It's Wednesday, and as usual I scout around various issues that I have been thinking…

Japan Finance Minister getting paranoid about MMT

The debates about MMT are expanding. There are weird offerings springing up each day. I read something yesterday about how MMT is really just Marxism in disguise and therefore a plot to overthrow entrepreneurship. Well in a socialist society there will still be a monetary system! Most of the critiques just get to their point quickly – MMT is about wild printing presses undermining the value of the currency! That should summarise 25 years of our work nicely. But there are also other developments on a global scale. A few weeks ago there was a lengthy debate in the Japanese parliament during a House of Representatives Committee hearing considering whether the October sales tax hikes should continue. The Finance Minister, Taro Aso was confronted by Committee members who indicated that it was useless denying that Modern Monetary Theory (MMT) was some abstract theory that was wrong because the Japanese are already “doing it”. The Minister told the hearing that MMT was dangerous and would undermine financial markets if anyone said otherwise. An interesting discussion took place. It highlighted some key features of MMT. It also indicates that progress is being made in the process of education aimed at giving people a better understanding of how the monetary system that we live within operates.

The true agenda

The Reuters Report (May 17, 2019) – Brainard: Modern monetary theory would pose risks in diminishing Fed’s authority – is only three paragraphs long but tells us a lot about the true agenda behind the myth of central bank independence.

The article was reporting on comments made by US Federal Reserve Governor Lael Brainard about Modern Monetary Theory (MMT).

It said that:

The set of ideas known as Modern Monetary Theory could poses risks in shifting authority over the economy from the Federal Reserve to Congress or other institutions more tied to political considerations.

She was quoted as saying:

Putting those responsibilities in an institution that has a lot of oversight but a little bit of independence – there are some virtues to that. And to the extent that moves to a different setting there may be risks.

The risk? That the voice of the people, exercised through their elected representatives might actually determine policy settings and those politicians will have to take responsibility for their actions and not be able to deflect such to unelected and largely unaccountable cabals like central bank committees.

The neoliberal way is to depoliticise economic policy.

That is shorthand for compromising democracy.

The Japanese MMT Laboratory

The Japanese Diet (Parliament) has been debating whether the planned sales tax rise on October 1, 2019 should go ahead or not.

I have written about the Japanese experience with sales tax rises before:

1. Japan is different, right? Wrong! Fiscal policy works (August 15, 2017).

2. Japan returns to 1997 – idiocy rules! (November 18, 2014).

3. Japan’s growth slows under tax hikes but the OECD want more (September 16, 2014).

4. Japan – signs of growth but grey clouds remain (May 21, 2015).

5. Japan thinks it is Greece but cannot remember 1997 (August 13, 2012).

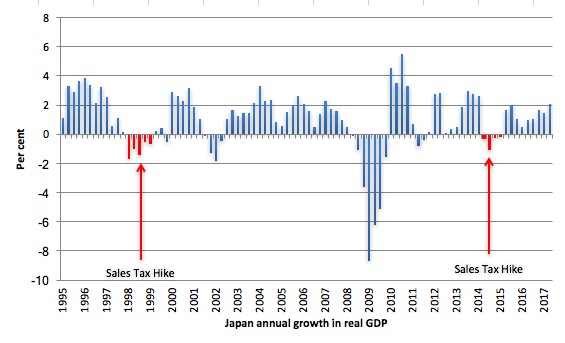

Everytime they hike sales taxes, it ends in misery – spending falls and economic activity comes to a crashing halt.

They saw that in 1997. And again in 2014.

In April 2014, the Abe government raised the sales tax from 5 per cent to 8 per cent.

After the sales tax hike, there was a sharp drop in private consumption spending as a direct result of the policy shift. At the time, I predicted it would get worse unless they changed tack.

It certainly did get worse. Consumers stopped spending and the impact of static consumption expenditure was that business investment then lags.

Here is the history of real GDP growth (annualised) since the March-quarter 1994 to the March-quarter 2015. The red areas denote sales tax driven recessions.

In both episodes, these recessions were followed by a renewed bout of fiscal stimulus (monetary policy was ‘loose’ throughout).

In both episodes, there was a rapid return to sustained growth as a result of the fiscal boost.

