It's Wednesday and I discuss a number of topics today. First, the 'million simulations' that…

Infrastructure report for the US – dire degradation of public infrastructure

I recently wrote about the degraded infrastructure in Europe as a result of years of unnecessary fiscal austerity – see Massive Eurozone infrastructure deficit requires urgent redress. Not only is the public amenity degraded but when transport cannot access key international trading routes (for example, bridges across the Rhine), then industrial prosperity and exports are undermined. The Eurozone nations are sinking into a mire of both human and physical infrastructure decay and the negative consequences will reverberate for decades to come. This is a global phenomenon. Recently, the American Society of Civil Engineers (ASCE) released its – 2017 Infrastructure Report Card – for the US and the results are dire. This Report comes out every four years and provides a good guide to the “condition and performance of American infrastructure”. It gives grades (like “a school report card”) “based on the physcial condition and needed investments for improvements”. Overall, the US, the richest country in the World, was awarded a D+, which means “Poor at Risk” or mostly below standard and “approaching the end of their service life”. You don’t really have to be an engineer to appreciate this. Any drive or walk through a US city these days will allow you to see this decay. It is totally unnecessary, totally preventable and very damaging to the well-being of the people and firms that rely on the public infrastructure for their own activities. Myopic and ridiculous.

I have written about my experiences in Manchester (UK) when I was studying for my PhD during the Thatcher years.

Fiscal austerity starved essential public works maintenance with catastrophic results, which ended up requiring much higher public outlays to remedy the situation that would have been spent on on-going maintenance.

That is why the myopic quest not to spend a few dollars today is ridiculous.

Please read my blog – The myopia of fiscal austerity – for more discussion on this point.

More recently, the Cameron government in Britain demonstrated it hadn’t learned any lessons from that period – please read my blog – British floods demonstrate the myopia of fiscal austerity – for more discussion on that point.

Overall, austerity-obsessed politicians typically cut public infrastructure spending first because it is less obvious to people.

Cutting a pension cheque, or some school support has fairly immediate impacts and, as such, invokes negative political consequences almost from the outset.

But cutting maintenance spending on bridges, or failing to continue developing public transport systems is more easy to hide. The decay occurs by stealth as the infrastructure ages, or the population steadily grows to swamp the existing infrastructure.

Eventually, we realise that our quality of life has been eroded but by then the political cycle has moved on and, in many cases, the culprits have retired on fat public sector retirement pensions and are swanning around on corporate boards channeling information and networks they built up during their political careers into the pursuit of their private prosperity.

The lax rules which govern the shift of retiring politicians from Ministerial positions to private sector lobbying and

Further, when governments impose fiscal austerity during recessed times, when the non-government sector is reluctant to spend, the typical asymmetry associated with private investment expenditure is exacerbated.

The UK, for example, is suffering very low productivity growth at present. The reason is a lack of investment. But the reason for that is, in no small part, the extended austerity after 2010 and then the slow growth that followed when the British government realised the grand austerity plan was not even achieving its goals of reducing the fiscal balance.

We often focus on the short-term negative impacts of fiscal austerity, but in this case, it also has serious long-term impacts on both the rate of business investment and the potential growth rate (which falls as capital formation stalls).

The longer it takes for business investment to recover, the worse will be the long-term impact on potential GDP growth. In turn, this means that the inflation biases are increased because full capacity is reached sooner in a recovery – often before all the idle labour is absorbed.

So, while George Osborne is long gone, the negative impacts of his policy folly will reverberate for a long time to come. His failings will continue on for many years and the flat productivity growth is one manifestation of that failing.

It is the same the world over.

The US situation is no different. The various levels of governments have imposed involuntary spending constraints on themselves with devastating consequences.

I have written about the situation in Flint, Michigan before. Please read my blog – We starve the state and public infrastructure development at our peril – for more discussion on this point.

In addition, the blog cited discusses the release of an Australian Local Government Association (ALGA) report on the state of Australian infrastructure.

Conclusion: 11 per cent of total public infrastructure assets were in a “poor or very poor condition”.

