Today (April 18, 2024), the Australian Bureau of Statistics released the latest - Labour Force,…

The government should pay the workers 100 per cent, not rely on wage subsidies

The buzz-word at the moment in Australian government and policy circles is ‘hibernation’ – the government is hoping, that the economy can behave like a crocodile and find some ‘river bank’ and have a ‘good sleep’ until the pandemic is over, at which time, it will burst forth into a new growth phase and unless the virus mutates into something worse in the meantime then all will be well. Their policy interventions to date – while they have been like dragging a chain as their conservative instincts are being dragged very quickly into the demands and realities of real world macroeconomics, which is different to the nonsense that is taught by mainstream economists in our now depleted universities – have been crafted to ensure nothing important changes in a structural sense in our socio-economic lives. The problem is that the existing system, which they are hoping to put into hibernation for a while, is putrid to the core and needs major changes if we are to achieve a socio-ecological transformation. Remember the failings of neoliberalism? Remember climate change? Remember the poles melting? Remember the engineered cuts to workers who rely on penalty rates at weekends to maintain a sense of material prosperity? Remember the 13.7 per cent labour underutilisation rate? Remember the failed public transport and energy sectors, privatised and lacking in investment? Remember the financial markets that were exposed by the recent Royal Commission as corrupt, inefficient and downright dangerous to the our material and psychological prosperity? We don’t need a hibernation. We need the Government to take advantage of the dislocation that is currently occurring to make some basic changes. Like wiping out the gig economy. Like … read on. At present, the stimulus interventions, which are mostly about saving capitalism from itself. We should be demanding much more.

There seems to be some consternation about the use of the term ‘stimulus’ to describe the government fiscal interventions around the world at present.

Sure, they are, to use the most-repeated word at present ‘unprecedented’, unless one goes back in history – history tells us things.

Sure, they are not your usual garden-variety fiscal stimulus to fill the gap left by a slump in business investment expenditure due to a bout of pessimism or a flight to saving by households for the same reason.

The scale is something else. I agree.

And the source of the crisis is quite different.

So we might think of what is going on as a major rescue mission.

But then I hold the view that one job lost anytime due to a lack of overall spending is a crisis and needs a rescue mission.

But if the language is to retain meaning and historical continuity, then what is going on is a fiscal stimulus! Sorry to disagree with those who think otherwise.

A fiscal stimulus is introduced when non-government spending falls (collapses in this case) and non-government economic activity needs to be stimulated.

The hibernation concept is clearly more about maintenance (more on this below) recognising, that for a time, economic activity will be lower by some margin because people cannot work (sickness or otherwise).

But if the fiscal intervention is properly designed then there should be no reason for us to slip into the horror story scenarios that are playing out in the media.

The Government’s latest salvo – hibernation

Crocodiles hibernate like other animals. They enter a “state of inactivity” where they reduce their metabolic rate” in order to “conserve energy when sufficient food is unavailable” (Source).

Prior to entering this state, the animals fatten up to ensure they have “enough energy to last through the duration of their dormant period.” That is, they ‘fatten up’ or store up nuts.

The Australian Treasurer has been talking about the challenge for the government is to design a policy intervention which will put the economy into hibernation.

The problems are many both in practical and ideological terms.

First, the economy did not ‘fatten up’ before the crisis. It was already heading towards recession as households started to reduce their consumption spending growth in the context of record levels of debt, business firms were refusing to invest, and government was blindly trying to conjure a surplus out of a train wreck it was creating.

When we entered the GFC, the unemployment rate was 4 per cent and the underemployment rate was 5.9 per cent and the broad labour utilisation rate (the sum of the two) was 9.9 per cent.

So at that point the economy was some distant from full employment and needed stimulus.

Now, the unemployment rate (before the COVID-19 impacts) is 5.1 per cent, the underemployment rate is 8.6 per cent and the broad rate is 13.7 per cent.

And the real GDP growth rate is around 2 per cent, which is, depending on how you measure it, between 1.25 and 1.5 percentage points below trend and the gap is widening.

So before the virus crisis, there was a need for fiscal stimulus of around 1.5 to 2 per cent of GDP, just to get us out of the prospect of recession.

Second, trying to put an economy to sleep implies that all the existing relationships – employee/boss; debtor/creditor; renter/owner; pension recipient/pension fund; and any number of contractual relationships – can be frozen in time and space.

What is actually going to happen is that the state will have to become more dominant as private capital withers somewhat.

Loans to business are largely useless to arrest the collapse. I covered this previously. Firms will not borrow if there are not sales to transact and produce for.

Loading up debt on an already heavily indebted sector, no matter how cheap the funds might be, is not a sound strategy.

Around the world, governments are responding to the likely unemployment crisis with offers, of varying degrees of generosity, of wage subsidies.

The British government is now willing to pay “80% of the wages for a furloughed employee, subject to a cap of £2,500 a month” as long as the employer maintains the relationship.

In addition, the – Coronavirus Job Retention Scheme – will also pay:

… employer National Insurance and pension contributions of furloughed workers – on top of 80% of salary …

The British government is encouraging furloughed workers to volunteer to help the NHS, while their existing workplace is closed. Many retail and hospitality workers are in this exposed group.

A furloughed worker is apparently one that has not been sacked, but, rather, is on unpaid leave from their usual employment.

There also appears to be no limit to the fiscal outlay proposed for this program.

