As part of a another current project, which I will have more to say about…

Another fictional characterisation of MMT finishes in total confusion

I am travelling across Europe today and so am just writing this in between various commitments. I will soon be back home in Australia and have received a lot of E-mails about the way the Australian media has been treating the recent upsurge in attention about Modern Monetary Theory (MMT). The short description is appalling – one-sided, no balance and hardly about MMT at all, despite dismissing our work as garbage. So par for the course really. While most of the articles have just been syndicated hashes of the foreign criticisms that have been published elsewhere from Krugman, Rogoff, Summers and others. But there was one article by a local journalist who tried to predict which side of history would end up looking good in all this and chose, wrongly I think, to throw his cap in with the New Keynesians. More alarmingly though is that this local effort clearly followed the international trend by setting out a fiction and then tearing into that fiction claiming to his readers that this was about MMT. He missed the mark and ended up totally confusing himself. So par for the course.

Remember back to August 2008, when the world was going into financial collapse that none of the New Keynesian macroeconmists saw coming – nor could have seen, given they didn’t even have a financial sector in their theoretical framework – Blanchard wrote his smug article – The State of Macro – which attempted to summarise the consensus that mainstream macroeconomists had reached on how to do economics.

The article would have been written before the worst of the GFC was revealing itself and tells you how removed the mainstream profession had become from reality.

The mainstream has evolved into following a standardised approach to the discipline. All those who sought to publish in the discipline had to follow that approach in order to engage and be successful. Variation was discouraged.

Blanchard wrote glowingly, that macroeconomic analysis had become an exercise in following:

… strict, haiku-like, rules … [the economics papers] … look very similar to each other in structure, and very different from the way they did thirty years ago …

Graduate students are trained to follow these ‘haiku-like’ rules, that govern an economics paper’s chance of publication success.

So if an article submission does not conform to this haiku-like structure it has a significantly diminished chance of publication.

You just have to see the calls by the current critics for a ‘formal model of MMT’ within the Aggregate Demand/Supply, IS-LM framework to see how cloistered (claustrophobic) their approach has become.

The reality is that the mainstream follow a formulaic approach to publications in macroeconomics that goes something like this:

- Assert without foundation – so-called micro-foundations – rationality, maximisation, rational expectations – imposed assumptions about human behaviour that no sociologist or psychologist would remotely recognise.

- These foundations cannot deal with real world people so assume there is just one infinitely-lived agent!

- Assert efficient, competitive markets as the optimality benchmark against which all other states will be assessed – in other words, abstract from the reality of existence.

- Write some trivial mathematical equations and solve – professional mathematicians shrink with embarrassment when they see the naive formality that economists think is state of art.

- Policy shock the optimal ‘solution’ to ‘prove’, for example, that fiscal policy is inneffective (Ricardian equivalence) and austerity is good. Perhaps allow some short-run stimulus effect.

- Get some data but realise poor fit – add some ad hoc lags (price stickiness etc) to improve ‘fit’ but end up with identical long-term results – of course, once you add these ad hoc lags the ‘micro founded’ framework, which is the ‘authority’ that is used to claim ‘scientific’ standing is abandoned.

- Irrespective of that abandonment, maintain pretense that micro-foundations are intact – after all it is the only claim to intellectual authority that these mainstream economists have – which is no claim at all in reality.

- Publish articles that reinforce starting assumptions.

- Get appointments, promotion

- Write commissioned reports (with fees and sponsors largely undisclosed) about how stable the financial sector etc is – parade the reports as independent academic research – and demand more deregulation, cutting of income support systems etc under the guise of ‘structural reform’.

- Knowledge quotient of all this – ZERO – GIGO.

And, on the side, they write ridiculous attacks claiming to be about MMT, when people start questioning the relevance and validity of their work.

And, they have an army of graduate student trolls who Tweet their heads off attacking MMT so they will look good in the face of the ‘high priests’.

It is highly unlikely any of them have read much of the primary MMT academic literature at all.

That is where the struggle of the competing paradigms is at.

The ‘haiku’ stuff was back in 2008.

Then go forward to October 2012, when Blanchard was forced to admit that the IMF had grossly erred in its modelling that was used to construct the Troika’s Greek bailout austerity package.

The policies that were imposed were disastrous, as any MMT economist (including myself) who offered predictions at the time, said they would be.

And then we learned of the mistake.

