The IMF and the World Bank are in Washington this week for their 6 monthly…

The Tories in Britain have a clear way forward – thanks to the Labour Party hacks

How things are changing. After the British election in December, the policy terrain in the UK has shifted such that the Tories are now being lectured to about the dangers of a stimulus package, while British Labour seems to be promoting leadership candidates that mostly were part of the problem that led to their failure. In the latter context, we are seeing King or, should I say Queen makers, who I would have thought were unelectable trying to influence the leadership choice. And former Labour advisors tweeting and what have you about what Labour should be doing when it was their advice that got the Party into the mess it is currently in. Meanwhile, the Tories have an almost open field to finish the first stage of the Brexit process off, and, secure the ongoing support of the voters that abandoned Labour in the election. The Tories will have restored sovereignty to Britain and freed themselves from the restrictive, neoliberal environment of the European Union. Now don’t get me wrong, I have no truck for the Tories. And all along, I considered that Brexit would deliver great outcomes for Britain in the hands of the Labour party as long as they simultaneously abandoned their neoliberal obsession with fiscal rectitude, as expressed by their ridiculous Fiscal Credibility Rule. Labour will now have to rue their ill-conceived abandonment of the Leave voters in favour of the cosmo Remainers. For now, the Tories have open slather – the worst of the outcomes possible. However, the only attenuating factor is that Boris Johnson is a smart operator and will be keen to ensure that the voters in the Midlands and the North remain Tory on an ongoing basis. That means he will have to do abandon the Tory austerity bias and invest billions into the regions that have been torn apart by his parties obsession with fiscal surpluses. That might, for a while, provide some good news for Britain.

Labour leadership

Apparently, there are now five leadership hopefuls left in the contest.

Of the remaining five, all were Remainers of varying intensity, with only one, Lisa Nandy expressing concern after the referendum about Labour’s shift towards reneging on its commitment to honour the June 2016 referendum result and the increasing call prior to the election for a second referendum.

The other candidates kept hammering on about the need for a ‘Peoples’ Vote’, which was code for repeating the process until they got their own way, irrespective of what the majority of voters wanted.

They got the ‘Peoples’ Vote’ in December, with the Tories dramatically increasing their majority. This left Labour in the wilderness with nowhere to go unless it changes its position significantly.

I thought it was apposite that one of the more intransigent internal critics of Jeremy Corbyn’s leadership and strident advocates for a ‘Peoples’ Vote’, who declared she would push for Britain to re-enter the European Union if elected, has been nominated by Birmingham MP Liam Byrne to become the leader of the Labour Party (Source).

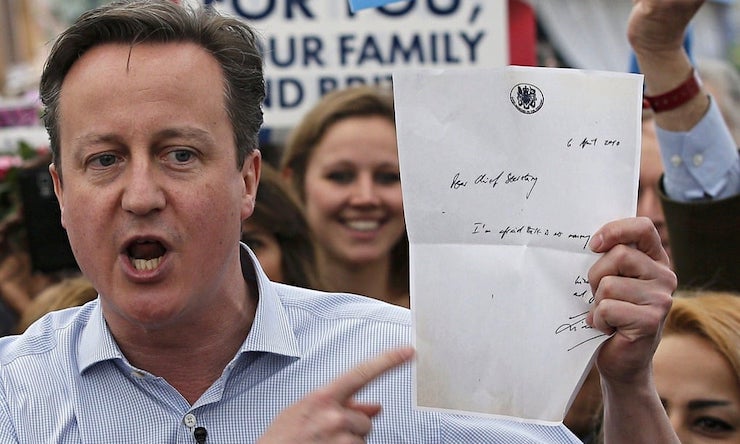

For those with a short memory here is a photo that should disqualify him from any influence within the British Labour Party.

The handwritten letter was written when Byrne was Chief Secretary to the Treasury in 2010 and upon his leaving he penned the message:

I’m afraid there is no money.

This was in the context of the GFC and Gordon Brown’s government pursuing fiscal austerity before the economy had recovered because, in Byrne’s own words “the responsible thing to do was draw up a long-term plan to cut spending … to halve the deficit in just four years” (Source).

So he wrote the note for the incoming Tory Chancellor, which of course gave David Cameron and George Osborne all the political ammunition they needed to discredit Labour and to justify their own pernicious austerity program, at a time when Britain required ongoing stimulus for many years to regain stability after the crisis.

Anything Liam Byrne might have to offer the Labour Party after that should be disregarded.