Nothing could be clearer.

And the debate is back on the table in the Parliament.

However, this time, the debate has introduced MMT understandings which make it more interesting and bring out some really important aspects of our work.

The debates prompted the Wall Street Journal (May 15, 2019) article – ‘We’re Already Doing It’: Japan Tests Unorthodox Economic Doctrine (behind paywall) – to write:

But in Japan, MMT is at the center of a policy battle with imminent consequences: whether to proceed with an Oct. 1 sales-tax hike designed to trim the deficit.

The government plans to increase the sales tax from 8 to 10 per cent and has wheeled out an array of mainstream macroeconomic arguments about the evils of fiscal deficits to justify the decision.

In his annual – Speech on Fiscal Policy by Minister of Finance Aso at the 198th Session of the National Diet (January 28, 2019) – the Finance Minister said that the Government was making:

… steady efforts to achieve economic revitalization and fiscal consolidation … secure a stable source of funds by raising the consumption tax rate in October this year.

The context of these remarks was the “the declining birthrate and aging population” and the need “to establish a social security system oriented to all generations and secure its sustainability”.

So the usual suspects – government cannot afford to pay pensions as the society ages and thus needs to cut deficits to increase its capacity to fund said pensions.

The Finance Minister (Taro Aso) was quoted in the WSJ article as saying that:

It could loosen our fiscal discipline and be extremely dangerous.

He also claimed that “he didn’t want Japan to turn into a ‘test site’ for foreign economic theories.

Well I am sorry to say that Japan has been a great ‘laboratory’ for demonstrating the underlying principles of MMT for decades now, given that it has been the first nation to really explore what we might think of as the ‘extremes’ of fiscal and monetary policy.

Relatively high and sustained fiscal deficits.

Relatively high gross public debt to GDP ratios.

Zero interest rates.

Negative 10-year Japanese government bond yields.

Low inflation to deflation.

In Chapter 2 of our new MMT textbook – Macroeconomics – (published by Macmillan, March 2019), which is titled “How to Think and Do Macroeconomics”, we have a section “What Should a Macroeconomic Theory be Able to Explain?” and in that discussion we discuss “Japan’s persistent fiscal deficits: the glaring counterfactual case”.

We state:

Consult almost any other macroeconomics textbook and you will find the following propositions stated, in some form or another, as inalienable fact:

1. Persistent fiscal deficits push up short-term interest rates because the alleged need to finance higher deficits increases the demand for scarce savings relative to its supply.

2. These higher interest rates undermine private investment spending (the so-called ‘crowding out’ hypothesis).

3. Persistent fiscal deficits lead to bond markets demanding increasing yields on government debt.

4. The rising public debt-to-GDP ratio associated with the persistent fiscal deficits will eventually lead bond markets to withdraw their lending to the government and the government will run out of money.

5. Persistent fiscal deficits lead to accelerating inflation and potentially hyperinflation, which is highly detrimental to the macroeconomy.

To the ‘we knew it all along’ crew or the ‘MMT is crazy’ crew or derivations, they have to confront the fact that the 5 mainstream propositions are all disproven by the realities that Japan provides.

Japan has run a persistent deficit since 1992. A massive build-up of private indebtedness associated with a real estate boom, accompanied the five years of fiscal surpluses from 1987 to 1991. The boom crashed spectacularly in 1991 and was followed by a period of lower growth and the need for higher deficits. The convention in Japan is that the national government matches its fiscal deficit with the issuance of bonds to the non-government sector, principally the private domestic sector.

Unsurprisingly, given the institutional practice of issuing debt to the private bond markets to match the fiscal deficits, the debt ratio has risen over time as a reflection of the ongoing deficits that the Japanese government has been running to support growth in the economy and maintain relatively low unemployment rates

If the mainstream macroeconomic propositions summarised above correctly captured the way the real world operates, then we should have expected to see rising interest rates, increasing bond yields, and accelerating inflation in Japan, given the persistent fiscal deficits.

Did the persistent fiscal deficits in Japan drive up interest rates and government bond yields? The answer is clearly no!

The overnight interest rate in Japan, which is administered by the central bank, the Bank of Japan has stayed exceedingly low and has not responded adversely to the persistent fiscal deficits.

