The IMF and the World Bank are in Washington this week for their 6 monthly…

The IMF still has the same spots

Just before Xmas (December 22, 2017), the IMF proved once again that leopards don’t change their spots. Thy released a Working Paper (No. 17/286) – Australia’s Fiscal Framework: Revisiting Options for a Fiscal Anchor – that demonstrated they hadn’t learned a thing from the last decade of crisis and fiscal interventions (stimulative and opposite). The paper demonstrates no understanding of context, history, or the role that fiscal policy should play in advancing general well-being. It is a technical exercise laden with the ideology of mainstream macroeconomics that fails badly. The problem is that the mainstream political parties (on both sides of the fence – Labor and Conservative – although pretending there is a fence is somewhat far-fetched these days) will use it against each other, and, in their shameful ignorance, against the best interests of the nation and the people that live within its borders. And … on reflection using the leopard example is an insult to the leopards. The IMF is an ugly, destructive institution that should be defunded and their buildings given over to the homeless.

The IMF authors are all ‘insiders’, by which I mean have had careers in the network of mainstream institutions (central banks, European Commission, World Bank, IMF etc). The reinforcing Groupthink that this sort of career path engenders is powerful.

It is no wonder they produce total garbage like this devoid of any critical scrutiny or self-awareness.

Rational expectations, no unemployment in long-run, real effective exchange rate (REER) balances the current account, and more – GIGO – garbage-in, garbage-out – sort of stuff.

Please see the following blogs (among others) for more discussion about these sorts of models:

1. A continuum of infinitely lived agents normalized to one – GIGO Part 3 (February 6, 2012).

2. OECD – GIGO Part 2 (July 27, 2010).

3. GIGO … (October 7, 2009).

4. The myth of rational expectations (July 21, 2010).

The numbers the paper produces come out of an application of the IMF’s G20MOD model, which is “an annual, multi-region, general equilibrium model of the global economy combining micro-founded and reduced-form formulations of various economic sectors”.

Which regular people should interpret as meaning a vacuous technical framework for generating results that will reinforce the mainstream macroeconomics ‘theory’ – that is, generate outcomes that reinforce ‘free market’ assertions.

This sort of model regularly fails to produce any traction with the real world – viz, the appalling forecasts generated by the IMF. Also never forget the Greek bailout fiasco where the IMF admitted after the damage was done that their model parameters, which influenced the scenarios used to craft the bailout and austerity, were grossly wrong.

Please read these blogs for a sample of how the IMF fails:

1. 100 per cent forecast errors are acceptable to the IMF (December 14, 2011).

2. Why haven’t any IMF officials been prosecuted for malpractice in Greece? (August 3, 2017).

3. The destruction of Greece – “only a down payment” according to the IMF (April 27, 2017).

4. Failed forecasts reflect flawed economic understanding – nothing else (May 21, 2012).

5. The IMF – incompetent, biased and culpable (February 11, 2011).

Background

The IMF is intent on pushing formalised fiscal rules onto nations within its purview, including Australia, which currently has no formal rules governing the conduct of fiscal policy other than a loose statement called the Charter of Budget Honesty Act 1998.

The Charter – a neoliberal ploy by the previous Conservative government in Australia – is a “framework for the conduct of Government fiscal policy” which, in its own words requires “fiscal strategy to be based on principles of sound fiscal management and by facilitating public scrutiny of fiscal policy and performance”.

It outlines what it calls the “Principles of sound fiscal management” which includes:

The Government’s fiscal policy is to be directed at maintaining the on‑going economic prosperity and welfare of the people of Australia and is therefore to be set in a sustainable medium‑term framework.

Note: this conflation between ‘prosperity’ and ‘well-being’ and some “sustainable medium‑term framework”.

Which is:

1. “maintaining Commonwealth general government debt at prudent levels” – with no specification of what ‘prudent’ means.

2. Fiscal policy to “adequate national savings” – no definition of what “national savings” are (non-government or government?) and what “adequate” might be.

3. Fiscal policy should moderate “cyclical fluctuations in economic activity” – the standard Keynesian line that fiscal policy should be counter-cyclical (buttressing weak non-government spending), not pro-cyclical (cutting when non-government spending is weak).

4. “ensure that its policy decisions have regard to their financial effects on future generations” – which plays into the ‘deficits are burdens on the grandkids’ narrative. More later.

