It was only a matter of time I suppose but the IMF is now focusing…

When 232 thousand becomes 630 – quite, simply horrifying Brexit losses

I read a lot of articles in the British and other press about how the Brexit camp lied or mislead voters about the benefits of Brexit. Apparently there is an immorality in the leave camp that led it to deliberately dupe the voting public and allow a bunch of racists to steal the vote. According to this narrative, a new vote is necessary to bring out the truth so that democracy rules. What a joke. The concept of democracy for the Europhiles in Britain is to keep holding national votes supported by a massive disinformation campaign until the votes delivers the result they want. That seems to be what is going on. In the meantime, the unsuccessful voting outcomes are put down to the ignorance of the voters, or the racism of the voters or some deficiency in the voters rather than deficiencies in the proposal the Europhiles are trying to push. And the on-going campaign has to be fuelled by a constant repetition of the disaster estimates. The case of the UK financial services sector is a classic demonstration of this phenomenon. It is at the point of being a ridiculous sham.

The Remainers have long been whipping up ‘Project Fear’ in relation to Brexit.

The recent UK Guardian article (August 12, 2018) – Hard-Brexit fantasists dislike hard economic realities – by the Remain-obsessed William Keegan, with amplifier up to ’11’, continues the theme.

He says that there is now evidence that the Leavers hate to confront:

They have got it, in spades. The so-called impact assessments for no deal are, quite simply, horrifying. They were underlined recently by the Bank of England governor, Mark Carney, who rightly drew attention to the messages coming through loud and clear from business, trade unions, the City and, not least, food suppliers, road hauliers, ports and airports.

Now, of course, when they have got what they asked for – namely, attention to the possibility of a cliff-edge Brexit – the Brexiters don’t like it and yell “project fear”.

Hmm, did I miss something. Damaging new evidence that is “quite simply, horrifying”.

In my blog post – Brexit doom predictions – the Y2K of today (August 28, 2018) – I mentioned that the UK Guardian thinks it is useful to have William Keegan continue his relentless articles about the dire costs of Brexit.

He rarely offers anything of substance. Just obsessive dislike for the idea that Britain will be sovereign again.

And over the weekend, the UK Guardian continued to pump out its anti-Brexit propaganda.

The UK Guardian article e – Brexit costing Britain £500m a week and rising, says report (September 29, 2018) – was in the current journalistic tradition of being recyclers of press releases put out by organisations seeking to advance their own agendas.

It provides uncritical coverage of the latest report from the Centre for European Reform (released September 30, 2018) – The Cost of Brexit to June 2018.

I covered their last ‘update’ from the Centre for European Reform in this blog post – How to distort the Brexit debate – exclude significant factors! (June 25, 2018).

The conclusion was straightforward.

1. The reliability of their estimates are doubtful.

2. A significant difference between the reference group nations they used to compare the UK GDP growth rates to was excluded from the analysis by the Centre for European Reform.

3. If we consider the different fiscal trajectories between the reference group and the UK, it is clear that post Brexit Referendum, Britain has diverged significantly from the reference group nations, all of which either maintained their fiscal support or increased it, while Britain has moved towards increased austerity marked by the current fiscal surplus.

In other words, Garbage In-Garbage Out.

The latest update claims that the “UK economy is 2.5 per cent smaller than it would be if the UK had voted to remain in the European Union”.

While the CER claimed they revised their second model (which presents the latest results) to meet criticisms received from economists, they certainly did not address the concerns I raised – that of omitted variables bias.

So nothing new except now they are adding some politicisation to their rubbish by claiming that:

The knock-on hit to the public finances is now £26 billion per annum – or £500 million a week … It is possible to work out how much extra borrowing the UK’s foregone output implies … Our estimate shows there is no Brexit dividend …

This is a political statement. Their metholology cannot differentiate in any robust way the causality.

The fact is that they cannot reasonably make the claim that “the culprit” explaining the slowdown in Britain’s real GDP growth “is the vote for Brexit”.

It is more plausible, given other indicators, that the fiscal contraction has driven the slowdown. Their methodology does not even include that possibility, which is the issue I raised in my analysis of their first report.

