Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

ECB asset purchase programs are the only thing keeping Member States solvent

I haven’t had time yet to fully work through the decision by the European Commission yesterday to provide grants and loans to struggling Eurozone countries. I will comment on that when I have had time to understand the implications and be in a position to provide fair comment. It seems to be a vastly inadequately response in quantum, on top of an existing lack of fiscal support. But more on that another day. Today, I am investigating the latest data from the ECB. On May 26, 2020, the ECB released its bi-annual – Financial Stability Review, May 2020 – which seemed to excite some journalists to advance narratives that ‘sovereign debt’ investors (although none of the Eurozone nations are sovereign) will soon become spooked by the sharp rise in public debt levels in Europe, which will “threaten to undermine private-sector spending” and stall any growth prospects. The quote is from a Financial Times article (May 26, 2020) – ECB warns of challenge for eurozone from soaring public debt – which followed the release of the ECB’s Review. The elephant is, of course, the ECB assets and its ability to control all yields on public debt at will.

My initial assessment of the European Commission’s much trumped fiscal stimulus is that it is hardly going to matter.

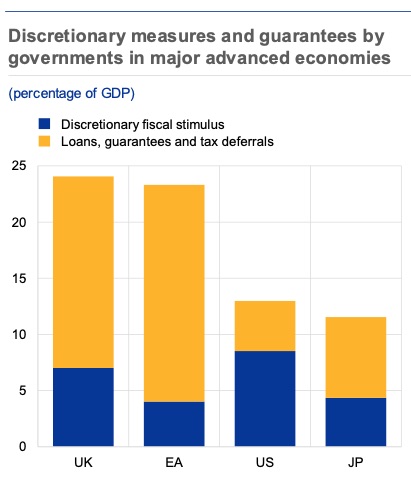

The ECB Review provides this graphic (this is the left-hand panel of Chart 6), which compares the discretionary fiscal stimulus and loan guarantees since the crisis for the UK, US, Euro area and Japan.

The actual stimulus component that matters is the blue bars and the European Commission and the Member States are starving their economies of spending.

An overall discretionary fiscal stimulus of 4 per cent of GDP is vastly underdone.

My preliminary calculations tell me the new Commission measure will add just over 0.5 per cent of GDP to that figure.

Hardly anything.

But I guess the Europhile Left will be shouting from the roof tops that finally the European Union is approaching a federal sharing arrangement.

Sorry to disappoint.

All this (minimal) largesse is temporary and the rules will be back in town before we know it.

The ECB Review concluded that:

1. The Coronavirus crisis has “amplified existing vulnerabilities of the financial sector, corporates and sovereigns”, which is what you would expect in a monetary union where the Member States have no currency sovereignty, which means they cannot protect their own banking systems.

Further, their capacity to run fiscal deficits is at the behest of the private bonds markets, if the ECB doesn’t protect them. The latter then is used as a lever to impose ideological conditionality.

2. “The pandemic has caused one of the sharpest economic contractions in recent history, but wide-ranging policy measures have averted a financial meltdown”.

3. “… repercussions of the pandemic on bank profitability prospects and medium-term public finances will need to be addressed so that our financial system can continue to support the economic recovery.”

4. The fiscal stimulus programs “should support the economic recovery … [and] … help the many corporates which are now facing cash-flow strains …”

5. “the associated increase in public debt levels could also trigger a reassessment of sovereign risk by market participants and reignite pressures on more vulnerable sovereigns.”

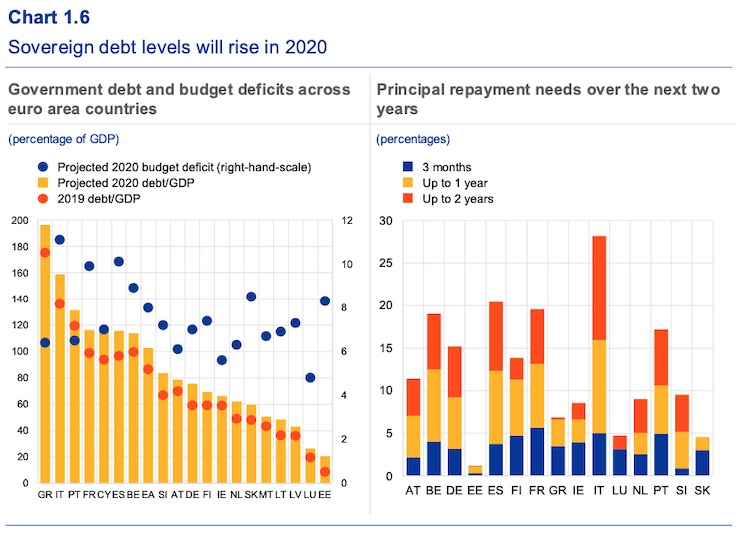

Chart 1.6 in the Review is reproduced here and is self-explanatory.

