The IMF and the World Bank are in Washington this week for their 6 monthly…

Bank of Japan once again shows who calls the shots

On August 1, 2018, the 10-year Japanese government bond yield, shot through the roof (albeit a very low one). Yields shifted from 0.05 per cent on July 31 to 0.129 on August 1, which was the largest one-day rise since July 29, 2016 (when the yield rose 0.101 per cent). The Financial Times article (August 1, 2018) – Japanese bond market jolted as traders test BoJ resolve – wrote that “traders wasted no time in testing the Bank of Japan’s resolve to loosen its target range for the debt benchmark”. So what was that all about? And what key point does it demonstrate that seems to be lost on mainstream economists who continually claim that government debt is, or can become a problem once bond markets demand higher yields? The Japanese bond market has shown once again that private bond traders cannot set yields on government bonds if the central bank intervenes. Next time you hear some mainstream economist claiming a currency issuing government is running deficits at the will of the investors (read bond markets) politely tell them they are clueless. Japan once again provides the real world Modern Monetary Theory (MMT) laboratory – every day it substantiates the underlying insights contained within MMT and refutes the core mainstream propositions. The bond market over the last month or so demonstrates that the Japanese government is increasingly net spending by using credits created by the Bank of Japan, whatever else the accounting structures might lead one to believe. With inflation low and stable, these dynamics surely put paid to the various myths that a currency-issuing government can run out of money and that central bank credits to facilitate government spending lead to hyperinflation.

I last wrote about the dynamics of Japan’s bond markets in this blog post – More fun in Japanese bond markets (February 7, 2017).

For further background, see this blog post – Bank of Japan is in charge not the bond markets (November 21, 2016).

Essential summary points:

1. If the demand for government bonds declines, the prices in the secondary market decline and the yield rises (see blog link above to understand why).

2. Once bonds are issued by the government in the ‘primary market’ (via auctions) they are traded in the ‘secondary market’ between interested parties (investors) on the basis of demand and supply. When demand is strong relative to supply, the price of the bond will rise above its ‘face value’ and vice versa when demand is weak relative to supply.

3. Any central bank has the financial capacity to dominate the demand for any specific maturity bond in the secondary markets and thus can set yields.

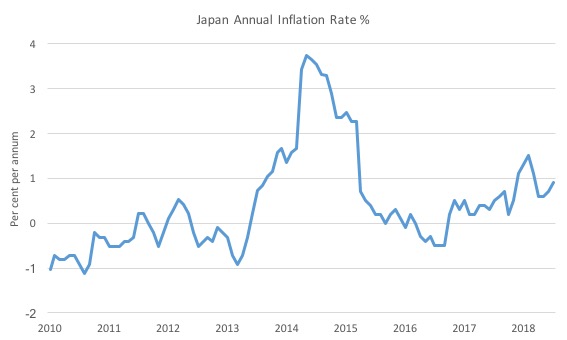

Those who follow Japanese economic policy shifts will know that the Bank of Japan has been trying to push the inflation rate up for many years.

The most recent attempt started on April 4, 2013 when its QQE bond-buying extravaganza was resumed.

Since then this policy has morphed into an even more ‘easy’ money policy initiatives – October 31, 2014 they revved up QQE, then introduced their Negative interest rate decision on January 29, 2016, and then on September 21, 2016, they introduced their yield curve control decision.

I outline those policy shifts in detail in the blog posts cited previously.

The point is that these monetary policy gymnastics have been largely unsuccessful. The spike in inflation you can see in 2014 was due to fiscal policy (consumption tax hike), which should tell you something about the relative strength of each of the two aggregate policy instruments (monetary and fiscal).

The point is that the Bank of Japan is now in a position of its own making.

Having sworn that it would maintain its bond-buying program until inflation was in the 2 per cent range and with the Governor Haruhiko Kuroda suggesting in a – Speech to the Foreign Correspondent’s Club of Japan – on March 20, 2015 that “CPI inflation is expected to reach 2 percent in or around fiscal 2015”, the policy is being extended well beyond its initial scope.

They are under attack from the banksters and speculators who are unable to make larger profits with long-term yields around zero.