Long-term (10 year) bond yields (interest rates) on government debt have also stayed very low and not responded adversely to the persistent fiscal deficits. If investors considered the government debt had become increasingly risky to purchase, they would have demanded increasing yields to compensate for that risk. There is no such suggestion – that bond market investors have become wary of Japanese government bonds – to be found here.

The corollary is that the investors have also not signalled any unwillingness to purchase the debt; demand for the bonds remains high and yields remain low.

For example, the most recent 10-year bond auction was on May 3, 2019 (Issue No. 353) carried a nominal coupon rate (yield) of 0.1 per cent. There was 2,200 billion yen on offer and the Ministry of Finance recorded 7,609.5 billion competitive bids for the debt. The yield at the “lowest accepted price” was 0.00.

You can access all data – Auction Results for JGBs.

In terms of inflation, after the property boom crashed and the Japanese government began to run persistent and at times, large, fiscal deficits, the inflation rate has been low and often negative. There is clearly no inflationary bias in the modern Japanese economy, as persistently predicted by the mainstream economic theories.

The conclusion is obvious.

First, despite persistent deficits and a rising public debt-to-GDP ratio, along with a downgrade of Japan’s credit rating by international ratings agencies, including Fitch in April 2015, international bond markets have not ‘punished’ the Japanese government with high ten year interest rates on public debt nor has the central bank lost control of the overnight interest rate.

Second, the persistent deficits have not led to high rates of domestic inflation.

It is clear that the mainstream macroeconomic explanation of the relationships between fiscal deficits, interest rates, bond yields and inflation rates is unable to adequately capture the real world dynamics in Japan.

Such a categorical failure to provide an explanation suggests that the mainstream theory is seriously deficient.

In later chapters of the textbook we provide a detailed MMT explanation of these empirical outcomes.

The point is that the body of work we now call MMT has an impeccable record of capturing the dynamics of the Japanese monetary system and provided sound explanations for the data movements.

So Mr Aso – Japan is already ‘testing’ MMT. Thank you.

The Diet Records

If you go keep tabs on the discussions in the Japanese House of Representatives (the Diet) you will have come across some interesting discussions last month surrounding the sales tax debate.

The 198th National Assembly Finance and Finance Committee 12th met on Wednesday, April 17, 2019. Taro Aso was in attendance as were a host of Finance Ministry officials.

The Transcript of Proceedings – 第198回国会 財務金融委員会 第12号(平成31年4月17日(水曜日)) – makes interesting reading and is where the WSJ report comes from (even though the report was 2 weeks after the hearing.

The Finance Minister was asked by a Committee member:

There has been a lot of debate about MMT in the United States … Those who are proposing it say that Japan is ‘doing’ MMT currently – the Bank of Japan is carrying out a lot of fiscal actions and keeping interest rates low. They say that Japan is a good example of the principles of MMT. Do the Ministers agree with that?”

He replied:

Money, Monetary Theory … MMT for short … this is often spoken about now by politicians, various people …

I don’t think we need to explain the theory here … there are many people in the US – many officials including Larry Summers who are against it … But to do it in Japan … and think about that kind of reaction the market would have … I do not intend to make Japan an experimental site for it.

To which a Committee member responded:

By the way, MMT stands for Modern Monetary Theory, so please do not continue to make a mistake …

But it remains that MMT proponents are saying that the Japanese government and the Bank of Japan have been demonstrating the principles of MMT for many years. Does the Minister think that they are mistaken?

Aso replied:

As I said before … we are not experimenting with Modern Monetary Theory.

Committee question:

But do you think it is a sound theory … please tell us whether you have a positive or negative impression.

Aso wavered.

A Committee member then said:

I think MMT is just an excuse to delay fiscal consolidation and I think it is an outrageous argument. As Finance minister I think you should be more resolute in your rejection. It seems like you are vague about it. If so, I think that confidence in Japanese finances will fluctuate. Do you think that is okay?

Aso:

Japanese public finances are not shaky. Interest rates are not rising in the current situation and our finances are fine in the medium- to long-term. We are reducing bond issuance by more than 10 trillion trillion yen.

