Since we began the Modern Monetary Theory (MMT) project in the mid-1990s, many people have…

British-EU disputes suggest the Tories are set to break away from the sordid Thatcher legacy

Wednesday brings music and not much blog posting activity. But I have been following the debate in the UK and Europe about the likelihood of some sort trade deal or not with some interest and amusement. There are several facets to the discussion: (a) the on-going hypocrisy of the European Union elites; (b) the necessity for major state intervention in Britain (and everywhere) and the possibility that the Tories will abandon Margaret Thatcher’s EU single market legacy is another sign that the paradigm shift in macroeconomics is well under way. (c) the way in which the Labour party are being wedged on the issue and refusing to come out in support of further state aid. Instead, inasmuch as they are saying anything, they are just repeating the mindless, neoliberal dogma about ‘free trade’. They will lose on that one, one thinks. All round it is interesting to follow as an external observer.

Some reflections on the current British-EU stand-off

The so-called ‘trade talks’ between the newly independent (and cheers for that) Britain and the European Union are floundering seemingly on the reluctance of the UK to proceed as if nothing changed when it left the neoliberal-entrenched EU.

It seems a major sticking point is the EU’s insistence on Britain agreeing to abide by EU rules that predicate against state aid to industry.

I have always found the claims of the EU to ‘free market’ purity to be ridiculous anyway.

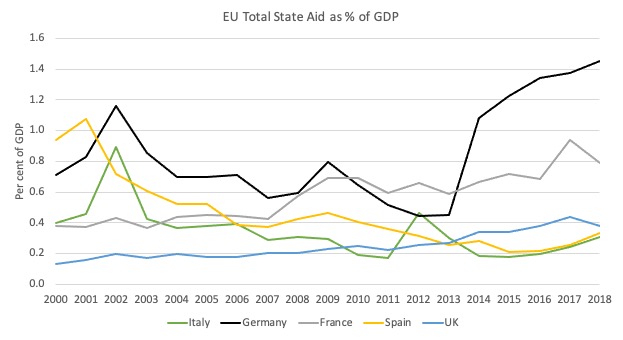

There is significant state aid to private industry throughout the EU and in some cases it has been on the rise over the last decade.

Michel Barnier is once again trying to play the bully-boy role, which he adopted prior to the Withdrawal Agreement, hoping to pressure the British polity into rejecting the deal and stalling Brexit forever.

His failure just made his aggressive tactics look like stupid.

Despite his insistence to the contrary, the remaining 27 EU nations are now the losers from the British exit.

While we have been confronted with the continuing claims by Michel Barnier that Brexit was Britain’s problem, the reality became clear in the earlier part of this year.

The EU ‘Budget’ lost between 60 and 75 billion euro over the next seven years and the austerity mindset, driven by Germany and the Dutch, with support from the so-called “Frugal Four” (Austria, the Netherlands, Sweden and Denmark) have insisted that those losses feed into cuts in various essential capital developments.

I considered that issue in this blog post – The EU outdoes itself in the madness stakes (March 2, 2020).

The fighting over the fiscal losses arising from Britain’s withdrawal have also impacted on the ability of the EU nations to properly deal with the pandemic.

Only limited fiscal support has been provided to date and if more comes after all the wrangling, it will probably be too late (in cyclical terms).

The whole place is a dysfunctional mess and it is to Britain’s advantage that they forge a separate path and use their own currency capacity to rebuild their economy after years of austerity and then the damage from the pandemic.

First, the issue of state aid is one of those examples of EU hypocrisy. Everyone is talking about Britain’s response but consider the fact that state aid is alive and well in Europe and like many things Brussels overlooks it.

The following graph shows the evolution of total state aid as a per cent of GDP for the major European nations and the UK from 2000 to 2018.

I am not criticising the provision of state aid at all. But its existence exposes the ad hoc nature of the hypocrisy involved.

The data is available from the – State aid Scoreboard 2019.

The point is that there is no sense that the major European nations do not indulge in providing state handouts to their industries.

