Edward Elgar, my sometime publisher, is interested in me updating my 2015 book - Eurozone…

Government goes missing in the European Union

On Tuesday (June 9, 2020), Eurostat published the March-quarter national accounts data for the EU and the Eurozone – GDP down by 3.6% and employment down by 0.2% in the euro area – which revealed that the decline in GDP “were the sharpest declines observed since time series started in 1995”. Of course, Europe went into this crisis in poor shape. Eurostat noted that “In the fourth quarter of 2019, GDP had grown by 0.1% in both the euro area and the EU.” So it was barely crawling anyway due to the austerity bias that is built into the monetary system. The larger Member States such as France and Italy (-5.3 per cent) and Spain (-5.2 per cent) are in terrible shape. In the last few weeks, we have been hearing and reading a lot of hype from European politicians about ‘Hamilton moments’ as various euro figures are bandied around about government support for the European economy. Emma Clancy’s article (June 6, 2020) – Behind the Spin on the EU’s Recovery Plan – is sobering if you are drunk on all the Euro elite hype. There isn’t really a recovery plan at all nor any significant shift in attitudes towards creating a functional federation, the only structure that will see Europe break free of this austerity bias. And as I examined the Eurostat data in more detail something very stark was apparent.

The coronavirus crisis is global, which means one cannot accuse the EU of anything in that regard. In general, lockdown strategies were at the discretion of the Member State governments and the variable outcomes reflect the veracity of decision making at that level.

It is clear that some Member States waited too long or have opened up too early and the consequences are for all to see.

But the economic policies of the Member States is another matter.

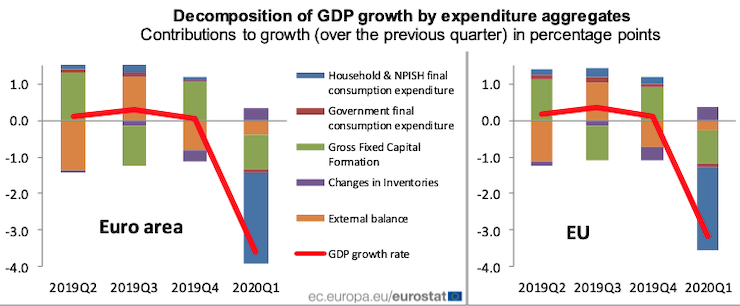

Let’s start with this graph which was part of Eurostat’s published data release.

It shows the GDP components and their contributions to ‘growth’ (growth being a euphemism for Europe these days).

What was striking about this graph to me is that only inventories were contributing to growth (see below).

In a period where the private sectors of the Member States were in melt down as a result of the lockdowns and it was obvious that GDP would take a huge hit, the sector that could have stepped in to the breach – I rephrase – SHOULD have stepped in to support employment and incomes – was absent.

Absent isn’t exactly correct.

The general government sector actually undermined growth.

I found that result stunning and an exemplification of what is wrong with Europe these days. It’s structures and cultures have combined to create dysfunctional responses from government to crises.

Eurostat note that:

During the first quarter of 2020, household final consumption expenditure decreased by 4.7% in the euro area and by 4.3% in the EU (after +0.1% in the euro area and +0.3% in the EU in the previous quarter). Gross fixed capital formation decreased by 4.3% in the euro area and by 3.9% in the EU (after +5.0% and +4.3% respectively). Exports decreased by 4.2% in the euro area and by 3.5% in the EU (after +0.1% and -0.1% respectively). Imports decreased by 3.6% in the euro area and by 3.2% in the EU (after +1.9% and +1.5% respectively).

And this translated into the following contributions to the GDP outcome:

Household final consumption expenditure had a strong negative contribution to GDP growth in both the euro area and the EU (-2.5 and -2.3 percentage points – pp, respectively) and the contribution from gross fixed capital formation was also negative in both zones (-1.0 and -0.9 pp respectively) as was the contribution of the external balance. The contribution of changes in inventories was positive for both zones (+0.3 pp for the euro area and +0.4 pp for the EU).

Two things to note:

1. They don’t mention the government sector at all.

2. The only positive contributor to growth in the EU and Eurozone were ‘inventories’.

What does that mean?

It means that sales were so weak and below the expectations of producers when they committed working capital to producing the goods and services that there was unexpected or unintended inventory accumulation.

