It's Wednesday, and as usual I scout around various issues that I have been thinking…

British data confirms strong FDI continues despite Brexit chaos

Wednesday and a shorter blog post so that I have a little more time to do other things. I don’t know what topic attracts the most hate E-mails that I receive on an almost daily basis: my position on the Eurozone, my position on the EU generally, my position on Brexit, my position of surrender monkey social democrats (parties and people), or my work on Modern Monetary Theory (MMT). I guess I could count and build up a frequency distribution but I just prefer to delete them these days – the first few words give the game away. Save your time. This week, I have had a torrent of such E-mails telling me more or less “see, you claimed Brexit would be good, but it is a disaster”. Last time I checked Brexit hasn’t happened yet. All that we are witnessing is a conservative government of considerable incompetence in disarray after being bullied by the neoliberal, corporatists in Brussels into a ridiculous ‘agreement’ that changed hardly anything. But there were some interesting data releases in the last few weeks that bear on the Brexit question. I have been looking into them.

A little Brexit reflection

The sense of Brexit chaos in the UK has been amplified by ridiculous new reports from HM Treasury, the Bank of England, and some attention-seeking private research groups who choose to lie and present incredulous analyses as fact.

Which government in their right mind would do nothing while the economy was shrinking 7 per cent? That is what HM Treasury modelled.

Which central bank would put up interest rates by 5 or so percent during a deep recession when they know exchange rate depreciation introduces temporary inflation spikes (if that)? That is what HM Treasury were claiming would happen.

Embarrassing the whole lot of it.

And where are the media reports telling the British people about the boom (yes, you read that correctly – there latest data shows a boom) in Foreign direct investment in the UK.

Silent.

Fakes the lot of them.

On December 4, 2018, the British Office of National Statistics released its updated bulletin – Foreign direct investment involving UK companies: 2017.

Now if the world was about to stop because the majority of British people voted to leave the corrupt and innefficient EU then Foreign direct investment should certainly be recording the insecurity associated with that decision.

We distinguish between:

Outward FDI … direct investments made by UK-based companies abroad, while inward FDI reflects the activity of foreign-owned companies in the UK. The difference between these (outward less inward) gives a net FDI balance.

What does the ONS find?

The ONS reported that:

In 2016, the values of both outward and inward FDI positions increased notably. The UK’s outward FDI position increased by £190.6 billion (or 17.6%) to £1,274.6 billion. The increase in the inward FDI position was smaller than that for outward FDI, growing by £154.8 billion (or 15.0%) to £1,187.3 billion.

And in 2017:

The value of the inward FDI position grew faster than the outward position: a £149.2 billion (12.6%) increase for inward FDI, compared with £38.7 billion (3.0%) for outward FDI … Therefore, the value of the stock of foreign-owned direct investments held in the UK in 2017 was slightly higher than the value of direct investments that UK companies held overseas, which would be the first time this has been recorded.

The HMRC (Revenue and Customs) noted that (Source):

… the UK remains a top destination for foreign direct investment (FDI), with inward stock at the highest level since records began 12 years ago.

Now, I am not saying that these trends are desirable per se.

The point is that in mainstream terms FDI inflows reflect a confidence from foreign investors in the future of the nation.

FDI by its nature is not speculative ‘hot’ money.

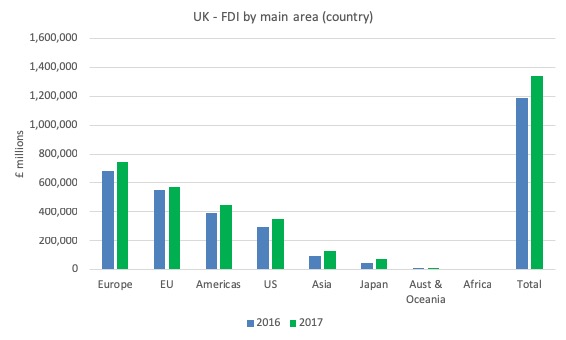

A more detailed examination of the dataset – Foreign direct investment involving UK companies: inward – produces the following graph.

It shows the Inward FDI by region (and I added the US and Japan) for 2016 and 2017, which the captioned percentages being the annual change.

I didn’t add India but the annual growth in inward FDI from that nation to Britain was 321 per cent from a low base

There was strong

That doesn’t look like a loss of confidence in the nation to me.

Even European investors are growing in their resolve to maintain commercial links with Britain.

Ask yourself basic questions about why people would put money up to invest in British sectors if they thought it was about to collapse.

