Today (April 18, 2024), the Australian Bureau of Statistics released the latest - Labour Force,…

Australian labour market remains in a weak state

The Australian Bureau of Statistics released the latest data today – Labour Force, Australia, June 2019 – which reveals a stagnating labour market with only 500 net jobs created in the month. The only bright spot was that there were 21,100 full-time jobs created (net). But total employment lagged behind the growth in the working age population, which meant that unemployment rose by 6,600 to 711,500 persons with participation unchanged. Working hours fell for the third consecutive month. Underemployment fell slightly (0.4 points) to 8.2 per cent further, largely reflecting the shift away from part-time work in a weak overall situation. The total labour underutilisation rate (unemployment plus underemployment) fell as a consequence to 13.4 per cent but its persistence around these elevated levels of wastage makes a mockery of claims by commentators that Australia is close to full employment. My overall assessment is the current situation can best be characterised as remaining in a fairly weak state. Most of the dynamics over the last few months have been due to swings up and down in part-time employment.

The summary ABS Labour Force (seasonally adjusted) estimates for June 2019 are:

- Employment increased 500 (0.004 per cent) – full-time employment increased 21,100 and part-time employment decreased 20,600.

- Unemployment increased 6,600 to 711,500 persons.

- The official unemployment rate remained steady at 5.2 per cent.

- The participation rate remained steady at 66 per cent.

- Aggregate monthly hours worked decreased 0.1 million hours (-0.01 per cent).

- Underemployment fell by 0.4 points to 8.2 per cent (1,112.3 thousand) and the total labour underutilisation rate (unemployment plus underemployment) declined by 0.3 points to 13.4 per cent. There were a total of 1,823.8 thousand workers either unemployed or underemployed.

Employment flat in June 2019

Employment growth fell away in June 2019 with only 500 net jobs added.

Full-time employment increased 21,100 and part-time employment decreased 20,600.

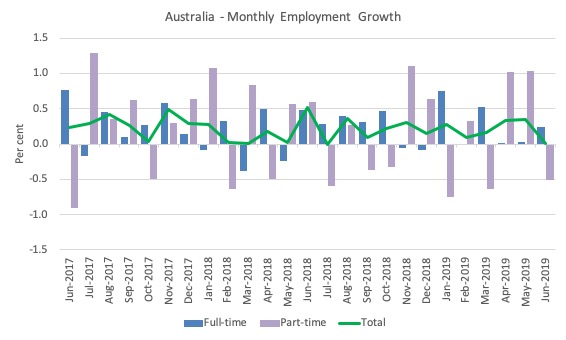

The following graph shows the month by month growth in full-time (blue columns), part-time (grey columns) and total employment (green line) for the 24 months to June 2019 using seasonally adjusted data.

The zig-zag pattern where employment growth has regularly been around zero remains evident.

All the dynamics in the last few months have been marked by swings in part-time employment.

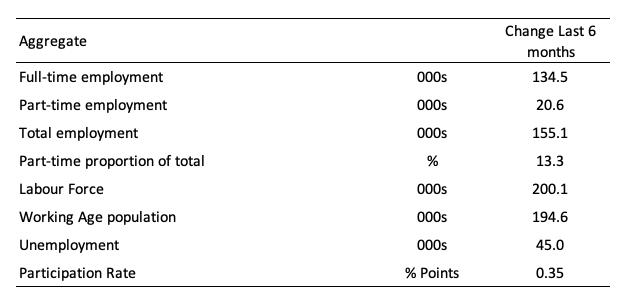

The following table provides an accounting summary of the labour market performance over the last six months. As the monthly data is highly variable, this Table provides a longer view which allows for a better assessment of the trends.

Assessment:

1. Total employment has lagged behind population growth which has resulted in the rise in unemployment.

2. Participation has been rising over the period further pushing unemployment up.

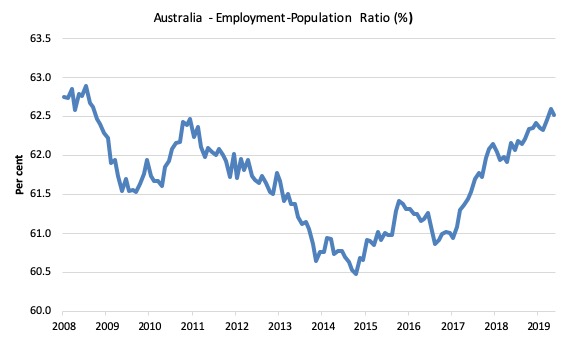

Given the variation in the labour force estimates, it is sometimes useful to examine the Employment-to-Population ratio (%) because the underlying population estimates (denominator) are less cyclical and subject to variation than the labour force estimates. This is an alternative measure of the robustness of activity to the unemployment rate, which is sensitive to those labour force swings.