So it looks like the Labour Party hasn’t learned very much and the old influencers are still pulling strings in the leadership battle. The five candidates who will go through to the next round hardly inspire confidence of a significant turnaround in Party policy in the areas that need to dramatically change.

I will talk about some of those changes in my seminars in London and Manchester in February.

The Tories and stimulus

I read this article in the Daily Telegraph (January 12, 2020) – Try as he might, the Chancellor cannot escape the constraints of budget deficit – from Roger Bootle (it is behind a paywall but if you examine the source code all the text is there).

Roger Bootle is a former financial market economist and has been a supporter of the Tory austerity over a number of years.

His only saving grace is that he is opposed to the European Union, but for very different reasons to my own opposition to the neoliberal cabal.

He wrote in 2015 that (Source):

… Mr Osborne had to impose some early fiscal pain …

However, he is no New Keynesian who believes in the “the doctrine of ‘expansionary fiscal contraction'”, which all the austerians were pushing at the time to pretend that what they were doing was promoting growth.

He also doesn’t believe in the other myth that accompanies that nonsense – “Ricardian equivalence … the idea that fiscal expansion has no impact because households and firms understand that it implies higher future taxes and they reduce their current spending accordingly.”

He wrote that “Economists who believe that people behave like this give the subject a bad name.”

But his support for austerity came down to his view that “The UK was fighting for fiscal credibility” and that the markets would turn on the government soon, even though “the debt to GDP ratio was not that high”.

He even acknowledged that the “financial markets have gobbled up British government debt” with the relatively high fiscal deficits.

But like all these soothsayers, he believes that in some mysterious future, the financial markets will turn on the British government and stop buying the debt and sell off the currency.

Who to?

They never analyse that. The ‘sell off’ bit is the scaremongering. Why buys the sterling assets and why is not part of the story.

Remember, for there to be a sell off there has to be buyers!

He also espoused the view that while fiscal policy had to be tightened through austerity, monetary policy could “offset the effects of fiscal tightening” via Quantitative Easing.

So “Mr Osborne’s tough early stance was about right” even though the economy tanked badly after showing signs of recovery after the GFC as a result of the fiscal support.

Fast track to January 2020.

In his Telegraph article, he is now giving out warnings to the Tory Chancellor not to introduce a large stimulus package, which I believe will be necessary to smooth the transition out of the European Union.

The Tories will also think it is necessary to shore up their new voters and to close the door on British Labour who will probably come up with an even more ridiculous Fiscal Credibility Rule than before in a pathetic attempt to show voters they are responsible.

That sort of reasoning was driven by the same paranoia that Roger Bootle invokes – that the amorphous financial markets are just waiting to pounce and kill the pound if the government dares to run a fiscal deficit!

I will address that issue at the end.

First, here is Bootle’s argument.

He notes that the Tories have shifted from a position where “the Government was absolutely obsessed with reducing the budget deficit and the ratio of debt to the size of the economy” to the current position where “the case for fiscal restraint has all but disappeared.”

He thinks the Tories:

… are in for a rude awakening.

But:

1. He realises with rates low in financial markets – investors are clamouring for risk-free assets (government bonds).

2. Central bankers are now calling for fiscal stimulus.

So his whole idea (“rude awakening”) is predicated on the “things can change” vagary that these soothsayers invoke to push their message when they have zero evidence to rely on.

The more amorphous and vague they are the better because then they can keep the scare going for longer even after, for example, Japan has shown the way for nearly three decades.

And then, once you have bought the “things can change” snakeoil, it is easy to lure you into the conclusion that:

If and when market conditions do change, it will be easier for the management of the public finances if the debt ratio is lower rather than higher.

In other words, according to this logic, an austerity bias is necessary.

And the horror story continues by – yes – as we would hope (:-)) – by talking about the “the exchange value of the pound”.

It gets confusing.

Fiscal stimulus, according to Bootle, is “likely to strengthen the exchange rate” but the UK needs “a stronger currency like a hole in the head”.

It is hard to get on terms with this.

The usual mainstream argument is that fiscal deficits cause a sell-off in the currency. So there are limits on borrowing.

But, for Bootle, the limits on borrowing relate to the need to reduce the exchange rate – because “the UK is running a huge current account deficit and seriously needs to improve its competitiveness”.

Neither position is tenable.

Which then relates to his next concern: “does it matter what it spends money on?”

Bootle claims that Britain is neither experiencing serious mass unemployment where any fiscal stimulus will be beneficial nor at full employment, where “extra government spending must squeeze out spending by the private sector.”

His reasoning about the latter is somewhat erroneous.