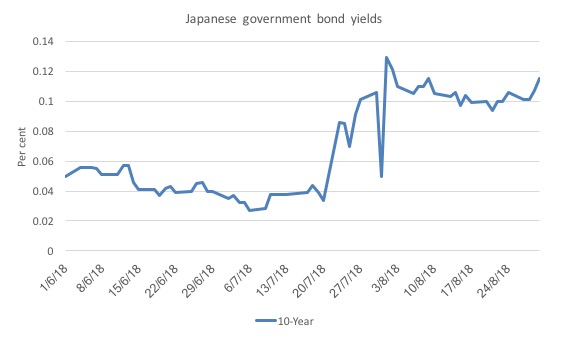

This graph shows the 10-year JGB yield from June 1, 2018 to August 30, 2018, with the spike on August 1 noticeable.

The games started the week before when the 10-year JGB yield rose on July 23, 2018 by 0.052 points. That was a precursor to the larger rise on August 1.

The largest single-day rise in 10-year JGB yields occurred on May 15, 1987, when yields jumped from 3.492 per cent to 3.83 per cent.

Speculation was rife that the BoJ would relent on its “QQE with Yield Curve Control” program and start allowing yields to rise.

There has been no shifts in inflationary expectations or, for that matter, bid-to-cover ratios (which might indicate that investors are increasing risk attached to these assets).

It was a case of the usual “unnamed sources” telling Reuters that the policy had to ease even further – see their news report (July 21, 2018) – Exclusive: BOJ to debate policy change in July to make its stimulus sustainable: sources.

The changes foreshadowed related to whether the bond-buying program was “sustainable” (Reuters word) given that it was likely that the inflation target of 2 per cent would take much longer than previously estimated to reach.

Reuters quoted a “source” who “declined to be identified” (meaning I usually disregard) as saying that the “cost of prolonged easing is becoming ‘hard to ignore'”.

Which you should read as saying the investors are annoyed that yields are being held at zero by the BoJ and want more amplitude to help them in their speculative behaviour.

The Reuters’ Report lists the investor concerns:

1. “The BOJ could tweak its yield-curve control (YCC) programme to allow for a more natural rise in long-term interest rates to ease the pain on banks from years of near-zero rates, they say”.

Which raises the questions as to why the debt is being issued in the first place. Who benefits? Obviously the banks want to return to the days where they could get risk-free annuities flowing to them from JGBs (aka corporate welfare).

2. “the bank’s huge purchases are drying up market liquidity and distorting price action” – meaning that the issuance of the JGBs is more about providing speculators with a risk-free asset which they can use as a benchmark to price their own risky assets and seek haven in when uncertainty increases (aka corporate welfare).

3. “the rising cost of prolonged easing, such as the strain on bank profits” (aka corporate welfare).

The reality is that the BoJ would face a huge credibility problem if it abandoned its zero-rate YCC policy with the key inflation rate measure still a long way from reaching the 2 per cent target.

How could they justify it other than as a sop to corporate Japan?

On July 31, 2018, the Bank of Japan released a statement – Strengthening the Framework for Continuous Powerful Monetary Easing – which provided the latest information from the Monetary Policy Meeting on its policy stance:

The announcement said that:

… the Policy Board of the Bank of Japan decided to strengthen its commitment to achieving the price stability target by introducing forward guidance for policy rates, and to enhance the sustainability of “Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control.”

Accordingly:

1. “The Bank intends to maintain the current extremely low levels of short- and long-term interest rates for an extended period of time”.

2. “The Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank” – so a tax on reserves.

3. “The Bank will purchase Japanese government bonds (JGBs) so that 10-year JGB yields will remain at around zero percent” and in a footnote they said “In case of a rapid increase in the yields, the Bank will purchase JGBs promptly and appropriately.”

That footnote tells you everything really. I will come back to it.

4. “the Bank will conduct purchases in a flexible manner so that their amount outstanding will increase at an annual pace of about 80 trillion yen”.

5. There were some changes in the way the BoJ deals with purchases of non-government bonds.

6. The other statements confirmed it was committed to maintaining its “QQE with Yield Curve Control” but would do so in a “more flexible manner” so as to reach a “price stability target of 2 percent a the earliest possible time, while securing stability in economic and financial conditions.”

Bloomberg reported that the ‘market’ considered that statement meant that the BoJ would “double” the permitted fluctuations in the 10-year bond yield from “0.1 percentage point on either side of 0 percent” to 0.2 per cent.

