It's Wednesday, and as usual I scout around various issues that I have been thinking…

Renationalisation – when self-promoted genius becomes plain lame

There are times when so-called progressives outdo themselves with their (usually self-styled) ‘genius solutions’ to the ravages of neoliberalism. They come up with elaborate ‘solutions’ that people on the Left get feverishly excited about yet fail to see how obviously ridiculous these strategies are when all the options are allowed. They, in fact, step further into the mirky neoliberal world by trying to be progressive because they fail to see what the basic issue is. One recent example of this was the proposal by Britain’s Big Innovation Centre to divert the private sector into doing good for society in general. Apparently, the British government could resume control of the failing (privatised) essential services without laying out a single penny. This would apparently allow them to avoid running foul of Treasury borrowing limits yet satisfy the overwhelming desire by the British public for a restoration of quality services. It is clear that the British public are sick to death of the privatised services and are ready for a large revival of public sector activity. In that environment, why would the government, with such a powerful mandate and plenty of political cover, maintain the economic myths that were advanced to justify the (unjustifiable) sell-offs of public enterprises? Once we cut through these economic myths, it becomes apparent how lame these ‘solutions’, which perpetuate profit-seeking, corporate ownership of the essential services in Britain, really are.

British citizens want an end to neoliberalism

Motivating the ideas that follow was a recent report from the British Legatum Institute (released October 2017) – Public opinion in the post-Brexit era: Economic attitudes in modern Britain.

The Report provides a very recent snapshot of public sentiment in Britain and the summary results are striking:

1. “on almost every issue, the public tends to favour non-free market ideals rather than those of the free market”.

2. “Instead of an unregulated economy, the public favours regulation.”

3. “Instead of companies striving for profit above all else, they want businesses to make less profit and be more socially responsible.”

4. “Instead of privatised water, electricity, gas and railway sectors, they want public ownership.”

5. “They favour CEO wage caps, workers at senior executive and board level and for government to reign in big business.”

6. “They want zero hours contracts to be abolished.”

That litany looks like a categorical rejections of the major policy manifestations of neoliberalism.

Capitalism (the neoliberal version) is seen as “greedy, selfish and corrupt” and that sentiment spans the age-divide.

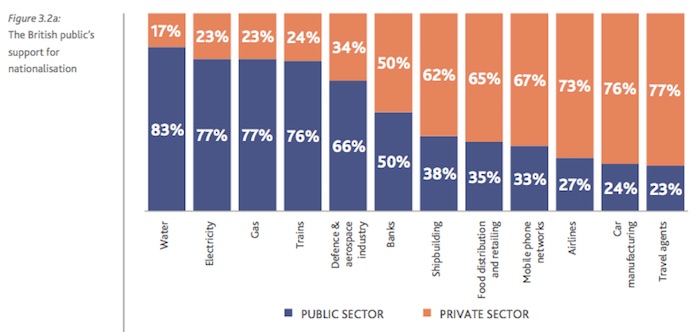

When asked to opine about the “public sector vs the private sector”, which goes to the heart of any proposals to reverse privatisation, the Report concluded that:

More than three quarters of the public say that water, electricity, gas and railways should be in the hands of the public sector …

Jeremy Corbyn’s pledge to nationalise railways has broad appeal across age groups and even among Conservative voters … This pattern is replicated for water, gas and electricity.

A categorical rejection of the privatisation agenda.

The following graphic summarised the results (Figure 3.2a in the Report).

The juxtaposition between “the free market vs the state” produced the following insights:

Regulation is deemed necessary, support for increased NHS funding is strong, zero hours contracts should be abolished and people’s obligation to pay taxes is deemed more important than rewarding them for working hard by allowing them to keep more of what they earn. Moreover, the public tends to favour increased taxation, bigger government and more spending as opposed to lower taxes, smaller government and less spending …

… even those who voted for the Conservative Party in 2017 tend to favour certain non-free market ideas.

