For years, those who want selective access to government spending benefits (like the military-industrial complex…

How social democratic parties erect the plank and then walk it – Part 2

In Part I, I considered an Australian-based attack on MMT from a Labour Party stooge. In this Part, I shift to Britain to address the recent article by a Northern Labour MP – Jonathan Reynolds – who is apparently, if his arrogance is to be believed, making himself the Labour Party spokesperson on matters economic. For the title of his recent article (June 4, 2019) was, afterall – Why Labour doesn’t support Modern Monetary Theory – which begs the question as to who actually doesn’t support MMT – all of Labour? Party? Politicians? Members? Who? I know of hundreds if not thousands of Labour Party members that are fully supportive of Modern Monetary Theory (MMT). So who is he talking about? The overriding issue that I introduced in Part 1 was that it is crazy for progressive politicians to use neoliberal frames, language and concepts when discussing their economic policy ambitions. Not only has the track record of the mainstream approach has been so poor but wallowing in these frames etc leads the so-called progressive side of politics to become trapped in the neoliberal tradition. The Reynolds article is no exception and if his view is widespread within British Labour then it will have a problematic future.

The Labour List apparently claims its purpose is to foster high quality debate

The Labour List, where the article was published, says that its mission is to be:

… the leading place for news, views and debate about the Labour Party … We are supportive of the Labour Party, but independent of it. There will always be debate within Labour and our purpose is to provide a forum for the full range of views rather than to take sides.

Well they appear not to live up to that charter.

A debate means different views have to be aired.

The editor of Labour List has not sought input from any of the core MMT economists to provide “the full range of views” and has denied a sitting Labour MP (Chris Williamson) the right to reply to this absurd piece from Reynolds.

When someone approached the Editor via Twitter with a reasonable request to seek input from one of the core MMT economists, he was met with the response:

I suggest you don’t tell me what to do.

Very collegiate!

And then some sycophant came in behind her vilifying the person who had made the request along the lines of “What makes you think you can dictate the editorial of other publications, just by virtue of being a Labour member?”

One would have thought a publication (Labour List) that was seeking to be “the leading place for news, views and debate about the Labour Party” would welcome diverse input from the Party’s own members.

But I forgot … the politburo doesn’t allow debate!

I note they did publish an article over the weekend just gone as a defense of MMT. The problem is that the author is not one of the core MMT group and thus makes simple errors that distract the readers’ attentions.

What could “Labour doesn’t support Modern Monetary Theory” mean?

When you consider the proposition that Reynolds is entertaining at first principles, you realise how confused he has become. It is the same confusion that formed advisor to the British Shadow Chancellor expressed in his recent Tribune article against MMT.

Think about the title of his article – “Why Labour doesn’t support Modern Monetary Theory”.

If he knew what he was talking about he would thus have to be claiming that the British Labour Party must disagree with the following propositions:

1. The British government has a currency monopoly in the issuance of the British pound.

2. All tax obligations to the British government can only be liquidated using that currency.

3. The non-government sector cannot get that currency (and therefore pay taxes) unless the British government spends that currency into existence.

4. The British government can never run out of that currency.

5. The British government can never become insolvent in any liabilities it has denominated in that currency – unless, of course, for political reasons it deliberately defaulted. There would never be a financial reason for such a default.

6. The British government can purchase anything that is for sale in that currency including all idle labour.

7. The Bank of England sets the interest rate and can control yields in any segment of the yield curve it chooses.

8. The funds to purchase Government bonds come from spending that has been previously made by the Government, which hasn’t yet been taxed away.

9. The bond markets must accept the conditions that the Government sets with respect to the sale of bonds and has no discretion outside of those conditions other than not to participate. In that event, the spending desires of the government are not impeded.

10. All spending, whether government or non-government carries an inflation risk. There is nothing particularly significant about government spending in that regard.

11. There is no diminution in the risk of inflation from government spending as a result of the government choosing to issue accompanying bonds or not. The funds to purchase the bonds were part of the unspent wealth portfolio of the non-government sector and were not being cycled into the spending stream.

12. Governments do not have to issue any debt in order to spend beyond their tax take. As noted this would not reduce the inflation risk from the spending.

13. The idea that by issuing debt, governments push up interest rates and ‘crowd out’ private spending that is interest-sensitive is a denial of how the modern monetary system operates.

First, the idea of a finite pool of saving that the government and non-government compete over is false. Deficit spending increases the pool of saving by stimulating GDP and national income.

Second, private banks do not loan reserves (debt issuance just swaps reserves for bonds). Banks make loans to any credit-worthy customers and in doing so create the necessary deposits. They handle their reserve requirements as part of the payments system separately from this lending process. So there can be no crowding out in any financial sense.

14. Monetary policy is proven to be ineffective in controlling the spending cycle within usual ranges. In fact, increasing interest rates is likely to be inflationary because it pushes up business costs and pumps higher incomes into the hands of the creditors.

I could detail more elements that define the core of MMT but these are sufficient. Note I have said anything about “printing money”.

So if “Labour doesn’t support Modern Monetary Theory” which one of these statements about the real world and its institutions, which apply in Britain as they do elsewhere, does Jonathan Reynolds claim “Labour doesn’t support”?

You see the problem.

Misrepresentation writ large

Reynolds sets the scene with this:

It is widely understood to hold that countries with a sovereign currency (such as our Pound Sterling) can print as much money as they like to meet spending commitments, without any adverse consequences occurring, because the central bank can always print more money.

Understood being the operative word.

No-one who ‘understands’ our work would make that statement.

“Widely understood” is a literary connivance to suggest support when only ignorance would prevails.

Further, that is a statement he has copied from various critics who also have not understood our work.

And it is not that the core body of MMT is so esoteric or complex that it evades comprehension. It is purely because these lazy minds have not bothered to take the time to read the core literature.

That is clear in most of the critiques I have seen.

It is also interesting that even in this poorly constructed opening, Reynolds basically recognises that a currency-issuing government such as in Britain has no financial constraints.

25 years ago, when we started out on this Project the small group of original MMT developers were always confronted with claims that government did face such financial constraints.

At least, the debate has now moved on to things like inflation rather than solvency.

There are a few old guarders who keep pushing the insolvency argument but they are close to the Max Planck funeral status.

It is also not true that anyone with serious understandings of MMT claims that the British Labour Party:

… is in fact committed to austerity because we do not support it … Claiming John McDonnell, Jeremy Corbyn or anyone else in the Labour Party are closet neoliberals is, with respect, absurd.

That is a false allegation.

The problem that has been noted is not that the Labour Party wants to become a party of austerity but that it maintains the neoliberal frames, language and concepts, whether they believe them or not, which will end badly for them in a political sense.

Reynolds claims that:

All of Labour’s plans are underpinned by our fiscal credibility rule, an overarching economic policy drawn up in conjunction with Nobel Prize-winning economists including some who have spent much time attacking neoliberalism.

We considered these issues in our recent Tribune article – For MMT (June 5, 2019).

See also my last blog post on the topic – The British Labour Fiscal Credibility rule – some further final comments (October 23, 2018).

First, the wording in the so-called Fiscal Credibility Rule is neoliberal – constructing government fiscal policy within the ‘household budget analogy’ – “everybody knows that if you’re putting the rent on the credit card month after month, things needs to change.”

No-one who knows anything about the British government’s financial capacities as a currency-issuer would ever talk about a government “credit card”. Households that use the currency have credit cards. Governments issue the currency and never have to seek credit.

Second, the Fiscal Credibility Rule’s intent is neoliberal, in that it constructs fiscal sustainability and best-practice fiscal policy in terms of financial ratios rather than in relation to a broader context focusing on things that matter.

Why is it a responsible strategy to “close the deficit on day-to-day spending at the end of a rolling five-year period, and make sure government debt is lower at the end of any five-year period”?

