Today (April 18, 2024), the Australian Bureau of Statistics released the latest - Labour Force,…

Australian labour market – mediocre and worse to come

This is the ‘calm before the storm’ data release, although the calm is already pretty poor. It will get worse in months to come. The Australian Bureau of Statistics released of its latest data today (March 19, 2020) – Labour Force, Australia, February 2020 – which continues to show that the Australian economy is in a weak state with a fairly moderate labour market performance being recorded for the start of 2020. The culprit in the coming months will be the coronavirus. But to date there is one culprit – the Australian government – which has been starving spending by its obsessive pursuit of a fiscal surplus. Employment growth was weak – 0.2 per cent and only outstripped the change in the labour force because participation fell by 0.1 points. As a consequence, unemployment fell by 26,400 as about that many workers exited the labour force. The fall in broad labour underutilisation from 13.9 per cent to 13.7 per cent is all due to the decline in participation. There were a total of 1,882.1 thousand workers either unemployed or underemployed. This is a deplorable result. My overall assessment is that the Australian labour market remains a considerable distance from full employment and that that distance is increasing. With the coronavirus about to dwarf everything, the prior need for a fiscal stimulus of around 2 per cent has changed to a fiscal stimulus requirement of several times that. There is clear room for some serious fiscal policy expansion at present and the Federal government should not delay any further.

The summary ABS Labour Force (seasonally adjusted) estimates for February 2020 are:

- Employment increased by 26,700 (0.2 per cent) – Full-time employment increased 6,700 and part-time employment increased 20,000.

- Unemployment decreased 26,400 to 699,100 persons.

- The official unemployment rate decreased by 0.2 points to 5.1 per cent because participation fell.

- The participation rate decreased by 0.1 points to 66 per cent.

- Aggregate monthly hours worked decreased by 3 million hours (0.17 per cent).

- Underemployment rose marginally (5.1 thousand) but the underemployment rate was steady at 8.6 per cent. Overall there are 1,183.1 thousand underemployed workers. The total labour underutilisation rate (unemployment plus underemployment) decreased by 0.2 points to 13.7 per cent. There were a total of 1,882.1 thousand workers either unemployed or underemployed.

Employment – modest rise overall in February 2020

1. Employment increased by 26,700 (0.2 per cent). This is mediocre.

2. Full-time employment increased 6,700 and part-time employment increased 20,000.

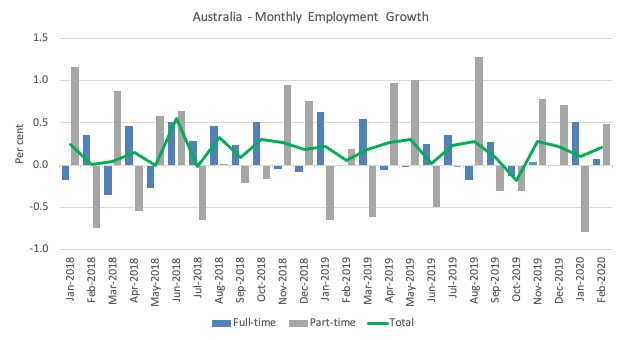

The following graph shows the month by month growth in full-time (blue columns), part-time (grey columns) and total employment (green line) for the 24 months to February 2020 using seasonally adjusted data.

The zig-zag pattern where employment growth has regularly been around zero remains evident.

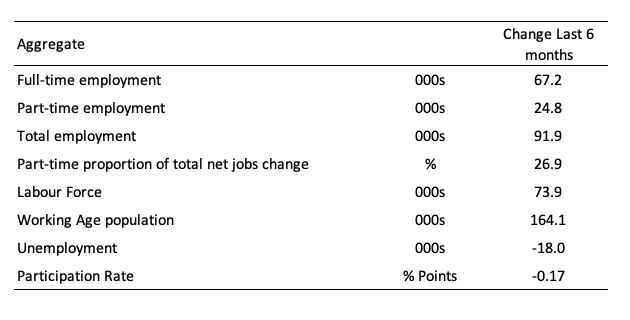

The following table provides an accounting summary of the labour market performance over the last six months.

As the monthly data is highly variable, this Table provides a longer view which allows for a better assessment of the trends.

Assessment:

1. Total employment has outstripped the labour force change because participation has fallen by 0.17 points.

2. As a consequence unemployment has fallen by 18 thousand.

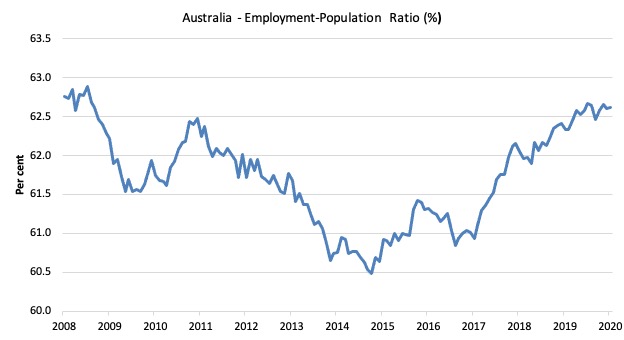

Given the variation in the labour force estimates, it is sometimes useful to examine the Employment-to-Population ratio (%) because the underlying population estimates (denominator) are less cyclical and subject to variation than the labour force estimates. This is an alternative measure of the robustness of activity to the unemployment rate, which is sensitive to those labour force swings.

The following graph shows the Employment-to-Population ratio, since February 2008 (the low-point unemployment rate of the last cycle).

