During the recent inflationary episode, the RBA relentlessly pursued the argument that they had to…

The conga line of MMT critics – marching into oblivion

The US-based Eastern Economic Association, which aims to promote “educational and scholarly exchange on economic affairs”, held its annual conference in New York over the weekend just gone. One of the panels focused on “New Views of Money” and I am reliably told turned into a bash MMT session as yet another disaffected economist, feeling a little attention deficit, sought to demolish our work. The technique is becoming rather standardised: construct MMT as something that it is not; refer to hardly any primary sources and only those that can be twisted with word ploys to fit into the argument; use this false construction to accuse MMT authors that are not cited of a range of sins; conclude that MMT is useless – either because the things it has right were known anyway and the novelties are wrong, proceed as normal. In denial. Afraid to admit you are part of a degenerative paradigm that has lost credibility. Bluster your way forward muttering something about optimising transversality conditions that need to be met. Feel happy to be part of the conga line. Well that conga line is heading for oblivion I hope. Where it belongs. On the scrap heap of anti-knowledge.

MMT and Google Trends

Google Trends allows one to track the evolution of a topic on the Internet and map the hot spots worldwide. It is really just a bit of fun but it keeps me amused sometimes.

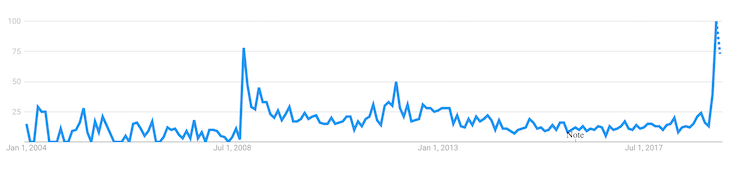

Here is the monthly time series from January 1, 2004 (when data began) to March 4, 2019 for the search topic – Modern Monetary Theory.

As Google tells us:

Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term.

The first spike began in August 2008 and peaked in October 2008 – the period when Lehmans went broke and everyone was wondering what was going on.

Interest fell after that but to a new higher level.

The next spike started in November 2018 and that is the AOC effect I would guess.

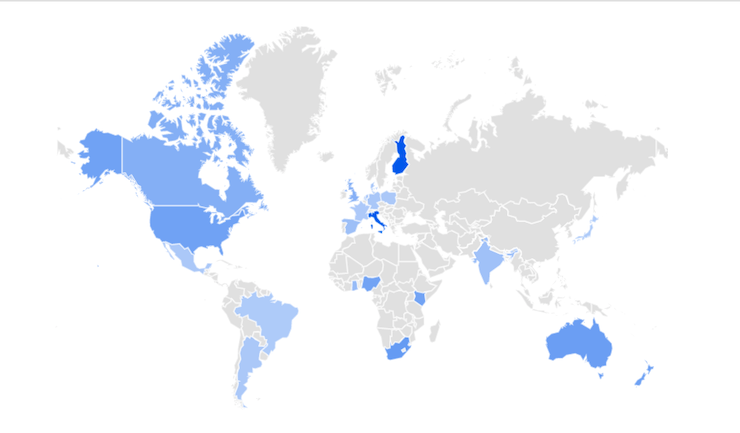

Here is the related map. In the last week, Finland has gone very dark blue, mostly concentrated around Helsinki!

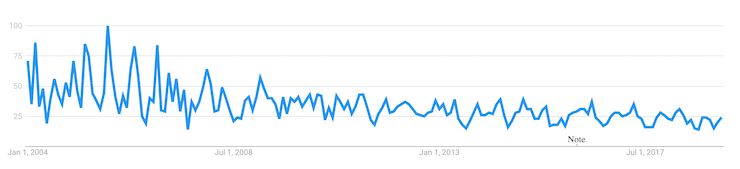

The second graph is for the search topic – New Keynesian Economics.

All the variance is pre-GFC and coincides with a period when the Great Moderation was all the rage.

Please read my blog post – The Great Moderation myth (January 24, 2010)- for more discussion on this point.

After the GFC emerged, the downward trend in interest in this degenerating paradigm in macroeconomics continued.

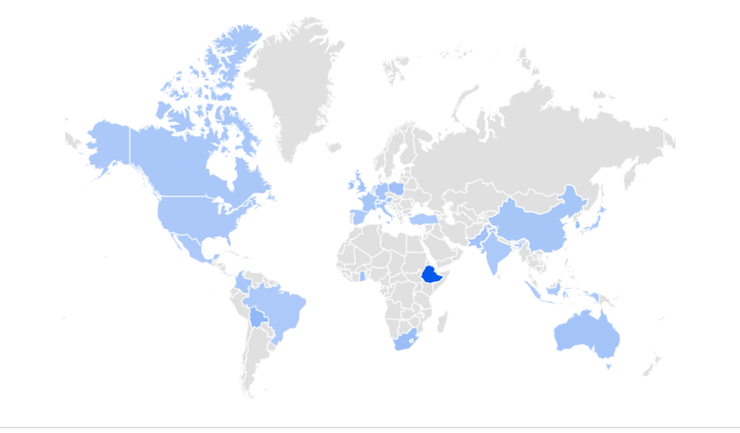

The map shows that Ethiopia was the current hottest spot.

I’m guessing China is doomed if they keep hiring US-trained economics Phds from orthodox programs – see map.

The rising popularity of MMT is bringing out a lot of people from the woodwork who have ignored our work until now but who, for one reason or another, feel they have to have a stake in the game or look stupid.

And, they mostly end up looking foolish given the quality of their criticisms.

I am not for one moment saying that the body of work we have developed is a theory of everything. In particular, it does not imply that politics is without constraints – real or otherwise.