So, the same the world over. The degradation of public infrastructure that hasn’t been privatised for a song and turned into profit is one of the defining characteristics of the neoliberal era and part of the process of suppressing the public and advancing the private.

Except in the this context, we have been duped into believing the ‘private’ is all of us – we were sold the myth that privatisation would benefit all. The reality is that the sell-off of public assets transferred massive wealth from the public sector (all of us) to a small private elite cohort.

And, the degradation of public infrastructure hurts most of us who rely on it for transit, education, health care, recreation, and the like.

The American Society of Civil Engineers (ASCE) note that their ‘D grade rating’ – “Poor at Risk” – indicates that:

The infrastructure is in poor to fair condition and mostly below standard, with many elements approaching the end of their service life. A large portion of the system exhibits significant deterioration. Condition and capacity are of serious concern with strong risk of failure.

It sits between C (Mediocre, Requires Attention) and F (Failing/Critical Unfit for Purpose) grades.

The ASCE use the following criteria in assigning these grades:

- Capacity: Does the infrastructure’s capacity meet current and future demands?

- Condition: What is the infrastructure’s existing and near-future physical condition?

- Funding: What is the current level of funding from all levels of government for the infrastructure category as compared to the estimated funding need?

- Future Need: What is the cost to improve the infrastructure? Will future funding prospects address the need?

- Operation and Maintenance: What is the owners’ ability to operate and maintain the infrastructure properly? Is the infrastructure in compliance with government regulations?

- Public Safety: To what extent is the public’s safety jeopardized by the condition of the infrastructure and what could be the consequences of failure?

- Resilience: What is the infrastructure system’s capability to prevent or protect against significant multi-hazard threats and incidents? How able is it to quickly recover and reconstitute critical services with minimum consequences for public safety and health, the economy, and national security?

- Innovation: What new and innovative techniques, materials, technologies, and delivery methods are being implemented to improve the infrastructure?

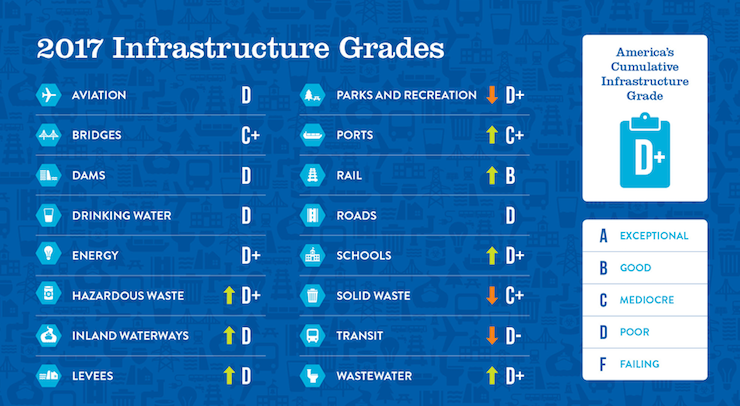

This graphic from ASCE shows the grades given across the different forms of infrastructure.

Can you believe that the richest nation in the World has allowed its drinking water infrastructure to lapse so badly.

Why does this matter?

Recently, I wrote about the 2017 Distressed Communities Index (DCI) for the US – see US growth performance hides very disturbing regional trends.

We learned that:

1. “millions of Americans are stuck in places where what little economic stability exists is quickly eroding beneath their feet.”

2. “17 percent of the U.S. population … live in economically distressed communities”.

3. “from 2011 to 2015, distressed communities ,,, experienced what amounts to a deep ongoing recession, with a 6.0 percent average decline in employment and a 6.3 percent average drop in business establishments.”

4. “58 percent of adults in distressed zip codes have no education beyond high school.”

And more, if you refresh your memory from that blog.

The overall conclusion is that the US is failing to provide any sense of prosperity for a significant number of their social settlements – communities, where people live.

This recent investigation by Ed Pilkington (published December 15, 2017) – A journey through a land of extreme poverty: welcome to America – is damming of the neoliberal system.

Not only is America failing its people (human resources) but the 2017 Infrastructure Report also shows it is failing to sustain its productive infrastructure.