The rolling bit gives them wiggle room in a recession but the requirement, in the words of the Rule itself “to ensuring that, at the end of every Parliament, Government debt as a proportion of trend GDP is lower than it was at the start” will not be sustainable in a deep recession without austerity.

There is no issue in a growth phase as GDP growth will probably outstrip the growth in debt (numerator rises by less than the denominator).

But the problem will be if Britain entered a deep recession (as it did in 2009).

Yes, the Rule has an opt out:

When the Monetary Policy Committee decides that monetary policy cannot operate (the “zero-lower bound”), the Rule as a whole is suspended so that fiscal policy can support the economy. Only the MPC can make this decision …

But this, in itself, is neoliberal depoliticisation. It gives policy primacy to the unelected, unaccountable Bank of England MPC. Classic neoliberal ploy.

It is only when they decide, that the Rule can be suspended.

And, as I noted in the my blog post – (October 23, 2018) – among others, during the GFC even when interest rates had fallen to 0.25 per cent, the MPC determined that monetary policy was still effective and there was further room for monetary action.

See the Bank’s Press Release (August 4, 2016) – Bank of England cuts Bank Rate to 0.25% and introduces a package of measures designed to provide additional monetary stimulus.

In other words, during the worst crisis to face Britain since the Great Depression, the Fiscal Credibility Rule would not have been suspended, and, as I have shown, the debt ratio would not have been able to be reduced in a single five-year term irrespective of whether one calculated it using actual, trend or any other GDP construct.

I see defenders of the Fiscal Rule continually (to this day) on Twitter claiming that this so-called Opt Out would protect Britain during a recession. They are in denial of the reality that Britain experienced during the GFC. How bad would it have to get before the MPC ceded control to the Treasury? Very bad, if not catastrophic, if history is anything to go by.

Which makes the words of Reynolds “we recognise the importance of suspending these targets in the case of an economic shock that stops monetary policy dealing with the problem” appear rather wan. The Labour Government would not be able to suspend those targets. A pack of MPC technocrats would have the final say and history tells us, as above – they wouldn’t concede to the Treasury.

Third, so while the Labour Party is decidedly not supportive of austerity, its Fiscal Credibility Rule will force austerity on it during a deep recession, unless it abandons it. And then, of course, the wrath will be brought down on it – because they have created the logic that would lead to such criticism.

Why not have a Fiscal Credibility Rule that says the deficit is sufficient when public services are of high quality and everyone who wants to work can find enough hours?

That would be providing a context that matters and shift from the narrow, self-referential financial criteria.

Fourth, why would Reynolds hold out the “(not) Nobel-Prize” in economics as an overarching authority on anything.

The “Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2009” (introduced because economists felt inferior as a result of being left out of Alfred Nobel’s bequest) is a ‘boy’s club’ (only one woman has ever received the award – Elinor Ostrom in 2009) that seeks to ratify the dominant paradigm.

I should add that Ostrom was against government regulation, not an economist, and when she did receive the award many male mainstream economics professors were aghast, with one writing that:

The announcement of her prize caused amazement to several economists, including some prominent colleagues, who had never even heard of her (Source).

Her award caused a lot of “disdain and name-calling on economics blogs”.

Also, think of the types that get this award.

For example, Eugene Fama was given one and he is the guy who thought financial markets on average always delivered efficient outcomes if left unregulated.

Kyldland and Prescott were given one – they are the Real Business Cycle crazies who claim any unemployment is a supply-side phenomenon reflecting how much people want to work. Their theory has zero empirical correspondence with the real world data.

Scholes and Merton were given one – they founded Long-Term Capital Management in 1993 which subsequently collapsed in the late 1990s. Their theories were criticised heavily (the book by Roger Lowenstein published in 2000 is worth reading on this).

I could go on.

Fifth, which actual “Nobel Prize-winning economists” have had input to British Labour Policy. Economists = plural.

As far as I understand from the statements that John McDonnell himself has made, there has only been one such person – Joseph Stiglitz.

And as far as I understand, Stiglitz was mostly consulted about industry policy, although the Committee he joined hardly met and splintered because several panel members objected to Jeremy Corbyn’s leadership.

The Prospect Magazine published an – Interview: Joseph Stiglitz-economics and its discontents (September 15, 2016) – which disclosed some interesting facts about the involvement he had with the short-lived Advisory Council:

The word in the press has been that the council was never convened. Stiglitz qualifies insisting “No, it did meet. But … I didn’t go to that meeting because I couldn’t get there.” Although the whole thing “has now been put on hold,” he did have “a little bit of a sense” of what they discussed at the meeting he missed: “I saw one document they came out with, which I thought was clever … saying that when you reach the zero lower bound of monetary policy … the case for fiscal policy … was strengthened.”

He also said that “I don’t know enough about the workings of the UK political system to know what is the best way of achieving those goals”.

If that was his ‘input’ to the Fiscal Credibility Rule then I doubt I would be advertising it as being the work of “Nobel Prize-winning economists”.

Sounds like spin to me.

Then we get the statement:

Advocates of MMT instead claim governments with sovereign currencies like the UK can simply spend whatever they like …

Lie. No MMT advocates would ever say that.

And:

Aside from the valid concern that printing additional money nearly always leads to higher inflation …

Who talks about “printing additional money” – none of the MMT economists.

What he is trying to assert, albeit clumsily, is that the expansion of bank reserves causes inflation.

Where is the evidence for that?

Why has the ECB failed to hit its inflation target for years and inflation is declining despite massively adding reserves to the system?

Why has Japan been fighting deflation for years?

Why has the US, which engaged in massive asset buildups on the Federal Reserve Bank’s balance sheet not seen accelerating inflation?

And so on.

The next step in his argument is this British exceptionalism that keeps coming out in these discussions.

Apparently, because “many businesses and individuals need access to foreign currencies as part of their essential business activities, not to mention the fact that the UK is dependent on imports for any number of life’s essentials”, there would be “dramatic international consequences in the form of a currency crisis and capital flight” if what?

Well he doesn’t actually say ‘what’ would trigger this, other than to write “over issuance of a currency”! I guess he is talking about the ‘printer gone crazy again’ claim.

But importantly, he doesn’t grasp the fact that every day the British government is spending its currency into existence and the Bank of England is playing its part in that process – busily crediting bank accounts on behalf of the Treasury and managing the liquidity implications arising from the additional reserves.

That is the point I made at the outset – the government is already doing what he thinks will lead to disaster.

That is what MMT is about – allowing us to understand that. It is not some new regime that anyone is moving to.

Which then makes statements like:

Far from allowing a radical domestic programme, MMT would quickly result in the UK facing conditions even worse than the austerity inflicted by the Conservatives and Lib Dems since 2010.

Notice – the inference that MMT is some new regime. Sorry Jonathan, you are embedded in a monetary system that MMT allows you to understand.

Unfortunately, you didn’t go to school long enough (the MMT one) and that has meant you have fallen into this mistaken conception that MMT is some scary new system.

Sorry to disappoint.

But on this exceptionalism argument (“particularly in a country like the UK”) I thought the following graphs might be interesting. I chose four different countries:

1. The UK obviously.

2. Japan – external surpluses, high gross public debt, continuous deficits for nearly three decades, low inflation, zero interest rates, low unemployment, industrial goods exporters with relatively stable terms of trade, and a stable currency.

3. US – external deficits, variable performance and all the rest.

4. Australia – smaller economy with external deficits since the early 1970s, mostly fiscal deficits, low interest rates, commodity exporter facing massive swings in our terms of trade, very high material standard of living etc.

