For years, those who want selective access to government spending benefits (like the military-industrial complex…

Scotland: a nation cannot be independent and use another nation’s currency or even peg to it

It is Wednesday and only a few points plus a sort of reflection on a recently departed musician. The few points really relate to the latest news from Scotland that it is thinking (once again) of seeking independence but using a foreign nation’s currency (one version) or pegging to another nation’s currency (another version. We should be clear – an independent Scotland requires its own currency, which it floats on international markets and has a central bank that sets its own interest rates (that is, determines its own monetary policy). Using a foreign currency or pegging to a foreign currency immediately voids national independence. The fact that the leading players in the independence debate don’t seem to comprehend that point is a worry. The fact that there is also strong sentiment to be part of the European Union post independence also tells me that the notion of independence is not well understood or developed in Scotland. That’s the bad news today. The good news is much more interesting – check it out.

Bonnie Scotland seems intent on going down the ‘gurgler’

I have written about Scotland before:

1. Australia and Scotland and the need to escape neoliberalism (May 20, 2019).

2. Some MMT considerations for an independent Scotland – Part 1 (May 7, 2019).

3. Some MMT considerations for an independent Scotland – Part 2 (May 6, 2019).

4. Ridiculous MMT critiques distorting Scottish independence debate (April 23, 2019).

5. Oh Scotland, don’t you dare! – Part 1 (June 4, 2018).

6. Oh Scotland, don’t you dare! – Part 2 (June 5, 2018).

7. I would be voting NO in Scotland but with a lot of anger (August 18, 2014).

8. Bonnie Scotland – ignorance or denial – either way it is fraught (October 13, 2013).

9. Bonnie Scotland – ignorance or denial – either way it is fraught (September 27, 2012).

Many of those posts were in response to my interest in the questions that were arising about Britain’s position in Europe and the possibility of Scotland breaking clear of the neoliberal chains that continued membership of the UK guaranteed – whether run by the Tories or New Labour.

I have also been fascinated with the Scottish question since I studied the Jacobite period quite intensely as a university student and beyond.

But they were also in response to calls from activists in Scotland for research evidence from an Modern Monetary Theory (MMT) perspective to help them lobby for the best currency outcome should Scotland become independent.

By the way events have unfolded in the last year, it appears that shifts within the independence movement has meant they are no longer interested in an MMT solution nor an anti-EU voice and I am no longer part of their dialogue.

They have instead sought to build a strategy using input from those who purport to be MMTers but who sadly lack the qualifications to claim that expertise and are pro-EU and all that that represents.

I sensed on my several visits there that there was always a friction between the pro-EU camp within the independence movement and those who, sensibly, understood the EU to be the bulwark of neoliberalism and that Scotland would only be going from the ‘frying pan into the fire’ if it left the UK but then sought EU membership.

The pro-EU camp also could not seem to appreciate that they would not be able to claim continuation of Britain’s membership, post Brexit and thus retain the Treaty Annexure exemptions pertaining to the maintenance of their own currency that was applicable to Britain (negotiated by Margaret Thatcher).

If they entered the EU it would be as a new country and they would then have to adopt the euro after the convergence criteria were met, which, as we all know forced the accession candidates in the late 1990s to invoke premature austerity long before the Stability and Growth Pact was introduced.

Which brings me to the latest development that echoes a long held proposition – that Scotland should adopt the Norwegian krone should it gain independence.

One word describes this proposal: madness.

This idea goes back to 2012 before the first independence referendum.

It was based on the idea that Norway and Scotland share an industrial bias – export sectors dominated by oil, which in Norway’s case, helps maintain a strong currency.

Scottish economists are scared of a new Scottish currency collapsing.

But the relative productivity of the oil sectors are very different even though the populations of both countries is similar. Norway is more efficient.

Further, the Scottish economy tracks the overall British economy fairly closely. And if you look at real exchange rate movements, the British and Norwegian economies do not move in sympathy in terms of international competitiveness.

In the blog posts cited above, I explain in detail why an independent Scotland requires its own currency, which it floats on international markets and has a central bank that sets its own interest rates.