Policy making is not like that at all.

A lot of artistry is required to implement significant economic interventions. That vulnerability is not confined to MMT.

So to criticise MMT on the grounds that the politics might be complex or thorny is not criticising MMT at all.

It is a reflection of the difficulties that arise when vested interests go head to head to get their pet projects ahead in the queue.

EEA Panel

I was told that Thomas Palley was in the audience and was like a stuck record – inflation, inflation, inflation, click, click, click.

It amazes me that Palley is wheeled out by the critics of MMT as providing some definitive closure on the shortcomings of MMT.

His main claim is that MMT ignores “the dilemmas posed by Phillips curve analysis” and has no formal model.

He also joined the chorus that there was nothing new in MMT and what was new was wrong – go figure!

I dealt with his misrepresentations in this blog post – I wonder what the hell I have been writing all these years (February 12, 2013).

He was an early critic.

I discussed the issues of formality in these blog posts (among others):

1. GIGO (October 7, 2009).

2. OECD – GIGO Part 2 (July 27, 2010).

I remind readers of the observation by American (Marxist) economist Paul Sweezy who wrote in the 1972 – Monthly Review Press – article entitled Towards a Critique of Economics that orthodoxy (mainstream) economics:

… remained within the same fundamental limits … of the C19th century free market economist … they had … therefore tended … to yield diminishing returns. It has concerned itself with smaller and decreasingly significant questions … To compensate for this trivialisation of content, it has paid increasing attention to elaborating and refining its techniques. The consequence is that today we often find a truly stupefying gap between the questions posed and the techniques employed to answer them.

Some of the great economic thinkers – Marx, Keynes, and many others did not use the sort of trivial formality that pervades neo-classical approaches and Palley’s hydraulic Keynesian framework.

And, if you get hold of our new textbook – Macroeconomics – you will see mathematical formality when it helps to simplify the argument and advance the understanding.

Otherwise, words more than suffice.

Evidently, another MMT critic at the conference was J.W. Mason, who apparently claimed that MMT was unsettled theory – I dealt with his misrepresentations in the three-part series:

1. The divide between mainstream macro and MMT is irreconcilable – Part 1 (September 10, 2018).

2. The divide between mainstream macro and MMT is irreconcilable – Part 2 (September 11, 2018).

3. The divide between mainstream macro and MMT is irreconcilable – Part 3 (September 12, 2018).

And there are more than enough words there to demonstrate my disagreement.

Evidently, Mason didn’t take any of the points on board and proceeded along his merry way to continue the same, deeply flawed misrepresentations of our work.

Enough said on that.

I was also sent a paper by one Gerald Epstein who is at UMass at Amherst and definitely not in the mainstream New Keynesian tradition. Rather he is part of the Political Economy Research Institute at that university and heterodox in outlook.

It was reported to me that during the EEA Panel he was very animated (shouting was the word) about MMT ignoring that taxes would have to rise to ‘pay for’ a Green New Deal.

Quite animated was what I was led to believe.

Well, whether his public performance was comment-worthy or not is not the point.

His paper – The Institutional, Empirical and Policy Limits of ‘Modern Money Theory – is pretty poor.

It is representative of the quality of the push back that we are receiving from those on both sides of the ideological divide – heterodox and mainstream right.

I cannot link to his paper – I received a copy via E-mail.

His overall conclusion is that:

… even though MMT might have made some valuable theoretical and doctrinal contributions, its major policy suggestions are of little practical relevance today.

It is a paper that insults people who are attracted to MMT and see it as a way out of the failures of mainstream economics (and I should add the lack of attention to core macroeconomic issues among heterodox economics).

Apparently, people are being lured into “simplistic policy solutions” as part of the “MMT ‘brand'” – which is similar to the other attacks along the lines that we have created a ‘cult’ and lured idiots who are desperate for answers with our hokey pokey.

I think that is insulting – not to me (I couldn’t care less) but to those who are attracted to our work and are non-economists.

Epstein writes that the “recent appeal of MMT is understandable” given the massive failure of mainstream macroeconomics” but that:

MMT theorists were not the first or only economists to criticize neo-liberal austerity economics.

He lists a series of papers including many of his own that in one way or another are alleged to provide such criticism.

Which then begs the question: Why haven’t these other “Keynesian and heterodox economists” broken through in the public debate?

If the failure of mainstream macroeconomics is so profound, and these economists have been offering viable critiques, why is it that only MMT ideas are providing people with plausible answers they seek?

The answer Epstein wants his readers to believe is that our approach is “simplistic” and people are stupid.

They have been told, apparently, that “government spending NEVER has to be paid for and can be implemented with a mere stroke of the monetary pen”.

The reality is that the other analyses he cites have little appeal – they are not part of a coherent, internally-consistent body of macroeconomic thought, and, in many cases, (for example, Palley) just default back to a mainstream macroeconomic framework anyway.

A problem with Epstein’s representation of MMT is that he deals in half truths – leaving out the context, making words serve two meanings, etc.

A classic ploy in fact.

An examination of his reference list shows he has cited just 7 articles by MMT authors out of 97 articles cited in total.

All of the MMT authors cited are US-based and largely write about US-centric issues.

Most of the MMT literature (of which I have personally contributed a significant amount) about small, open economies; development economies; capital flows and constraints; exchange rates and trade is ignored by him – and that is convenient to his purpose.

Because then he can say these 7 articles – which he equates are the MMT story – miss key issues. Which he does.

But that ploy doesn’t allow for a criticism of MMT. It just reflects the obvious fact that he hasn’t bothered reading a sufficient quantity of the published MMT literature. The ‘straw person’ reference comes to mind.