Clearly, since 2012, Germany has significantly expanded its state contribution to industry through aid.

Spain and Italy, by contrast have been reducing the commitment to state aid.

And, the UK has hardly demonstrated a tendency to expanding its state aid prior to the pandemic, although there has been an increase since 2008 in response to the GFC.

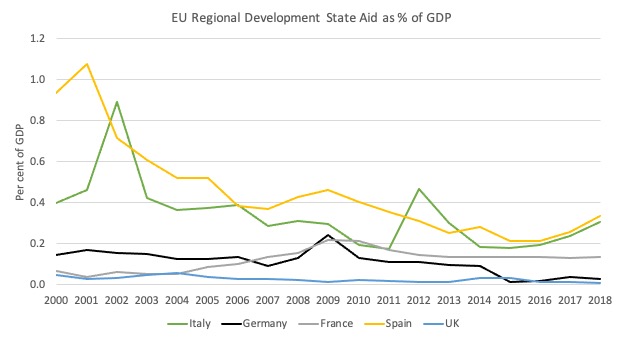

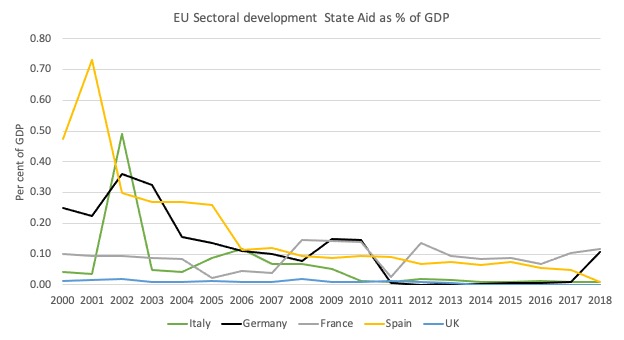

Where has this aid been going?

The next graph breaks the total down in to the regional development objective.

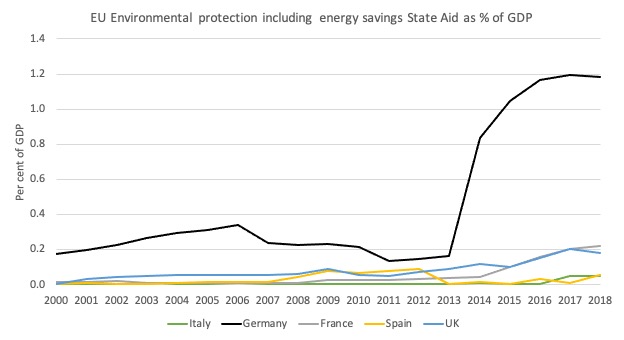

And Environmental protection including energy savings. This is driving Germany’s upward trend.

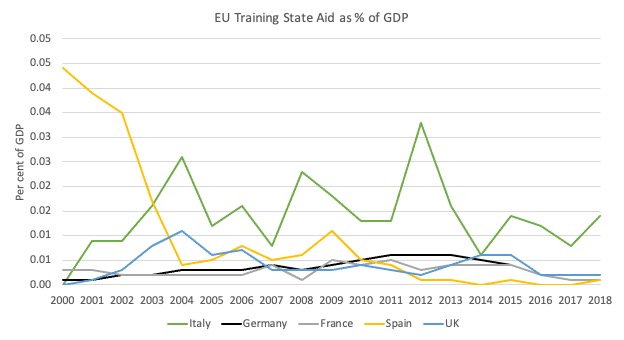

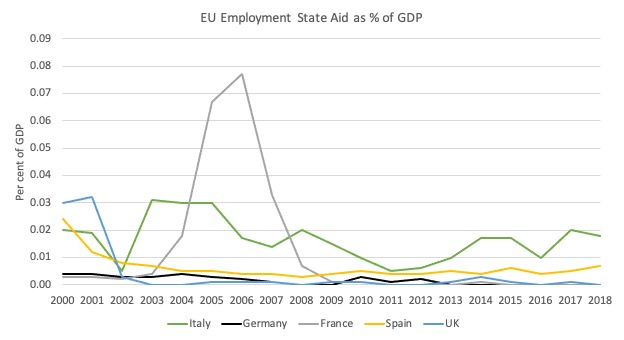

And Training – hardly anything, although in the UK’s case it stands out in providing state aid to human capital development and employment (see next graph) relative to the rest. But the amounts involved are not large.