We have transmitted to the market our intent to consolidate and there has been no adverse market response – no sudden fall in government bond tenders and no rise in interest rates …

We must continue in this direction which is why we have to increase the consumption tax …

Committee Member:

The point is that the government has controlled the market and has kept interest rates low so that the government could make the debt environment easier and fiscal consolidation has been delayed … This is the essence of MMT and it says that Japan demonstrates best practice.

In other words, MMT proponents say that the Japanese government should postpone fiscal consolidation …

Aso wavered.

Committee Member:

We repeat the same point … as a finance minister, do you think that MMT is correct or do you think it is wrong? Please answer only that point.

Aso:

… I think I cannot follow such a dangerous story.

And so it went.

In the news brief – [PDF] 衆議院財務金融委員会ニュース (April 17, 2019) – which reported on the Committee proceedings it was stressed that it was necessary for the Minister to show a resolute attitude in rejecting MMT so that the market confidence in Japanese government finances was not undermined.

It was also stressed that if people started to follow MMT then the environment for fiscal consolidation would not be favourable.

I found this exchange really interesting. Think about it in relation to Lael Brainard’s fear that if politicians get hold of fiscal policy then they might pursue more “expansive social programs”.

The amazing thing about the Japanese discussion is that MMT provides a superior understanding of the dynamics of their monetary system.

It is not a matter of adopting MMT.

MMT should not been seen as a regime that you ‘apply’ or ‘switch to’ or ‘introduce’.

As I have noted regularly, MMT is rather a lens which allows us to see the true (intrinsic) workings of the fiat monetary system.

It helps us better understand the choices available to a currency-issuing government and the consequences of surrendering that currency-issuing capacity (as in the Eurozone).

It lifts the veil imposed by neoliberal ideology and forces the real questions and political choices out in the open.

An MMT understanding means that statements such as the ‘government cannot provide better services because it will run out of money’ are immediately known to be false.

Such an understanding will change the questions we ask of our politicians and the range of acceptable answers that they will be able to give. In this sense, an MMT understanding enhances the quality of our democracies.

By providing a detailed analysis of the link between fiscal policy and bank reserves, for example, MMT clearly helps us understand why the Japanese interest rates and bond yields have been maintained at very low levels indefinitely even though the fiscal deficits have been relative large for decades.

You do not get that understanding from reading a mainstream macroeconomics text book. Their predictions were completely wrong because their monetary framework, inasmuch as there is one, is deeply flawed – basically articulating a fictional world.

When mainstream economists say there is ‘nothing new’ about MMT or ‘we knew it all along’ they are simply lying and trying to cover their deep ignorance of the operations of the monetary system.

I challenge anyone to produce a mainstream textbook current or past that provides the deep insights about reserve operations, fiscal deficits and can explain the Japanese situation.

So poor Mr Aso – he thinks if he admits all that then the financial markets will go crazy. Yet, the financial markets already know all this stuff. While they may not call the reality they trade in MMT, the fact is that it is.

They haven’t been scared off in the last several decades and will not be if anyone dares to admit the obvious. MMT is all around us. Get used to it.

During the Japanese government discussions it was also highlighted that the Bank of Japan has been buying up an “increasing proportion” of government bonds which means that there is no real need for the bond market auctions anyway … another central MMT proposition.

This prompted a government member to tell Mr Aso that “You’re totally wrong. We’re already doing it”.

Finally, the other feature of the Committee discussions was in that the proponents of MMT in the House of Representatives spanned the ideological range.

There are two groups who are opposed to the sales tax rise and have invoked MMT as a defense:

1. “Ruling party conservatives”.

2. Communist Party members – one MP said that “MMT is gaining popularity in the US and Europe … it was a public backlash against austerity policies and the accumulated dissatisfaction has finally exploded. The same applies to Japan”.

The point is that MMT is agnostic about policy bar its preference for an employment buffer rather than an unemployment buffer to discipline inflation.

In general, it makes no sense to talk about an “MMT-type prescription” or an “MMT solution”.

To make that MMT understanding operational in a policy context, a value system or ideology must be introduced.

MMT is not intrinsically ‘Left-leaning’.

A Right-leaning person would advocate quite different policy prescriptions to a Left-leaning person even though they both shared the understanding of how the monetary system operates.