In the national accounts framework, the statistician considered unintended inventory accumulation to be a component of capital formation (or investment) and so the build up of unsold goods is an ‘investment’ for the future.

Which sounds good – ‘investment’ – but is actually an additional sign of disaster.

I investigated further.

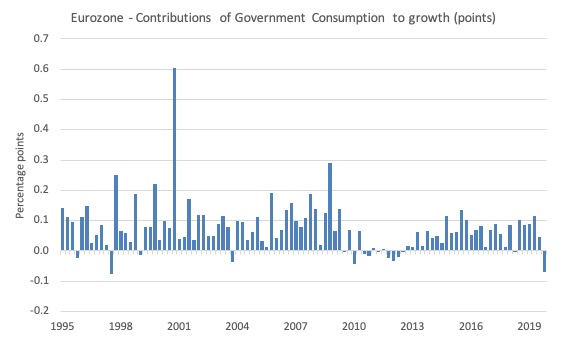

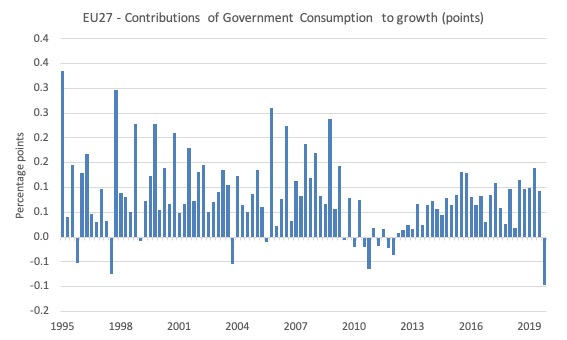

The following graphs show the contributions to GDP growth of General government final consumption expenditure (in percentage points) for the Eurozone, first, then the European Union without the UK.

The data confirms what we know.

When times are tough in the Eurozone, the government goes missing.

During the GFC, government recurrent expenditure was exacerbating the decline in private sector spending.

And in the March-quarter 2020, just when you expect the government sector to be injecting fiscal support, it once again undermines growth – making the economic consequences of the pandemic worse.

Given the dominance of the Euro 19 Member States in the EU27, the graph is similar.

In other words, at crucial times in the recent economic history of Europe, government recurrent spending has been pro-cyclical.

What does that mean?

It means that when the private economic cycle is going down, the government spending cycle follows it and makes it worse.

That is the anathema of irresponsible fiscal policy management.

But it is a central characteristic of the Economic and Monetary Union, which forced nations to surrender their currencies and then imposed ridiculously pernicious fiscal rules on the governments for political reasons.

The result is a dysfunctional monetary system and millions of people being unnecessarily unemployed and disadvantaged as a result.

I investigated further.

Why?

Well because it might have been that the austerity bias was just concentrated on recurrent (consumption) expenditure and the overal negative impact of the government sector was attenuated by its contribution via gross capital formation – or investment spending.

This is the spending that builds transport infrastructure, schools, hospitals, urban infrastructure and that sort of essential capacity.

It also provides a basis for private sector capital expenditure – leveraging of the public infrastructure.

Given the way the data is presented by Eurostat, it is more difficult to decompose the aggregate investment data into sectors.

We know from the March-quarter national accounts that “Gross fixed capital formation decreased by 4.3% in the euro area and by 3.9% in the EU” and the “the contribution from gross fixed capital formation was also negative in both zones (-1.0 and -0.9 pp respectively)”.

So it is hardly likely that government investment spending was so large that it offset the recurrent austerity.

First, the overall investment ratio in the Eurozone slumped from 23.7 per cent in the December-quarter 2007 to a low of 19.3 per cent by the March-quarter 2013.

Overall capital formation slumped 21.1 per cent over that period.

It is still below the pre-GFC peak.

By the March-quarter 2020, total investment spending in the Eurozone was only a fraction above the December-quarter 2007 value (index value of 100.1 compared to 100).

So for more than 12 years, total investment spending in the Eurozone has been below the level it reached just prior to the GFC.

That alone is a damning statistic.

