It's Wednesday, and as usual I scout around various issues that I have been thinking…

An MMT response to Jared Bernstein – Part 1

There was an article posted by American political analyst Jared Berstein yesterday (January 7, 2018) – Questions for the MMTers – which I thought was a very civilised exercise in engagement from someone who is clearly representative of the more standard Democratic Party view, that the US government has to move towards balancing its fiscal position and reducing government debt in order to meet the social security challenges posed by an ageing population and the accompanying increase in dependency ratios. He is sympathetic to Modern Monetary Theory (MMT), given that he wrote “there’s no distance between my views and a core principal of MMT: the need for deficit spending when the economy is below full employment”. In other words, he notes that “MMT or whomever else argues on behalf of expansionary fiscal policy is correct”. But that is a fairly standard ‘progressive’ position when the economic cycle is below full capacity. This position typically alters quite dramatically when so-called longer terms considerations are brought into the picture. Jared Bernstein worries about the inflationary consequences of fiscal policy (so do MMT economists by the way) and thinks central banks should be the primary macroeconomic policy makers (MMT economists reject this). He also thinks that if the government doesn’t sell bonds to match its deficits then there will be “currency debasing”. MMT economists have pointed out the fallacies of that proposition but he is still in the dark about it. And he also things that fiscal position should be balanced at full employment. MMT economists do not agree with that proposition pointing out that it all depends on the state of saving and spending decisions in the non-government sector. It is likely that continuous deficits will be required even at full employment given the leakages from the income-spending cycle in the non-government sector. So while his queries are conciliatory and written in an inquiring fashion, the gulf between this typical ‘progressive’ view of macroeconomics and MMT is rather wide. This is Part 1 of a two-part series that responds to the questions that Jared Bernstein raises and hopefully puts the record a bit straighter.

Jared Bernstein was close to the Obama Administration and has clearly articulated a ‘progressive’ viewpoint within the strange milieu that is American politics.

It is also getting more strange by the week – from the outside anyway.

He currently is associated with the Center on Budget and Policy Priorities, which is a US ‘think tank’ that says it researches “federal and state policies designed both to reduce poverty and inequality and to restore fiscal responsibility in equitable and effective ways”.

Their list of policy priorities conforms squarely with my own values – health, low-income assistance – food, housing, climate change, pension systems.

But the devil is in the detail and I think they over obsess about whether the US government can afford these progressive programs.

Their analysis of the Trump tax cut disaster has focused on the effects on the deficit using statements such as “adding nearly $1.5 trillion to deficits over ten years” to scare people into abandoning political support for the Republicans.

This analysis, has, in turn, been used by Democratic Party politicians and economists supporting them to relentlessly attack the tax cuts on the basis of their implications for the deficit.

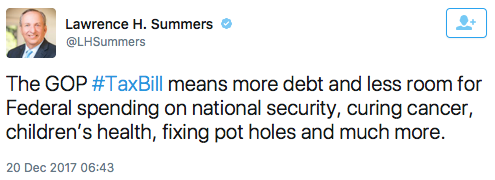

For example, Lawrence Summers – he of the “Committee to Save the World” – tweeted late in December (20/12/2017).

This view is erroneous in fact but representative of the demise of a true progressive opposition in the US.

I discussed this issue in detail in this blog (November 9, 2017) – When neoliberals masquerade as progressives.

Also, see this blog for my analysis of the track record of Lawrence Summers in the lead up to the GFC – Being shamed and disgraced is not enough (December 18, 2009).

With the idiocy of the Trump administration in full glare, the Democrats should have an open door to regain political control in the US.

But all they seem to obsess about are deficits.

As an aside, on the misleading way in which social media is used, I saw a tweet from a New York Times columnist (Bret Stephens) yesterday, which announced:

BretStephensNYT: What single payer looks like in Britain: mobile.nytimes.com/2018/01/03/wor…

The inference in Stephen’s tweet was that if the US pursued single payer medical care system it would end up like the British system.

The link was to this NYT article (January 3, 2018) – N.H.S. Overwhelmed in Britain, Leaving Patients to Wait.

It documented the difficulties the National Health System is facing as ideologically-motivated austerity cuts are hacking into the capacity of a formerly excellent health care system to survive.

The state of the British NHS at present tells you nothing about the effectiveness of single payer health systems. It just demonstrates what happens to public services when the government stops funding them.