The UK Guardian’s ‘news’ presentation of the story is deliberately polemical.

They have a picture of a big red bus that the Leave campain used with the caption “We send the EU £50 million a day let’s fund our NHS instead. Vote Leave. Let’s take back control”.

And then open with the claim (merely repeating the press release from the CER) that the research results (from CER) are in “stark contrast to the £350m “dividend” promised by the Leave campaign.”

The really dishonest claim is that:

… the government’s austerity drive would be on the way to completion had Britain voted to stay in the European Union … The model also suggests that had Britain not voted to leave, the deficit would be down to just 0.1% of GDP, or £2bn. It would mean the austerity drive in place since 2010 would be all but complete.

Think about this for a moment.

Their ‘model’ does not consider the degrees of fiscal shift in any of the nations considered. They just take the different growth paths (as if they were independent of the fiscal shifts over time) and make a facile calculation that any primary school child could probably accomplish that if the fiscal balance was x times sensitive to growth and growth fell by y, then the fiscal balance would be different by x times y.

So if growth was z per cent higher than it is, then the fiscal balance would vary by that factor and so be in larger surplus than it is.

Of course, if the fiscal austerity had not been moderated (to some extent) by George Osborne in 2012 as national growth was crashing under the strain of the fiscal cuts, then the growth rate would have been that much lower than it was over period 2012-2018.

And the difference between the comparison nations in the CER report and the UK would have been that much larger.

In other words, they are trying to capture both sides of the debate:

1. The Labourites who will be concerned about growth and employment.

2. The Tories who will be miffed that their cherished austerity is not moving fast enough.

The UK Guardian article goes on to details rumours of British industry leaders having secret meetings with Europeans to plan relocations etc.

The UK Guardian has form in this respect though.

I saw a Reuter’s report last week (September 26, 2018) – Exclusive: With six months to go before Brexit, 630 finance jobs have left – Reuters survey – which reminded me of the long stream of claims since 20156 that the UK financial sector was about to leave London (and other British cities), bound for Paris, Frankfurt, Amsterdam and anywhere else those making the claims could land a dart on a map of continental Europe.

Remember all that?

In 2016, TheCityUK commissioned a private ‘global management’ consulting company to analyse what a vote for Brexit would do for the financial services sector in the UK.

It released the report – The Impact of the UKs Exit from the EU on the UK-based Financial Services Sector.

The Report claimed that:

We have assessed the impact at a granular business line and product level to allow us to impact of outcomes on each business area. We looked at the value chain for each activity, which allows us to separate activitis along this chain that are impacted by regulatory change from those that are not.

So that sounded as though it was a seriously researched study.

It then poses a serious of constraints that would emerge if there was a “low access scenario”. None of them are very credible.

But the final result is that the ‘study’ estimates that up to 75,000 jobs will be lost.

To put that forecast into perspective, the UK financial sector currently employs about 1.1 million people.

Based on the accuracy of the forecasts I wonder why the company hasn’t closed its door for lack of business.

In April 2016, PwC released a report – Leaving the EU: Implications for the UK financial services sector – which concluded that in relation to the Financial Sector there would be:

… a reduction of 70,000-100,000 in … number of people employed … in 2020.

They also claimed there “could be potential knock-on impacts” on the financial sector, but do not put any employment numbers against that assertion – rather they claim it would correspond to “a further reduction in FS GVA of around 2 per cent by 2020” and get worse over time.

Given the inital impact was estimated to be around “3.1%-5.5%” of Gross Value Added (GVA) which corresponds to “70,000-100,000” then 2 per cent might be around 45,000 extra jobs lost.

Whatever, PwC was postulating massive job losses.

Soon after Ernst Young decided to make itself relevant to this debate by offering their own forecasts (June 23, 2016) – UK/EU: Working through uncertainty Practical considerations for Financial Institutions.

It claimed that:

A UK exit from the EU may have a greater impact on the financial services sector than for any other area of the economy.

It was then reported that they considered around 83,000 jobs would be lost.