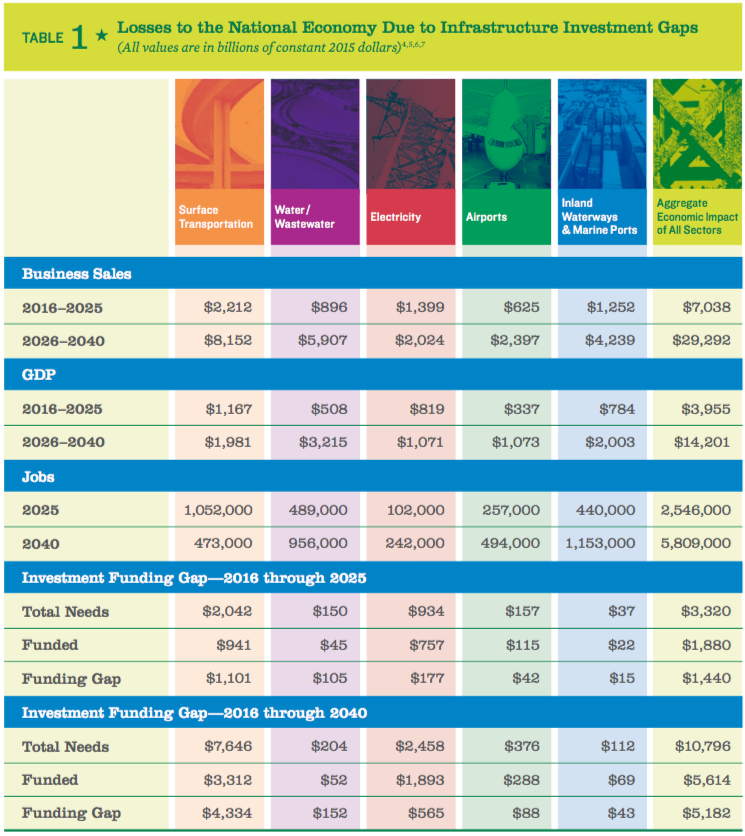

In its accompanying – Failure to Act: Closing the Infrastructure Investment Gap for America’s Economic Future Report from 2016, the ASCE estimated that the economic impact of failing to close the infrastructure investment gap would mean:

- $3.9 trillion in losses to the U.S. GDP by 2025;

- $7 trillion in lost business sales by 2025; and

- 2.5 million lost American jobs in 2025.

On top of those costs, hardworking American families will lose upwards of $3,400 in disposable income each year – about $9 each day.

The following graphic (Table 1 from the ASCE Report) catalogues the “losses” to the National Economy Due to Infrastructure Investment Gaps:

Those estimates were in 2015 US dollars. So the 2017 estimates are higher. I estimated that the total funding gap for investment between 2016 and 2040 in the US was $US5,356 billion (up from the ASCE estimate at 2015 of $US5,182 billion).

Which makes it hard to understand why the business sector goes along with the ‘cut the deficit’ narrative pushed by the neoliberal spin doctors.

It is actually damaging to a vast number of businesses – small and upwards.

It is certainly damaging to the millions of workers who could have sustainable employment opportunities but are left either idle or in precarious, low-paid work.

As the ASCE Report concluded:

the fundamental impacts of underinvesting in infrastructure will be higher costs to businesses and households as a consequence of less efficient and more costly infrastructure services. For example, travel times will lengthen with inefficient roadways and congested airports and airspace, and out-of-pocket expenditures to households and business costs will rise if the electricity grid or water delivery systems fail to keep up with demand. Goods will be more expensive to produce and more expensive to transport to retail shelves for households or to business customers. Business- related travel, as well as commuting and personal travel, will also become more expensive and less reliable. As a consequence, U.S. businesses will be more inefficient. As costs rise, business productivity falls, causing GDP to drop, cutting employment, and ultimately reducing personal income. Higher costs will also render U.S. goods and services less competitive internationally, reducing exports and decreasing dollars earned and brought into the U.S. from sales to international customers. Impacts will be spread throughout the economy, but will fall disproportionately on technology and knowledge-based industries that drive innovation and economic development.