And while I don’t wish to conduct a microscopic critique of the scheme, there are many issues that undermine the efficacy and equity of the scheme. As I understand the detail more I might write something specific about it.

But, overall, there is limited conditionality imposed on the employer. For example, the employer does not need to be paying the additional 20 per cent.

So the risk of enterprise is not borne by the employer – they get 80 per cent of the salary paid by government and the workers take a 20 per cent wage cut.

That appears to be a common theme emerging in all these wage subsidy schemes that even unions are falling over themselves to praise.

The Australian government released Fiscal Stimulus Mark 3.0 yesterday and the centrepiece is the wage subsidy scheme.

They resisted this sort of intervention but the business lobby has pressured them to introduce the subsidy.

And why wouldn’t they?

The details of the scheme are still being publicised but we know that:

1. The federal government will pay businesses a fortnightly subsidy of $A1,500 per employee under the ‘JobKeeper’ program.

2. The projected outlays will be worth $A130 billion and this takes the sum total of the three fiscal interventions, so far, to 10.7 per cent of GDP.

3. Firms would have to pass on the full amount to workers.

4. The scheme will last for only six months backdated to March 1, 2020.

4. To access the subsidy, a firm with an annual turnover of less than $1 million has to have faced a 30 per cent fall in revenue in March 2020. If the turnover is more than a million then the turnover drop has to be 50 per cent. As usual, in these sorts of threshold rules, those on either side of the border are treated quite differently.

4. It differs from the British wage subsidy, which only applies to furloughed workers. Any worker that has already been laid-off would have to be reemployed for the firm to get the subsidy.

5. An advantage of the scheme, is that low income earners will probably receive a pay increase, given they earn less than $A750 per week. The minimum wage in Australia is currently $A740.80 per week.

6. In other words, an employer can hire, rehire, or retain minimum wage workers under the JobKeeper subsidy and get the worker’s efforts for no outlay, courtesy of the government.

7. However, the sunset clause means that things will have to be back to normal by the end of September or else we could see massive layoffs occurring. That typically happens with wage subsidy schemes. When the scheme ends, either overall or for a particular worker, the firms shed the labour.

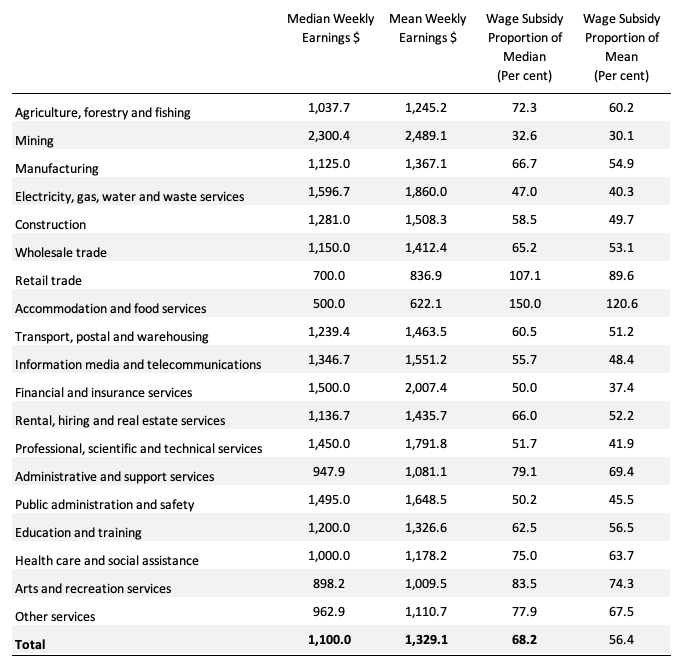

The following table shows the Median and Mean Weekly Earnings ($A) across the Australian industry structure as at August 2019 (most recent data).

The final columns expresses the wage subsidy as a percentage of the median and mean earnings.

The Treasurer said that:

This $1,500 payment is a flat payment and is the equivalent of around 70 per cent of the median wage and represents about 100 per cent of of the median wage in those sectors most heavily impacted by the coronavirus like retail, like hospitality and tourism.

While that is true, the data in the table is incomplete.

The following facts apply as at August 2019:

1. Median weekly earnings for workers with paid leave entitlements for the nation as a whole were $A1,250.

2. For workers without paid leave entitlements the figure was $A542 per week.

3. The overall total was $A1,110 per week.

4. In that context, the wage subsidy for the median worker with existing entitlements would be only 60 per cent of their weekly pay.

5. For full-time workers, the subsidy will be worth about 50 per cent of the median weekly pay. In their case, the firms will likely lay the worker off.

Another issue of the wage subsidy is that it allows firms that are ‘high-cost, low productivity’ to survive, when many of these might reasonably go broke and their worker reabsorbed elsewhere, given the stimulus measures will support economic growth to some extent.

I am usually opposed to wage subsidies because firms typically exploit them and lay off workers immediately on their termination, or take them for jobs they were going to create anyway.

In this case, though, the playing field is quite, starkly different.

Firms are facing extinction as they are forced into hibernation by the governments – state and federal.

But the fact that many workers will still lose their jobs because the wage subsidy is too low relative to their weekly wage is a major shortcoming of the scheme.

Further, think about the low-wage workers. The wage subsidy is a per head payment independent of hours workers.

So imagine a situation where a firm has several underemployed workers on its books all working a few hours a week each. Underemployment is rife in the sectors that have been forced to close or restrict their custom.