He thinks the squeeze comes “as market rates of interest rise in response to increased government borrowing”.

But there is no reason for yields to rise at full capacity. As long as there are credit-worthy borrowers walking into banks, the latter will create loans which create deposits, irrespective of what the government is doing.

So there is no finite pool of savings which drive interest rates up.

What happens at full employment is that the government has a choice:

1. Maintain the current nominal growth in spending and hence the relative size of the government and non-government sectors.

2. Try to gain a greater share of real productive resources, which requires the government to introduce complementary policies (to the spending increase necessary to elicit that increasing share) which deprive the non-government sector of the use of the resources that the government wishes to transfer into public use.

In that sense, the government is squeezing out private spending.

If it didn’t do that, then inflation would be the upshot as the total nominal spending growth in the economy would be incompatible with its productive capacity.

Roger Bootle does believe “the amount of spare capacity in the economy is greater than official estimates suggest”, which means that firms will initially respond to a fiscal stimulus by increasing output, which will have the beneficial effect of also increasing productivity.

His preference is for increased public investment, given that “the UK’s rate of both public and private investment is very low compared to most other advanced countries”.

But he does not think the government should be relaxing “current spending”, which is spending on employment, consumables (which provide services in the current year), such as the NHS and other service delivering departments.

Although he thinks the election promises should be “honoured”, the government should be reducing current spending to free up room for “major tax cuts”.

Overall, this is the standard argument from a ‘deficit dove’.

It is based on a sequence of myths, that are shared by the austerians, who just give them more weight:

1. Governments have to fund their spending.

2. Recurrent spending should always be covered by taxation revenue.

3. Private investment is usually “more beneficial” relative to public investment because the “public sector has a poor record of assessing the costs and returns to investment”.

4. Tax cuts have to be ‘paid for’ with recurrent spending cuts.

These underlying contentions are mostly wrong.

If public debt was truly a problem, then the government could simply not continuing matching their deficits with debt-issuance.

For more discussion about that option, please read these blog posts (among others):

1. OMF – paranoia for many but a solution for all (November 28, 2013).

2. On money printing and bond issuance – Part 2 (August 27, 2019).

3. On money printing and bond issuance – Part 1 (August 26, 2019).

If tax cuts are deemed appropriate, then there is no need to adjust spending downwards, unless it is concluded that the deficit should not change.

That assessment can only be made in relation to the state of the overall economy, rather than a knee-jerk view that all recurrent shifts in the fiscal position have to be product of exact offsets.

There is also no evidence that private investment decision making leads to superior outcomes in terms of resource usage.

The sort of vague paranoia that Roger Bootle is expressing here – the “things can change” vagary – is also deeply held within the British Labour Party.

When I criticised the Fiscal Credibility Rule, I was told by Labour insiders (including the Shadow Chancellor) that I didn’t understand the financial markets.

Apparently they did.

When I met with the Shadow Chancellor in October 2018, it was clear that they believe that the financial markets in Britain (the ‘City’) will crucify a government that runs a progressive policy campaign without the fiscal rule.

It means that British Labour has not advanced much since the mid-1970s when Dennis Healey mislead the British people by claiming that the government had run out of money and had to borrow from the IMF.

Amorphous sorts of claims about destroying a currency etc abound but the fact is that if the government brings its legislative capacity to bear the financial markets are the losers not the power brokers.

Iceland, a tiny little country with a huge financial system (relatively), has demonstrated exactly how that legislative capacity can overpower even the most powerful foreign banking interests.

The point is that Labour’s Fiscal Credibility Rule was really a document designed to appease the financial markets.

It is some mumbo jumbo that British Labour naively thinks will placate the currency traders and others who might bear malice against its undoubted progressive policy agenda.

The problem is that this reinforces the narrative that deficits and public debt are in some way ‘bad’.

I think this degree of paranoia is misplaced and reflects a fundamental failure to understand the financial markets and what they require.

I have had several meetings in recent months with some of the largest investment managers in the world. These are the people who the Shadow Chancellor and his advisors are fearful of.

They have been seeking me out to learn about Modern Monetary Theory (MMT) because they realise that by adhering to the views of the mainstream economists, they have been exposing their investors to losses and reduced returns.

I never give investment advice. But I am happy to educate and move more people away from mainstream economics.

The point is that the British Labour advisors and the politicians have fundamentally misunderstood the situation.

First, austerity around the world and a reliance on monetary policy has generated financial market outcomes that are unsustainable for financial investors.

All around the world, interest rates and yields on assets are falling and we are now seeing negative interest rates on long-term bonds becoming the norm.

