Yesterday, the Bank of Japan increased its policy target rate for the first time in…

Some reflections on my time in Japan while I am too busy to write

Today, I have several commitments in Tokyo and then a long flight so I decided not to try to finish Part 4 of my Q&A – Japan style series and will post the final part on Monday. For today, you will have to be content with some photos from the current trip to Japan and some comments. But who are those business-suited people in Tokyo wandering around in the mornings picking up garbage (see below)? Normal transmission resumes on Monday.

Tokyo lecture, November 5, 2019

It is clear that MMT is a talking point in Japan and there are many different interests who are pushing it into the political and economic debate. On Tuesday, I gave a presentation at the Japanese Diet and attended a reception afterwards with various government members.

Here is a photo of the audience in Tokyo at the Diet (Parliament) where I presented a symposium on Tuesday, November 5, 2019. The event was a ‘sell out’ (well over 300 attended) and the audience included Members of the Japanese Parliament, Cabinet ministers, advisors, bureaucrats and the general public.

A full video of the presentation will be available soon and I will post a link.

A 1 hour press conference followed with all the major agencies involved.

Reuters Japan wrote about it in this report (November 5, 2019) – 消費増税、3度目の誤り=MMT理論のミッチェル教授が都内で講演 – which roughly translates to “Consumption tax hike – the third error according to Professor Mitchell at an MMT Lecture in Tokyo”.

The article did not report very faithfully what I actually said but did get the following points right:

1. Government fiscal policy is not financially constrained for a currency-issuing government.

2. Raising the consumption tax rate in Japan will have a negative impact on the economy, similar to previous tax increases.

3. Professor Mitchell described MMT as “a lens-like framework for understanding macroeconomics …”

4. If a country issues its own currency and is not at full employment, there are no (financial) restrictions on fiscal spending. He explained that such fiscal spending is possible until there is a tight supply and demand situation in the real economy and price pressure enter the picture.

5. Professor Mitchell stressed that current mainstream economics cannot explain the current state of developed economies such as Japan.

6. He criticised the Green New Deal terminology and suggested what was really at stake was a government funded framework to ensure that the pain of adjustment was shared across all sectors and communities. If there is a Just Transition framework as the focus then the climate issues, which depend on human agency, will be addressed.

Here is another picture from the Diet Room as my host Professor Fujii was doing the introductions.

I want to thanks Professor Satoshi Fujii who organised the events (and logistics) and his graduate student team who helped make the event, the press conferences, photo sessions and reception dinner work smoothly.

Special thanks to Numajiri for escorting me around Tokyo.

Special thanks to Eric (Nyun) for his tireless work promoting MMT in Japan and Chie for all her help.

Kyoto, November 4, 2019

I attended a lovely lunch with the – Rose Mark Group – in Kyoto on Monday which was followed by a workshop on MMT. Many of the questions that I have been answering in my blogs this week came out of this interaction.

They are a leading progressive anti-austerity movement in Japan.

I will post the video link when it is ready for release.

The room was at capacity and the interaction was productive.

Here is a photo we took together before the workshop.

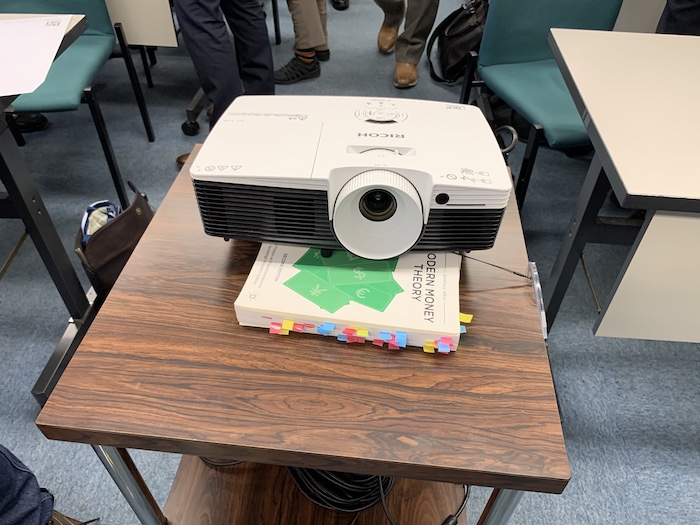

The next photo was the product of a bit of humour at the workshop.

The projector for the workshop needed to be raised and one of the organisers was carrying around Randy Wray’s book on MMT and decided it was a perfect wedge. I told the audience that I was going to tell tales (-: So Randy! Guess what, there has been a productive use found for your book!

But with all those inserted coloured tags, you can also see devotion to study!