And Employment – hardly anything.

And Sectoral Assistance – hardly anything.

There are other categories such as SME and risk capital, Culture, Heritage conservation, Rescue and Restructuring, Closure aid, Compensation of damages caused by natural disaster, Promotion of export and internationalisation, etc., which have limited data available or very small amounts involved (in the main).

Second, consider the challenges into the future.

1. Addressing the years of austerity – damage to basic infrastructure, education and training, services, reversing privatisation, etc.

2. The climate challenge – a massive transformation in the production and consumption patterns is required to facilitate the transition to a low carbon-intensive economy.

3. Pandemic – and on top of that a massive health challenge, which has exposed the weaknesses in our health systems, mostly arising from austerity and the application of a ‘free market’ mentality.

What does that all imply?

Massive and continuous state outlays, the scale of which we rarely see (outside of war), will be required to provide the financial support to meet these three challenges.

The British government simply has to reject the Thatcherite narrative (which was really first rehearsed by Dennis Healey and co in the mid-1970s) and return to the sort of vision laid out by Tony Benn when he was the Secretary of State for Energy in 1976.

He issued several documents in November 1976 outlining his alternative plan for Britain, which included the rejection of any dealings with the IMF.

This was in relation to Cabinet submissions from the Chancellor (Healey) proposing to invoke harsh (neoliberal) spending cuts and depoliticise the decision by claiming that the IMF was forcing them on Britain in return for a loan that was essential because Britain (a currency issuer) had run out of money.

As a real alternative to the Monetarist direction the British Labour government was proposing to take, Benn presented a paper to Cabinet on November 29, 1976 – The Real Choices Facing the Cabinet – which proposed a six point “national recovery plan” which was characterised by:

1. Introduction of import quotas on manufactured goods.

2. Introduction of “import deposits” as an interim measure while the quotas were being worked out.

3. Introduction of capital controls to “check speculative outflows” (p.4).

4. “Reintroduction of a Capital Issues Committee” (p.4), which would serve to ensure that bank credit was directed into areas of “national priority” to reinforce the protection of the homemarket provided by the import controls. This was like a national infrastructure assessment process that is common in many countries, including Australia.

5. Reduce interest rates “for all but official holders of sterling” (p.4). In other words, provide cheap finance to industry but not provide an incentive for those foreign interests with the remaining sterling financial assets to continue selling.

6. Introduce planning agreements with industry and provide “more funds for the National Enterprise Board and the Scottish and Welsh Development Agencies” (p.4).

The intent was to “re-industrialise” Britain and rebuild its export base (p.4).

In this context, Benn argued that the IMF might extend a loan to help the plan succeed and if any additional conditions were required they should focus only on “tougher import restriction” (p.5).

I discussed that in this blog post – The British Left is usurped and IMF austerity begins 1976 (June 29, 2016).

Please also see these blog posts:

1. IMF changes tune on industry policy – shamelessly – Part 1 (April 8, 2019).

2. IMF changes tune on industry policy – shamelessly – Part 2 (April 9, 2019).

3. British Tories reject the ‘free market’ neoliberal myth (December 11, 2017).

History tells us that Labour did not follow Benn’s vision and the Winter of Discontent followed, which paved the way for Margaret Thatcher’s dreadful period in office.

Now Britain has a chance to return to that sort of state intervention – and should – to meet the challenges specified above.

It will be another sign that the paradigm shift in macroeconomics is well under way.

And a no-deal Brexit will allow the government to provide extensive state support and choose industry winners – South Korea style, in a way that the EU would never allow.