The results are strongly anti-neoliberal across age groups, gender and political leaning. I will leave it to you to explore them in more detail – there is a lot of interesting data in the Report that I have not commented on for space reasons.

Whichever major utility you choose, the research evidence is that the privatisation in the UK has been disastrous.

For example, research from the University of Essex provides a damning picture of railway performance.

This summary article (July 8, 2016) – Chaos on Southern trains a symptom of Britain’s rotten privatised railway industry – documents the “interminable delays, last-minute cancellations and gross over-crowding of services” on the privatised Southern Railways service.

The operator responded to criticism with a new ‘solution’ – to “cancel 341 daily train journeys, representing 15% of its services”, apparently, to “provide their passengers … [with] … more certainty”.

We learn that the promises that were used to justify the privatisation of British railways in the 1990s at “bargain basement prices” (“better value for money”) have not been achieved.

Instead, “state subsidies have soared”:

… total government support to the industry soared from £2.68 billion in 1994/5 to £4.79 billion in 2014/15. Passengers are now enduring fare levels rising far faster than inflation.

Further, there is evidence that the Government’s “franchise model” is failing and the Government has been forced “as the operator of last resort” to “take over services” once the private operator has abandoned their role.

The basic conclusion is that the privatised system is “highly fragmented and inefficient” with losses rife and inflated fares for consumers.

On December 8, 2014, Corporate Watch published a report on the impact of privatisation in energy, rail and water – Energy, rail and water privatisation costs UK households £250 a year.

The title says it all:

– Households across the UK could save £250 each on their electricity, gas and water bills and train fares if the services were publicly financed.

– Private electricity, gas, water and rail companies pay out £12bn a year to investors and shareholders in interest and dividends.

– In total, cheaper government borrowing rates could save the UK public £6.5bn: £4.2bn on energy, £2bn on water and £352m on rail.

The Report concluded that:

To satisfy investor expectations, the bills and fares charged by the privatised companies continually outstrip inflation. Between 2007 and 2013, household gas and electricity bills rose in real terms by 41% and 20% respectively. In real terms, water bills have increased by 50% since privatisation, while rail fares are 23% higher than they were in 1995.

While advocating nationalisation, groups like Corporate Watch fall into the neoliberal trap by talking about the need for:

… government … to raise an equivalent amount of money to that currently invested in the companies …. raising taxes, cutting public spending in other areas, selling of other public assets … but most comparable to how the companies are currently financed would be borrowing from international markets.

They quote Financial Times economics journalist Martin Wolf as saying that government has “the ability to borrow cheaply”.

They then analyse the “impact on the public sector debt” but while rising, the utilities would pay for themselves and so the “extra debt taken on to bring the utilities into public ownership should not add to the deficit”.

Alarm bells ringing all over Britain! So-called progressives leading the neoliberal charge in perpetuating the standard economic myths about the capacities of the currency-issuing government.

Then genius becomes lame

Enter the ‘Big Innovation Centre’ which “convened the Purposeful Company Task Force in 2015” (overloaded with corporate heads, financial market players, business school academics and business consultants).

The UK Guardian journalist Will Hutton co-chaired the group and on May , 2016 it released its Interim Report – The Purposeful Company: Policy Report.

Their concept of the ‘Purposeful Company’ is a profit-seeking firm that where “Purpose informs its existence, determines its goals, values, and strategy, and is embedded in its culture and practice.”

Apparently:

… purposeful companies contribute meaningfully to human betterment and create long-term value for all their stakeholders.

Think hype and you won’t stray to far from understanding what this “Big Innovation” stuff is all about.

The problem with all this ‘innovation’ and so-called progressive way forward hype is that they are embedded in a mainstream economics mindset which erroneously claims there are intrinsic financial constraints that the currency-issuing British government must obey.

Once this thought regression enters the picture the degree of ‘progression’ in the ideas quickly vanishes.