I wrote about that pathetic back down – which cost hundreds of thousands of Greek workers their jobs in Greece – in these blog posts:

1. So who is going to answer for their culpability? (October 12, 2012).

2. Governments that deliberately undermine their economies (November 19, 2012).

3. The culpability lies elsewhere … always! (January 7, 2013).

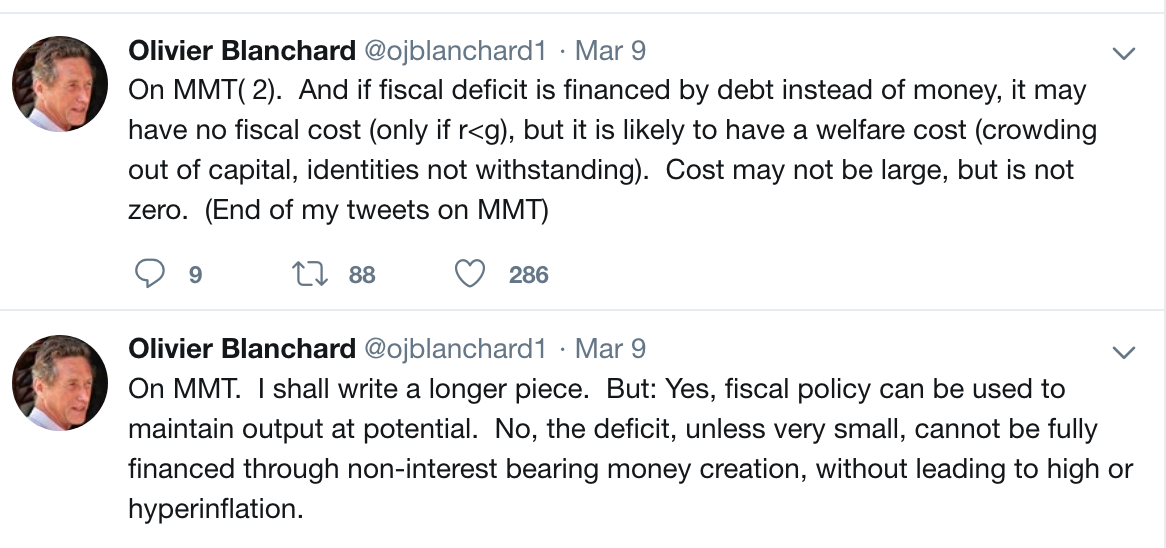

And now Blanchard is Tweeting that like Paul, Ken, Larry and all the rest of the buffoons, he has something deep and meaningful to say about MMT but that we will have to wait with baited breath before he deigns to write it.

For now we should be consoled with these insights – crowding out, hyperinflation. Same old. Been there done that.

The longer piece will just elaborate on that. Nothing new. No engagement. Ignore.

What these guys (and they are all men so far) don’t seem to realise is that we have been working on this stuff for 25 years now and have PhDs just like them and know their stuff like the backs of our hands.

I also liked the pithy analysis of the hypocrisy of the “high priests” of mainstream macroeconomics by Lars Syll (March 10, 2019) – Summers shameless assault on MMT.

These assaults on MMT reflect the circling of the wagons – they will attempt to protect their own place in history by whatever means they can.

But I think, ultimately, they will be found on the wrong side of history, where they have been for decades but no one really directly and comprehensively challenged them about that until MMT came along.

The Australian media has been giving air to all these criticisms via syndication. So in the last few weeks, Australian readers of the major dailies have awoke to headlines about MMT being rubbish, garbage, dangerous etc.

No balance. No attempt to seek critical input.

The media owners clearly just want to push the US line.

And it was only a matter of time before some wannabee local financial journalist would seek to make his/her own mark and summarise the arguments under his own byline.

Last week (March 5, 2019), Fairfax press ran the story – Memo to Bernie and AOC: Debt and deficits still matter – from local journalist Stephen Bartholomeusz.

He is touted by media masthead he works for now as “one of Australia’s most respected business journalists”. His article about MMT would not hold to those standards (even) if they are true.

It looks like he has only read KLOP (Ken, Larry, Olivier and Paul), which sounds like … you know what … and decided to represent them as his own deep analysis.

Not much new in other words and not much indication he has actually read the academic literature from the core MMT group.

His grasp on our work is so tangential that he ends up totally confusing himself as you will see.

He began by quoting from the testimony that the US Federal Reserve Board chairman provided recently to the US Congress:

The idea that deficits don’t matter for countries that can borrow in their own currency, I think, is just wrong …

Powell was answering a question about MMT. His statement indicated that he was not qualified to comment on MMT.

He admitted he hadn’t read any of the literature.

And he will not find it written in any of the core MMT literature that “deficits don’t matter”.

So he must have been talking about something other than MMT, a point that Stephen Bartholomeusz seems to have missed, which is no surprise because by quoting Powell’s ignorance, he disclosed he hadn’t read much either.

But why let you stop making out that you are an expert in these matters?

Stephen Bartholomeusz continued:

The “Green New Deal” and “Medicare for All” programs championed by young Democrats like Alexandria Ocasio-Cortez (AOC) and older ones like Bernie Sanders would see massive increases in US government spending to respond to climate change and economic inequality. The programs have been costed at more than $US90 trillion ($127 trillion).

First, the ‘costing’ at $US90 trillion, whether correct or not, does not lead to the conclusion that the GND would “see massive increases in US government spending”.

There would certainly be increased public spending on GND projects but overall the net spending injection would have to be determined by how much idle capacity was left to be brought into productive use.

At the point where no such idle capacity exists, then the process of trade-offs begins which means spending has to be diverted into GND projects and away from other current uses, whether they be government or non-government.