The following graph shows the Employment-to-Population ratio, since February 2008 (the low-point unemployment rate of the last cycle).

It dived with the onset of the GFC, recovered under the boost provided by the fiscal stimulus packages but then went backwards again as the Federal government imposed fiscal austerity in a hare-brained attempt at achieving a fiscal surplus in 2012.

The ratio fell by 0.1 points in June 2019 to 62.5 per cent and remains below pre-GFC peak in April 2008 of 62.9 per cent.

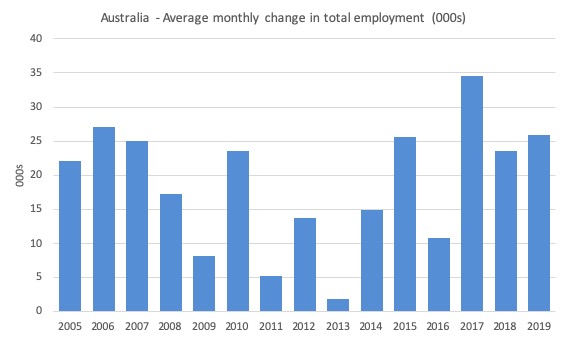

To put the current monthly performance into perspective, the following graph shows the average monthly employment change for the calendar years from 2005 to 2019 (the current year having only 4 observations in the average so far – so caution in interpretation is necessary).

It is clear that after some lean years, 2017 was a much stronger year if total employment is the indicator.

It is also clear that the labour market weakened considerably over 2018.

So far 2019, has been only slightly stronger than 2018.

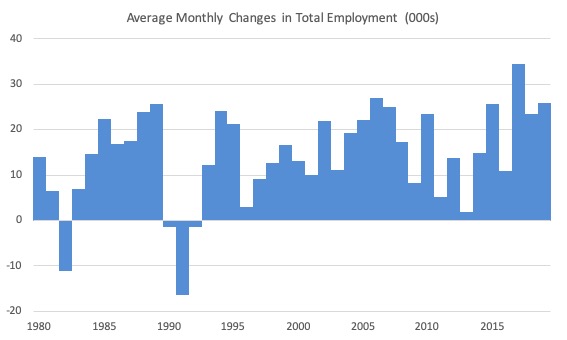

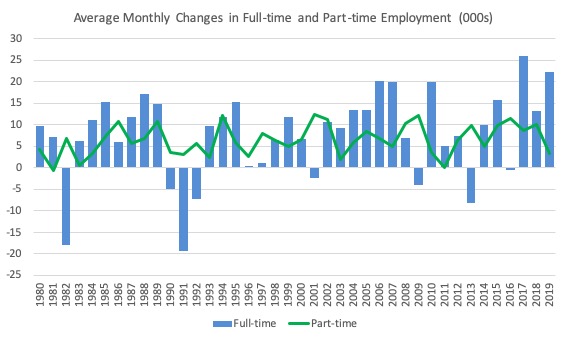

To provide a longer perspective, the following graphs shows the average monthly changes in Total employment (upper panel), and Full-time and Part-time employment (lower panel) in thousands since 1980.

The interesting result is that during recessions or slow-downs, it is full-time employment that takes the bulk of the adjustment. Even when full-time employment growth is negative, part-time employment usually continues to grow.

Unemployment increased 6,600 to 711,500 persons

The official unemployment rate rose from 5.192 per cent to 5.238 per cent – a nudge up.

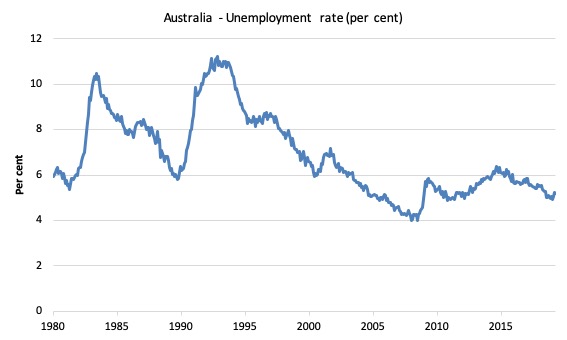

The following graph shows the national unemployment rate from January 1980 to June 2019. The longer time-series helps frame some perspective to what is happening at present.

Assessment:

1. It is still 0.3 points above the level it fell to as a result of the fiscal stimulus (which was withdrawn too early) and 1.3 point above the level reached before the GFC began.