How the European Commission deals with the huge deviation from the Stability and Pact thresholds will be interesting to follow.

They have temporarily relaxed the thresholds during the pandemic but it is only a matter of time before they start making noises about the Excessive Deficit Mechanism.

They have not, unlike the assessment of some progressives, abandoned their fiscal rule mindset and the austerity that goes with it.

The right-hand panel hints at when the crunch will come.

The ECB writes:

Debt levels across euro area countries are projected to increase significantly by between around 7 and 22 percentage points in 2020 … pushing the aggregate euro area government debt-to-GDP ratio above 100%. Moreover, a number of countries are facing substantial debt repayment needs over the next two years …

For example, Italy has to turnover 15 per cent of its total debt within the next 12 months. Slightly smaller but significant proportions apply to France, Belgium, Spain, Finland, and Portugal.

It will be all up to the ECB to smooth out these repayment schedules, given they will be holding a significant proportion of the debt anyway.

The Financial Times article went further:

A decade ago, fashionable economic thinking suggested that beyond 90 per cent of GDP, government debt levels became unsustainable. Although most economists do not now believe there is such a clear limit, many still think that allowing public debt to build up ever higher would threaten to undermine private-sector spending, creating a drag on growth.

The decade ago reference is to the likes of Reinhardt and Rogoff who kept the financial journalists spellbound with their ridiculous 80 per cent public debt threshold (as a per cent of GDP) before insolvency is reached claim only to be exposed as incompetent or fraudsters when spreadsheet manipulation was discovered.

Remember all that.

Well, who would believe any of that now.

But they still cannot let it go and so you get “many still think” its true.

Who thinks it?

What credibility has anyone who thinks it?

And how would a rising debt ratio provide a drag on growth?

Well we have to go back to the inapplicable and wrong loanable funds theories and the money multiplier theory and all the rest of the baggage that remains in the mainstream body of knowledge (because they have nothing if they jettison it) to create an argument that deficits and debt damage growth.

What is plain to see is that they support growth. Even the ECB recognises that (see quotes cited above).

There will be no “negative feedback loops” arising from the rising debt levels unless the ECB withdraws its ‘fiscal support’. And because they know that if they did then insolvency for many Member States would follow soon after, they will keep running their asset buying programs.

Interestingly, the same Financial Times journalist (Martin Arnold) who authored the article cited above, also, intereviewed ECB Executive Board member, Isabel Schnabel on May 25, 2020 – see Interview with Financial Times.

In that interview we read:

1. The German Constitutional Court’s recent decision – see my blog post – BVerfG decision once again exposes the sham of the Euro system (May 6, 2020) – does not apply to the ECB and they won’t be changing anything as a result.

2. On the negative way that Germans seem to think about central banks not acting like the Bundesbank, “many of the narratives that are very popular in Germany cannot be maintained because they simply do not match the facts.”

And “For example, if anything, inflation has been too low in the past years, while originally the German fear had been that inflation would be too high.”

3. That “I do not have the impression that there is serious concern about debt sustainability” She pointed out the “very large demand for the bonds that are being issued with often very high bid-to-cover ratios.”

4. On the role of the ECB to “close spreads in government debt markets”, she said that “divergence in sovereign spreads poses risks of fragmentation” (their standard line) but that it was not the ECB’s role to ensure there were “zero” spreads against the bund across the Eurozone – “and they shouldn’t be, given different fundamentals.”

She denied the ECB was “targetting spreads”.

On March 18, 2020, the ECB press release – ECB announces €750 billion Pandemic Emergency Purchase Programme (PEPP) – announced an extra public and private bond buying program.