That is also what the FT article (August 1, 2018) – Japanese bond market jolted as traders test BoJ resolve – had reported, viz … “The central bank doubled the level it will permit 10-year yields to climb from 0.1 to 0.2 per cent”.

As a result the yields started moving about as the bond traders ‘tested’ the BoJ “resolve” (FT words).

One market trader, quoted in the FT article interpreted the developments in this way:

The message Kuroda was keen to give was to allow a wider movement in 10-year bonds but that doesn’t mean he’ll allow it to drift … The market is now going to find out what it can get away with.

That statement is very significant.

When a child tests their parent’s resolve to see what “it can get away with” it demonstrates who has the power in the relationship.

It is the same with the relationship between bond markets and central banks. The former operates within the space granted to them by the policy decisions of the latter.

The central bank always calls the shots on yields and the bond markets only set yields if the government allows them to.

This should tell you that all the claims made by mainstream economists and the sycophantic commentators that just copy their words that bond markets will drive yields up when they lose trust in a government’s ability to pay and this sparks a crisis which can only be resolved by fiscal austerity are hollow.

The bond markets can never drive a currency-issuing government into insolvency.

The bond markets can never drive yields up to elevated levels unless the government (via its central banks) allows that.

The bond markets are mendicants in this context.

And it didn’t take long for the JGB speculators to learn the lesson – again.

Just two days after the MPC met (July 31, 2018), the BoJ launched a so-called “special buying operation” (outside schedule), which stopped the rising yields in their tracks.

This demonstrated that the speculation in the week or more before that the BoJ would allow the fluctuations in 10-year bonds to double was folly.

On August 2, 2018, the Deputy Governor of the BoJ told journalists that “If yields rise rapidly, the bank will purchase JGBs promptly and appropriately” (Source).

The graph above (10-year bond yields) shows that the BoJ is maintaining a slightly wider yield margin under its yield curve control and QQE program but not as large as the financial markets desire.

Mainstream economists eschew this sort of strategy and claim that the central bank can only achieve this outcome if the targeted yields are consistent with what the bond markets want anyway.

That is, of course, a false claim.

In reality, the only consequence of a discrepancy between the targeted yields and the market expectations of future yields held by bond traders would be that the central bank would eventually own all of the bonds in the target range.

There would be no problem arising from that eventuality.

The bond traders might boycott the issues and force the central bank to take up all the volume on offer. So what? This doesn’t negate the effectiveness of the strategy it just means that the private buyers are missing out on a risk-free asset and have to put their funds elsewhere. Their loss!

Eventually, if the government bond was the preferred asset the bond traders would learn that the central bank was committed to the strategy and would realise that if they didn’t take up the issue the Bank would.

The Bank of Japan’s current policy is demonstrating that it runs the show not the bond markets.

To repeat the reality again:

1. The Japanese government can never run out of money (yen). It is impossible. Therefore it can never become bankrupt.

2. The Bank of Japan can maintain yields on JGBs at whatever level it chooses, at whatever maturity range it targets, and for as long as it likes. The bond market investors are incidental to that capacity and are supplicants rather than drivers.

3. The size of the Bank of Japan’s balance sheet (monetary base) has no relationship with the inflation rate.

4. If the Bid-to-Cover ratios at bond auctions fell to zero – that is, private bond dealers offered no bids for an auction – then the government could simply instruct the Bank of Japan to buy the issue. A simpler accounting device would be to stop issuing JGBs altogether and just instruct the Bank to credit relevant bank accounts to facilitate the spending desires of the Ministry of Finance.

5. If private investors choose to buy other assets once the risk in international markets subsides then the Japanese government (the consolidated central bank and treasury) could just buy more of its own debt – to near infinity.

Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

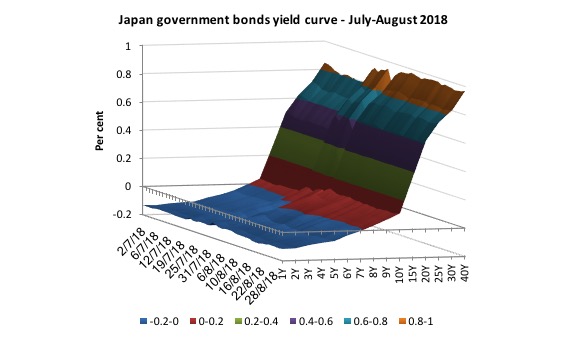

Here is my latest ‘surface’ graph for Japan for the period July 1, 2018 to August 31, 2018.