That is highlighted by these recent debates in the Japanese Parliament where conservative politicians and Communist party members have invoked MMT understandings to argue against sales tax hikes designed to reduce the fiscal deficit.

Conclusion

Progress is being made.

Now MMT is entering parliamentary debates and is the subject of condemnation motions and all the rest of it.

Things are moving along nicely.

And I hope Mr Aso can sleep well once he works out that MMT is all around him and the sky remains well above his head.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

The so called “independence” of a central bank is really strange. In Germany it goes like “the politicians were irresponsable in handling money in the 1920s, so this should be taken away from them forever.” But only a few years later, Germany (and german politicians) startet WW II and the holocaust. If we take this argument further, german politicians should not be allowed to do anything anywhere anymore. So … yes, politicians as representatives should take resposibility for money and must be held responsible for the policy they adopt. May they choose wisely – MMT.

Theory is bad. Practice is OK.

Great post and it is terrific to see the dawning of a more financially aware age.

One thing I would like to say/ask is on the impact of private debt.

In general interest rates move inversely to the stock of private debt. As the stock of private debt has grown larger in absolute terms and in terms of a percentage of GDP, the interest rate on that debt has come down to enable that debt to be serviced.

We appear to be reaching a point in the “western”, “developed” economies whereby the stock of private debt is now so large that interest rates have reached or are close to zero.

The affordability of the stock of private debt is limited by incomes, which are largely stagnant and have been since the 1970s.

It is not just that natgov deficits patently do not lead to higher interest rates but also that the weight of the stock of private debt is also pushing them down in order to keep the debt “performing”.

One aim of neoliberalism is to shut down national government fiscal policy (using its currency creation powers to promote the public purpose) in favour of commercial banks providing the money supply at interest.

Has this neoliberal feature now reached its practical limit? Peak debt and have nowhere left to go?

Are the next logical steps, if one follows the prevailing neoliberal policies, zero interest rates, and credit collapse?

I have a bone to pick, not with Bill’s thinking but with his language.

Bill regularly describes MMT as ‘a lens’. But, he also regularly insists that the JG is ‘intrinsic’ to MMT.

The JG is not a lens, it is a policy prescription. If it is intrinsic to MMT, then MMT is not a lens. The analysis in terms of buffer stocks is ‘a lens’, but the the JG goes beyond that.

My understanding is that what Bill means is that MMT is indeed ‘a lens’, and using that lens opens up a range of policy options (like not issuing bonds to match deficits), but one policy in particular (the JG) emerges so strongly (sustainable inflation control without massive real costs) that it is impossible to claim one is taking the MMT lens seriously without adopting it. I think he more or less says exactly that in this post.

Personally, I would have Bill continue to describe MMT as ‘a lens’, and avoid describing the JG as ‘intrinsic’. Some other form of words – “MMT’s one inescapable policy recommendation?” – would help avoid confusion and make misrepresentation (like Mr Aso’s) more difficult. But Bill is the professional here – I am sure he can do better!

Following up on Michael’s thought…

Imagine placing the decision of whether to go to war in the hands of “independent” central bankers, rather than politicians. Would that ease anyone’s concerns?

Dear Andrew Watson (at 2019/05/21 at 8:34 pm)

I have dealt with this previously on several occasions. It is a technical matter and relates to economic theory.

First, a lens is not necessarily just descriptive. In this case it is a window to achieve a better understanding, which ties together descriptive facts and conjectural reasoning.

Second, part of the innovative conjectural structure of Modern Monetary Theory is how it deals with the so-called ‘missing equation’ of macroeconomic theory – the Phillips curve. That relationship (between inflation and unemployment or some proxy of the state of demand in the economy) is a core component of mainstream macroeconomics going back to the 1950s. It has evolved in specification and structure since the early inclusion in the late 1950s but remains core. It links the real economy (state of activity) with the nominal economy (prices).

The innovation in MMT is to observe, theoretically, that the Phillips curve is just a buffer stock mechanism, where the buffer is unemployment. Then, to consider whether a superior buffer stock is available. In this context, we replaced unemployment with employment and found a new feature absent from the standard Phillips curve – that an employment buffer controls price inflation without unemployment. That is, we eliminate the trade-off in the mainstream macroeconomics framework.