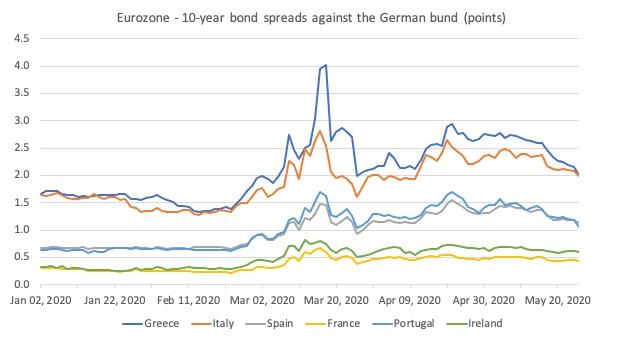

The following graph shows the 10-year government bond spreads against the German bund (percentage points) since the beginning of 2020 and explains the timing of the ECB’s announcement.

The recent peak in the spreads occurred on March 18, 2020 (for Greece) and March 17, 2020 (for the other nations shown).

The PEPP differered from the existing Public Sector Purchasing Program (PSPP), in that, it included Greece for the first time, and so the spread on the Greek 10-year bond quickly followed suit.

It also differed because it allowed the ECB to break with the stricter rules governming the PSPP, in particular that the bonds purchased from any country had to be in proportion (with ceilings) to the so-called capital key (the Member State contributions to total ECB capital)

But I think this graph makes it clear that the ECB was able to quickly manipulate the yield spreads.

You can also see that the ECB has also managed the spreads in according with the pre-crisis relativities, which is what Isabel Schnabel referred to as their assessment of the “different fundamentals” – largely, credit risk.

These spreads are managed by the ECB through its bond-buying programs as I have explained many times before.

The ECB now has several asset buying programs in place.

The long-standing public sector purchase programme (PSPP) (began on March 9, 2015) buys up various government bonds in the Euro area.

The ECB say that:

Since December 2018 government bonds and recognised agencies make up around 90% of the total Eurosystem portfolio, while securities issued by international organisations and multilateral development banks account for around 10%. These proportions will continue to guide the net purchases.

As at May 22, 2020, the ECB had purchased 2,216,852 million euros worth of bonds under the PSPP. The can loan some of these assets back to the markets “to support liquidty and collateral availability”, which is the way they get around the Treaty no bail-out clauses.

The reality is that the ECB is funding significant proportions of Euro Member State fiscal deficits and without these programs, several countries would have already gone broke.

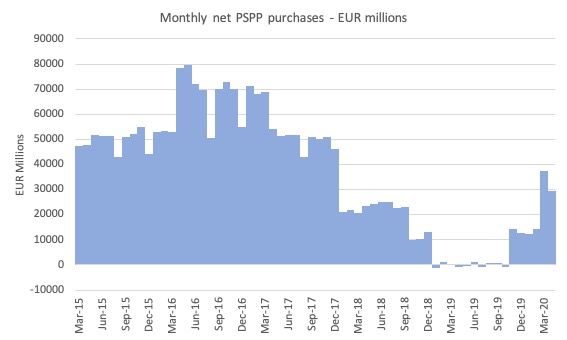

In their – Public sector purchase programme (PSPP) – Questions & Answers (updated April 2, 2020) – we learn that from November 1, 2019, the ECB committed to monthly bond purchases under its Asset Purchase Program (APP), which includes the PSPP, to the value of “€20 billion.”

The ECB provides a time series of the – Cumulative purchase breakdowns under the PSP.

The following PSPP totals have since been realised since November 2019:

1. November 2019 – €14,478 million.

2. December 2019 – €12,515 million.

3. January 2020 – €12,336 million.

4. February 2020 – €14,137 million.

5. March 2020 – €37,323 million.

6. April 2020 – €29,624 million.

So they have significantly upped the monthly purchases in this program.

The following graph shows the entire history of the program since March 2015. The negative values are redemptions (when they write the asset off).

One of the issues is whether the ECB has been violating the so-called proportions relating to its capital key.

The ECB say:

PSPP purchases will continue to be guided by the ECB capital key on a stock basis. The ECB capital key provides a straightforward and stable guideline for the composition of purchases across jurisdictions. The Eurosystem will continue to gear its monthly purchase allocation to align a jurisdiction’s share in the stock of PSPP purchases as closely as possible with the respective share of the ECB capital key by the end of the net asset purchases. This gradual adjustment over time gives due consideration to market neutrality and safeguards orderly market functioning.