2. There is clearly still considerable slack in the labour market that could be absorbed with fiscal stimulus.

Broad labour underutilisation remained down 0.3 points to 13.4 per cent

The results based on the Monthly data for June 2019 are (seasonally adjusted):

1. Underemployment decreased by 0.4 points to 8.2 per cent (1,112.3 thousand).

2. The total labour underutilisation rate (unemployment plus underemployment) fell 0.3 points to 13.4 per cent.

3. There were a total of 1,823.8 thousand workers either unemployed or underemployed.

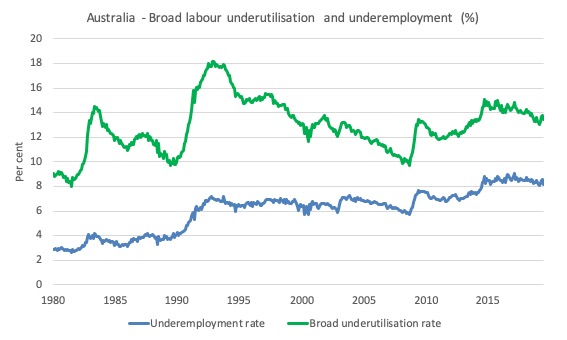

The following graph plots the seasonally-adjusted underemployment rate in Australia from January 1980 to the June 2019 (blue line) and the broad underutilisation rate over the same period (green line).

The difference between the two lines is the unemployment rate.

The three cyclical peaks correspond to the 1982, 1991 recessions and the more recent downturn.

The other difference between now and the two earlier cycles is that the recovery triggered by the fiscal stimulus in 2008-09 did not persist and as soon as the ‘fiscal surplus’ fetish kicked in in 2012, things went backwards very quickly.

The two earlier peaks were sharp but steadily declined. The last peak fell away on the back of the stimulus but turned again when the stimulus was withdrawn.

If hidden unemployment (given the depressed participation rate) is added to the broad ABS figure the best-case (conservative) scenario would see a underutilisation rate well above 14.5 per cent at present. Please read my blog post – Australian labour underutilisation rate is at least 13.4 per cent – for more discussion on this point.

Teenage labour market deteriorates further in June 2019

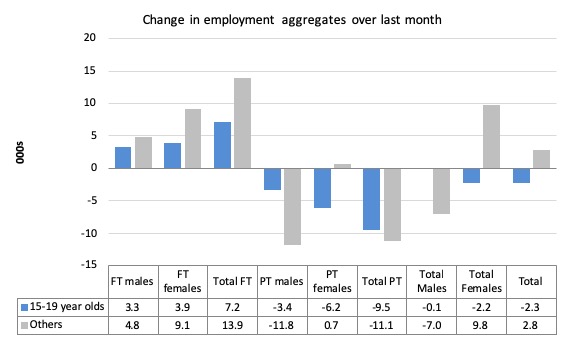

Total teenage net employment fell 2.3 thousand in June 2019 although this was confined to part-time work, which fell by 9.5 thousand.

Full-time teenage employment rose by 7.2 thousand – so some consolation.

The following graph shows the distribution of net employment creation in the last month by full-time/part-time status and age/gender category (15-19 year olds and the rest)

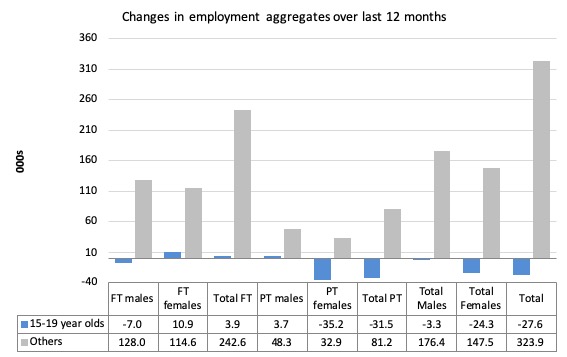

Over the last 12 months, teenagers have lost 27.6 thousand (net) jobs overall while the rest of the labour force have gained 323.9 thousand net jobs.

The following graph shows the change in aggregates over the last 12 months.

In terms of the current cycle, which began after the last low-point unemployment rate month (February 2008), the following results are relevant:

1. Since February 2008, there have been 2,220.7 thousand (net) jobs added to the Australian economy but teenagers have lost 68.2 thousand over the same period.

2. Since February 2008, teenagers have lost 97 thousand full-time jobs (net).

3. Even in the traditionally, concentrated teenage segment – part-time employment, teenagers have gained only 28.8 thousand jobs (net) even though 1068.9 thousand part-time jobs have been added overall.