The pension funds and insurance funds are also facing a major asset-liability mismatch as a result.

And to resolve the mismatch, they are seeking to generate higher returns on their assets, which means they are taking on higher risk and exposing themselves to higher probabilities of insolvency in the face of any new crisis.

It is an unsustainable position.

And it is making life very difficult for the large investment funds who seek stable returns.

What they are hankering over is an end to the neoliberal era of passive fiscal policy and monetary policy interventions that are driving yields into negative territory.

They are getting on board the shift to fiscal dominance that the central bankers are demanding.

They are becoming increasingly attracted to MMT because they can see that we have consistently articulated the case for fiscal dominance.

After many years of monetary policy dominance, which has failed to deliver on its promises, the game is up.

That is why these investment bankers have been talking to me about policy choices etc.

So if the British government forgets about stupid fiscal rules and just uses its fiscal capacity to improve service delivery, invest in nation building infrastructure that will crowd-in private investment, then also given that Britain enjoys the rule of law (provides contractual certainty and enforceability), has a skilled labour force, etc. then far from selling off the currency, I would expect FDI to be flooding in.

This is also in the context of the world being awash with savings which are just sitting in unproductive deposits somewhere because there are insufficient investment opportunities available as a result of the austerity bias.

So the very people that the British Labour politicians think would destroy the currency if they break out of the neoliberal framing and rules, would, in fact, be shifting massive flows of investment into Britain – and pushing sterling up.

But I am forgetting.

Labour lost. They took bad advice and made stupid decisions that abandoned their loyal voters.

So, it will be the Tories who have the opportunities to stimulate growth in a post-Brexit Britain and further damage the Labour Party’s electoral prospects.

For more discussion about this theme, please read these blog posts (among others):

1. Is the British Labour Party aboard the fiscal dominance train – Part 1? (September 23, 2019).

2. Is the British Labour Party aboard the fiscal dominance train – Part 1? (September 24, 2019).

3. ECB confirms monetary policy has run its course – Part 1 (September 17, 2019).

4. ECB confirms monetary policy has run its course – Part 1 (September 18, 2019).

5. On money printing and bond issuance – Part 1 (August 26, 2019).

6. On money printing and bond issuance – Part 2 (August 27, 2019).

7. Inverted yield curves signalling a total failure of the dominant mainstream macroeconomics (August 20, 2019).

8. We are approaching a period of fiscal dominance (August 12, 2019).

9. Forget the official Rule, apparently, there is a secret Fiscal Credibility Rule (June 19. 2019).

10. The British Labour Fiscal Credibility rule – some further final comments (October 23, 2018) – this post has an extensive list of links to earlier blog posts on this topic.

Conclusion

The Labour Party leadership battle inspires no confidence.

The same failed advisors are out there in the social media handing out more advice.

Remain is still dominating the urban cosmo narratives.

Meanwhile, the Tories, with an increasingly clear way forward, are seizing the opportunities.

The problem is that “things can change” and by that I don’t mean that the financial markets will do anything. I mean that the Tories are not social democratics. Their DNA is mean and nasty. So don’t expect the stimulus to create a progressive dreamworld.

But then the British people have Labour to blame for allowing the Tories to take control of the Brexit process.

That is enough for today!

(c) Copyright 2020 BIll Mitchell. All Rights Reserved.

Then isn’t Labour mean and nasty for leaving working class voters unprotected now for four decades?

It’s like there’s no left left, anywhere.

A fine mess indeed. If a glint of light exists, perhaps it lies with the break-up of the UK as a political and economic union, leaving hopefully a united Ireland and independent Scotland, England & Wales. Should Scotland be persuaded to remain outside the EU too, then a fertile project encompassing most of the principles you advocate, could set a different path and an incredible example for the other British nations to follow.

Sure at a crossroads, but Robert Johnson ain’t playing the tune this time..

As usual, a most stimulating and penetrating analysis of (among other topics) British politics, by a progressive “outsider” (who is in fact far more of an insider than many of the ever-so-clever native “progressives” possess the wits to be, or to become!).

Personally I take a more sanguine view of the Tory Party than Bill, and I base mine on a (perhaps?) slightly longer historical perspective. Not for nothing was the phrase “one-nation conservatism” coined. As people will no doubt be aware it derives from the sub-title of Disraeli’s novel “Sybil”, which was “,,,or, The Two Nations” (which I must confess I haven’t read but the theme of which that sub-title clearly signals). Basically it was a protest against the social and by extension political divide in mid-Victorian Britain between the classes and between great wealth and desperate poverty. As we all know, Disraeli went on to become the founder of the modern Conservative Party and to be ranked historically among the great British Prime Ministers.

