I have just finished reading a report from the Population Strategy Council (PSC) of Japan…

Bank of Japan’s QE strategy is failing

On April 20, 1018, the IMF presented its – Asia and Pacfic Department Press Briefing – in conjunction with the release of the April 2018 World Economic Outlook and the upcoming (May 9, 2018) release of its Asia and Pacific Regional Economy Outlook. The Deputy Director of the Asia and Pacific Department, one Odd Per Brekk, told the audience that Japan should continue its Quantitative Easing (QE) program and maintain transparency in its purchase volumes so as to ensure the strategy to accelerate the inflation rate up to the 2 per cent target is achieved. Part of this strategy involves shifting inflationary expectations from their recent low levels. Critics of the program shriek that the asset base of the Bank of Japan is now approaching the nominal GDP level and given that a high proportion of those assets are comprised of Japanese Government Bonds, that reversing the strategy eventually will be difficult and risks involving the Bank is huge losses, which might render it insolvent. Insolvency has no application in the case of a central bank which can never go broke. Further, the Bank never needs to reverse the QE purchases. There is no relevance in the rising assets to GDP ratio. The problem is that QE will not achieve the desired end. The Bank has expanded its QE program significantly yet the inflation rate and inflationary expectations remain well below the 2 per cent target. They will eventually work out that the mainstream theory that predicted otherwise is erroneous.

Mr Brekk indicated that “Japan has actually been a bright spot in the global economy over the last couple of years” and had “grown above potential for … more than two years now”.

He said this growth was due to “external demand as well as some more fiscal stimulus than we expected”.

He indicated that:

The growth drivers in 2018 in Japan include private investment, which is expected to increase, also due to the Olympics in 2020. And, as I said, a favorable external environment will also likely continue to underpin solid export growth with spillovers to investment and imports.

He also gave an assessment of “Abenomics at the five-year mark” and indicated that the fiscal strategy “has clearly delivered results in terms of incomes and employment including higher labor force participation of women and elderly workers, the strongest growth in employment record for the last two decades, if not more.”

In terms of inflation – he noted “the gradual increase that we have been seeing in inflation over the last year or so” and that “you have to realize this was never going to be a sprint given Japan’s decades long stagnation, but rather a sustained effort to change mindsets and practices”.

In other words, the IMF was urging the Bank of Japan to continue to maintain its huge “monetary stimulus” in order to increase the inflation rate, which is languishing at around half the Bank’s stated target.

Mr Brekk told the press (Bloomberg) after the briefing that (Source):

The message has to be the commitment to reaching the 2 percent inflation target and to put in place the policies needed to get there …

Monetary policy in Japan is very much focused on changing expectations. The main challenge facing the Bank of Japan is to re-anchor inflation expectations at 2 percent … From that point of view, communication by the Bank of Japan on the commitment to stay the course is the right one …

Moving fully to the yield curve control framework would help strengthen the message that you can sustain and that you will sustain an accommodative monetary stance.

The reference to “moving fully” is in the context of the bank stating that it will continue to increase its Japanese government bond holdings annually by around 80 trillion yen, when in fact, in the recent past the purchasing rate has been around 50 trillion yen.

The Bloomberg reporting of the event chose to give air to alleged:

… worry about the sustainability of the BOJ’s policies given the 2 percent inflation target remains distant and the size of its balance sheet is approaching that of the nation’s annual economic output.

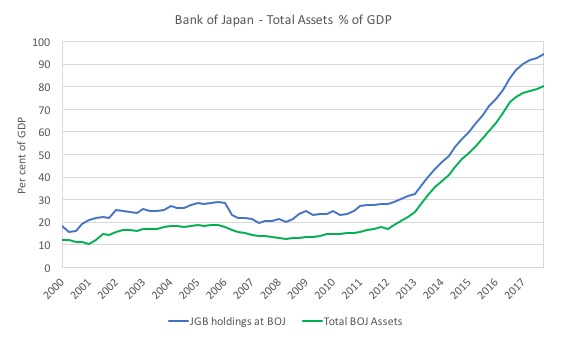

The relevant graph that follows is the Total assets held by the Bank of Japan as a per cent of GDP (blue line) and the proportion held as Japanese Government Bonds between the March-quarter 2000 to the December-quarter 2017.

In the December-quarter 2017, total assets stood at 94.5 per cent of GDP (and JGB holdings were 80.2 per cent of GDP).

Why this particular statistic matters is beyond me but apparently the “critics” think it matters.