They went one step further with their so-called – Financial Services Brexit Tracker – which apparently was offering some sort of ‘real time’ tracking of the job losses.

Its December 11, 2017 update:

According to the latest EY Financial Services Brexit Tracker, a total of 10,500 UK financial services jobs, including many front office roles, could be relocated to the continent in time for Day One of Brexit.

Their 2016 estimate was 12,500 jobs.

On January 10, 2017, the Independent published an article – Brexit: London financial hub could lose more than 200,000 jobs amid uncertainty, LSE boss warns – reported that the London Stock Exchange:

… has warned the UK’s vote to leave the EU poses a risk to the global financial system and could cost the City of London up to 230,000 jobs …

We were told that:

I’m not just talking about the clearing jobs themselves which number into the few thousands.But the very large array of ancillary functions, whether it’s syndication, trading, treasury management, middle office, back office, risk management, software, which range into far more than just a few thousand or tens of thousands. They would then start migrating.

On October 31, 2017, BBC news reported that – Bank of England believes Brexit could cost 75,000 finance jobs – which were told by “senior figures at the Bank are using the number as a ‘reasonable scenario’

On September 18, 2017, the Reuters report – Exclusive: 10,000 UK finance jobs affected in Brexit’s first wave – Reuters survey released the latest results of their “survey of firms employing the bulk of workers in international finance” in Britain.

123 firms are included in their sample.

The results indicated that:

Around 10,000 finance jobs will be shifted out of Britain or created overseas in the next few years …

They recognised that these results were rather at odds with the estimats what these self-aggrandising management consulting firms had been pumping out.

Reuters said:

The findings suggest that the first wave of job losses from Brexit may be at the lower end of estimates by industry lobby groups and firms, which could mean London will keep its place as the continent’s top finance center, at least in the short term.

The language in that update was also changing – the estimates were more nuanced, 2020 was now being “ten or twenty years” and the like.

The unfolding estimates are, in fact, quite difficult to keep up with. As the real world destroys the credibility of one report and its estimates, without a blush, a new report comes out, with some ‘revised’ estimates.

There seems to be no embarassment. The new reports might mention that this or that has changed, that this uncertainty has been introduced, or some other ad hoc excuse, but then proceed, unabashed, to offer the latest disaster scenario.