They say that but then do this.

The following graphic is the latest Capital Key data (for the 19 Member States).

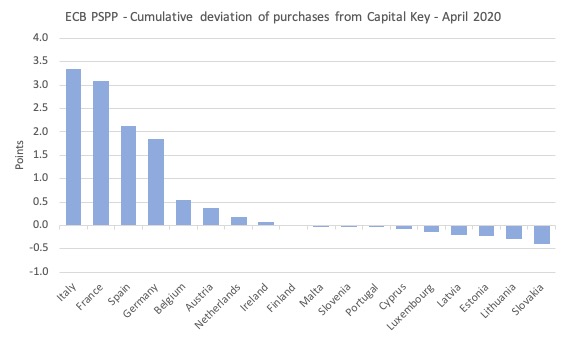

The next graph shows the proportion of Member State bonds held by the ECB as at April 2020 expressed as a deviation from the proportion of capital held.

Greece is omitted as it was barred from the PSPP.

It has been obvious the ECB hasn’t followed the ‘capital key’ guideline very closely at all in allocating its monthly purchases.

And it is oversubscribed in terms of the big four economies, which reflects their importance in maintaining the overall structure of the monetary union.

There was also the problem with the PSPP that the ECB could not hold more than a certain proportion of each Member States debt and that those limits would have been exceeded in this crisis given its scale.

They could have just abandoned those voluntary limits.

But instead, they chose to create a new, more flexible program called the – Pandemic emergency purchase programme (PEPP) – which has “an overall envelope of €750 billion” and will run to the end of 2020, at this stage.

The ECB explained the difference between the PSPP and the PEPP programs in this document (April 2, 2020) – Pandemic emergency purchase programme (PEPP) Questions & Answers.

Purchases began on March 26, 2020.

They have not released the data at the Member State level yet but we know that as at May 22, 2020, the ECB had purchased a total of 211,858 million euros worth of bonds.

So in two months they have averaged 105 million euros. Extrapolated out to the end of 2020 would suggest a program of around 950 billion euros. We will see on that.

Conclusion

All of this highlights the arbitrary nature of the Eurosystem relative to the imagery of being run according to legal frameworks (Treaties) and strict regulative structures that are derived from those treaties and subsequent decisions.

The ECB is the currency issuer and it does more or less what it likes to keep the Member States solvent.

It can clearly always do that.

The fact they constantly evade what I consider to be their legal responsibilities under the treaties is overlooked by all the players.

The problem, though, is that the Member States are not willing to force changes that would formalise this behaviour and separate it from harsh conditionality that we saw during the GFC and will see again in the not too distant future.

In a sense, the ECB misuses its power in a system where the structure and rules centralise power.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

The Full employment white paper from yesterday

Is a reminder on so may different levels that choosing both..

a) Member of the EU or EFTA

b) UBI

Are wrong political and economic choices and would only be chosen if you embrace neoliberalism.

Also, China has just instructed 5 of their largest state owned corporations to stop buying different types of imports.

Section 90 of the White paper

Good luck trying to manage things that way in the EU or EFTA asking privatised companies to act like that.

Read the full employment white paper from yesterday

Then get a big red marker pen and cross out what would not be allowed either in the EU or EFTA.

You end up with not much of a plan at all.

From my admittedly superficial understanding, it does appear that the EU framework needs a complete overhaul. The ECB is acting as a federal central bank for the EU members which, if taken seriously by each of the nations, might allow it to work. But no one seems brave enough to just say ‘To Hell with this, we’re going to be all in spending enough to support the EU nations. Without all the contingencies.’ Image if the Federal Reserve put ‘contingencies’ on Nebraska or any other state. The Federal Reserve does what is required. Most recently, as it looks to be the case with the ECB, the Fed has been buying up the Treasury debt without even a nod to the primary or secondary markets. That means when the time comes to pay down, or ‘roll off’ the debt, it’s a left hand pocket/right hand pocket transaction. Like owning the property where your business resides. The business pays rent, which is income to the owner of the property, which in effect is the same entity.

Of course, direct grants unhindered by unnecessary debt accounting is a much cleaner and more effective way to go. The money is there, either way.

Dear Bill,

“2,216,852 euros” is perhaps 2,216,852 million euros, around 2 trillion?

