I have received several E-mails over the last few weeks that suggest that the economics…

How do budget deficits finance saving?

I am often sent E-mails asking me to explain succinctly (what my other explanations are not!) how public deficits finance saving. What does it mean? How does it work in a macroeconomic system? What is the difference between automatic stabilisers and discretionary budget dynamics? What would have happened if the government had not have increased the growth in spending? All these sorts of questions. So this short blog – to make up for yesterday’s ridiculously long blog – will cover those issues. It should clear up any outstanding issues about why deficits are important to underwriting growth.

You might also like to read a blog entry on the UMKC site written in 2000 (recently recycled to keep reminding us) by Warren Mosler and Eileen Debold, both significant figures in bond markets and investment banking. They have a nice graph of the US economy which makes their point very well.

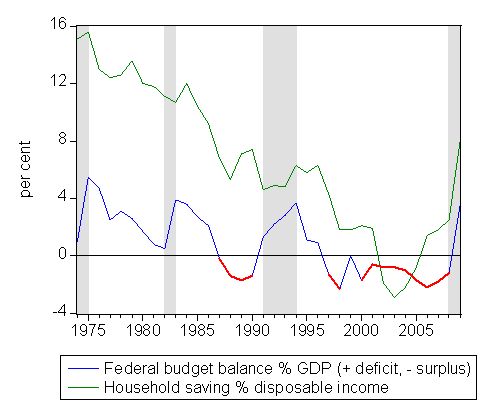

The following graph is of the Australian economy from 1974 to 2009 (the last year is just my estimate) and shows the Federal headline budget balance as a percentage of GDP (blue line except when in surplus where it is a red line) and Household savings as a percentage of disposable income (green line). Unlike others I consider a budget surplus to be “in the red” (that is a poor result) because it will always be the precursor to bad things to come despite the rhetoric to the contrary.

The shaded areas broadly correspond (approximate given this is annual data) with recessions (or significant downturns). If you study it carefully you can see that when the economy has gone into downturn, the budget deficit has increased. You will also see that just prior to the downturn, the budget has been in surplus or heading towards surplus. These dynamics are not accidental.

You can also see that over the period shown there has been a bias towards the budget deficit being smaller (trending down) as neo-liberal discretionary policy changes sought to diminish the size of government relative to the private sector. Over the same period, the household saving ratio (saving as a percentage of disposable income) has been steadily falling too. However, whenever there has been a sharp rise in the deficit (during the downturns shown) the household saving ratio has risen somewhat.

Now if we consider that in the post 1991 growth period, the financial engineers have been extremely active in pushing a diversity of financial debt products onto business firms and households. In the 1980s it was largely the private firms that became heavily leveraged but by the 1990s and beyond it was the household sector. Partly this has been due to the rising house prices that required increasing levels of debt to purchase. But it has also been strongly driven by diversifying the types of debt that households have been carrying.

So in this period we had margin debt emerging for the first time as household tried to live the shareholder dream whereby everyone becomes a capitalist!

By the 1996, the credit binge was accelerating and this allowed the conservative government to indulge in its obsession with budget surpluses. So even though the fiscal drag was destroying private sector purchasing power (and undermining their wealth as public debt was reduced), the increasing debt being borne by the household sector propped up spending sufficiently to allow tax revenue to rise faster than outlays. The result was a sequence of surpluses.

Ultimately, the household sector reached the point (around 2001-2002) where the saving ratio became negative – that is, the household sector was dis-saving overall. The increased precariousness of household finances was evident during this time. Even though GDP growth continued the central bank was very reluctant to increase interest rates by more than 25 basis points at a time because they became scared that there would be mass insolvency. Statistics like forced mortgagee sales rose quickly during this period.

So the only way the previous government was able to run so many surpluses in a row (the red segments) was because the non-government sector (principally the household sector) was living beyond its means – increasingly and funding that excess with rising levels of debt. If the financial engineers had not been so successful for so long, then you would have had a 1991 type recession much earlier following the surpluses.