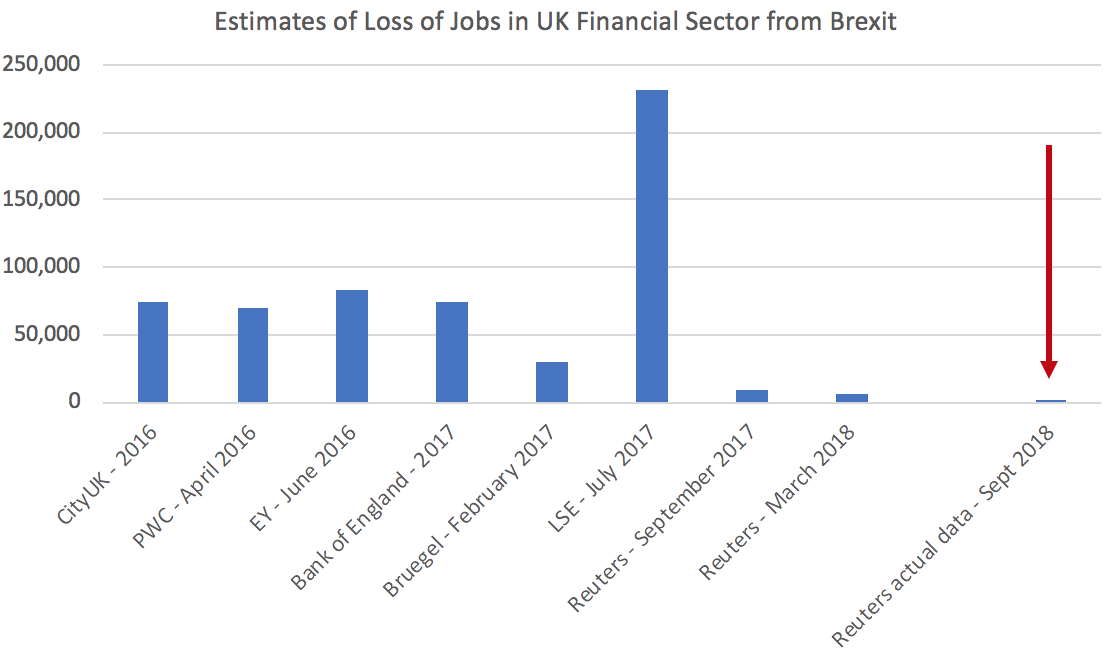

The following graph shows (as best I can assess) the evolution of the estimates of job loss in the UK financial services sector as a result of the Brexit referendum.

The red arrow is provided because it is actually hard to see the actual data – what has actually happened.

The number is 630!

Not 630 thousand. 630 full stop.

And we cannot even concluded those are jobs that have been scrapped.

Reuters reports that:

As few as 630 UK-based finance jobs have been shifted or created overseas with just six months to go before Brexit, a far lower total than banks said could move after Britain’s surprise vote to leave the European Union …

Reuters goes on to say that:

The survey findings suggest London, which has been a critical artery for the flow of money around the world for centuries, is likely to remain the world’s largest center of international finance. While New York is by some measures bigger, it is more centered on American markets, while London focuses on international trade.

They quote various players in the debate who are now admitting that the job losses are “likely to be much more modest than initially predicted”.

They suggest that the situation was a case of “Bankers Bluff”.

We might less kindly say a total lie to get leverage for the banks at a time when their reputation has been damaged.

Conclusion

The Brexit discussion has seen some outrageous lies entering the public domain as a means to scare people either way. These on-going estimates of job losses pumped out by the Remain vote are clearly intending to create enough pressure so that the Government will lose nerve and offer a ‘second’ referendum.

A sort of democracy where the elites (in this case the Europhile elite) just keep holding votes until they get what they want.

And to push that agenda, a vapid campaign on extreme estimates – or as Keegan claims “quite simply, horrifying” estimates – need to be continually created.

And the fact that only up to 630 jobs have either been lost or created outside Britain since the Brexit referendum, when some of the estimates of job losses were of the order of 230 odd thousand, is just an inconvenient diversion for these ideologues.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Thank you Bill. Your capacity for analysing and exposing the b-s is much appreciated, as ever.

Isn’t that what the EU does, if at first your referendum does not succeed try and try again?

I doubt the disastrous Euro project would’ve ever got off the ground if the will of the people was listened to.

Prof, I think you aren’t considering here the hard brexit crowd who is advocating some crazy policies that would definitely hugely disrupt the British economy for the worse. I think you need to be clear about which type of brexit you support.

There is and was over exaggeration of the perils of Brexit and one is to be congratulated for pointing them out. It seems that IF different economic programs were to be invoked after Brexit that Brexit could work. The Conservatives are on a neoliberal austerity bent forever. Labour though slightly better use neoliberal math almost exclusively. If MMT policies were to be applied who would be ELECTED to institute them? Until there is an answer(public and government support of MMT) staying in the EU with a sovereign currency feels responsible.

77% of pro-Brexit voters put “brown people” as their first reason for voting Brexit. Given this can MMT advocates say that their favouring of Brexit comes from telling the voters the truth? As a citizen of UK Brexit as envisioned will destroy my freedom of movement, has reduced significantly my retirement income and has imperiled the whole S-1 support of UK residents abroad. One can say these details can be worked out but certainly not by the politics or politicians currently on offer.

It is quite obvious that the original Brexit vote was influenced more by opinion, rhetoric and prejudice than rational argument and analysis – its outcome can therefore be questioned (by both leavers and remainers).

Even with another vote it will be almost impossible to fully appreciate the enormity and breadth of its impact over the course of its influential life.

At least MMT provides an economic argument with a discernible effect.

Heim says:

“77% of pro-Brexit voters put “brown people” as their first reason for voting Brexit”.