In this situation, the firm could offer more hours to, say one worker, and take them up to, perhaps, full-time work, given that the average extra hours an underemployed workers desires is around 14.

They would likely only be paying the minimum wage anyway, especially as penalty rates in many of the sectors most affected have been cut over the last few years.

In that case they could lay-off a number of workers and save on the administrative costs of maintaining them on the books and pass the wage subsidy onto a single worker working longer hours than before.

That is not a desirable implication.

Moreoever, a firm can only claim the JobKeeper payment for a casual worker as long as they have been contracted for the last 12 months. The very nature of the sectors most exposed to casual work – short contracts – militates against these workers under the scheme.

And what of the gig economy in general. These workers are considered to be ‘entrepreneurs’ as they are legally cast as independent contractors, which is a convenient dodge used by employers to get around paying a host of statutory payments, which would be forthcoming if they were classified as employees.

In this case, the worker is the firm and would only get help under the scheme if their revenue had fallen by at least 30 per cent since the beginning of March. The level of accountability required to establish that may be beyond the capacity of the workers who buzz around our cities these days on scooters delivering all sorts of stuff.

It is also undesirable to impose wage cuts on workers because of the way we enter into financial arrangements in the normal course of our lives. A major commitment that many workers enter into is the purchase of their homes. Further, workers use credit to smooth their consumption expenditure over time. These contractual commitments are always specified in nominal (that is, money) terms. For example, a worker has to pay a certain quantity of dollars per month to service their home mortgage.

In other words, the solvency of the workers is a nominal concept. If they cannot get sufficient money each period to service their nominal contractual commitments then they are in trouble.

In this context, if the general price level rises and the real value of their money wage declines, for a time, they are able to change their budget allocations (perhaps eliminate some non-necessary items of expenditure) and still maintain their nominal contractual obligations. At some point, this becomes impossible but within the usual variations in the real wage this is how households cope.

However, if the real wage was to be adjusted via reductions in the money wage, workers might find they do not have enough money income in a period to service their contractual obligations and they would then have to default and face insolvency.

It is better to pay the workers directly

For all the reasons noted above I am opposed to the wage subsidy scheme.

I don’t think workers should have to take a significant wage cut.

Why are governments only willing to cover a proportion of the wages of workers in the crisis?

Currency-issuing governments clearly have no financial constraints preventing them paying the entire wage bill if it wanted.

In Australia, compensation of employees (wages and salaries) constituted 42.2 per cent of GDP in the December-quarter 2019 or $A212,320 million.

Total individual income tax revenue received by the federal government is around $A230 million or around 46 per cent of GDP. Company tax revenue is about 20 per cent of GDP.

So think about that sort of scale in the context of the 6-month wage subsidy worth $A130 billion.

Given all the anomalies associated with the wage subsidy, it would be much better giving the payments directly to workers.

If the firms were reluctant to retain the services of the worker, the worker would still receive the payment but the firm would receive no productive benefit.

So there is a massive incentive for firms to keep the worker employed and the hysteresis effects of long-term unemployment are thus avoided.

Clearly, not all workers will lose their jobs or even face the prospect of losing their jobs.

In my blog post last Thursday – “We need the state to bail out the entire nation” (March 26, 2020) – I provided some arithmetic assessments of the possible unemployment disaster, based on historical aggregates.

The following Table is conjectural and depends on a lot of unknowns. The government could render it irrelevant if it chooses the right policies.

We started this crisis with 720 thousand unemployed and an unemployment rate of 5.2 per cent (that is, in a much worse state than the period leading into the GFC).

We also have much higher underemployment now than we had then.

| Fall in GDP (per cent) | Rise in UR (points) | Estimated UR (per cent) | Unemployment (000s) | Change in Unemployment (000s) |

| 1 | 2.3 | 7.5 | 1,024 | 304 |

| 2 | 4.5 | 9.7 | 1,335 | 615 |

| 3 | 6.8 | 12.0 | 1,647 | 927 |

| 4 | 9.1 | 14.3 | 1,958 | 1,238 |

| 5 | 11.4 | 16.6 | 2,269 | 1,549 |

| 6 | 13.6 | 18.8 | 2,580 | 1,860 |

| 7 | 15.9 | 21.1 | 2,892 | 2,172 |

| 8 | 18.2 | 23.4 | 3,203 | 2,483 |

| 9 | 20.5 | 25.7 | 3,514 | 2,794 |

| 10 | 22.7 | 29.9 | 3,826 | 3,106 |

The point is that even if GDP contracts by 10 per cent, the unemployment rate might only rise to 29.9 per cent with an extra 3,106 workers losing their jobs.

The alternative wage payment plan

I thus advocate that the following:

1. The federal government offers a full-wage payment to any worker who has lost their job since March 1, 2020, based on the last pay slip they received. This would apply to all income recipients.

2. Firms could negotiate with these workers to restore their employment for the duration of the crisis. A sunset clause would have to be a rolling date based on medical advice.

3. Where governmental restrictions were operating on firms – closures etc – the firms could reemploy the worker and the government would continue to pay the wage, while the worker was in social inclusion for whatever reason.

4. Workers unable to perform their current work would be able to participate in a range of activities aimed at advancing public purpose as long as medically-safe working environments could be found.

5. Penalty rates would be restored based on the June 30, 2018 levels and added to the estimated income of workers that the government would pay.