It dived with the onset of the GFC, recovered under the boost provided by the fiscal stimulus packages but then went backwards again as the Federal government imposed fiscal austerity in a hare-brained attempt at achieving a fiscal surplus in 2012.

The ratio was constant in February 2020 at 62.6 per cent and remains below pre-GFC peak in April 2008 of 62.9 per cent.

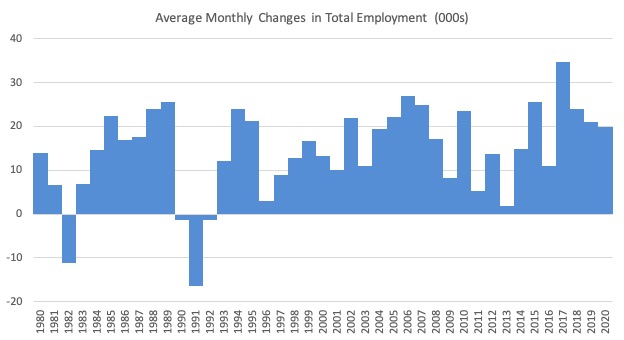

To put the current monthly performance into perspective, the following graph shows the average monthly employment change for the calendar years from 1980 to 2020 (to date).

It is clear that after some lean years, 2017 was a much stronger year if total employment is the indicator.

It is also clear that the labour market weakened considerably over 2018 and that situation worsened in 2019.

2020 has not started well.

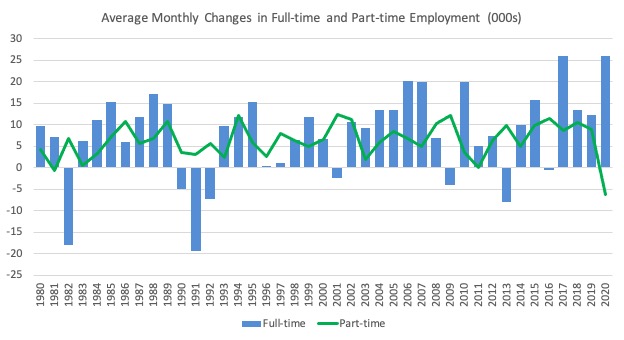

The following graph shows the average monthly changes in Full-time and Part-time employment (lower panel) in thousands since 1980.

The interesting result is that during recessions or slow-downs, it is full-time employment that takes the bulk of the adjustment. Even when full-time employment growth is negative, part-time employment usually continues to grow.

Remember: the average for 2020 is on two-months only (explaining the dive in part-time employment)

Unemployment decreased 26,400 to 699,100 persons because overall participation fell

The official unemployment rate decreased by 0.2 points to 5.1 per cent but this was due to the decline in labour force participation (see below).

The actual values were 5.290 per cent in January 2020 and 5.097 per cent in February 2020.

The policy settings are such (austerity bias) that unemployment is now stuck at elevated levels with an strong upward bias as a result of the coronavirus crisis.

Without a massive fiscal intervention, unemployment could easily hit 10 per cent by the end of the financial year (June).

It is also well above the level that would be associated with any inflationary impulses being sourced from the labour market

The Government has been deliberately holding unemployment at a level that will restrict wages growth and increase family hardship.

It has forced us to begin this next crisis in a much worse shape than the nation was in prior to the GFC. The consequences will be correspondingly worse.

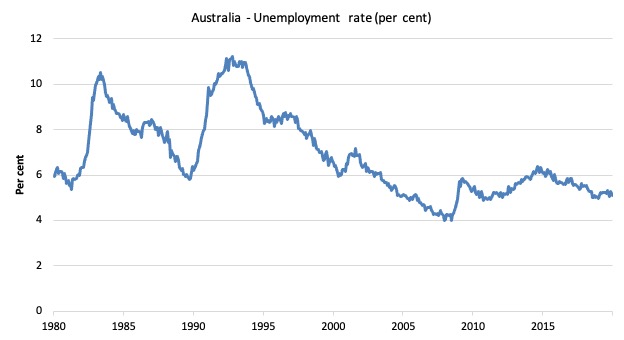

The following graph shows the national unemployment rate from January 1980 to February 2020. The longer time-series helps frame some perspective to what is happening at present.

Assessment:

1. It is still 0.2 points above the level it fell to as a result of the fiscal stimulus (which was withdrawn too early) and 1.1 points above the level reached before the GFC began.

2. There is clearly still considerable slack in the labour market that could be absorbed with fiscal stimulus.

3. Its persistently elevated level is directly related to the fiscal austerity that the Federal government has in place. Worse is to come.

Broad labour underutilisation fell by 0.2 points to 13.7 per cent because overall participation fell.

The results for February 2020 are (seasonally adjusted):

1. Underemployment rose marginally (5.1 thousand) but the underemployment rate was steady at 8.6 per cent.

2. Overall there are 1,183.1 thousand underemployed workers.

3. The total labour underutilisation rate (unemployment plus underemployment) decreased by 0.2 points to 13.7 per cent.

4. There were a total of 1,882.1 thousand workers either unemployed or underemployed.

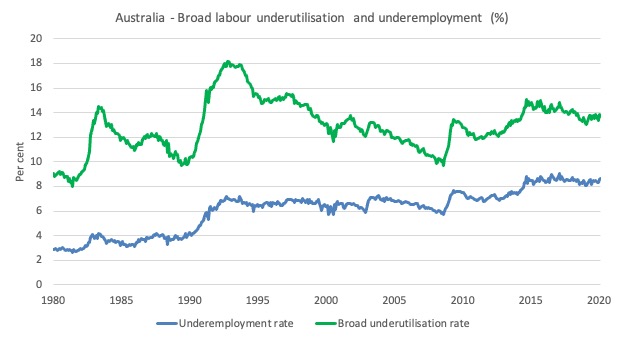

The following graph plots the seasonally-adjusted underemployment rate in Australia from January 1980 to the February 2020 (blue line) and the broad underutilisation rate over the same period (green line).