I would urge subscribers to abandon the NYTs. It has become a neo-liberal mouthpiece.

Anyway, the issue of taxes and more was raised by Jared Berstein in his – Questions for the MMTers – and given his article reflected his curiosity and civility, I thought it would be worth responding because he raises some points that are often misunderstood by the broader MMT community even, as well as the wider audience.

I am also writing this from a global perspective, rather than a US-centric position. Every nation has institutional and cultural nuances that intervene in discussions about political realities.

It may be that the US has more institutional constraints on government than other nations. I doubt that and I am not ignorant of the institutional structure that the US government works within, including the legislative structure.

The point is that when you start digging into the specific structures you usually find commonality – that the elected government has the capacity to change things (change voluntary constraints it has previously embedded) if there is sufficient political will to do so.

For example, it is often claimed that the US central bank is ‘independent’ of the elected government, a point that Jared Bernstein makes (see below).

But the Board of Governors of the Federal Reserve “is a federal government agency consisting of seven members appointed by the President of the United States and confirmed by the U.S. Senate” (Source).

The Federal Reserve Act could also be amended at any time there is legislative will to allow the President to sack the central bank governor when he/she chooses.

Similar arrangements exists in most nations.

The point is that what looks like constraints on government are often just a reflection of the current political outlook and ideology and if there is sufficient support for change then the nation state typically has that power.

As we explain in our latest book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017) – the Right have used that legislative power to advance their own agenda while the Left has been duped into believing that globalisation, think tanks and lobby groups have rendered the nation state impotent.

Far from it, these powerful political forces (think tanks, lobby groups) have co-opted the state and its legislative machinery. It is just that the progressive side of politics still raves on about the dangers of deficits etc and refuses to organise properly around a truly progressive agenda.

Overheating is possible, and taxing is a lousy mechanism for dealing with it

This is the first thing that Jared Bernstein “doesn’t get” about Modern Monetary Theory (MMT).

He asserts that:

To dial back fiscal stimulus, MMT’ers argue for tax increases.

His objection is that tax increases are politically tricky to engineer and, “don’t happen quickly”. Further, there is a “huge industry to fight you tooth and nail”.

He thinks that the better way to stop an “overheating” is for the central bank to “take money out of the economy” because it can do that “without political interference”.

First, the view that the core (academic) MMT position relies solely on tax increases for counter-cyclical macroeconomic stabilisation is not accurate.

The misunderstanding arises from the discussion within MMT on the role of taxes, which has its roots in the functional finance literature developed by Abba Lerner in the 1940s.

MMT is emphatic that an intrinsic characteristic of a fiat currency system is that tax revenue is not required to fund government spending.

Please read my blog – Taxpayers do not fund anything – for more discussion on this point.

Within that discussion, the MMT literature indicates several other ‘functions’ that taxes play in the monetary system, none of them related to ‘funding’ government spending.

Note, as per above, it may ‘look as though’ taxes are financing spending – if the institutional machinery requires certain accounting machinations to be satisfied – but intrinsically it is not the case.

MMT says that the imposition of taxes creates unemployment within the non-government sector which can then be absorbed through appropriate government spending.

Which means that if there is mass unemployment, then, either taxes are too high or spending too low (or a mix of both).

MMT also points to the resource allocation impacts of taxation (for example, taxes on tobacco or carbon to discourage use).

MMT argues that taxation changes is one of several fiscal instruments that can be used to moderate or stimulate total spending in the economy, which then allows the government to regulate price pressures that arise from nominal demand outstripping the capacity of the economy to respond in real terms (producing goods and services).

Abba Lerner wrote in his 1943 article – Functional Finance and the Federal Debt – (page 39):

Government should adjust its rates of expenditure and taxation such that total spending in the economy is neither more nor less than that which is sufficient to purchase the full employment level of output at current prices.

This was his famous “steering wheel” analogy – where the government adjusts policies to keep the vehicle on the road!

Lerner outlined three fundamental rules of functional finance in his 1941 (and later 1951) works, the first rule being that:

The government shall maintain a reasonable level of demand at all times. If there is too little spending and, thus, excessive unemployment, the government shall reduce taxes or increase its own spending. If there is too much spending, the government shall prevent inflation by reducing its own expenditures or by increasing taxes.

References:

Lerner, A. (1941) ‘The Economic Steering Wheel’, University of Kansas Review, June.