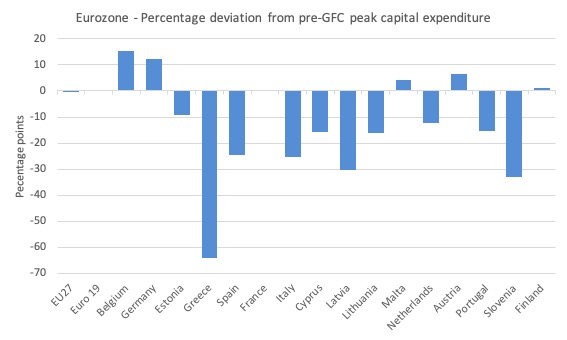

The following graph shows the performance of the Member States (where data is available) in terms of the percentage point deviation from the December-quarter 2007 levels of total gross capital formation evident in the March-quarter 2020.

A negative bar indicates that the level is below the December-quarter 2007 level.

Estonia is 9.4 per cent below.

Greece 64 per cent lower (shocking policy abuse), Spain 24.4 per cent, Italy 25.4 per cent, Cyprus 15.7 per cent, Latvia 30.2 per cent, Lithuania 16.1 per cent, Netherlands 12.2 per cent, Portugal 15.2 per cent, Slovenia 33.2 per cent.

So the application of the fiscal rules and the austerity mindset within the Eurozone has meant that several of the largest economies (and smaller ones) have been undermining their future productivity and prosperity by creating conditions where governments and business stopped investing in new capacity and technologies.

The pain of that folly will resonate for generations to come.

That is how bad the dysfunctional monetary system they created is.

Using AMECO data, I investigated further.

This data allows us to split Gross Capital Formation in millions of euros in the government and private sectors.

1. For the period 2008-2014, public investment expenditure fell by 14.3 per cent in the Eurozone. So the austerity was impacting negatively on both recurrent and capital spending during the worst of the GFC.

2. Between 2008 and the end of 2019, public investment expenditure has only grown by 1.42 per cent overall – in other words, hardly at all.

3. But the spatial divergence is huge in a monetary system that was claimed to be constructed to promote convergence across Europe.

4. Between 2008 and 2014, public investment expenditure fell by:

– 1.8 per cent in Estonia.

– 56.7 per cent in Ireland.

– 51.37 per cent in Greece.

– 56.64 per cent in Spain.

– 26.81 per cent in Italy.

– 39.56 per cent in Cyprus.

– 26.56 per cent in Lithuania.

– 16.82 per cent in Latvia.

– 8.04 per cent in the Netherlands.

– 48.18 per cent in Portugal.

5. Between 2008 and 2019, public investment expenditure fell by:

– 28.14 per cent in Ireland.

– 69.1 per cent in Greece.

– 47.6 per cent in Spain.

– 19.31 per cent in Italy.

– 29.3 per cent in Cyprus.

– 21.28 per cent in Lithuania.

– 37.07 per cent in Portugal.

These contractions are catastrophic in terms of future productivity growth and prosperity.

They undermine the ability of nations to pay higher real wages without impacting on inflation.

It is obvious that the fiscal positions of the Member States have moved to lower deficits (higher surpluses) since the GFC.

But part of that shift has been the systematic trashing of economic potential which will blight the Member States for generations.

The cuts to public capital expenditure signify a lost past and an endangered future.

Conclusion

For those progressives who hang on to the dream of “Europe” that works, this data should be enough to tell you that the system they claim to support will never deliver the ‘dream’ they long for.

This is a massively dysfunctional system.

Even at a time when the world has fallen into the worst economic crisis in nearly 100 years along with a health emergency not seen since the early C19th, the governments still cannot break free and underpin growth.

The data released this week by Eurostat (as shown in the initial graph above) is stunning really – and I have been examining data for quite a while now.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

After lockdown there will be a huge fiscal error.

There is always a huge fiscal error. The previous fiscal errors made this current fiscal error, a fiscal error

They will balk at the numbers and tighten prematurely. Across the developed world.