That is why it matters.

That is why maintaining first-class public infrastructure provision is crucial.

This is part of the real cost burden we are leaving our grandchildren.

Conclusion

All of this is, of course, totally unnecessary and totally preventable.

The US government has the financial resources to ensure that infrastructure provision is first-class and maintained that way.

Irrespective of the constitutional divide in spending responsibilities, the US Federal government can always ensure any level of government in America has sufficient resources to maintain this infrastructure.

The degradation reported by the ASCE is alarming and will impose massive costs to the US society in years to come.

A massive example of the ongoing failure of neoliberalism.

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

Completely agree. It makes one feel that any American pol who isn’t in favor of massive infrastructure spending should be trotted out in public and kicked squarely in the ass…until he/she wakes up about it.

This article reminded me of a John Oliver, Last Week Tonight programme from 2015, on Infrastructure (on Youtube). Also recommend the harrowing article highlighted above by Professor Mitchell: A journey through a land of extreme poverty. The Guardian does still include some reasonable reporting. I currently reside in China which seems to find the money, or I should say the people to reward with the trading lubricant of money, for infrastructure. As for my homeland, the UK; it can apparently find the money to bring more people to London a little quicker in the future on HS2.

The reason that infrastructure is neglected in a highly competitive western world is obvious; even if it is also acknowledged as contemptible. Those countries, once regarded as superior throughout the post-world war period, are having to adapt to a more challenging era, primarily from economies based in the East.

Even if the need for adequate infrastructure is acknowledged it is not credited as the primary generator of GDP growth or superior productivity – the focus of attention is therefore concentrated on what will bring success in the pursuit of more direct competitive (and productive) advantage; QE to release resources to promote goods and service advancements, for example.

Ideological battles may ensue over which policies are the most appropriate, but the Western world still has to come to terms with a loss of economic status and power. Is MMT up to that level of argument – something which goes far beyond Job Guarantees and infrastructure projects.

I am aware of course of Bill’s blog: British Tories reject the ‘free market’ neoliberal myth

Posted on Monday, December 11, 2017

In that piece he referred to Tony Benn’s 1989 memoirs – Against the Tide, Diaries 1973-76, which described “Strategy A which is the Government of national unity, the Tory strategy of a pay policy, higher taxes all round and deflation, with Britain staying in the Common Market. Then Strategy B which is the real Labour policy of saving jobs, a vigorous micro-investment programme, import control, control of the banks and insurance companies, control of export, of capital, higher taxation of the rich, and Britain leaving the Common Market.”

There is a need to describe the expected outcome of strategy B in terms of retaining Britain’s competitive position in the world and how this can be measured against the changing productive capacity and wealth of rivals.

OT, but I’ve been trying to proselytise the JG, and Bill’s extensive critique of UBI, in the Comments below this, on the right track but uktimately inadequate, Guardian article today:

https://www.theguardian.com/commentisfree/2017/dec/18/universal-income-no-panacea-labour

I would appear to be something of a lone voice, unfortunately : (

There’s plenty of spending in the US; however, enormous sums are handed either to the pentagon or the military-industrial complex for distribution on their projects with cuts to spending occurring elsewhere .

In North America we are generally told we are no longer in an industrial economy having moved up to the “knowledge based” economy so there is little need for most of the old types of infrastructure; we hear it on the news almost daily.

Ironically though, in Canada, we have a new “infrastructure bank” to attract foreign investment to Canadian public infrastructure projects and federal ministries considering divestiture of public infrastructure.

I think the UK infrastructure had begun to rot many years before the 2010 period of austerity, when power was handed to the Conservatives and “Tory-lite” Liberal Democrats in the late unlamented Coalition. It just got a lot worse then. One reason why I will never, ever, forgive the Lib Dems. The trouble was that Labour in that period was still in its late Blairism stages, and Gordon Brown had been as guilty of Blair (if not more so) in cosying up to the financial sector.