As an example, the recent UK Guardian article (January 9, 2018) by Will Hutton – We can undo privatisation. And it won’t cost us a penny – unsurprisingly embraces the ‘Big Innovation’ idea with some fervour.

In his enthusiastic embrace of the ‘Big Innovation’ plan, Hutton also failed to see the obvious. They were playing into the neoliberal myths about currency-issuing governments and thus failing to offer a truly progressive solution.

Hutton recognises the message from the survey data that I summarised above. He thinks the results are “astonishing” and that “Jeremy Corbyn’s commitment to renationalisation surprised everyone with its popularity”.

One suspects if he think these results are “astonishing” and surprising then he has probably been spending too much time mixing with his corporate ‘task force’ which was clearly dominated by many of those who have benefitted the most from the privatisation.

So it is clear that the British public overwhelmingly want the utilities (rail, water, energy, etc) serving the public interest rather than generating “profit targets”.

But Hutton says that the problem with “renationalisation” is that it is:

… expensive: at least £170bn on most estimates. Of course the proposed increase in public debt by around 10% of GDP will be matched by the state owning assets of 10% of GDP, but British public accounting is not so rational. The emphasis will be on the debt, not the assets, and in any case there are better causes – infrastructure spending – for which to raise public debt levels.

And once owned publicly, the newly nationalised industries will once again be subject to the Treasury’s borrowing limits. If there are spending cuts, their capital investment programmes will be cut. What voters want is the best of both worlds. Public services run as public services, but with all the dynamism and autonomy of being in the private sector, not least being able to borrow for vital investment.

And there is the rub.

Hutton reframes the overwhelming sentiment against neoliberalism expressed in the Legatum Institute survey within a neoliberal frame, which, of course, then takes the argument down a non-progressive path.

Further, he not only invokes erroneous macroeconomic propositions but also perpetuates the basic myths of privatisation that private ownership is full of “dynamism and autonomy” whereas public ownership is not.

The extensive research evidence over the last 30 years of so demonstrates categorically that the privatised enterprises are anything but ‘dynamic’ or ‘autonomous’.

How can he suggest that the privatised British rail is autonomous when the extent of public subsidy has risen dramatically just to keep the franchises afloat?

Further, consumers are rorted with price rises well in excess of inflation, services have deteriorated, and the inefficiency is the norm rather than the opposite.

Of course, Hutton has a motivation for combining these two myths. After all, he chaired the ‘Big Innovation’ task force that is pro-corporate.

Which is behind his apparently ingenious plan to improve the public services “without spending any money”.

This is straight ‘Big Innovation’ stuff.

Apparently, the genius is to “create a new category of company”:

… the public benefit company (PBC) – which would write into its constitution that its purpose is the delivery of public benefit to which profit-making is subordinate. For instance, a water company’s purpose would be to deliver the best water as cheaply as possible and not siphon off excessive dividends through a tax haven. The next step would be to take a foundation share in each privatised utility as a condition of its licence to operate, requiring the utility to reincorporate as a public-benefit company.

The claim is that “Because the companies would remain owned by private shareholders, their borrowing would not be classed as public debt.”

Smart eh?

No payouts would be required because the “existing shareholders in the utility would remain shareholders, and their rights to votes and dividends would remain unimpaired”.

Brainwave!

Government would have no say in the “operational running of the industries”.

Autonomous!

Although the government could resume ownership if performance faltered.

In other words, no risk of enterprise is transferred from public to private sector.

The problem is that most of the research is pointing to the fact that these privatised franchises are struggling to make money independent of heavy government subsidies and massive fare and charge escalation.

And, into the bargain, the service performance of these privatised entities has been abysmal. Improving services to anything near to acceptable would add costs and/or eat into profits. Shareholders would revolt if dividends were cut.

How does that square with the creation of corporate entities that subjugate profits in favour of better service? Answer: it doesn’t.