6. Any worker that was previously unemployed (before March 1, 2020) would be offered an unconditional job at a socially-inclusive minimum wage – a Job Guarantee – which would become a permanent automatic stabiliser in the Australian economy. A range of other benefits – social wage (child care, transport subsidies, etc) and training opportunities would be available.

Where there were insufficient medically-safe activities to perform in the current climate, the Job Guarantee workers would be paid their full wage entitlements and maintained in employment, but stood down until it was safe to venture forth.

7. The government would legislate so that all gig economy workers were of the same legal status as employees.

8. The government would pay all entitlements that an employee with entitlements receives to those workers currently without entitlements for the duration of crisis.

The annual publication – Characteristics of Employment, Australia – (most recent release August 2019) allows us to assess the scale of the problem for casual workers without entitlements.

From Table 3. Distribution of weekly earnings for employees by industry we see that:

(a) There were 10,683 thousand employees in August 2019.

(b) 8,081.2 thousand had paid leave entitlements (75.9 per cent).

(c) 2,601.8 thousand did not have paid leave entitlements (24.4 per cent).

(d) The proportions between the ‘haves’ and the ‘have-nots’ in this regard has been relatively stable over the last several years, although the ‘have-nots’ have expanded somewhat in relative terms.

(e) The data only allows us to determine these proportions for employees. It does not include the Owner managers of incorporated enterprises, independent contractors or self-employed.

(f) If we considered employees without paid leave entitlements as a proportion of all workers then the proportion falls to 20.13 per cent.

Thus, the federal government would pay sick pay entitlements etc to those currently not enjoying these benefits, notwithstanding casual loadings (which are insufficient anyway to bridge the gap) that would normally be attributed to a worker the 75.9 per cent of employees.

9. There would not have to be any rental subsidies, or suspension of credit or mortgage debt payments, because there would be no income losses.

Locking in the status quo

The entire concept of hibernation as constructed by the Australian government is to salvage capitalism from itself.

There is no recognition that there was a serious crisis on our hands even before we entered the medical emergency. What the government wants to do is to reduce the scale of the collapse and preserve the status quo so that it is back to business as usual when the virus is contained (if it ever will be).

I reject that logic.

We were facing a socio-ecological crisis even before the medical crisis. The former doesn’t go away just because all of us are now at risk of sickness and death from the coronavirus.

If you think about the way the US stimulus has been designed, it is a wonder any Democrat supported it in the Senate. It is an unashamed handout to Wall Street and the finance sector with a dollop of support for the unemployed.

And the same thing applies to the Australian intervention.

Firms are not required to alter the way they do business, banks are not required to stop being speculative casinos, big polluters can go on polluting, gig economy employers (sorry hirers of fellow entrepreneurs) are not required to improve working conditions or share the risk of enterprise with the workers, and so on.

The firms just get a free kick, particularly if they employ workers at the lower ends of the income distribution scale, for the next 6 months. Party time for them.

Shareholders are not forced to take a hit. The risk is transferred from them to the public purse. The public purse can easily take that risk. That is not the issue.

The issue is if the government is injecting more than 10 per cent of GDP into the economy over the next several months, why doesn’t it use that injection to advance a solution to the socio-ecological crisis?

And I am still worried that the austerity-turn will come sooner than later and we will be back to that again.

We might overcome the virus but the neoliberal infestation continues unabated.

Conclusion

I will consider these issues further in the coming days.

We haven’t yet discussed nationalisation of essential services, transport etc.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

Hi Bill,

‘And I am still worried that the austerity-turn will come sooner than later and we will be back to that again.’

Both major parties have already started to talk about this. Framing the spending as sustainable, and trotting out that the huge new debt must be paid back in future. The scene is already being set for what they will do post this intervention.

The shadow treasurer was at it this morning banging on about the debt and it will need to be paid by our children. Frustrating listening to it.

Mark.

Notwithstanding the economic analysis here, off-guardian.org holds 24 statements dated 24 and 28 March by virologists and epidemiologists from various countries (Germany, UK, Italy, UK, USA) questioning the statistical and medical basis of the current 24/7 media Narrative. They include an open letter to Merkel from a Mainz professor who at one time apparently was the most cited scientist in Germany.

It is shameful that there appears to be no medical person inside the self-sealing Australian news bubble to dissent from the Book of Revelation-style Narrative of the meejah, the ones who brought us Saddam’s WMD (?); Martin Bryant at Port Arthur; 9/11; the Vietnamese motor boat (non-) attack “causing” the US war with N. Vietnam, and many more.

Unlike overseas, not a single medico or other academic or other public servant has questioned the sudden cuts in civil liberties, even the usual left-liberal Law academics have seemingly self-isolated.

@Mark Noonan

Yep, as expected Jim Chalmers was bleating on about “generational debt” , completely unable to be straight with the public (I suspect he actually does understand) simply because he is a politician. He stressed that the level ot government spending that was occurring is necessary and more would likely be needed but naturally, he made no attempt to correct the interviewer who rabbited away about the debt being borne by our children.

“And I am still worried that the austerity-turn will come sooner than later and we will be back to that again.”

Yes, very much. Or if inflation would rise due to a supply shock, it would be blamed on the stimulus.

There’s no limit to human stupidity.

“who rabbited away about the debt being borne by our children.”

That has to be countered ever time by asking “and whose children are you going to take the asset from?”.

It’s vitally important we get the message across that the ‘asset’ circulates in the same way as the ‘debt’ and is passed down the generations too – largely in our pension funds.