In that period, the surpluses were not supported by a debt-binge (or rather the debt-binge was short-lived and choked by very high interest rates) and so the Keating surpluses of the late 1980s quickly became huge deficits as the automatic stabilisers put a floor under the economy. The costs of that surplus period are there for all to see – the prolonged and very serious 1991-1993 recession.

In the recent period, it was clear that the household sector could not dis-save indefinitely and eventually households would start to repair their fragile financial positions by increasing saving. Once they did that, the economy was always going to crash under the fiscal drag coming from the surpluses.

You can see now that as the household saving ratio has risen sharply so has the budget deficit. It more or less has to respond in that way because of the automatic stabilisers. However, in Australia’s case the federal government has also accelerated the move into deficit with two rather substantial and early fiscal stimulus packages.

What these packages achieve is simple. They provide a spending stimulus as the private sector reduces its spending and seeks to save. The net spending from the government allows production levels (and sales) to be higher than they otherwise would be in the face of a private sector spending contraction. The higher than otherwise output and employment levels allow the income levels in the economy to remain higher than they would otherwise be and this supports the private saving intentions (savings is a function of national income!).

It is in this sense that modern monetary theorists say that net public spending “finances” non-government saving. It provides the spending boost which allow income to remain higher than otherwise which in turn provides the capacity for the private sector to save.

Had the deficits not been rising as quickly, then the output loss would have been greater and the rise in private saving actually realised would have been smaller (because GDP would be lower). But this situation would continue to drive the deficits up via the automatic stabilisers but the government would have very little to show for the higher net spending. It would have worse unemployment and a longer recession to deal with.

The point is that it is typical for the household sector to save a proportion of disposable income. The dis-saving period is very atypical in our history. In that case, with a current account deficit, the only way that the domestic private sector can realise its desires to save is if the government is in deficit. We should consider deficits to be normal, typical and productive aspects of economic life.

They provide the spending capacity to underpin high levels of employment and high levels of private saving – both goals that allow for sustainable growth and reduced poverty.

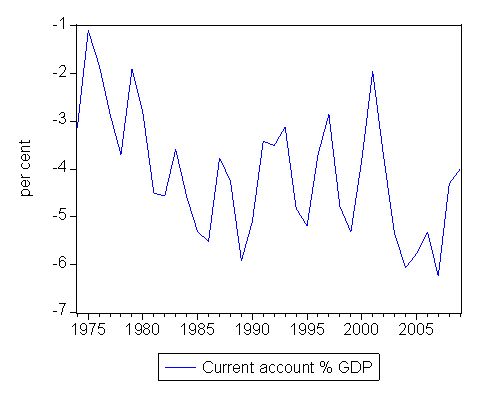

As an aside, the Australian graph is not as obvious as the US graph because we have more noise from our external sector. We are much more open than the US economy which is relatively closed. To give you an idea of the external sector the second graph is the Current Account deficit as a percentage of GDP. You can see it is always in deficit although there is no obvious trend – which means that we can consider it a relatively constant source of foreign savings being made available to our economy over this period.

The way to think of this is that the excess of imports over exports (taking into account invisibles) is possible because foreigners want to accumulate financial assets denominated in AUD and are willing to sacrifice more real wealth (goods and services) that they receive in return to accomplish this investment strategy. Our real terms of trade have therefore been firmly in our favour over this period. Most mainstream economists will tell you this is a demonstration of us “living beyond our means” and that the foreigners are financing this excess. When you think of it correctly – in a modern monetary sense – it is us who are financing their investment strategies and in return we are extracting a surplus of real goods and services from them. Sounds to me as we win out in real terms.