There are many similar issues that arise from this ‘plan’.

But the essential problem with these ‘solutions’, which is also present in the Corporate Watch report (noted above), is even more basic.

The self-promoted ingenious solution by the likes of ‘Big Innovation’ – better service to the public without any increase in public spending – is predicated on false notions of the capacities of the currency-issuing British government.

Once we abandon those false notions, the ‘ingenious’ solution doesn’t look so smart at all. It looks plain stupid.

Consider the situation. The public is now overwhelmingly swinging away from the basic precepts that underpinned the dominance of neoliberalism.

The average citizen has learned the hard way how deeply flawed neoliberalism is. They have endured elevated levels of labour underutilisation, flat wages growth, declining real wages, increased precariousness of their employment, deteriorating public services in areas that really matter – water, power, transport, health, education – inflating charges for the same, bank collapses, and more.

They have come to ‘know’ through experience what a dud neoliberalism is.

They now favour a return of a larger public sector taking renewed control of the essential utilities. They also want labour markets reregulated to eliminate obscenities like ‘zero hour contracts’.

A government elected within that milieu will have a very strong mandate to reverse many of these neoliberal ravages.

It doesn’t take too much imagination to then realise that the public will be receptive to new economic ideas, which expose the fiscal myths that were used to justify a lot of these flunky privatisations in the first place.

Why should the public reject the basic precepts of neoliberalism yet hang on doggedly to the dodgy financial myths?

There is tremendous scope for a newly elected government in this environment where anti-neoliberal reforms are elevated to priorities to reframe the whole ‘public finance’ debate.

In the same way that such a government would have the political cover and legislative power to renationalise the privatised essential services, it could use that capacity to ditch stupid (and meaningless) constraints such as the Treasury borrowing limits, which have starved public enterprises in the UK

For example, such a government could immediately repeal the – Budget Responsibility and National Audit Act 2011 – which imposes unnecessary fiscal rules on the government.

In its place it should introduce a new fiscal charter – which might be called “The Full Employment, Social Equity, and Environmental Sustainability Act” – and would require it to use fiscal policy to advance those essential aspects of well-being.

In doing so it would eschew any notion of ‘fiscal deficit targets’ or ‘debt targets’ but reeducate the public into understanding that the fiscal outcome was not a sensible policy target and the fiscal outcome would be whatever was required to satisfy the objectives of the new ‘Act’.

Ideally, such a government would introduce new rules for the Bank of England, which would require it to take instructions from the Government on its spending priorities and facilitate the same with appropriate credits to relevant bank accounts.

Such a government would close the – UK Debt Management Office – as it would become redundant in this new era of progressive government and policy making.

Owners of previously privatised companies would be compensated in return for the resumption of public ownership, but the value of the companies would be discounted by the net present value of the public subsidies that the companies had received over the course of its operations.

In other words, this era would reverse the neoliberal rule where returns are privatised and losses socialised.

Once you realise all that is possible, then these elaborate manoeuvres to keep these essential services in the hands of private, profit-seeking corporations – specially constituted or otherwise – look pretty lame and just apologist.

Conclusion

Privatisation has failed.

The people know it.

The environment is changing. People are moving back to a more sensible view that public activity will serve their interests better than these sham companies that are parasites on the public purse while pocketing large profits for their owners.

In that situation, it is just a small step to further expose the economic myths that were expounded to justify these failed privatisations.

That is what my new book with Thomas Fazi (published September 20, 2017) – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World – is partly about.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Amen.

In NZ we need to start with the electricity industry. Prices have doubled in real terms since privatization began. Households are suffering.

Health costs of unheated homes on children enormous. Not enough investment in renewable energy.

In NZ we have a government with such a mandate, but poisoned by the myths, and kneecapped by a press that is brainwashed by orthodoxy, it does not have the insight or the cojones to take on the market. It has signed itself up to balanced budgets. That will be its downfall.