That is a good plan Bill. But it would never make it through the US Congress unless at least twice as much was added in for business interests as for the workers. Just my opinion of course.

Isnt looking great is it,hiw do they expect to go back to ,normal,After this ,hiw can we go back to private sector debt ?and wheres the production …it would be dystopian surely ,modern version of work camps etc…its fecked

Fortunately there is an alternative to lockdowns and drastic government interventions in the economy.

(1) Protection of the elderly and vulnerable (maybe 10% of the population). These account for the bulk of COVID-19 deaths. Extra public spending will be required for this.

(2) The remaining 90% of us should be allowed to go about our normal social and economic lives. The majority will get the virus, but most will survive without severe symptoms. When about 60% have had the virus and survived (probably within 1 year) the disease will become far less prevalent, i.e. “herd immunity” will develop.

Sadly perhaps 0.2% will die. But this is likely to be the case eventually even with containment/suppression policies.

Moreover, the serious adverse effects of lockdowns, business failures and unemployment etc. on physical and mental health and social life would be avoided.

They were all saying that we had reached the end of the credit boom. That the Banks couldn’t lend any more. The 99% had no money. It was just like every other drop in the capitalist cycle. But then we got a new shock. The virus. Which stops our workforce from producing anything other than food. And medicine (if you’re not one of the unfortunates living in the US). So we’ll all (well those who are not one of the class of workers who take our rubbish etc) just sit on our hands (in our homes) till the stockpile – sorry, the virus – is gone. Just like old times.

Neil, that perennial question about who bears the debt burden invariably sets me thinking.

What of debt-ridden governments that can no longer play a dominant role in the world economy, where fiscal expansions have for instance failed to generate much growth in GDP.

I can’t trace Bill’s commentary on this aspect.

What “debt burden”?

All money is either saved or spent. If it is spent it is taxed away. In a sovereign money system it can’t go anywhere else.

Any interest paid is spent, which generates activity, which employs people producing output for the interest receivers, or it is saved which is inert.

Interest on government debt is little more than a welfare payment. If we don’t like who gets that welfare, then we need to change the instruments so the right people get the welfare. Or stopping issuing welfare payments.

It was like a breath of fresh air, hearing the governor of the Bank of Canada admit early on that monetary policy had run out of ammunition to combat yet another crisis, and then proceed to recommend strong fiscal policy intervention.

Then came the shameful squabbles among parliamentarians over who should wield the lions share of any fiscal authority put into play? This gave a sense of nostalgia for the late 1970’s and 80’s.

The governments response to date has been less than radical; similar measures to put the old paradigm on ventilator support until the virus passes, debts to be deferred a few months etc.

The only activist component seems to be an unstated decision to prune any weaker players out of the economy, by offering loans were there should be subsidies, and setting wage subsidies at 75% of the former income, and then only for businesses reporting a 30% or greater decline in revenue.

The cat is nonetheless out of the bag now, the admission of the unsatisfactory nature of monetary measures when the brown stuff hits the fan, is a significant one, and the years ahead are going to get interesting.

National security concerns dominate western nations, who may not move much faster with change than the US, where the complete inadequacy of lassiez faire capitalism to cope with any great crisis has become quite evident at this point.

Neil, of course, yes it is about the distribution of income that is important – and I presume in an economy that is declining in the world order that becomes a very big political question.

I assume too that a JG in a similarly declining (comparatively) economy that has replaced the thrusting capitalist free-for-all with a more benevolent welfare society there could well be similarly important distribution questions to consider.

“The issue is if the government is injecting more than 10 per cent of GDP into the economy over the next several months, why doesn’t it use that injection to advance a solution to the socio-ecological crisis?”

The most important question not uttered by really anybody but Bill so far. The prominent U.S. MMTers are talking hibernation/stasis when massive vulnerabilities have been exposed by the virus that can only be addressed by a much larger public sector. I would push for direct government sector employment at competitive wages in addition to a JG to address this crisis.

We’ve known for a long time that we live in plutocracies. Of course, plutocrats will go to any lengths, under threat, to preserve their elite position, so why be surprised or even outraged when current actions are being taken precisely as one would anticipate? Still, there is a new opening right now for those who desire a better, more beautiful world, for those of us who have not allowed ourselves to become resigned to “fallen” human nature and the consequently corrupt social orders it “inherently” engenders. Because the trillions being instantly poured into shoring up the status quo proves beyond dispute the validity of MMT’s understanding of fiat money, we know that such money can also be used for other, nobler purposes. And because this current pandemic has hit the one nerve of humanity that has remained alive under neoliberalism, emergency medicine, we have an extraordinary opportunity to make our case that fiat money be created and employed to take care of everyone, not merely the elite, in a host of other ways as Bill suggests. Why do I cite emergency medicine as perhaps the last humanistic neoliberal outlier? Just think about what happens here in America when a homeless person collapses in the street. First responders rush to the scene, the homeless person is taken in an ambulance to the nearest hospital, and perhaps hundreds of thousands of dollars of medical care are provided on the spot to him or her. The humanity ends there, of course, because as soon as the homeless person is revived and stabilized, he or she is sent back to the street for it to happen all over again. But while this is largely an American example (since we lack universal health care), I consider it a telling example, because America, in so many ways, is the most neoliberal of nations. My overriding point is that we have an opening, a big opening, a long-term opening, a life-and-death opening, to demand that fiat money, the existence of which can no longer be denied, come to the rescue of all of us and to our precious, imperiled planet, which gives life not only to us but to all living things. If we focus on this bigger picture and not allow ourselves to get distracted and bent out of shape by each successive self-protective machination of the plutocrats, I believe we can move a substantial distance toward that better, more beautiful world which is vitally necessary to avoid further human degradation and looming global ecocide. Things for me have come full circle. The revolution I thought was around the corner as a young man has instead burst forth before an old man’s eyes. But it can catch fire and gradually consume the status quo only if we, to use William James’ language, will ourselves to believe that it can, overcome our cynicism and pessimism and summon every last vestige of our hope and courage. Neoliberalism drained from us the one thing that Albert Schweitzer said was essential for genuine civilization: belief in human moral and spiritual progress. We must seize this extraordinary moment not only to begin to reclaim the political state but also to reclaim at once this existential state, which neoliberalism has done all in its power to erode, indeed to mock. Bill is obviously with the program, has been for a long, long time, has devoted his life to it. Are the rest of us up to it? Each can answer only for him or herself.

