Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

Eurozone inflation heading negative as the PEPP buys up big – don’t ask the mainstream to explain

Governments save economies. Never let a mainstream economist tell you that government intervention is undesirable and that the ‘market’ will sort things out. Never let them tell you that large-scale government bond purchases by central banks lead to inflation. Never let them tell you that the government, when properly run, can run out of money. There is unlimited amounts of public purchasing capacity. The art is when to apply it and how much to release. That can only be determined by the behaviour of the non-government spending and saving and the state of idle capacity. It can never be determined by some arbitrary public debt threshold or deficit size. And the central bank can always buy however much debt they choose. At present the ECB is buying heaps and keeping the Member States solvent. That is not its state role but given there is no other institution in the Eurozone that can serve the fiscal function effectively and ‘safely’, it has to do that. Otherwise, the monetary union would quickly dissolve. I would take their bond buying programs further and write off all the debt they purchase. Immediately. Go on. Just type some zeros where they have recorded large positive Member State debt holdings. That would be something good to do in a terrible situation.

The fictional world of mainstream macroeconomics

I stumbled on an old edition of the IMF’s Finance and Development series yesterday while looking something up. I read this quarterly publication because it gives a good summary of where orthodox views in macroeconomics and development economics are heading.

The September 2007 edition of FD (Volume 44, Number 3) carried an profile of American economist Robert Barro – Topping the Charts – which for its timing (just before the GFC) and now (during the worst downturn since the 1930s) makes interesting reading.

I am an insider – I have been trained as an economist.

I did all the hard postgraduate courses in theory and maths and econometrics.

I was exposed to all the psychobabble that reinforces and protects the mainstream Groupthink (absorbing none of it!).

Yet I am still surprised how the nonsense that forms the basis of mainstream thinking has been able to survive for so long.

I know why. It protects and advances the interests of the top-end-of-town.

But the surprise is in the fact that the overwhelming majority of us who are not served very well – and increasingly so – by they system they have created – are largely compliant.

Sure, when a black man is murdered by the cops in the US, there is a response, but like the Rodney King bashing, the reaction dies down again.

Re-reading the 2007 article in FD profile of Robert Barro reinforces how a body of fiction became the orthodoxy and has blighted the lives of thousands.

And how a generation or more of young students end up with postgraduate qualifications in fiction and enter the labour market in positions of influence and a swagger built on the arrogance that these mainstream qualifications engender and push out policies that can never work in the interests of the workers and their families.

And then they overreach (GFC) or a unpredicted crisis occurs (pandemic) and their blathering nonsense is exposed for all to see.

Barro was “one of the ringleaders of the Chicago School” that “supplanted … Keynesian macroeconomics” in the early 1970s and paved the way for the current orthodoxy in macroeconomics.

This new approach rejected the ideas of Keynes who “popularized the idea that government policies could smooth out ups and downs in income” using fiscal policy.

I have analysed Barro’s work previously and I don’t want to repeat that exercise:

1. The fantasy Barro(w) is still being pushed (May 14, 2012).

2. Pushing the fantasy barrow (February 25, 2010).

The summary, which the FD article covered well, goes like this.

He claimed that the effective role of government intervention should only be:

… to define and protect property rights … ensuring (but not producing) a baseline level of education, providing a minimal welfare net, and participating in a narrow range of infrastructure investments, such as highways and airports

Beyond that, any government activity “is detrimental to growth”.

His 1970s work argued that:

… governments should take a laissez-faire approach to smoothing out fluctuations in income.

That is, let the ‘market’ sort them out.

This idea that consolidated in the 1980s “was part of the so-called rational expectations revolution that supplanted the dominant Keynesian view of the time that governments should use macroeconomic policies actively to tame the business cycle.”

The idea was based on the claim that if the central bank increased base money growth and people anticipated that decision, then the central bank would lose “their credibility as inflation-fighters” and accelerating inflation would occur.

Further, on the fiscal policy front, Barro’s 1974 paper (in JPE) argued that fiscal deficits would be counterproductive because rational agents would thwart their effectiveness.

How?

Higher deficits would be seen as higher future taxes, so households and firms would simply stop spending to save up to pay the higher taxes.

Truly! That is what this lot argued and it led to a widespread rejection of fiscal deficits.

And, if governments borrowed in order to deficit spend (note the fictional causality), the same story played out.

The upshot of all this mumbo jumbo was that:

… the government’s ability to get today’s generation to spend more by running budget deficits would be nullified.

