It was only a matter of time I suppose but the IMF is now focusing…

Poverty among the unemployed now close to 50 per cent in the EU

Last week, Eurostat released it updated data covering people who are at risk of monetary poverty. In the press release/news page (February 26, 2018) – Almost half the unemployed at risk of monetary poverty in the EU – we learn that 48.7 per cent of unemployed persons in the EU “were at risk of poverty” in 2016, even “after social transfers” were taken into account. The situation has deteriorated significantly since 2005 as a result of the impacts of the GFC and the policy response taken by the European Commission and the Member States (under the EC’s thumb). While the usual suspects perform badly on these indicators (Spain, Greece, Italy), a stark result is that 70.8 per cent of German unemployed persons are at risk of poverty. This proportion has jumped from 40.9 per cent in 2005 (a 29.9 percentage point shift). So, even in the strongest Eurozone economy, the policy frameworks are delivering terrible outcomes. Increasing divergence and inequality and rising social exclusion are the most striking characteristics of the 13 years of European Union history since 2005. It doesn’t look like a policy bloc that any sensible nation should aspire to be part off (or remain within).

Relative and absolute poverty concepts

Eurostat defines “persons at risk of poverty” as being:

… those living in a household with an equivalised disposable income below the risk-of-poverty threshold, which is set at 60% of the national median equivalised disposable income (after social transfers).

This is a relative measure of poverty as opposed to absolute measures.

For more information see – Relative poverty, absolute poverty and social exclusion

Many conservatives claim that we should not worry about poverty in advanced nations because in absolute terms no one is starving.

It is obvious that a person living in a village in Africa that is malnourished and on the edge of death through starvation is in a different predicament to someone living below the standard poverty lines in a major city of a wealthy nation.

In the former case, we would say the person is living in absolute poverty, according to standards that apply to all societies across the globe.

Those standards are normally defined in terms of some ‘dollar-per-day’ benchmark. These benchmarks are not without controversy.

But they define poverty in terms of what is required to purchase some fixed quantity of goods and services that relate to basis necessities.

The World Bank focuses on absolute measures and on October 15, 2015 increased the poverty line to $US1.90 per day – see The international poverty line has just been raised to $1.90 a day, but global poverty is basically unchanged. How is that even possible?.

When you read official reports from one organisation or another that claim poverty is falling, you have to be careful to understand what the basis of the benchmark being used and how it has been adjusted over time to allow for nominal changes in prices.

Clearly, the $US1.90 benchmark has limited applicability for the advanced nations. That is not surprising, given that “The specific value of the international poverty line was, by design, anchored on the poverty thresholds used by some of the world’s poorest countries” (Source):

Which is why relative measures, which relate deprivation to some income (or consumption) level that is a proportion of a specific nation’s average (or median), were introduced.

The “capabilities framework” (Amartya Sen) was influential in this regard.

Accordingly, an individual has a “space of capabilities” available to them, which will likely be:

… that the same set of capabilities might require different baskets of goods and services in different countries (or at different times). The ability to stay warm might require different goods in the Central African Republic and in Poland. The goods and services required to effectively look for a job in a village in Uttar Pradesh and in Mexico City may well be different.

So as the British Poverty Site concludes:

… there should be certain minimum standards below which no one should fall … as society becomes richer, so norms change and the levels of income and resources that are considered to be adequate rises.

In the recent years, this concept has anchored debates about social inclusion and exclusion, in the sense that an individual cannot fully participate in society unless they have command of a certain quantity of real resources and that quantity will be vastly different in Australia relative to say, Mali (Africa).

Both concepts of poverty are valid and provide us with valuable information about societal trends.

The Eurostat data is clearly a relative concept.

The Eurostat results

The latest Eurostat data (February 26, 2018) – Almost half the unemployed at risk of monetary poverty in the EU – shows that:

1. Since 2006, “the proportion of unemployed persons at risk of poverty has risen continually, from 41.5% in 2006 to 48.7% in 2016”.

2. The “Highest share of unemployed persons at risk of poverty” is in Germany – “the widest gaps between the proportion of unemployed and employed persons being at risk of monetary poverty were recorded in Germany (70.8% for unemployed persons vs. 9.5% for employed persons, or a 61.3 percentage point gap) …”

3. “the rate of unemployed persons at risk of poverty was highest in Germany (70.8%), followed at a distance by Lithuania (60.5%). Over half of unemployed persons in Latvia (55.8%), Bulgaria (54.9%), Estonia (54.8%), the Czech Republic (52.3%), Romania (51.4%) and Sweden (50.3%) were at risk of poverty.”