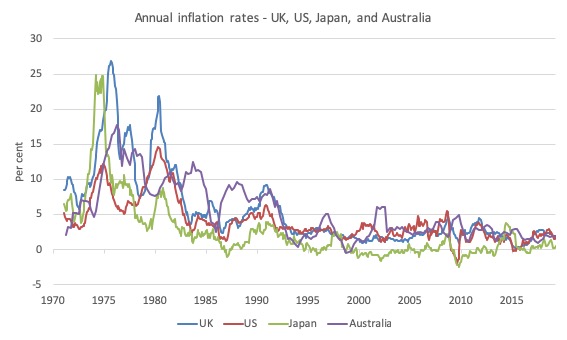

The first graph shows the annual inflation for the four countries from January 1971 to March 2019 (note the Australian data is quarterly and interpolated between months, which doesn’t alter the point).

See anything particularly special about the inflation history of the UK? You will struggle.

All four nations were impacted by the two OPEC oil shocks in the 1970s. There were some other eccentricities in the data (for example, the little Australian spike in early 2000s due to the introduction of the GST).

But overall the inflation history is similar for the nations despite massively different economic structures and export-import performance.

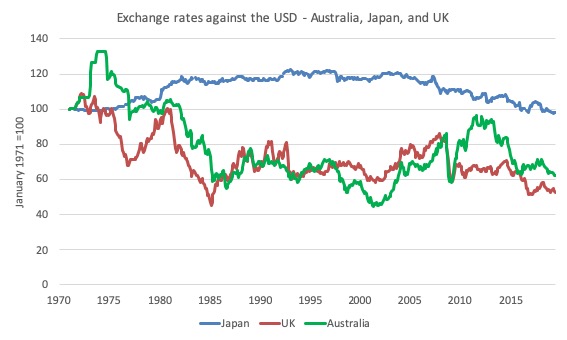

Now, look at the next graph which shows the evolution of the currencies against the US dollar over the same period.

There are notable differences between the nations with Australia experiencing much larger swings in our currency than the other nations and Japan very stable.

For Australia, though, these swings are driven by terms of trade shifts (commodity prices) and have nothing to do with the fiscal position of the government.

Yet the inflation histories are similar.

Reynolds studied politics and history and then law at the University of Manchester. He is obviously oblivious to that University’s part in the perpetuating the Monetarist myths in the 1970s when it hosted the famous ‘Manchester Inflation Project’.

Brian Pullen, who taught Modern History at the University (now retired) wrote in his well-researched book – A History of the University of Manchester 1973-90 (Oxford University Press, 2013) that:

Members of the Economics Faculty debated the causes of inflation and the merits of restricting the money supply and cutting public expenditure, even at the cost of increasing unemployment. Financed for five years by the Social Sciences Research Council, the Manchester Inflation Project followed the lead of two youngish, internationally known professors, David Laidler and Michael Parkin, who had recently migrated from the University of Essex and would leave together for the University of Western Ontario in 1975.

I was a PhD student at the University of Manchester at the tail end of the ‘Inflation project’ and spoke, first-hand, on a daily basis with some of the core Monetarists in Britain at the time.

They persisted in claiming that the central bank was responsible for inflation, despite the early attempts by the Bank of England (under the CCC policy) to control the money supply, following the monetary targetting dictates of Milton Friedman, being a monumental failure.

I discussed that failed experiment in this blog post – The Monetarism Trap snares the second Wilson Labour Government (March 9, 2016).

The Inflation Project failed to find any relationship between “currency issuance” (whatever that means in Reynolds’ head) and the inflation performance.

Reynolds is merely rehearsing the failed logic that his alma mater was at the centre of, a little before his time there.

Further, why did Reynolds omit any mention of the Job Guarantee – which is the MMT price stability framework – in his discussion about inflation? And why didn’t he make it clear that under current proposed policy, a future Labour Government would use unemployment to control inflation rather than an employment buffer stock (as in MMT)?

Reynolds also seems to think that because “quantitative easing was pursued in the UK in response to extraordinary economic conditions” that it would be different if there was continuous growth going on.

There is no explanation given. It is clear that adding reserves to the banking system via an asset swap with the central bank doesn’t cause inflation in bad times nor good times.

The Eurozone has been growing in recent years but the ECB has been adding massively to its bond acquisitions. Same for the Bank of Japan.

Where is the inflation and currency crises? Nowhere!

His assertions are just typical neoliberal scaremongering.

The problem is the ‘boy cried wolf’ once too often – a long-time ago – and the claims have no credibility any more.

And finally, he tries to tar the credibility of MMT by writing that:

… it supporters include members of the Tea Party and Trump supporters in the US.

Good. It means they understand the workings of the monetary system and the capacities of the currency-issuing government within it and so their political statements will be unable to rely on the usual neoliberal lies about ‘how to pay for it’, ‘the government has no money’ and all the rest of it.

It means their ideologies are exposed in the public debate.

If they have an MMT understanding then, for example, they would not be able to say that we cannot pursue a Green New Deal because we would not be able to pay for it.

Or that the Social Security system will go bust financially.

Or any number of lies that conservatives hide behind to justify taking policy actions that they know are unpopular and further the interests of the top-end-of-town at the expense of the rest of us.

So it is a good thing that the Right and the Left develop an MMT understanding. Then the quality of our public debate, and, in turn, our democracies, will be enhanced.

Conclusion

The Reynolds input reflects another progressive politician that is eager to ‘walk the plank that he erects for himself’.

He thinks it is better to keep the public in a state of ignorance about the alternatives, effectively, in the naive belief that the ‘markets’ will be nice to them.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Interesting. There do seem to be peddlers of neoliberal influence within parties, around the world. They take a my way or the highway approach and for some reason plenty of other members end up supporting their distorted perspectives.

What was it Mark Twain said? “Never debate with idiots. They will drag you down to their level and then win due to experience.

The left has been deeply infected with this class of elites that have gone thru all the “best” schooling and stuff and having gone into politics.

Clearly there are two factions within labor in UK and there are two factions within democratic party here in the USA.

I think Reynolds is worse then Meadway. I thought this was appalling. And the behavior of LabourList’s editor is repellent. But what can you expect when Corbyn has surrounded himself with Stalinists? There are three and possibly four of them. Two come from well off families. This is not a million miles from English history of the thirties, forties, and fifties.

I don’t like pushing historical analogies too far, but the English seem to like to embed their circumstances historically. The problem with doing that is that the analogy may be weak. The rise of the Nazis, for example, had a definite class pattern. In the votes in 1932 and 1933, the middle class and lower upper class voted Nazi while the working class voted Communist. Does this show a close parallel with what is going on now? If so, I don’t see it. I see similarities, but that is all.

None of this takes away from the fact of what the belief systems of Corbyn’s advisors seem to be and how unacceptable they are. Anyone who looks up Murray’s history, for example, will, I suggest, not like what they find.

It’s pretty remarkable when you see how abysmal the Tories have managed the economy since Thatcher, that the Labour party would even feel the need to compete against this neoliberal framing. Just tell them their recipes have been tested and failed and it’s time for a new approach.

“3. The non-government sector cannot get that currency (and therefore pay taxes) unless the British government spends that currency into existence.”

Why doesn’t bank created money count for paying taxes?

“5. The British government can never become insolvent in any liabilities it has denominated in that currency – unless, of course, for political reasons it deliberately defaulted. There would never be a financial reason for such a default.”

Can there not arise a situation where a government has accumulated so much debt that the interest and repayments require a significant proportion of government spending to cover? If this is occurring at a time that inflation is problematic then will not the government be constrained in the money it can create?

“What he is trying to assert, albeit clumsily, is that the expansion of bank reserves causes inflation.”

Is that correct? Is he not saying that government expenditure that is financed by reserve expansion adds to inflationary pressure? It is the spending that soaks up real resources.

“Why has the US, which engaged in massive asset buildups on the Federal Reserve Bank’s balance sheet not seen accelerating inflation?”