It might turn out that the so-called (scary) “massive increases” don’t turn out to be all that large at all in absolute terms.

A few paragraphs later, Bartholomeusz shifted, seamlessly, from “massive increases in US government spending” to “a massive increase in government debt and deficits”.

And reminded readers that the US “already has massive debt and deficits”.

What exactly is a massive deficit? According to Bartholomeusz it is one that “is closing in on $US1 trillion a year”.

That would be a large absolute deficit in terms of, say, the Australian economy, but in terms of the scale of the US economy it was recorded at 3.7 per cent of GDP in 2018.

In 2009, it was 9.7 per cent of GDP.

Since 1929, the US fiscal deficit has averaged 3.02 per cent of GDP and has been in deficit 84 per cent of the years to 2018.

Each time it has gone into surplus, a recession has followed soon afterwards.

So a deficit of 3.7 per cent of GDP doesn’t sound massive in that sense.

While a trillion dollars invokes ‘big’, and that is why Bartholomeusz used the absolute figure, no serious economist would make any conclusions based on such a number.

The point is that Bartholomeusz knows his readers will not be discerning enough to scale the deficit appropriately.

Further, even a number like 3.7 per cent of GDP makes no sense in itself.

What is it in relation to? What is the context?

To make sensible assessments about the appropriateness of a particular fiscal position, one has to understand the non-government sector spending and saving position, which includes the external sector.

If the 3.7 per cent deficit was “massive” (meaning in Bartholomeusz-speak inappropriate), and, out of kilter with the spending and saving decisions of the other sectors (private domestic and external), then we should be observing inflationary pressures rising quickly and wages growth escalating in the face of over-full employment.

Neither are happening and are no where near happening.

Mr Bartholomeusz wants to write about MMT but he clearly hasn’t understood the way MMT economists go about analysing a situation.

If he did, he would not have started scaring people with totally over-the-top words such as “massive” in relation to a 3.7 per cent deficit that is supporting a balance sheet restructuring in the non-government sector.

He then tells his readers that:

The core of the MMT concept is that, because the US borrows in its own currency – the world’s reserve currency – it can simply print more dollars to cover its expanding borrowing requirement.

Where exactly did he find that core proposition in the writings of the major MMT developers? He didn’t and should be honest enough to admit he hasn’t read any of it.

He would have found that sort of terminology and construction in the recent KLOP (Ken, Larry, Olivier and Paul) rants.

MMT does not privilege the US because it has a reserve currency.

While it is true that the existence of the US dollar as a desired reserve currency means that they do not have to worry about foreign reserves as much as other nations with less attractive currencies, this doesn’t undermine domestic sovereignty.

Further, MMT economists never talk about ‘printing money’ – because that process doesn’t remotely describe how governments spend their currency into existence.

And, of course, it invokes the scenarios that the conservatives love to invoke of crazed government officials in basements of central banks running printing presses at breakneck speeds to keep up with the hyperinflation.

What MMT tells us is that any currency-issuing government can purchase anything that is for sale in that currency including all idle labour.

It would simply credit relevant bank accounts to make those purchases operational.

What other monetary operations that might accompany that process would depend on institutional arrangements (for example, the government might voluntarily impose a rule on itself to match any spending beyond the numbers it records against a taxation account with some numbers in a debt account and create liabilities accordingly) and political choice.

The operations would not depend on any intrinsic financial constraint.

Mr Bartholomeusz then writes:

Provided the Fed kept US rates below the rate of growth in GDP and the growth in the debt, the US could always service its debts.

This is factually incorrect.

The currency issuer can always service its liabilities as long as they are denominated in the currency that the government issues.

It doesn’t depend on what is happening with the public debt ratio.

He then further demonstrates an unfamiliarity with the core MMT concepts, despite holding himself out as a person qualified to write articles on the topic:

Instead of targeting inflation the goal would be full employment.

MMT is explicit – we propose a macroeconomic framework that allows for full employment and price stability.

And, then, it was bound to happen, the ‘socialist’ scare enters.

Mr Bartholomeusz writes that:

To the extent that inflation did emerge, government policies – targeted taxes and industry policies – would be used to stamp it out, implying a degree of central planning and intervention in the economy that one suspects wouldn’t be easily accepted in the US and which could, by crowding out private sector investment, change the very nature of the US economy.

Well the GND if implemented will “change the very nature of the US economy” and reposition it for a sustainable future.

That much is correct.

But in what way does the normal management of economic policy – tax adjustments, sectoral policies etc – define “central planning”?

Since when has counter-cyclical fiscal policy management become “central planning”?

We lose all meaning in our language if we stretch words and concepts too far.

Further, in what way will the GND lead to the “crowding out private sector investment”?

One would suspect it would crowd in private investment in the new GND sectors.

Where in any GND charter does it say that the non-government sector is prohibited from investing, producing and employing?

And, with the central planning reference as a segue, it doesn’t take long for Mr Bartholomeusz to wheel out the Weimar/Zimbabwe stories, except he hasn’t a clue about what happened in those nations that caused the hyperinflation.