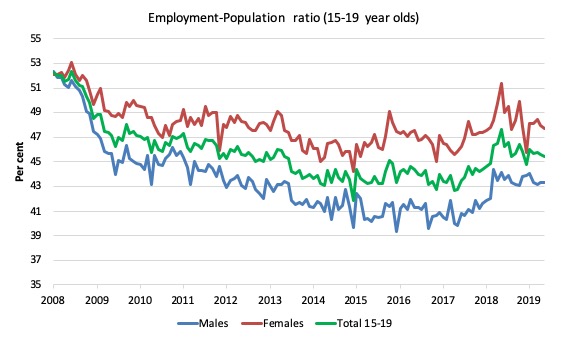

To put the teenage employment situation in a scale context (relative to their size in the population) the following graph shows the Employment-Population ratios for males, females and total 15-19 year olds since February 2008.

You can interpret this graph as depicting the loss of employment relative to the underlying population of each cohort. We would expect (at least) that this ratio should be constant if not rising somewhat (depending on school participation rates).

The absolute loss of jobs reported above has impacted more on males than females.

The male ratio has fallen by 9 percentage points since February 2008, the female ratio has fallen by 4.4 percentage points and the overall teenage employment-population ratio has fallen by 6.8 percentage points.

The other statistic relating to the teenage labour market that is worth highlighting is the decline in the participation rate since the beginning of 2008 when it peaked in February at 61.4 per cent.

In June 2019, the participation rate was 55.3 per cent (up 5 points on the previous month). This is a very unreliable statistic overall – it fluctuates widely on a monthly basis.

However, the difference between the 2008 level, amounts to an additional 83.5 thousand teenagers who have dropped out of the labour force as a result of the weak conditions since the crisis.

If we added them back into the labour force the teenage unemployment rate would be 25.3 per cent rather than the official estimate for June 2019 of 17.7 per cent.

Some may have decided to return to full-time education and abandoned their plans to work. But the data suggests the official unemployment rate is significantly understating the actual situation that teenagers face in the Australian labour market.

Overall, the performance of the teenage labour market leaves a lot to be desired. The decline in full-time employment for teenagers was particularly worrying.

This situation doesn’t rate much priority in the policy debate, which is surprising given that this is our future workforce in an ageing population. Future productivity growth will determine whether the ageing population enjoys a higher standard of living than now or goes backwards.

I continue to recommend that the Australian government immediately announce a major public sector job creation program aimed at employing all the unemployed 15-19 year olds, who are not in full-time education or a credible apprenticeship program.

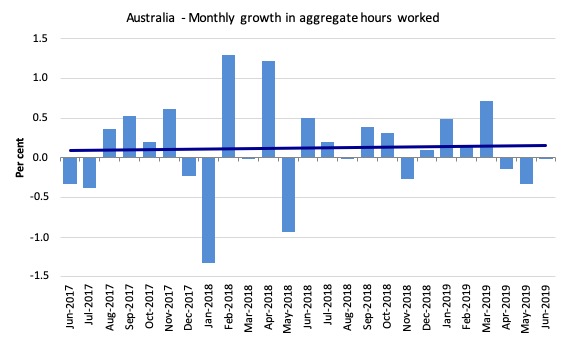

Hours worked decreased 0.1 million hours (-0.01 per cent) in June 2019

A weak result again – the third consecutive month that aggregate working hours have fallen.

The following graph shows the monthly growth (in per cent) over the last 24 months.

The dark linear line is a simple regression trend of the monthly change – which depicts a flat trend – distorted somewhat by the outliers.

Conclusion

My standard monthly warning: we always have to be careful interpreting month to month movements given the way the Labour Force Survey is constructed and implemented.

The June data reveals a stagnating labour market with only 500 net jobs created in the month.

The only bright spot was that there were 21,100 full-time jobs created (net).

But total employment lagged behind the growth in the working age population, which meant that unemployment rose by 6,600 to 711,500 persons with participation unchanged.

Working hours fell for the third consecutive month. Underemployment fell slightly (0.4 points) to 8.2 per cent further, largely reflecting the shift away from part-time work in a weak overall situation.

The total labour underutilisation rate (unemployment plus underemployment) fell as a consequence to 13.4 per cent but its persistence around these elevated levels of wastage makes a mockery of claims by commentators that Australia is close to full employment.

My overall assessment is:

1. The current situation can best be characterised as remaining in a fairly weak state.

2. Most of the dynamics over the last few months have been due to swings up and down in part-time employment.

3. The Australian labour market remains a considerable distance from full employment. There is clear room for some serious policy expansion at present

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

So what you are saying Bill is that labour is continuing to lose the class war?

There are also 1.1 million marginally attached to the labour force, of whom 90 thousand are discouraged jobseekers.

https://www.abs.gov.au/ausstats/abs@.nsf/mf/6226.0

Even the Guardian (Australian edition) appears to be starting to catch on, with the latest article in the opinion section titled “Having a constant pool of unemployed workers is deliberate policy”.

Neoliberalism may still be top dog but it is definately wounded – the faster it bleeds the better.