Judged against that background it is Thatcher and her disciples who are the aberration, not the other way around. It remains to be seen to which side of that divide Boris will ultimately turn out to belong. For the time being I’m warily hopeful but it’s far, far too early to jump to any conclusions either way and those who have already written him off are in my view just giving way to prejudice.

I only hope I won’t all too soon be forced to eat my words!

How fitting that it should be Liam Byrne who is nominating a person – Jess Philips – to succeed the genuinely progressive socialist Corbyn who (to judge from the position she has adopted) would be the most disastrous of all the choices the Labour Party could make – the party having already ditched the one who would have been the least disastrous, Clive Lewis.

If there was one single symbolic act which more than any other conclusively cemented in the public’s mind the – wholly undeserved – image of the Labour Party as financially irrecoverably feckless it was Liam Byrnes’s (a Treasury Minister’s no less) “humorous” little jape. In one fell swoop he discredited all the efforts which Gordon Brown had for years painstakingly expended to build up a reputation for “prudence” (a word he reiterated so frequently as to deaden the senses!).

If there’s one single ancestor for Labour’s misbegotten “fiscal rule” it’s Byrne, because its whole raison d’etre was to serve (as Macdonnell’s advisers were hoping it would) as the trick which would neutralise the lethal effect upon Labour’s image which Byrne inflicted. But for that little note penned in a thoughtless moment there might never have been a “fiscal rule”.

Not that that would have made any difference anyway, as things turned out.

The thought of Byrne as West Midlands mayor is enough to curdle one’s blood. The man is a one-man disaster-area!

2 trivial corrections, Bill. Clive Lewis was an arch remainer – he resigned from shadow cabinet over it in 17. And you met John McDonnell in October 2018, not last year.

Thanks for depressing me even more:o( I’ve been trying to be positive by encouraging MMT people to talk to CLPs.

Carol Wilcox is right – although Clive Lewis has made statements about ‘moving on’ etc after the General Election Catastrophe, prior to that he was most definitely NOT a supporter of Brexit – far from it.

He was a very strong and vocal supporter of the ‘progressive’ Europhile group “Another Europe Is Possible” who proved themselves completely incapable of answering the obvious question of “Okay then, how?” which I and many others posed repeatedly to them and their big name supporters. I wrote to Lewis more than once and tweeted repeatedly, to no avail.

Another Tour de Force Bill, for which much thanks.

However, there is an unfinished sentence in the paragraph below. I will highlight the beginning of the sentence:

Re: the Labour Party Leadership election, other people have commented on Clive Lewis.

The other “missing” candidate is Ian Lavery, who decided not to stand, although many people wanted him to. I’m not sure what his original position was on Brexit, but after the election result, he was one of the few senior Labour figures to correctly identify Brexit as being the major factor in the result.

Bill, regard to Liam Byrne, his Wikipedia page provides some context for his leaving note …

Departure from the Treasury

On leaving his position as Chief Secretary to the Treasury following the change of British government in May 2010, Byrne left a note to his successor David Laws saying “Dear Chief Secretary, I’m afraid there is no money. Kind regards – and good luck! Liam.”[18] Byrne later claimed that it was just typical humour between politicians, but regretted it since the new government used it to justify the wave of cuts that were introduced.[19][20] The note echoed Chancellor Reginald Maudling’s note to James Callaghan: “Good luck, old cock … Sorry to leave it in such a mess.” after the Conservatives’ defeat at the 1964 election.[1][21]

@robertH

I’m not sure about your sanguine view. Disraeli was a consumate opportunist, and his political “philosophy” owed more than a little to the need to appeal to the new class of voters created by the enlargement of the franchise.

I would say Boris is a worthy heir to that heritage. The question is, what does he believe he needs to do to keep former Labour voters happy enough to stay on board? And can he stop himself self-destructing long enough to enact such a plan?

Johnson has no policies to tackle the housing crisis, which a tory who sat next to me at the polling station, agreed was the biggest problem.

Dear Carol Wilcox (at 2020/01/14 at 10:16 pm)

Thanks for the corrections. I have fixed the errors.

I am sorry for being a depressing agent. I would hope to only ever be the opposite, but, then, this is the real world.

best wishes

bill

Brilliant Bill !

What I also find fascinating is this from one of Bills recent quotes..