He writes:

History hasn’t been kind to the theory. Germany in the 1920s, Argentina almost routinely and Venezuela more recently are examples of what can happen when governments overdose on debt and lose control of inflation.

Exactly wrong and a violation of the historical record.

Please read my blog post – Zimbabwe for hyperventilators 101 (July 29, 2009) – for more discussion on this point.

A currency-issuing government that increases its spending may increase the risk of inflation, just as any growth in nominal non-government spending might.

If the growth in nominal spending maintains proportionality with the growth in productive capacity then it is unlikely to trigger any demand-pull inflation.

That is irrespective of the monetary operations that might accompany any increase in public spending.

Mr Bartholomeusz clearly doesn’t understand inflationary processes.

Nations can run continuous fiscal deficits forever without “debasing” their currency.

He also becomes very confused.

On the one hand, he claims that the US government will be ‘printing money’ to fund the GND but then writes that MMT “appears to pre-suppose that the rest of the world would keep lending the US money, investing in US Treasuries even as the value of the investments was being devalued by the government printing presses.”

At this point, you realise he hasn’t understood anything.

In his mythical world, with the printing presses running flat chat, why would the government be issuing debt?

Nonsensical confusion.

And finally, the old hoary “MMT can’t work” story, which suggests that MMT is a regime.

Mr Bartholomeusz claims that “without the co-operation of the Fed – MMT can’t work”. Of course, MMT already is working – on a daily basis – in our monetary economies.

It is not a regime we shift to but a framework for understanding how modern monetary systems function – whether the central bank officials know that or not.

Here are some questions for Stephen which the management of the Fairfax media group which pays his salary should force him to answer:

How much of the MMT literature from the core MMT developers have you read Stephen?

How far does your reading go back?

Which peer-reviewed articles and books have you read from the core MMT developers that you can cite as indicating that your representation is ground in the MMT literature?

What qualifications and experience have you got to write such an article?

Conclusion

Australian readers: bug Fairfax and tell them to stop publishing this fake knowledge and deceiving their readers.

They have become nothing better than a snake oil sales company.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Please, please publicise Blanchard’s “longer piece” on why a deficit “cannot be fully financed through non-interest bearing money creation, without leading to high or hyperinflation” when he produces it. Having something to laugh at always cheers me up….:-)

Yes, no surprises there. the attention to MMT has just ballooned in the last few months, possibly because AOC referred to it in Congress and alerted people who are now being flooded with GIGO summaries. Soon enough I feel the “I told you so” ‘s will start appearing claiming they knew it all along. No one will admit they got it wrong.

Love your articles! I guess I started reading them because I consider neoliberals to be a pox on the world!

They are talking about MMT more now and are upset that’s good!!

All these fossils reacting to MMT, i must say i never expected this. Good news.

The first time I started getting articles criticizing MMT on Google Discover a few months ago, I got a little scared – oh, no, maybe the world is even more complicated. Except… in my time here, you had already gone over those “arguments” over and over again, and no critic had done their homework.

Nothing has changed so far, it’s still the same lazy thing over and over again, almost verbatim. I must be honest, it made be be a little more attentive to the details, as I’m still very much a layman, so there’s that.

It’s amazing how valueless their droning arguments are; it shouldn’t be surprising after I learned some things during the GFC and the Eurozone’s response, but it’s still impressive. Despite the «strict, haiku-like, rules», there’s not even one shared coherent argument, it’s always a contradictory mess once they start expounding on it.

Congratulations on hitting a nerve.

WooHoo!

I think we are winning Bill.

MMT is discussed at the grassroots level through social networks and online thorough a huge community.

The power structures that exist (including supposedly ‘progressive’ organisations [*cough* ACTU *cough*] seem to dismiss anything that does not conform with their understanding of ‘how things work’

… and why I’ve pretty much given up on reading even Gittins, who gets it half right half the time…let alone Bartholomeusz.

Bill, are you using a speech to text input to write these entries? I ask because it should be “bated breath” — homonyms are problematic for such programs (as they are for spell check)

/pedantry

Regardless, love seeing the orthodoxy embarrass itself so thoroughly lately — keep the pressure on them!

Wow! Even the RBA are out today running down MMT – with an argument that sounds like “it’s mostly wrong but the bits that are right, we knew them all along”.

Hi Professor Mitchell

Keep up these informative posts! I think they’re extremely useful for some like me that wants to continue to learn about MMT!

I had one question (please don’t take my question the wrong way!) regarding your following comment:

“Further, MMT economists never talk about ‘printing money’ – because that process doesn’t remotely describe how governments spend their currency into existence.”

If the government does decide to spend (hopefully in a way to utilise under-utilised resources) isn’t that effectively just putting money into a bank account as well as creating bank reserves? So in a sense isn’t that just creating money out of thin air? so it is like “printing” money?

M

Hi Bill

You probably need to add Professor McKibbin in the AFR also, whom then puts out the following:-

“Proponents of an old idea in new clothes – modern monetary theory (MMT) – argue that central banks can solve all these problems by simply buying the large amounts of government debt and increasing the money supply…This can only be described as a classic free lunch.”