And that became a mainstream view – as the FD article notes – “Barro’s model became standard, so that even its critics were forced to use it as the starting point for their own models.”

This is how nonsense permeated the profession and poisoned the minds of young aspiring economists who didn’t have the moral fibre to stand up to the professors pushing this fiction, and, instead, complied to get good grades and access to jobs that the mainstream ‘network’ (Groupthink fosters these pathways) generated.

Soon enough, they youngsters became the professors and senior officials and the brainwashing and lack of courage continued.

But none of it stands the test of time does it?

The only reason the capitalist system continues is that government is at the centre propping it up.

As is now.

The bail out of all bail outs.

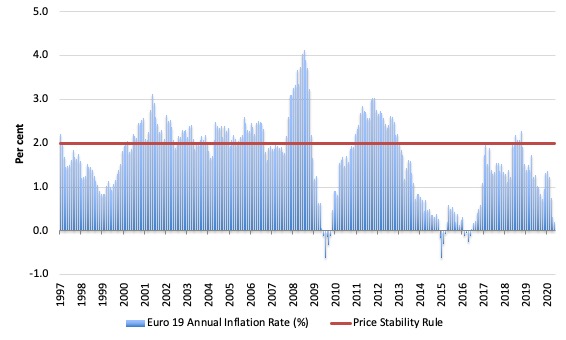

European inflation

In this blog post – Monetary policy has failed – we must reprioritise fiscal policy (February 5, 2019) – I discussed the ECB failure to meet its most basic legal responsibility – to meet its price stability targets.

By way of summary, the ECB’s monetary policy charter requires it “to maintain price stability”, which they define as:

… a year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2% … the ECB aims at maintaining inflation rates below, but close to, 2% over the medium term.

The definition is clear enough and certainly allow some latitude around the 2 per cent target in the short run. But, equally, the definition would certainly exclude systematic departures from the target over an extended period.

On May 29, 2020, Eurostat published the latest inflation data – Euro area annual inflation is expected to be 0.1 % in May 2020, down from 0.3 % in April 202 – the title being self-explanatory.

The following graph shows the history of the All-Items HICP [prc_hicp_midx] series since the first month of 1997. The inflation rate is computed as the annual change in the index. The red line is the ECB’s definition of price stability, which

The data shows that the inflation rate has been anything but stable under the watch of the ECB.

And, last week’s news that deflation is on the way only reinforces that message.

How does one reasonably interpret this apparent failure?

The only conclusion that could be drawn is that the ECB has just plain failed to fulfill its stated policy mandate.

In other words, the claims that the euro has been a success in terms of maintaining price stability are just nonsensical.

The behaviour of the data is not surprising to an analyst cognisant with Modern Monetary Theory (MMT).

In the absence of an institutional bias towards inflation (indexation schemes, etc) or a imported raw material (for example, energy) shock, inflation will be low if not negative if aggregate spending growth in the relevant ‘economy’ is weak (in relation to what is required to maintain high pressure and low unemployment).

So the specific lack of correspondence between the actual Euro area inflation rate and the ECB’s price stability target provide us with evidence that the Euro area has been wallowing in a low growth environment, contrary to claims by Euro officials that the euro has been a “historic success” in terms of promoting strong real growth.

But it also reflects on validity of the core ideas of mainstream macroeconomics and the type of thinking that Robert Barro injected into the profession.

Theirs is a fictional world.

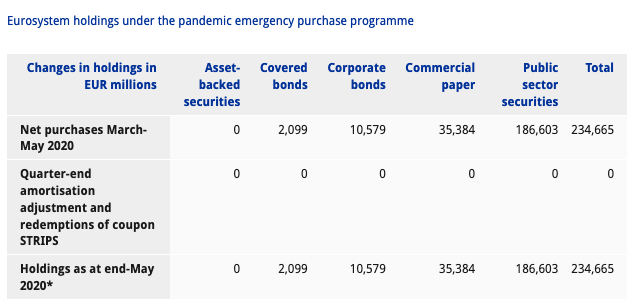

PEPP update

Last week, just before the latest inflation data came out in Europe, I wrote this blog post analysing the latest ECB asset purchasing programs – ECB asset purchase programs are the only thing keeping Member States solvent (May 28, 2020).

At that time, the detailed breakdown of the latest bailout, aka the ‘ECB Member State deficit funding scheme disguised as a bank liquidity measure’ – which goes by the title the – Pandemic emergency purchase programme (PEPP) – had not been released.