The next photo was at the vegetarian lunch before the event. There is a strong Buddhist tradition in this area of Kyoto and the traditional vegetarian food is excellent and provided to be consistent with my own dietary preference, for which I was very grateful.

I was asked to make a 3 minute introduction and I stressed the importance of building global MMT-anti-austerity networks. I hope that the Rose Mark group reach out to the MMT groups in other countries (GIMMS, Spain, Italy, France, Germany, Finland, Australia, New Zealand, the Netherlands, etc).

And I hope those groups reach out to Rose Mark and start building the global anti-austerity, pro MMT coalition. Strength in numbers.

I want to thank the Rose Mark team – Professor Matsuo Tadasu, Professor Park Seung-Joon, Akiko Oisi, Minako Saigo, Noriko Kawai and all the rest of the Ritsumeikan University and Rose Mark team for their help and hospitality.

Kyoto, Saturday, November 2, 2019

I presented an MMT workshop at Kyoto University to a good group of academics and post graduate students.

Here is a photo of the room about 30 minutes before the session began.

There will be a video of this session as well.

As in the other Kyoto event, the presentation was consecutively interpreted which is a pretty tough gig. You continually lose the flow of the narrative and keep wondering where to stop so the interpreter can do their part.

The presentation at the Diet in Tokyo was simultaneously interpreted which is a lot easier. One just has to speak more slowly than usual and make technical terms very clear.

Thanks to Kyoto University (and Professor Fujii) for hosting this event and the hospitality they extended to me.

Other activities

Yesterday, I did a range of media interviews including a long session with a TV documentary series – The Capitalism of Greed – that is produced by NHK (the national broadcaster in Japan).

That program will air in early January with Japanese sub-titles I believe.

It was great interview because it went broadly into the history of economic thought and right through to the development of MMT and then onto specific policy issues relating to Japan and how I constructed them from an MMT perspective.

The other 7 odd interviews were pretty standard – rehearsing the fears that MMT was an out-of-space plot to destroy the world. But we got through them just fine and I will be interested to see how the mainstream press renders the answers.

At the reception last night at the Diet, I met a number of senior government members of the Diet including some Ministers and we were able to have a frank discussion. There is clearly a rift in the ruling coalition and one Member indicated that the MMT group within the government was growing in size.

There is a lot of energy around pushing the agenda and I was happy to play a small part in it.

The range of people I met was diverse in political terms and while some progressives might think it wrong to discuss MMT and policies with more conservative interests, my view is that education is a powerful tool and if the progressive side wants to expand in size then it has to by definition recruit dissidents from the other side of the fence.

I was doing by hardest as an MMT recruitment officer.

The other point I would make is that the more conservative interests helped book the Diet facilities for two days to allow the presentations and press work, including the TV recording and was able to get me into the top levels of the Japanese government to talk about MMT in a casual and effective environment.

Anyway, there are now plans afoot for another speaking tour over a longer period in the new year. I will make those plans public when they are consolidated.

And outside of work

I saw some ancient places and drank fine green tea in beautiful tea houses like this one at Arashiyama, which is a short train trip from Kyoto. We made it a longer train trip because we boarded the express train instead of the local train at Nijo and it didn’t stop at Saga-Arashiyama as we planned. So we saw a bit more of the countryside than originally intended but that included some beautiful gorges in the mountains near there.

Anyway, this was nice time.

And, while I was out running in Tokyo yesterday, up around the Yotsuya station and Sotobori Park, I came across a large group of men and women (mostly men) dressed to the ‘pins’ in business suits (men with ties etc), wearing white gloves and green vests (with a cement company sign on the back).

They were carrying huge plastic garbage bags in one hand and a extension hand for picking up things in the other and they were wandering around picking up every bit of paper and other rubbish they could see. They were in parks, around the local station, and in the streets.

I decided not to take a too-closer up photo of the group (didn’t want to be rude) but snuck a rear shot of one of the stragglers and here it is (from afar).

I have sought information on who these people are and am awaiting a response.

But the cities are spotless compared to Australian cities and this is one reason. But who are these characters?

By the way, both in Kyoto – along the Kamo river; and in Tokyo – around the Akasaka Imperial Property (outer boundary) and the Imperial Palace circuits – are brilliant places to train.

Normal transmission returns on Monday but in-between will be the hardest quiz I can think of.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

“I hope that the Rose Mark group reach out to the MMT groups in other

countries (GIMMS, Spain, Italy, France, Germany, Finland, Australia, New

Zealand, the Netherlands, etc).”

Unfortunately, we don’t have an MMT group in New Zealand unless someone knows of one?