” Groups work out all sort of ways to behave like that. When anomolies come in from the real world they revise history. They rewrite history to reflect the group. Look at all of the revisions carried out after the great depression. Some of stories now being told about the great depression do not reflect reality. they also just deny things and make stuff up. Deny that the whole financial system was saved in 2008 by global government deficits. That’s how they overcome their own personal doubts and maintain membership of the group. ”

The liberal left big named economists are retreating into this type of GROUPTHINK on twitter. They refuse to accept why Labour lost. They have huddled together on social media with liberal journalists from the Guardian. Trying to rewrite recent history making stuff up to reinforce the group and groupthink.

It is fascinating to watch. As they have suddenly realised they are being attacked from all sides and are slowly becoming irrelevant as the economics paradigm shifts.

I’ve never seen anything like it. Continuing to support policies that lost Labour Scotland and now the North of England.

It would be a move in the right direction if the Guardian sacked the liberal journalists who have paraded around our Sunday morning breakfast tables for far too long now. The are way past their sell by date, from a time that has passed them by.

I suppose this is what living through a paradigm shift looks and feels like 🙂

Simon Wren Lewis latest blog post…..

MMT gets a mention.

” So how do we ensure as far as we can that fiscal policy makers will not repeat the mistakes of 2010 in the NEXT RECESSION? The first best would be to have better fiscal policy makers, but alas that is not always possible. There are three widely discussed possibilities.

The first is MMT. This in effect reverses the conventional assignment, with fiscal policy doing the demand and inflation stabilisation in all states of the world. If that happens debt looks after itself. I am not in favour of MMT, because I think independent central banks have been very successful at controlling inflation, and a government using fiscal policy would be less successful”

So once again only fiscal policy during recession not in normal times. Pure deficit dove simply cannot move away from this position.

With Japan and the ECB suffering from deflation for years. With nonsense happening at the FED and Threadneedle Street and in Australia and elsewhere.

What central banks is he talking about, last thing I see is success ? How difficult is it to control inflation when the economic policy is austerity !

He must mean Gringotts Wizarding Bank or The Iron Bank of Braavos. Or a parallel universe where everyone works in an unelected, technocratic fiscal council. Who are all called Simon working on the output gap.

If by any chance you can find a central bank that he is talking about on planet earth. Answers on a post card please to..

Hughie Green

10 Teddington Lock

Middlesex TW11 9NT

GROUPTHINK is strong in the Borg. Resistance is futile.

I agree with Carol that the Tories will not do anything to deal with the housing crisis. The wealth transference created by the forty year housing bubbles (biggest one under Blair) is a ticking time bomb which will eventually undermine the Tories and is one of the reasons why younger voters (18-45) have a higher proportion of Labour voters.

There was a good article by Andy Becket in the Guardian that pointed out demographic shifts in the supposed ‘Labour heartlands’ showing that these areas had lost much of their you which WAS voting Labour but after moving to the large urban centres, leaving many of the smaller towns with a higher dependency ration and we know that older voters (>45) tend to vote Tory. AS the present cohort are pushed OUT of the housing market they may well not become Tory voters as they age.

So the so-called Labour Heartlands’ were, in reality nothing of the sort.

There is still plenty of foreign money pouring into London for luxury properties-this is the ‘taking back control’ that Johnson apparently used as a tag phrase alongside ‘get brexit done.’ In other words, there won’t be any taking back control because the foreign money started pouring into luxury housing the moment the election result came in.

Sajid Javid the Chancellor has already announced that the current-spending budget will have to be in balance in three years’ time, so not exactly departing with mainstream thinking. and as bad as the rolling window of Labour without the rolling bit.

I doubt the Tories will do very much to alter the private debt issue as I suspect the spending will be localised and not large enough to make dents into the widespread debt peonage of the population with average unsecured debt at around £15,000 per capita. (https://www.theguardian.com/business/2019/jan/07/average-uk-household-debt-now-stands-at-record-15400)

Johnson also announced that no-one will have to sell their house for social care , yet Age UK has said that money for social care is only enough to keep things ticking over as they are. Johnson’s record of ‘mouth-farting’ doesn’t allow one to invest much confidence in these utterances.

This what the Tories have stated about Social Care:

‘the Conservative manifesto argues that, because social care is a “long-term problem” the party will “build a cross-party consensus to bring forward an answer that solves the problem, commands the widest possible support, and stands the test of time”.

It continues: “That consensus will consider a range of options but one condition we do make is that nobody needing care should be forced to sell their home to pay for it.”

While the manifesto set no timescale for this, nor any details about how the Conservatives would go about this, the Conservatives subsequently said it was something they would do in the first 100 days of being re-elected.’