For readers unfamiliar with reading surface charts of yield curves, the vertical axis shows the yields (depicted in the coloured legend at the bottom of the graph). The horizontal axis shows the maturity of the debt instrument issued from 1-year to 40-year JGBs.

The depth axis shows the date span covered.

In the shorter maturities JGBs, there is remarkable stability across this period with the negative interest rate policy being maintained.

Investors are providing loans to the Japanese government at negative rates righ up to the 7-year maturity.

You can also see the ripples across most maturities at the end of July, coinciding with the ‘testing’ period.

And then once the BoJ reasserted its position and the fluctuation range was clearly lower than the markets hoped for, the surfaces became stable again.

Increasing Bank of Japan holdings of Japanese government debt

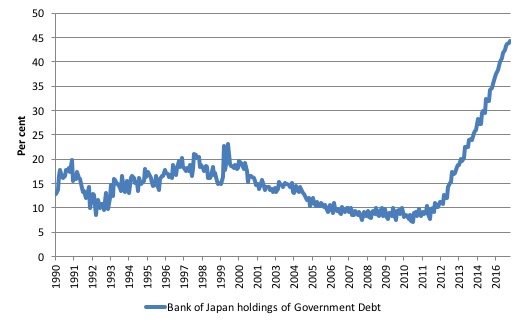

To further accentuate the point that the central bank calls the shots, the following graph shows the proportion of total national government debt in Japan that is held by the Bank of Japan from January 1990 to June 2018.

The secondary JGBs market has been very thin since the QQE program began and sellers in that market have declined.

Why? Because as the auction yields have gone negative, current bond holders who purchased the debt instrument at positive yields, will worry about having funds (from sales) which are only going to attract negative returns (losses). The smart strategy in that case is to maintain long positions.

In February 2011, the Bank of Japan held 7.1 per cent of all the outstanding JGBs (across most maturities). By September 2016, that ratio has risen to 47.4 per cent and will rise further as the QQE program continues.

Since the April 2013 announcement, the monetary base has risen from 1,495,975 trillion yen to 4,976,398 trillion yen (as at end June 2018).

Where is the accelerating inflation? Answer: in flawed Monetarist textbooks!

Since the April 2013 announcement, bank reserves have risen from 595,334 trillion yen to 3,444,126 trillion yen.

Where is the boom in bank lending? Answer: in flawed mainstream monetary textbooks!

The monetary operations really just mean that the Japanese government is spending by using credits created by the Bank of Japan, whatever else the accounting structures might lead one to believe.

With inflation low and stable, these dynamics surely put paid to the various myths that a currency-issuing government can run out of money and that central bank credits to facilitate government spending lead to hyperinflation.

Conclusion

Once you appreciate the fact that the central bank can control government bond yields at any level it chooses, the next step in the transition is to realise that such interventions are, in fact, redundant.

The best thing that a sovereign government can do is consolidate its treasury and central banking operations (make them consistent in a policy sense) – which would make macroeconomic policy totally accountable to voters unlike today where the central bankers do not face election.

Then the treasury should net spend as required to ensure that the economy achieves and sustains full employment and price stability. This may under some circumstances (very strong external surpluses) require a fiscal surplus, but normally for most countries it will require continuous fiscal deficits of varying proportions of GDP as the overall saving desires of the private domestic sector varied over time.

The treasury should issue no debt at all. Even those who argue that the government should issue short-term paper to allow the central bank to reach its target interest rate via liquidity management operations now realise that interest payments on excess reserves accomplishes the same end.

All those commentators who claim that accelerating inflation would result if governments abandoned debt-issuance but continued to run deficits have been repeatedly shown to be wrong.

No increased inflation risk would be introduced by the government refraining from issuing debt to match any fiscal deficits it might be recording. The monetary operations that accompany fiscal policy changes have very little impact on increasing or decreasing the inflation risk of continuously running an economy close to full capacity. The risk is real but can be managed.

Further, there is no financial reason for issuing the debt because the sovereign government retains monopoly control over the currency. The practice of debt-issuance is a hang-over from the gold standard era where governments had to fund their spending in order to retain control over the exchange rate.