Nothing short of that will deliver independence.

In this article – Scotland should choose the krone (January 25, 2012) – carried the subtitle “Which currency should an independent Scotland use?”

The irony of recommending the use of a foreign currency and being independent seems to pass these commentators by.

But the problem is deep in Scotland it seems.

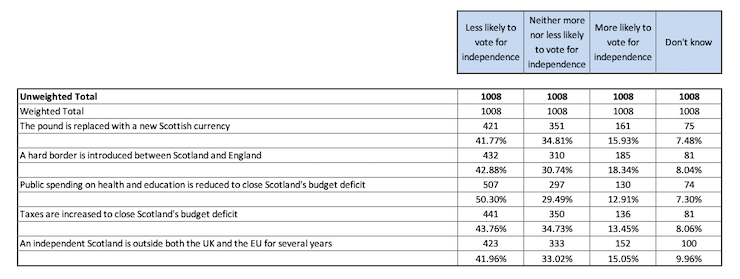

The – Survation poll – conducted over September 10-12, 2020 – revealed that:

1. 42 per cent would be less likely to support independence if “The pound is replaced with a new Scottish currency”. 15.93 per cent said they would be more likely to support the vote. 34.8 per cent were indifferent.

2. 41.9 per cent would be less likely if “An independent Scotland is outside both the UK and the EU for several years”. 33 per cent indifferent, 15.1 per cent more likely.

This Table from the Poll shows the problem:

I am sorry to say that it doesn’t look like a very prospective future for Scottish independence with all that going on.

MOOC Modern Monetary Theory: Economics for the 21st Century

So here is the good news!

I mentioned a few months ago that I would soon have a big announcement to make. I can now make public what I have been up to over the last several months by way of advancing Modern Monetary Theory (MMT) education initiatives.

We are now well advanced on the development of a MOOC that will be launched in March 2021.

I am working with – NewcastleX – which is my university’s digital team to create the course material which will be available all around the world for free.

That is the philosophy of a MOOC.

The course – Modern Monetary Theory: Economics for the 21st Century – will start on March 3, 2021 and you can get all the enrolment details (it is free) from the link.

This will mark the first stage of the – MMTed project – that I have been trying to get off the ground for a while now.

We have been hampered by lack of funds to date, but the partnership with the University on this MOOC has really been a massive first step. The digital learning team at the University is first-class and have really helped me understand how these new platforms work.

In terms of – MMTed – if you are able to help on an ongoing basis that would be great. But we will also appreciate of once-off and small donations as your circumstances permit.

You can contribute in one of two ways:

1. Via PayPal – which is our preferred vehicle for receiving donations.

The PayPal donation button is available via the MMTed Home Page or via the – Donation button – on the right-hand menu of this page (below the calendar).

2. Direct to MMTed’s Bank Account.

Please write to me to request account details.

Please help if you can.

I am very grateful to all those who have donated funds to date. You will start to see the product of our work and your assistance with the launch of the MOOC.

Other courses will start being offered immediately after that.

Music – A mountain has gone!

This is what I have been listening to while working this morning.

I have never really like the Les Paul Junior guitar.

I was partial to the fuzz box but since the early 1970s have never used one.

I don’t particularly like rock and roll and certainly not the heavier tendencies.

I never liked guitar hero bands.

But you have to admit that in the modern history of electric guitar – Leslie West – was one of the better players and his power trios really marked a time in that history.

So why have him on my ‘show’ today?

Because he died on December 23, 2020 at the age of 75. He was a physical wreck all his life but could really play the guitar.

Here the UK Guardian’s – Leslie West obituary (December 28, 2020).

I liked the comment from the Kiss guitarist “Leslie’s tone could stop a rhino in full charge.” That would make any guitar player proud I think.

While Leslie West is most associated with the band – Mountain – I thought he played the best when Mountain split in 1972 and he teamed up with bass player – Jack Bruce – after – Cream – collapsed in a morass of Clapton-Baker ego, to form – West, Bruce and Laing – dubbed the US Cream.