The difference between the two lines is the unemployment rate.

The three cyclical peaks correspond to the 1982, 1991 recessions and the more recent downturn.

The other difference between now and the two earlier cycles is that the recovery triggered by the fiscal stimulus in 2008-09 did not persist and as soon as the ‘fiscal surplus’ fetish kicked in in 2012, things went backwards very quickly.

The two earlier peaks were sharp but steadily declined. The last peak fell away on the back of the stimulus but turned again when the stimulus was withdrawn.

In the coming months these graphs will turn sharply upwards.

If hidden unemployment (given the depressed participation rate) is added to the broad ABS figure the best-case (conservative) scenario would see a underutilisation rate well above 15 per cent at present. Please read my blog post – Australian labour underutilisation rate is at least 13.4 per cent – for more discussion on this point.

Aggregate participation rate – decreased by 0.1 points to 66 per cent

The fall in the labour force participation rate eased the pressure on official unemployment.

By how much would unemployment have risen if the participation rate had not fallen?

The labour force is a subset of the working-age population (those above 15 years old). The proportion of the working-age population that constitutes the labour force is called the labour force participation rate. Thus changes in the labour force can impact on the official unemployment rate, and, as a result, movements in the latter need to be interpreted carefully. A rising unemployment rate may not indicate a recessing economy.

The labour force can expand as a result of general population growth and/or increases in the labour force participation rates.

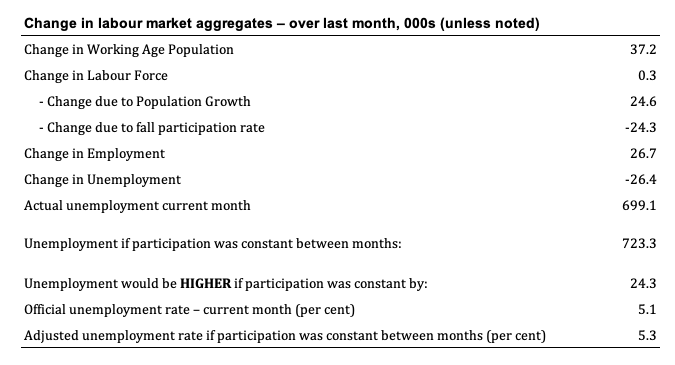

The following Table shows the breakdown in the changes to the main aggregates (Labour Force, Employment and Unemployment) and the impact of the rise in the participation rate.

The change in the labour force in February 2020 was the outcome of two separate factors:

- The underlying population growth added 24.6 thousand persons to the labour force. The population growth impact on the labour force aggregate is relatively steady from month to month but has slowed in recent months; and

- The fall in the participation rate meant that there were 24.3 thousand workers dropping out of the labour force (relative to what would have occurred had the participation rate remained unchanged).

- The net result was that the labour force increased by only 0.3 thousand (rounded).

Assessment:

1. If the participation rate had not have fallen, total unemployment, at the current employment level, would have been 723.3 thousand rather than the official count of 699.1 thousand as recorded by the ABS – a difference of 24.3 thousand workers (the ‘participation effect’).

2. Without the fall in the participation rate in February 2020, the unemployment rate would have been 5.3 per cent (rounded) rather than its current value of 5.1 per cent (rounded).

3. Hidden unemployment rose slightly in February 2020 – a sign of a weakening situation.

4. In other words, the entire drop in unemployment and the unemployment rate is due to the drop in participation – nothing therefore to celebrate.

Teenage labour market – full-time employment contracts further in February 2020

1. Total teenage net employment rose by 9.6 thousand in February 2020.

2. Full-time teenage employment fell by 4.9 thousand and part-time employment rose by 14.4 thousand.

3. The teenage unemployment rate fell by 0.4 points to 18 per cent.

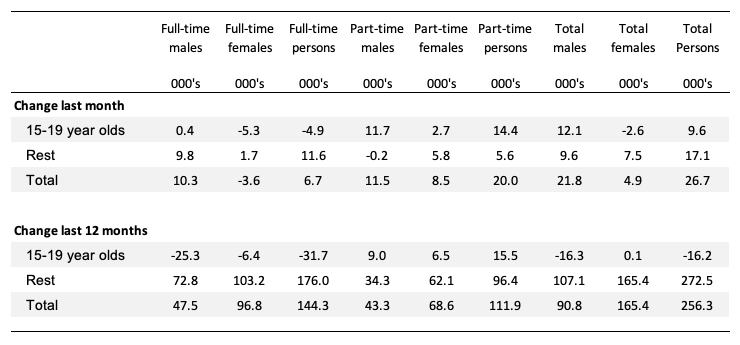

The following Table shows the distribution of net employment creation in the last month and the last 12 months by full-time/part-time status and age/gender category (15-19 year olds and the rest).

Over the last 12 months, teenagers have lost 16.2 thousand net jobs, while the rest of the labour force gained 256.3 (net) jobs. The overall shift in employment is fairly weak.

In terms of the current cycle, which began after the last low-point unemployment rate month (February 2008), the following results are relevant:

1. Since February 2008, there have been 2,367.6 thousand (net) jobs added to the Australian economy but teenagers have lost 75.7 thousand over the same period.