We only knew that as at May 22, 2020, the ECB had purchased a total of 211,858 million euros worth of bonds under the PEPP.

Well, a week later and the ECB has now released the detailed country and public/private purchases breakdowns.

They tell an interesting story and reinforce the narrative above about the lack of inflation pressure.

As at May 30, 2020, the ECB had purchased a total of 234,665 million euros worth of bonds under the PEPP.

This table gives the break down across the categories of assets purchased.

The breakdown of the private bonds was interesting – mostly commercial paper.

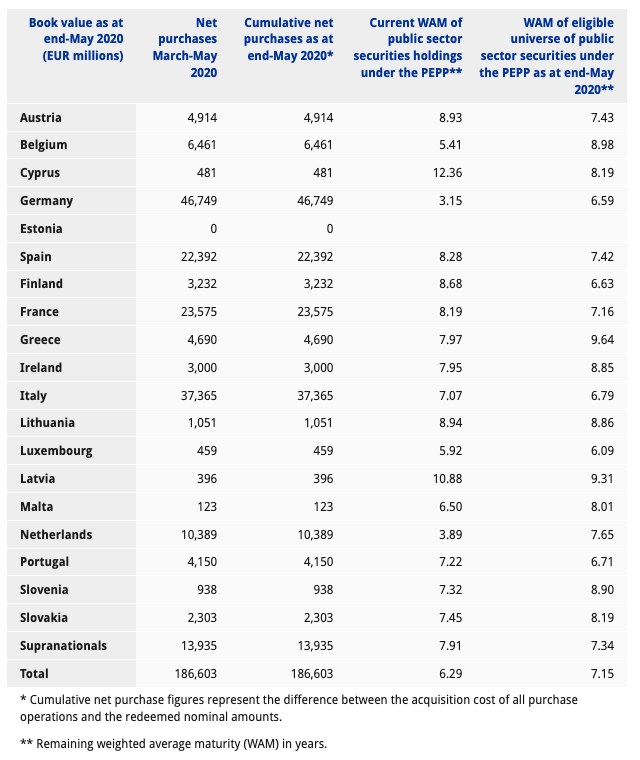

The next table shows the Member State breakdown and the weighted average maturity (WAM) of the purchases under the PEPP.

Not suprisingly, the ECB has been purchasing a lot of Italian government debt and the maturity profile of that debt is longer than, for example, Germany, where the ECB is buying more short-term debt.

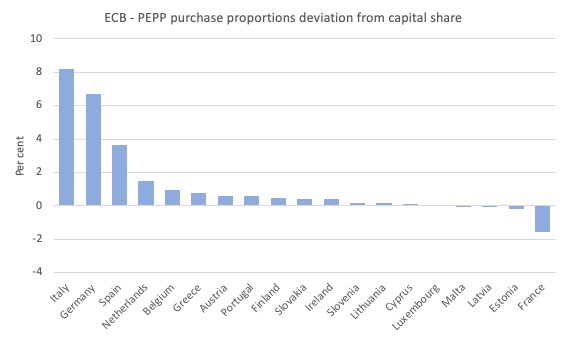

The question of interest though is the extent to which these purchases are deviating from the capital contributions of the Member States to the ECB.

Please read last week’s blog for more detailed discussion of the capital key.

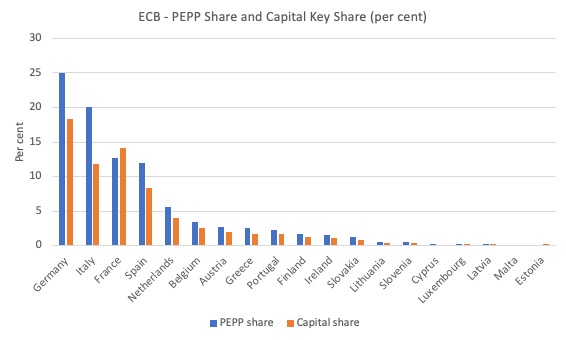

The following graph shows the PEPP shares by Member State – as a percent of the total purchases – from March to the end of May 2020 (blue bars) and the Capital share (orange bars).

ECB purchases of German debt dominates and is above their capital share as is the case of Italy and Spain. Of the large purchases, France is the only Member State under-represented.

To see this in another way, the next graph shows the percentage point deviation from the capital key of the ECB bond purchases.

Once again, we conclude that there has been massive central bank funding of Member State fiscal deficits – Italy is the stand out – in a deflationary environment.