Lerner, A. (1943) ‘Functional Finance and the Federal Debt’, Social Research, 10, 38-51.

Lerner, A. (1944) The Economics of Control, New York, Macmillan.

Lerner, A. (1951) The Economics of Employment, New York, McGraw Hill.

Please read my blog – Functional finance and modern monetary theory – for more discussion on this point.

However, for the record, Lerner’s 1977 article – From Pre-Keynes to Post-Keynes – published in Social Research, 44(2), pp.387-415 is much more nuanced. The link, by the way, is to JSTOR and a subscription is needed.

He was reflecting on policy in the context of stagflation which emerged following the OPEC oil shocks and paved the way for the neoliberal dominance.

Lerner essentially argued that the propensity for wage-price spirals to form as cost pressures mount (say, from an imported raw material rise) made it difficult to apply the simple ‘steering wheel’ approach – turning on the net spending spigot (via tax and/or spending changes).

MMT also consistently advocates government efforts to ensure that real wages broadly rise in proportion to labour productivity growth, as an inflation-suppressing strategy.

In this light, Lerner suggested a range of wage-price measures in his 1977 article. In other words, he introduced additional policy tools to discipline inflation biases.

He thought that unless these institutional biases towards inflation were addressed, ‘demand management’ policies will not work very well.

It is important, though, to understand that he was talking about stagflation, which he separated into two components: “stagnation and inflation”.

He wrote that:

The stagnation component (inadequate total spending at the current wage and price level to yield full employment) calls for macroeconomic governmental measures for increasing total spending. The inflation component, which cannot be excess-demand inflation, calls for microeconomic market adjustments of wages and prices, with the government only internalizing an externality by administering the wage-increase permits.

In other words, an understanding of the context is important. If inflation is accelerating as a consequence of excessive spending yet unit cost pressures are not present, then the basic principles of functional finance remain valid.

One might also read Mathew Forstater’s Levy Working Paper No. 254 – Toward a New Instrumental Macroeconomics: Abba Lerner and Adolph Lowe on Economic Method, Theory, History and Policy – for an excellent account of the way in which fiscal policy can work.

One would argue that the current neoliberal period, where real wages growth have lagged significantly behind labour productivity growth, that any inflationary pressures are likely to be of the more simple type – excessive nominal spending growth.

But the point is that raising taxes to stifle such excessive nominal spending is one option only but not necessarily the preferred MMT option.

Typically, a mix of fiscal responses will be required depending on the circumstances, the existing tax and spending structure, the state of income and wealth distribution in the particular country, how fast inflation is accelerating, and more.

The core (academic) MMT group would never say that any national government should rely on taxes to fight an inflationary spiral.

Further, governments have shown they can cut spending quickly and still prosper politically, if the political forces are aligned.

There are many areas of government spending that can be wound back without impacting significantly on the well-being of most of us or invoking distributional consequences that would have negative impacts at the lower end of the income distribution.

For example, consider the incidence of corporate welfare, which includes “a government’s bestowal of money grants, tax breaks, or other special favorable treatment for corporations”.

The so-called “Socialism for the rich, capitalism for the poor” or “privatising the gains and socialising the losses” is rife in most fiscal systems, especially in this neoliberal period.

While conservatives rail against governments spending on public health and education or income support for the poor, the reality is that corporate welfare spending often dwarfs these progressive targets.

The 1993 article by Daniel Huff and David Johnson – Phantom Welfare: Public Relief for Corporate America – published in the Social Work journal [38(3), pp.311-16)] – quantified the extent wo which federal subsidies in the US benefit the corporate sector.

In 1993, they estimated this largesse to be “in excess of $150 billion a year”, which “represent a major redistribution of wealth that partially accounts for the growing gap between the rich and the poor”.

Not much has changed since they published their research.

There are huge opportunities within the military-industrial complex in the US to make cyclical cuts, which will attenuate nominal demand growth and multiply through the economy.

A social democratic government elected on a broad progressive consensus and a willingness to acknowledge MMT principles would be in a position to resist the neoliberal aspirations of those corporate interests who would fight “tooth and nail”.

During the full employment era following the Second World War and before the neoliberal dominance, governments regularly resisted the conservative lobby groups, which was one of the reasons the corporate sector in the US engaged Lewis Powell.

Please read my blog – The right-wing counter attack – 1971 – for more discussion on this point.

Neoliberalism is not inevitable.

There are other considerations.