Major problems in the UK with poorer families with kids now at home having to increase debt to cope.

Still major issues with the five week wait for Universal Credit which was initially introduced as an extra punitive measure to further demonise welfare claimants.

Could well be a stacking up of mortgage debt over the next few months as well:

‘This means you will see an increase in your monthly mortgage repayments once your mortgage payment holiday period is over. The shorter the term left on your mortgage, the larger the increase in your monthly payments, once the mortgage payment holiday is over. You should consider the impact the higher mortgage repayments will have on your future monthly financial commitments.’

All the myths about ‘how do we pay back the money’ are being wheeled out with fury, so don’t expect much change once we are hopefully through this. let’s remember we are dealing with shysters here: witness Johnson talking in a faux emotive manner about ‘OUR NHS’ the man that was part of a Government that would see the whole thing being outsourced to hell but then Redcar, Grimsby and Scunthorpe came along and the possessive pronoun was wheeled out.

oh, and just in case anyone thinks the Tories have ditched mainstream thinking, here’s the Work and Pensions minister mouth-farting justification for the benefit increase (which, in real terms, is no increase):

‘”Our balanced fiscal approach has built a strong economy, with 3.6 million more people in work since 2010. And it’s that strong economy which allows us to bolster the welfare safety net by increasing benefit payments for working-age claimants now.”

The condescension and hypocrisy never ends.

Robert Pearson makes a good point…….

“We need to keep shouting this. You cannot attempt to stimulate demand in the face of a massive supply shock. If MMT doesn’t fight this, we are going to be blamed for the inflation. Point out that creating money to purchase real resources, that are no longer going to be for sale, might not end well.

We should all be very concerned at the number of policymakers that acknowledge we need to slash the productive capacity of the economy, by telling all but essential workers to sit at home, whilst simultaneously trying to ensure that the purchasing power of all households and some) firms remains at levels only slightly below pre-crisis levels. Incomes of all, both those still working and those whose job is effectively to now stay at home, have to fall to match the fall in the productive capacity of the economy. After all, if the plan is only to supply essential goods and services, then it is only essential goods and services that we will be able to buy. We won’t need any income above what is necessary to buy what is available for sale. Maintaining incomes at 80% of pre-crisis levels or higher will inevitably lead to price inflation of those essential goods and services that are still being produced (which we’re already seeing). It’s a horrible message to have to get across, but it’s very simple. We cannot consume more than we are producing and we should not even be attempting to try to do so. ”

So are we relying too much on the Tory government doing the right thing ?

Does our fate lie in the hands of the right ?

1. They can keep incomes high as long as spending stays low. There are good reasons to do this, tools they can use to keep spending down, and good reason to think spending may stay down on its own.The

2. They could keep incomes high at the lower end to help people pay down debt and accumulate some savings. They can hope spending stays down because

a) People don’t want/ can’t spend that much at the moment anyway.

b) They can just ask them not to spend (volunteer saving policies),

c) They can order the public not to spend (although I doubt that would be necessary) and/or

d) If it gets that bad and there ends up being shortages and they need to ration, the rationing itself will prevent three public from spending.

e) Job guarentee/ UBI / deficit spending in the form of a helicopter drop.

f) Will they tell that outfit that is swapping illiquid assets for liquid ones to stop doing it. The asset has to be a government liability – Will they make it a long dated govt bond, but that’s still pretty liquid. Would they make it a bond that cannot be sold, and cannot be pledged. Will they make a registered bond (gov has the name of the person who owns it) and not redeemable until the maturity date.

g) Will they do things like deferred pay and introduce refundable taxes.

Or will they since they have their hands on the levers. Do what they always do and not let a good crises go to waste. Allow inflation to explode and blame MMT and reset policies to match the neoliberal agenda.

Stay tuned and find out on the next episode of soap……..

In my opinion, reading the comments in the so-called mainstream media, there is zero chance of any change of the paradigm when the coronavirus lockdown ends. Neoliberalism is firmly in place and “fiscal discipline” will be restored like the Bourbon monarchy in France after 1815. “They had learned nothing and forgotten nothing.”

Only little countries on the periphery like Poland or Hungary which are in fact not “liberal” but “illiberal” democracies can buckle the trend and only in one way – “Hear Nothing, See Nothing, Say Nothing”. The neoliberalism in Poland (represented by people like prof. Jerzy Hausner) is rearing its ugly head for the third time. The liberals are fretting about our grandchildren having to pay back the public debt.