The point of this blog post is to emphasise that it doesn’t matter one iota and that it rapid acceleration since the Bank of Japan started buying JGBs in large volumes in order to increase the inflation rate demonstrates how ineffective monetary policy is in influencing the path of the inflation rate, despite the massive increase in central bank assets.

Inflation is still benign in Japan

The latest data from Japan’s e-Stat service (released April 18, 2018) for the Consumer Price Index, March 2018 – shows that the:

1. All items rose by 1.1 per cent annually but was down 0.4 per cent on the month to March 2018.

2. Excluding the volatile items (fresh food and energy) the annual inflation rate was only 0.5 per cent and the monthly fall was 0.1 per cent.

In other words, the annual inflation rate is still around 50 per cent of the Bank of Japan’s stated target.

It CPI index hasn’t changed much since the mid-1990s.

A long way to go in other words.

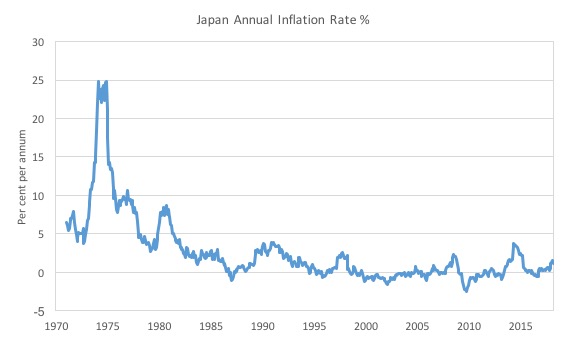

The following graph shows the history of Japanese inflation since 1970.

QE history in Japan

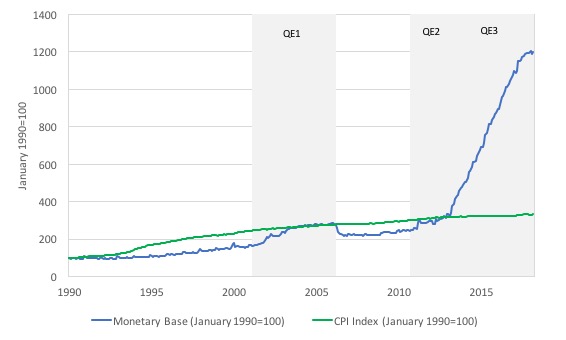

The Bank of Japan’s quantitative easing history began in earnest in March 2001 (QE1) and this increased the BOJs monetary base by around 60 per cent.

You can see that in the first graph above.

The Bank terminated that program in March 2006, whereupon the Bank sold down its holdings (also shown in the graph).

A second (QE2) program began in October 2010 and as time has passed it has become QE3, which is a much larger scale intervention that that began in April 2013.

Another way of looking at the relationship between monetary policy changes in Japan and the evolution of the inflation rate is shown in the following graph. The shaded blocs are the three QE periods during the sample shown.

I indexed the monetary base and the Consumer Price Index to 100 in January 1990.

The graph shows the evolution of these indexes up to March 2018.

The monetary base index was at 1200.5 in March 2018, while the CPI was at 332.7.

The overwhelming conclusion is that there is no relationship between the evolution of the monetary base (driven by the Bank’s purchases of JGBS in large volumes) and the evolution of the inflation rate.

One could argue that the reversal of QE1 revealed a lack of commitment by the BOJ to really drive the inflation rate up. My assessment is that QE doesn’t work whether it is extended for lengthy periods or not.

The reversal that followed the introduction of QE2 just reduced the monetary base (and the total assets held by the BOJ).

Inflation expectations

The latest data on inflation expectations is also indicative that the QE policies are not having the desired effect.

New Keynesian suggest that prices are adjusted to accord with expected inflation. With rational expectations, the mainstream models predict that inflation will respond one-for-one with shifts in expected inflation.

The Bank of Japan has been trying to manipulate that ‘theoretical claim’ in real space through its QE experiments.

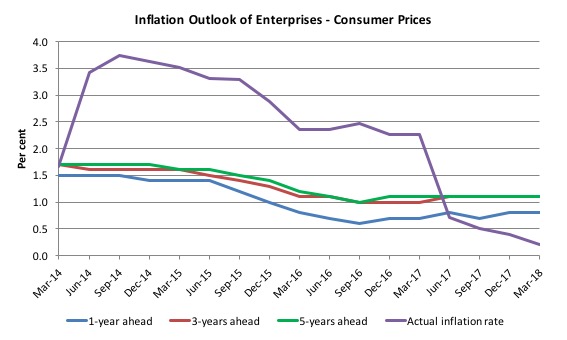

The following graph is taken from the – Tankan Summary of “Inflation Outlook of Enterprises – the latest data being released on April 2, 2018, covering expectations up to March 2018.