Whether the Tories have the calibre to do that properly, as opposed to just doing deals with mates in failing sectors, is another matter that I pass no judgement on at this stage.

But passively accepting a ‘free trade’ deal with the EU will not be in its interests.

Barnier is still trying to claim that the EU promotes ‘competition’, but that is just a ruse. It does not. It promotes cabals of entrenched capital interests and allows state aid, nationalisation, when it advances the interests of the elites.

There are two additional things of interest here;

1. These developments are creating massive tensions within the Conservative party itself. More government intervention is anathema to many of the Thatcher-type ideologues who are now forced to suck it up because the smarter operators in government know that they have a unique chance to play the Labour party out of the game forever in the former Labour seats that the Tories won in the December election.

That reality, alone, drives a more interventionist dynamic.

2. And what of the Labour Party? Where are they in all of this? Its new leader – a key Remainer who vowed if they win office to take Britain back into the EU is clearly being wedged by current developments.

Starmer is clearly not sure what strategy to adopt now.

He has been claiming Britain has to honour the Withdrawal Agreement but when it comes down to the next election will the British people care about that? I doubt it. They will care about how Britain is travelling in terms of work, wages, housing, energy, and health.

All of those things are within the capacity of the current government to improve.

Just like the Tories ran the “Get Brexit done” simplicity in the December election, you can see them running a “Do you support Britain or Brussels” type campaign in the next election.

Labour will lose that one too.

And where does Labour stand on the state aid question?

Mostly silent, although in a recent ITV interview (September 9, 2020)- Keir Starmer: Boris Johnson must ‘get on’ with Brexit deal and focus on fighting coronavirus – the Labour leader is still pushing the

‘free market’ line, supporting the EU’s insistence that Britain doesn’t go it alone.

Starmer has now abandoned, its seems, any call for a new referendum on Europe.

But it is clear Labour are as confused as ever.

Expressions of Interest sought for MMTed courses

MMTed will offer some trial courses in the coming months to test our systems for scale and interest in the offerings.

The first course will be – Basic concepts in Macro – and is designed to cover some elementary topics to allow participants to grasp the ‘macroeconomic’ way of thinking, essential terminology and language, and the basic issues of measurement and conceptual demarcation.

It will be a precursor to more advanced offerings in macroeconomics and monetary theory.

Students who have previously studied economics will find repetition but also reinforcement of their prior learning, although the way we approach this material is conditioned by what we teach later – that is, from an Modern Monetary Theory (MMT) perspective.

So it is moot as to whether such a person will gain much from this introductory course.

Students with no background in economics at any level but who want to improve their grasp on basic concepts and frameworks will obviously benefit greatly from starting their journey with MMTed at this stage.

We are still not sure when the first course will begin or under what conditions (times, etc) it will be offered. We hope to launch the first classes in October once we see what the demand is.

We are now seeking expressions of interest from any one who wants to enrol in this course.

You should send an E-mail to Melinda Hannan at coffee@newcastle.edu.au and provide the following information:

1. Name.

2. E-mail address that works.

3. Previous educational attainment – level and discipline.

4. The preferred time and days that you are available for face-to-face interaction. It would also help if you provided the city where you reside.

The minimal private information will never be disclosed to anyone outside of MMTed. But it will help us design the timetable to best suit those who are interested.

The introductory course will be freely offered. You are, however, advised to have access to our textbook – Macroeconomics – to facilitate your studies.

An expression of interest is no guarantee that you will be enrolled in our student system. We will see the potential demand first and then scale enrolments to our resources, which are still very limited at this stage.

We will rank the expressions of interest by receipt time and date.

Music – There’s a reward for me

This is one of the great songs from a great 1975 album – Life of Contradiction – by the ‘father of reggae’ – Joe Higgs (released on the Micron label).

I purchased this album around 1976 (it took some time to get to Australia) and is one of my favourites.

Joe Higgs is a legend of the Ska, Rock Steady, and Reggae – both as a recording artist himself but also as a mentor to the original Wailers in Trenchtown.