The build up of reserves has not translated into real spending. It merely resulted in an asset price boom. The people who handed over bonds merely went and brought property and equities, not TV sets and cars.

“But overall the inflation history is similar for the nations despite massively different economic structures and export-import performance………For Australia, though, these swings are driven by terms of trade shifts (commodity prices) and have nothing to do with the fiscal position of the government.”

You may have explained this more fully elsewhere, but prima facie this is bald assertion. The devil is in the detail. A close examination of the charts shows some marked differences.

“The Eurozone has been growing in recent years but the ECB has been adding massively to its bond acquisitions. Same for the Bank of Japan……Where is the inflation and currency crises? Nowhere!”

Some answer as above. The money created i9s not spent on TVs, cars, holidays etc.

I was interested to read, in Dan McCurry’s reply to Jonathan Reynolds’ faulty criticism of MMT (in a LabourList article entitled “Why Labour shouldn’t rule out Modern Monetary Theory”)

that:

“The only person who advocated QE while using taxation to reduce inequality was Milton Friedman in an essay of 1948. He proposed that all money be created by government rather than by high street banks. In other words, nationalisation of the money supply”.

Apparently economics, like politics, makes strange bedfellows.

But is Curry’s understanding of MMT also be flawed? eg he says:

“Simon Wren-Lewis proposed that the state create money but if inflation builds then taxation should be used to reduced the amount of money in circulation. I think this is faulty because it is using a tool at the circulation stage rather than the creation stage, which seems difficult to control and will have a very long lag. The existing tool of interest rates is proven effective at influencing whether people borrow or save, which is the moment that money is created”.

I asked Bill before what can be done to provide a “soft landing” for the Australian people in regards to the current Aust. housing bubble which is starting to burst. He didn’t reply, which is his right.

Yesterday I was youtube surfing and happened onto some videos about that mess.

It seems to me that that bubble is starting to burst. That housing prices also push up housing rents because recent buyers must raise the rent to make their higher mortgage payments, and others can then also raise the rent they are demanding. That given flat real wages and rapidly rising rents the working class will be squeezed.

.

So, what is the solution? I’m no expert, but I’ll make a suggestion.

. . 1] Find a way to freeze (by law) house prices and in fact roll them back by a little (5%?). Nixon had a wage and price freeze the US, can Aust. do something similar?

. . 2] Cause a one time spike in inflation. One way to do this would be for the Aust. Gov. to give every person/resident in the nation a large one time injection of “cash”. Critics of MMT point out that if printing money was so good would it not be good to give every person (say) $1M? . And then point out that all you would get from this is inflation. [This is not true because it would also wipe out a lot of debt, like all current credit card debt would be paid off the next day as people rushed to stop paying 35% interest.]

. . But, maybe that idea can be used in a *carefully calculated* way to cause a spike in inflation. I’m no expert, but maybe a $30K or $50K cash injection given tax free to every resident would cause inflation of just the right amount.

. . 3] Raise the minimum wage and in-fact find a way to raise all wages by some large amount so that people could still buy things at the new higher prices with their wage income when they have spent all of their free cash.

. . 4] Find a way to regulate the banks so that they don’t cause another housing price bubble to form. That is, don’t let them create cash to make loans to buy assets, such loans can only be made with depositors money. That is require that banks transfer dollars from some account in their books into the borrower’s account and not just create dollars.

. . This may require something like the old US Savings & Loan system. And, just prohibit banks from making such loans. But, I’m no expert. However, where there is a will there is a way. At least when it comes to things in “the law” like this.

. . 5] Make current holders of Aust. bonds whole by paying them a larger principal when their bonds come due [equal to the amount of inflation]. This is for foreign bond holders mostly.

.

I know this sounds crazy. Really, really crazy! But what the US Fed. Res. did in the fall of 2008 when it gave or loaned $27T to the international banking system would have sounded “really, rally crazy” in Jan. 2007 if it had been suggested then. As I see it, this idea is QE for the masses to undo the damage that QE for the banks and the rich has already done to the Aust. economy.

Will this program be tried in time? Hell NO! . There isn’t time to calculate the amounts even if the Gov. decided to do it, and the new Gov. would NEVER decide that this is a good idea. Hell, even core MMTers are likely to reject this idea.

.

I’ll hit post now but this idea needs more work and proofreading.

“Why doesn’t bank created money count for paying taxes?”

From the bank customer’s point of view, it does. A customer borrows an amount from the bank, the bank credits the customer’s account, the customer writes checks against this larger amount, even checks to the Treasury.

However, when Treasury sends the check to the bank for payment (as any other vendor would do with a check), the bank must have money transferred from its reserve account at the Central Bank to Treasury’s account. Government spending crediting reserve accounts gave the bank the balance to honor the taxpaying customer’s check.

This is all in the working of the payment system using fiat money. The customers

have their money because the private banks say so. The banks themselves don’t trust each others’ mere word — they only trust the Central Bank’s word on the amounts in the reserve balances when they deal with each other, or with Treasury.

The Central Bank is the final authority — the final will — on the ownership of the fiat money that it administers. There is no higher authority that could force the C.B., and its government, to become insolvent in their own money.

Thanks Steve_American,

The Australian housing bubble is something that I have given a lot of thought to, also.

The creativity of your suggestions highlights the effect that MMT has had on opening our minds and liberating our thinking.

While I don’t know if your suggestions are feasible, we seem to agree that they are not going to happen!

There are simply so many dimensions to the housing bubble that it is not going to be solved by policy alone, as the problem runs deep into human fear and instinct.

As I see it, although MMT has opened our minds, it is only one part (albeit an important one) of the larger world juggernaut.

Seismic shifts are underway: the US is pushing back against China, and China is moving toward its aspiration of world supremacy.

Resource limits, pollution limits, climate change, and wealth inequality are going to necessitate, I think, the end of the centuries long global experiment in capitalism. And of course, those powerfully positioned will not easily be giving up their vested interests.

One can sense the Black Swans paddling nearer. Shocks from unexpected quarters seem almost inevitable.

So, I foresee a world-wide revolution based on a shift in priorities, from economic values to human values. How widely MMT is understood might affect just how messy or orderly that revolution will be.

It’s the cowardice of these alleged progressives and socialists that I find most disgusting. Much of the more considered (or at least longer) criticism focuses on threats to the exchange rate – that the Pound (or whatever) will essentially collapse under a Labour Government employing principles of MMT (James Meadway & Paul Mason have both said as much).

However you look at this it shows a huge lack of conviction on their behalf – they’re either scared of the bond-fairies or (and this is probably worse) so unconvinced of the beneficial effects of of progressive, more equitable, programme of economic policies, that the don’t even consider that the ‘problem’ would more likely be that the value of the pound would rise significantly.

Hi Bill

Just a point of clarification. Chris Williamson is not a sitting Labour Party MP. He has been suspended (ridiculously) on suspected (ie trumped up) antisemitism charges.

He is is still an MP however, and the first to fully embrace MMT.

Dear JonM (at 2019/06/10 at 6:39 pm)

I realise he has been suspended. But I still think of him as a Labour MP – my description was a pointed barb at those who suspended him.

best wishes

bill

@Adrian Kent,

“It’s the cowardice of these alleged progressives and socialists that I find most disgusting”

Yet the funny (tragic) thing is that these right-wing MPs promoting orthodox economics and the hegemony of the markets actually think they’re being brave, tough, and “realistic” by facing down the demands of members and voters for more radical, progressive and traditionally left-wing policies!

Thomas Frank described this venal and bullying attitude, in the US, in his excellent book “Listen, Liberal”, whilst the Blairites (and Callaghan/Healey before them) demonstrate the same fake tough-guy, kick down/ kiss up, tendency in the UK.

It’s shameful, and needs to end if any progress at all is to be made.

Another superb article Bill.