Instead we have one of the world’s most economically neoliberal governments and they are a Labour Party!

During my holiday in Japan last year I also saw small platoons of men with rakes, sweeping up the autumn leaves from the footpaths in the parks. The number of them (mostly older fellows) was quite striking, as we don’t have any equivalent workers in Australia (although the robotic sweeper might come through the parks in autumn). I assume it is some kind of job program for older workers?

Looks like a great trip.

I’ve had three for three on every quiz this year so looking forward to a challenge!

They have to spend those deficits on something, don’t they? And it seems to be either laying concrete or manicuring the trees.

At least one place where prof. Mitchell’s work is treated with the respect it should be treated with.

I hope to see an MMT lecture in my nation’s parliament one day, full audience at the edge of their seat.

I already loved Japan. Now it’s even closer to my heart.

This is awesome to see Bill. Keep up the great work

The proponents of UBI are very often the same folks who discount MMT and sovereign currency issuance. Perhaps we can ask them then where they think the money will come from to pay this UBI, considering the entire point of UBI is to maintain a non-productive workforce that isn’t hit with income taxes. That should get them scratching their heads.

My guess is that they are ‘white collar workers’ doing something useful for a change.

Here in the US, work crews cleaning roadways and parks are often people who have been sentenced to community service for some minor legal infraction. If they were cleaning parks here I might speculate that they were ‘white collar criminals’ serving their sentences. Except that the US justice system hardly ever prosecutes that type of crime.

おかえりなさい! Looking forward to seeing the videos of your talks.

No idea if the park sweeping adults were volunteers, community payback, or even participants in a Job Guarantee scheme, but Primary School children are often seen sweeping the pavements outside their schools in Japan, and internal school cleaning forms part of the curriculum there.

There are no rubbish bins, apart from recycling receptacles next to vending machines; everyone takes their rubbish home with them, and the streets and pavements are spotless.

You never see a Japanese person eating in public – except on the shinkansen bullet train, when snacking, or eating from a bento box, is all but compulsory!

Dear Bill,

Why is the alternative macroeconomic perspective (MMT) seriously considered by some of the academics and politicians in Japan but not in Australia, France or the UK? I would suggest the following answer – precisely because of the same reason why Keynesian economics dominated in the West during and after WW2. Because the Japanese society feels threatened by the growth of the immediate Western neighbour. When Uncle Joe was about to roll his tanks over Western Europe it was not enough to prepare B-29 bombers fitted with nukes. (the Soviets copied B-29 as Tu-4 in 1949). Western European working classes had to be appeased so that the tragic events of 1933-1945 would not happen again. A West German or Italian worker had to have a skin in the game so that he would not sympathise with the communists. I have never been to Japan and my exposure to their culture is extremely limited but I can imagine the strategic thinking there – what the relationships with China and the US will be in 10 or 20 years time? Chairman Xi is not interested in any kind of hostile military domination but what about the economic growth and re-engineering the whole region around one dominating economic player? The solution from 1274 and 1281 (to take benefit of the geographical isolation) is simply not applicable now. The Japanese economy is growing at a very slow pace and the society seems to be stagnant. The country has more than 10 times smaller population than China. I think that it is precisely the fear of China growing and dominating the whole region what has forced some of the politicians to consider “other options”. This immediate geopolitical problem does not exist in Western Europe or Australia. We may be wasting our time trying to directly impact the political life here, MMT ideas will find precisely zero traction until there is an immediate threat to the dominant position of the current oligarchy. Then the Liberal Party of Australia will suddenly discover that they were always Keynesians and would even consider income redistribution measures. Barnaby will have stopped worrying and learned to love the budget deficits. It is possible that this moment will arrive in America sooner as they have more to loose or rather that they have already lost more (the status of the only global superpower). We just need to wait for the next crisis for the “new consensus” to emerge. But it needs to get worse before it gets better.

Adam,

Europe is all about geopolitics the underbelly of Russia.

Even the far right in both France and Italy no longer want to leave the Euro. Why the madness has to keep in expanding. It is certainly not about economics.

Why the establishment in the UK refuse to implement the result of the brexit referendum.

Fantastic trip. I find Japan the most civilised place I have ever been, and now this includes openess to MMT analysis.

Rob, we need an MMT think tank in NZ desperately. Labour and Greens are too cowardly to embrace its analysis on their own. Wider understanding of it could prompt them to be more open.