Significant forward planning is required to ensure that the fiscal policy can be relatively responsive to the cycle. MMT economists are fully aware of the technical, legislative and implementations lags that can accompany large-scale public spending.

But well thought out preparation and well planned projects can allow the government to turn on spending fairly quickly in a downturn and turn it off (or restrict it) in times of high pressure.

For example, the decision by Norwegian authorities to fast-track the construction of Oslo Airport at Gardermoen was a highly effective fiscal intervention to ease the pain of the 1992 recession.

While the location of the airport was controversial, the intervention was effective and finite. It also carried scale such that components could be expanded or restricted at fairly short notice to meet with the changing cyclical conditions.

Another good example is the highway projects in Japan. The Japanese government has a well-designed infrastructure plan in place that allows it to expand and contract government spending to extend the highway and related infrastructure (bridges, waterways etc) to suit cyclical conditions.

This type of spending can be highly responsive with minimal lags.

There are many other examples.

Further, MMT economists realise that the expansionary and contractionary capacity of tax changes are dollar-for-dollar less than for public spending changes.

Tax cuts in a downturn are in part saved and are subject to longer lags than government spending injections. The reverse occurs in an upturn with tax hikes.

Tax changes operate through shifting private spending decisions as disposable income is impacted. Those behavioural shifts take time.

Whereas government spending shifts are direct and can add or subtract dollars to and from the economy virtually immediately.

So to claim that MMT economists are biased towards the use of tax hikes to pull back an overheating economy is more than inaccurate.

Finally, MMT economists also recognise that inflation can come via exchange rate movements, which may require specialised policy responses.

For example, if there are speculative capital outflows which put downward pressure on the currency in the foreign exchange markets then MMT economists would suggest capital controls are an effective way to stabilise the currency and prevent the inflationary impacts emerging. Iceland’s recent use of capital controls demonstrates the effectiveness of this strategy.

But it is true that discretionary cuts in spending and/or increases in taxes will create unemployment, which is the way that generalised fiscal stabilisation works to curb excessive spending.

In this context, MMT also emphasises the role of the automatic stabilisers, which exploit the inherent fiscal parameters to moderate spending changes (up or down) as the economic cycle changes.

The automatic stabilisers serve to moderate the effects of income changes on spending in two ways. First, the initial income changes impacts on disposable income. Second, changes in disposable income then translate into spending shifts.

Once again, one needs to analyse the specific situation. The automatic stabilisers in the US are somewhat weaker than in other advanced nations because the welfare state is less pervasive.

But the difference has been estimated to be relatively small (see Automatic stabilisers and the economic crisis in Europe and the US.

In general, the cycle impacts on the tax revenue that the government receives. When times are bad and output and employment falls, tax revenue declines, which pushes out the fiscal deficit and attenuates, to some extent, the decline in total spending.

Remember that part of the income that is lost would have been taxed anyway.

But if I was to consider this impact in the US, I would conclude that the stabilisation coming from the tax structure is fairly powerful.

It appears that when the US economic cycle improves tax revenue booms. The Clinton surpluses point to that as do the way in which the fiscal deficit has declined sharply in the US in the current period despite there being significant remaining labour underutilisation remaining.

But can we rely on that degree of stabilisation to ensure there is enough counter-cyclicality in-built into the fiscal structure? I doubt it.

Which is why MMT advocates strengthening of the automatic stabilisers via the – Job Guarantee – a major innovation that many critics seem to hate.

Once you understand the mechanisms through which the Job Guarantee work, you soon realise, for example, that progressives who advocate Basic Income Guarantees have no concept of an inflation anchor.

The link above takes you to the vast number of blogs I have written about the topic.

Essentially, the Job Guarantee renders the automatic stabilisers very powerful and ensures that government spending become highly counter-cyclical.

By shifting workers from the inflating sector to a fixed price sector, the spending associated with the Job Guarantee will provide that inflation anchor without creating mass unemployment and increased poverty, typically associated with contractionary fiscal policy.

The Job Guarantee is an example of spending on a price rule rather than a quantity rule, the latter being the typical fiscal approach. In other words, the government announces a fixed wage at which it will employ any number of workers who cannot find work elsewhere.

Whereas a quantity rule, allocates a certain monetary outlay and then competes at market prices for the resources. Such an approach cannot provide an inflation anchor.

I won’t go into any more detail about that (for space reasons).