Bill the link at the bottom of the article to your new book fails.

Yes Greg you are right I am afraid.

I am more excited about Corbyn and UK Labour. I think we might see real change in the UK. Then NZ Labour might buck up their ideas. At the moment they are pretty vacant in terms of economic policy.

On the other hand, their hearts are in the right place. If we can just nudge them in the direction of a job guarantee and some deficit spending…. progressive economic conference anyone???

“I am more excited about Corbyn and UK Labour. I think we might see real change in the UK.”

Not really. Just a bit more tax and spend, but still fundamentally on a European Union one world globalism trajectory that means you can’t actually create more jobs than people that want them.

UK Labour is sticking with its ‘Scandinavian socialism’ fantasy – even though unemployment in Sweden is 6%.

Hence why labour are obsessed with the Single Market – even though that is all about propping up private sector jobs in large corporations.

The great beauty of unemployment from a political point of view is that unemployment benefit, guaranteed income and the like allows you to have a higher headline ‘minimum wage’ but the shortage of jobs means that the annual income in the gig economy is far lower. People have a job for three months and then are unemployed for nine.

The legatum survey seems to be cognitively dissonant with the continuous polling of 40% for the Tories with Labour on about 41%-which seems rigid at present. This could mean that neo-liberalism still has some legs.

I can only guess that there are still large numbers of people in the ‘I’m-alright-Jackist’ camp and that rising indebtedness of the poorest groups, food bank use, privatised scam and rip-off , crap jobs and grotesque CEO earnings (Britain is 3rd in the world rankings on this), although causing some concern , are outweighed by a desire not to ‘rock the boat’.

Labour is still very poor at challenging the myths -the let the Tories get away with everything:

‘Corbyn will bankrupt britian’

‘Corbyn is on planet venezuela’

‘ We’ll become Greece..’

There’s always a cavernous silence from Labour as if they have suddenly been afflicted with ‘selective mutism.’ Why-when these things can be challenged? And with the brexit hot-air debate dividing the ‘Left’ there is more gifting to neo-liberalism going on.

The quoted comment, “people’s obligation to pay taxes is deemed more important than rewarding them for working hard by allowing them to keep more of what they earn”, suggests that the UK public has not yet come to grips with the maxim that taxation does not underwrite government expenditure, nor have the politicians, including Corbyn. This could lead to a Deficit Dove position rather than the much more effective Deficit Owl position. And be a font, in utero, of future crises of the same kind. (A song from the Sixties comes to mind – Where Have all the Flowers Gone?.)

Hutton’s so-called ingenious solution is, as you indicate, moronic. I have never been convinced that he has ever understood the Keynesian principles of which he has indicated he is a supporter. And I doubt that he would support your more than sensible policy recommendations.

larry says:

Tuesday, January 16, 2018 at 21:48

I have always found Hutton, as a journalist, to be a disappointing damp squib. In The Observer, on 07.01.2018, he wrote about how (in spite of all the problems in the EZ), the Euro had “come through”. I wrote a letter to the editor suggesting that if Hutton really thought that the Euro had “come through”, then he should read Yanis Varoufakis’s recent books, detailing “in excruciating detail”, just what a disaster area the Eurozone is. (Needless to say, it wasn’t printed).

Dear Bill,

An interesting survey by the Legatum Institute.

However, admittedly without reading the report, I suspect it may have simply been a prelude for call to arms to counteract these nationalising desires of the UK public.

Please check out this excellent blog for the low-down on Legatum, as well as other right wing so-called “Think Tanks”:

https://ducksoap.wordpress.com/2017/11/28/legatum-institute/

Mike, I couldn’t agree more. Hutton’s position on the Euro shows he knows nothing. I would also recommend Varoufakis’s Adults in the Room. You are right. It is at times an excruciating read.

The people commenting here read and know things. I have hope that eventually actual knowledge will supercede the feeble proffering of cliche and received wisdom.