He also cites with authority the likes of Jeffrey Frankel, Paul Krugman the IMF, and a range of other mainstream sources who allegedly, in one way or another, present damming evidence against MMT.

In another context, a heterodox economist wouldn’t give this lot the time of day. But they become trusted ‘authorities’ when it comes to slamming MMT.

Certainly, MMT has brought the capacities of a currency-issuing government into the open.

The fact is that the government which spends the currency into existence does not have any prior intrinsic financial constraints. All semblance of such constraints are creatures of the government itself.

And so it comes down to what we mean by “paid for”.

Epstein would know he is toying with words to make a point that he would not be able to make if he was to spell the whole deal out properly.

He wants the reader to concentrate on the financial aspects of “paid for” and ignore the real resource costs of government spending, which will vary according to the state of the economic cycle.

The correct statement is that government spending has no intrinsic financial constraints but may have real resource constraints which might impact on its ability to pursue its socio-economic mandate.

In that sense, the “paid for” would relate to the real resources utilised by the spending (the ‘true cost’).

His paper builds up to the finale which focuses on:

… the validity of the rhetorical claim that has captivated so many followers on the progressive left: “when we propose progressive programs, MMT demonstrates that we do not have to discuss or worry about how we are going to pay for them”

I will only focus on that point.

The rest of the paper is not compelling and rehearses many of the standard arguments now being raised against MMT – for example, it only applies to the US as the reserve currency-issuer; that foreign exchange markets will crucify a government that tries to run policies that are counter to the interests of the speculators; that we ignore the plight of development economies who cannot export enough to get the foreign exchange necessary to buy necessary imports; that MMT is a “nationalist oriented policy, or ‘America First” and stuff like that.

Some of those points are not covered in the 7 MMT articles he bothered to cite. If he had have read a little more broadly then all of those issues have been covered in one way or another over the last 25 years of work.

Of his final section, Epstein writes:

… discusses some of the political/policy claims of MMT advocates and shows that they are internally contradictory and possibly even dangerous. In particular the MMT advocates’ claim that progressive’s don’t need to discuss how “to pay” for their policies is misleading since, even within the strict confines of MMT theory, progressive policy advocates and politicians cannot avoid trade-offs and assessing priorities of their policies – that is, they cannot avoid discussing the opportunity costs of their projects and yes, even how to “pay for them”.

The short response is: No we cannot avoid discussing the opportunity costs and the fact that once we get to full capacity then trade-offs have to be made.

That is a central proposition in MMT.

We have never avoided, skirted around or ignored that issue.

But those opportunity costs are real not financial.

Epstein wants his readers to be conflate those two cost concepts.

While his misrepresentation is rife throughout the paper it reaches a new scale in the final Section VI.

Among the things he writes about what MMT is asserted to claim:

1. “we do not have to worry about deficits. Better yet, we don’t have to worry about paying for our proposed policies; in fact, we don’t even need to raise taxes.”

A mix of statements – with some partial truths lacking context.

We do need to worry about deficits if they are too large or too small relative to the spending and saving intentions of the non-government sector. That is the correct statement.

We do need to pay for our proposed policies – if by that we mean the real resources costs that will be incurred.

However, that is not the usual English meaning of the words ‘pay for’, which connote financial constraints.

We might need to raise taxes sometimes – depending on what the state of the cycle is and what other policy tools we have in place.

See, how Epstein ignores the nuance. In fact, he is not really talking about MMT at all here but some concocted version which he creates as a rhetorical device. This is becoming the standard methodology in all these recent attacks.

He can then build on that concoction with this:

The need to “pay for” our spending is a destructive diversion based on a dangerous misunderstanding of how our economies operate.

So now we have MMT as a dangerous insurgency into a real politic – luring people who are stupid – into believing that we can have every material desire we want satisfied at all times without issue.

In this concocted narrative, MMT just tells people not to worry – shout your desires – and the ‘printing press’ will take care of the rest.

But having established that, he then warns the stupid people out there:

… this appearance of liberation and power is an illusion. Worse, it is a dangerous illusion.

Dangerous becomes the repetitive theme. It beggars belief that someone would actually spend time in front of a computer playing these sort of rhetorical games.

I wonder if Professor Epstein could actually point to the published (peer-reviewed) MMT literature where any of the core developers have written anything that remotely resembles this depiction?

The whole MMT journey to date has been to caution readers about the actual nature of constraints on government spending rather than the false constraints taught in economics courses around the world and wheeled out continually by self-serving politicians and lobbyists.

By showing there are no intrinsic financial constraints on such spending, MMT, in no way, is advocating a carte blanche.

Every resource that is currently in productive use cannot be used elsewhere – obviously.

Every idle resource has a number of possible uses – obviously.

We understand perfectly that one we get to full employment that there are likely to be “trade-offs and the need to prioritize spending programs cannot be avoided.”

Trying to suggest that this point is ignored by MMT writers is an absurdity.

But where Epstein is really headed here is to hoist MMT on the ‘pay for’ petard.

He uses the Green New Deal as an example.

I wrote about the point he is making in these blog posts:

1. The erroneous ‘lets have a little, some or no MMT’ narrative (February 20, 2019).

2. The Job Guarantee is more than a Green New Deal job creation policy (December 17, 2018).

Basically, the GND would require a major transformation in society with new resource usages coming in and old usages going out.

That means winners and losers.

That means politics.

MMT is not about political theory or praxis.

But Epstein claims, in the context of the massive transformation that the GND would require, that:

The illusion of empowerment that MMT brings is that the coalition of forces that promotes these plans don’t have to discuss who is going to pay for these programs.

We are back to his tricky play on “pay for”.