The point is that the Job Guarantee creates what I have called ‘loose’ full employment to distinguish the resulting state from an economy where all labour is being employed at market-determined wages.

The desirable outcome is that the Job Guarantee pool is low. But its cyclicality provides a powerful inflation anchor.

But the application of the policy still requires that the government initiates the transfer of workers from the inflating sectors of the economy to the fixed price sector (JG) through spending cuts and/or tax increases.

That is the reality of a monetary economy where nominal aggregates compete for real resources.

Fortunately, we do not get many periods where a government has to invoke these type of measures.

I note that some commentators (no links to stop them getting unwarranted advertising revenue – click bait) have tried to piggy back off Jared Bernstein’s queries by claiming that Modern Monetary Theory (MMT) does not have an inflation theory.

Either they cannot read, cannot understand what they read, have never watched videos from key MMT academics on the subject or are just plain spiteful and seeking attention. Probably the latter.

There is a well articulated theory of inflation embedded in the academic MMT literature and I have written and spoken hundreds of thousands of words on the topic (which was after all the topic of my PhD thesis).

Please read my blog – I wonder what the hell I have been writing all these years – for more discussion on this point.

The MMT textbook (Mitchell, Wray and Watts) has a very well articulated section on inflation. See the introductory version – Amazon.com.

The more advanced text will be published by Macmillan in October 2018, which offers a more detailed analysis of how inflation occurs and what can be done about it.

How does a central bank ‘take money out of the economy’?

In rejecting the use of fiscal policy to stabilise an ‘overheating’ economy, Jared Bernstein advocates a reliance on the central bank.

He wrote:

That’s why we have a Federal Reserve that can quickly and without political interference decide to take money out of the economy (to be clear, monetary policy also has distributional implications). That seems like an immeasurably more reliable way to handle the overheating problem, but I don’t think the MMT crowd agrees, or at least I don’t understand where the Fed and interest rates exist is their cosmology.

What does the claim “take money out of the economy” mean?

Does he think that the central bank ‘controls’ the money supply which was the basis of Monetarism in the late 1960s and beyond? Attempts to do so failed badly and were quickly abandoned.

If he believes that then you know he doesn’t understand the way the central bank and the commercial banking system operates.

The fact is that within their remit, central banks cannot control the money supply which means they cannot take money out of the economy as he suggests.

Sure enough, as per above, the US government could change the Federal Reserve Act to allow the Board of Governors to confiscate

reserves from the banking system, which would just compromise financial stability and be a stupid policy. It would have no impact on bank lending, which we know is not reserve constrained.

The main policy tool that the Federal Reserve and all central banks have at their disposable is the ability to set the short-term policy interest rate, which then condition the term structure (other interest rates at longer maturities).

Certainly, the central bank can alter this rate at will. But whether that capacity is sufficient to act as a powerful counter-stabilisation force is moot. MMT academics definitely do not think so.

We have seen many things during the crisis that bear on policy effectiveness. One of the most glaring things that should be obvious to anybody who has been keeping their eye on the ball is that central bank policy tools are very ineffective in influencing the inflation rate.

Central banks around the world have been running near zero interest rates at the short end for nearly a decade now, with the concomitant reductions in the investment rates at the longer maturities.

They have been swapping reserves for government bonds in massive proportions – thinking that the extra cash would lead to a flood of lending and push up prices.

Nary a nudge in the official price indexes has been observed.

MMT economists indicated all along that such quantitative easing would not stimulate aggregate spending. The only way it could have was via the reductions in the investment rates in the maturity ranges the central banks were targetting.

The QE increased demand for bonds in those ranges which suppressed yields and rates associated with other financial assets within that range thus fell as well.

But with the parlous state of the economy, not even lower interest rates would stimulate demand for loans.

The point is that the demand for loans is not determined by the volume of bank reserves. Rather it depends on the expectations of returns and in a gloomy environment no one will borrow even if credit is cheap.

The same works in reverse. In high pressure times, the expectation of high profits would be strong and the demand for credit would remain strong even if rates went up.

It is possible that if the central bank hiked interest rates to very high levels that widespread bankruptcy would occur in the home mortgage market and that would impact on overall spending.

But no responsible government would allow that sort of counter-stabilisation to be used as the default given the devastation it would cause and the fact that it would impact badly on those least able to defend themselves (low income groups etc).

This also raise the additional issue that MMT economists point out.