“…The basic problem with MMT is it has been tested by countries and the result has always been hyperinflation, massive social and economic destruction and a crisis followed by more conventional economic policies being imposed. All existing experience – Venezuela today, Zimbabwe in 2008; Yugoslavia in 1994; Hungary in 1946; Greece in 1944; Wiemar Germany in 1923 – demonstrate the large costs”

“…Most taxes are transparent such as income or profit taxes but the usual tax that eventually finances large and persistent fiscal deficits and exploding government debt is the inflation tax.”

Clearly the good professor is not overly scholarly as there appears to be considerable reading gaps in his knowledge!

Dear Bill

Spotted another!

Another shocker from Bartholomeusz. Goes on to claim its a ‘mystery’ why the world economy is weak, goes on to say we have already been in a fiscal expansion for 10 years like ‘MMT’ proponents want. Hence claiming even ‘MMT’ does not know what to do 😉

Is this what’s going to happen next to MMT selectivity to try and attack the theory? Ad-nausea

Of course the article mentions Zero Full employment (Job Guarantee), Zero about private debt levels, Nothing about the Financial sector deregulation. Nothing about how ‘full employment’ is measured etc.

You can zap the link/quotes if you want 😉

Here: https://www.smh.com.au/business/the-economy/global-slowdown-is-becoming-more-intense-and-no-one-knows-why-20190313-p513td.html

As follows:

“The inability of the developed economies to generate any momentum is spawning novel suggestions for how to spur some growth, including the radical Modern Monetary Policy (MMT) embraced by the Democratic Party progressives.”

“MMT thesis that deficits don’t matter for countries that can borrow in their own currency and can print more currency to fund their increased spending – probably aren’t going to provide a solution.”

“The persistently weak conditions of the major developed economies – despite a decade of unprecedented stimulus via unconventional monetary policies and the ultra-low rate environments they created and against the backdrop of relatively expansionary fiscal policies – have economists befuddled.”

“The short description is appalling – one-sided, no balance and hardly about MMT at all, despite dismissing our work as garbage. ”

You once said that the duty of any political party is to ‘oppose’. As far as I am aware, this opposition is only limited by any legal duties that may exist, but apart from that, it is fair game. As all economics is political, then I’m not sure why you might get ‘appalled’.

Dear Bill,

Here’s an excerpt from Krugman’s latest column whilst talking about trade deficits

https://nyti.ms/2VCSEno

“On the contrary, other countries are sending us valuable goods and services, which we’re paying for with pieces of paper – paper that pays very low interest rates. Who’s winning, again?”

What MMTers have been saying all along.

Cheers,

Sanjay

I love Lars’ photo of Summers napping at the table. A physical manifestation of his cognitive life.

Kent wrote: [quote]”…Most taxes are transparent such as income or profit taxes but the usual tax that eventually finances large and persistent fiscal deficits and exploding government debt is the inflation tax.”

Clearly the good professor is not overly scholarly as there appears to be considerable reading gaps in his knowledge![/quote]

Yes, the professor is spouting nonsense. Since 1992 for the last 27 years there has been little inflation while the debt went from [number from memory] $5T to $20T. This is a 4 fold increase in US national debt and yet there was little inflation.

Where is the inflation tax he is talking about? Is it still to come?

Well, I am sick and tired of economists being the ‘boy who cried WOLF’ for decades and the wolf never showing up.

I saw a report on youtube from a RT report from 2013 datelined Moscow.

In it a woman ‘expert’ said that the world was abandoning the US dollar and there would be a huge selloff of dollars any day now. That was over 2000 days ago, and still no selloff. I guess she is not much of an expert. Actually I guess she was spouting propaganda to harm America at the orders of Putin.

Mind you I like some shows on RT, like Thom Heartman. [spelling?]

My point is experts who turn out to be wrong all the time.

Bill,

On another site a friend is open to MMT,but has an objection that I see as flawed.

Can you help me set him right?

He worries that long term deficits can cause problems in the long term, even if they are good in the short term.

I asked him to name just one example.

He responded that he thinks that the Repub’s massive deficits since Reagan have *caused* the flat wage growth that started with Reagan’s terms.

I think he is flat wrong. Not one of the rebel economist’s videos & articles I have seen even hints that this “cause” is true. Rebels like you, Kelton, Wray, Mosler, Keen and Blyth.

So, is there any sense in which he is right?

“… professional mathematicians shrink with embarrassment when they see the naive formality that economists think is state of art.”

Even when I was in graduate school 40 years ago I wondered, “How does the math which mainstream economists toss around stack up in the eyes of actual mathematicians?”

It would be nice to have links to actual examples of mathematicians evaluating economists’ math.