The Charter also outlined a series of hoops that any government had to jump through with respect to reporting fiscal aggregates to the public, mid-year reviews, statements about the ‘intergenerational’ effects and the rest of it.

History tells us that these hoops are typically just smokescreens used to advance political purpose rather than act in an educational way.

But, as it stands, the Charter doesn’t tie down any specific fiscal rules – there is no statement that the fiscal balance has to be zero or in surplus.

The terms ‘deficit’, ‘surplus’, ‘full employment’, ‘unemployment’ are not mentioned.

Economists – within and outside of government and its bureaucracy – have imposed their assertions on what the Charter means.

So we have heard that Australia should have – fiscal surpluses always; fiscal surpluses in good times to pay for the deficits in bad times, balanced fiscal position over an economic cycle – and all the rest of the mainstream mumbo-jumbo that even the so-called progressive politicians in Australia repeat.

The IMF Working Paper recognises this noting that:

The framework provides for “constrained discretion,” advocating a principles-based approach rather than a numerically-oriented, rules-based fiscal framework. The Charter lays out procedures for setting fiscal objectives based on its “Principles of Sound Fiscal Management,” which are stated in general terms.

The dominant policy position since the Charter was introduced has been biased, as the IMF Working Paper notes towards “Budget balance policies”.

Both sides of politics (Labor and Conservative) are obsessed with ‘balanced budgets’ and regularly mouth the erroneous claims from mainstream macroeconomics to justify this bias.

Such erroneous claims include:

1. Fiscal deficits drive up interest rates and crowd out productive private investment.

2. Fiscal deficits are inflationary.

3. Fiscal deficits undermine the well-being of future generations because they have to be paid back with higher future tax burdens.

4. Fiscal deficits ultimately lead to the government being unable to fund itself as bond markets lose faith in the capacity of the government pay back to the rising debt.

5. Fiscal deficits ultimately lead to a sell-off of the currency, a collapse in the currency and hyperinflation coming via the rising import prices.

6. Fiscal surpluses contribute to national saving.

And more.

All demonstrably false as they stand.

For example:

1. Fiscal deficits do not compete for scarce savings in the non-government sector. The stimulative effects on national income actually drive up savings as disposable income rises. Further, bank lending is not constrained by reserves which means that they will extend loans to credit-worthy customers on demand – so there is no crowding out operating through the financial sector.

2. All spending carries an inflation risk if nominal expenditure growth outstrips the capacity of the productive sector to respond by increasing the supply of real goods and sectors. Fiscal deficits are not inherently inflationary. They can be continuous forever as long as they offset the non-government desire to save (withdrew income from the spending cycle).

3. Fiscal deficits are never paid back. Future generations choose their own tax burden through the political system. Fiscal deficits provide, in part, for better infrastructure, education, health services etc that generate benefits that span generations.

4. The bond markets can never send a currency-issuing government broke. Such a government never even has to issue debt in order to spend. And if it does, it can always services liabilities that are denominated in the currency it issues. The bond markets are supplicants not a source of spending capacity.

5. A floating currency can come under speculative attack and depreciation may result. Whether this is a problem depends. A sovereign government always has the capacity to impose capital controls or outlaw certain financial transactions if a problem develops. Ultimately, depreciations have been finite and generate reversing capital flows.

6. Fiscal surpluses destroy non-government financial assets. The concept of saving – sacrificing current consumption spending to generate higher future consumption spending – is inapplicable to a currency-issuing government. It can spend whenever it likes and is only constrained by what is available for sale in the currrency it issues. It never needs to ‘save up’ (like a household) to expand its future spending capacity.

Please read the following introductory suite of blogs – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3 – for basic Modern Monetary Theory (MMT) concepts.

The problem is that the IMF Working Paper is motivated by these falsehoods, which tells you that it won’t end well!

It notes that the “Budget balance” approach dominates Australian fiscal policy as a means of satisfying the Charter’s “sustainable medium‑term framework” requirements.

It thus seeks to compare that approach with:

… the possibility of the Government employing a different basis for achieving its medium-term fiscal strategy – a long-term debt anchor.

That is what the Working Paper does – models within the GIGO G20MOD – the two approaches and concludes they deliver similar outcomes.

What the IMF Paper argues

The IMF assert that there is some long-term fiscal deficit to GDP target that is always met by “constant” adjustments to “lump sum transfers” which include “pensions, aged care provisions, unemployment insurance” – noting that there is no unemployment insurance system in Australia.