This is one of my favourite songs from their third album released in 1974 – Live ‘n’ Kickin’ – it was from a live concert.

This band got lost in a haze of drugs, which was unfortunate.

The song – Politician – was originally recorded by Cream on – Wheels of Fire.

Leslie West’s playing is cleaner (less fuzz and noise) here, which better demonstrates his virtuosity and the bottom end was one of the best (Corky Laing and Jack Bruce).

You might also like to hear Mountain playing at Woodstock in 1969 with their classic song – Southbound Train – a pretty good performance.

He told the Rolling Stone magazine in an interview published August 24, 1989 – Woodstock Remembered: Mountain Guitarist Leslie West on Playing the Fest – that playing at Woodstock was only Mountain’s third gig and on arriving at the site by helicopter “it felt like something out of Close Encounters of the Third Kind.”

And because he is gone and won’t be coming back, we can listen to another of his great songs – Mississippi Queen – which came out on Mountain’s debut 1970 album – Mountain Climbing! – released after Canadian – Corky Laing – took over the drums and added significance heaviness to the sound.

This was an album that was often playing when I lived in a large house full of people and musicians in Melbourne during the early 1970s.

It is the only Mountain album I have owned.

This version is from the re-released album (1995) but the track is original (1970).

Pretty good.

Anyway, as I get older, I notice all these characters are dying. It is a queue it seems.

RIP Leslie West.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

“Scottish economists are scared of a new Scottish currency collapsing.”

Which in itself shows that they, and whoever is pulling their strings, do not understand MMT.

At the moment the price of a new Scottish currency is infinite, since no amount of any other currency would get you it.

What that table tells you is that the political approach in Westminster to any further sabre rattling from Scotland would be to withdraw the Barnet formula and allow Scotland to operate like Guernsey, Jersey and the Isle of Man – which given that all three have to run a substantial surplus to stay afloat would require the Scottish government to make some very hard choices.

The accounts of the state of Jersey are particularly illuminating, since they look like they have been prepared by some financial conglomerate, not an independent state.

In Scotland today, as it was in Portugal many years ago, the elites are pushing for the EU integration, saying to the lower classes that “it will be in the best interest for all”.

The “trickle down” mantra for short.

And then they destroyed the Portuguese economy in 20 years.

Industries closed by the thousands and services (particularly those connected to tourism) flourished.

With an external big deficit and a government deficit limited by EU rules, the private sector just went on a debt spiral. That’s pure and simple algebra.

And then came the GFC.

Many households colapsed and defaulted their credit repaying to the banks and, in consequence, lost their homes.

The oligarcies where more indebted than households and all of then defaulted on their credits.

Not because they could’t pay, but because they knew the state would nationalize their debt, to save the banks.

And then came COVID-19.

Peoples rights are beeing “mannaged” by the elites and their handy servents in power.

The economic debacle will extend to new heights.

So you see why the elites want the EU and the euro.

As the SNP has already voted and announced their intention to set up a central bank and Scottish currency isn’t this an old argument that has already been at least partly settled?

Dear Neil Wilson, re ‘Scotland to operate like Guernsey, Jersey and the Isle of Man (with oblique accounts to match). That’s logical from a City of London perspective, as those are all tax haven satellites, with just a few peasants who get by on tourism. There are of course similarities with Ireland, which manages nifty tax moves within the EU (that at least keep more people employed onshore than in Greece which has the floating tax dodge industry only to benefit the very few). There’s also the American heritage tie-in and golf courses. It also has some similarity to Norway: both have vast tracts where few live, though much of Scotland is now owned by unidentifiable offshore entities rather than the related English and Scottish gentry.

So a couple of things. At Modern Money Scotland we promote a Scottish currency and its champion – Dr Tim Rideout. We understand that fiscal and monetary independence is key to being independent, along with the abundance of natural resources that we are lucky to have in Scotland.