A friend who is a professional financial advisor (who knows I am partial to MMT) recently passed on an article to me that was written by the CIO of Oppenheimer Funds. I am omitting the link to it so as to not spread more tripe, but if Prof. Mitchell wants it, I will happily send it to him. The article is titled “MMT: Confusing a Political Idea with a New Economic Theory” and contains many of the same mis-characterizations of MMT that are discussed in this post, including the hyper-inflation nonsense. Among other things, he criticizes MMT for the use of the word “Modern” because he dislikes any group that calls itself modern. I wrote a detailed response to this for my friend and a few others for whom I write an occasional economic blog and my response to this was simply that the author clearly had no understanding the MMT is not a “modern theory of money”, but rather a “theory of modern money” which are two very different things. He next conflated the job guarantee with Fed “money printing” to finance it in order to conclude it would create hyper-inflation. I pointed out that the monthly cost of the MMT job guarantee, if implemented in the U.S. at a $15/hr. rate and given the current unemployment rate, would be only a fraction of the amount that was being computer generated by the Fed for QE at its height. And the real net cost would only be some fraction of that, given the reduction of unemployment payments and the economic expansion that would result. So even if the government DID decide to pay for it in that manner, which is clearly not something that MMT would automatically assume, it would hardly be the makings of Zimbabwe style hyperinflation. His analysis didn’t even stand up to some simple arithmetic. I think these more casual authors are starting to parrot the mainstream economist “experts” without real comprehension. I believe that there are many people like me, with scientific training unrelated to economics, who simply resonate more with MMT’s approach than with mainstream economics, for all the reasons that Bill provides in this post. And that scares the existing financial world.

@Steve_American

“Where is the inflation tax he is talking about? Is it still to come?

Well, I am sick and tired of economists being the ‘boy who cried WOLF’ for decades and the wolf never showing up.”

Ditto the debt-deficit chicken-hawks, of whom I ask, “if the sky is always falling, why is it that it never hits the ground?”

Mr American, let’s see if I can answer in Bill’s place. Your friend has poop for brains. What is the cause of action from large fed govt deficits to flat wage growth? The govt isn’t borrowing the money to spend and making it unavailable to the wealthy and the powerful to pay for bigger wages!!!!!!! It’s ass-backwards. The large deficits come from cutting taxes on the wealthy and the powerful while at the same time expanding federal spending so the economy would not slow down and might speed up. The flat wages comes from the destructive attacks by the wealthy and the powerful on organized labor – the air traffic controllers fired, anti-union legislation, failure to defend rights to organize. And don’t forget the Reagan amnesty to 5 million illegal immigrants to supplant and undermine the wages of workers here. Tell me Mr. American, if you give people the exact objective and goal of their illegal acts, don’t you in fact encourage more of it? Ol Reagan said he was punishing them, he’d be tough on them from now on. Reagan. What a big liar. LOOK. THE WEALTHY AND THE POWERFUL ALWAYS NEED MORE CHEAP LABOR. If you wanted to build a bridge to the moon you could rest a foundation on that. The big deficits – that’s just the w&p with their snouts in the public trough.

You see, Mr American, no sooner than the New Deal was conceived the w&p were thinking how to reverse it. They needed to discredit Keynes. Friedman saw his place. Putting their heads together, they came up with TRICKLE DOWN. If you want success, you serve. They waited for something to blame on Keynes. The energy stagflation of the 70’s was all they needed. They had been building strength for decades.

Remember the republican national convention for president. All 17 candidates had one economic policy – cut taxes on the wealthy to get the economy moving again. Well Reagan started all that in the 80’s. And that is what he did. They thinking was “if we quit taxing the wealthy so much, they’ll have the motivation to act, and the explosion of economic growth and wealth creation would be so great that the govt debt would actually decrease from the surge in growth. And everyone would benefit, because, even though the wealthy hate to share, inadvertently there would be some leakage, that would trickle down to the great bulk of the population.” Of course it didn’t work. The w&p never share. You have to fight them for your due. The idea of “trickle down” is what I call a “SELF SERVING LIE OF THE WEALTHY AND THE POWERFUL.” That’s all it is. It’s never challenged in the media. They know who they serve. I’ve heard it for decades, investigated it myself, and understand it’s true nature. It has many implied deceits written into it, repeated so often that it becomes a truth that everyone knows and accepts: our well-being is held hostage by the w&p, our own agency amounts to nothing; government, or organized society can accomplish nothing of merit on its own; we need to be humble and supportive or they leave us; we need to be uncritical because their confidence and heroic actions are our only chance.

Yok.

Here’s a read along these lines of yours. a parallel description.

I don’t agree with all of it but it is interesting. It reminds me of Churchill’s description of Socialism “The politics of envy” and I don’t agree with that either

https://straightlinelogic.com/2019/03/08/the-experiment-by-robert-gore/

Yok, thanks.

That is basically what I thought. But, he was open to my explaining things so telling him he has shit for brains was not going to convince him.

I do believe that you don’t really believe what you wrote in your last few sentences.

I think you think that there is hope to overthrow the W&P and get back to Government “of the people, by the people and for the people.”

BTW — a guy gave me a book, “The Family” 2008 by Jeff Sharlet, about the conspiracy that was started in 1937 to repeal the New Deal. I still have it. The group is called “the foundation” or “the family”. If you want to find it you can google this, “Jeff Sharlet the family, ‘you can rape 3 little girls’ “. This last comes from a quote in the book where the son of the founder told the author that the organization didn’t care if you had done terrible things, if you joined them, God and they would forgive any transgression. Notice it says little girls and not young girls which can include women over 20 years old.