Reading about the Carillon debacle today in UK shows the relevance of this discussion.

I still agree that Corbyn’s Labour has a long way to go and has yet to embrace MMT.

However, after years of Blairism, I do at least hear them willing to challenge shibboleths like privatization. Which is something. I’d like to hear a bit more of that in NZ.

Neil Wilson, I guess I’m someone who has “fallen for” the Corbyn “Scandinavian Socialism Fantasy” as you put it. As I saw it though, Sweden of a few decades ago is the political/economic model to be inspired by rather than current Swedish policies that have themselves taken a neoliberal lurch. Sweden used to have full employment policies that viewed 3% unemployment as a disaster. http://www.diva-portal.org/smash/get/diva2:129267/FULLTEXT01.pdf That’s what I see Corbyn/McDonnell as emulating.

Something from Corbyn’s lot that is more MMT and less “old school Nordic” looks to be Angela Rayner’s “National Education Service” policy. It looks to me to do pretty much what is hoped for a Job Guarantee. If people can take up a bursary to do a relevant vocational (or other) training course at any point; then that bursary becomes in effect a Job Guarantee wage. It would also allow people to widen their skill base and hopefully be generally personally rewarding. When I heard about this I thought of someone I knew who wanted to train as a bricklayer to get better paid work than he got as a construction site labourer. Basically he could not afford to take an course with no bursary. A bursary would make all the difference and would help to ensure that wages etc for labourers were sufficiently attractive that they didn’t all walk out and train to do other work unless they really wanted to.

When Sweden decided to get back into the submarine business after foolishly selling Kockums to the German company HDW that basically starved Kockums of contracts, they sent in armed soldiers to sieze important equipment and documents at Kockums so that the former German owners wouldn’t strip the business before leaving.

I think something similar is needed once a genuinely progressive government wins office wherever that may be. The police should be sent round to escort 99% of the central bankers from their positions and a thorough purge of all neoliberals from all relevant ministries undertaken. Legislation in regard to truth in journalism similar to the Canadian legislation would also be essential. A crime commission to investigate and prosecute decades of white collar crime should also be established. The major banks should lose their government guarantees and exposed to true market conditions and competition from publically owned banks. When they fail their customers can find new providers.

The job must be done and far too many have suffered and died needlessly after 40+ years of destructive neoliberalism and austerity for the needed reforms to be compromised and corrupted.

If Reagan, GW Bush and Trump could have substantial deficits, then so can Jacinda Adern. Send in the police if any bankers or media moguls get in the way.

New Karolinska Solna University Hospital (NKS) is Swedens first PPP project in healthcare, a total disaster on any perspective. Exorbitantly expensive over all, new scandals come on all the time. All bathroom floors have partly negative slope on the floors and so on. Not so little the fault of right wing politicians in the Stockholm County Council. The focus was on architectural design and only after a competition had been held was there feedback from a medical perspective. But that also the left wing focuses these days, to focus on exterior kitsch. The project was even criticized by the then right-wing gov. finance minister, from a neoliberal perspective, he said PPP was for 3:e world countries that did have trouble borrowing, not the case for Sweden’s Count Councils that borrow cheaper than the private sector.

Despite this the present Social-democratic finance minister have recently advocated PPP to build and repair highways. She is obsessed having surplus, there have been general gov. surplus since 2015 and is projected to grow. Gen. Gov. gross debt is 38% and net surplus 23% of GDP. Sweden have about 300000 pensioners below EU:s poverty level, mainly women that cause of the system construction didn’t get enough pension points.

Neil Wilson

” a European Union one world globalism trajectory that means you can’t actually create more jobs than people that want them”.

Puzzling. Why would anyone want to create more jobs than people that want them? Is the your preferred policy aim to fabricate a bogus labour shortage?

I don’t get it (Oops, beginning to sound like Paul Krugman…).

Robert because there are more people that want jobs than jobs that are available.