Not only has there been no inflation but the bond-buying has not driven an expansion in real GDP growth – quite the opposite.

The only conclusion is that this form of aggregate policy intervention is largely ineffective in the face of Member State’s not being able to expand their fiscal deficits sufficiently.

I know that the European Commission has relaxed (for the moment) the Excessive Deficit Mechanism and the strict fiscal rules, but there remains a mentality in Europe that fiscal deficits should still be constrained.

The only effective function that the ECB is performing is keeping the Member States from becoming insolvent, which prolongs the life of the common currency, but little else in that austerity-biased world.

MMTed Q&A Live Stream clarification

Last night, we launched the first episode in our MMTed Q&A.

You can see the – Video – of the program, if you missed the live program.

At the end of the live stream there were issues with the saved file for some reason (I am guessing my incompetence).

We were, however, able to save it but lost the streamed version.

At that time, there were still many people watching a delayed version of the live footage. They were lost in the process.

Further, all the comments were lost.

The archived version, thankfully survived.

You should jump 4 minutes or so to miss the “Starting Soon” screen, which was in play before the actual program began to stream the rest of the content.

So for all those who commented – thank you very much and I am sorry they didn’t survive for others to share.

We will be back next week with Episode 2.

All production difficulties will be worked out by then – learning as we run!

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

“Higher deficits would be seen as higher future taxes, so households and firms would simply stop spending to save up to pay the higher taxes.”

Didn’t anybody point out that by definition they’d already done that or there wouldn’t be a deficit in the first place?

The savings that match the deficit are the present value of the stream of taxes necessary to eliminate the deficit.

They just need to fix their maths so it is stock/flow consistent and they’d have their answer.

They don’t want to “fix their maths” — they want to tell stories that help them get the political outcomes they desire, at the expense of the bulk of the citizenry.

“The only reason the capitalist system continues is that government is at the centre propping it up.” This crucial point needs to be made RELENTLESSLY by MMT proponents. That “propping up” entails, of course, not only the trillions of fiat money subsidies poured into the coffers of the biggest capitalist players in the prior GFC and even more so in this current pandemic crisis, but also the untold trillions poured over the course of decades into addressing, in a woefully inadequate manner, the so-called externalities of capitalism, the environmental and human carnage it leaves in its wake in its frenzied pursuit of profit alone. The “invisible hand” is actually around the throat of humanity and all living things, and while we still have breath to talk, we should be shouting out constantly this terrible truth.

“Higher deficits would be seen as higher future taxes”….

Household reaction to the perceived threat of taxes emanating from government debt induces an instinctive empathy between cause and effect.

Deficits on the other hand are have an illusive element that often evades common parlance.

To most people Debt and Deficits have nevertheless, a negative association; debt being an obligation and therefore thought of as conceptually similar to that of deficit.

The irony is that whilst debt is accepted as a basic element in the productive use of Capital, deficits are often associated with resources wasted by the public sector.

This represents an ideological conflict which Monetarist/MMT literature to some extent encourages. The allocation of resources by debt or deficit in this enlightened era deserves a more pragmatic explanation than that.

Prof’ you write, “And the central bank can always buy however much debt they choose. At present the ECB is buying heaps and keeping the Member States solvent.”

The average Central Bank doesn’t have any capital/equity to “BUY” anything from the non-government sector, unless its currency issuing Treasury funds the purchase. A Central Bank BUYING Treasury Bonds, is just a “repo” operation. That is, the Central Bank is just swapping Treasury securities back into Treasury reserves (cash); that bought the government securities originally. There is no net change in the “Units-of-Account” (Pounds Sterling say) in the Sterling area economy. Accepting the anomaly that is the ECB, is both a currency issuing Treasury and a Central Bank at the same time.

Newton Finn,

“The “invisible hand” is actually around the throat of humanity and all living things, and while we still have breath to talk, we should be shouting out constantly this terrible truth.”

Love your graphic depictions of social and economic reality. 🙂

Newton,

“”The only reason the capitalist system continues is that government is at the centre propping it up.” ”

However, I would say one thing.

If we didn’t buy the produce of capitalists and offer our labour to them, the capitalist system would be dead in the water.

We are very much part of the problem.

Thanks for the compliment, Henry, and yes, we’re all not only complacent but complicit in the neoliberal nightmare. Obviously, we must live our lives in the midst of the madness, which will entail participating in it to a certain extent. But we shouldn’t allow that inevitable hypocrisy to shut us up. We might yet find a way to get together in massive strikes and shut neoliberalism down for good. Are we not in uncharted waters, roiling with peril and promise, as we speak?