Dear Derek,

If Russia has such a big underbelly, why is Kharkov (Харьков) still in Ukraine? Nobody will tell me that this is not a predominantly Russian-speaking city, I actually worked there for about a week in 1996. The Russians did not even succeed in taking this city over after the “revolution of dignity” – not only because of the machinations of Kernes. Russia is a military superpower but they are still poisoned with neoliberalism and suffering from corruption. They also learned not to overextend, after the disastrous war in Afghanistan and the collapse of the USSR. Do you really think they will for example send tanks to Poland or Germany if they cannot get back Novorussia? What for? The whole idea of the Russian meddling here and there is just plain lie invented by these who really meddle and micromanage everything in the world – the CIA and the rest of the military-industrial-financial complex. Not that the Russians would not like to meddle or that they did not try undermining and de-legitimising American or Western “democratic” institutions. On the last front they did not need to put much effort, the American oligarchs are tearing the system apart nicely on their own. But the Russians don’t have much influence in Europe because they are objectively weak, all they can do is to turn the natural gas tap off – and get instantly replaced on the market by someone else. There are 3 countries which lead the once-a-four-hundred-years change in the centre of human civilisation: China, China and China. The Russians are also well aware of that but what can they do? That’s why they decided to side with the emerging and unstoppable Asian superpower, which by the way is still building Socialism with Chinese Characteristics they just choose not to export their system elsewhere and hide the truth about their economic system from the ideological enemies. The Europeans are just becoming more and more marginalised in the global game not only because of their geographic location far away from the true centre of the emerging Asian civilisation of the 21st century. Europe will remain relatively rich but I can’t see any reasons why its Western part not going to linger in semi-persistent stagnation. Central and Eastern Europe will continue to catch up but eventually will stagnate as well. These are macro processes affecting the forces of production on the global scale and the rest is just the consequence. Sorry for sounding Marxian…

Well Rob and Cs, that makes three of us who want an MMT think tank in New Zealand. Perhaps you two could start one. I will support you in any way I can but at 80 there are limitations….

Patricia, I’m 73 (yes…an OK Boomer).

Former British MP & Waikato University vice-chancellor Bryan Gould is sympathetic I believe, but he too is knocking 80.

I read in the Guardian today that both British Labour and the Conservatives are campaigning on abandoning their fiscal rules.

It’s a case of who can out-spend the other!

Dear Bill

Thank you for attending the lectures in Japan.

I heard from my friend that you know a lot about Japanese history.

There is an excellent researcher of the history of Japanese currency named Akinobu Kuroda

at Tokyo University. He has also published many papers in English.

https://www.u-tokyo.ac.jp/focus/en/people/people000942.html

https://harvard-yenching.org/scholars/kuroda-akinobu

You can also watch some of his lectures on youtube.

https://www.youtube.com/watch?v=rFnDuYoz2Oc&t=965s

It may stimulate your intellectual curiosity.

Adam K,

I don’t get this supposed Russian threat either. It’s a country run by oligarchs who have much of their wealth invested or stashed in Western Europe, and who very much enjoy the comforts and displays that come with that wealth when they come here. What interest could they have in burning it down when they can buy off whoever they want whenever they want? They would much rather throw chaos in election processes so that we fight each other and nothing changes.

Dear Bill,

I’m Yosuke YASUDA, a game theorist who interviewed you on a recording of NHK on Wednesday. Many thanks for your long talk and cooperation. It was a really exciting time. Please keep in touch!

Patricia and Rob, what if a NZ university could be lobbied to hold some kind of MMT event? It is timely and topical. Bound to give media attention to the department. Any progressive NZ economist academics secretly reading this blog? Could they do something? I am a nobody alas. Greens and labour are currently wedded to fiscal soundness to do anything.

Keeping it real there Adam K.

Thanks for the comments. Food for thought.

Russiagate was a distraction so we don’t talk about Hillary stealing the primary from Sanders and losing to Trump. It’s just cover for the embarrassment and the cheating, nothing more.

Sorry for the OK boomer thing from a millennial.

Dear Yosuke (at 2019/11/19 at 1:25 am)

Thanks very much for the feedback and for the time we spent together in Tokyo on Wednesday discussing economics. I thought it was a really productive interchange and I appreciated the time you and your NHK team took to give me a chance to talk about MMT and its place in economic thought in an extended interview – beyond the ‘ten-second screen grabs’.

I will look forward to seeing what you all finally come up with when the program goes to air on Japanese TV.

We will keep in touch and I will be back in Japan in the not to distant future if all goes well.

best wishes

bill

Bill, it is the weekend again. I see that comments are not activated for the Quiz this week.

Because it is the weekend and so people have less to think and talk about, I hope it is OK for me to post another screed.

I posted this last week on that other site to a thread asking “Why did the US national debt grow?”

There were about 14 replies, and every one was based on Mainstream thinking.