Whether the Scottish people will vote to go back into the EU is an unknown right now. This possibility can only occur:

1. Once we get a referendum and the people of Scotland vote for independence

2. A pro-EU party or coalition are in power

3. We install our own currency and central bank

4. We call referendum on re-joining the EU

This will be a number of years after the vote for independence and we can’t get a section 30 yet.

At Modern Money Scotland our first job is to convince independence voters that we need to have our own currency to be independent, so that they, in turn, can convince those who previously voted no what the ‘mechanical’ workings of independence are.

We are a long way from rejoining the EU and if an independent Scottish people vote for that, that is their democratic right. When we become independent and there is a referendum on the EU, I for one will work to educate both myself and others on both the pros and the cons.

Independence first though, eh?

“By the way events have unfolded in the last year, it appears that shifts within the independence movement has meant they are no longer interested in an MMT solution nor an anti-EU voice and I am no longer part of their dialogue.

They have instead sought to build a strategy using input from those who purport to be MMTers but who sadly lack the qualifications to claim that expertise and are pro-EU and all that that represents.”

Not sure who you’re getting at there, but you’re wrong. We are building on an MMT framework and making progress. You must visit the Modern Money Scotland Group and the Scottish Currency Group on facebook. The SCG has Warren, Stephanie and others on board, and MMS has recruited Fadhel for his expertise on emerging nations and degrees of sovereignty. You’re welcome to join, you know where to find us.

Agreed, the EU question is a thorn in the side, but those of us who understand MMT are working to educate people, but the EU question has to be separated from the initial issue of independence and currency.

“Independence first though, eh?”

Except that it would seem that the currency question needs to be resolved first, because the outcome of any indyref looks to be dependent on the agreed future currency policy itself.

This was never resolved prior to the 2014 referendum, and the result (No to independence) was arguably a consequence of that indecision.

It’s all a bit chicken and egg of course, but voters should know precisely what they’re voting for in advance, and if the campaign for Scottish independence is pitching its bravery in the forging of a new nation state then for goodness sake demonstrate the courage to introduce your own currency while you’re at it, as well as the wisdom and intellect to fully explain why it’s essential! That way you* will build the confidence in the voters that you know exactly what you’re doing and why.

The irony of leaving one oppressive union only to then tether yourself to it financially (£), or replace it with an equally oppressive currency regime (€), or one over which you have no control whatsoever (NOK) would be laughable if it weren’t so serious.

@KvS, *”You” here refers to Scotland and the Scottish independence campaign, not you personally of course!

Don’t forget that it’s perfectly possible for MMT economists to be pro-EU. The difficulty is the “requirement” to adopt the euro: no MMT economist would be happy to see a country voluntarily choosing to give up its own currency.

But one thing that Brexit has taught us is that there are often compromises to be had. Who is to say that a newly independent Scotland couldn’t negotiate some deal with the EU which allowed them to maintain their own currency, for example.

“Who is to say that a newly independent Scotland couldn’t negotiate some deal with the EU which allowed them to maintain their own currency, for example.”

Of course they could.

Indeed, some EU countries have still successfully retained their own currencies, and may well do for the foreseeable future, even though their stated intention, and treaty commitment, is for eventual euro membership.

The issue, however, is not that Scotland couldn’t also maintain such a strategy, but that those parties negotiating membership, or eventually governing Scotland, may well want to join the euro, regardless of the opt-outs, or fudges, available.

@ Andrew Wainwright,

“Don’t forget that it’s perfectly possible for MMT economists to be pro-EU.”

I’m told that it’s also “perfectly possible” for atheists to be actively pro Christianity. But I have my doubts on that. Many on the left in the UK are loudly vocal in their opposition to Tory induced economic austerity but are quiet as mice when the EU imposes much worse on its own citizens. That’s the problem you have when you try to reconcile the irreconcilable.

As Bill says there is more to having your own currency than giving it a different name to the euro or pound sterling, and more to independence than having your own seat at the UN. There’s no point Scotland having a Scottish Pound (or whatever they want to call it) unless they have total control, free from the constraints of the SGP, over their own fiscal and monetary policies. And they aren’t going to be able to negotiate that with the EU.