But I don’t understand what

…is referring to. Perhaps too subtle for my sleepy brain this rainy Monday morning.

Neil, your quote from McCurry is not the only mistake he made. His comment about the use of interest rates as a means of inflation control via an indirect form of taxation is faulty. As is his contention that funding a national investment bank will obviate the need for the Treasury to raise money from the bond markets. The Treasury has to do no such thing. The article is a bit of a mixed bag.

Mike, the reference to Planck is that he is considered to have said that science progresses one funeral at a time. More or less. Perhaps it is only in the so-called hard sciences that out of date ideas are buried with their originators/proponents.

Thank you Larry! (I remember the funeral saying, but did not remember that Planck is supposed to have said it. 🙂 ).

@Mike Ellwood,

“…but did not remember that Planck is supposed to have said it. 🙂 ).”

I did pipe up from the audience at the London launch of “Macroeconomics” earlier this year, suggesting Max Planck’s name when Bill quoted this phrase without attribution – but he dismissed me rather peremptorily, insisting it was someone earlier than that…

Glad to see he’s come around! ; )) (See Part 1 of ‘Walking the Plan(c)k’ posts).

Mr S, I remember you saying that. Shame we didn’t meet up later.

Mr S, I have found a number of potential references to Walk the Planck — Nature, the Physics Aviary. Scientific American, and all of them behind a paywall. Could you be more specific?

Orthodoxy has proven itself as thick as a plank.

Allow me to suggest a further, even more fundamental alteration in our terminology when we frame economic issues through an MMT lens. It has already been suggested that we should talk about “investment,” not “spending,” when a currency-sovereign government makes decisions to create money for a public purpose. So why should we be talking about a “deficit” at all, inescapably getting caught up in all of the conditioned negativity associated with “deficit spending?” What meaning does the word “deficit” have when used to describe a positive difference between how much money such a government invests in its economy and how much it removes through taxes or bonds? “Deficit” inherently implies (connotes) a lack, a deficiency, a problem. Why use such a term to describe a situation where public investment (money flowing through the federal faucet into an economy) exceeds, at a particular time, the flow of money being drained out of an economy by offsetting federal actions? Come to think of it, I really like that negative word “drain,” instead of the positive word “surplus,” to describe a situation where the volume of public investment falls below the outflow. I guess what I’m suggesting is that MMT should consider developing an ENTIRELY new economic vocabulary to get its essential points across and avoid falling into the traps of language previously framed to reinforce the neoliberal narrative. We need not defend “deficit spending” at all if we do not recognize the meaning of the phrase but instead offer more accurate, less misleading terminology. How about “positive vs. negative investment” in lieu of budget deficits vs. surpluses? The latter frame automatically puts us back on our heels; the former puts us immediately on offense. Why should we struggle to re-define THEIR terminology, when we could come up with far more clear, far less confusing, economic language of our own?

I think Bill is being overly generous when he writes that the silly critiques of MMT such as the one noted in this blog are due to lack of knowledge. I believe these authors have no interest in knowing any details but are writing their critiques to curry favour with some political faction that uses neoliberal analysis. At this stage it cannot be lack of knowledge or even laziness – 6 years ago perhaps but no longer. Plenty of articles and interviews by core MMTers are available on the web. It takes no more than 1/2 hour to search, locate and read basic MMT analysis.

There are more lengthy critiques for which lack of knowledge or willful misunderstanding do apply but not these simple “MMT says you can print any amount of money you want” kind.

On a related point there are political party types who fear the overt use of MMT analysis and I do have some sympathy for their concern. They are afraid they’ll be called cranks and be dismissed out of hand. In my opinion their concern is overblown. MMT analysis can easily be used as long as some vocabulary is avoided.

Re Steve American and the Australian housing price bubble.

I think analysis of the reasons for the bubble is required. I know nothing of why a bubble has occurred in Australia but in Canada it is due to a mix of excessively easy credit, speculation, foreign buying to acquire real estate in a safe country, and money laundering. This has especially been the case in Vancouver, and to a fair extent in Toronto as well. Prices at the high end have begun to weaken as the Bank of Canada has toughened credit rules and provinces have imposed taxes on non resident buyers and empty buildings and condos. It also seems that money laundering is now coming under scrutiny.

Politically it is a difficult issue as many people, well beyond the speculators (etc), have benefited from high prices, so counter measures have been taken fairly slowly. How effective they are in the long run remains to be seen.

Henry Rech. Your question, “why can’t bank money be used for paying taxes?” shows that you still don’t really understand MMT. It’s why you have all the other questions and exceptions. You don’t understand wealth and power and what is really going on.

The issue of how to deal with the housing bubble is interesting and possibly fundamental.

The housing bubble I think is similar in most countries (well, I’m saying this off the top of my head actually!). In the UK case it started in the 1970’s. If I remember correctly, James Galbraith, in his book, ‘The end of Normal’ wrote that around the mid 70’s banks decided that profit from productive investing was not so great and that land/housing was the next ‘big one.’ So with deregulation they went for broke causing massive wealth transference and sealed in inequality.

With 40 years of bubbling and a culture of housing as a piggy bank it is politically hard to change except now demographics come in as house ownership has been in absolute decline since 2003 (Thatcher’s great house owning nation!!) and under Blair from 1997-2007 there was an almighty bubble with a 370% increase in mortgage lending.

What to do? This is all 100% inexpert , top of my head stuff:

1. Credit controls (in existence before the phases of bubbling started)

2. Some for of LVT

3. Massive social housing which creates a cultural shift from ‘house as piggy bank’ to ‘house as a place where you live.’

4. Bail outs for negative equity (let buy-to-let landlords go to the wall?).

5. Maybe a role for Central Bank to buy up parts of mortgages?

All this stuff has still not been thought through but I sense it is part of a real paradigm shift we desperately need.

@Steve_American

Such a wide ranging and complex intervention seems “brave” shall we say.

Why should not the RBA simply intervene in the mortgage market with view to setting a market range on housing stock and encouraging owner occupier over speculators. The Job Guarantee framework provides an excellent example of how such a programme would operate, call it the Housing Guarantee.

@larry,

“Mr S, I have found a number of potential references to Walk the Planck – Nature, the Physics Aviary. Scientific American, and all of them behind a paywall. Could you be more specific?”

Nothing so esoteric, sorry to disappoint you – simply a lighthearted reference to the to the titles of Bill’s last two blog posts.

The housing bubble in Australia has already burst, guys. High incomes due to the mining construction boom coincided with lax lending practices. Both of these have now ended.

If you had a map of the time property prices fell, you would see that they first started falling in the mining towns and hubs (e.g. Broome WA had a nearly 50% drop in values), and then the cities which hosted a large population that followed the mining construction jobs (Perth, Darwin, and to a lesser extent Brisbane and Adelaide), and now the effects are being felt by Melbourne and Sydney after the royal commission bringing all the poor practices of the banks into the light.

The difference I see between this housing bubble in Australia and, say, the one in the US, was that the bubble was caused by loans to disproportionately large incomes instead of loans being written for people on disproportionately low incomes.

Those involved in the mining construction have been given lifelines by a handful of big infrastructure projects, and they are generally quite employable if work is available, so keeping the construction sector busy is as soft a landing as you’re gonna get.

To add on to my comment – if Australia had fallen into recession at the time of the GFC, the bubble would have burst much, much, sooner. ‘Burst’ is probably the wrong description, really, it has more

‘deflated’ over the years.

@ Mel

According to the loans create credit/money doctrine, the creation of credit/money is totally independent of bank reserves. The credit/money is directly created by the private bank.

The only constraint on lending/credit creation is the availability of creditworthy borrowers.

The central bank does not create the money, and more than that, it cannot control the lending/credit creation process. It can only control the rate of interest.

The role of reserves is to support the interbank payments system.