I examined the time series data relating to this issue and produced the following graphs.

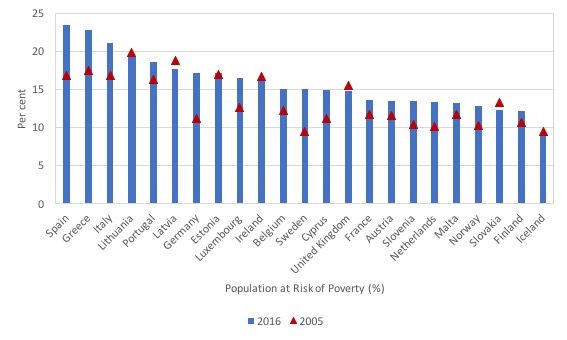

The first graph compares the ‘risk of poverty’ measure for the overall populations in 2005 (red triangles) and 2016 (blue columns, latest data).

The data is ranked from high to low as at 2016.

The rise in the ‘at risk group’ in the overall population has been obvious in most of the European nations that Eurostat presents consistent data for.

Unsurprisingly, Spain, Greece and Italy are the worst performed nations in 2016 and have deteriorated significantly since 2005.

The performance of Germany is particularly interesting given it is held out as the ‘engine-room’ of the Eurozone. Overall, it has endured the second largest deterioration over the period (5.9 percentage points). Spain had the largest deterioration (6.6 percentage points).

Interestingly, the nations that endured the largest bank crash in the GFC, Iceland, has marginally improved its position on this measure.

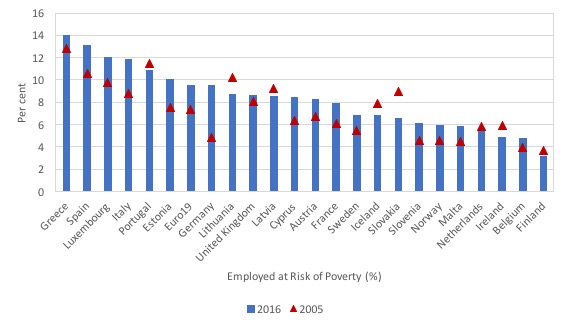

The next graph shows the ‘at risk’ data for those in employment in 2005 and 2016.

Again, the majority of nations in the sample experienced deteriorating situations with Greece and Spain, once against the worst performed.

While Germany was the 8th worst nation in the sample on this measure, it produced the largest shift in the indicator – from 4.8 per cent to 7.1 per cent of employed persons at risk of poverty. No doubt this is partly due to the rise of the Minijobs after the Hartz changes.

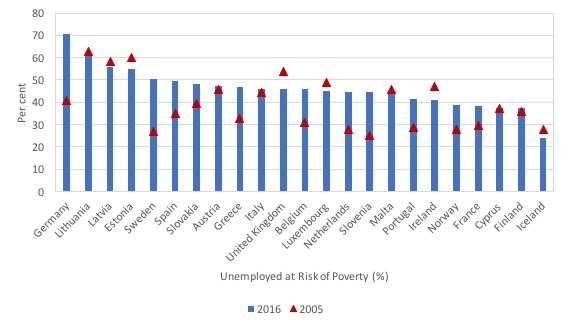

Finally, the next graph shows the ‘at risk’ data for those who were unemployed in 2005 and 2016. Germany stands out, with a massive 70.8 per cent of its unemployed ‘at risk of poverty’.

The Baltic States clearly have held the situation relatively constant but have not reduced the risk exposure of their rising jobless pools.

Iceland, again, stands out at the lower end. This is a nation that has used its currency sovereignty to ease the burden of the GFC crash on its people. It has allowed its exchange rate to take a significant proportion of the adjustment, as opposed to the Eurozone nations that have adjusted, in part, through internal devaluation.

At any rate, the overall conclusions of Eurostat are staggering. The obvious conclusion is that on the things that matter – employment, unemployment, social inclusion – the European Union is not delivering acceptable outcomes. The Eurozone, in particular, has failed dramatically in this regard.

Poverty and behaviour …

The mainstream economics mantra is that poverty can be understood in terms of individual preference and agency.

In the same way that unemployment was recast to be an individual problem – laziness, lack of job search effort, excessive real wage aspirations, distortions arising from the welfare system that subsidises leisure (for example, unemployment benefits) – poverty is also constructed as arising because people will not help themselves.