As a (relatively) trivial example, a lot of the road surfaces in Oxfordshire, where I live, would disgrace some third-world countries. And Oxfordshire has some of the most expensive housing in the country, after London. I suspect this is no coincidence.

The prominent ideological bias on these pages attempts to emphasize the social (and should we also add compassionate) discord with a capitalist doctrine that exploits resources (and should we add, its brutality).

That still leaves unanswered how a sovereign country maintains and improves its competitive role in the hierarchy of competing nations. The doctrine of socialism has not automatically signified an ideological purity; or is there an unsaid insinuation that a more humane society may have to pay the price of its superiority in settling for a lower standard of wealth than that of its arch rivals.

“That still leaves unanswered how a sovereign country maintains and improves its competitive role in the hierarchy of competing nations.”

There isn’t a competitive role. That’s neoliberal bull.

Ultimately if you want to export to a nation you have to take their exports, or hold their currency. That’s it. If you don’t, then you can’t sell them anything, which means you don’t make it, which means the country you were exporting to can make it itself.

The free floating currency – managed as shares are on an exchange – provides the necessary firebreak that separates currency zones from each other and allows them to operate in a decoupled manner, should they so wish.

You can always tell somebody who doesn’t get it when they use the world ‘wealth’ as though that is something substantive.

(Re: UK infrastructure): And almost as if on cue, a new report about the disgraceful state of Liverpool prison:

http://www.bbc.co.uk/news/uk-42310501

(Admittedly, with our still Victorian attitudes to many things, routine humiliation of prisoners is probably regarded as only their just deserts, and all part of the punishment).

Oh, dear, just spotted this, which may be another US example:

http://www.bbc.co.uk/news/world-us-canada-42401707

(Train crashes on to Highway)

Neil,

I assumed that it was still possible for sovereign nations to compete even if they didn’t trade across international borders; ie there is still an international league table based on say, GDP levels (that is what I meant by wealth). Of course, how you measure what can be achieved with GDP and productivity levels on a comparative basis is another matter – that is why I was highlighting the emphasis on social bias.

I’m not sure what the purpose of your insult was meant to achieve.

Great article.

Mr. Philip Alston went to LA (where I live), the South, and then he went to Puerto Rico. He was shocked by the level of entrenched poverty.

Gogs, if I understand you correctly, the problem is that what you assert is “obvious” is not only not obvious, but seen to be rather obviously false, once one has absorbed enough functional finance = MMT = intuitive common sense.

The reason that infrastructure is neglected in a highly competitive western world is obvious; even if it is also acknowledged as contemptible. Those countries, once regarded as superior throughout the post-world war period, are having to adapt to a more challenging era, primarily from economies based in the East.

No, that is not at all the reason. Adequate infrastructure etc increases competitiveness, GDP, productivity, whatever, helps countries meet such challenges far better than quackery like QE.

a more humane society may have to pay the price of its superiority in settling for a lower standard of wealth than that of its arch rivals.

Again, from the viewpoint of MMT & functional finance – this is obviously false. There is no tradeoff in practice. There is no price for a “more humane society”: The standard of wealth of the “more humane society” will be greater than that of sound finance “arch rivals”.

That still leaves unanswered how a sovereign country maintains and improves its competitive role in the hierarchy of competing nations.

Again, this question is answered. People may not like the answer, may think it is wrong, but that is different. The answer is simple: adopt functional finance, MMT, a JG. (In particular, spend adequately on infrastructure.) That will improve a nation’s competitiveness whatever that means. Was looking for a good statement from Abba Lerner in his Economics of Employment to that effect, that functional finance countries will “outcompete” sound finance ones. Haven’t tracked it down yet, but it is there somewhere.

Ensuring adequate infrastructure, functional finance spending etc is what the Eastern societies, above all China, do to “challenge the West”. Partly, they did it by listening to old Keynesian MMT /FF/ institutionalist, whatever, fellow traveler economists (e.g. James Tobin, James Galbraith) who, being in touch with reality, were not listened to at all by the Western countries. So their success in the international league table is proof of the claims of the superior “competitiveness” of functional finance / MMT.