Firms are asked to assess the future price movements in output prices and consumer prices.

The first graph shows the outlook for output prices – 1-year ahead, 3-years ahead and 5-years ahead.

While the expectations have risen in recent months, that is more the result of increased output growth. In the early periods of QE3, the expected inflation rate for output prices fell sharply.

The second graph shows the outlook for consumer prices – 1-year ahead, 3-years ahead and 5-years ahead. It also includes the actual inflation rate (Purple line).

Again it is hard to see any substantial movement in consumer price expectations.

Conclusion

While the Bank of Japan can accumulate JGBs in whatever volumes they choose and can never go broke if the price of those bonds in the secondary markets create “losses”, the policy will not deliver the inflationary spike that the IMF and the Bank is seeking.

Inflation will accelerate if fiscal policy pushed the growth rate and the demand for real resources above the potential growth rate and the resource availability.

QE is a sideshow.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

It’s amazing how long a belief can sustain itself. The Olympics in London came at a fortuitous time and the Olympics in Japan similarly.

Hello Bill

The Special Advisor to the Japanese Cabinet, Prof. emeritus Koichi Hamada of Yale University, two days ago gave an interview in the Nikkei Daily Newspaper, the largest business daily in the world, forecasting that the BoJ will soon look into the possibility of buying foreign bonds to boost QE. This possibility has been alluded to several times in the recent past in the same (in Japan most influential) newspaper suggesting that the BoJ may actually take that step fairly soon.

My question does not concern the effectiveness of this operation. I wonder what it does to the balance sheets of the involved parties and if it is possible that a government creates domestic currency in order to buy foreign assets. What is the effect?

How large are the monetized part of the BoJ holdings(JB´s)? I mean the portion of new debt that been bought instantly by BoJ? I guess it accelerated from QE2!

Has my question any relevance at all? For every “old” bond that is bought by BoJ there is “room for another one to be issued”(c.p.)!

Should anyone be even worried at all by inflation being below 2%?

So long as indicators of the real economy – such as employment levels – are satisfactory.

And if employment is too low (unemployment is too high), then they should push fiscal stimulus, with the only “danger” being that inflation might rise – but this is supposed to be what they are trying to achieve in the first place.

I actually said 10 years ago that Japan(BoJ) could or might “kill” it´s bonds in the end. The slow death at BoJ.

“possibility of buying foreign bonds to boost QE”

You have to buy foreign currency first since the bonds are not denominated in Yen. So if you are issuing currency to buy foreign currency you are operating a mercantile export process designed to weaken your currency against your counterparts.

Which is what all net exporters do eventually if they want to continue net exporting. Which means you don’t need to pay interest on bonds – particularly to foreign investors. They are desperate for them anyway.

Please correct me if I am terribly wrong here.

How can a sovereign nation get foreign currency?

1. Net exports placed as foreign currency reserves by the cb

2. Borrowing foreign currency by the treasury, cb or the private sector.

3. Buying foreign currency against its domestic currency(if there is demand).

1-2 creates domestic currency if exchange is taking place(1. exchange for what´s already exported)

3. Using cash at hand or what is created out of thin air but also to some extent by market operations(i.e forwarding or other derivative-contracts).

I agree with Mr Wilson! Another tool in the box!

“They will eventually work out that the mainstream theory that predicted otherwise is erroneous.”

Hi Bill, apologies if this sounds crazy and off-the-wall, but have you ever considered the possibility that they have known that all along, and that the 2% inflation target may have been introduced for political, not economic reasons? The origin of the change from a 1% target to a 2% target was the political comeback of Shinzo Abe in 2012, and the marketing and re-branding of him as a politician with a vision for the economy and a willingness to take action. It was also used as a pretext to replace the “timid” Shirakawa (who said the 2% target was not achievable) as head of the BOJ and put the Ministry of Finance man Kuroda (who said it was) into the position. Kuroda has since spent the last 5 years not hitting the target, but claiming he will “soon” over and over. It’s like he knew all along he wouldn’t, and the plan was to just keep denying that he wouldn’t. Meanwhile, the two real political objectives were accomplished successfully.

When the IMF talks about moving fully to YCC they are talking about abandoning the 80 trl yen quantity target that is necessarily obsolete. They are not talking about achieving both the rate and quantity target – not even the IMF could get that wrong! A fully implemented YCC policy does not have any sustainability issues re. bond scarcity.