BTW — On another site I suggested and many of them did start putting all statements that were ironic etc. and the opposite of what they believe in green ink. It made it easier to tell when someone was kidding and when he was serious. Others rejected the idea because as they said, “Where is the fun in that?”

Bartholomeusz has a later piece that takes two casual sideswipes at MMT without which he couldn’t support his illuminating thesis that “Global slowdown is becoming more intense – and no one knows why”.

https://www.smh.com.au/business/the-economy/global-slowdown-is-becoming-more-intense-and-no-one-knows-why-20190313-p513td.html

It contains this gem.

“Equally, simply redistributing existing wealth from the haves to the have-nots within stagnating or low-growth economies is more likely to detract from growth than generate it.”

So true. One person on $650K eats more than ten people on $65K. That’s how increasing inequality stimulates demand, adds to turnover, generates more jobs, increases profits and stimulates growth in the food and hospitality industries, with beneficial spill over effects throughout the economy.

Steve. You’l have to edit my remarks for your friend. I wanted to give you something to work with, depending on how your friend is coming at you.

Steve & Yok,

I highly recommend The Plot to Seize the White House by Jules Archer. This is about the attempted coup using the military that certain rich people attempted against FDR. He names names. You will recognize some of them right away. But they picked the wrong general. Brigadier General Smedley Butler played along and eventually got their names and went straight to the McCormack-Dickstein Committee. Scandously, all that happened was that they were phoned up and told to cease and desist or their names would be splashed all over the front page of every newspaper in the country. Of course, they stopped, but then got richer during the war.

Mr Doyle. I’ll check out the read.

Steve. I think what got me going, was something I see a lot of in conservative arguments, and most especially from Milton Friedman – the use of false associations. I heard ol Milty put Albert Einstein with Henry Ford together as examples of “free enterprise capitalism,” to the pleasure of his audience. Albert never had employees, never engaged in free enterprise, never had a lot of money, was never a capitalist, and gave all his contributions within a socialist context of working for the public institutions. I don’t blame yours friend. He’s been bombarded by the lies all his life. To me, the attribution of no wage growth to government deficits is just such a remark – it has no logical, to me, line of action. Induce people to turn away from collective action and the expansion of democratic power, induce people to betray their own interests – that’s what I hear coming out of your friends mouth.

I suggest you-all google “The Family” & Jeff Sharlot and click on the Amazon page.

Then read some of the reviews of the book.

This will give you an idea of what it says.

It should scare you.

Yok, my friend stopped replying so I have given up on him.

I tried to convince him and he disappeared.

Larry. Thanks for the book recommendation. I will read it.

Steve. Too bad about the friend. I believe I look for truth, justice, good will. I give people and ideas a hear out. If they give me stuff from Rush, Rove, Colter, I address them on their terms. I’ll check out Sharlot.

John Doyle. I’ve read part of “The Experiment” by Robert Gore. I’m not sure why you recommended it to me. I believe everything I’ve stated here to be true. I believe I’m motivated by a search for truth and justice. I don’t consider myself parallel to Gore…. He reminds me of Friedman. I place myself in opposition to Gore and what he’s trying to do. I find in his article many false attributions, associations and statements of history. He’s a myth creator. He’s a propagandist and I consider him a liar. He doesn’t make logical sense to me. He works by conjuring up sentiments, feelings through using images. And he assigns those images to groups. The typical rewrite of the wealthy and the powerful: Once there was a time, when everyone was happy, hopeful, striving, working together, without strife and prosperity abounded. Then along came the thinkers, resenting the most successful of the worldly, practical people they set about undermining the social organization and prosperity that the successful people had engendered. They are the trouble makers.”

All that is a myth. A lie. Of the many things that is, it is an attempt to manipulate people who feel inadequate, self conscious about their intellectual abilities. Through giving them a sense of belonging to a group where they can be a success and where their inadequacies don’t matter. The truth is, that outside of very small numbers of people like those of MMT and a straggler here and there, the vast bulk of the intellectual world serves wealth and power. They support them and they’re well rewarded. MMT people aren’t going to make any money. The wealthy and powerful rightly see them as a threat. They’r blacklisted. Here’s another truth for you, for the other foundation of the bridge to the moon: “WHEN THE TRUTH RUNS AGAINST THE INTERESTS OF THE WEALTHY AND THE POWERFUL, THE WEALTHY AND THE POWERFUL STEP ON THE TRUTH.”

Thanks for the links to some interesting books guys.

………

As I see it persuading the current ruling elites of the merits of MMT, of full employment, of optimally using the fiscal headroom to improve human welfare and of preventing catastrophic climate change is not working as these elites collectively still prioritise greed. It still is a ‘every man for himself’ world for them in the main. There may be some compromises but the trend will probably remain a worsening one overall and neoliberal ideology still dominates. The market is however now delivering somewhat on the transition to renewable energy in many countries for example but only after governmental and international intervention and the science tells us this transition globally remains far too slow and much higher levels of governmental intervention is essential.