Here’s the truth of it……

The crux of the issue.

Why I left the so-called MMT’rs in Scotland. Who’s eyes glaze over when Warren talks about the MONOPOLY price setter or you get into the technicalities of the accounting and deeper aspects of trade and MMT. Moving goods and services around and inflation. It’s hieroglyphics to them.

I left because they are liars and MMT Scotland became the broom cupboard of Richard Murphy and the Common Weal. It is an outrage they call themselves MMT’rs in the first place. They are part of the SNP machinery. Looking for jobs with the SNP.

I got everybody together to set up MMT Scotland it was myself the BBC asked for to do the interview regarding MMT Scotland. Even though I stayed at the back and out of the limelight as I was never interested in being front and centre. Never wanted to be noticed but I knew MMT as I’ve been at this for over a decade.

Not 2 years like Malcolm or 6 months like Kairin van Sweeden. It was my £ thousands that made it happen. I even had to threaten to cancel the Glasgow event to get the rest of them to put their hands in their pockets. Then they ran off with the ticket money for both the Glasgow and Edinburgh events. They think they are MMT experts but They are anything but. Why they dropped MMT from the name They couldn’t live up to it. God knows how many times They tried to write a job guarentee paper and failed.

They all know what the SNP is offering is not independence. I’ve got emails between myself and Robin Macalpine of the Common weal to prove it.They all know it but refuse to talk about it. It is their policy not to talk about it and cuddle Richard Murphy instead. Avoid speaking about the EU at all costs.

Why – Why did they choose to do this.?

Because the Scottish electorate are ill informed about the EU and the majority support it. They don’t want to scare the horses because all that matters is independence. By telling the truth they will scare the horses and never get independence. The SNP and so called MMT’rs strategy in Scotland is clear milk Lib Dem and Labour voters so they can win the independence vote promising the heart of Europe.

Robin Macalpine does not have The funds or the will to take on either Civic Scotland or The SNP.

The So called MMT’rs have deluded themselves to believe they can win independence and then somehow stop the SNP at the last minute before the SNP rejoin the heart of Europe. Read Kairin and Malcolm’s comments that is what they believe. That is what they have pinned their hopes on.

Delusional beyond ignorance. The SNP are laughing at them. Just read the Growth commission and what all the top SNP people and Andrew Wilson say on a daily basis. They are all pro EU and because those people who go to conference don’t know any different they will ride rough shod over the top of all of them. When it gets voted on at conference.

Karin says Scottish people should vote on the EU, that is their democratic right. How can that be when the majority don’t even know what they are voting for ? Because modern money Scotland and Indy think tanks will not and refuse to talk about it.

They all called me a liar when I walked away they said I misrepresented them. I refuse to work with liars and told everyone this is who they are. I’ve highlighted it many times.

Yet they have been up and running for 3 years. There’s all sorts of papers on modern money Scotland website. Not one about the EU. Not one so who was the liar Karin? Just By reading Karin’s and Malcolms comments you can see what they are all about. Lie to the people of Scotland get Indy first then try and talk about the EU. By then it’s too late of course.

I walked away because they didn’t stay MMT consistent. It was Richard Murphy’s version of MMT. Take the bits they liked get rid of the bits they don’t. Which again shows the don’t even understand the lens but pretend they do. Fail to recognise what the MMT economists out together works together not in isolation.

I walked away because I believed we should have been telling the truth to the people of Scotland from day one. The MMT way- tell the truth and let the people of Scotland make a decision on independence so the people of Scotland understood fully what type of independence the SNP were offering. If that meant a NO vote so be it. At least the voters would have the full picture regarding the EU and what it was the SNP were selling.

That’s the MMT way. Not what Karin and Malcolm are doing keeping the people of Scotland in the dark after making a decision never to talk about or publish anything on Modern money Scotland about the EU. Hoodwink and lie to the people of Scotland to get independence first regardless of the consequences. Even if that means being tied to Europe forever.