Kind regards,

Willem

Why is it detrimental to one state for another to get a higher share than its capital key?

What harm is done to one country by another issuing more bonds and the ECB buying them?

I believe Reihnhart has been named the new World Bank chief economist. Draw your own conclusions.

Derek Henry wrote:- “Read the full employment white paper from yesterday”

I’d like to but, *whose* white paper? published *where*?

Did you not read Bill’s post yesterday Robert ?

@ Derek Henry

Doh!

(Must be getting old – or have drunk too much wine).

The mental gymnastics these people go through to maintain their faces is pretty hilarious.

Can anyone say whether this statement Is correct?

In china, the ultimate creditor is the government, unlike in the West where the ultimate creditor[s] are private sector bond-holders.

Sounds like someone trying to find an excuse to not do the same, because we’re free market (ha) democracies not a brutal dictatorship. Because you know, the economy has feelings or something.

@Neil Halliday

I don’t believe that statement is correct, no. Wynne Godley’s sectoral balances tell me that net private assets denominated in any sovereign currency correspond exactly to the sum of public debts issued in that same currency.

R & R saw what wealth and power were looking for at that time, an intellectual buttress for the imposition of austerity, and they provided it. Recognizing and catering to the propaganda needs of the elite, will assure you of a successful career.

Thanks for the replies. I suppose a related question is:

Can the Chinese government create a covid-19 rescue-package which avoids the ‘burden of covid-19 rescue-package debt repayments on future generations’ that we continually hear the MSM banging on about, in the West.

“‘burden of covid-19 rescue-package debt repayments on future generations’ ”

What burden? Do the future generations not also inherit the Treasury Bond assets from Grandad as well?

Once you do both sides of the balance sheet it becomes obvious. The “burden” will disappear automatically when the corresponding “savings” are spent.

Loans create deposits only because those deposits are saved. Once they are un-saved deposits destroy loans.

“What burden? Do the future generations not also inherit the Treasury Bond assets from Grandad as well?”

I think the MSM story refers to interest payments on government debt, causing more austerity in the future . In any case, poorer people don’t hold Bonds.

A few days back I said life would be much simpler if the sovereign currency-issuing government did not borrow at all. Neil Wilson replied saying government has to borrow to fund bank reserves – or something like that – which obviously I did not understand. and neither does the general public understand the intricacies of reserve banking, including the ‘clearing’ function of the reserve bank.

[No doubt this clearing function is related to Keynes’ idea of an international ‘clearing union’, rejected by the anti *international rules-based system* people in 1944 (Bretton Woods) and 1946 (San Francisco). This is related to the heated debate in a recent blog here about the rights and wrongs of Brexit: for my part we don’t need an EU, we need a UN (in which all nations have currency sovereignty, overseen by Keynes’ ‘clearing union’. But as I noted above, people want the ‘freedom’ to make war, in preference to acceptance of an international rules based system].

For my part, I see MMT as a step toward a world without private banks. Why do we need lending institutions that charge interest for profit. A single government bank could dispense zero interest loans according to the capacity of the borrower to repay the loan.

I recall interest on loans is illegal in Islam. Perhaps they are onto something…

Somebody has to pay bankers to do loan assessment. Somebody has to stand the loss when loans go bad.

Why are those two processes better decided administratively and socialised than via the usual market competition.

The actual problem is that banks aren’t sent into bankruptcy quickly enough, the shareholders wiped out and depositors protected (either by being fully insured or off balance sheet).

That’s a failure of regulation not private markets

In terms of government borrowing the balance sheet calculation is this:

(G – T) = (S – I)

For the left to balance the right has to balance. That means fewer savings or more borrowing – which is of course what Interest Rate Targeting tries to achieve.

I struggle to understand Neil’s comments, but I think I understand his reasoning for private banking. It’s a debate going on in the international LVT group I belong to where the US people, in particular, quote Ellen Brown and public banking. This seems to be related to Positive Money here. I recently posed a question on this to a UK academic associated with the New Economics Foundation – promotes PM (and LVT) ideas. Doubt I’ll get a response.

I once heard an argument for private banking, justifying the charging of interest, which was “consider it as a service fee”. The problem with that, of course, is that fees are usually a one-off payment which are paid up-front. Is there a solution to this?

Sorry if my thoughts are too naive for this forum.