisation debate. This example is not unique.

State-owned enterprises have eaten up inefficient privately owned firms all around the world as governments sell off public assets in the belief that prices will fall, services will improve and costs will be lower.

The reality now some 35 years or so into the privatisation experiment is that none of these claims have been realised.

In many cases, costs are higher and the privatised firms rely on higher public subsidies than was the case when the operations were completely in public hands. Prices are not uniformly lower after privatisation.

Profit-seeking firms seek to gain by cutting costs and under investing in essential infrastructure, which leads to poor outcomes for Society (blackouts, poor repair times etc).

And, millions of jobs have been lost in this cost-cutting mania.

In Australia, we are now enduring massive increases in energy prices. The Australian Financial Review article (August 4, 2017) – Australian households pay highest power prices in world – reported that:

Australian residential customers are paying the highest electricity prices in the world – two to three times more than American households …

Prior to the privatisations and creation of the national grid “Australia had the lowest retail prices in the world”. The privatisation was meant to lower prices – that was the promise. All it has done has increased prices, reduced quality of service and transferred real income from workers and households to the power companies.

While inflation is around 1.7 per cent per annum, electricity and gas prices in Australia have been hiked by around 20 per cent on July 1, 2017 by the three largest producers (Source).

In the case of gas, Australia exports massive volumes of gas, despite shortages in the domestic market. Energy providers have been forced to buy our own gas back on global spot markets at higher prices than it is sold into those markets by our gas companies. If you think that is ridiculous you are correct.

Then there is the manipulation of prices by energy companies by withholding supplies and causing blackouts – just to maximise profits. Please read my blog – Market manipulation and electricity blackouts – for more discussion on this point.

Enter the latest retail sales data.

Retail Sales data

And today we had the Retail Sales data, which led the ABS to report that:

Australian retail turnover fell 0.6 per cent in August 2017 … This follows a fall of 0.2 per cent in July 2017.

What the ABS didn’t say in its press release was that this was the worst outcome since 2012.

The sky darkens a bit more when we learn that most areas of retailing went backwards:

In seasonally adjusted terms, there were falls in food retailing (-0.6 per cent), cafes, restaurants and takeaway food services (-1.3 per cent), household goods retailing (-1.0 per cent) and clothing, footwear and personal accessory retailing (-0.2 per cent). There were rises in department stores (0.7 per cent) and other retailing (0.1 per cent) in August 2017.

Further, while politicians claimed the slowdown in economic activity is concentrated in the mining states as the boom ended, the retail sales data shows that all states and territories are going backwards.

The ABS press release said:

… there were falls in all states and territories … Victoria (-0.8 per cent) and Queensland (-0.8 per cent) led the falls …

There were also falls in New South Wales (-0.2 per cent), Western Australia (-0.6 per cent), South Australia (-0.6 per cent), the Australian Capital Territory (-0.8 per cent), Tasmania (-0.7 per cent) and the Northern Territory (-0.7 per cent).

So no massaging that.

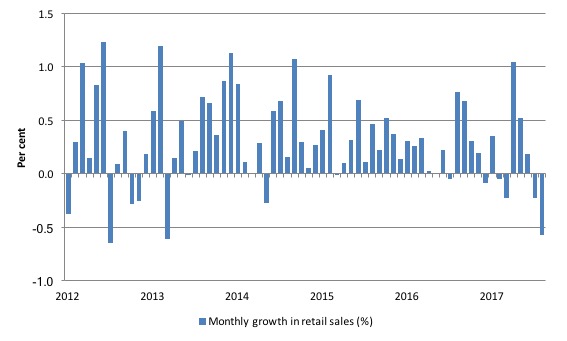

The following graph tells the story for total retail sales from January 2012 to August 2017. Clearly, if we use the two negative quarters as constituting recession, then the retail sales sector is now recessed.

Retail sales account for around one-quarter of all household spending and is probably the most discretionary – more easily adjusted when households are struggling.

Less discretionary spending – utilities, education, housing, etc – is harder to cut. But when retail sales expenditure is falling, it is a good indicator that overall household spending will fall.

Conclusion

What we are seeing in Australia at present is the dots being connected – flat wages and cuts in real income, rising debt, falling retail sales – they are all linked.

They all indicate that the resurgence of the neoliberal agenda after government fiscal expansion saved the economy from ruin.