Just prior to the latest Eurostat “at risk of poverty” data release, I read an interesting article from a US researcher in the field of behavioural science (February 19, 2018) – How poverty changes your mind-set.

The author (Alice G. Walton) motivates the discussion with reference to political developments in the US with respect to poverty and welfare provision.

She quotes a Republican senator from Utah as saying:

I believe in helping those who cannot help themselves but would if they could … I have a rough time wanting to spend billions and billions and trillions of dollars to help people who won’t help themselves, won’t lift a finger, and expect the federal government to do everything.

She writes that the Senator’s opinion is:

… a common view that removing government support would force many poor people to improve their conditions themselves. Without welfare and government assistance, would able-bodied people find a job, get an education, stop buying lottery tickets, and focus on paying bills?

The same argument is used by mainstream economists in relation to unemployment.

Refusing to accept that unemployment arises from a systemic failure to generate sufficient jobs to match the desires of workers, they suggest that if the government cut unemployment benefits – which they see as subsidising idleness – then the unemployed would be more motivated to seek out work and cut their wage demands back to something consistent with their ‘productivity’ (what the capitalist assesses they are worth).

The mainstream approach can be distilled down to a simple idea that if you make humans desperate enough they will do anything

The idea that an individual can lift themselves up from their ‘bootstraps’ resonates strongly in society – which is unfortunate because it is part of the neoliberal smokescreen that has been erected to give cover for the capture of the government by the Right to advance their own interests.

Please read my blog post – What causes mass unemployment? – for more discussion on this point.

Modern Monetary Theory (MMT) tells us that state money (defined as government taxing and spending) introduces the possibility of unemployment. There is no unemployment in non-monetary economies.

As a matter of accounting, for aggregate output to be sold, total spending must equal the total income generated in production (whether actual income generated in production is fully spent or not in each period).

Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages). Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account through the offer of labour but doesn’t desire to spend all it earns, other things equal.

As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment.

In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

So we are now seeing that at a macroeconomic level, manipulating wage levels (or rates of growth) would not seem to be an effective strategy to solve mass unemployment.

The point is that when total spending is constrained to be below that necessary to support production levels consistent with full employment, the result will be unemployment.

An individual who finds themselves without work has no capacity – acting alone – to alter that situation overall.

They may be able to alter their position in the jobless queue (through retraining and the like) but a macroeconomic constraint (a lack fo spending and jobs) is binding on individuals.

The other way to think about it is that a currency-issuing government can buy whatever is for sale in that currency including all idle labour.

As a result, after all the private spending decisions have been taken, the persistence of idle labour reflects a political choice by government not to use its fiscal capacity to bring those workers back into productive use.

In other words, the governent chooses the unemployment rate.

The existence of mass unemployment is the result of the government’s fiscal deficit (surplus) being too small (large) relative to the spending and saving decisions of the non-government sector.

An individual is powerless to change that overall constraint.

I have recounted the following little anecdote before but it is good to remind ourselves of the idiocy of the mainstream of my profession.

Once upon a time when I was a postgraduate student and there were around 10 unemployed for every registered vacancy in Australia, a professor at the university I was studying at during this period, a rather mediocre character with very few (if any) peer reviewed publications and zero research grants (such was the day) was waxing lyrical about the lazy unemployed and what they should do to get off the welfare list.

His said well (more or less verbatim):

If they really wanted to work they could go down to the municipal tip and scratch together some scrap wood and some old pram wheels and build a cart, then follow the milkman around each morning and collect the horse dung and start a garden fertiliser business.

So, consistent with the US Senator’s opinion quoted above about the unemployed ‘helping themselves’.

The mediocre professor wanted the unemployment benefit eliminated to get “these characters off their bums”.

I remember the session vividly. His cure for the alleged indolence of the unemployed was for them to start their own businesses.

I put my hand up in the class and said (more or less):

There are two problems you ignore. First, the local council, which administers the municipal garbage tips, does not allow people to scour them for rubbish because of health concerns.

Second, more importantly, the milk delivery workers now have trucks. The horse and cart milkmen were eliminated a few decades ago.

Laughter all round and relations between me and that professor soured even more than they already were.

The professor was just repeating the mainstream claim that mass unemployment is largely a voluntary state and if we take away income support payments, job search activity (including starting up their own businesses) will increase and the unemployed will be employed quickly.

Desperation and fear rather than hope.

Anyway, the behavioural science article (cited above) supports the view that the conservative narrative gets the causality around the wrong way.