If another Balcerowicz’s plan is implemented and unemployment gets again above 20% mark, Poland as a nation will not survive another wave of emigration because of the very low fertility rate. This will not be allowed to happen as the nationalists have means to suppress the liberals, branded as a “fifth column”. But virtually nobody speaks about the MMT. One thing is to talk, another to quietly move things around.

On the Australian front, the former Reserve Bank governor Bernie Fraser said “There is going to be an awful overhang of debt and at some point there is going to have to be a bit of reckoning with that and some winding back.” If austerity is implemented, the housing bubble will collapse. The balance sheet depression (not recession) will follow. I would say that residential real estate is the real place where there is an awful amount of overhang. A lot of families owe $500k, what will happen if the value of the property falls below $400k? We have seen this phenomenon in the US. The government cannot prevent the fall in the price of the residential land unless the RBA starts buying real housing assets in another round of the QE. This is not very likely to happen.

This is the final collapse of the neoliberal socioeconomic system in English speaking countries, not just another crisis. We are transitioning to Latin American model with strongmen in power, a small group of ultra-rich oligarchs pulling the strings, a hollowed middle class desperately trying to cling to the old lifestyle and the rest of population living in true poverty. A century of stagnation will follow and the centre of human civilisation and progress has already moved to East Asia.

I can now see why Bill is taking the time to write a 10 point MMT plan for the crises.

He smells what could happen since the right in both the US and the UK have their hands on the levers. Could easily cause inflation and then blame MMT.

The US not so much because Trump has an election to face and will do everything to get the economy back on track.

Not so much in the UK we have just had the election so they could allow inflation to explode to keep their gold standard, fixed exchange rate myths alive. Nobody will listen how we would have done it differently they would simply add spending + inflation = MMT.

So I wouldn’t celebrate in the UK just yet. The virus could make or break us will it land on heads of tails.

By the end of it all if the Tories allow inflation to explode.

Simon Wren Lewis and his merry band of liberals will be screaming louder than ever for his unelected, technocratic, fiscal councils made up of the usual suspects.

We are standing naked, waist deep in shark invested waters wondering which way the tide is going to turn.

Many say it will never be same after this.

The establishment are laughing saying oh yes it can. Let’s have inflation rates of 10%. We will show you how to keep things the same. We’ll train the public to shout MMT instead of Venezuela and Zimbabwe.

What is the point in govt paying 100% of the salary of people earning $120k at a time when no one can spend their money in the economy as normal? There does seem to be good reason to think in terms of hibernation given so many goods and services are off limits.

Enforcing hibernation instead of trying to mimic business as usual increases the chances that large numbers of people will change their thinking. Most people haven’t yet been exposed to ideas like a job guarantee. The longer this dislocation lasts, the more hope there is that new ideas will be considered and adapted. And to be frank, the more that Steuart Robert’s “deserving people” end up on the scrap heap, the less likely a neoliberal snapback will be, and the more likely people-friendly ideas will be floated.

Dear Bill

I would like to suggest an alternative to your suggestions as I feel its more important to get people working again quickly and producing. Unfortunately some industries will not be able to be saved.

I see the fiscal stimulus as slightly different.

My suggestions

1) 20% reduction in all HECS debt

2) No charges for 2020 courses. Its important to get the tertiary education sector up and running again.

3) Initiate a billion tree planting program through all local councils (3 years)

4) Accelerate major gov’t capital works eg Badgerys creek

5) Identify a number of industries whereby we need to have in Australia and subsidies there capital works, eg masks and gowns, pharmaceuticals. Also strategic oil reserve.

6) Offer 10000 places in military for under 25, can learn to cook, drive trucks, etc.

7) Initiate a rural bridge replacement program.

8) Convert all sewage treatment systems Australia wide to tertiary treatment.

9) Build 10 new hospitals specifically for the aged or quarantine (futureproof).

10) Have airline kitchens make meals for all pensioners in isolation in conjunction with meals on wheels.

Main comment is to build the economy. For our future. We cannot wallow in isolation for ever.

And take advantage of the opportunity to build job guarantee positions.

Kind thoughts to you and your family.

A walk to Bar Beach is not so bad in April.

Cheers

Lots of things

Nothing will change unless the pictures in our heads change.

Instead of looking at what IS and being flexible, we look at the pictures rigidly and try to make them reality – rather than looking at reality and being fluid with it. The reality of a human being is that they want to be fulfilled.

Covid-19 makes it harder because it requires us to have strength, courage and clarity – to not give the virus to anyone and to not get the virus from anyone, First – then deal with the economy.

The Aus-govt. has not responded in a timely or effective way to covid-19 because the pictures in their heads are different to the pictures in the heads of independent medical professionals (or environmental scientists). The general public are confused. In India, the pictures in Modi’s head said lock down the country for three weeks; and the reality is he has created a human disaster that could end up spreading covid-19 far more widely and rapidly in that country. America is now number One in a not so great way. Many of the world ‘leaders’ are not all that good at leading. At least Boris is confined to writing letters.

The reality is that pictures in the heads of neoliberals will not change unless they do. They do not know how to put these pictures aside and deal with reality. There is a whole tertiary education system feeding them and a greedy business class not willing to change; not to mention the MICC and an insane desire to dominate globally – all because of pictures in people’s heads. I think this is why educating the general public is so important.