But therein lies the contradiction. As we connect the dots we understand that the essential links for prosperity are being broken.

Real wages have to rise in proportion with productivity (at least). The wage share in national income has to rise again. Households have to ‘fund’ their consumption expenditure from income growth rather than by accumulating ever-increasing debt.

If those things do not happen – then crisis will follow.

Reclaim the State book offer

Go to www.reclaimthestate.org – for discount codes.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Given that the IMF is doing bits of backtracking again and is realising that the public are smelling their bullshit, I suspect that deficits will increase to stave of insurrection but they will not increase enough to make inroads into the vested interests (bank lending/house price/land speculation) so that the present set-up can hobble along a bit longer. The Tories in the UK did this in 2013 with a slightly increased deficit which brought about a slight ‘improvement’ then giving them false ground to claim austerity was working.

It’s all a apathetic game. I think credit levels are about 170% of GDP in the UK at present with people splashing out on SUV’s as if there is no tomorrow whilst barely being able to pay basic bills. So the feel-good factor of driving around in a huge ‘panzer’-like vehicle covers it all up. I suppose in Australia, with wide open spaces, driving an SUV doesn’t look quite as ridiculous as the cluttered UK streets with these leviathans crawling along at a snails pace in massive traffic queues.

Meanwhile across the pond….

What planet do these economists live on?

“New Zealand retail spending on electronic cards was flat in September, which economists said was due to cooling house prices.

Seasonally adjusted retail spending on credit and debit cards rose 0.1 per cent from August, having dropped 0.2 per cent that month, Statistics New Zealand said in a statement. Total spending, including non-retail industries, fell 0.1 per cent, having risen 0.6 per cent a month earlier.

“Consumer spending has cooled significantly in recent months – in fact, the level of card spending is down since the start of the year,” said Westpac chief economist Michael Gordon.

“Consumer spending in New Zealand tends to have a strong link with the housing market, and the slowdown in spending is consistent with the cooling in house prices over the last year. In the absence of a renewed fall in interest rates, we expect the housing market, and therefore growth in consumer spending, to remain subdued over the next couple of years.”

Of course it has got nothing to do with the astronomical household debts to disposable income ratio of 168% at the endof the June 2017 quarter eh?? Sheesh…

And across the ditch, since the privatisation of our electricity market starting in the 1980s, the cost to residential consumers has “doubled in real terms”.

http://www.stuff.co.nz/business/industries/9661789/Academic-attacks-electricity-report

Penal rates?? I laugh when someone says there are still penal rates in Australia. In NZ I don’t think I’ve ever been paid a penal rate for working on a weekend in any of the retail or hospitality jobs I’ve done since I started working in 1994. Shame Australia is doing away with the last remnants of civilised labour practices.

made me think of this, from ~1928

“It is utterly impossible, as this country has demonstrated again and again, for the rich to save as much as they have been trying to save, and save anything that is worth saving.

They can save idle factories and useless railroad coaches; they can save empty office buildings and closed banks; they can save paper evidences of foreign loans; but as a class they can not save anything that is worth saving, above and beyond the amount that is made profitable by the increase of consumer buying.”

I think this is from “Business Without a Buyer”

by William Trufant Foster and Waddill Catchings” 1928

This was obvious, tribal logic for >50,000 years. What happened?

now we manage by numbers, not by human outcomes

past a few million, what’s the point of diverting & hoarding so much fiat that could be distributed?

extreme hoarders don’t believe that none of are as smart as all of us?

that’s not arrogance, it’s stupidity

Further to this excellent article… most working families have low disposable income so living costs and discretionary spend all happening on household credit cards.

This has given some artificial retail support. IMO what we are seeing now (given no increased unemployment correlation) is a state of exhausted credit balances, and available $ redirected to egregiously high monthly repayments (thx to 20% Credit Card rates).

Considering this is in a market where QE fosters wholesale interest rates of 1-2%, there is massive margins for financiers and allowing this situation to continue is unconcsionable.

It is a matter of time before mass layoffs in retail sector … retailers with high fixed costs (rent/ power) and falling sales mean staff cuts across the board … economic recession big time.

Sensible CC interest rate caps need to be legislated to a Personal Loan rate, and banks not permitted to charge above. This to apply to all open cards. This would free up substantial householder liquidity for productive spending that is being sucked out by the finance companies and banks to support perpetual record profits.