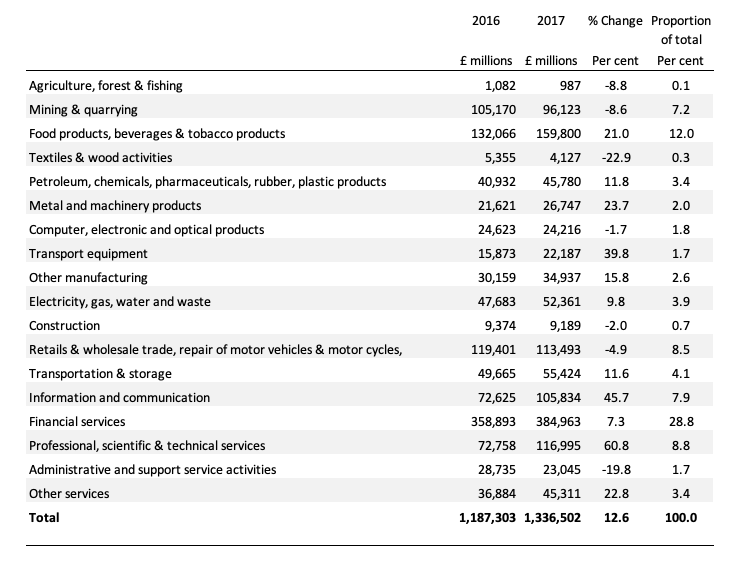

Which industries attracted this inward FDI?

The following table shows the breakdown by sector for 2016 and 2017, the percentage change over the year and the proportion of total inward FDI.

1. The Financial Services sector attracted relatively strong FDI and is the largest recipient. Hardly a sign that all the banksters are heading abroad.

2. Manufacturing sub-sectors such as food, metals, transport equipment, etc all attracted strong FDI growth.

3. Skilled sectors (Professional, scientific & technical services, Information and Communication) were heavily engaged.

And what about manufacturing?

Hmm.

The latest IHS Markit/CIPS UK Manufacturing PMI for November (released December 3, 2018) showed that:

1. “November saw a slight acceleration in the rate of improvement of UK manufacturing business conditions”.

2. “the performance of the sector remained comparatively lacklustre”.

3. “The trend in output strengthened slightly during November, as new order intakes rose following October’s decline”.

4. “Companies remained confident on balance”.

So not stunning but certainly not collapsing.

There is a continuing confidence level among British producers for conditions over the next 12 months.

By contrast, the latest IHS Markit Eurozone Manufacturing PMI for November (released December 3, 2018) shows:

the continued growth slowdown of the single currency area’s manufacturing economy. Although remaining above the crucial 50.0 no- change mark for a sixty-fifth month running, the final PMI came in at 51.8 in November, down from 52.0 in October and the lowest reading since August 2016 …

The euro area’s ‘big-four’ economies posted the lowest manufacturing PMI readings of all countries covered by the survey during November …

Growth of production only marginal as demand continues to falter …

Business confidence remains weakest in around six years

And what about exports?

HM Revenue and Custom reported (December 6, 2018) – Exports continue to rise across the UK.

The latest data shows that in the “year ending September 2018”:

– Exports of goods from England increased by 3.1% to £247.6 billion

– in Scotland, goods exports increased by 6.2% to £29.6 billion

– in Wales, goods exports increased by 3.0% to £16.9 billion

– in Northern Ireland, goods exports decreased by 0.2% to £8.6 billion

HMRC said that “The most popular non-EU destinations include USA, that 19.9% of exporters sold goods to, Australia (7.9%) and Switzerland (7.3%)”.

Sure enough there has been a generalised growth in world trade, which Britain has participated in.

But British firms are still producing and exporting and the data shows non-EU exports of goods and services are higher than UK exports to the EU (since 2009) and that new, non-EU markets are emerging (

HMRC report that (Source):

The fastest growing export market for the UK since 2010 was Oman, with exports increasing by 354% to £3 billion. This was followed by Macedonia (FYROM) with UK trade growing by 318% to £1 billion and then Kazakhstan which was up by 210% to £2 billion.

These new markets are the future for Britain.

Recent Interview

In case you have seen this interview I did last week here it is:

UK Labour’s Fiscal Credibility Rule: Neoliberal Orthodoxy Dies Hard (December 6, 2018).

I talk about the problems that British Labour are making for themselves with their adherence to neoliberal fiscal rules.

Music for today

I have been trying to become good at the piano, which I like to play a lot.

Lately, I have been working through some quite difficult technical exercises from Jazz legend Oscar Peterson, which are designed to either drive one insane or put one on the road to ‘stardom’.