Monetary policy has ambiguous impacts. An interest rate rise benefits creditors but punished debtors. What is the net effect of this distributional shift? No central banker can tell you.

I thought the Financial Times article (October 5, 2017) – Fed has no reliable theory of inflation, says Tarullo – was interesting in this regard.

It interviews a recently retired US Federal Reserve Board member (Daniel Tarullo), who told the FT that:

The substantive point is that we do not, at present, have a theory of inflation dynamics that works sufficiently well to be of use for the business of real-time monetary policymaking.

Further, MMT economists note that the time lags in the use of monetary policy are uncertain. Even if there is a spending sensitivity to large shifts in interest rates (small shifts are unlikely to carry any sensitivity), the impact works indirectly through changes in the cost of credit which then have to alter other spending behaviour.

And, unlike fiscal policy which can be targetted by demographic cohort and spatially attenuated (to impact on specific regions), monetary policy inasmuch as it works at all is a blunt tool – a short of shotgun approach.

Finally, there is some thought that interest rate rises push up inflationary pressure given their impact on the cost structure of firms that have price setting power.

So it is true that MMT economists favour fiscal policy as the main counter-stabilisation tool over monetary policy. Monetary policy is not an effective tool as the last decade has demonstrated.

Conclusion

I will conclude this series tomorrow with Part 2 where I consider whether a central bank can obstruct a government intent on fiscal stimulus/contraction; whether at full employment the fiscal balance has to be zero (it does not!) and whether in order to spend the national government needs to raise taxes.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

“But its cyclicality provides a powerful inflation anchor.”

Probably worth mentioning that the JG is not only cyclical, but it is spatial and temporal as well.

Not all parts of a currency area reach maximum output at the same time or to the same extent. JG warms up the cold spots and cools down the hot spots – and it does this instantly and automatically.

Monetary policy has a significant time lag on its effect, and as any systems control engineer will tell you if you have a delay between the control input and measuring the feedback effect you will get a dampening harmonic that tends to throw the system out completely.

“I would urge subscribers to abandon the NYTs. It has become a neo-liberal mouthpiece.”

‘Become’?

” . . . I don’t understand where the Fed and interest rates exist is their cosmology.”

This is where interest rates ‘exist’ in this ‘cosmology’?

“Abstract

The rate of interest – the price of money {sic} – is said to be a key policy tool. Economics has in general emphasised prices. This theoretical bias results from the axiomatic-deductive methodology centring on equilibrium. Without equilibrium, quantity constraints are more important than prices in determining market outcomes. In disequilibrium, interest rates should be far less useful as policy variable, and economics should be more concerned with quantities (including resource constraints). To investigate, we test the received belief that lower interest rates result in higher growth and higher rates result in lower growth. Examining the relationship between 3-month and 10-year benchmark rates and nominal GDP growth over half a century in four of the five largest economies we find that interest rates follow GDP growth and are consistently positively correlated with growth. If policy-makers really aimed at setting rates consistent with a recovery, they would need to raise them. We conclude that conventional monetary policy as operated by central banks for the past half-century is fundamentally flawed. Policy-makers had better focus on the quantity variables that cause growth.”

Bernstein makes reasonable criticisms of MMT, I think. His basic point is that MMTers have not thought thru EXACTLY what the rules governing the central bank, treasury etc would be in an MMT regime. Designing a set of rules isn’t difficult, but it needs doing, else those still to be converted to MMT (like Bernstein) get the impression that MMTers are less than totally clued up.

One possible set of rules is basically that some central bank committee decides what the deficit in the next year or so shall be. It’s then left to politicians to decide on strictly political matters, like whether the deficit (or occasional surplus) is effected mainly by tax cuts or public spending increases. Bernanke expressed sympathy with that idea here (Para starting “A possible arrangement..”):

http://fortune.com/2016/04/12/bernanke-helicopter-money/

Another possibility would be to give politicians direct access to the printing press: i.e. have politicians decide what the deficit would be. That idea always produces a knee jerk reaction along the lines if “Weimar” and “Mugabe”. However, as one of the charts on Billyblog shows, there doesn’t seem to be much relationship between central bank independence and inflation. So with the possible exception of some South American countries, perhaps giving politicians access to the printing press would not be a disaster. See:

https://billmitchell.org/blog/?p=9922

I think one of the problems Jared has with MMT is shared by many, the concept that money does not have to be raised first before spending occurs. His idea that the Fed sets the budget deficit is just special pleading for household economics, I don’t think anyone can know what the deficit should be in advance. I think this is an important reason, that of uncertainty around budget outcomes at least initially causes people to rush to their safe space.