These outlays thus rise and fall to ensure that the government meets its deficit target which, in turn, means it “pins down the long-term government debt”.

They propose three fiscal rules:

1. “Expenditure rule (ER)” – some government spending component can be controlled.

2. “Budget balance rule (BBR)” – via some specified restriction after some time horizon elapses.

3. “Debt rule (DR) – brings the government debt to some specified target level over some time horizon.”

The rules in G20MOD are “strict”, which means that “the target level for the BBR or the target path for the DR is met in full each year”.

So the actual fiscal outcome in any year is given by the “target” plus or minus the cyclical provision of lump sum transfers.

These models have to be “calibrated” – which just means that the relationships between variables have to be given a numerical form – for example, how much changing one variable will change another.

Standard practice in this sort of exercise is to just make numbers up that suit – in addition to using other statistical techniques (such as econometric estimation).

The IMF Paper admits that the “calibration is for a steady state of the model”, which means that the numbers are made up to ensure its “long run” properties hold.

The long-run properties are just assertions that are derived from mainstream theory. So this means the ‘model’ is made numeric in such a way that what you theorised is found to be so. In other words, the model provides no validation of the theory – it is designed to ensure what you conjecture emerges.

The authors admit that because of this “the numbers may not match raw data in quantity” – meaning that the empirical world is disregarded to ensure the results of the simulations conform with the theory, which led to the design of the model in the first place.

Circular nonsense really.

They claim that:

Australia exports about 24.6 percent of GDP, and imports 23.5 percent of GDP, which is marginally below the G- 20 average of 26.6 and 26.9 percent of GDP, respectively.

However, imports are typically higher by some margin than exports, which is one of the reasons that our current account is always in deficit.

For example, since the March-quarter 2000 (to the September-quarter 2017), exports have averaged 20.3 per cent of GDP, while imports have averaged 21.4 per cent.

Further, official Balance of Payments data – shows that on average (since the March-quarter 2000 to the September-quarter 2017), the trade balance as a per cent of GDP was a deficit of 1.1 per cent, while the current account balance averaged a deficit of 4.3 per cent over the same period. More on that later.

These discrepancies with reality that are built into the calibration process throughout the models structure.

The IMF Report documents Australia’s “Performance before the Global Financial Crisis”.

It claims that it was the “global commodity boom” that allowed the fiscal balance to be in surplus and “further strengthened fiscal sustainability, creating ample fiscal buffers”.

The facts are:

1. The fiscal balance was in surplus from 1996 to 2007 (barring the 2001-02 fiscal year) mostly due to the fact that the financial deregulation created credit conditions that drove household debt to record levels and the household saving ratio into negative – and unsustainable – levels.

The contribution to tax revenue from the commodity boom came later.

To consider this period of fiscal surpluses to be normal is far fetched. In fact, the period was an outlier in our history which show that the Australian government mostly has run fiscal deficits while household saving as usually varied between 12 and 16 per cent of disposable income.

That is the norm. Fiscal surpluses were an aberration brought on by substantial growth in tax revenue as households spent like crazy with credit they received from banks and other finanacial institutions in the frenzy that the GFC brought to a sudden halt.

To construct that period as being sustainable shows how blinkered the IMF understanding is. Of course, the same institution was praising governments before the crisis urging them to deregulate the financial markets even further to stimulate more growth.

As non-government debt levels rose dramatically, the IMF was constructing this as nirvana. They failed to see that the trends would crash.

2. The statement that fiscal surpluses create “ample fiscal buffers” is plain wrong. It assumes that the surpluses go into some ‘storage area’ (I call it the ‘tin shed in Canberra’) and that the Australian government is financially constrained and needs to store up ‘money’ in order to spend.

Of course, all related statements are false.

The surpluses disappear into the ether after being accounted for. In a flow sense, they just mean that the government is injecting less financial assets into the economy via its spending than it is taking out via its taxation.

In stock terms, this means that the surpluses are undermining non-government sector net financial assets – reducing them.

If you want a more prosaic expression – surpluses destroy non-government wealth.

Further, a currency-issuing government’s spending capacity is not dependent on its past fiscal balances. It can always purchase – in every period – whatever is for sale in that currency, irrespective of what it did yesterday, last week, last year or whenever.