The key is that the Job Guarantee is a conjectural framework which just happens to have a ‘policy’ look about it, in the same way that unemployment in the standard framework might be considered a ‘policy’ variable. But to only see it in that light demeans the structural status of the adjustment function in the macro specification.

So the Job Guarantee is much more than a ‘policy’ setting. It is a framework to replace the Phillips curve and is thus a core theoretical component of MMT which just happens to have a policy manifestation.

best wishes

bill

Bill – the ‘Reclaiming the State’ book ‘purchase’ link (at right) is faulty.

Returns ‘Oops… the page you requested cannot be found.’

Delete this comment as convenient.

Dear Dunkey2830 (at 2019/05/21 at 11:27 pm)

Thanks very much. The publisher changed the page. Fixed now.

best wishes

bill

Hi Bill

[Bill deleted link – Thanks Mark but I really don’t want to support people reading this sort of rubbish]

Another article against MMT without reference to any MMT work, and lots of references to criticisms of it. An interesting read as it covers all the usual suspects, and misrepresentations of MMT, and some new ones on why MMT is wrong.

Regards,

Mark Noonan

In my opinion at least some of these guys who are in power know perfectly well how things work even if they don’t have a consistent scientific theory and will never admit that in the Congress, Diet, Duma or whatever.

There is a very significant development on the political plane. The Americans have started considering accepting the old concept of zones of influence which was missing since 1991. There is an article in “National Interest” written by Ted Galen Carpenter on 12/05/2019 exploring the possibility of exchanging Ukraine for Venezuela and accepting Russian “close neighbourhood” (ближнее зарубежье) concept in exchange for the Russians accepting the Monroe’s doctrine. The article was quoted by RIA Novosti – this is where I have found it. Such a global reconfiguration would bring the world back to the situation created in 1815 which also existed in a different format in the period 1945-1989. This needs to put in the context of the new cold war between the US and China. It is interesting that Russia is not expected to get out of Syria etc. But the rules of their engagement there have been sorted out already between Putin and Netanyahu.

This is extremely important because despite of not admitting that the Americans are also reverting back to military Keynesianism in their ultimate struggle against China. They may not be too far away from accepting the principles of “functional finance”. The only way to stop China overtaking the US is to replicate the elements of Chinese state capitalism model in the US (CIA and military-industrial complex would play the role of the Communist Party). This would actually look like the current Russian model…

MMT may be getting more attention but do you think its the good type of attention Bill? The idea that “doing” MMT will lead to (insert some terrible scenario here) as already gotten old especially since every nation is currently “doing” MMT.

See today’s FT on Japan’s Consumption Tax: https://www.ft.com/content/78998dcc-7a97-11e9-81d2-f785092ab560. Perhaps needs a response.

I was interested to read the RBA Governor, Philip Lowe’s speech yesterday.

https://www.rba.gov.au/speeches/2019/sp-gov-2019-05-21.html

He did float the idea of “additional fiscal support, including through spending on infrastructure.”

It looks like progress, until you see – even to the untrained eye like mine – the naivety of Lowe’s thinking (call me old-fashioned but I’d expect the boss of the central bank to know at least as much about economics as any other dude).

It’s like the Board are just sitting, watching events unfold while wondering, index finger to mouth, on what might be causing it all and what on earth they might do about it. For example, “we have been asking ourselves: what rate of unemployment is achievable in Australia without generating inflation concerns?”

It was also interesting (positive!) that the ABC chose to highlight Lowe’s mention of fiscal stimulus in its PM segment, despite it being a small part of the overall speech.

And then, later in the same PM bulletin, Anthony Albanese says “If you look at my record you’ll see… I believe firmly in nation-building infrastructure as a key driver of economic growth.” Bill, maybe there’s an ally in Albo?

But Bill, just a gentle observation about basic human interactions: If you express contempt towards people (recent examples: Chris Bowen, Ian Verrender) they will never come to you for advice. So it you want a seat at the table, I would suggest not shredding them.