Ralph why should any part of government try to set private sector desired financial surpluses at all?

Ralph’s been asleep at the wheel.

Replacing the Budget Constraint with an Inflation Constraint

http://neweconomicperspectives.org/2015/01/replacing-budget-constraint-inflation-constraint.html

Is the way to go.

“His basic point is that MMTers have not thought thru EXACTLY what the rules governing the central bank, treasury etc would be in an MMT regime.”

Warren did this years ago with his banking rules.

The job of the central bank is to clear the cheques of Treasury and those of the regulated banks. And that’s about it. There is little else for a central bank to do. Arguably it could be replaced with a blockchain.

RE response to Bernstein….for sometime it has been a mystery to me why we speak of the necessity to use deficit spending to address unemployment-fundamental in MMT-and yet we do not have an index to underscore the adverse impact of unemployment on the economy? It is common sense. And recognizing is the seminal point in finding a solution to unemployment. We can’t fix a problem when we ignore its causes. and out of frustration I created a “law” I believe identifies the problem. Unemployment is a NO ONE WINS….the jobless lose, civility loses [Ferguson, etc.,], and the Market loses, to wit:…. to wit:

THE LAW OF DIMINISHED INCOME TO THE MARKET FROM UNEMPLOYMENT [hereafter D/UE LAW]

3% is the zero-sum threshold above which unemployment triggers diminished labor training and skills, under-utilizing capital resources, reducing the rate of productivity advance, increasing unit labor costs, reducing the general supply of goods and services–and the loss in income to the Market is compounded exponentially with each percentage point of increase in unemployment, above 3%.

Short Definition:

3% is the zero-sum threshold above which unemployment starts substantially undermining the Market–and the loss in income to the Market is compounded exponentially with each percentage point of increase in unemployment, above 3%.

Jim Green

Will Richardson,

I didn’t suggest government should “try to set private sector desired financial surpluses”. The private sector deficit or surplus is simply the result of government’s surplus or deficit respectively. And government’s “surplus/deficit” needs to be whatever brings full employment. I don’t think many MMTers would disagree with that.

Neil,

Central banks do quite a bit more than simply “clear the cheques of Treasury and those of the regulated banks”. Under the existing system, they adjust interest rates. In contrast, under the system I advocated above (where interest rate adjustments play much less of a role) CBs could determine the size of the deficit/surplus.

This is a nice and respectful reply. Hopefully Bernstein thinks it through and sources the links.

One thing I would add which is nitpicking and shouldn’t take away from the overall point. I know MMT’ers emphasize the demand side. Bill says: “But with the parlous state of the economy, not even lower interest rates would stimulate demand for loans.”

In my experience; however, during the Financial Crisis the supply side was just as critical. Even as the Fed was lowering interest rates to spur loan demand, i.e. “adding stimulus,” overleveraged banks were changing lending standards which led to many loans being turned down which would have previously (or even in a neutral lending environment) been accepted.

It’s also worth mentioning the balance sheet effects on the private sector depending upon the policy relied upon. Fiscal adds and subtracts private equity whereas monetary policy effects both fiscal through the interest earned on government bonds and private leverage through an increase or decrease of private loans. Single-minded reliance upon the central bank to spur loan demand will ultimately result in an over-leveraged private sector.

Looking forward to part 2.

A brief addendum to the above…..such an index, generated from this “law”, would underscore the importance of limiting unemployment-and as a justification for deficit spending to correct the problems caused by unemployment. Since WW II, in the U.S., and driven by our hysteria over communism-our job creation has been based on the fraudulent concept that “the market can provide anybody wanting a job, with a job”….it is PURE BS….and yet to this day….this fraud permeates our job creation policies-and in spite of the fact that this model has not resulted in a UE rate below 3% since 1953! Leaving millions jobless in its wake…it has also created drug-driven war zones in our inner-cities, in every major city-and created an epidemic of gun violence in America. Many years back Dr. Bill Mitchell propsed the Buffer Stock Employment Model-and it is a valid in addressing UE today, as then.

“Essentially, the Job Guarantee renders the automatic stabilisers very powerful and ensures that government spending become highly cyclical”

Hi Bill,

The above quote in your article might have a typo. Did you mean highly counter-cyclical?