2. Since February 2008, teenagers have lost 125.9 thousand full-time jobs (net).

3. Even in the traditionally, concentrated teenage segment – part-time employment, teenagers have gained only 50.2 thousand jobs (net) even though 1124.1 thousand part-time jobs have been added overall.

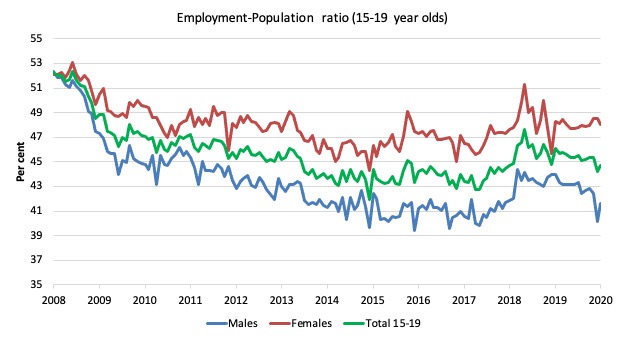

To put the teenage employment situation in a scale context (relative to their size in the population) the following graph shows the Employment-Population ratios for males, females and total 15-19 year olds since February 2008.

You can interpret this graph as depicting the loss of employment relative to the underlying population of each cohort. We would expect (at least) that this ratio should be constant if not rising somewhat (depending on school participation rates).

The absolute loss of jobs reported above has impacted more on males than females.

The male ratio has fallen by 10.7 percentage points since February 2008, the female ratio has fallen by 4.1 percentage points and the overall teenage employment-population ratio has fallen by 7.5 percentage points.

The other statistic relating to the teenage labour market that is worth highlighting is the decline in the participation rate since the beginning of 2008 when it peaked in February at 61.4 per cent.

In February 2020, the participation rate was just 54.6 per cent. This is a very unreliable statistic overall – it fluctuates widely on a monthly basis.

However, the difference between the 2008 level, amounts to an additional 94 thousand teenagers who have dropped out of the labour force as a result of the weak conditions since the crisis.

If we added them back into the labour force the teenage unemployment rate would be 26.4 per cent rather than the official estimate for February 2020 of 18 per cent.

Some may have decided to return to full-time education and abandoned their plans to work. But the data suggests the official unemployment rate is significantly understating the actual situation that teenagers face in the Australian labour market.

Overall, the performance of the teenage labour market leaves a lot to be desired. The decline in full-time employment for teenagers was particularly worrying.

This situation doesn’t rate much priority in the policy debate, which is surprising given that this is our future workforce in an ageing population. Future productivity growth will determine whether the ageing population enjoys a higher standard of living than now or goes backwards.

I continue to recommend that the Australian government immediately announce a major public sector job creation program aimed at employing all the unemployed 15-19 year olds, who are not in full-time education or a credible apprenticeship program.

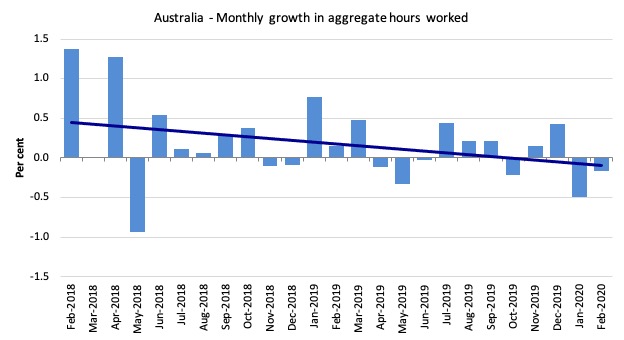

Hours worked decreased by 3 million hours (0.17 per cent) in February 2020

The second consecutive month that working hours have fallen.

The following graph shows the monthly growth (in per cent) over the last 24 months.

The dark linear line is a simple regression trend of the monthly change – which depicts a decreasing trend.

Conclusion

My standard monthly warning: we always have to be careful interpreting month to month movements given the way the Labour Force Survey is constructed and implemented.

This is the ‘calm before the storm’ data release and the situation will get much worse in months to come.

The February 2020 data reveals that the Australian economy is in a weak state with a fairly moderate labour market performance being recorded.

Employment growth was weak – 0.2 per cent and only outstripped the change in the labour force because participation fell by 0.1 points.

As a consequence, unemployment fell by 26,400 as about that many workers exited the labour force.

The fall in broad labour underutilisation from 13.9 per cent to 13.7 per cent is all due to the decline in participation. There were a total of 1,882.1 thousand workers either unemployed or underemployed.

This is a deplorable result.

My overall assessment is:

1. The current situation can best be characterised as being in a weak and deteriorating state.

2. The Australian labour market remains a considerable distance from full employment and that that distance is increasing.

3. This persistence in labour wastage indicates that the policy settings are to tight (biased to austerity) and deliberately reducing growth and income generation.

4. With the coronavirus about to dwarf everything, the prior need for a fiscal stimulus of around 2 per cent has changed to a fiscal stimulus requirement of several times that.