What’s your source for that assertion please? I trust it’s a lot more impeccable than the sources employed by the anti-Brexit propagandists quoted in Bill’s article.

Gogs says:

“It is quite obvious that the original Brexit vote was influenced more by opinion, rhetoric and prejudice than rational argument and analysis – its outcome can therefore be questioned”.

As was the vote in 1977 which endorsed joining. I voted enthusiastically for joining in the fond belief (shared I would opine by a very large number of others) that what I was voting for was what was then called “the Common Market”, ie something vaguely presumed to be scarcely more all-embracing than a customs union cum free trade agreement. That delusion was keenly fostered by many people (starting with Heath himself) who knew full well what it had the potential (duly realised at Maastricht) to turn into, which they either pooh-poohed or at best kept quiet about.

In other words I in common with many others was conned, quite simply.

Paraphrasing Plato (who was an aristocrat whose personal interests were disadvantaged by the Athenian democracy, and who unashamedly advocated what we would now call “technocracy” exercised by oligarchs under the aegis of a tyrant), democracy is the worst conceivable form of government.

Paraphrasing Churchill (also an aristocrat, but of a very different kind):- “except for any of the others”.

The Brexit vote was no more and no less democratic than any other democratic vote (including any general election FPTP or otherwise) can or ever will be. That’s life. A second Brexit referendum would only make an already poisoned debate far, far worse – and its result in no way more valid.

(@Gogs: I’m not imputing a contrary opinion to you. My post is merely prompted by yours – with which BTW I fully concur)

How many city people (not just bankers but lawyers too) are in favour of brexit, is one thing that never gets mentioned.

Nigel Farage

Dominic Raab

Jacob Rees-Mogg

The criticism of brexit by the FIRE is all noise.

The financial sector is apposed to eu regulation. That what it reduced, but they want their current benefits too.

https://www.ft.com/content/658bd8e0-c91d-11e5-be0b-b7ece4e953a0

…and, to add a rider.

Piquant to reflect on the fact that Plato’s ideal regime has been realised with uncanny accuracy in present-day Athens, with the role of tyrant being filled by the Troika, and of both oligarchy and technocracy by the EU (with the German finance ministry and the Bundesbank-dominated ECB very much to the fore) and the Greek populace relegated en masse to the role of wretched serfs. He would have considered his ideas to have been fully vindicated, in much the same way as Hayek and “the Chicago boys” looked upon Pinochet’s Chile as a vindication of theirs.

It strikes me that neoliberalism viewed as political philosophy (which it is) incorporates significant elements of Plato’s, especially in its inherent elitism and its utter contempt for the plebs. Friedrich von Hayek (note the “von”) as a Plato for our times? Trump as a philosopher-king…? (No worse than the Tyrant of Syracuse, who was Plato’s own prototype candidate for that job).

All the weeping, wailing and gnashing of teeth being paraded by many among the opponents of leaving the cuddly EU, on behalf of the lily-white-innocent UK FIRE sector which – they claim – is being threatened with rape and pillage, leaves me cold.

In fact that’s putting it very mildly: the sooner the UK’s grossly bloated financial sector (aka casino) is drastically scaled-down, and forced to cease to seduce and suborn a good slice of the talent in this country into serving it by holding-out obscenely-inflated “rewards” in return for work of zero value to society, the better for all (including aforesaid slaves to mammon themselves).

Those sad refugees may. if they choose, flee to Frankfurt, Paris or wherever. We have no need of their “talents” – not unless they’re willing to put them to worthier use after suitable re-training. Some though might make useful recruits to the Fraud Squad, where they would work on the right side of the law for a change. Others to the Revenue (ditto), and still others to assorted regulatory bodies (ditto again).

Some might even become proselytes for MMT; they certainly wouldn’t lack the necessary grey matter to get it – if only they were willing to purge themselves of the junk currently occupying that space.

Thanks for the latest on overblown employment impacts!

Heim, May I ask, what’s your opinion of the current Labour Party leadership, which also supported Brexit? Mostly neoliberal in your estimate? Or never electable perhaps? If the latter, they are still an option. Or am I missing developments there? (I’m across the pond, in the US, and don’t follow the news there all that closely.)