I hope to stay sane and get some way down that road (-:

Anyway, for the British who have such an awful government and such a confused state of affairs at present, I thought this little gem from Canadian pianist Oscar Peterson and his Trio would help.

It is the – Hymn To Freedom – during a live concert in Denmark in 1964.

It appeared a year before on the album – Night Train (released 1963) – is one of my favourites and is on my regular play list.

A great trio and playing from all three who definitely reached ‘stardom’.

Oscar Peterson wrote the piece in 1962 and it became part of the list of ‘freedom songs’ that were sung during protests by the Civil Rights Movement.

The blues meets church.

It also had lyrics written by one Harriette Hamilton:

When every heart joins every heart and together yearns for liberty, that’s when we’ll be free.

When every hand joins every hand and together moulds our destiny, that’s when we’ll be free.

Any hour, any day, the time soon will come when we will live in dignity, that’s when we’ll be free.

When everyone joins in our song and together sings in harmony, that’s when we’ll be free.

You can find sung versions of the piece on YouTube.

There is a long way to go.

But for the British, Brexit is a first chance to go for freedom on your own terms. Finding those terms seems to be the problem.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Bill, what is the effect of the devaluation of the £ v the $ and the Euro on the figures quoted?

Bill,

When I was learning Jazz piano I used John Mehegan’s books which helped me learn Jazz chording and there are also good books for finding patterns over chords in the study books by David N Baker.

There is also a great book by the late jazz flautist Sam Most called ‘Transformation of the Jazz Solo.’ Page after page of single line solos over chords, not for the faint-hearted!

After the be-Bop and Cool Jazz Period a lot of Jazz educational material arose involving many mind boggling repetitive exercises. But I guess if you can handle econometrics with the obvious virtuosity that you have then I suspect you can handle this stuff as well!

If you want a mind boggling Jazz guitarist, try Alan Holdworth who has to be the ultimate patterns over chords player: http://www.youtube.com/watch?v=IcPbmPM7epY Something transcendental about his playing that I can barely follow!

If you are trying to play any of Peterson’s notated solos then there is a lot of very busy stuff-he goes from one end of the piano to another and the notation looks like the score of a mahler SYmphony on two lines!

Anyway I wish you good luck-let us all know how you get on. Maybe some keyboard work of your own on Youtube soon or with your band?

Hello Bill,

Thanks for a very clear and factual analysis of the confidence in the uk economy despite brexit chaos.

The graphs and your analysis give us ways of showing people the facts and opening their eyes to what is really going on.

All the best

Ron

Great Interview:

‘So the question remains “what are they doing there in Britain as a progressive opposition with this fiscal rule?” It’s madness.’

Yes, I admit myself to be totally bemused by people who espouse that they have socialist and democratic viewpoints and then in the next breath they support the EU project and attack Left advocates of Brexit.

Their argument often is that the Tories run Britain and the Tories are neoliberals. Some of them even admit that the EU is a neoliberal project too. At that point I say, hang on, so you are telling me that you prefer a big neoliberal project with a democratic deficit (the EU) over a smaller neoliberal project in a democratic country where it is still possible to throw the neoliberals out by a vote and change things. How does that make sense?

Actually, so-called leftists who support the EU are very confused. They have been greatly fooled by neoliberal propaganda. They themselves are far more essentially neoliberal than they realise. Their real problem is that they understand nothing about political economy and lack the intellectual education and rigor to subject capitalism to a proper critique. Most of them still believe implicitly in capitalism. Fact is, if you don’t critique and reject capitalism you are not a socialist. The two systems are mutually incompatible. Capitalism is anti-socialist and anti-democratic. Neoliberalism is simply the ideology of late stage capitalism.

Great to have this kind of analysis to hand. The assumptions made in the scare campaign are crazy.

Bill,

This NZ Herald journalist is (I think) contradicting your post on FDI.

I sent him the link to this post after he wrote this:

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12176235

In reply he wrote to me;

“According to the Office of National Statistics business investment in the year ended June fell 0.2 per cent. That is by domestic and foreign investors. Normally one would expect and want to see a positive number, at least in line with the other major components of GDP like private consumption.

And for foreign direct investment it is instructive to look, again on the official ONS numbers, on how the net international investment position has changed over the two years since June 2016. Then Britain was a net direct investor to the rest of the world to the tune of 128 billion pounds. By June this year the net balance was 70 billion in the red, a decline of nearly 200 billion pounds.”

I don’t have the technical skills to counter this though?

Thanks

William.