See pages 154 – 157 of Bill et al’s “Macroeconomics”.

@ henry rech

I think money CAN be created by the reserve (central) bank when directed to do so by government, AS WELL AS private banks when they write loans for credit worthy customers.

Rent controls are the most important tool to deal with housing inflation.

Combined with land value tax and we can see the liquidation of the rentier class.

No worries, Mr S. Very good.

Just rang Reynolds office to arrange a(nother) meeting – I failed to get there last year. It is ostensibly about LVT but we will raise MMT.

Dear Carol Wilcox (at 2019/06/11 at 7:47 pm)

Good work. Ask him which side of history does he wants to be on!

best wishes

bill

@Henry Rech:

That is not correct. Mel’s answer was basically correct; like any answer, more clarification could be added. You aren’t distinguishing between bank money and state money (reserves). This is absolutely fundamental – in MMT and in common sense and usage. It is as crazy as confusing dollars and pounds or lira. Only in bad economics are such things improperly elided.

Don’t ever do this!- This confusion is worse than not being clear on the amount of money or an interest rate! Bank money and state money are not the same. Money issued by Bank A and by Bank B is not the same. The work of banks and central banks is to make these different things “look the same” to most outside observers. But one will have no understanding of MMT and money if one conflates them.

Banks cannot use their own credit/money to pay the state, e.g. for taxes, or as the agents of others’ tax payments as Mel outlined. They have to use reserves, which are state money and only created by the CB. They have reserve requirements – of not going below zero at least. If they happen to on one day, the CB will quasi-automatically give them an overdraft, but extend a discount rate, penalty rate loan to them, just as banks do for customers with overdraft protection. They can’t do this forever (at least not without bribing the authorities). Do this enough, for long enough and the bank is declared insolvent and closed and taken over by the authorities.

A CB or government that allowed bank-created money to be used for final payment of taxes would be giving that bank all of its monetary, financial and economic power. Which is why it never does.

@Larry: “But what can you expect when Corbyn has surrounded himself with Stalinists? ” Did you not read the description of LabourList: “We are supportive of the Labour Party, but independent of it”? Reynolds is on John McDonnell’s Shadow Treasury team – he is not Corbyn’s baby. Your comments are irrelevant here.

Newton Finn wrote:- “I guess what I’m suggesting is that MMT should consider developing an ENTIRELY new economic vocabulary to get its essential points across and avoid falling into the traps of language previously framed to reinforce the neoliberal narrative”.

I couldn’t agree more! In fact I’ve been trying (without any sign of success) to voice the same plea myself.

I guess we just have to keep plugging away! Still I must say I do find it odd that with all the stress placed (rightly) on framing this aspect of framing is never given the attention it (IMO) deserves.

@ Some Guy

I believe you are confused.

The bank created money appears form nowhere – this is the power of private banking. It does not come from reserves. I can raise a loan with a bank and use that money to pay my taxes.

And private bank reserves need not be incremented by operations of the central bank. A private bank can increment its reserves by selling an asset (see p.159 of “Macroeconomics”).

Henry Rech:I believe you are confused.

No, I am not. I don’t know what you are reading, but you are either misinterpreting it, or it is not well written. I don’t have the recent book yet, but I have been thinking about this stuff and answering questions about it to the satisfaction of the MMT thinkers for years now. If you explicitly quoted something, I and the others trying to explain things to you could understand and explain your mistake better.

HR:I can raise a loan with a bank and use that money to pay my taxes.

Yes, YOU can. You aren’t a bank. That fact is what makes bank money “twintopt” (“that which is necessary to pay taxes”) for individuals and firms, makes it equivalent to state money for them. It isn’t twintopt or equivalent to state money for BANKS.

Look at page 35-6 of Wray’s 1998 book, Understanding Modern Money.

HR:And private bank reserves need not be incremented by operations of the central bank. A private bank can increment its reserves by selling an asset (see p.159 of “Macroeconomics”).

I said nothing to the contrary. But a private bank can only increment its reserves by getting reserves from someone else whose reserves initially came from the central bank. The banking system as a whole cannot get reserves from anywhere but the Central Bank. Period.

@Henry Rech

Not confused.

The credit creation process does not depend on reserves; the payment process does depend on reserves.

So if people were content to borrow money without spending it, reserves would never be a concern. But as it is private banks need to maintain enough reserves to support the spending that their borrowers indulge in. The essence of the private bank lending process is the bank agreeing to spend its (reserve) money on the borrower’s behalf, in return for various considerations.

Cameron Murray published an article at http://www.fresheconomicthinking.com , called _The bank competition myth_ that illuminates the relationship between lending, spending, and reserve levels.

@Some Guy

” I don’t know what you are reading”

I referenced specific pages in Bill’s new book “Macroeconomics”.

See my comment s above.

@Mel

“…Cameron Murray published an article …”

I presume you are referring comments like the following from Murray’s article:

“By controlling the second function of banks by making them use a currency controlled by the central bank, it indirectly controls the former function of money creation.”

This seems to be in direct conflict with the following from Bill’s new book:

“The process of extending loans (credit) which creates new bank liabilities, is unrelated to the reserve position of the bank.” (p.155),

“A corollary of the “loans create deposits” insight is that banks do not loan out reserves, which raises the question of what role does bank reserves actually play?” (p. 156)

And,

“Reflecting what happens in the real world, MMT demonstrates that the central bank cannot control the monetary base, because monetary policy is conducted by the central bank setting a target interbank rate and providing the right level of reserves to the banking system so that banks lend to and borrow from each other at the target rate…..Second, a bank is not constrained by its reserve position in deciding whether to make a loan to a particular customer.”

Henry, I meant I did not know what specific passages of that book. As I said, I don’t have it, but I am sure they aren’t saying anything in those passages they haven’t explained many times before.

What Cameron Murray said and Mel and I are saying is NOT in direct conflict, is in no way inconsistent with what Mitchell and Wray have said, what you have quoted. You are seeing contradictions that are not there, based on misinterpretations that we are trying to help you out of.

Those passages I quoted from Wray’s old book should help with what appears to be one of your misapprehensions, which is not distinguishing carefully enough between bank money and state money. There is not the slightest question that banks cannot use bank money for tax payments to the state. I hope that you will understand how and why this is impossible.

HR, quoting the recent book: “The process of extending loans (credit) which creates new bank liabilities, is unrelated to the reserve position of the bank.”

This shouldn’t be taken out of context and misinterpreted. Bill’s sentence does NOT mean that the reserve position of the bank can become ever more NEGATIVE without consequence (say, by extending enormous loans that are never paid back). Any more than a customer at a bank can have ever-increasing, unbounded overdrafts on his account, larger and larger negative balances, without consequences. If he did, to all intents and purposes, he owns the bank. The same for the bank versus the central bank / government.

The ability of a bank to be a bank, to perform the process of extending loans IS related to the reserve position in the above way – the reserve position (or bank capital, against which a discount rate loan of reserves may be counted) cannot be constantly or increasingly NEGATIVE or below the various requirements. Bill is just talking about the day to day process of a normal bank here.

I mean MMT is not supposed to be some crazy magical new theory or new policy. That is what many of its critics paint it as. This type of stuff is supposed to be talking about what happens in the real world, and the sentences in MMT books should be interpreted that way. So if one thinks a sentence means things like banks have magical powers to create money to pay bills to other banks, to the state with no consequence at all, ever, to the end of time, then you are misinterpreting it.

Warren Mosler used to own a bank. If his bank could have done that, I think he might have used a few trillion of his magic money to buy up a large portion of the stocks on the NY Stock Exchange for instance. Why not?

On the other hand, the US government, the Treasury, the Fed did very similar things at the time of the Global Financial Crisis. Because they could & Mosler who unfortunately wasn’t in power in government or in possession of a magic bank, could not.