5. There is clear room for some serious fiscal policy expansion at present and the Federal government should not delay any further.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

Hi Bill

The question being debated is who do we look after. A fellow called Christopher Joye thinks it should traders in RBMS. Here is a recent contribution of his:

“When all is said and done, markets will get what they want through signalling what is and is not acceptable. Order will eventually be restored. And this crisis will pass, probably within one or two months. Those that survive will face the investment opportunity of a lifetime. ”

From his article:

https://www.afr.com/markets/debt-markets/virus-gets-upper-hand-in-battle-against-central-banks-20200313-p549ru

Former deputy governor of the Reserve Bank replied today:

https://www.afr.com/policy/economy/the-rba-s-job-is-to-back-banks-not-bail-out-gamblers-20200316-p54agp

Loved thislchallenge:

Now you want the RBA to rescue all these markets, right across the board: “It is imperative that global synchronised monetary policy immediately offers to vouchsafe liquidity and funding to all parts of the financial system.” Phew! “Vouchsafe liquidity and funding”. It has a biblical cadence, but doesn’t it just mean “bail out”?

And again. I have noted your comments and Warren Mosler’s that QE is like shifting of money from a savings account to a checking account and it won’t have an impact. At the same time, someone like RBMS trader, Christopher Joye, wants it. What is in it for him?

https://www.afr.com/wealth/personal-finance/central-banks-battle-global-virus-20200306-p547hd

Bill,

Off Topic but regarding the job guarantee.

Have you seen this in the Daily Mail this morning with the heading…

EVERY Briton could be paid a universal salary by the government to see them through the crisis.

Job guarantee without the work

Coronavirus – the ultimate test

It seems that the virus has reached its peak in China and is now due to fall and this may be followed more quickly worldwide than initially supposed.

In view of the colossal global fiscal injection already committed it is possible therefore that the efforts to sustain living standards and associated infrastructure investments will achieve their aim (notwithstanding all the friction generated in trying to ascertain who should get what and when).

What next? All this has to be unwind to some extent as economies recover – some obviously more quickly than others. It is timely for MMT devotees to describe the process involved and the principles involved in ensuring that the results are thriving economies free of large disruptive imbalances or inflationary bias.

Is anyone willing to embark on this explanatory task for us.

Gogs,

The explanation itself (of the “unwinding”) is desperately simple – recognise the money creation capacity of the currency issuer; its reception by the central bank chiefs is the tricky bit.

Thanks Neil for your reference to the central bank’s role in the unwinding process, but I am still having difficulty in determining how MMT principles will be applied in practice in what is likely to be a highly politically dominated process.

I am envisaging a sequence of events where there may be conflicting views of how the “unwinding” process should be prioritized (I cannot for instance, see all elements of society being satisfied with the pace at which life returns to some acceptable level of activity – something which has its origins in the government’s original endeavours to meet the differing conditions of employee and gig sectors, for example. And of course, there will be many other such conflicts of equity and priority.

The unwinding will be the same old same old.

Deficits have to be slashed

National debt has to be halved. They will set an imaginary figure that needs to be reached.

Cuts will have to be made on all the per usual scale goats.

They will not go off script they will stay to it to the letter. Exactly, what happened after the financial crash.

It will be imperative for MMT’ rs to highlight the flaws and myths in their arguments now the curtain has been pulled back.

I would not be surprised in the future if a MMT economist writes a book about it. How MMT principles were used during the virus.

Thinking about it.

It would be a fascinating book.

Using the time line of the virus and using every response each continent used, over laying all of those with the fundamentals of MMT. Showing how MMT’ rs were right all along and should be used during normal times. Highlighting the flaws and myths right across the timeline in mainstream thinking.

You see the future of this crisis a little differently to me, Derek. If I have interpreted your remarks correctly the criticism you make is on the historic role of monetary economics (mainstream). But I see a Western world that has absorbed the lessons (finally) of Keynes (Kalecki) and is prepared to run up GDP deficits that were previously considered sinful (I take Trump as an example).

The result of international economics having observed an ideological illumination is that the focus of attention shifts from balanced budgets to the desire to allocate resources more beneficial to the well-being of society.

That transformation throws the responsibility on politicians to find an appropriate policy format rather than hide behind the competitive process of a capitalistic market place. But politicians are nevertheless, still going to find it extremely hard to prioritize policy that will satisfy society’s many factions – in fact it will be much harder in many respects than relying on an abstract arbitrator like “The Market”.

That’s why I think the post-caronavirus political economy will be rather fascinating.

> It seems that the virus has reached its peak in China and is now due to fall and this may be followed more quickly worldwide than initially supposed.

It’s hard to believe it can be contained effectively everywhere while life returns to normal, it’s characteristics make it very hard to track with freedom of movement and gathering. It’s much more likely that we are going to have several waves with varying levels of restrictions until it no longer threatens health system collapse.

Unless it mutates, then all bets are off.

World economies will be highly unstable and depressed until there is widespread herd immunity in the major economies, e.g. more than 70 % of the population have immunity. This could be achieved by sufficient people contracting and surviving COVID-90, or by vaccination.

Unfortunately effective accination will take at least 2 years, possibly much longer. Meanwhile the current policies of containment/suppression of the disease will prevent or delay the development of herd immunity at enormous social and economic cost.

.

The recent very influential (Imperial College London) report can be downloaded from:

https://www.imperial.ac.uk/media/imperial-college/medicine/sph/ide/gida-fellowships/Imperial-College-COVID19-NPI-modelling-16-03-2020.pdf

.

This report is being widely interpreted as justifying a short-term supression policy. However, on my reading, the report justifies the original UK strategy – take the pain now ass much as possible and go for herd immunity asp.

.

Figure 3 in the report seems to show that a rigorous suppression strategy now will merely postpone the crisis – it will greatly reduce the crisis in May-June 2020, but a few months after the measures are relaxed the crisis will re-appear (in December 2020).

.