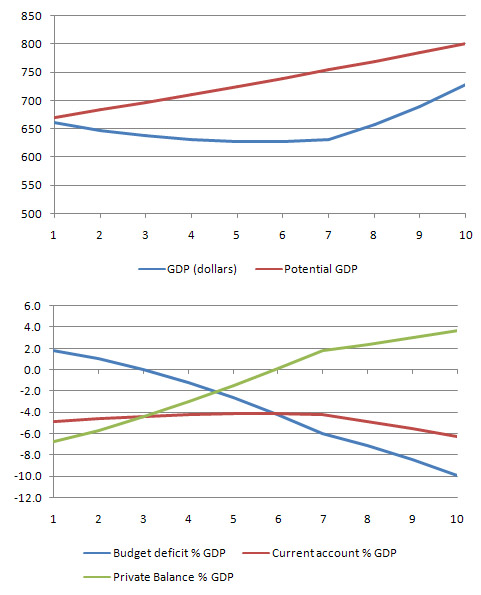

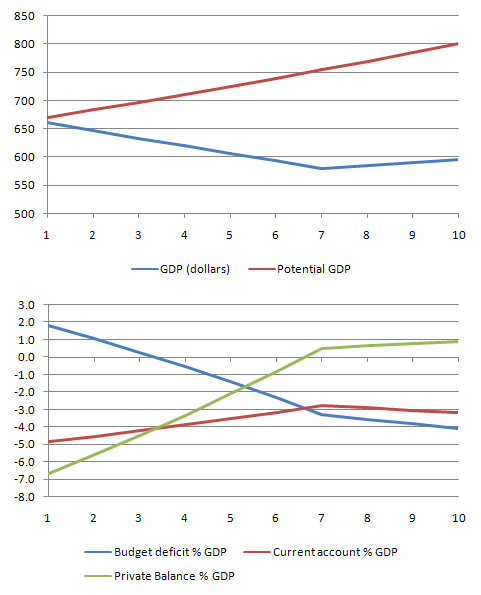

The second set of graphs are from a simulated (very simple) macroeconomic model I have to demonstrate things. It assumes inflation and the exchange rate are constant which in this sort of environment is a reasonable assumption. It assumes that consumers save 20 per cent of every dollar they earn and government taxes a flat 20 per cent in the dollar. For every dollar of production generated, 20 cents go out to imports. Export demand is also assumed constant to isolate that from the analysis. So imports rise with income (GDP)

Potential GDP is assumed to grow at 2 per cent per year. The gap between GDP and Potential GDP will give some indication of the change in unemployment although the labour market is implicit only. The wider the gap the worse the economy is performing and the higher will be unemployment. The top graph in each pair shows this relationship.

The bottom graph in each pair shows the sectoral balances – the Budget balance as a % of GDP (surplus +, deficit -); the Private sector balance (the gap between saving and investment) as a % of GDP; and the Current account balance (exports minus imports) as a % of GDP. The three balances as a matter of national accounting have to add up to zero. If we summed the external and private balances we would get the non-government balance (broadly) and that would equal the mirror image of the government balance (the budget balance).

Simulation One – Government spending grows by 1 per cent per period

In the first simulation, the economy is nearly at full capacity but private spending is in excess of income and the budget balance is in surplus. In this environment the private sector is increasing its indebtedness to maintain spending growth. This is an unsustainable position and eventually the private sector will reduce its deficit position. We model that here by private investment (a component of aggregate demand) contracting by 10 units for each of the first 6 periods and then bottoming out for the last four periods of the 10-period cycle shown.

The government reacts immediately and increases real spending by 1 per cent per period (from an initial 2 per cent growth rate). You can see that while GDP falls initially eventually the net spending stimulus turns the economy around and it starts heading back into growth. I could have clearly tweaked the results to get the growth happening earlier and stronger but the dynamics would have been the same. The simple fact is that the deficit in this economy is still not large enough.

The deficits though help the private balance move into surplus (as desired by their discretionary spending choices).

If the government had not have increased the discretionary component of the budget (increasing spending each period) the drop in investment would have had much more dire circumstances and the income adjustments would have still sent the budget into deficit (a bit more slowly) and provided the funds to allow the private balance to go into surplus. This is shown in the second simulation.