While the mainstream economists claim people are poor because they make ‘bad decisions’ and choices (including to remain lazy), research in behavioural science reveals that:

Contrary to the refrain that bad decisions lead to poverty, data indicate that it is the cognitive toll of being poor that leads to bad decisions. And actually, decisions that may seem counterproductive could be entirely rational, even shrewd.

Which turns the issue on its head and opens up a new discussion about solutions.

Across a number of controlled experiments (she cites several), the behavioural scientists have found that poorer people “engage more deeply in solving” their problems than rich people.

Of importance is the finding that when confronted with a scarcity of resources (poverty), pushing credit onto individuals leads to worse outcomes.

The evidence, for example, is that when policy makers “reduce the up-front cost of future-oriented behaviors” for poor people, the outcomes improve significantly.

They cite examples where poor children were given “free school uniforms” and enrolments at schools rose by “more than 6 per cent”.

One of the defining features of Welfare States was to provide early interventions to ease resource constraints on poorer families.

But in the neoliberal era, governments have cut many of these interventions and forced ‘user-pays’ doctrines onto many aspects of social provisioning.

The results are unsurprising. Outcomes decline.

The literature in this area also shows that many poor people will forgo take up of health services if the “cost or the distance is too great” for them.

User-pays health services discourage take up and deliver poorer health outcome for the disadvantaged.

The point of the article is that poverty causes changes in behaviour that policy makers should take into account when designing policy interventions.

Making it harder for an unemployed person to live – cuts to income support or more pernicious work tests – do not help.

The problem is beyond the individual’s capacity to solve and needs a state intervention.

Conclusion

The rising poverty levels in Europe is a testament to the failure of the policy making framework in place.

Events – Lectures

This week – Tuesday, Wednesday and Thursday – I will be conducting lectures in the postgraduate program at the University of Helsinki in Global Political Economy.

The lectures run from 14:15 to 15:45 and are in the Soc&kom Building (Room 210) – Snellmaninkatu 12, 00170 Helsinki.

They are open to all although they are clearly aimed at the students taking the specific academic program.

Last week, several non-enrolled students monitored the lectures – so all are welcome.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Excellent article. One could say that these states, or the EU, no longer view the unemployed as citizens with a right to any share in society. The unemployed are treated as invisible, even when they have to be stepped over as homeless people. Professor Mitchell, you may wish to amend the title of this article from ‘the unemployment’ to ‘the unemployed’.

The conservative or libertarianist that despises the unemployed and the poor and blames them for their own predicament is a stupid or bigoted person as although an individual may make it to the front of the queue, all of those in the queue cannot possibly find suitable employment when the economy is operating well below it’s potential.

The central banker, political power broker, minister, politician or ruler that implements the policies that inevitably result in high levels of unemployment or poverty, in an earlier era would have earned a place in the queue – to the guillotine.

Some 12,000 Australians cancelled their private health insurance in December quarter of 2017.

It is not reported properly any more but most people are going through a serious recession. I feel that reality is hidden from us. But do we have a seed of hope in this article here?? I hope so.

https://www.theguardian.com/commentisfree/2018/mar/05/eliminate-deficit-economic-hope-george-osborne-austerity-poverty

The unemployed now have to deal with dehumanising hiring practices too. Use of software (Hint its not ‘AI’ but that’s the show pony word at the moment) to filter out job applicants and exclude any human interaction:

https://www.theguardian.com/inequality/2018/mar/04/dehumanising-impenetrable-frustrating-the-grim-reality-of-job-hunting-in-the-age-of-ai

I speculate that the companies are harvesting data from the job applicants too. Probably.

Expect more anti-EU election results from Italy to come soon.

Time to rethink charitable donations and the structure of charities? Offering full time jobs instead of spending corporate money on sponsorship and naming rights would be more beneficial and have a bigger multiplier effect? Most sponsorship $ are there to advertise the company or individual really?

“As a matter of accounting, for aggregate output to be sold, total spending must equal the total income generated in production (whether actual income generated in production is fully spent or not in each period).

Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages). Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account through the offer of labour but doesn’t desire to spend all it earns, other things equal.

As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment.

In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.”

I am thinking of getting Christmas cards printed with this oft-repeated few paragraphs of Bill’s and sending them to all NZ MPs. If they could all just grasp this basic idea we could move forward.

Another contender for alternative name for Modern Monetary Theory in the article above: currency issuing government ( raises curiosity of newcomers e.g. “I thought the government already issued currency” )