The authors state that:

“we emphasise that is not at all certain that suppression will succeed long term; no public health intervention with such disruptive effects on society has been previously attempted for such a long duration of time. How populations and societies will respond remains unclear.”

“Unless it mutates, then all bets are off.”

How viruses “mutate” is fascinating – particularly RNA viruses like this one.

Essentially these viruses replicate themselves by causing a cell to create bits of virus and the new viruses are formed via the quantum mechanical effects of protein folding. Which means that if a cell happens to be infected by two or three different viruses the resulting virus that reconstructs can be a chimera of all of them.

That effect is most pronounced when you have lots of viruses flying around in a dirty space with live hosts in close proximity – Chinese wet markets and First World War trenches.

I’m with Gogs. There may never be a better teaching opportunity for MMT than the proposing of solutions to the current corona virus panic/pandemic–not on the medical side, of course, but on the economic side; i.e., HOW WE PAY FOR what needs to be done to protect public health and mitigate recession/depression. I hope that as we speak, the key figures in the MMT movement are following Bill’s lead and teleconferencing to come up with detailed proposals to present, as a united front, to currency-sovereign countries struggling to control this crisis. Has there ever been a time when the concept of fiat money, invested wisely and responsibly, might be better received by both politicians and the public?

@ Neil Wilson

Thanks for being so thoughtful as to share that piece of truly fascinating information.

You can have no idea how much more cheerful about the future reading it made me feel,

(I’m 84 by the way. Might one ask;- how old are you?)

I hope gogs and Newton are right out future depends on it.

But we have been here before. I just can’t see them surrendering what they have built over decades.It will still be one he’ll of a fight.

I explained it to my colleagues showing and explaining to them how the truth is staring them in the face. They still do not get it and it is there right in front of them.

They say our taxes will need to go up or we will be leaving the debt to our children and grandchildren. When I asked them where all this money is coming from. The money has to come from somewhere they do not believe where it comes from when you tell them.

How hard do you think it will be for the neoliberals to keep the hundreds of millions on side who think like that and they control the media. When the vast majority can’t see it when it is right in front of them ??

Try it with your friends and family and colleagues and see what response you get. They will look at you as if you have 3 heads. When the truth is right under their noses.

It is a fantastic opportunity for us but they are not going to surrender. They would rather rewrite history and lie about it just like the financial crash.

Derek, I like you I have tried to impart MMT principles to family and friends. A few do get it but most do not and yes they react as if you’ve gone off the planet. In the wider world and mainstream media it’s all dominated by taxes fund spending, deficits result in debts that will have to be repaid eventually and will embeggar taxpayers for years etc,

I find it enormously frustrating, the damage done and the pain that will be inflicted on the poorest and most vulnerable.

It is interesting that so many are advocating a UBI, some for a permanent one and others for a limited time, no one is advocating a job guarantee. I find that unfortunate. While a job guarantee is probably not useful at the moment when we are all told to stay at home, it should be considered for the future. A UBI is not suitable for the long term. In my view it would just encourage companies to keep more of their profits.

@ Patricia Smith

My opinion for what it’s worth is that you’re right on all counts.

It took me an awfully long time (even after I first began getting to grips with what MMT tells us) to become convinced about the JG’s merits. Now that I have I *still* think it’s a difficult concept to convey. I just can’t imagine its conceptual basis being assimilated among the wider public, only among a small subset..

Nevertheless while before I regarded it as a bit of an albatross around MMT exponents’ necks, and thought they therefore ought to downplay it almost to invisibility, I’ve changed my mind about that: it does indeed seem to occupy a pivotal place and therefore to be an integral part of the theory’s implementation.

So, how to communicate it?. My view is that there’s only one way, namely by demonstrating it in action; and how does that get to be done? That where my thinking comes to a halt, alas.

@robertH

The demonstration in action of the job guarantee (or the nearest thing to it I can think of) was FDR’s Works Progress Administration (WPA) in the US during the Great Depression.

It *can* be done. Is there the will to do it?

“The demonstration in action of the job guarantee (or the nearest thing to it I can think of) was FDR’s Works Progress Administration (WPA) in the US during the Great Depression.”

Yes, that’s the one usually cited and it does of course provide a number of pointers. But there’s no way it could carry any weight across any broad cross-section of today’s population nine decades later as a demonstration of the JG concept *in action* – excepting only a tiny fraction of history-buffs and MMT nerds.

“The past is a foreign country …”

.

@ Kingsley Lewis

I haven’t read the IC report yet (but I will). Thanks for the link.

Even in default of having yet read it, however, I do have some qualms about its drift (as summarised in your post).

If I’ve understood correctly, building the “critical mass” for widespread herd immunity demands a certain quantum of sacrificial victims along the way. Since I’m personally well into the cohort in which most of those sacrificial victims would be found, you’ll probably understand my qualms!

From an entirely self-centred point of view I would most strongly object to adoption of anything short of the most rigorous achievable suppression policy because that’s the only one that appreciably lengthens the odds in favour of my surviving to whatever (uncertain) time I was going to have died anyway rather than of my being cut down by covid-19 prematurely – so to speak.

It becomes a simple matter of individual self-preservation when viewed from the micro POV: notwithstanding that seen coldbloodedly from the macro POV it might be regarded as being for the sake of the common good were I (and others of my age-cohort) to have been sacrificed, that hardly provides any consolation at the personal level when one is oneself directly in the line of fire (which I take it you, for example, are not).

On another site I’m seeing glimps of the plan in USA.

I live in SE Asia now and so am cut off to some extent.