Do taxpayers pay their taxes with bank created dollars or with reserve dollars?

.

Recently I had this discussion on a discussion site. I want to expand my argument.

I claim that we all pay our taxes with a mix of both sorts of dollars, but vastly mostly bank created dollars.

I understand the fact that in the payment process the dollars in the check we write is converted into “reserve” only dollars. I claim that that fact is not relevant.

.

Most Americans are familiar with the Biblical story of Jesus vs the Temple moneychangers. I strongly feel that the Jews who took their Roman coins to the Temple to give them to God were giving those Roman coins to God. I claim that the fact that the moneychangers converted those coins into Hebrew coins that were appropriate to give to God does not effect the fact that the Jews used their Roman coins to give them to God. They had no other coins to give. The Temple authorities used those coins for whatever they needed to buy. They just had to get them from the moneychangers in exchange for the Hebrew coins the Jewish taxpayers had given them.

.

In the same way, (as a self-employed carpet cleaner) I got most of my income in the form of checks which I deposited. The dollars in those checks were part of the money supply. The money supply is a combination of bank created dollars and reserve dollars; even though the reserve dollars never actually leave to Fed. Res. system. The dollars I got from my customers were what I used to pay my taxes, the fact that they were converted into pure reserve dollars does not change the type of dollars they were at the time they left my control and came under the control of the banking system.

.

This is how I see this question.

.

What is the role of “fiscal conservatives” in an MMT world?

.

What would they be asking for?

Have MMTers given this any thought?

Do MMTers care about this?

.

I hope this is not deleted as off topic or at least that Bill takes it to heart.

“I claim that we all pay our taxes with a mix of both sorts of dollars, but vastly mostly bank created dollars.”

As far as I can understand, the money we use these days is fundamentally a matter of personal reputations. Each reputation is based on precise and accurate accounting done by banks — without that they would be mere hearsay.

Considered as units of account, all dollars (for example, and within a particular national banking system) are the same. What distinguishes “bank created” from “reserve” dollars is the matter of who’s doing the accounting. If it’s the Central Bank saying you’re good for $5, then you own 5 reserve dollars. Almost all my money is Credit Union dollars; the CU will vouch that I’m good for (some number of) them. You probably will doubt the CU, you’ll ask the Central Bank whether my CU is good for the amount.

So as I see it, there’s no intrinsic difference between one dollar and another. It’s the information and authority flows that make us consider them differently.

Every referendum campaign, election campaign or horse race for that matter, has to have a defined finishing post. In the Grand National, the horse that’s ahead after 4 miles 514 yards is declared the winner. The finishing post of the EU referendum campaign was 10.00pm on June 23, 2016.

It’s just that the jockey on ‘Remain’ has carried on whipping his horse and is saying “I’m ahead now so I want the winning post moved to here”.

That’s all that’s going on here and we all know it.

The Grand National is run annually. The official government leaflet on the EU referendum I received through my front door (which encouraged me to vote Remain, incidentally) said it was a ‘once in a generation’ vote. If Rejoiners want to take a long, long run-up at the next EU referendum, that’s fine by me.

Officially, the Labour Party leadership supported Remain. However, they were accused by the more enthusiastic Remainers (including the right-wing of the Labour Party) of only supporting it lukewarmly. Probably a fair assessment, given Corbyn’s history of Euroscepticism.

I suspect that even he didn’t expect the Tories to make such an absolute pig’s ear of the negotiations which they actually have done. But he probably expected (correctly) that there would be splits in the Tory party which would give him a good chance of winning a future election.

Where he has been at fault I think is in not taking more political advantage of the chaotic way the Tories have “managed” Brexit. The right-wing / Blairite pro-Remain section of the Labour Party are angry with him for not using the disaster that Tory-mismanaged-Brexit is looking like becoming as an argument for reversing Brexit altogether (i.e. ignoring the result of the referendum). But clearly he would never have done that.

What I think he wanted was a “soft-ish” Brexit with a “Norway Option”-style deal, preferably on better terms that what Norway got.