Simulation Two – Government spending growth constant per period

In this case, the real government spending growth remains a constant 2 per cent per period and the tax rate remains at 20 per cent (so no discretionary fiscal policy change is modelled). You can see that the deterioration in the economy as the private sector withdraws spending is severe and the weak growth that emerges after period 7 comes exclusively from the automatic stabilisers (modelled here as the declining tax revenue as GDP falls) and the declining imports (as GDP falls). It is a parlous outcome.

So the automatic stabilisers provide a floor that the economy will not fall below but the capacity underutilisation in this second case is much higher and so the implied unemployment is much higher. The recession in this case would be much more protracted than in the first case.

The point of the simulations is not to capture everything about the macroeconomy. But what they will reliably represent are the dynamics between the major macroeconomic aggregates during a typical recession and early recovery period. I could have made them much more complicated to bring in other detail but the message would be the same.

The fiscal balance is essential to stabilise output when the non-government sector is in retreat. The economy will also be in better shape if the budget balance actively provides the stimulus necessary to support output when the non-government sector is desiring to increase its saving. The more aggressive is fiscal policy as non-government spending is in decline the more quickly GDP will recover and the higher will be the savings volume in the private sector.

If fiscal policy is reactive only (that is, reliant on automatic stabilisers) then the private saving balance will not increase as much because the income adjustments that make it possible for the private sector to save yet still allow the economy to grow will not be funded as strongly by the fiscal sector.

Digression: ABS to launch new employment series

The Australian Bureau of Statistics will tomorrow publish a new labour market measure – aggregate monthly hours worked – when it releases the monthly Labour Force data. Apparently, the data will be backdated to July 1985. The measure will provide a richer measure of labour demand than just employment by persons. Among other things, it will allow analysts such as me to work out how much labour hoarding is going on over the business cycle.

Digression: Two interesting phone calls this week

On Monday I received a call from Peter Andrews who is the Natural Sequence Farming person that you may have seen recently (and in the past) on Australian Story 2005 and Australian Story 2009 Part 1 and Australian Story 2009 Part 2.

He has created permaculture havens in deeply drought-affected areas of our continent using skill and understanding. A lateral thinker no doubt.

He wanted to discuss forming a network of like minds to combine my interest in job creation and land rehabilitation with his approaches to permaculture. Further discussions are pending.

Then today Opposition leader Malcolm Turnbull rang me to discuss these matters. Seems he is keen to develop policy in this area. He had met with Peter Andrews last week. Anyway, we had an interesting chat and exchanged (non-fake) E-mails. More to report later maybe. It would be ironic if the Federal Opposition became the champions for large-scale public sector job creation while the Labor Government sat on its tails and were content with work experience and wasteful training programs while unemployment soared.

For overseas readers, the Opposition leader is currently embroiled in a fake E-mail scandal where a senior Treasury official invented an E-mail purporting to reveal impropriety by the Prime Minister and induced the Opposition to use the fake E-mail as a basis for calling for the Government to resign. It has turned pear-shaped for the Opposition beyond imagination.

Dear Bill,

Why are you forming alliances with the enemy ?

Peter Andrews has done a lot of work for Gerry Harvey and therefore I hope he is not sympathetic to the slave labour practices that Gerry Harvey advocates. Mr. Harvey does not have much sympathy for the workers of the unemployed of Australia. His companies usage of AWA’s is a disgrace:

http://www.theage.com.au/national/harvey-norman-defied-federal-ban-to-offer-awas-to-new-employees-20080713-3ej8.html

And let’s not forget Gerry Harvey’s ideas about creating a 2nd tier of guest foriegn workers and paying them 50% of the local wage.

http://www.news.com.au/couriermail/story/0,23739,22625338-3122,00.html

Interesting how Gerry Harvey wants a free market for labour but says nothing about the anti-competitive practices of the horse breeding industry. By refusing to endorse methods of artifical insemination which would make the industry contestable Gerry Harvey seems to be happy to increase his own wealth but heaven forbid that anyone else would want to improve theirs.