Epstein is using one construction of “pay for” (financial) to try to refer to another construction of “pay for” (real resources) and pretending, despite acknowledging differently earlier in his paper, that MMT ignores the latter.

The point is what MMT offers here is the knowledge that the tricky political issues surrounding demands on real resources are not ‘financial’ in nature.

That is an important contribution because it lifts the veil of ideology that mainstream macroeconomics introduces to the public debate.

If everyone sees the world through the MMT lens, then they would immediately reject a politician who tried to claim we cannot save the planet because we do not have enough money.

Or on that tried to claim that we have to tolerate mass unemployment because the government cannot afford to create new jobs.

The ‘not enough money’ is the way the mainstream construct ‘pay for’. MMT explicitly rejects that.

But no MMTer would deny the second construction – the real resource ‘pay for’. Except, as noted above, that is not the usual English-language connotation of the term ‘pay for’.

The important point about MMT is that we are absolutely insistent on separating out those two constructions to make sure the public debate focuses only on the second.

Epstein knows that and yet he tries to play ‘smart alec’ because he thinks there is ‘currency’ to be made by lining up with the MMT critics. In part, he is trying to defend his own work which has never got to the nub of these problems.

MMT offers no illusion.

We never hold out that societies can have everything always.

The implementation of a Green New Deal will be an incredibly tricky process and good luck to the government that starts down that track.

There will be significant losers and some of the sectors that will lose out are politically powerful.

Big money will be thrown at lobbying government to not do things that they should do for the sake of the planet. Threats, extortion, all of the standard political gymnastics will be in force.

But that says nothing about the validity of MMT despite Epstein claiming otherwise.

Conclusion

And in the interim, the New Keynesian heavies have been out in force embarrassing themselves – Krugman, ‘Mr Spreadsheet’ Rogoff, Summers and more – all rushing to the join the conga line of critics.

All essentially following the same pattern – little citation, false constructions, idiotic inferences.

We are (hopefully) witnessing what a degenerative paradigm (in the meaning that Imre Lakatos gave to that term) looks like as it declines into oblivion.

What these characters don’t seem to realise is that they are probably helping disseminate our work to a wider audience.

We should thank them for that.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

There is no such thing as bad publicity and without knowing it the critics are spreading MMT and that is a good thing indeed.

When I explain MMT I find the best argument is presenting the sectoral balances and working out the private domestic sector balance. It stops critics in their tracks, especially if they are an intelligent person to begin with, and you can see them experience a moment of clarity when they see the truth and logic in the flow of funds and become converted.

It is what converted me years ago. The pure mathematical logic of it.

It is the strongest argument MMT has – so use it.

Just now, I was arguing with a guy (on a forum) who told me first that “MMT and mainstream economists don’t really disagree about deficits, MMT doesn’t bring any new insight”, but then claimed that “it’s ‘demonstrably false’ that deficits don’t raise interest rates”.

So there you have it: MMT doesn’t say anything new or different, we basically agree, but MMT is compeletely wrong nonetheless. Good luck understanding the reasoning.

Dear AlexHache (2019/03/07 at 5:41 am)

Point the person to check out google maps to see if they can locate where the conga line currently is – it is gathering speed somewhere between here and oblivion. All like minds should join.

best wishes

bill

I have no formal education in economics but I hope to have just made a small contribution.

My son’s girlfriend has just started uni, studying law (university of Queensland). It seems economics is part of the law degree. I picked her up from campus the other day and she began telling us all about her first lecture in economics, which (as I expected) was sounding very mainstream. I said to her “for an entirely different perspective on what they are teaching you, read Prof Bill Mitchell’s blog and then decide for yourself if that or what you are being taught accords with the actual reality you observe. Do economies really function according to the mainstream doctrine and do human beings really all behave as purely rational, self-maximising individuals?”

Hopefully I have helped in some small way by giving a bright young person (hi Merryn, if you’re reading this) a chance to decide how things really work before the formal indoctrination is drummed in.

Employment is the Conga’s achilles heel.

With your encyclopedic memory Bill, I am sure you can recall the following blog: https://billmitchell.org/blog/?p=41327 –

There is no internal MMT rift on trade or development

Posted on Thursday, January 10, 2019 by bill

I mention it because the subject captures accurately the role of MMT in understanding trade- oriented macroeconomics beyond mainstream’s austerity solution. In it you refer to the situation of (a developing nation’s) depreciating currency and dwindling currency reserves in the face of a failing combination of imports and exports.

Now, in a developed economy like the UK say, this situation might be a remote possibility but I have been unable to resolve a nagging doubt about where an economy might end up if a lot of its resources were, over time, used to prop up industrial/service enterprises that supported a full employment program (including JG) rather than allowing employment upheavals that would create mass job losses before re-directing workers to newer skills.

It is easy to see how this would arise if trade unions were trying to protect jobs that were to be lost before alternative opportunities appeared – something that is very likely in our fast moving global world.

You state: “In the short run there is probably no alternative but to urgently restore reserves of foreign currency either through renegotiation of foreign debt obligations, international donor assistance or default.”

An insight would provide an essence which I think widens the lens of MMT somewhat.

“Epstein is using one construction of “pay for” (financial) to try to refer to another construction of “pay for” (real resources) and pretending, despite acknowledging differently earlier in his paper, that MMT ignores the latter.”

***

It would be helpful to concretize what it means to “pay for” things in the sense of real resources. For example, if a job guarantee leads to full employment, would there be inflation risk that has to be paid for through taxes or other means? If Medicare for all creates such demand that there is a shortage of doctors, does that have to be “paid for” by massive doctor recruiting? Or if Medicare for all frees people to spend more on other things, would that have to be limited by tax increases.