There is no sensible informational content or knowledge in the claim that surpluses increase “fiscal buffers”. Total nonsense.

The IMF Paper notes that:

At the onset of the global financial crisis … Australia undertook one of the most sizeable fiscal stimulus programs among advanced economies of roughly 4.5 percent of GDP. With this, the Government firmly entered into a period of high deficits, reversing its debt trajectory from FY2008/09 onwards. This necessitated a new auxiliary strategy, based on reducing the deficit, or ‘budget repair’

And as a result, Australia was one of the only advanced nations that did not record a recession during the GFC.

And, the ‘budget repair’ period, which began in 2012 as the pressure on government from conservative commentators (and institutions such as the IMF) reached fever-pitch proportions, has heralded a new period of slowdown, entrenched high labour underutilisation, and a falling household saving ratio as the fiscal squeeze impacted on wages and income growth.

Not a desirable combination of outcomes.

And all because the Australian government has embarked on this false notion of ‘budget repair’, which is “designed to deliver sustainable surpluses as soon as possible, of at least 1 percent of GDP”.

This is pure ideology.

There is no economic sense in the figure that the Australian government touts as being a suitable “medium-term fiscal strategy”.

More facts.

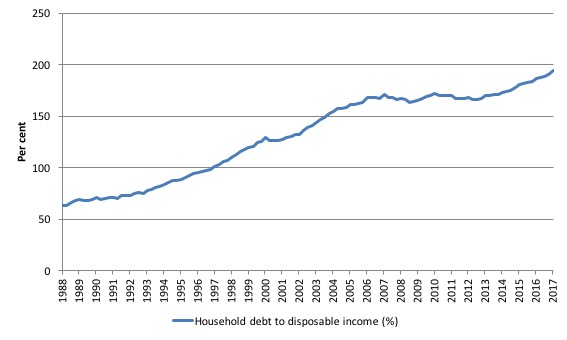

The latest RBA data – Household Finances – Selected Ratios – E2 – shows that the ratio of household debt to annualised household disposable income is now at record levels – each month a new record is established.

The following graph shows the ratio from 1988 (the beginning of the series) to the June-quarter 2017.

In June 1988, the ratio was 63.2 per cent. It peaked at 171 per cent in the June-quarter 2007, just before the GFC emerged.

It stabilised for a while as the fear of unemployment and the economic slowdown curbed credit growth for a while. But that didn’t last.

Over the last two years it has accelerated considerably and now stands at 193 per cent.

The position of Australian households, carrying record levels of debt, is made more precarious by the record low wages growth and the conduct of the private banks.

Please read my blog – Australia’s household debt problem is not new – it is a neo-liberal product – for more discussion on this point.

Sustaining household consumption growth and continued growth in real estate prices by pushing ever-increasing levels of debt onto households is not a sustainable strategy.

But it makes no sense to analyse household debt in isolation to what else is happening in the economy. In that sense, the sectoral balances framework is a suitable way of thinking about these issues.

Please read the answer to Question 2 in my blog – The Weekend Quiz – November 18-19, 2017 – answers and discussion – for more discussion on the derivation of this framework.

We can partition the economy into three broad sectors which produce ‘sectoral balances’ between their income earning and spending activities:

1. Government (G spends, T taxes).

2. Private domestic (S saves, I invests).

3. External (X exports, M imports, FNI net financial flows), so (X – M + FNI) = CAD (Current Account Deficit)

Given that, national income accounting gives us the sectoral balances equation:

(S – I) = (G – T) + CAD

This expression just says that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

National income variations ensure that this expression always holds because S, T and M rise when national income grows.

The problem is that shifts in behaviour of any sector, impact on the balances of the other sectors via these income changes, and feedback on the sector initally changing its behaviour.

This has major implications for the design and imposition of so-called fiscal rules, which is the IMF’s obsession.

For example, output, employment and national income are positively driven by aggregate spending. Firms form expectations of future aggregate spending and produce and hire accordingly even if they are uncertain about the actual demand that will be realised when the output emerges from the production process and sales occur.

Imagine if the government imposes a fiscal rule that requires it to cut its spending and/or increase taxes in order to reduce its deficit.

The first signal firms get is that public spending falls and government supply contracts start drying up. Capacity that was created to service that demand becomes idle.

That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms layoff workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

As national income falls, tax revenue falls and the cyclical components of government spending rise (for example, unemployment benefit payments).