The backing band on this album was the – Now Generation Band – which was one of the premier studio bands in Kingston in the late 1960s and 1970s.

The BBC review described the album as “A work of astonishing depths and bruised, aching humanity” (Source).

It is hard to disagree with that assessment.

He also recorded an acoustic version which appeared in the 1977 film – Roots, Rock, Reggae (which runs for 52:51 minutes).

This version is raw, matching the lyrics, but very powerful.

If you want to listen to the original Ska version released in 1965 when Joe Higgs was in a duo with Roy Wilson you can find it – HERE.

I prefer the later, solo version in the Rock Steady pattern.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

State Aid has always been legal in the EU. Only that it has to be approved by the technocrats in the EU commission – rather than happening because the voters voted for it.

So there is “good” state aid, approved by your unelected betters in Brussels, and “bad” state aid, put in place by the legislature elected by the people.

Fully agree Bill but as you know the British Govt is way beyond Thatcherism now. None of this or Tony Benn’s Alternative Economic Strategy, will come to pass.

As Neil, says “State Aid has always been legal in the EU”, but I’m more concerned about the implications of No Deal for SMEs dependent on EU trade. With a Benn-type strategy this could be managed, but I can’t see the tories coming up with what is anathema to all of them. They’re really spitting feathers at the moment being forced into all this intervention. ‘Free trade’ was never what I voted for.

The British people do care about housing, among the other things listed, and the tories know it. But they haven’t a clue how to fix it.

“I’m more concerned about the implications of No Deal for SMEs dependent on EU trade.”

They can either pay the full cost of engaging in that trade, or they close. Fundamentally they have been subsided up to now by people paying 16% tariffs of oranges, etc and that is over.

It’s a redistribution away from exports, which are a real cost, towards imports which is a real benefit. The currency will move as required to balance those forces and resources reallocated accordingly.

Nothing to worry about in aggregate. But those who backed the wrong horse will lose out. That’s capitalism!

It’s disgusting…

A complete and utter disgrace the left still refuse to have a LEXIT vision. They’ve never had one.

What makes it even worse. Is They have sat and watched the UK govt destroy every mainstream myth regarding the UK monetary system. The UK treasury and the BOE have shown quite clearly during the virus that they can do whatever it takes to make Brexit a success. They can’t run out of keystrokes.

The liberal left are a farce. Simon Wren Lewis blog of endless impending doom and his articles in the Guardian of why everyone should have voted remain. Should be enough to retire him, send him out to pasture on a farewell speaking tour in European capital cities.

The GROUPTHINK tour. One last album from the liberal middle class wailers. The liberal metropolitan elite top up your pension, so I can live in Islington tour.

The album would be called: Who’s ever met a working class leave voter, as I’ve never had one round for dinner.

With special guests : We’re not an economists, we are political activists support band.

Hits include:

Ain’t nobody here but us Chlorinated Chickens

Room with a Kaldorian view

Equilibrium at dawn

The zero lower bound train to Harlem

Fiscal sustainability rocking on a Rogoff porch

Monetized Gold in them hills

Debt to infinity and beyond

I like to loan out reserve balances for ma Bourbon

With the No 1 classic:

Floating on the deficit and inflation balloon over the autumn coloured mountains of the Netherlands.

New Release:

Please man for the love of God just go. Retire and leave us all in peace.

I guess we could discuss whether the UK should be able to apply state aid without recourse to the EU or not once it is no longer part of the EU, but that isn’t what bothers me about this…

…what bothers me is that the UK has signed an international treaty, and now the Government are propsosing legislation which unilaterally breaches parts of that treaty (it’s more than just state aid).

The UK Government knows that it is in breach with the withdrawal agreement, it’s not an accident nor an oversight. The civil servant who heads the department responsible for the bill has already resigned – he is required to resign by the civil service code.

On the international stage this is a serious act of bad faith, the Americans have already reacted to it, and it’s going to make negotiating any kind of deal with EU even more difficult, especially if they think we will renege on the parts of the deal we don’t like.