Forgot to mention that I’m looking forward to Bill’s review of Lowe’s speech ~)

Bill. You better watch out that a hostile interviewer pulls you into JG, and you give an answer like you gave Andy…. “conjectural framework, policy look, policy variable.” A complex convoluted explanation won’t win anyone over. You’ll lose people. Beware of pride. A lens helps to see and understand, but does not oblige action – like an early astronomer. A policy means directed action – it is an application of understanding. Be careful of the effect of success on yourself and others. Don’t rush forward. I don’t know all your thinking on it, but I can tell you how it would be attacked: PIE IN THE SKY THINKING, FANTASY LAND, IMPRACTICAL. Don’t let yourself be pinned down at a position difficult to defend.

Dear Bruce Daniel (2019/05/22 at 1:36 pm)

I am not wanting “a seat at the table”. I am an academic not a lobbyist.

best wishes

bill

Dear Yok (at 2019/05/22 at 2:04 pm)

Thanks for your comment.

I have given many answers to the same question – starting with the most simple to the one I gave yesterday. The point gets tiresome.

To really get to the nub of that issue, one has to take the time to delve into the more complex economic literature and history of thought. That is what my reply yesterday was intimating. It is a difficult topic and requires a fairly deep understanding of the significance of the concept of employment buffers to the development of the ideas. At some point if you want to invest in something that is of that ilk, then more effort is required than reading a blog post or a Tweet.

I don’t expect people to invest that deeply. But I tire of people, who do not want to go deep, accusing us of being wrong. You can disagree with our conclusion but at least take the time to work through the complexity before you do.

There was also no “pride” in my answer at all. I am an academic and my professional life is concerned with the development of knowledge that can be applied or not to practical solutions. I protect the knowledge we have generated.

I have also been giving answers to the media on these issues for more than 25 years.

best wishes

bill

Nothing pie in the sky about making sure people who want to work are able to Yok. Nothing impractical about that either. ‘Impractical’ is a good description of current policy of relying on the desperation of unemployed people to moderate wages and control inflation. ‘Moronic’ might be a better way to describe a policy designed to waste people’s time, talents and abilities. Job Guarantee is a great idea and I hope Bill continues to push it forward.

Hi Bill,

What is it about the japanese economy that a mere 2% hike of a sales tax drives it into recession?

Love that quote in the beginning of this wonderful article.

“Oh, we can’t adopt MMT because the authority of our nation will be passed onto elected officials.”

Haha!

So glad I ran into MMT. It’s liberating. I have been studying for a long time, MMT is one of the most liberating subject and experience that I have ever come across. =)

I think it’s inappropriate, and maybe more than a mite presumptuous, for any of us to aspire to “guide” Bill as to how to promote his own and his fellow-scholars’ ideas. Surely, that has to be for them to decide?

It’s not as if Bill hasn’t very patiently (like the excellent teacher he is) explained and defended his standpoint in that regard here. He has repeatedly emphasised that the role of the core-scholars is, in the first instance, development and rigorous exposition of the underlying theoretical framework.

Scholars in some disciplines go no further. In the field of macroeconomics, however, theory divorced from practical application is functionally about as useful as a eunuch in a harem. So theory and its real-world application become inextricably intertwined and reciprocally interacting. I think the analogy of the lens is an apt one but – like any analogy – it oughtn’t to be applied with such inappropriate rigour that it breaks under the strain and ceases to be useful.

I confess I’ve been guilty in the past of offending against the position this comment is propounding. But I’ve mended my ways – or tried to!

This article confirms yet again to my mind that the biggest obstacle to comprehension of what MMT teaches is the belief (whether knowingly adopted to hide-behind, as in the present case, or not) that a choice exists between being for or against MMT’s “introduction” .

Of course that nonsensical proposition is again routinely, as so often before, demolished by Bill in his blog. But plainly it’s immune to that treatment. It seems to me that a breakthrough in eradicating that profound misconception could – if able to be achieved – do more than any other single thing to enable the debate to move onto a different plane where, whatever the disagreements, the opposed parties would at any rate be using the same words to mean more or less the same thing.