Ah, so that’s what happened to the Tooting Popular Front.

The ‘Monetary Authorities’ may be able to ‘manage’ demand, but it is supply that is the problem?

” Planet Earth, though, does not work that way. To have what humans call wealth, you have to have resources and you have to have the means to extract, transport and utilise these resources in order to create the goods and services that are bought and sold in the global marketplace. But before you can do any of that, you have to have energy. And while the new currency being borrowed into existence in the financialised economy was a claim on energy, it was not energy itself. . . .

With oil extraction already past peak, any attempt to return the global economy to its pre-pandemic level via the fabled “V-shaped recovery” is likely to generate oil shortages which could see prices temporarily rise above a depression-inducing $100 per barrel. No amount of central bank financial alchemy is going to add oil to depleted fields or remove the gunk from shutdown wells, pipelines and refineries. And so a black new deal can only occur by diverting a large part of the energy previously used in the wider economy to the extraction of the last of the accessible fossil fuels – in its way, essentially the same imperialism as the green new deal, in which a handful of people in a handful of wealthy states enjoy one last energy-consuming blowout before industrial civilisation crumbles to dust; except in this version we incinerate what remains of planet Earth through runaway global warming.”

From the consciousnessofsheep

“And while the new currency being borrowed into existence in the financialised economy was a claim on energy”

Why so many people get this wrong I don’t know. We really do need to get the causality sorted and out there

The problem is that too much currency was accumulated to inert savings in the first place – due to fear. Which reduced the claims on energy so much that oil prices went negative.

So we needed to either accommodate those savings or confiscate them…

“… But before you can do any of that, you have to have energy.” ‘Energy’ is created from resources and “the means to extract” – that is labour and capital. Energy is capital – it’s not a separate factor of production. This is economics not physics.

“… too much currency was accumulated to inert savings”. Of the three elements that extract spending power from the domestic economy, savings is the one that is difficult to control. Perhaps we need a wealth tax?

More specifically it would actually be a “failure to circulate Treasury “units-of-account” fast enough so they can be taxed more frequently back into non-existence”. Reducing the so-called national debt.

Hence, it is an anomaly for the Treasury (National Loans Fund in the UK) to be paying interest on its outstanding units-of-account, be they in reserves/cash or securities form. After all, MMTers know the natural rate of interest is zero. Unfortunately, MMT hasn’t yet developed a weapon of mass destruction that could eradicate the neo-liberal macroeconomic ideology.

“Perhaps we need a wealth tax?”

Why? Don’t you like pensions?

People save to be more secure, show off to their peers and to pretend they are not creating their own currency out of thin air. Since it neatly solves the accumulation problem, what’s the issue other than jealousy?

Solve the income problem and the excess cash problem will look after itself.

Neil. I like pensions; but, where is it written that my non-government pension funds have to include risk free government bonds that pay free money as interest, rather than non-government stocks and bonds that pay dividends? My State Pension is guaranteed by the Magic Money Tree. My defined benefit non-government pension funds, will be eventually be absorbed into the State Pension Protection Fund and; similarly, controlled by the Treasury Magic Money Tree. Please tell me where you think I am getting it wrong. 😉

“Further, on the fiscal policy front, Barro’s 1974 paper (in JPE) argued that fiscal deficits would be counterproductive because rational agents would thwart their effectiveness.

How?

Higher deficits would be seen as higher future taxes, so households and firms would simply stop spending to save up to pay the higher taxes.”

The new classical macroeconomist is admitting that changes in aggregate demand {spending} can affect the income/output of an economy. i.e. Income/output is not ‘supply determined’?

Postkey wrote,

[q]”Further, on the fiscal policy front, Barro’s 1974 paper (in JPE) argued that fiscal deficits would be counterproductive because rational agents would thwart their effectiveness.

How?

Higher deficits would be seen as higher future taxes, so households and firms would simply stop spending to save up to pay the higher taxes.”[/q]

I’ll give you million to 1 odds that those economists didn’t be sure to note that by buying the resulting bonds the people with money were already ‘saving’ more.

Were they really saying that the people who were worried about the future taxes needed to save both the cash being spent and the cash used to buy the bonds?

I doubt it.

So, again they were just wrong, and they were probably just making up an argument to reach the desired conclusion, which should get them put in jail.