***

I’ve begun trying to explain MMT by saying a body like the CBO should be replaced (or re-oriented) to assess new spending not by its effect on the deficit, but by its effect on inflation.

Bill,

Thanks for the post. You have cleared up a few issues for me.

But I have to say that reading the various comments on various blogs one gets the impression that MMT proposes that there are no constraints and that anything is possible. And I have to say that, by omission, even contributions from the main MMT developers can give this impression.

Anyway, I have gathered below what I thought were the salient and crystal clear points in your discussion above.

1. The fact is that the government which spends the currency into existence does not have any prior intrinsic financial constraints. All semblance of such constraints are creatures of the government itself.

2. The correct statement is that government spending has no intrinsic financial constraints but may have real resource constraints which might impact on its ability to pursue its socio-economic mandate.

3 ……..we cannot avoid discussing the opportunity costs and the fact that once we get to full capacity then trade-offs have to be made………. That is a central proposition in MMT…….But those opportunity costs are real not financial.

4. We do need to worry about deficits if they are too large or too small relative to the spending and saving intentions of the non-government sector. (I’m not sure I understand this one.)

5. We do need to pay for our proposed policies – if by that we mean the real resources costs that will be incurred.

6. We might need to raise taxes sometimes – depending on what the state of the cycle is and what other policy tools we have in place.

7. The whole MMT journey to date has been to caution readers about the actual nature of constraints on government spending rather than the false constraints taught in economics courses around the world and wheeled out continually by self-serving politicians and lobbyists.

8. By showing there are no intrinsic financial constraints on such spending, MMT, in no way, is advocating a carte blanche…….Every resource that is currently in productive use cannot be used elsewhere – obviously…….Every idle resource has a number of possible uses – obviously.

9. We understand perfectly that one we get to full employment that there are likely to be “trade-offs and the need to prioritize spending programs cannot be avoided.”

10. The point is what MMT offers here is the knowledge that the tricky political issues surrounding demands on real resources are not ‘financial’ in nature…….That is an important contribution because it lifts the veil of ideology that mainstream macroeconomics introduces to the public debate.

11. The ‘not enough money’ is the way the mainstream construct ‘pay for’. MMT explicitly rejects that……But no MMTer would deny the second construction – the real resource ‘pay for’ – ……. The important point about MMT is that we are absolutely insistent on separating out those two constructions (i.e. financial resources constraint vs real resources constraint) to make sure the public debate focuses only on the second.

“If everyone sees the world through the MMT lens, then they would immediately reject a politician who tried to claim we cannot save the planet because we do not have enough money.” For me, this is by far the most powerful statement in an extraordinarily powerful post. Not only does MMT provide a clear lens through which to view macroeconomics, but it also provides a firm foundation for desperately-needed hope in a neoliberal world order hellbent on ecocide. The gift of this hope, uncovered by this lens, is why MMT must ultimately prevail. No mere academic debate, this battle Bill and others are fighting is, without hyperbole, a matter of life and death on a planetary scale.

@ Newton Finn

” For me, this is by far the most powerful statement in an extraordinarily powerful post.”

Fine. But don’t forget there are resource constraints.

John Quiggin gave MMT the tick of approval in his Blog yesterday. What would Keynes say about the neo-Keynesians? Austin Robinson (Joan’s husband) recalled a comment from Keynes about a meeting of economists he attended during the Bretton Woods years. ” I was the only non-Keynesian there,” remarked Keynes.

I get your point of view, but you spend far too much time disputing that which is irrelevant. Epstein is not even an afterthought. MMT is shaking the walls! Just keep explaining its virtues.

I’ll be anticipating ‘reviews’ of Macroeconomics. My guess is nearly all of them won’t even know where to start, in the sense that it will be overwhelming for them. Am assuming there will be such in academia and journals. Awaiting the pleasant thud when it arrives from Booktopia.

Alan, do you know what the Australian domestic private sector balance was in financial year 2017-2018, and what the external sector balance and the government balance were? I’d like to learn how to navigate and interpret the national accounts.

Summers’ piece was a particularly egregious collection of straw men masquerading as MMT precepts. Thanks to this blog, along with Wray, Mosler and Kelton, its getting easier to spot the them — many thanks!

Summers blows with the wind. If you step back and look at Epstein, what you see is invective driven by hate. That, in itself, to a thoughtful person, is reason to question where he comes from. I don’t think you could have released your textbook at a better time.

By the way, the absence of curiosity among the so-called intellectuals, is stunning.

Actually I’m kind of moderately excited by the air time MMT is currently getting here in the US. Any publicity is better than no publicity, even if it is only a knife fight. Kelton is doing an amazingly good job responding to Krugman et al. NYT vs Bloomberg Inc. I am even hopeful that Bernie might this time around be able to wield some good MMT ideas to back up his proposals. I truly hope AOC is tuned it because the GND is DOA if not.

Response to Jerry Roberts says:

Thursday, March 7, 2019 at 11:15

I wouldn’t take anything John Quiggin says seriously.

Terms like seigniorage and debt monetization can not happen under a fiat currency system.

Nor have any MMT authors ever referred to either of those terms.

Quiggin says:

“The central idea of Modern Monetary Theory (MMT), as I understand it, is that, rather than worrying about budget balances, governments and monetary authority should set taxation levels, for a given level of public expenditure, so that the amount of money issued is consistent with low and stable inflation. In this context, the value of the net increase in money issue is referred to as seigniorage”

I’ve taken the Wikipedia definition of seigniorage:

“…where sovereign-issued securities are exchanged for newly-printed banknotes by a central bank, allowing the sovereign to “borrow” without needing to repay.[3] Monetary seigniorage is sovereign revenue obtained through routine debt monetization, including expansion of the money supply during GDP growth and meeting yearly inflation targets.[3]”

He hasn’t understood that all spending by a currency issuer is new money. It hasn’t sourced ‘funds’ from anywhere. It doesn’t borrow. That is a nonsensical concept. The idea that money is ‘created’ beyond tax ‘revenue’ is incorrect. All federal government spending are new dollars. So seigniorage is an operation that does not exist. Quiggin hasn’t understood MMT at all.