Is the plan really to —

1] Provide sick leave to 20% of the population?

2] To provide aid in the form of tax credits for later and not cash now?

3] To give a lot to people who make 70K/yr. and nothing to those who make 10K/yr.

If so then MMT is not being used. And is too little to save the economy.

Also, then the plan is evil, very evil.

No Steve that isn’t the plan. As bad as we in the US often are, we are not complete idiots.

So, anyone, what is the plan in the USA?

Especially, will people on Soc. Sec. get any cash?

Maybe to help pay their co-pays for Medicare.

Steve, seen on another site:

“During the Democratic presidential primary debate this past Sunday, Joe Biden was asked how he would respond to the coronavirus pandemic sweeping the world.

His response: “Nobody will pay for anything having to do with the crisis. This is a national emergency. There isn’t a question of whether or not this is something that could be covered by insurance, or anything else. We, out of the Treasury, are going to pay for this.

This was a noticeable rhetorical shift for Biden, who has spent the entire primary season attacking his opponent Bernie Sanders for not adequately explaining how he would “pay for” his ambitious spending proposals, and who only days ago indicated that as president, he would veto legislation enacting Medicare for All because of concern over the price tag. Indeed, Biden has been a proud deficit hawk his entire career”.

…………

So…with this view now evidently becoming more widely held in congress, perhaps we can hope for a less evil plan than the one you fear…..

BTW, way off topic,

I was on a site called BoardGameGeek.

It is for board gamers. It has conventions so people are more known for who they really are.

I used to post about AGW, aka ACC; MMT and other of my personal ideas.

It really needs someone to carry on about MMT and maybe ACC too.

If you want real conversation with many people commenting on things this site is for you, even if the only board game you know is “Monopoly”.

PS, do not mention me. I got banned for suggesting that European nations should do a better job of enforcing the laws against hurting others.

Ignominy is not going to enhance MMT knowledge

As we open up the floodgates of funding to counteract the enormous economic consequences of coronavirus there is worldwide relief that governments are finding a way to support living standards. There is also universal recognition of the heroism of front-line medical staff and other key workers who take enormous risks to themselves and their families by manning check-outs at local supermarkets.

We all look forward to a time in the not too distant future when life starts to return to normal; indeed, I am already being asked rudimentary questions about the repercussions of burgeoning government debt – surely, I am asked, this will impose considerable burdens on future generations.

No, I say with less than full confidence in my convictions. I cite an Australian with a different view on how economies work, especially with regarding the role of money. When I try to explain that taxation does not fulfill the role the role most people ascribe to it I realize I’ve already conceded the argument .

If I go on to describe the role of government debt as being very different to that of household debt I realize my sanity is about to be queried and if I also say that this Australian treats opposing views on economics with ignominy it only adds to my dilemma – and I wouldn’t dare mention that the Aussie has ideological views that correspond in many ways to Jeremy Corbyn.

So, while I might cite in my defence numerous supportive viewpoints on the role of taxation, I can’t find succinct explanations of the role of government debt – even Bill’s favourite example seems to be downplayed by Japanese commentators.

Yet, if we are to convince the electorate that there is indeed a better economic way beyond coronavirus (whatever ideological label you wish to give it) the ordinary man and woman must appreciate that this complex economic world is capable of being understood.

It would help therefore if the protagonists involved in this interminable feud refrained a little more from carrying out something that looks to the ordinary citizen like a cartoon series.

Bill,

As others have said, I find it strange and disturbing that the US MMT community seem to be advocating UBI. They have not taken into consideration that the response to the virus may actually cause a supply shock, thus making huge stimulus possibly very risky re inflation.

If we thought stimulus was necessary, I can think of many more targetted ways of spending, including JG, strengthening social security and enhancing the public sector.

Kind Regards.

Well Charles, at the moment a large percentage of us are forbidden to go to work so as not to spread this thing as much as possible. Some sort of UBI or at least a temporary cash payment for a time is going to be necessary if people are to pay their rents or mortgages and utility bills and buy food. I guess my point would be that it is a bad time to start a job guarantee if you already don’t want people to leave their homes. That is just going to have to wait until it is safer. And something needs to be done immediately.

Jerry Brown,

But UBI is payments to everyone whether they need it or not. I absolutely think there is a place for transfers to people who need it, either through ehanced social security, or some other method. I think giving money to people who don’t need it is wasteful and inflationary.

Charles J, at the moment I am afraid it would be too difficult to distinguish those who really need it from those who don’t really. And too divisive. And it has to happen very soon. Not saying that if we had six months to come up with a better plan we couldn’t. I’m saying that in the US we can’t wait six months for a better plan. Believe me- I am all for a Job Guarantee and not for permanent UBI program. But this thing has happened and we need to mitigate the effects that we can mitigate right now.

Jerry,

You say UBI needs to be done, but you haven’t addressed my contention that the reaction to this virus will also be affecting supply, as well as demand, and therefore we have to consider any inflationary risk, and mitigate against it somehow if there is.

Oh yes there is a supply shock here. Especially in hospitals as medical workers get sick. But we know how to grow food as you can tell by looking at the average fat American. I don’t expect (desperately hope) that part of our economy will suffer too much of a supply disruption. A temporary income support can enable people to purchase that food. Anyways- if you are worried giving rich people money is going to cause inflation- take comfort that they probably will just put it in the bank rather than run out and spend it causing inflation. Plus so many of them lost money in the stock market over the last few weeks I’m almost feeling sorry for them. Well not quite that. Still say screw most of them most of the time.