And, the fiscal deficit may, in fact, rise.

Household saving will decline as will private domestic investment spending – as pessimism rises.

Import expenditure declines and the nation might experience a lower current account deficit but that is not a good outcome, given it has arisen from the national income collapse.

So the imposition of a fiscal target can impact on all the balances and be self-defeating.

In Australia’s case, the latest economic predictions are contained in Budget Paper No.1 and are as follows:

1. The fiscal deficit for 2016-17 of -2.1 per cent of GDP reducing to -1.6 per cent of GDP in 2017-18, then -1.1 per cent (2018-19), -0.1 per cent (2019-2020) and a surplus of 0.4 per cent in 2020-21.

2. The current account deficit to be come down from 4.4 per cent in 2015-16 to -1.5 per cent of GDP in 2016-17 and 2017-18, then stabilising at 2 per cent (2018-19).

I note that the average current account deficit since fiscal year 1974-74 to 2015-16 has been -3.9 per cent of GDP. So we might consider that sort of performance to continue over the fiscal projection period. There is certainly no expectation that the current account will suddenly record close to balance as is projected by the Government over the fiscal forecast period.

The G20MOD model calibrates to ensure the Real Exchange Rate balances the current account, which is a totally unrealistic scenario for Australia.

So what does that mean in terms of the sectoral balances?

We know that the financial balance between spending and income for the private domestic sector equals the sum of the government financial balance plus the current account balance.

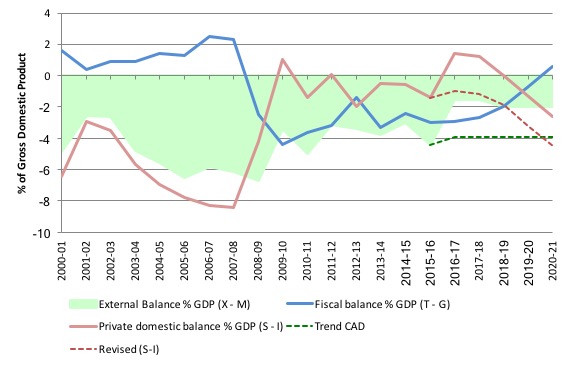

The following graph shows the sectoral balance aggregates in Australia for the fiscal years 2000-01 to 2020-21, with the forward years using the Treasury projections published in ‘Budget Paper No.1’. The projected data starts in 2017-18.

All the aggregates are expressed in terms of the balance as a percent of GDP

So it becomes clear, that with the current account deficit (green area) more or less projected to be constant over the forward estimates period, the private domestic balance overall (solid red line) is the mirror image of the projected government balance (blue line).

In the earlier period, prior to the GFC, the credit binge in the private domestic sector was the only reason the government was able to record fiscal surpluses and still enjoy real GDP growth.

But the household sector, in particular, accumulated record levels of (unsustainable) debt (that household saving ratio went negative in this period even though historically it has been somewhere between 10 and 15 per cent of disposable income).

The fiscal stimulus in 2008-09 saw the fiscal balance go back to where it should be – in deficit. This not only supported growth but also allowed the private domestic sector to rebalance its precarious debt position somewhat.

Re-check the Household debt graph (above) which showed that the sector started to stabilise its debt to income ratio after the onset of the GFC with support from the fiscal deficit.

You can see the red line moves into surplus or close to it. The long-run average private domestic deficit is 2.1 per cent of GDP and was achieved largely when the household saving ratio was between 10 and 16 per cent and private investment in capital formation was strong.

The fiscal strategy outlined by the Government last May clearly implied that the private domestic sector would resume accumulating debt as it progressively spends more than its income.

In fact, the external deficit assumptions built into the fiscal strategy were overly optimistic and so I remodelled the outcome based on the the long-term average current account deficit of 3.9 per cent – the dotted lines show this alternative scenario.

Under this more realistic assumption, the private domestic sector experiences increasing deficits – heading towards the pre-GFC levels.

Either way, the fiscal strategy being followed by the Government (which the IMF calls the “budget repair strategy”) has pushed Australia back on to the path back of excessive private domestic debt levels.

A return to pre-GFC behaviour, which was unsustainable.

Further, the fiscal estimates last May suggested that total private investment would decline by 6 per cent in 2016-17, be flat (no growth) in 2017-18 and exhibit modest growth in 2018-19.