So to ask, but has Mr. Bernstein been shown Bill’s work, and his response?

Thank you for an excellent and informative post, one that puts a lot of meat on the MMT bones. I, too, look forward to the sequel.

The point is Ralph CBs shouldn’t do anything more than clear cheques, because they are insufficiently accountable to the public. Parliament is perfectly capable of deciding what is required on its own. The spurts should advise, not decide.

Either you believe in democracy, or you don’t.

“…it is true that MMT economists favour fiscal policy as the main counter-stabilisation tool over monetary policy. Monetary policy is not an effective tool as the last decade has demonstrated.”

THAT is the problem with MMT. Indeed monetary policy is not an effective tool if you don’t have your hands on its lever. So why are we not campaigning to get rid of those stupid “self-imposed restraints” and make monetary policy effective? Why not push for the NEED Act HR 2990 to be reintroduced and passed? Lets cut through the BS.

What policy tools are available to combat cost-push inflation?

@Howard Switzer,

With respect, I think you need to re-read the 900 words that preceded that statement you quoted. (Onwards from “How does a central bank ‘take money out of the economy’?”)

It’s pretty clearly articulated why monetary policy CANNOT be effective, and it is not due to self-imposed restraints, but the limitations of monetary policy itself. In any case ‘self-imposed restraints’ is a term used almost without exception to describe the rules around fiscal policy: debt ceilings, bond issuance, etc.

What are the restraints to monetary policy that you feel could be changed to have the desired effect here?

Brillant article Bill. Abba Lerner’s 1977 article on controlling inflation is novel. He provides three options, his own wages- increase permit scheme, the Weintraub- Wallich tax income policy and the Seidman tax rebate scheme and a combination approach that is probably more effective. His realisation that cost- push inflation could be treated similar to a negative externality like pollution with a permit is enlightening. So a microeconomic instrument has been fashioned to deal with a macroeconomic problem.

RE: “… The point is that the demand for loans is not determined by the volume of bank reserves …”

• Can someone explain this. I understand that any particular bank is not constrained by its 10% of deposits reserve requirement (in the US). But if you look at the private banking sector as a whole – as a consolidated entity if you will – if deposits hit the 10x reserve level and the bank wants to make more loans (and deposits), presumably the big bank will approach the Fed and offer to sell some securities to increase its reserves. If the fed is then in a contractionary mood and refused to buy securities and increase reserves, wouldn’t that constrain lending? From a practical standpoint, doesn’t the Fed accommodate or restrict lending through open market operations through maintenance of the overnight rate and reserve levels?

@Francisco,

Don’t confuse reserve requirements with capital requirements.

When the bank creates the loan, it creates a deposit in the borrower’s account. As the borrower draws that down and pays that money to the vendor of whatever the loan was for, that transfer may affect the reserves position for the bank (it may not, if the vendor also banks at the same institution).

Securities are traded on a secondary market – the bank is always going to find a taker for their securities at some price. Or more likely they will chase deposits from other customers to ensure their reserve balances are sufficient. Or they just pay the penalty rate if they’re not.

But all of this is entirely orthogonal to the process of loan creation. Loans are made to credit-worthy customers, without any consideration of the reserve position of the bank.

If I’ve misunderstood your question, shout out.

RE: “… Don’t confuse reserve requirements with capital requirements. …”

– I’m not. Capital requirements (Equity/Assets) are one thing Reserve Requirements (Reserve Deposits/Deposits) something else.

– I did point out that the secario analyzed should be for one large consolidated entity in the economy.

RE: “… Securities are traded on a secondary market …”

– SAme. I’m assuming one consolidated bank. The bank therefore owns all the reserves so nothing to chase.

RE: “… Or they just pay the penalty rate if they’re not. …”

– But my assumption is the Fed is grumpy and wants to contract so not selling reserves.

RE: “… But all of this is entirely orthogonal to the process of loan creation. Loans are made to credit-worthy customers, without any consideration of the reserve position of the bank. …”

– But why wouldn’t it be a consideration if they have the meet the 10% reserve requirement? My point is that the reserve requirement doesn’t bite because the Fed stands ready to accommodate. If the Fed didn’t, then it WOULD bite. So indeed the multiplier is nonsense, but the reserve doesn’t bite only because of the nice Fed (or deficit spending Treasury) providing needing reserves reserves.