@Some Guy

“There is not the slightest question that banks cannot use bank money for tax payments to the state. I hope that you will understand how and why this is impossible.”

Sorry, I don’t and I see it as entirely possible if not regular.

And it’s not necessary to respond as we have now already circled the same tree a couple of times.

Thanks.

Henry Rech: Well, I’ll respond anyways.

You are welcome to have your own theory; but you shouldn’t call your own theory MMT or say that MMT books etc hold this theory when they don’t. I quoted one explicitly and directly contradicting this belief. You haven’t quoted anything that explicitly and directly supports your belief; your argument is based on a strained and stretched misinterpretation of a different and not really relevant statement.

All MMT (and many other non-MMT) sources, Mitchell, Wray & Watt’s recent textbook says what I & everyone else here is saying:

In a modern bank/ central bank system, USA, UK, Australia, etc banks can’t make final payments, tax payments to the state with bank-created money.

I’ve been following the discussion between Henry and Some Guy and Mel here. Mostly I agree with Mel and Some Guy’s side of it. But it seems to me that the government, as the entity ‘owed’ the tax debt, is pretty much in the position of deciding what it will accept as settlement of the debt, as in it may decide to accept ‘bank money’ if for some reason it wanted to. I mean MMT might say it is stupid for the government to do that (and I would agree)- but governments do stupid things all the time.

So I think it might be better to stick with something like ‘as a general rule, the currency issuing government is only going to accept its own currency as payment of taxes’ without ruling out the possibility that a government decides to settle for something else. MMT is not in a position to tell the IRS what they can accept as payment let alone telling Congress what it must do. There is theory, there is description of best practice, and then there is the often muddled actual state of affairs.

@Some Guy

“You haven’t quoted anything that explicitly and directly supports your belief;..”

So you say.

I think we will have to agree to disagree.

Jerry,

To mind you have said some odd things in your comment above.

How can a government tell if the cheque I’ve sent is private bank created money or central bank created money?

Please explain.

What I will agree to say is that every dollar of private bank credit ends up being “backed up” by an increase in central bank reserves once the loan monies are spent.

However, it is the private bank that raises the loan and creates the money (as all the references from Bill’s book that I have provided say). I can take that money and pay my taxes and I have no doubt that it will be accepted by the Tax Office, every time.

“Warren Mosler used to own a bank. If his bank could have done that, I think he might have used a few trillion of his magic money to buy up a large portion of the stocks on the NY Stock Exchange for instance. Why not?”

All the money Warren Mosler’s bank lent into existence created a liability on it’s balance sheet. Usually, that liability was a deposit repayable in US dollars (the ones spent into existence by the FED) at short notice.

Warren Mosler’s bank, therefore, had a solvency risk to manage, which imposed limits on it’s capacity to create money. Private banks have to repay their debts as and when they fall due or they are insolvent.

The FED/TREASURY do not confront a similar problem.

@ Jerry Brown

It’s as clear as daylight that you’re wasting your time trying to engage with Henry Rech (in an effort to “bridge the gap”, so to speak). The opinions he’s formed with respect to the validity or otherwise of MMT’s analysis are obviously set in concrete and nothing is ever going to dislodge them. He will always interpret/misrepresent anything to the contrary in such a way as to force it into compliance with them and then take his stand on that unaltered, immutable, position (as he does in this instance). IMO life’s too short to be bothering with futilely exchanging debating-points.

It appears he has bought the book (intended as a teaching medium) not in order to learn anything from it – which he was never going to – but for the sole purpose of refuting its argument to his own personal satisfaction. Seems a bit perverse to me but there’s no accounting for personal foibles, and anyway it’s his money to waste if he wants to. Every copy sold is grist to MMT’s mill after all!

“Treasury Tax and Loan Service, or TT&L, is a service offered by the Federal Reserve Banks of the United States that keeps tax receipts in the banking sector by depositing them into select banks that meet certain criteria.

TT&L accounts are Treasury accounts created at commercial banks to accept electronic tax payments and to disburse Treasury funds. This is an alternative to the direct deposit of tax payments into Treasury accounts with Federal Reserve banks.” (This quote from Wikipedia)

That TT&L accounts exist means that Henry is at least partially correct- at least sometimes the government will consider your personal tax liability to have been settled by your payment in bank created deposits. But what that actually means is that the Treasury has agreed to a transfer of your personal tax obligation (owed in the form of US Dollars) in exchange for an obligation from the bank- also owed in the form of US Dollars. That the Treasury might be willing to hold a deposit in an account at the bank for some period of time is just an option that the Treasury might choose to exercise if and when it wants to. If it does, then the debt has only been transferred from the individual to the bank and remains payable in the form of US Dollars. When the Treasury decides to close that account, that debt is only payable in US Dollars. That is how the government can tell when the payment is government created money.

And the US government is the only creator of US Dollars.

So Henry, I really don’t think you have much of an argument here. You are mostly making distinctions of no difference.

RobertH, I enjoy arguing with Henry. Usually. I wouldn’t say that he is not interested in learning- I would say he is often just rather skeptical. Which isn’t necessarily a bad thing at all. And he often brings up good points and presents them in a way that can be challenging to counter. Which is great as far as I am concerned.

Henry Rech:How can a government tell if the cheque I’ve sent is private bank created money or central bank created money?

Please explain. (Directed to Jerry, but I’ll answer)

Very easily. The same way you do in everyday life. This is like asking how do you tell whether a printed dollar bill is an Australian or an American dollar. You just look at it. If the cheque says “X Bank”, then it is X-Bank created money. If it is a government check, a central bank note or coin, it is central bank/state-created money. There is never any doubt or difficulty.

Henry Rech:However, it is the private bank that raises the loan and creates the money (as all the references from Bill’s book that I have provided say). I can take that money and pay my taxes and I have no doubt that it will be accepted by the Tax Office, every time.

Nobody disagrees with this. We have all been saying this. YOU can. The BANK can’t.

Once you send in your taxes, with a bank cheque, YOU are done. The BANK isn’t. Paying taxes with bank money is a multi-stage process. Ordinary people and firms see the first stage. Banks and central banks do the second stage behind the scenes.

@Some Guy

“There is never any doubt or difficulty.”

OK. So if I send in my bank cheque to the Tax Office will the Tax Office reject the payment?

I presume you pay taxes. How did you pay for your taxes?

“Paying taxes with bank money is a multi-stage process. ”

Yes, I agree. But it starts with private bank created money.

The reserve system is merely a system of squaring up claims.

@robertH

“Seems a bit perverse to me but there’s no accounting for personal foibles, and anyway it’s his money to waste if he wants to. ”

I don’t think I’ve wasted my money at all. While I haven’t read the text from cover to cover, it appears to me to be not so much a text about MMT – some of the MMT related exposition is a bit thin, a little disappointing – however, it is a very good intermediate macroeconomic theory text.

@Jerry

“You are mostly making distinctions of no difference.”

I don’t think so.

MMT says taxes can only be paid for with CB created money.

This is patently not correct.

Do you pay taxes Jerry? How do you pay for your taxes?

@Jerry

“MMT says taxes can only be paid for with CB created money.”

Sorry, I’ll rephrase that – MMT says taxes can only be paid for by money spent into an economy by government.

robertH

” IMO life’s too short to be bothering with futilely exchanging debating-points.”

It’s called the contest of ideas. Polemics will only get you so far, if not be eventually unhelpful to your cause.

Yes I pay taxes to the US Government. Usually, now that I am ‘self-employed’, with checks drawn on my bank account. But also in many other ways Henry.

For years when I was an employee, most of the tax was taken out of my paycheck before I received my pay. Using your sense of distinctions of no difference, since I never actually was the person remitting the tax payment- therefore I didn’t pay the tax. Heck, many years the Treasury would even send me a check in April that they called a ‘refund’- so using your logic not only did I never pay any tax, I must have been costing the Treasury extra. Similarly, when I bought a bottle of whiskey or a gallon of gasoline I never sent any payment to any Federal agency so I must not have paid any federal tax on those purchases.