And the September-quarter national accounts showed that household consumption is moderating as the strain of record levels of debt and flat wages growth are starting to impact.

Trying to impose a fiscal rule that deliberately hacks into the deficit will exacerbate that moderation in non-government spending growth.

The IMF Paper notes that:

With the commodity price bust, followed by the end of the mining investment boom, Australia’s budget repair faltered, as automatic stabilizers pushed up spending, and the Government’s revenue forecasts proved to be overly optimistic relative to outcomes …

Which meant that if the Government had have continued with its “budget repair strategy” then the economy would have entered a deep recession.

The real politic meant that even the Conservative government abandoned its strict austerity drive.

But the IMF take on that is:

While a postponement of fiscal consolidation may have been warranted on the grounds of economic stabilization, the repeated underperformance against budget plans and the repeated lengthening of the consolidation horizon may have weakened the credibility of the budget repair strategy, and possibly that of the medium-term fiscal strategy. Net debt has increased rapidly after the global financial crisis … followed by some sustainability concerns, at least in the context of Australia maintaining its AAA rating on sovereign debt, particularly since Standard and Poor’s placed the Australian sovereign’s AAA rating outlook at negative in 2015 …

All of which highlights the insanity of all this type of ‘analysis’ or ideological diatribe.

The Australian government realised if it continued to hack into net discretionary spending then unemployment would have risen well above its already entrenched high levels.

The only purpose of fiscal policy is to enhance the well-being of the citizens.

A government doesn’t do that by deliberately rendering them jobless by pursuing pro-cyclical fiscal policy.

Which then shows that the rest of the nonsense – AAA ratings etc – are all spurious concerns.

Responsible fiscal policy is not about delivering a particular fiscal balance, or following the dictates of the corrupt rating agencies.

The IMF Paper then delved into the so-called “demographic concerns” about fiscal sustainability.

I have dealt with that nonsense in these blogs (among others):

1. Another intergenerational report – another waste of time (February 2, 2010).

2. Democracy, accountability and more intergenerational nonsense (May 22, 2009).

3. Intergenerational fairness improved by fiscal deficits (August 6, 2014).

4. Australia – the Fourth Intergenerational Myth Report (March 5, 2015).

The final sections of the IMF Paper compare the model outcomes of imposing a “debt-anchor” to a “fiscal deficit target”.

They claim that “households and firms” enjoy the “certainty” of a “long-term debt anchor” because it means non-government wealth over lifetimes is predictable.

If you believe any of that then send me an E-mail and I can offer you the Sydney Harbour Bridge for sale at a low price.

Moreover, the IMF admits that this “certainty … may come at the cost of an increase in unhelpful pro-cyclical fiscal consolidation in times of economic slowdowns”.

Just consider that for a moment!

Procyclical fiscal shifts put members of households out of work – tens of thousands of them – yet apparently they feel better because the “certainty about the future debt path … would help households and firms in their long-term planning”.

GIGO.

The IMF Paper also claims that:

… the medium-term balance anchor introduces uncertainty as it has no mechanism to prevent the drift of government debt. Whenever there are shocks to the economy, even if the economy starts at the medium-term balance anchor, returning to the medium-term balance anchor will result in net debt drifting.

Another ridiculous statement.

First, the Australian government does not have to issue debt to match fiscal deficits. They could stop doing that anytime they chose.

Recall back in 2001, when it was running surpluses and initiated a review of government debt under pressure from the financial markets – the government bond markets were becoming very thin (as the government did not roll over debt upon maturity).

The outcome was that the Federal government was pressured by the big financial market institutions (particularly the Sydney Futures Exchange) to continue issuing public debt despite the increasing surpluses.

Given they were generating surpluses, then it was clear that according to the mainstream logic – that debt was issued to fund deficits – the debt-issuance should have stopped.

The fact was that the liquid and risk-free government bond market allowed speculators to find a safe haven. Which means that the public bonds play a welfare role to the rich speculators rather than fund government spending.

Please read my blog – Direct central bank purchases of government debt – for more discussion on this point.

Second, whether there is a debt-anchor or a target fiscal balance – fiscal policy has to become pro-cyclical in a downturn and exacerbate the decline in non-government spending.

Both targets would lead to irresponsible fiscal policy.

Conclusion

There was more that I could have considered in this IMF Report – all nonsensical.

The paper demonstrated scant regard for our history – current account deficits, household saving, private debt levels etc.