With that I must conclude with a hearty thank you to Bill and anyone engaged in the task. If only MMT was as contagious as the flu. Learning travels best and fastest when it is fun and a little bit of wry humour involved – something to capture the public imagination.

Given the Aus-govt. response to the bush fires and now covid-19 they deserve to be cut down in the next election – but who have we to replace them? A wide brown land with nothing much in sight. I think if the general public get a whiff of something good they will move. But there is so much noise to compete with. What other choice do we have?

So now is the time for courage, clarity and strength. I do not agree with fatalism. Human beings have survived every other empire that has come and gone on this earth – why not this one too? The people win out in the end. Because they have an unquenchable drive to be content. They also have musicians…

Hi Bill,

I don’t often agree with GetUp, but on this occasion they are making some noise on the need for a job guarantee – not specifically your prescription, but perhaps a step in the right direction?

[Bill edited out a link he does not wish to promote]

Dear Malcolm Crout (at 2020/04/01 at 1:28 pm)

Thanks for your E-mail.

I think GetUp is fringe group with limited influence these days, especially after their disastrous campaign around Adani and the last federal election.

It will be a mistake to associate MMT advocacy with them. It will just isolate major segments of the debate and we will be ignored.

I don’t support their advocacy.

best wishes

bill

Thanks for your important work, Bill.

Some questions and thoughts on the JobKeeper thing:

Given the scale of the what the Government has introduced, the likelihood that introducing it took place through gritted ideological teeth, and that it is a temporary measure, I think it is unlikely to be withdrawn and something like your proposal introduced instead. In that case, how could the policy as it now exists be improved?

My suggestions:

1. It should apply to all workers regardless of visa status or employment contract. Thus all casuals should be covered, as well as migrant workers and asylum seeker workers.

2. Redundancies and layoffs should be banned in companies receiving the subsidies.

3. I agree that the payment amount should be increased, but should (not can) the government pay multi-hundred thousand dollar salaries , or even $150k salaries? Simply for how it plays in the public realm, should there be a cap on amounts to be paid?

I understand your critique that the scheme is not radically transformative of capitalism. A couple of points: the policy, it seems to me, is important because it is likely to stave off the mass immiseration that otherwise seemed to be heading our way. I have no desire to see the retention of the current system, but with the current local and global balance of power between left and right, I don’t see any progressive change happening in the context of mass immiseration and 20% (or higher) unemployment. I think only the forces of reaction and authoritarianism would benefit from that, as they did in the 1930s. Although it is hard to say, we may have to save capitalism in the short term with state intervention, to move beyond it. Further, I’m concerned that your proposal, because it would work independently of the employment relationship, would render most workers effectively welfare recipients, a very different relationship between most workers and income than if they are maintained as employees. Finally, isn’t it easier for the government to introduce the scheme that it has, utilising the employer’s payroll system, than to try to work out how much to pay everyone individually and then make the payments? Dealing with tens of thousands of companies is surely easier, and quicker, from a public service administrative basis than dealing with millions of individual workers.

OK,we are predicting that Neo-liberal economists and politicians will spend a lot on the wrong things in the corona crisis. Which will cause some prices to rise. this will be called “inflation” even though it isn’t sustained. And then they will say the MMT has been proven to cause inflation just like they predicted.

What can we do about this? Well, we need a platform to talk to all the people of our nations, UK, Aust., US, etc. The Neo-liberals literally own the Media. So, the Media will not be our platform. This leaves us with ‘Social Networking’. I.e., the Internet.

Ideally we could create a “phone tree” like system on the internet. That is we all send messages to everyone on our contact list. The core MMTers can wright the shot sweet messages and we all spread them all around.

The messages are things like —

1] Brexit should be mated to stimulus spending to provide the people with money to buy stuff in the transition. This may make some prices rise BUT this is not sustained inflation.

. . The corona crisis is the same, only for the whole world, not just the UK.

2] MMT does not suggest that money be given to the top 30% of earners in this crisis. They don’t need it. It is the bottom 70% who need more money in this crisis. And some small business.

3] We need a Job Guarantee Program.

4] Etc. Etc.

7] In the recent past, we have allowed the system that worked from 1945 to 1975 to be destroyed. The key element of this system was that the really rich paid 90% or at least 77% on their top earning bracket. this is necessary because any economic system will tend to move the money up through the population from the poor up to the really rich and super rich. this can’t be avoided. The only solution was the strongly progressive income tax system. This took mo re from the really rich and spent it back into the economy at all levels. it didn’t all go to the poor, much went to middle class Gov. workers and upper class defense contractor business owners,

etc.

. . . Like we said, if this is not done the money mostly ends up in the hands of the really rich and super rich. What is there that is going to stop this from happening?

Neil, putting it another way … to destroy the debt amounts to destroying the asset.

@ John Hermann,

That is true in the aggregate, but not really true for the bond holder.

Someone is taxed and then the bondholder is forced to accept cash for his bond.

. . The thing is the rich don’t want to be taxed and the poor can’t be taxed. The middle class has been divided into the upper-middle class and the poor middle class. The upper middle class are with the rich and can’t be taxed and the poor middle class don’t have enough money to be taxed enough to pay off the bonds.

. . Obviously the rich are shooting themselves in the feet with their greed, but being greedy means they can’t see it.

Guess I’m forgetting that most(?) production is now Just-in-time. (A means of production which was going in the 1980s.) I wonder what the proportion of all units is JIT? (ie by $, not by number of items?) Must still be a lot which isn’t JIT?