So, my reply was this. It has gotten no likes, but over 200 views.

“All of the above is based on the thinking and standard practice during the time of the gold standard. During that time all nations had to protect their gold supply. One way to do that was to borrow before they could deficit spend.

. . . The reason they had to do this was that gold does not grow on trees.

BTW, whenever a nation had a boom in gold and/or silver mining, that nation did great economically, because its money supply could grow. the one exception to this was Spain right after it began to loot the New World. The reason for this was that Spain didn’t tax itself enough, had a bunch of wars, and so had to borrow to pay for the foreign made things it needed like cannons. Religious bigotry kept Spain from learning how to make its own cannons.

Anyway, back to my point.

In 1971 the world went off the gold standard. That was 48 years ago. while there might have been some problems at first, it is totally clear NOW that this was not the end of the world. It can be seen now that fiat currencies can work just fine. Today, even Japan, with its national debt at 236%of GDP is doing pretty much fine.

While gold does not grow on trees, this is not true for money. The double negative means that money does grow on trees, at least in the sense that paper money is made from trees, and money that resides in computer memories is made with keystrokes on a computer.

. . . So, claim that nations like the US & japan that have their own currencies and float it and never borrow in a foreign currency DO NOT have a NATIONAL DEBT. Instead they have 2 kinds of currency. One is the paper dollars which you earn no interest for holding. The other is the dollar denominated bonds which do pay interest. Both can be and are created with keystrokes.

. . . I claim that is is just silly to count the bond dollars as debt when the US Gov. can and has paid them off as they came due with newly created dollars. It is as silly as counting all the non-bond dollars as part of the debt also. [Again this was a distinction that was held over from gold standard thinking. It should not have been held over though.]

Now I’m not claiming that there is NO CONSTRAINT on what the US Gov. can spend. There definitely is a constraint. However, this constraint is related to the real resources, real things that have been made, and real hours that real live workers can work. It is not a constraint that is derived from any limit on the number of dollars the US Gov. can create and spend. For example, it is widely reported that in 2008 & 2009 the US Gov. and Fed. Res. Bank created and gave away to the world’s banks, US banks, and to people over $27 trillion dollars. Can anyone explain where that money came from using gold standard thinking. It may or may not have been mostly paid back, but much it it is still in circulation. However, it is certain that there has been no large amount of inflation since 2008. Does mainstream economics have an explanation for why $27T didn’t cause massive inflation? Or, does mainstream economics just ignore all requests for an explanation? Ill bet you-all there will be no reply to this challenge.

So, what is the national debt? OK here is the answer. All so called debts can be looked at from 2 opposite POV, the lender’s and the borrower’s. From the POV of the borrower it is a debt, but from the POV of the lender it is an asset. The dollars that are called the national debt {from the POV of the holders} is their asset. Those dollars {from the POV of the US Gov.} are not really a debt because the US Gov. can create new dollars and end the debt at any time. Economically it makes zero sense to tax those dollars away from the economy to be able to give them back to the economy. While it matters to the individuals who are taxed and those who are paid, the damage to the economy will be massive because the bond holders think they have dollars, taxing dollars away from others who do have actual dollars to give them to the bond holders reduces the total money supply. And there is no reason to do this. It would be far better to just create new dollars to retire the bonds over the next 10 to 20 years. This would not destroy the money supply and would not grow it either {if it is in any sense true that the US has 2 kinds of dollars, those that pay interest and those that don’t}.

So, in conclusion, nations like the US, UK, NZ, Canada, Aust., & Japan, but not nations that use the euro, do not have a national debt.

The figure that is published for this is JUST the number of dollars that the US has deficit spent and has not taxed back, yet.

Economic theories that say otherwise are all just old gold standard thinking that has not been discarded yet. It should have been discarded soon after 1971. But, it serves the interest of the 1% and they have kept it as part of the mainstream theories because it serves their interest to do so, while it crushes everyone else economically.”

I hope this stimulates some discussion this weekend.

Steve, sorry to be a little late to the party, but I do want to respond to your request for discussion.

Don’t be afraid of the term “National Debt”, just be clear about what it is. Which is, as you point out, the other side of the coin from the net US dollar assets of the private sector. Also, be clear about what obligation that “debt” implies: the US Government is obligated to accept that money as payment of tax liabilities. That’s all. And the nature of that “debt” or obligation means that the US Government can always fulfill its end of the bargain. The Government can never be forced by circumstance to default on its commitment to accept the dollars as tax payment.