I’ll refer to Bill’s post deficit spending 101 – Part 2

https://billmitchell.org/blog/?p=352

“In a broad sense, a federal (fiat currency issuing) government’s debt is money, and deficit spending is the process of monetising whatever the government purchases.

It is actually rather obvious but all government spending involves money creation. But this is not the meaning of the concept of debt monetisation as it frequently enters discussions of monetary policy in economic text books and the broader public debate.”

Dear Jerry Roberts (at 2019/03/07 at 11:!5 am)

When there is upheaval in a ‘scientific’ community, all sorts of responses start coming from the mainstream. John Quiggin has previously been hostile to our work and framed that hostility in mainstream terms. Some people will be trying to reposition themselves as MMT gains support to try to get on the right side of history. It won’t work!

best wishes

bill

Hi Bill,

US Jacobin Magazine has published a long critique by Doug Henwood, who is a Marxist (he sometimes calls himself “sound money socialist”! ).

What do you think about it? Are you planning to respond to him?

@Ajit

Link to Wray’s response here

https://www.nakedcapitalism.com/2019/02/randy-wray-response-doug-henwoods-trolling-mmt-jacobin.html

Tcherneva response here

https://jacobinmag.com/2019/02/mmt-modern-monetary-theory-doug-henwood-overton-window

Obviously, extreme individualism lies at the core of neoclassical/neoliberal thinking. That is why the rational, self.maximizing and perfectly informed set of individuals is the basis of that doctrine. However, I also consider two logical errors in reasoning at the core of fallacious economic thinking. They happen at a most fundamental level and they don’t require economic indoctrination since they both can be attributed to “common sense”.

The first one is the fallacy of compositon that constitutes the paradox of thrift and it’s easy to understand why it’s so popular, too. After all, nearly all our daily interactions are with other currency-users and the vast majority has never even seen a member of the currency issuing entities in his life. So it’s easy to belive that even governments/central banks share the same behavior and constraints we as users have. That’s why everybody “knows” what money is but has a very hard time actually explaining what it really is and where it comes from.

Accordingly, thinking within the frame of the paradox of thrift sets the stage for a massive occurance of Goodhart’s law in the economic/financial system (when a measure becomes a target, it ceases to be a good measure). “A balanced budget”, hefty quarterly/yearly profits, amassing large amounts of cash, they all are examples of what is popularly considered a “good measure for success” at state, corporate and personal levels. Now all countries pursue “fiscal discipline” because that is somehow good, hedge funds slash and salvage companies in a couple of months for profit und leave mere husks and unemployed workers behind and most of those individuals who don’t have to sell their time for survival will sacrifice it freely for more money. All that while we ignore the elephants in the room that are climate change, wars and human misery around the world. In fact, we all but abandoned the lofty ideal of an egalitarian and sustainable society that is worth living, becasuse we “can’t afford it”.

I recall a cartoon in which a former investment banker is speaking to a gathering of survivors at a campfire in which resembles a postapocaliptic wasteland. He is telling them something like:

“Yes, the planet got destroyed. But for a magical moment in time we created amazing value for our shareholders.”

That sounds frighteningly realistic.

@xenji

Quiggin sounds quite confused indeed. But then so do most “professors” who pretend to assess MMT. It’s fascinating really; all the intelligence and all the erudition in the world won’t save you if you don’t have an open mind.

“He wants the reader to concentrate on the financial aspects of “paid for” and ignore the real resource costs of government spending, which will vary according to the state of the economic cycle.”

He is stuck in the neoclassical mindset? All unemployment is voluntary?

@Henry Rech,

I doubt if any serious student of this blog would ever forget that there are (real) resource constraints. Bill refers to this time and time again.

If anything, it is more likely that the mainstream tend to forget this, with their obsession with financial constraints. Whenever public spending comes up, it’s always:

“Fine, but how are you going to pay for this?”

“You’ll max out the credit card”

“We’ve run out of money”

…and similar rubbish.

BTW, I love the image of “The Conga Line of MMT critics”. I visualise them as having two left feet. 🙂 (Or more likely, two right feet).

Hi Bill, When we met in Newcastle you told me the only other professor of economics who knew MMT after yourself in Australia was John Quiggin. That to me said he was on the MMT side, but is that not strictly true?

Jerry Roberts, that meeting of economists had to have taken place between mid-1944 and mid-1946, as Keynes died in April of 1946. This is early days for the Bretton Woods system, Harry Dexter White’s brainchild. As for what Keynes reputedly said, it reminded me of what Marx said, talking of contemporary acolytes, Marx said, and I paraphrase, if that if Marxism then I am not a Marxist. Certainly, Joan Robinson thought that the Bretton Woods period was not truly Keynesian, as she called it ‘bastard Keynesianism’. Samuelson called it ‘neoclassical synthesis Keynesianism’.

Great post, thanks.

I think it’s important to understand the rhetoric used by critics, because that’s all it is; rhetoric.

“The correct statement is that government spending has no intrinsic financial constraints but may have real resource constraints which might impact on its ability to pursue its socio-economic mandate.”

If MMT only gets this into “the common people’s” head, then it has one a great victory.

