Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – May 5-6, 2018 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Over a given economic cycle (peak to peak), if a nation’s external sector is on average balanced and the government gap between its tax revenue and spending is, on average, equal to 1 per cent of GDP, then the private domestic sector’s spending-income balance will on average be in:

(a) Deficit of 1 per cent of GDP

(b) Surplus of 1 per cent of GDP

The answer is Deficit of 1 per cent of GDP.

This is a question about sectoral balances. Skip the derivation if you are familiar with the framework.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

(1) GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all tax revenue minus total transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total net taxes (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

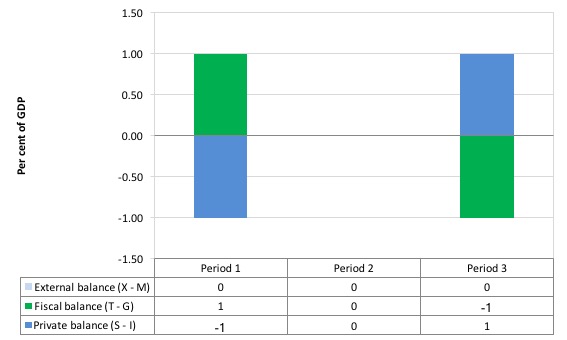

Consider the following graph which shows three situations where the external sector is in balance.

Period 1, is the case in point with the fiscal position in surplus (T – G = 1) and the private balance is in deficit (S – I = -1). With the external balance equal to 0, the general rule that the government surplus (deficit) equals the non-government deficit (surplus) applies to the government and the private domestic sector. In other words, the private domestic sector must be spending ore than it is earning (a deficit).

In Period 3, the fiscal position is in deficit (T – G = -1) and this provides some demand stimulus in the absence of any impact from the external sector, which allows the private domestic sector to save (S – I = 1).

Period 2, the fiscal position is in balance (T – G = 0) and so the private domestic sector must also be in balance (spending equals its earning).

The movements in income associated with the spending and revenue patterns will ensure these balances arise. The problem is that if the private domestic sector desires to save overall then this outcome will be unstable and would lead to changes in the other balances as national income changed in response to the decline in private spending.

So under the conditions specified in the question, the private domestic sector cannot save. The government would be undermining any desire to save by not providing the fiscal stimulus necessary to increase national output and income so that private households/firms could save.

You may wish to read the following blogs for more information:

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Barnaby, better to walk before we run

- Saturday Quiz – June 19, 2010 – answers and discussion

Question 2:

If the private domestic sector is locked into a process of deleveraging, then to avoid the employment losses arising from this lost private spending, governments have to expand public deficits.

The answer is False.

The answer also relates to the sectoral balances framework outlined in detail above. When the private domestic sector decides to lift its saving ratio, we normally think of this in terms of households reducing consumption spending. However, it could also be evidenced by a drop in investment spending (building productive capacity).

The normal inventory-cycle view of what happens next goes like this. Output and employment are functions of aggregate spending. Firms form expectations of future aggregate demand and produce accordingly. They are uncertain about the actual demand that will be realised as the output emerges from the production process.

The first signal firms get that household consumption is falling is in the unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms layoff workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

At that point, the economy is heading for a recession. Interestingly, the attempts by households overall to increase their saving ratio may be thwarted because income losses cause loss of saving in aggregate – the is the Paradox of Thrift. While one household can easily increase its saving ratio through discipline, if all households try to do that then they will fail. This is an important statement about why macroeconomics is a separate field of study.

Typically, the only way to avoid these spiralling employment losses would be for an exogenous intervention to occur – in the form of an expanding public deficit. The fiscal position of the government would be heading towards, into or into a larger deficit depending on the starting position as a result of the automatic stabilisers anyway.

So an intuitive reasoning suggests that a demand gap opens and the only way to stop the economy from contracting with employment losses if it the government fills the spending gap by expanding net spending (its deficit).

However, this would ignore the movements in the third sector – there is also an external sector. It is possible that at the same time that the households are reducing their consumption as an attempt to lift the saving ratio, net exports boom. A net exports boom adds to aggregate demand (the spending injection via exports is greater than the spending leakage via imports).

So it is possible that the public fiscal balance could actually go towards surplus and the private domestic sector increase its saving ratio if net exports were strong enough.

The important point is that the three sectors add to demand in their own ways. Total GDP and employment are dependent on aggregate demand. Variations in aggregate demand thus cause variations in output (GDP), incomes and employment. But a variation in spending in one sector can be made up via offsetting changes in the other sectors.