Also, regarding your point that the US has two kinds of dollars. My explanation is that the Government issues three kinds of money: paper notes and coins (walking around money), deposits at the Federal Reserve Bank (aka “reserves”, checking account money) and Treasury securities (savings account money, or maybe better, “future money”). All three kinds are financial assets of the private sector and liabilities (debt) created out of thin air by the Government. In practice any of the three kinds can easily be swapped for one of the other kinds, although Treasury bonds swap for reserves or cash at a slight discount.

For me, it helps to start by recognizing that money is a promise (more formally, a promissory note denominated in units of currency). Two reasons this works well: one, money really is a promise. Two, people understand promises. They understand that every valid promise implies a corresponding obligation to fulfill the promise. And if the promise is denominated in units of currency, it’s justifiable to characterize the obligation as a “debt”.

@ Creigh Gordon

“Two, people understand promises. They understand that every valid promise implies a corresponding obligation to fulfill the promise”.

Can you be sure about that?

I would point to the fact that until very recently English banknotes had printed on them “The Bank of England promises to pay the bearer on demand the sum of £— “, with that promise being endorsed by the (facsimile) signature of the BoE’s serving Chief Cashier (for the time being) on each and every note.

That *preserved the appearance* of a promissory note. But the promise had ceased to have any real-world meaning (in other words, became effectively fraudulent) when banknotes ceased to be convertible into gold sovereigns, so a fraud in which both parties – lender and creditor (the public) – were implicitly complicit. Yet the banknotes went on proclaiming it with all due solemnity long after that date. People read the promise but knew perfectly well that it was an empty one.

My point is that what people can accurately be held to “understand” is far more complex than you are construing it to be: people’s perceptions and beliefs are heavily coloured by tradition and custom – they’re not *solely* the outcome of applying rational, accounting-type, calculation.

@ Creigh Gordon,

You wrote,

“. . . And if the promise is denominated in units of currency, it’s justifiable to characterize the obligation as a “debt”.”.

I disagree because — what people call the debt is just the bonds. You said there are 3 kinds of $$ the the US Gov. creates. OK, fine. But, then why didn’t you include all 3 in what you call debt? Or, if you did then why didn’t you call out everyone going on about the national debt for NOT including all 3 kinds in their total?

Sorry, I didn’t reply sooner, but you replied soon after I gave up looking to see if anyone had replied.

@ Adam K

(A belated comment on your very thought-provoking post)

Your argument is very powerfully expressed and persuasive but not (IMO) watertight.

For one thing it’s too eurocentric: whilst you accurately describe the placating of the working-class in Europe you fail to appreciate that the same process was every bit as prevalent in the USA throughout the whole of the same, postwar, era. It was when the unions (assisted strongly by pro-union legislation – eg the National Labor Relations Board) reached their apogee. None other than Richard Nixon famously remarked: “We are all Keynesians now”. But that cannot be attributed to the same causes in the USA as those you rightly say were propelling it in Europe’s case because none of those causes were operative in the USA. Which might indicate that they don’t amount to a *watertight* explanation in Europe’s case either: other factors were clearly at work – in both cases – as well as those you do mention.

Secondly I believe you may be under-estimating China’s ambitions: I think they’re just biding their time (meanwhile steadily building-up their military capability) until the propitious moment to strike presents itself. I’ve no doubt at all that China’s medium-term aim is to re-absorb Taiwan into the motherland; meanwhile their provocative operations in the South China Sea seem to me to be clearly designed to probe American resolve and to build a bridgehead in readiness for use when the circumstances are right.

Thirdly this:- “The whole idea of the Russian meddling here and there is just plain lie invented by these who really meddle and micromanage everything in the world” is IMO far too sweeping. It’s most certainly not an outright lie, though it may well be a bit of an exaggeration. And nor is it just “meddling”: try telling that to the Georgians (South Ossetia?). It has an unmistakable military ingredient which we here in countries bordering the Baltic Sea are only too conscious of. I think your account is almost derisive in that respect, and doesn’t do you justice if I may make so bold as to say so.

@ Creigh Gordon,

Let me go a step further than I did 2 posts up.

OK, the US has created 3 kinds of dollars. Fine.

But, all can be used to pay your taxes. As you say this is the only promise that that US Gov. makes about its money.

Everyone counts just the bonds dollars as being the debt. But, all 3 kinds are equal in that they are created by the US Gov. Using your logic all 3 kinds are equally “debt”. If this is so, then how in the heck can the Gov. pay its debt off? All 3 kinds of dollars are debts. So, trading paper dollars or reserve dollars in a computer memory somewhere for bond dollars is paying off 1 kind of IOU with another kind of IOU, right? What good does it do for the American people to think of the US Gov. bonds as a debt when its paper dollars are also a debt?