It imposed fiscal rules on false relationships as if it was telling us something about reality.

And it was not worth reading although I have already been asked about it by the press for comment.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Dear Bill

Another great post! Discussion especially relevant here in Norway, where issues of Household debt and fiscal strategy & oil fund are very much in the news. Would love to see an academic paper rebutting this fiscal rule modeling, but have not so far seen any that engage directly with them?

Thorvald- there is an article by Bill on this blog from 2014 dealing with the Norwegian ‘wealth fund’.

See: https://billmitchell.org/blog/?p=28913

‘… followed by some sustainability concerns, at least in the context of Australia maintaining its AAA rating on sovereign debt, particularly since Standard and Poor’s placed the Australian sovereign’s AAA rating outlook at negative in 2015 … ‘. Amazing they still write this gibberish. The entire thing is nonsense of course but I find this bit outright insulting.

I feel your frustration Bill when you and your branch of economics knows how to financially address our most serious problems of high real unemployment and underemployment, how to adequately fund vitally important government services such as education, healthcare, pensions and public infrastructure and most urgently the transition to environmental sustainability. The mainstream of economics and politics generally ignore the truth and just march in unison towards economic disfunction, appalling levels of wealth inequity and ultimately environmental destruction.

I should also include industrial and manufacturing destruction in the case of Australia where one of my previous employers Toyota Australia and the entire Australian automotive manufacturing industry was forced out by the neo-liberal obsession with totally free trade with low labour cost and technologically capable nations like Thailand and China. The Toyota Altona plant was a $2 billion asset that was still state of the art for current generation conventional and hybrid vehicle manufacture and had higher levels of productivity and quality than the almost identical Toyota plant in Thailand that was built at about the same time. Due to higher Australian labour and government imposed costs the cost of production for the same model, the Camry, in Thailand was however about 10% less on average depending on currency movements. When the Paul Keating Labor government ended its term in office the tariff on imported vehicles was 15% and this was sufficient to ensure a profitable local car manufacturing industry with considerable exports. Holden at various times also were able to export but Detroit often got in the way and after the GFC Obama was not going to let Holden export to the US given the huge bailout given to the US owned manufacturers. Ford gave up on Australia when Canada offered a much bigger subsidy for a new engine plant and so Ford Geelong was left with the obsolete in line six cylinder engine and the Falcon and Territory were denied export access by Dearborn.

The industry was set up to fail by John Howard when he signed the Thailand Australia FTA and cut the tariff from the minimum needed 15% to 10% and eventually to a meaningless 5%. At the same time an erratic subsidy system was put in place but this was constantly denigrated by the neo-liberal mass media and ‘free market’ experts as a wasteful subsidy for ‘lazy’ and ‘inefficient’ multinational car companies. Well now the most productive segment of Australia’s manufacturing industry is being closed down and most of the Australian public believe the lies they have been told for the last two decades.

There is however some hope globally with some political movements centred on Bernie Sanders, Jeremy Corbyn and possibly Jacinda Adern in New Zealand as well as the international Green movement that promise a better way. Even here a full embrace of competent macroeconomics has not been completed but there is definitely pressure for this to occur.

In Australia the Labor Party remains firmly neo-liberal in the vitally important areas of fiscal policy, full employment policy, international trade policy and ensuring the Australian people receive just compensation for the exploitation of our mineral and energy resources. The government guarantee for our banks must also be removed with only depositors deserving of a guarantee but at least we gained a Royal Commission into the much despised banking sector ( the MMT economists must make a submission even if it is to be ignored).

In Europe the level of dissatisfaction with the neoliberal ‘progressive’ and conservative ruling establishment is at record levels but an overwhelmingly neoliberal commercial and state owned mass media keeps much of the populace confused and so counter productive election of far right ultra nationalist parties and leaders continues to occur. I believe this is by design as the last thing the neoliberal ruling elite and the corporate/banking oligarchy want is economically competent progressive governments and parliaments that will expose and undo their disfunctional policies of the last 30+ years. The case for reform is overwhelming and eventually the Eurozone will fall apart.

Thanks Simon for reference to blogpost, recall having read long time ago. Still valid points

Just what the heck is wrong with IMF?

What a bunch of pathetic criminals.

“advocating a principles-based approach rather than a numerically-oriented, rules-based fiscal framework. ”

Oh, so, like a self-help book, then. At least those are useful for burning.