It’s not impossible that the UK will end up in a tit for tat tariff stand off with the EU… unlikely… but not unthinkable.

“On the international stage this is a serious act of bad faith”

Only from legalists and globalists – and with the usual ill informed propaganda. Those who believe the international globalist sphere should trump the domestic one. And it’s hypocritical of the EU which has been in breach of the Dublin Agreement all year.

International law has no force in the UK domestic sphere other than by Act of Parliament. If Parliament decides to change how part of a treaty acts on the domestic sphere then it is entirely within its rights to do so. That’s what clause 38 of the Withdrawal Act guaranteed they would be able to do – which parliament passed and which in any case was nothing more than confirming what every student of the British constitution already knew.

Just as any student of the International law knows there is no enforcement mechanism regarding Ireland. No court has standing – because it was previously part of the British Empire. Another little safeguard the UK put in place.

@ Neil

“people paying 16% tariffs of oranges”

There is no 16% tariff on oranges, it’s a myth. The standard rate is 3.2% but and it’s a big but very few countries get that, all those that qualify for GSP have a zero rate, so few get 3.2% (US and a few others basically) not South Africa which is the one I have heard used.

It shows how far the middle ground has moved since the 80’s

When the Tories can keep out flanking Labour on the left. The liberals can’t seem to grasp it is their fault.

The Brexiverse when the right acts like the left and the left act like liberals.

“There is no 16% tariff on oranges, it’s a myth. ”

They imposed 16% in Nov 2016 (according to eutariffs.com), and the tariff is now marked as “variable” – all to protect the Spanish orange market in season.

And of course it’s the same for many of the goods that come into the EU from the outside where they wish to protect the internal producers – where the UK doesn’t have any producers.

Obviously once we’re clear of the CET we can drop all those to zero (if we have any sense). That’s the tax we eliminate.

According to MADB Satsumas (0805211010) have both a 16% tariff and a minimum price – except for South Africa.

https://www.trade-tariff.service.gov.uk/commodities/0805102810 0805102810 sweet fresh oranges of either high or low quality.

As you can see, this says 3.2% but and what most people don’t look at is the import tab with all the exceptions and that is the mistake made. Go down to South Africa and you see it has a preference of zero and in fact most countries have zero, only really some of the wealthier countries ever get a tariff against them.

Yep we can obviously and will can set them where we want from January and I can’t see any reason that oranges need a tariff against them unless we prefer to import them from GSP qualifying countries as aid over importing them from the US. That is of course another story 🙂

I did reply Neil but placed a link in forgetting that it goes into Moderation

I use the UK Gov tariff as the search works better.

Satsumas do have 16% but as explained in my other comment make sure if using the UK one you click the import tab as that gives you all the exceptions and there are always lots have zero (all GSP countries are set at zero).

Ok, let’s do a specific example. What’s the tariff and minimum unit price for Moroccan Satsumas at Christmas this year? From what I can see they knock the zero tariff off at the end of October and it goes back to 16% until March.

We used to get a ton of Moroccan stuff in the supermarket at Christmas when I was a kid. Satsumas and Dates particularly.

Next year we can presumably maintain that zero tariff year round and remove the minimum pricing. Which means Moroccan stuff will be back in the supermarkets at Christmas.

Out of that season it would be 96.60 EUR per 100 kg, without weighing at satsuma i have no idea what that means % wise but unlikely to be anywhere near 16%.

Yep we can and I am not saying we can’t and a bit like the oranges example I am pretty sure we are not big exporters of citrus fruits, you may want to keep a tariff on some countries though but that as i said is a different story. We won’t be taking down our regulatory barriers as I understand it currently (whether they will in Jan is open to debate, i expect port health etc to be overwelmed) so conformity certs are still going to be required…as they will on Spanish fruits.

Oh BTW forgot to say HMRC aren’t going to use an emergency tariff they are going to use the schedules they lodged at the WTO (or at least that’s what they are saying) which are pretty much the same as the EU’s external tariff and includes still using the EUR on standard import values. Madness.