I’m claiming that the American people need to forget such thinking, because the US Gov. *can’t* pay off one kind of debt with IOUs of another sort. The whole mind set is bogus. Forget the whole thing and just think of the bonds as the assets of the holders, just like the cash of the holders is their assets.

Creigh Gordon: Quite right. You’re explaining the basic MMT position, which is often distorted and made more complicated than it really is – even occasionally, I daresay, by MMT thinkers. What is bogus and reminiscent of gold standard thinking – and of the degeneration of postwar Keynesianism – is distinguishing between bonds and dollars. Calling one debt and not the other, not realizing that they certainly are both part of a National Debt, which certainly is a “debt” just like that word is used in any other context – is the problem, is the confusion, the bad mind set. Of course it means that cash and bonds are both assets of the private sector. But financial assets and credits are just the same thing, absolutely identical to the financial liabilities and debts which they are – just viewed from the opposite perspective.

Steve_American: “What good does it do for the American people to think of the US Gov. bonds as a debt when its paper dollars are also a debt?”

The good of it is that dollars ARE debts, just like bonds. Basic words should be used consistently, without a mystical taboo against calling a spade a spade, or a “dollar bill” a “debt”, an IOU. Because they certainly are. This is like asking “what good is it to think of coins as money when dollar bills are also money?” The good is that NOT thinking that way is crazy.

To quote FDR – to all intents and purposes a leading MMTer: “Government credit and government currency are one and the same thing.”

“So, trading paper dollars or reserve dollars in a computer memory somewhere for bond dollars is paying off 1 kind of IOU with another kind of IOU, right?”

That’s why it’s not “paying off”. Trading reserves for dollars is no more paying off a debt than getting 5 ones for a Five dollar bill, or any “making change” is paying off a debt. Buying and selling bonds is much more like making change than it is like paying off a debt.

The only way for a government to pay off a debt is for it to sell something to the private sector, or to accept a tax payment. To cancel it – an obligation of the government, against an obligation going the other way, an obligation to the government – which could be created by a tax assessment or a transfer of property from the government to the private individual – a sale.

@ Some Guy,

OK, I’m dense. I’m sorry but what good does it do to convince the American people that the national debt is NOT $21 trillion; instead it is $21T + $5T {the cash} + $30 T? {here the $30T is my guess of how many “reserve dollars” the Fed. Res. has on deposit.} And then telling them the US can *NOT* pay it off with dollars?

My idea is better. Convince them that they are *ALL* IOUs and therefore will never be all paid-off. That the nation can go on rolling the bonds over forever. And if they can’t sell bonds one day it is no big deal because they can just pay the bonds off with newly created dollars and spend dollars into the economy as long as it is done in moderation.

I have argued on other sites that it is flatly impossible for the US to pay-off the national debt {=bonds}. To even try is to cause another Great Depression, sort of like but much worse than what is being done right now in Europe. I think only one person said, “I get it, you’re right, it’s impossible”.

You said the US Gov. would have to sell its assets {Army forts, Navy ships, Air force planes, all the gold in Fort Knox, and national parks?} to get Money to pay the national debt off. I have 2 questions. What money would it accept for a plane and then pay some bond off? Dollars or what? And then what would the economy use as money, if the US Gov. has taxed enough to extinguish all the paper and reserve and bond dollars it had issued in the past. Then what?

Why is thinking about doing this a good idea? Far better, it seems to me, to just accept that the bonds can never be paid-off except with newly created magic money tree dollars. And that paper and reserve dollars are just IOUs that you use to pay taxes.

Steve, you’ve asked a complicated question to answer (why is the National Debt not bonds + cash + reserves). The (somewhat simplified but I think basically right) answer is that the cash + reserves are created by the Fed and used to buy bonds from the private sector (us). The Fed has a balanced book, holding Treasury bonds worth (I think something like) $5T and liabilities of cash and reserves of $5T also. As a result, we don’t hold $21T of bonds, we hold (something like) $16T of bonds and $5T of cash and reserves.

In other words, the Treasury has created $21T of outstanding bonds over time and sold them to the private sector (us) in order to fund government spending. So we in the private sector would be holding $21T of bonds, except that we have sold some to the Fed in order to get cash and reserves. That means that the National Debt at $21T and the private sector’s holdings of government-issued financial assets (bonds + cash + reserves) are also $21T.

Further, if the Government paid off all the bonds by creating cash and reserves, interest rates on reserves (the basis of monetary policy) would drop to zero and stay there, unless the Government decides to pay interest on excess reserves (which is what it now does). That’s all that would happen.