Australia is an interesting example as there are now a lot of renewable energy projects underway and especially in the detailed planning stage and this is despite a coal obsessed right wing neoliberal federal government being in power for nearly two terms now that has cut every renewable energy program implemented by the previous Labor federal government. The dumb conservatives foolishly removed Labor’s carbon tax and as a result Australia’s greenhouse gas emissions went from descending to ascending but all was not lost. “According to Bloomberg New Energy Finance, in 2017, Australia was the world’s third highest clean energy investor on a per capita basis – four times the investment per capita of China and five times France.” Sections of industry, the states especially as well as domestic consumers with PV rooftop panels, have been the main drivers including some states with conservative governments like Tasmania that are going to massively invest in pumped hydro, wind power and another transmission link to the mainland.

The first ten years of the 40+ year neoliberal era may have made some sense some of the time, for example by better targeting social welfare through means testing, reducing trade protection for many industries that had low productivity and quality compared to imports and improving the productivity of some state enterprises and administrative bureaucracies. After the first 10 years of the neoliberal era normal politics should have led to the pendulum then swinging back so that any of the excesses or failures of neoliberalism were repaired. In this way a more optimal balance between state intervention and market operations could have been obtained. The problem was and remains that capital learnt (relearnt) how to take control of much of governments and parliaments functions and even how to indoctrinate much of the electorate so that they actively assisted the goals of capital.

The MMT proponents, those seeking progressive change and the international conservationist movements for example have been trying to cast off the neoliberal disaster by engaging with citizens and to my mind they have decisively won all the intellectual arguments and there is no doubt that GOOD IDEAS ARE POWERFUL but it is an uphill fight if your ideological opponents buy printing ink by the barrel, dominate the electronic mass media and buy the democratic process and institutions.

Social media has allowed some gains with reaching and persuading citizens and has been the core of Bernie Sanders Our Revolution movement and many other small social change movements but only recently have a few key figures from these movements attained elected office. For the recent Congressional mid term elections in the US even though the Democrats regained a majority in the House of Representatives, most of the newly elected members were well funded ‘corporate’ Democrats and a strong correlation remains between money spent on electioneering and winning office.

Although progress is slow and patchy my guess is pressure in the pot is building and the ‘corporate’ politicians are losing popularity, and gains will be attained in the coming years in the US, the UK, a bit in Australia which is likely to soon elect a slightly less neoliberal Labor federal government in a few months; and elsewhere. Will this be fast enough to meet the global warming challenge that will not wait? And what about the expected fightback by the worst of capital if electorates decide they want more than a few crumbs?

In regard to the book – ‘The plot to seize the Whitehouse’, I haven’t read it but judging from some of the reviews and details on Wikipedia, I seriously doubt JP Morgan and other right wing bankers and industrialists could have succeeded with a military coup against FDR’s government in 1933. Former Marine General Smedley Butler was supposed to have led 500,000 unhappy war veterans and hangers on in an attack on the centres of government in Washington. Why would these bankers have chosen General Butler when it was clear he was a bit of a lefty well before then and went around on speaking tours against the many wars he and the US were involved in, that mainly protected predatory US business interests in Central America and Asia? Also most of these unhappy war veterans were pissed off with Herbert Hoover for denying them compensation for their service especially WW1 vets and with the challenges of surviving through the Great Depression? The political tide had already turned against Hoover to FDR. Yes the right funded their own veterans organisations but they would not have been able to muster 500,000 supporters let alone 500,000 wanting to topple a progressive government that offered realistic solutions for them. 5,000 maybe or even 50,000? The plotting may well have occurred but the plots themselves probably were ridiculous and doomed to fail, but as I said I only read some of the reviews.

Regarding the right wing evangelists in ‘The Family: The Secret Fundamentalism at the Heart of American Power’ this is more likely to be valid and current. I can understand better now why some have said, ‘don’t worry too much about Trump, its Mike Pence we should be very concerned about’ or similar.

I can’t imagine Butler throwing his lot in with the likes of J. P. Morgan given the writings of Butler. He catalogued the way American corporations profited from wars in a very scathing way.

Actually, My understanding of Sharlot’s book is that The Family is just using religion as a cover. For most members it is all about money and power. Some may be more about religion.

Repealing the New Deal, which needed Neo-liberal economics to become mainstream, was the founding goal.

It was 10 years ago, my take of Sharlot’s book is that The Family is just using religion as a cover. For most members it is all about money and power. Some may be more about religion.

Repealing the New Deal, which needed Neo-liberal economics to become mainstream, was the founding goal.

. . . As I remember they get college age men to confess to evil deeds to keep them in line later. A lot like Scientology does. Anyone who joins them gets help to move up in the power structure over time. There are both Repuds and Dems in the group. They don’t care your Party. Even when the Repuds lose the groups still wins.

Yok,

I put it up because it paralleled what you were saying at the time. It wasn’t a recommendation.