At present it’s overwhelmingly a dialogue of the deaf. Outside of blogs like Bill’s and apart from some notable exceptions in politics and the media there is either a willful refusal or an apparently-genuine inability, as the case may be, to take-in the inescapable facts that a) the Bretton Woods fixed-exchange-rate gold-exchange standard effectively came to its end some 48 years ago when Nixon closed the gold window or, b) that MMT provides a simple, clear, and exact description of the operation of the fiat monetary system which – despite all attempts to fool us into believing otherwise – is the one we’ve actually been using ever since.

Of course the great majority of people are never going to be interested enough in the subject to care a damn one way or the other; I was once in that boat myself. But that fact isn’t going to change and wouldn’t have to be critical, if only the decision-takers – poor dears – had managed to catch-up with reality after only such a short time as half-a-century (soon). But they haven’t, and won’t. If they were to, the argument could then start to be about real decisions instead of being more like blind man’s bluff – with the blind men being the ones with the power, God help us.

Just patiently exposing the myth, time after time after time. isn’t going to cut it. Sorry. What we’re up against (apart from massed vested interests but they’re nothing new) is the 48-years-out-of-date, dysfunctional and downright deceptive public accounting conventions which appear to tell a different story. That story serves only to obscure rather than reveal the true picture from the public – even the educated public. How can that seemingly impregnable bastion of obfuscation be stopped from presenting a completely misleading picture to the man or woman in the street? Because until it is – until the sectoral balances plus explanatory commentary are in at least the financial media every quarter or whatever – MMT’s message isn’t going to make much of a dent, if any, in the public consciousness IMHO.

Bill and Jerry. Didn’t say I rejected JG. I believe I like the idea of it. With my understanding, it’s not apparent to me that it is possible and practical, so I don’t embrace it. I’m trying to help Bill protect himself and the others. The greater exposure you get, the curiosity, interest, the more wealth and power will feel the threat and the need to discredit you. Publicly. Crush this nonsense once and for all, so the media and academia can put it behind them. Don’t expect intellectual or moral honesty. They’d love to secretly record all your debates, catch you somewhere with your guard down, and plaster it all over the media. I like Warren’s style: so many of the things he says reveal truth in a blatant way. Watch where you are and where you take a stand. ON a public stage, think like a lawyer and jury, tailor your presentation to the level of the people listening.

Yes Japan are doing MMT with low inflation without any buffer system, unemployment or

JG. That’s what my lens sees.

Better late than never in response to RobertH’ realism about the chances of educating the public or ruling circles about MMT.

Democracy doesn’t necessitate that the public understand MMT and that as a consequence then demand the many beneficial policies that can be derived from that understanding. Voters want outcomes and at some point politicians and political parties will grasp some of the implications of MMT and tailor their promises and policies to suit.

Has not Donald Trump already done this by implementing massive tax cuts for the wealthy, big defence spending increases and some increased spending on infrastructure and then ignoring the fiscal consequences for the federal government. He probably understands that federal deficits don’t actually matter if inflation remains low?

Similarly the more progressive Democrats like Bernie Sanders as well as the Green Party of the US are offering a very ambitious Green New Deal as well as much improved government services across the board and their proposed defence spending cuts and even increased taxes would only cover a fraction of the spending increase which again means they have ceased fussing about the federal deficit. The GND even incorporates a JG and quite frankly necessitates an excellent understanding of macroeconomics to optimise the outcomes which means the MMT proponents will need to be deeply involved. Stephanie Kelton is still involved with drafting Bernie Sanders 2020 campaign policies in many key areas as far as I can tell.

The global warming crisis also necessitates that a GND or something similar be planned and initiated in all the major emission nations or regions by the end of 2021 to have any hope of staying under the 1.5C global warming limit and stabilising at 350ppm atmospheric CO2.

The various power centres that currently rule can use their control of the mass media, their money and influence, their think tanks, their compliant academics, bureaucrats and political class; to politically destroy anyone offering a GND in the minds of a gullible and self centred electorate but many within the ranks of the ruling oligarchy do accept and now fear global warming so may even abandon the fossil fuel sector to its fate. The defence industrial and allied state security power centres and the Israel and Saudi Arabia lobby however won’t like a budget cutting progressive administration so may back Trump or create a more global warming compatible equivalent. The kleptocracy in the FIRE sector will also fight the progressive wing of the Democrats.

We will find out by the end of 2020.