But one year I badly underestimated my tax liability and had to send the Treasury a check drawn on a ‘home equity line of credit’ loan. You are correct that the government accepted that check as payment of my tax. But what do you think the government did with that check when they received it? I doubt they put it in a picture frame and hung it on the wall at the IRS building. I bet they did what MMT says they do- had the Fed Bank transfer reserves from the commercial bank to the Treasury account at the Fed. And considering that the Federal Reserve System is a creation and part of the US Federal Government, reserves at the Fed Bank can, ultimately, only come from prior government spending or lending or money creation. They are not created by commercial bank loan creation.

Jerry,

“Yes I pay taxes…….with checks drawn on my bank account.”

And where did the money in your cheque account come from? Presumably from income earned in your work effort or investments perhaps or perhaps you borrowed it. And where did that money come from if it wasn’t borrowed? Was it from money spent into the economy by the government or from someone borrowing money in the private banking system and creating a stream of spending of some sort? How can you tell where your money ultimately came from? You might be able to track back if you’re keen enough. However, when you send your cheque in to the tax office does the tax office launch an investigation into how the money originated before it decides to accept the cheque in payment for taxes? I don’t think so. It doesn’t care where the money came from.

So to say that taxes must be paid with by money spent into the economy by government is patent bulldust.

“….reserves at the Fed Bank can, ultimately, only come from prior government spending or lending or money creation. ”

So what? Reserves aren’t necessary for money creation. They are the means by which inter party claims are settled – that’s all. Refer in my previous comments above to references in Bill’s book. They contradict most of what you said.

“some of the MMT related exposition is a bit thin, a little disappointing”

I think I was unfair in this characterization of Bill’s book. The MMT perspective is woven into the text all over the place. I guess I was expecting chapter headings like “MMT and Fiscal Policy …” or “MMT and Monetary Policy” etc..

Dear Henry Rech (at 2019/06/16 at 5:37)

The book is called “Macroeconomics” for a reason and MMT represents the core of the exposition. We are past the stage where we feel the need to delineate that in the general narrative.

best wishes

bill

Me: Paying taxes with bank money is a multi-stage process.

Henry Rech:”Yes, I agree. But it starts with private bank created money.”

Yes, of course paying taxes with private bank created money starts with private bank created money. But that is not the only way to pay taxes. You can pay taxes with state money, not involving any bank money. The universal rule is that the only way to finally pay taxes, for the transaction between the government and the private sector to be ended – involves somebody, somebody assessed a tax or his agent, paying the tax with state money, reserves, not bank money.

Henry Rech: The reserve system is merely a system of squaring up claims.

It is a very good rule, that you are honoring here – that when anyone says “merely” – that “merely’ points to the most important thing, the heart of the matter, the crucial point.

Of course the reserve system is a system of squaring up claims. So is the private bank money system. That is all that money is in any money system, always and everywhere – it is all about keeping track of, reconciling, canceling claims (“obligations”, “credits” , “debts”, “liabilities” ). “Money is credit and nothing but credit”

But if you agree that it is a multi-stage process as we described in the usual case of sending in a bank check, then you seem to be agreeing now with the statement that banks can only pay taxes with reserves, not bank money.

Some Guy,

You say:

“Yes, of course paying taxes with private bank created money starts with private bank created money.”

So you agree the taxes are paid with private bank created money.

Yes, taxes can be paid by government created money.

But who’s to say what type of money is being used when you write a cheque from your account in favour of the tax office, unless of course you have specifically raised a private bank loan to pay your taxes.

The settlement and clearing system does NOT create the money. The money has already been created either by the government spending new money into the economy or by private banks creating credit.

The settlement system need not be one at the back of which is a central bank. There could well be a settlement and clearing system privately run (such as there is for share transactions, for instance). In modern economies, it happens to be a clearing system based on central bank reserves.

The clearing system does NOT create the money.

I get you don’t accept this.

I don’t accept your proposition that it does and it seems to me that Bill et al’s new book agrees with me, as far as I can see. I have not decontextualized the statement’s made in the book and referred to by me in my previous comments. Read them for yourself.

I guess we will have to agree to disagree.

Henry Rech: The clearing system does NOT create the money.

I get you don’t accept this.

Huh? Who said that? I never did. Of course the clearing system doesn’t create money. It is not “my proposition” that it does.

The reserve system clears and records claims (obligations, credits, debts etc). The Central Bank (and/or the state) can and does create reserves/state money that is accounted for, recorded in the reserve system when it pays interest on reserves, when it buys a financial asset from a private asset holder, etc. You’ve said such things yourself above.

Henry Rech: But who’s to say what type of money is being used when you write a cheque from your account in favour of the tax office.

An easy question. There is no doubt or complexity here. What’s puzzling is why you ask “who’s to say”, why you think there is some imponderable puzzle here.

(1) First, Because the cheque is on your bank account, your bank money, the money in your bank account is used.

(2) And then because that makes the bank owe the tax office, the bank’s state money = the bank’s reserves are used to settle the bank’s debt.

That’s the end. BOTH bank money and state money is used when you write a check for your taxes from a bank. Always. That bank money was created by that bank. The state money was created by the state. Period.

I have found some of your most recent comments incomprehensible. Whether we agree or disagree is now obscure. You seem to be disagreeing with yourself.

What exactly do you believe to be true? What and how are you arguing? Do you think MMT is wrong or right?

Are you trying to say what is in Bill’s recent book agrees with your statements, but that Bill & MMT is wrong? (Of course I disagree: IMHO Bill’s book agrees with other MMT books, it doesn’t agree with your statements (as anyone else here understands them), and MMT is true.)

In these comments you say and imply that I and others believe things we don’t believe and never said. (Or if your statements are interpreted differently, you are saying things we all believe, but claiming there is some difference.)

Some Guy,

As far as I can see you have said nothing new so I have no further comments.

Thanks for discussing these things.

Some Guy,

” ….the bank’s state money = the bank’s reserves are used to settle the bank’s debt……….BOTH bank money and state money is used when you write a check for your taxes from a bank. Always. That bank money was created by that bank. The state money was created by the state. Period.”

I understand that the Canadian payments system is conducted within the private banking system – there are no central bank reserves.

How does that fit into the scheme of things?

Here’s the abstract of a paper describing the system (I haven’t read the paper yet):

https://www.tandfonline.com/doi/abs/10.1080/09538259.2019.1616922

Henry,

“Payments Canada (formerly the CPA, Canadian Payments Association)[1] is an organization that operates a payment clearing and settlement system in Canada. The Canadian Payments Association was established by the Canadian Payments Act in 1980. Among other responsibilities, it regulates and maintains directories of bank routing numbers in Canada.[2]” ( Quoted from Wikipedia)

So apparently the association might be described as a partially private sector clearinghouse for the Canadian banking system. ( It was established by an act of the Canadian government though and is overseen by the Canadian Finance Minister so how ‘private’ can it actually be.)

https://www.bankofcanada.ca/core-functions/financial-system/canadas-major-payments-systems/ tells us some of the procedures and rules that institutions using this system must follow. And tells us that at the end of the day final settlement takes place on the books of the Canadian central bank, the Bank of Canada, where all participants must maintain accounts. And presumably, reserves of the Canadian Dollar in order to settle them.

So Henry, regardless of the complications of the quasi private clearinghouse, final settlement occurs at the Bank of Canada in Canadian government money- not private bank created money. So while complicated, it fits rather nicely into the ‘scheme of things’ that Some Guy has been trying to explain. Final settlement takes place in the government money when taxes are paid or when banks settle up between themselves.

Jerry,