The practice has lingered because it is now a convenient ideological cum political tool used by neo-liberals to limit the size of government and to give the corporate sector access to corporate welfare (the risk-free government debt) that they use to create profit.

If everyone knew that there was no functional (financial) reason for the government to issue debt and that it just transferred public funds into the hands of the speculators then I think attitudes might change.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Excellent post. Very useful.

Thank you.

Yes. This is a very, very good post.

Excellent!

Till this day, I’ll never understand how for the last 40 years people have believed that govt debt is warranted and that somehow insolvency is a problem for a country that issues its own currency!

Hyperinflation never occurs without the convergence of several disasterous economic, financial and political circumstances, however, regular garden variety inflation will always occur in modern economies if money is continually pumped into them, and hurtful but less than hyperinflationary rates unless an alternative . This doesn’t invalidate MMT money mechanics, but it will enable regressive forces to “rag on” about relatively high inflation and try to reverse the additional money necessary to keep the economy out of recession. The problem with the terminally orthodox neo-liberals is they think the economy tends toward equilibrium and the problem with all heterodox theorists is they think the economy tends a little bit toward disequilibrium. The fact is the economy is actually in a continual state of alternately financially raped and smothered chaos because it is bounded neither on the lower end by costs nor the upper end by price. Money itself is not the operant cause of “monetary” inflation hence it is a misnomer. The actual deepest cause of inflation is the complete lack of any actual regulatory means of preventing commercial decision makers from raising their prices, especially in an austere system with a chronic shortage of aggregate deamnd. Put this together with the actual chaotic nature of the economy and you’ve got a seemingly unresolvable problem. That’s where the paradigm changing alternative of painless and beneficial integration of price deflation into profit making systems comes in with the dual policies of a universal dividend and a 50% discount/rebate policy at the point of sale throughout the entire length and at the terminal ending point of the legitimate economic/productive process at retail sale. I know the idea of a UBI or universal dividend seems to be anathema to you Bill, but Employment Only as the paradigm of income has never been adequate and will be increasingly less so as time goes on. And if anyone is having trouble finding purpose without putting in their 40hrs/wk a job guarantee fits snugly within the new paradigm of Direct and Reciprocal Monetary Gifting.

You can be sure that “the usual suspects” remain busy keeping the populace ignorant of the facts.

A steady and deafening drumbeat of “Venezuela! Turkey! Greece!” continues to batter my data-feeds and email inbox.

Yes, very nice article. Thank you, Professor Mitchell.

The point is that these monetary policy gymnastics have been largely unsuccessful. Bill Mitchell

Because, except for physical fiat, aka “cash”, the non-bank private sector may not even use money (i.e. fiat) but instead must use bank deposits?

But suppose instead that all citizens were allowed inherently risk-free checking/debit accounts at the Central Bank itself alongside those of the banks? And that government-provided bank deposit insurance and other disincentives to use those inherently risk-free accounts at the Central Bank have been abolished?

THEN imagine the power of monetary policy? Imagine, for example, that negative interest were applied to large account balances at the Central Bank? And that the proceeds were equally distributed to all individual citizen accounts at the Central Bank?

The possibilities are numerous and have the advantages of, for example:

1) Not increasing the size of government – thus precluding objections from that quarter.

2) Decreasing the power of the banks to hold the economy hostage by providing an additional, inherently risk-free payment system to the one that must work through the banks.

Thanks for this useful post. One question though, regarding one of your conclusions: “….Then the treasury should net spend as required to ensure that the economy achieves and sustains full employment and price stability…”

A couple of weeks ago, Jerome Powell candidly admitted (https://www.federalreserve.gov/newsevents/speech/powell20180824a.htm) that policies guided by “stars”, such as the natural rate of employment or potential output growth, was not “straightforward”. However, by targeting “full employment”, isn’t MMT also aiming for these same not-so-reliable moving targets?

Dear Bill

When Mauricio Macri became President of Argentina, he decided that Argentina should borrow in US dollars again. Now Argentina is going to get a 50-billion dollar loan from the IMF, and the IMF will no doubt demand various austerity measures. If Japan demonstrates that a government which borrows in its own currency cannot go bankrupt, then Argentina demonstrates that a government which borrows in a foreign currency can run into financial difficulties.