Why JG has to be implemented

As Bill concludes: “This is a massively dysfunctional system.” This is becoming increasingly clear to more and more of us, so why is this oppressive, ecocidal neoliberal system allowed to remain in place? In “Equality,” written during the first Gilded Age, Edward Bellamy offered at least one good reason. “That lack of constructive imagination on the part of the mass is the obstacle that has stood in the way of removing every ancient evil, and made necessary a wave of revolutionary force to do the work. …People could not clearly realize what was to take (that evil’s) place.” Without big, bold ideas about what a better, more beautiful world would look like, actually feel like to live in; how it would operate and cover essentials like social cohesion, personal initiative, etc; how production and distribution would occur without the “invisible hand” of the “free market” now tightened around our throats by its inevitable plutocratic devolution–without such big ideas we can only focus on and criticize this tree or that in the neoliberal forest, rarely if ever reaching the overriding issue of that forest itself. My fear is that neoliberalism and its accompanying postmodern mockery of all “big narratives” except its own (TINA), have so crippled our individual and collective imaginations that we are devoid of thinkers of sufficient substance and scope to lay out detailed and viable visions of radically ecological and egalitarian post-capitalist societies. Where is our 21st Century Edward Bellamy, who once–if only for a brief, shining moment–rocked America and the world with his concrete and compelling vision of a radically egalitarian social order?

“In the national accounts framework, the statistician considered unintended inventory accumulation to be a component of capital formation (or investment) and so the build up of unsold goods is an ‘investment’ for the future.”

I yelled out oh my god at this as I read this part!

Heart goes out to poor people in europe. However, they ought to realize by now that austerity is killing them and if they know, they need to start doing massive strikes and defund econoomics departments.

Neo-liberalism, the EU, the western response to Covid – it’s all a re-expression of Laissez-Faire of the 19th century, so loved by the Robber Barons. LAISSEZ-FAIRE — LET THINGS RUN THEIR COURSE. Within that thinking is a core of malice.

” it’s all a re-expression of Laissez-Faire of the 19th century,”

That is the liberal trader’s view of the world. All a machine running in harmony with no nasty politics involved. And that’s the view in both Liberal theory (economics and politics) and Marxist theory (base and superstructure) and therefore why we have ‘economics’ rather than ‘political economy’.

The mistake is that bifurcation. One you grasp that it’s all politics and therefore all an expression of power plays it all becomes clear.

Bill,

“The general government sector actually undermined growth.

I found that result stunning and an exemplification of what is wrong with Europe these days. It’s structures and cultures have combined to create dysfunctional responses from government to crises.”

I can attest to that. Currently I am acting as advisor to a regional parliament group in economic affairs in the Basque Country. We are preparing all sorts of proposals asking for emergency funds for municipalities, job creation plans, projects for home insulation improvement, etc… Everything is being turned down by the ruling Basque Nationalist-Socialist coalition.

We are told amazing things by them: “your proposlas are inconvenient/irresponsible”, “this is proof of the maturity of our institutions: if tax revenues go down then all levels of government have to adjust in a risk sharing model”, “if we only depend on government spending for the recovery that would not be a good thing”.

The ruling parties in Europe are like Nero playing the harp as Rome burns.

Bill,

Has anyone prepared economic scenarios for a long term solution for both post Covid -19 Recovery and a genuinely sustainable Europe? This to compare with a scenario of current trajectory based on the dysfunctional response.

EU LONG TERM SOLUTION – SCENARIOS

– Taking the Eurostat figures above as starting point ( the problem to solve)

– Re-iterate the solution ( EU goal of a prosperous and sustainable, socially responsible EU trading bloc )

– Redesign The Treaty permitting ECB to purchase unlimited bonds , cancel debt or hold in perpetuity + whetever else required to achieve EU stated goals.

– Apply MMT principles or other intelligent economic strategies to show the real options to solve the problem long term.

– Include the removal of all the obstacles by different countries preventing a genuinely sustainable Europe

– Present the scenarios solving the problem and compare with scenario of current trajectory country by country.

WHY PREPARE THESE SCENARIOS ?

1. To demonstrate clearly to all decision makers AND the citizens of Europe what needs to be done to achieve Real Recovery and Sustainable Growth for Eurozone.

2. To Identify clearly the obstacles which need to be removed for this to happen.

3. To demonstrate the catastrophic impact of the current ( dysfunctional) trajectory.

4. To use as many scenarios as necessary to try to solve the problem including minor tweaks so that there is no ambiguity that Austerity will be the outcome under current Treaty. ( WOPR tic tac toe in War Games comes to mind here )

[Bill edited out link to site I did not wish to promote]

5. To demonstrate from above ( failed ) scenarios that the Treaty does need to be redesigned.

6. To demonstrate that either the Treaty is dead ( and very possibly the European Project in current form ) or that the EU countries get real and remove all obstacles quickly for it to become a de facto unified trading bloc to achieve its stated objectives.