One can see Grand Canyon sized get outs here!

I don’t see the Tories changing their deeply-ingrained economic thinking enough to not panic about running a stimulus like that. Remember Trump talking-up the Foxconn plant in Wisconsin? To employ 3000 in 2020 then 13,000 in 2022. Not even off the ground. These people are surrounded by quackonomists who ‘warn’ them off this ‘dangerous Keynesianism’.

With all the UK’s fiscal/monetary op-outs any UK government could have run a bigger deficit and enacted government investment policies rather than austerity. Nothing stopped them. Brexit may please some for different reasons (and it is a correct strategy in the long-term), but it has been a red-herring with regard to austerity in Britain. Which is why it puzzles me when you write: “The Tories will have restored sovereignty to Britain and freed themselves from the restrictive, neoliberal environment of the European Union”.

Isn’t it true that the restrictions they face are actually relatively minor (in exchange for not being able to e.g. vote on the board of the ECB etc, which hardly mattered to the UK anyway)? It seems to me incredibly optimistic to imagine that ‘restoring sovereignty’ to the UK, which it already has currency-wise, will somehow make ANY possible government use it to enact sound economic policy. In the meantime Brexit has already caused heavy social (and some economic) dislocation for hundreds of thousands of people caught in between and not just ‘city elites’. With no guarantee at all that this will somehow kick the supports from under the EU neoliberal project. For now I remain unconvinced by this ‘shock treatment’ strategy.

I’m glad that Robert H is ‘sanguine’ about the Tories and rocks gently in his rocking chair of complacency on his verandah entirely undisturbed by the suffering and upturned lives of those on Universal Credit who go through nightmares of insecurity due to in built absurdities of the system that the Tories do not intend to change, at least with no urgency.

Likewise, those having to pay the bedroom tax who have to consider moving out of their communities due to the extra bedroom they are deemed to have even when occupied by severely disabled adults that the government continues to fight in court creating stress and hell for some of our most vulnerable citizens.

‘Only one of the main parties regards the UK social security system as essentially fit for purpose – unsurprisingly the Conservative party, which has overseen it for the past nine years. After £34bn of benefit cuts since 2010, serial problems with its flagship benefit system, universal credit, and rising destitution among its poorest citizens, its manifesto message is broadly “we’ll give you more of the same”.'(Guardian https://www.theguardian.com/politics/2019/dec/10/welfare-misery-tories-universal-credit-child-poverty).

Good reasons to be ‘sanguine’ . But of course Robert calls it ‘prejudice’ if we offer any form of assessment about the Tories as he awards them honorary ‘tabula rasa’ status despite the facts listed above which they have no intention of changing or even offering a critique of.

Rock-away m’boy! Untouched by anything that might tarnish your serenity and peace of mind and your state of ‘choiceless awareness.’

@ dnm

“I’m not sure about your sanguine view. Disraeli was a consumate opportunist, and his political “philosophy” owed more than a little to the need to appeal to the new class of voters created by the enlargement of the franchise”.

But, but… wasn’t he (if my memory serves me right) himself the instigator of that very enlargement of the franchise? Which – if I’m right – makes him rather more than merely “a consummate opportunist” (which he undoubtedly was – so was Lincoln, and Roosevelt…).

It depends upon one’s point of view as to whether the same glass is “half-empty” or “half-full”!

As to Bojo, all I’m saying is “let’s wait and see”.

@ Simon Cohen

“I’m glad that Robert H is ‘sanguine’ about the Tories and rocks gently in his rocking chair…”

That made me chuckle i must admit! Perhaps if you’re lucky I’ll bequeath it to you – I think you’re in dire need of relaxation accompanied by some philosophical reflection. BTW you completely ignored the caveats I entered – but no surprises there,

Why not pause for a little while and let the dust settle? After all, endless variation on the same theme does get a bit wearing on the listener. And, please, don’t cite *anything* in The Guardian as authoritative. The Guardian’s pose as Olympian exemplar of rectitude and conscience of the nation wore a little thin some time ago. Or hadn’t you noticed?

“quackonomists” is very good!. I wish I’d thought of it!

(As Whistler riposted to Oscar Wilde:- “You will, Oscar, you will”).

These are the ‘predictions’ of a ‘Thatcherite monetarists’.