Malcom Turnbull is a gem as well. His green credentials are woeful- what about his role in the Solomons as head honcho for Axiom Holdings?

http://www.abc.net.au/am/content/2004/s1210315.htm

Well done Bill – Like I said previously you have become one of them. I used to really look up to you 10 years ago but that person who was crusading for the rights of the working classes appears to be long gone now.

Dear Bill,

Your mentioning the two telephone conversations supports my impression that

there appears to be a rapidly increasing interest in the JG and the macroeconomic monetary theory which underpins it. I was recently asked about this stuff in a town out in the bush and after telling these people “off the cuff in 10 minutes” they said they’d be interested in hearing more perhaps in the form of a powerpoint presentation. (BTW three of these people were unemployed and had given up on even registering with Centrelink for the usual reasons.) I’d like to do it but whilst I am gaining a more and better understanding of the material I felt I’d have to have the support of an expert in designing such a presentation.

So the thought has come to me that maybe the time is approaching when more people might like to have a general understanding of the basics in the approach both of JG and macro. Naturally you and others like you such as Randy Wray, Warren Mosler etc are far too few to be traversing across the land to “spread the word”. Just as Al Gore has been training up an army of keen folk to go out and inform people about the impact of carbon dioxide on climate change and what can be done about it so a group of interested semi-expert JG people could undertake a similar task. The sorts of groups who could be addressed would be local councils, charities involved with the unemployed, business service groups etc.

Naturally the presenters would need to have a reasonable grasp of the material and be prepared for all the likely questions and know when they need to refer questioners to other sources such as the experts etc. They wouldn’t need to have the level of understanding as required to grasp what drove Lefty to head for a beer in the JKH initiated discussion a couple of days ago. And Lefty would be a good candidate for just an activity as being suggested.

Only a thought!

Dear Alan

There is a difference between talking to people and being co-opted by them or forming alliances with them. My agenda is clear and unequivocal and is 100 per cent unable to be co-opted into some other ideological pursuit.

But if the conservatives become advocates of the Job Guarantee and abandon their vicious attitudes to the unemployed wouldn’t you feel happy about that? And if they take my ideas and pervert them to their own advantage am I to blame for that? I would be certainly be co-opted if I continued to work with them by providing them with advice or intellectual authority while they were simultaneously screwing the ideas and turning them into another punishment regime. The hard facts of life is that ideas have to be taken up by politicians for them to become policy. I don’t see my work as being an exercise in just “playing chess”. But I will never allow those ideas to be diminished by ideology which is not the same thing as saying I might change my mind if I find research evidence that is problematic for my current set of views. I am a researcher after all.

You may think otherwise but if I only spoke with my “friends” – that is, people who agreed with everything I said then it would be a very isolated world. Further, as an educator I think I can change perceptions through knowledge.

And I have an extensive list of retail stores that I will not shop from (often to my own personal inconvenience) after finding out that they have abused my sense of fair working conditions.

best wishes

bill

Dear Bill,

It all reminds me of a passabge from The Great Gatsby which reads:

“They were careless people, Tom and Daisy–they smashed up things and

creatures and then retreated back into their money or their vast

carelessness or whatever it was that kept them together, and let other

people clean up the mess they had made. . . .”

They cannot be trusted . End of Story.

Cheers, Alan

I suspect Turnbull’s agenda is pretty much irrelivent now.

You might want to try talking to Andrew Robb or the Mad Monk perhaps.

Alan is of course, correct. They cannot be trusted. They haven’t the slightest interest in the job gaurantee in the context of public purpose – they are interested in political purpose. It would be nice if some good came of that but if they decide they cannot wring any political advantage out of it, then that will be that.

Still, you never know……

Dear Lefty and Alan

For me it is not about trust. I know what their motivation is. Politicians are politicians. But they are the vehicles for ideas to become policy. At some point you have to deal with them if you want to get the ideas into the policy arena. It is not that you trust them to do anything wholesome. You just hope they see the idea which is wholesome being a vehicle for their own agenda – then the motivations align and progress is possible. The alternative is you leave it to the neo-liberals.