Equating financial constraint with real resource constraint is the ideology of today; the TINA we cannot contest. This is how Capital governs us in today’s world. You want anything done, then capital decides. (I think this why MMT rubs other economists the wrong – they’ve been fooled into serving this ideology.)

They say ideology explains the gaps in our knowledge and how well neoliberalism works this – what happens if Government runs a deficit: INFLATION!. Any thoughtful analysis of what actually happens when Governments actual runs deficits quickly dispels this idea. But I think you put it better, Bill:

“If everyone sees the world through the MMT lens, then they would immediately reject a politician who tried to claim we cannot save the planet because we do not have enough money.”

I was at Newcastle “Newie” University (I’m a former Novocastrian). If I only I’d know about MMT then I’d have switch courses. At least I have the blog.

Cheers

Responding to Henry Rech: MMT has ALWAYS been clear about resource constraints. On the other hand, mainstream economics has NEVER been clear about the ultimate resource constraint; i.e., those natural resources essential for the preservation of a healthy biosphere. Which is precisely why mainstream economics is not only wrong but lethal.

The medical equivalent to professional economists misguiding the public about MMT realities, would be a group of medical professionals obscuring from the public view the existence of a cure to a serious, debilitating and often fatal disease. The results are comparable. How do they sleep at night?

Dear Bill,

Is your talk in Vienna next week still a thing, and if so, when and where?

I was a pro-MMT participant in and co-organizer of two Review of Keynesian Economics sessions on MMT and functional finance, respectively. One of the fallacies that kept coming up about MMT was that we are calling for “monetization” of the debt. I have realized the critics may be referring to the MMT point that the central government spends with electronic “keystrokes,” Treasury checks, etc. rather than having to issue debt first to finance spending. In essence, a central government spends using money, but outstanding stocks of government liabilities (bonds vs. currency, for example) are determined by many factors, including asset demands, the Treasury’s policies for managing the debt, etc. This confusion may also be leading to the strange claim that we are saying things do not have to be paid for.

Dear Ajit (2019/03/07 6:19 pm)

A sound money socialist tells you everything.

I have previously noted that I don’t intend to respond. His attack was nasty and personal and didn’t say anything new. Just an attention-seeking exercise as the world passes him by.

best wishes

bill

Newton Finn,

“On the other hand, mainstream economics has NEVER been clear about the ultimate resource constraint”

I’m not so sure about that. It seems to me that the ecocidists don’t believe the science and have ideological predilections and vested interests which keep them from joining the movement.

“The gift of this hope, uncovered by this lens, is why MMT must ultimately prevail. ”

You seemed to be cock o’ hoop about ecocide being avoidable because MMT says there are no financial constraints. There is no gift of hope in MMT clearly bringing the resource constraints to the fore. There are stark choices to be made. If there is any hope it is that there are people willing to make choices, which will not be without consequences. In fact, it is neoclassical economics that provides the economic theory that explains how real resources are allocated between competing uses, except that the assumptions that the theory is based on, are stupid. 🙂

So many comments but to my mind some are gems:

“government spending has no intrinsic financial constraints but may have real resource constraints which might impact on its ability to pursue its socio-economic mandate.” – Henry Rech

“Not only does MMT provide a clear lens through which to view macroeconomics, but it also provides a firm foundation for desperately needed hope in a neoliberal world order hell-bent on ecocide. The gift of this hope, uncovered by this lens, is why MMT must ultimately prevail. No mere academic debate, this battle Bill and others are fighting is, without hyperbole, a matter of life and death on a planetary scale.” – Newton Finn

“all the intelligence and all the erudition in the world won’t save you if you don’t have an open mind.” – AlexHache

Jerry Roberts, Larry: That quote seems to be from a comment by Austin Robinson on p. 58 of T. W. Hutchison’s Keynes v. The Keynesians: An Essay in the Thinking of J. M. Keynes & the Accuracy of its Interpretation by his Followers- Institute of Economic Affairs (1977)

You can read or download a pdf of the book at the Institute of Economic Affairs website.

Keynes v. The Keynesians

[note: Lydia Lopokova: Lady Keynes]

I think Austin Robinson’s brief remarks there are more sensible and accurate and Keynes- & MMT-consistent than either Hutchison’s or his now more famous spouse’s remarks, who also mentioned the quote in a 1979 paper.

The 1st paragraph [for me] described how the 1972 Club of Rome report, “The Limits of Growth” was supposedly refuted. They made up strawmen from the report and refuted them and claimed they had refuted the report. For me, they had not. So, far the report is spot on. OTOH, the sh*t has not hit the fan yet, so the trends we can see since 1973 are just business as usual and don’t really prove that the point of the report [that the sh*t would hit the fan in 2050 plus or minus 20 years] is true.

So, this tactic is OLD.

Andreas Bimba

“”government spending has no intrinsic financial constraints but may have real resource constraints which might impact on its ability to pursue its socio-economic mandate.” – Henry Rech”

Not my words. That was me quoting verbatim extracts from Bill’s piece above.

So it is. Sorry Bill and Henry.

Some Guy, many thanks for the reference. Much appreciated.

”Conga line of MMT critics marching into oblivion” – hilarious!

A great image too! I see Rogoff, Summers, Krugman, etc., dancing in a jagged line, toppling off the end of the Earth.

Xenji — John Quiggin’s piece did not tally with what I have read by Bill but at least people are talking. Larry and Some Guy — I picked up the reference in Keynes and his Battles by the French Canadian scholar, Giles Dostaler. I referred to the Bretton Woods years as that dramatic time when Keynes and White were working out the system. It was such a shame that Keynes died young and Hayek lived for ever.

I always liked Larry as a counterpoint to the other two. Moe and Curly were the other ones.