The following blogs may be of further interest to you:

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

Question 3:

If the external sector is accumulating financial claims on the local economy (that is, providing foreign savings to the domestic economy) and the GDP growth rate is lower than the real interest rate, then the private domestic sector and the government sector can both run surpluses without damaging employment growth.

The answer is False.

When the external sector is accumulating financial claims on the local economy it must mean the current account is in deficit – so the external balance is in deficit. Under these conditions it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the national accounting rules and income adjustments will always ensure that is the case.

The relationship between the rate of GDP growth and the real interest rate doesn’t alter this result and was included as superflous information to test the clarity of your understanding.

See the answer to Question 1 for the background conceptual development.

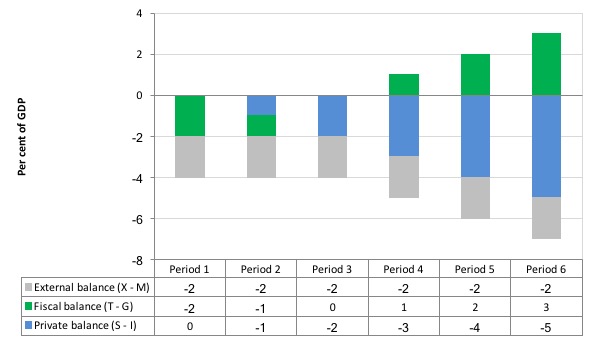

Consider the following graph and associated table of data which shows six periods. All periods have a constant external deficit equal to 2 per cent of GDP (light-blue columns).

Period 1 show a government running a fiscal deficit (T-G < 0) equal to 2 per cent of GDP (green columns). As a consequence, the private domestic balance is in balance because the fiscal deficit exactly offsets the external deficit.

Period 2 shows that when the fiscal surplus contracts to 1 per cent of GDP the private domestic sector goes into deficit of 1 per cent of GDP.

Period 3 is a fiscal balance and then the private domestic sector’s deficit is exactly equal to the external deficit. So by spending more than it earns, the private domestic sector exactly funds the desire of the external sector to accumulate financial assets in the currency of issue in this country.

Period 4 to 6 shows what happens when the fiscal balance goes into surplus – the private domestic sector’s deficit increases by each per cent of GDP the fiscal surplus rises.

Periods 4 to 6 cannot be a sustainable growth strategy because eventually the private domestic sector will collapse under the weight of its indebtedness and start to save. At that point the fiscal drag from the fiscal surpluses will reinforce the spending decline and the economy would go into recession

Note also that the government balance equals exactly $-for-$ (as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances). This is also a basic rule derived from the national accounts.

Most countries currently run external deficits. The crisis was marked by households reducing consumption spending growth to try to manage their debt exposure and private investment retreating. The consequence was a major spending gap which pushed fiscal positions into deficits via the automatic stabilisers.

The only way to get income growth going in this context and to allow the private sector surpluses to build was to increase the deficits beyond the impact of the automatic stabilisers. The reality is that this policy change hasn’t delivered large enough fiscal deficits (even with external deficits narrowing). The result has been large negative income adjustments which brought the sectoral balances into equality at significantly lower levels of economic activity.

The following blogs may be of further interest to you:

Vice President of the ECB, Vítor Constâncio yesterday…..

Some commentators were nevertheless concerned by the increasing size of the ECB balance sheet. Based on the high long-run correlation between inflation and money growth, they interpreted the huge growth in the ECB monetary base as a signal of future high inflation risks. These fears obviously disregarded three things: first, no theory of inflation is directly related with the central bank’s balance sheet;

It is Draghi’s Giuliani moment

Draghi has lied so long now about QE and interest rates to manipulate the Euro he has backed himself into a corner he can’t get out of with his double speak.

Draghi knows full well the only way out this is mess is to stop QE and start increasing interest rates but he can’t

a) He’s lied for so long abou it

b) He has to face the Germans when inflation rises

It was always going to be about Germany and Germany has a choice now that both the UK and the USA are in rate hike mode. Japan has the same choice

1) Draghi do nothing which means the Euro gets stronger and destroys their exports

2) Draghi stops QE and starts increasing interest rates and they put the ghost of Weimer to bed once and for all.

Vítor Constâncio has done Draghi a favour and I wouldn’t be suprised if it was planned. He’s trying to help Draghi out of his corner.