Regards. James

A very good post Bill, thank you and I fully agree!

But the next logical questions concerning cb-policy would be about;

a) what kind of inflation matters? Lack of demand-inflation for cost-push inflation due to i.e currency competition! And why 2% in todays different global environment etc.

b) what if stagflation is “around the corner”? How to respond? Stagflation not because of commodity-inflation but of market-competition(falling global demand and margins force (overleveraged) businesses to price-compensate or go bankrupt). Would MMT-policy maintain negative rates in an increasing cost-inflation scenario? I suppose so! Would cb´s again buy bad debts from banks to keep credit alive! When stock-prices go down the pension-crisis will also exacerbate.

Would governments in i.e Europe then eventually learn how to respond(the hard way)? Maybe a stagflation-scenario is what it takes to finally bring the neoliberals to their knees! Still the cost would be very high.

c) Inflation has reached it´s targets in the US and they are normalizing rates. 2% are also reached in the EU. Should ECB still cling to negative rates? Yes we know some euro-members definately need the ECB support. Trade-wars often starts with currency-wars! The USD will probably set the stage for a renewed crises. Will China comply in the next “Plaza Accord”? Another 1987 coming……with a less positive outcome due to private debts? Will the euro survive!

@Prof Bill – How powerful would the central bank of India be against the bond markets? Would the same mechanics apply to them as it applies to japan?

Dear Ram (at 2018/09/03 at 9:36 pm)

Same mechanics.

best wishes

bill

That was a great contribution to macro economics.

Food for thought:

At this pace the BoJ would own 100% of JGBs in ~6 years. If it maintains yield curve control then it will be holding a basket of JGBs that have a negative real yield. If the government wants it can continue to fund itself via the BoJ. It can fund itself to the extent it wants… it could create enough money to theoretically buy every good the people of Japan want from abroad and to hire immigrants or robots to provide every service the people of Japan want. So, theoretically, taken to the extreme, with a government generous enough to its own citizens, none of the citizens would have to produce any goods or perform any service. So it seems the suckers in this global economy are the citizens of countries where the governments actually want to run exports and accept foreign currencies for those exports. Those people have it the hardest. But then, of course, if a government coddles its citizens too much the country loses its productivity, industry, skills. And then if the exporting nations suddenly stopped accepting that country’s currency in exchange for exports then the coddled citizens would suddenly face extremely hrad times. So, as a matter of national security, it seems that government policy should focus on trade balances.

“targeting full employment”

The driver of the proposed job guarantee is (therefore) not targeting some estimate or statistic. The driver is people coming in to apply for jobs. It’s close to the most direct estimate of need.

“Dear Ram (at 2018/09/03 at 9:36 pm)

Same mechanics.

best wishes

bill”

Thank you for the post, my question is – if the central bank of India (or any other not so developed and effective economy as Japan is) does the same as Japan, would not rupee start depreciating immediately leading to significant inflationary pressures in the economy ? Who would like to hold the currency ? Look at Egypt for example.

Dear Bill,

Japan has regularly produced Current Account Surpluses for a very long term.

How does this affect their ability to mange large deficits and low interest rates in comparison to countries like the USA and Australia that have historically run current account deficits ?

Regards

Alan Dunn

How do you explain the Russian defaults then?

Anyone able to comment on what recent out of season rises to retail home loan interest rates in Australia says about the RBA’s ability to call the shots on interest rates?

@Tom – Russia ran a fixed exchange rate and needed foreign reserves to maintain the Ruble within the ‘band’ allowed vs the dollar. The war in Chechnya and the collapse in crude oil prices didn’t help their foreign reserve position. You’re welcome.

What an excellent article that summarises “everything” – probably one of my top 3 favourites on this blog.

Together with Wray’s 30page 2014 paper titled “Central Bank Independence: Myth and Misunderstanding” (but which I’m reading ad really mainly talking about the relationship of interest rates and government deficit spending and the non-likelihood of a CB going rogue and “independently” raising interest rates long enough to cause trouble before “gov” would put it in line) this article is so relevant to 2020 as we’re now seeing these policies and operations being copied and fully practiced also outside of Japan, incl. in Australia.

http://www.levyinstitute.org/files/download.php?file=wp_791.pdf&pubid=2011