“In November M3 in the United States of America jumped by another 1.0%. In the last three months M3 rose at an annualised rate of 12.5% and in the year to November it was up by 8.5%. (We use the M3 estimates prepared by the advisory firm, Shadow Government Statistics.) These rates of money growth are a clear departure from the pattern (of annual money growth between 3% and 5%) which prevailed for eight years until spring 2019. If the Institute’s emphasis on the relationships between broad money and nominal GDP, and between real broad money and real aggregate demand, proves correct, early 2020 should see above-trend growth demand growth in the world’s largest economy. Given that the American economy is operating with low unemployment, above-trend demand growth implies capacity strains later in the year and risks of higher inflation in 2021. (The explanation for the upturn in US money growth is that to a significant extent the Federal deficit of $1,000b. is being financed from the banks, i.e., it is being monetised.)

Elsewhere the message is closer to ‘steady as she goes’. The Eurozone also has enjoyed rather strong money growth in recent months, but this feature has not been as marked as in the USA. In China and India money growth in 2019 has been steady at high rates appropriate in these economies with strong underlying trend growth in output. (But India suffers from serious ethnic and religious tensions at present, which may have economic consequences.) Japan’s money growth is stable at a very low rate, while the UK has a money growth recovery in conjunction with a clarification of the Brexit process. The overall conclusion is that during 2020 the world economy will see at least trend growth of demand and output, after a lacklustre 2019. “

@robertH

“Instigate” is too strong a word. The first Reform Act passed years before the start of his political career, but both parties were still reacting to it and to the political currents of intervening years (Chartists etc.). He opposed one Bill, and touted his own, both with an eye to electoral advantage.

As for Boris, I will be very surprised if he does any more than minimal voter appeasement, while allowing the neolib restructuring to continue as it has under previous recent conservative administrations.

@ dnm

It was the 1867 Act to which (dimly recalled) I was referring originally (not the 1832 Act – at which time Dizzy was only 28 and not yet an MP). I checked my facts and the following was the outcome:-

“The act of 1867 added 938,000 voters to an electorate of 1,057,000 in England and Wales. In towns working-class voters were in a majority, but most of the new county voters came from the middle class, and the general result was slightly in favour of the conservatives”. (Woodward, “The Age of Reform 1815-1870” in the Oxford History of England series, Oxford University Press, 2nd edition (1962)).

You wrote:- “As for Boris, I will be very surprised ,,,etc”

Either Boris will surprise you or dismay me. We shall see.

Derek’s citation of Simon Wren Lewis’s views on MMT sadly demonstrate that SWL still doesn’t understand MMT. I know that he didn’t use to, but I thought he might have learned by now, what with the paradigm shifting, and all, but evidently, he hasn’t. This is a pity, because this country desperately needs some of its own home-grown MMT-literate economists, or at least some who are genuinely willing to learn, which SWL evidently isn’t.

We need Bill’s MMT Ed programme to take off and succeed.

As for PM Johnson (I refuse to refer to him by his first name – he’s no friend of mine): he will give with one hand and take away with the other. This process has already started. He asked his cabinet to go through the books, and dig up any “vanity projects” left over from the days of Cameron and May, so they could be cut. I don’t know what sort of projects these might have been, but we can be sure that sooner or later, he will start cutting into worthwhile projects. That’s what Tories do.

And (perhaps a relatively small point), but he’d announced free parking in English hospitals. Turns out that will only be for a very small proportion of people who need to visit hospitals. Surprise, surprise. And given that most hospitals use their parking revenue to support their general expenditure (a dubious practice which would not be necessary in an ideal system), the limited amount of “free” parking which will be allowed will probably just fall on the hospitals’ own revenues, and will not be refunded in full by the government, if at all.

I find the statement – Simon Wren Lewis doesn’t understand MMT – hard to believe. What is there to understand? It seems blindingly obvious that MMT describes the way money works in an economy that issues its own currency. This man is a retired professor. Presumably he must have a minimum amount of intelligence to have got into that position. MMT isn’t like Quantum Electro Dynamics, it’s like basic arithmetic.

Ferdinand, you wrote: ‘In the meantime Brexit has already caused heavy social (and some economic) dislocation for hundreds of thousands of people caught in between and not just ‘city elites” Where is evidence of this? It’s like the sort of gloomy news The Guardian’s Brexit Watch has been trying to rake up and pin on Brexit for months ignoring whether it was actual and in any case, other economic factors occurring regardless of Brexit, such as private debt build-up. There are indeed many, but not hundreds of thousands, of citizens of other EU countries in the UK who have to get the better of the awful UK Home Office, just as other immigrants have had to do, with more inhumane consequences since Cameron’s idiot migration target boasts. To its credit, the Guardian did also remind me recently of the awful social dislocation of immigrants stuck on Lesbos, because of EU countries’ collective uselessness.