I deal with these characters often and usually it is a disappointing outcome.

best wishes

bill

I agree.

It would be nice if their self-serving motivations ended up sparking the value of the idea in the minds of the public.

BILL,

When somebody sits on the middle of a fence the will eventually fall off ,and it mat not allways be the greenest side they fall on,good luck

Dear Bill,

This is not a case of dropping some data into E-Views and running the model. We are talking about real people here that in all likelihood will be used and abused as slave labour by these neo-conservative dogs.

When the experiment fails you can go back to your research but what about those less fortunate persons who will be forced into selling their labour at a price well below the market rate?

Cheers, Alan

I’d just be worried that they sell it as a kind of punishment for ‘dole bludgers that havent worked for 5 years, and are now forced to contribute to society’ kind of thing. But saying that, if it gets the JG into the national discussion it can only be a good thing. Also, I think that the focus on land degradation is clearly the kind of market failure that the JG was designed to tackle.

Alan and Lefty, Bill could quite easily ignore Turnbull and the JG would remain a marginalised idea. At least its getting some attention from a major party (although I’m surpirsed at which one!). The JG wont get anywhere if you are unwilling to talk to politicians who have peddled neoliberal crap in the past.

Dear Stuart,

Economically illiterate politiicans can be replaced so why not replace them with oness that are versed in the economics of a modern money economy?

Why waste time trying to teach old conservative dogs new tricks ?

What is needed is an army for the future and that means communicating with the youth of Australia now so that by the time they are ready to vote they will be able to force change. Moreover, some of these youth (many) are quite remarkable people who at this stage in their life are not fully commited to any political ideology just yet.

Why not seek out the better ones, bring them on board and then launch them into the political arena to displace the conservative dogs currently in office? How on earth would the current crop of politicians compete for votes with Good looking and intelligent youth who know what the youth of Australia want?

I’m not talking about young politiicans who pretend to be concerned with youth (hello democrats) either. I am talking about youth that are very active in the community today be it in sport, business, politics, art, the environment, animal welfare, and so on.

These are the people Bill should be trying to bring on board, not grubby over the hill Politicians with no idea of what social inclusion means. Turnbull and company are the in the past. Bill needs to look towards securin g the future.

Cheers, Alan

Alan, I agree that the Job guarantee needs to be communicated to the general public. Thats my point. This gives the opportunity to at least get the JG into the policy debate. Unfortunately most of the youth (Me being one of the exceptions) dont find blogs on economics, let alone post keynesian economics all that interesting. The youth arent going to look for stuff on the JG if theyve never heard of it.

Stuart,

I wasn’t suggesting turning the youth of Australia into modern money economists as I don’t believe it is necessary. Just informing the unemployed or underemployed youth of Australia that they are in such a position because their government and corporations have failed them should is sufficient.

A person in a burning house doesn’t care how the fire started – they simply want to be rescued.

To go into technical detail about the hows and whys of it all just takes the battle back to neo-liberal territory. Then the problem becomes one of how do youth differentiate between the modern money school and the neo-liberals.

cheers, Alan

Stuart: I’m not actually all that surprised at the place the attention has come from (although that may seem counter intuitive). It goes to the heart of what both myself and Alan have said. They don’t care about the social benefits of the job gaurantee – they are a desperate bunch who have gone from masters of the nation to facing near-extinction in two short years. They will try anything to save their political skins and I speculate that they are hoping that unemployment will rise high enough so that they can use the offer of a job gaurantee to garner enough votes at the coming election to save themselves from complete anihilation.

The outlook for the coalition is probably the bleakest it has ever been in their entire history and they are desperately groping for anything they can use to keep their heads just above water – even if they don’t give a rat’s about what it is.

But Bill is correct – politicians are the vehicles for ideas to become policy. If they run on this – even if they neither believe in nor care about it – they will put the idea in the minds of the public, and that would be a great start.