You can see of the Larry backflips here 😉

https://www.youtube.com/watch?v=vuqQ3FZuSUs

woop-woop-woop

Thanks also from me to Some Guy for the great “Keynes vs the Keynsians” link.

I am also indebted to Sarah Holland of the UK GIMMS group for Tweeting this link to a fascinating article which I think is quite germane to Bill’s blog posting:

https://www.thefullbrexit.com/remain-and-reform

“The Folly of “Remain and Reform”:

Why the EU is Impervious to Change”

By Lee Jones

Bill,

I beg your permission to be wicked here….With a salute to George Lakoff; Since they are in a conga line, we should change “marching”, to “dancing blissfully”..LOL

I hope Bill does not mind my publicising the following:

The Full Brexit group have organised a tour, at which the main speaker is Costas Lapavitsas.

https://www.thefullbrexit.com/tour

There are in fact only two dates left:

London Monday 25th March 2019 18:30

Durham Thursday 28th March 18:30

The theme of the tour is: “Transforming Britain After Brexit”

Re- Some Guy says:

Friday, March 8, 2019 at 12:03

Your ref to that Institute of Economic Affairs book Keynes v. The Keynesians provoked my curiosity so I scrutinized its advisory panel list. One name popped up to immediately jog my memory of those long-lost days when the influence of economic controversy shaped political ideology and policy: Professor A A Walters.

Sir Alan Walters was economic adviser to Margaret Thatcher who clashed with her Chancellor but shaped modern Tory fiscal policy – (adapted from The Telegraph obituaries; 5 January 2009.)

Walters was a preacher of the doctrine of Monetarism and clashed with Nigel Lawson, Margaret Thatcher’s Chancellor. A leading proponent of the Milton Friedman mantra, Walters became convinced that the prevalent view in Britain – that the quantity of money in the economy was not paramount – was dangerously wrong.

Following the Conservatives general election loss in February 1974 Walters met, through Alfred Sherman, director of the Centre for Policy Studies (CPS), Sir Keith Joseph and Margaret Thatcher and was instrumental in convincing them of the case for monetarism.The age of Thatcherism was thus born, together with all the Monetarist severity that accompanied it.

Alan Walters has ever since been regarded with vile contempt by those supporting more fiscally oriented economics. It is a little surprising therefore to record a contrasting origin to Walters’s stringent approach located in his early life; the son of a grocer and one-time Communist who eked a living between bouts of unemployment selling his wares in the neighbourhood from a clapped-out van, he failed his 11-plus, left school at 15 and found work as a machine operator in a shoe factory.

After numerous rejections, to secure a place at University College, Leicester, to read Statistics going on to Nuffield College, Oxford, where he took an MA in Economics.

Perhaps his misconceptions of macroeconomics were based nevertheless on good intentions.

I love that story thanks Gogs. It is a key point about good intentions. Economics has to serve a social purpose and we should be able to discuss these theoretical points in a good-natured and respectful manner. I liked J.K. Galbraith’s comment on monetarism.The applause from the rich for the monetarists has been well deserved.

As someone who is not an economist and has an interest in both MMT and Marxism I find the debate between Marxists and MMTers quite interesting. I do feel that Marxism does offer the best critique of MMT in that it is ultimately wage exploitation that drives profits and investment, not government debt as MMT would argue. Fundamentally MMT differs from Marx’s money theory by saying that money is not tied to any value… being that money is the primary force behind value and investment for MMTers. I guess a Marxist would argue that MMT’s emphasis on the monetary system detracts from any really critique of the capitalist modes of production and any dialectical understanding that the exploitation of labour under capitalism is the biggest driving force behind growth and profits. I’m kind of on the fence tho I find myself leaning more towards Marx these days. I feel like MMT people need to engage with Marxist more.

Dear Adam (at 2019/03/10 at 9:09 pm)

Where did you get these ideas about MMT from? There are some, very bad, so-called Marxist critiques of MMT emerging which miss the mark completely.

Overlay a class conflict lens on the MMT lens and what do you think you get?

best wishes

bill

Thank you Bill for addressing the critics. This is especially timely given Larry Summers’ recent opinion piece in the WaPo.

I tried to address his points in a response below. I hope I got the points correct regarding MMT.

https://www.quora.com/Former-treasury-secretary-Larry-Sommers-slammed-a-hotly-debated-economic-theory-for-suggesting-that-government-debt-should-not-be-interpreted-as-a-constraining-factor-to-fiscal-policy-is-he-right-in-doing-so/answer/Jeff-Sturm-2

As always I remain flummoxed how the topic has become so political. I could have enjoyed practicing economics myself beyond my academics had the topic not become such a lightning rod between our major political parties.

It was one of those moments where I wanted to scream “Stop! Let the economists talk.” Sadly, Mr. Summers himself sounds far too much like a politician.

Actually, my presentation was on “unsettled questions” where I thought there was space for empirical work of interest to both MMT and non-MMT people. I didn’t say a word of criticism of you guys!

I originally got in touch with Matias Vernengo about a possible EEA session on MMT as a forum for overflow questions after a frustrating session at a conference in UMass Amherst last year–the URPE 50th Anniversary–where Epstein presented his work in progress. The new paper you mention is a preliminary draft of the paper. We wound up with two varied sessions, including one in which Josh discussed implications of work based on Domar-type formulas and dynamics and another in which I presented a defense of MMT against arguments by some UMass Amherst and PERI scholars. Epstein’s coauthor for one paper at the Amherst conference, Junji Tokunaga, has expressed an openness to talking with me about our respective positions in Massachusetts–perhaps a hopeful sign for better mutual understanding of our differences if nothing else.