As convincing as MMT sounds in most aspects it seems that it cannot explain why a government could not use its domestic currency in order to purchase foreign assets – in the case of Japan the BoJ buying foreign bonds, etc. – maybe even other foreign assets.

Dear Non-economist (at 2018/04/25 at 6:47 pm)

I am not sure what you mean here.

A currency-issuing government can clearly buy “foreign assets” as long as it can find a counter-party in the foreign exchange markets to swap its currency for the relevant foreign currency.

I don’t recommend that it do that. But it can.

best wishes

bill

Dear Bill

Thank you very much for taking the time to address my question although you have a public holiday in Australia. I am writing from the opposite part of the world (Switzerland).

Above I was referring to the fact that the most influential business daily in Japan, the Nikkei Newspaper (btw. it also owns the FT), recently featured several articles hinting that the BoJ may soon start buying foreign bonds as part of its QE. To me this sounds as if a government could (theoretically in huge quantities) creat new domestic funds and purchase foreign asset (the purchase of the foreign currency is no problem; every central bank has a specialized desk for that), the effect being 1) the creation of further reserves in the domestic currency, 2) welcome downward pressure on the domestic currency and 3) foreign assets free of charge.

Apologies for this simple thinking, but I honestly “spread the word” and would like get more skilled to do that.

Once there was the system with fixed currency-regimes. Nowadays every exportnation competes by depreciating their currency. Some day the action-reaction processes will come-back in a Minsky-way.

Will MMT be here in time? Probably not.

@Non-economist

Wouldn’t the sort of currency action about which you are asking generate the sort of international hostility that currently greets “competitive devaluation”? Presumably there would be suitable forms of retaliation once the operation were known and understood.

It is fun to consider all of the ways that nations can play “beggar thy neighbor” in a Mercantilism that never really died, though, isn’t it? ;-D

“(the purchase of the foreign currency is no problem; every central bank has a specialized desk for that)”

It becomes a problem when you start to run out of liquidity. After all if you are issuing to purchase and driving your currency down, you’re asking the other side to take a loss

Non-economist: That’s an odd question coming from Switzerland. Last I checked, Switzerland has accumulated the third largest foreign exchange reserves in the world, after China and Japan, much bigger countries. This is due to people sensibly fleeing the euro and the Swiss central bank responding by keeping the franc down for a long time, to support export industries, by purchasing foreign currencies as you mention. Due to popular pressure, the franc was more recently allowed to float up. George Soros nearly lost his shirt betting the wrong way, unwinding his positions just in time.

Finding a counterparty would be the trick.

But we know that (1) the Japanese Government, through the Bank of Japan, can create enough yen to buy anything in the local market. (Even outbidding other parties. Outbidding would be inflationary, and they had better have an idea for dealing with that.)

They could also (2) create enough money to buy as many foreign-denominated bonds as a counterparty would sell them. This would amount to scheme 1, but handing the purchasing power, including the right to use it, to foreigners in exchange for printed pieces of paper shaped like bonds. If the BoJ bought enough bonds, the foreigners could buy Mt. Fuji, or anything else for sale in Japan, with — whatever — social consequences.

We see this kind of thing in action in the housing bubble/crisis in the U.S., where median earners in the big cities can’t afford to live there because of rent or purchase prices. They’ve been outbid by investment money. This is what Modern Money can do when the people who control it use it for the wrong things.

I’m sorry that George Soros only “nearly” lost his shirt.

Mel: What would the foreigners buy with their JPY? JP real estate, equities, machinery? All this would help the BoJ reach its declared target. Sounds like a good idea to me. At least so thinks Mr. Hamada, advisor to the JP government.

Honestly, I’m not clear on what the target is, and what the benefits of hitting the target would be.

I wonder not if but when the mighty dollar again will start its rise! Another modern Plaza Accord followed by a stockmarket-crash(think 1987)? History always repeats they say………man never learns!

Perhaps it is unavoidable due to market cycles(aka human behavior).

Non-economist: They would likely buy nothing and hold the JPY as an asset, betting that favourable exchange rates would make them a profit.

As always a great post. Q.E is clearly not as effective as central bankers like to make out although I do not agree with you that central bank insolvency “doesn’t matter”.

If the central bank is technically insolvent then it’s not the end of the world – it can rebuild it’s capital position organically over time while issuing reserves to meet liabilities as they fall due. However it does matter to the conduct of monetary policy. If a central bank wants to tighten policy it needs to sell assets to reduce the level of reserves in the system – which it cannot do if it is technically insolvent. Admittedly this would be a rare scenario and a number of central banks have operated while insolvent (e.g. Chile), but I think your statement does not reflect the truth.