This is a bit of a cartoonish view, but I think it describes reality in broad strokes. Will this be convincing to the average person on the street? That’s a tough one. “The deficit will burden our children and grandchildren” is a powerful argument because it is easy to understand and appeals to common sense and personal experience. Cracking that nut will be difficult.

Steve, a little bit further on “the US Gov. *can’t* pay off one kind of debt with IOUs of another sort.”

There are three ways a debt can be discharged. It can be forgiven, it can be paid in kind (gold, for example, although our government doesn’t do that anymore) or it can be swapped for another debt. There are no other possibilities. The swap could be another IOU or it could be the canceling of a tax liability.

Steve_American: “OK, I’m dense. I’m sorry but what good does it do to convince the American people that the national debt is NOT $21 trillion; instead it is $21T + $5T {the cash} + $30 T? {here the $30T is my guess of how many “reserve dollars” the Fed. Res. has on deposit.}”

Because that is uhh, The Truth. And it makes sense. And respects the standard dictionary meanings of words. And is the MMT position. FDR managed to convince people it was correct – even eventually some of his economists 🙂 – so why should MMTers balk? Wray often enough makes precisely this point, says that is the only correct and meaningful definition of “National Debt.”

“And then telling them the US can *NOT* pay it off with dollars?”

Of course the government can replace/trade/”pay” privately held “bonds” with “dollars” it just prints/creates. The point is that this operation, reasonable enough is not “paying off”. True “paying off”, as you say, would be crazy. A virtue of “no bonds” is that it makes things clearer. If all there is is dollar bills, then how could the dollar bills be paid off? – except by the government selling things or taxing them.

“Convince them that they are *ALL* IOUs”

In other words convince them they are debts. Because IOU = debt = credit. So your position seems to be “Don’t call it a debt, call it a debt instead”. That makes no sense. Making no sense is what mainstream economics does. Not MMT.

“You said the US Gov. would have to sell its assets {Army forts, Navy ships, Air force planes, all the gold in Fort Knox, and national parks?} to get Money to pay the national debt off.”

No, I did not. Not at all. I said that government sales (of real goods and services) are one way to lead to a credit/debt going the other way, which is basically the only way to cancel a debt, to cancel outstanding currency/reserves or outstanding bonds. People suggest other ways, but they don’t notice that they are embraced, subsumed by “opposite credit/debt way”, which in turn can only come from a “sale” – which considered widely embraces taxation. So a point is that one should think of (financial) taxation as a sale by the government. This essentially is in Mitchell Innes.

Of course the government doesn’t need to and cannot get government issued money from sales or taxes. The point of the sale or tax is to get rid of something or more usually to get the money out of private hands.

The right way to start thinking about it is FDR’s: bonds and dollars/reserves are the same thing. Don’t even bother to distinguish them on the first pass. I really mean this. When you see the word “bond” erase it and write “money” or “currency”. Or vice versa.

Sorry if prolix. DIdn’t have time to write something shorter.

@robertH:

When I speak of people understanding promises, I’m thinking of ordinary promises like “I promise I’ll be there by six o’clock.” People understand that such a promise is created out of thin air, implies an obligation or debt on the part of the promiser, and may be subject to default depending on circumstance. These all are characteristics of the money promises made by governments or banks.

@ Creigh Gordon

“People understand that such a promise is created out of thin air, implies an obligation or debt on the part of the promiser, and may be subject to default depending on circumstance. These all are characteristics of the money promises made by governments or banks”.

No, I don’t think they people do understand that: that’s the problem. People don’t understand that a banknote issued by the BoE (say) is really only a promissory note, aka a promise by the BoE (= govt)), aka the govt’s *IOU*, which is owed to them. Because they can’t see what that “something” you say is owed to them *is* or where it can possibly be located. They don’t perceive it to be a debt owed to them in any way at all, in any normal sense of that word, semantically.

Hell, *I* don’t understand it that way and I’ve tried very hard to! I’ve read Mitchell Innes straight, upside-down and sideways, a dozen times! You may well retort that that just shows I’m a bad student, not that what is being taught isn’t correct. And you might well be justified in saying that.

But we’re discussing *Everyman’s* perception, not MMT wonks’!

Everyman certainly does understand that the govt is bound to accept his money (the banknote) in discharge of his obligation to pay his tax-bill (or go to jail). But he doesn’t connect those two things: in his mind they’re completely dissociated

Satoshi Fujii has uploaded the full Tokyo lecture to his YouTube channel. A real treat for Japanese viewers – I think Bill’s gained some more fans!

https://www.youtube.com/watch?v=tEsA_ajiJxU&list=PL3g-WZ0bpgTMB3iikecxY7ZM21QTZ2A1u