It’s as if these fools don’t look at any charts

1) Pick Theory

2) Test Theory

3) Check Data

Are we really saying these fools don’t check Data ?

https://d3fy651gv2fhd3.cloudfront.net/charts/argentina-interest-rate.png?s=apdr1t&v=201805041641v&d1=20130101&d2=20181231&url2=/argentina/inflation-cpi

https://d3fy651gv2fhd3.cloudfront.net/charts/russia-interest-rate.png?s=rrefrate&v=201804271040v&d1=20130101&d2=20181231&url2=/russia/inflation-cpi

I wouldn’t be suprised if Warren is phoning Argentina as we speak.

First, I would instruct the Argentina central bank to set rates to zero or, even better, negative. That alone would do the trick as the inflation would be stopped dead in its tracks.

You might get one big and quick zombie spike down in the Peso first, as they react on their religious beliefs that the zero rate is inflationary.

And if I REALLY wanted to make it happen quick and brutally, I would tell the government to enact steep, steep austerity.

In a few month’s time the Peso would be the strongest currency in the world.

No wonder the nutjobs shout Weimar, Zimbabwe, Venezula and Now Argentina at us all the time.

The central banks just keep feeding the zoo !

Derek Henry,

“Are we really saying these fools don’t check Data ?”

Correlation does not imply causality.

(It seems you subscribe to the neo-Fisherite theory?)

“No wonder the nutjobs shout Weimar, Zimbabwe, Venezula and Now Argentina at us all the time.”

I would be one of the nutjobs that suggest that MMTers have a good hard look at these examples of monetary profligacy. I certainly don’t understand MMT as much as I would like so perhaps I am missing something.

Derek Henry,

Argentina’s GDP is growing around 2.5%. Its inflation rate is around 25%. Its unemployment level is around 8%. External debt is low but rising.

How would MMT evaluate the state of the Argentinian economy?

What policy prescriptions would it propose to have inflation down at more acceptable levels – or is 25% OK?

Is 8% unemployment OK? How can it be improved?

Dear Henry Rech,

The case of Argentina is really interesting – ” rinse and repeat”

This is from the summary of a paper found in Journal of Post Keynesian Economics Volume 40, 2017 – Issue 1 by Roberto Frenkel and Diego Friedheim, “Inflation in Argentina during the 2000s”

“There was an informal indexation mechanism in the labor market. Average monthly wages rose at annual rates that were almost always higher than the sum of past annual inflation plus the annual increase in productivity. The over-indexation of the unit labor cost was the main inflationary factor in the period.”

Adam K,

“There was an informal indexation mechanism in the labor market.”

So what and what does it exactly mean?

The fact is that the “system” allowed wage rises of a particular level. What action would MMT prescribe?

The case of Argentina has been “rinsing and repeating” since the Baring Crisis and probably beyond.

Dear Henry Rech,

A Post-Keynesian model of inflation was integrated with a SFC model of the whole economy in “Monetary Economics” by W. Godley and M. Lavoie (Chapters 9 and 11). Workers set their target real wages based on their bargaining power. This target gets applied to the level of prices from the previous period. The wage demands are met. Firms determine their markup on top of the labour costs from the previous period, setting the prices in the current period. In the original model real wage demands depend on the employment rate what gives us a kind of adaptive expectations Philips curve. If we replace this with inflation indexation leading to real wages growing faster than the productivity growth it is obvious that the system will either experience accelerating inflation or it might stabilise with high inflation and high unemployment (but we would need to build a more sophisticated model possibly with a segmented job market to demonstrate the second case).

Replacing the indexation by a Job Guarantee as the tool to set minimum wages might in my opinion stabilise the economy and solve the problem of unemployment, other fiscal policy tools as targeted spending and extra taxation of certain social groups may also be needed. I don’t think that direct price and wage controls (except for setting the minimum wage) have ever worked without disrupting the market processes. I am not sure whether my Central-European experience could be transplanted to Latin America, one thing I know for sure is that austerity is bad in any form.

Adam K

I have yet to see a straight answer to my questions on real world issues (Argentina, stagflation).

And we have Derek Henry above suggesting austerity for a quick fix.

MMTs response to inflation is to induce a recession in the private sector and take up the increased unemployed thru the JG scheme.

Inducing a recession in the private sector will reduce the level of output. Adding unemployed to the JG scheme, which does not replace the lost output, implies inflation will not dissipate because demand has not changed markedly.