And I would rather higher inflation than more homeless hungry people any day of the week.

Jerry,

I could not agree more with everything you wrote there.

You said what I was going to say.

Three thumbs for you.

Giving the last Koch brother a few $K will not change their net worth enough to matter, at all.

I just hope they *give* us retired people a few $K also. Less than everyone else would be fair though.

Thanks Steve.

@ jerry Brown

“… at the moment I am afraid it would be too difficult to distinguish those who really need it from those who don’t really. And too divisive”.

That seems to me to be a decisive argument: I’d go slightly further and say “impossible” rather than “too difficult”.

Which begs the question:- what size of universal payment – assuming it to be lump-sum not continuing income-support – is being envisaged under such a scheme *for those whose need is greatest*? Strikes me that’s a pretty fundamental (and very tricky) judgment having to be made.

@ Steve

“I just hope they *give* us retired people a few $K also. Less than everyone else would be fair though”.

On what grounds could one differentiate between retired people who *needed less* (or none?) and those who would be among the cases most of all in need regardless of whether retired or not)?

@ both

However, isn’t it the case that the social-welfare-type income supports already in place in all (or most, other than the USA) developed countries are already aimed *in principle* at doing what you’re proposing? Accepting that of course they all might need temporarily (like for a year or more) beefing-up in various well-targeted ways? A formidable administrative task, admittedly.

Maybe what you’re both reflecting is what’s generally perceived elsewhere as being a woefully inadequate level of basic social support in the USA? Therefore, as saying the USA is a special case?

Robert, I don’t know enough to comment on the actualities of social welfare in other countries. I honestly don’t even know enough about what the US has. Been fortunate enough to not need to deal with them personally for the most part. Consistently advocating more for many years though.

If you know many Americans you probably know many of us think the US has always been a ‘special case’. Often we call it exceptional rather than special but it is basically patriotism and a lack of actual historical knowledge.

But whatever. Supposedly our Senate is going to vote on some sort of emergency assistance in 7 hours. I suppose the House of Representatives won’t oppose it and I think the Donald will sign it. Should know in 24 hours what they have come up with. I’m sure there will be plenty wrong with it but hopefully some helpful things.

And then when it is law they will appropriate the funds and we will see MMT in action as always.

Robert,

Most people on Soc. Sec. have no other job. So, they have not lost any income.

Most people on S.S get *all* their income from their Gov. payment.

I’m not sure the actual percentages but it has got to be over 50% and so “most”.

They may have more out go though. Maybe Medicare co-pays.

Jerry,

When I was talking about a supply contraction, I was not talking about medical supplies or food. I was talking about bars, gyms, cinemas etc, and all the other services that we are being told not to use, and are therefore contracting. There is no way around that.

I think it is worth mentioning that at least New York State has been declared a disaster zone and is therefore eligible for Federal Emergency Management Agency assistance- which to my knowledge doesn’t come with any fixed budget limit. They are setting up field hospitals in New York according to the Governor. So that is also a federal government response to this crisis. And this will happen in other states and we will see it will only be limited by our real resources constraints. And it is MMT being demonstrated also. Man this is difficult times

Charles if we can’t use them at all how can we spend extra on them and cause inflation? It isn’t a time to worry about inflation.

I’ll take this chance to remind everyone that our Bill has defined ‘inflation’ as a sustained rise in the price level.

A short rise in prices that stops but doesn’t drop back is NOT inflation with Bill’s definition.

It must be sustained. I guess it’s because the market can adjust if it isn’t sustained.

To all of you (us) who wonder about the validity of a Job Guarantee, it is because everybody who is physically able should be given such benefits so they may partake in useful work; have adequate holidays and work a set number of hours; always rely on professional standards of social and medicinal benefits. The time will come when such guarantees of living to a minimum standard will no longer be necessary, but until we achieve that and leave behind the current fashion for ‘dog eat dog’ which western civilisation encourages, the need for a Job Guarantee will continue.

We have suddenly been set adrift on dangerous and uncharted waters. NOW is the time for the simple concept of fiat money–yes, simple, easily understood by even a child–to supplant the false household budget paradigm hammered into the public and political mind. Perhaps the best and quickest way to do this is to ask people to imagine that they had a perfect counterfeiting machine in their basement, able to crank out currency indistinguishable from official forms of money. Would they have any worry in the world about meeting their family expenses and paying their bills? THEY don’t have such a perfect counterfeiting machine, of course, but currency-sovereign governments DO. In fact, it’s NOT a counterfeiting machine at all but the very official way that very official money is created. Those focused on ferreting out the details and nuances of MMT may shrink from this brutally honest and blunt approach, but it’s the only way I can imagine to bring the essential point of MMT home to the masses now reeling from the existential crises brought on by the global pandemic/panic. Coupled with making this essential point should be erasing, once and for all, the bugaboo of inflation, again with a simple explanation that inflation occurs only when too many dollars (or whatever) are chasing too few goods and services. So long as those goods and services remain underutilized and available or can easily and quickly be expanded, there is NO inflation problem. End of a very short and vitally necessary story to be told ASAP to a global audience that will never be more receptive to hear it, believe it, and embrace it. MMT’s moment is NOW!

@ Newton Finn

Agree 100% with your declared aim.

Also think your exposition (“MMT for Dummies”?) is first-class – the best of its kind I can remember seeing.

So, you have my vote 🙂

What next?

(BTW although British my home is in a eurozone country, so analogous in MMT terms to any single one of the American states – which means I could not anyway make use of your script without radical re-working. But that’s no criticism of it of course).