WHO SHOULD CARRY OUT THIS BODY OF WORK?

1. Economist led teams with researchers, data analysts , private sector cross discipline members focused on different scenarios , component parts and strategies to solve the problem.

UNTAPPED ASSETS

The following is a list of the professionals who have most to lose by Austerity and lack of adequate scale and diversity of investment. There seems to be considerable discussion in webinars and online on what should happen by people with the requisite skills to lead scenarios but couched in the failsafe ” personal opinions only ” and received as A ‘great contribution to the debate’ by their peers.

The following resources we have in public and private sectors ( in Ireland )

-Data from all sources , open data and private sector if requested CSO AIRO EUROSTAT and others

-ESRI and IFAC teams

-Experienced researchers in all disciplines

-Experienced data modellers , statisticians, visualisers

-Experienced Planners and Architects , Engineers

-Experienced Cross Discipline Problem solvers in private , public sectors and academia from all

backrounds

-Experienced Economists with differing approaches – leads team to research , analyse different

approaches and evolve clear strategies / scenarios

-Experienced , bright moderators

I really do not understand why they do not try to solve the problem by putting their ideas into practice and using real data. Is it a lack of confidence ?

The greatest source of Untapped Assets is within the 3rd Level Education where the network of thought leadership , skills and practitioners collide.

It is also the sector most affected by Covid-19 where overnight their business models of International Students and Student Accommodation crashed.

This sector has the most to gain by solving this problem and re-imagining (with evidence) a European economic model ( and revised Treaty as necessary ) which really works for each country and provides a solid funding foundation for Education – all for the long term.

On the face of it ( and my understanding as a non- economist ) MMT with the necessary inflation controls in place seems to be the most intelligent solution.

If it is proposed as an economic evidenced scenario using real data and solves the problem for the long term , where all others fail then it will make a significant breakthrough.

HOW CAN THIS BE DONE QUICKLY IN CRISIS MANAGEMENT MODE ?

1. OPTION A: |Official | Governments set up Economic Crisis Management Teams similar to their Medical Crisis Teams ( Bletchley Park, Brain Trust, Skunk Works etc ) with brief to develop alternatives and use ” whatever it takes” resources to make this happen. McKinsey have identified as Twin Policy Responses ( Medical and Economic) as critical to effective Recovery.

2. OPTION B: |Unofficial | In event that official channels unwilling to do this that the initiative is taken by Universities in their own countries and European networks , well honed in Horizon 2021 collaboration.

In each case the use of Technology – Zoom ( and others) , breakout rooms for feeding in data , responding to queries can be used to fast track the scenarios.

Using best practice research techniques , ” what it takes resources” the same data and differing economic strategies used to solve the problem and generate the scenarios quickly.

The resulting scenarios would then clearly communicate the outcomes of the different economic models including the current trajectory to decision makers and citizens.

Then a real discussion could begin quickly , again in crisis management mode to agree a long term and genuinely sustainable strategy for Europe with the clear facts in place for all to see.

HOW CAN THIS BE PUT IN MOTION NOW?

OPTION A: ?

OPTION B: ?

Wonderful economic analyses of EU by Bill with supporting evidences, Thank you so much for this!

I am particular concerned when he said it will be difficult for nations to increase real wages without causing inflation.

If EU is a company, it will not be a happy one to work or invest in for the foreseeable future, especially for the low and middle income workers!

vorapot

GDP Falls for April:

Uk -20.3%

Spain -21.8%

Italy -19.1%

France -20.1%

Germany -18%.

Though, even political economy didn’t help improving their analyses. I have read a few works lately and all of them (including marx of course) take their dumps on political economy.

You are right though, the idea of separating the two is silly.

Climate change and racism are also partly tied to capitalism too.

“GDP Falls for April:”

And yet we are all fed and watered, and other than the boredom things are ticking along sort of ok.

Almost like chasing GDP figures doesn’t actually matter that much and we should find a new metric to pursue.