I’m very confident I will be proved right in the end and these liars will ultimately be seen for what they are charlitans. I’m very confident if Scotland wins the independence vote they will remain tied fully to the EU and the nightmare that it is. Tied to neo!liberal central. Then Robin Macalpine the Common weal and modern money Scotland and Richard Murphy will have some explaining to do. Malcolm and Karin will vanish disappear and blame someone else call everyone liars when they are the charlitans. Once the reality bites of living under EU rules takes hold. The people of Scotland will turn on all of them with a vengeance.

They will have lied to win the Indy vote. Lie to try and disown what they created afterwards it is what amateurs do. While I watch from afar saying I told you so. More importantly my conscience will be clear because I told the truth from day one. That means more to me than anything else.

They scurry around the many different MMT economists until they find ones who they can hang on to. They lie to them as well. When MMT economists explain the truth they scurry to Richard Murphy. Anything but tell the truth about the EU. Anything to keep quiet for that little bit longer. Hang onto anybody that allows them to milk Lib Dem and Labour voters longer with the promise of Europe to win Indy.

After the people of Scotland turn on them they’ll end up with nobody…. You’ll see.

The liars that got Scotland trapped is what they will all be remembered for.

They can call me a liar again on here after I posted the truth above.

I simply don’t care. If Scotland’s wins independence I will be proved right again. You’ll all see these liars won’t be able to stop the SNP.

Ask them

Ask them to show you the dozen or so articles the MMT’rs in Scotland have written about during the last 3 years on the topic of the EU and what the SNP are offering. Ask the MMT’rs in Scotland to show you what they even think about the EU. Ask modern money Scotland to show you what they have written.

Nothing they can’t show you a God damn thing. They lie about it instead and lied for over 3 years. They’ve never written one article and then have the utter brass neck to call themselves MMT’rs.

Ask them……

Richard Murphy has written 2 articles in 5 years and he writes 5 articles a day. Lied the rest of the time the true Mark of a complete and utter charlitan.

“but the EU question has to be separated from the initial issue of independence and currency.”

See delusional beyond ignorance. Thick as mince .

The SNP has been screaming at Malcolm for 15 years that in fact it isn’t separated that they don’t want it to be separated.. No he’s not deaf just stupid and chooses to ignore what the SNP has been shouting for 15 years. He’s even read the Growth commission and still doesn’t hear it.

How many times does Nicola Sturgeon have to say ” heart of Europe ” On TV before Malcolm gets it. He’ll just about get it after the SNP have left a footprint all over his face after marching right over the top of him at conference.

A complete idiot who thinks he can stop the SNP via Facebook after lying to the people of Scotland for years. Indy is all that matters come he’ll or high water regardless what type of Indy it is.

Let’s imagine the EU implodes tomorrow and thus disappears as an issue in the Scottish Independence debate.

It still remains that the independent Scottish government (ISG) would have to be recognised by Westminster (WM) in order to be legitimate and to receive recognition from other states.

WM’s position is that the ISG would have to agree to accept responsibility for a per capita share of the UK’s national debt. They would do this by issuing new debt instruments, payable to WM, and denominated in sterling.

There is no leverage that would move WM off this position, and “No Deal” is not an option.

So the ISG starts life owing billions in UK£, and thus would not, in our lifetimes, or those of our children, be monetarily sovereign.

As Britain is now by default the first member of the notional EUN – the European Union of Nations where each nation ideally must use its own free floating currency and is able to define their own fiscal policy, trade policy, state aid for industry/commerce policy and immigration/movement of workers policy for example all within a preferential trade and standards harmonisation zone; then nations like Greece, Italy and Portugal that have been so disadvantaged by the EU are now free to join the EUN as the successor organisation to the EU.

If Scotland or Wales or Northern Ireland also decide to become independent and adopt their own free floating currencies, then the EUN umbrella could automatically accommodate that outcome.

Eventually as the peoples of more EU nations may witness the benefits of the EUN, they may decide to vote to jump ship to the EUN until one day even the isolated continental islands of Germany and France and later even Russia and the CIS states may join forming a truly pan European and indeed a partially Eurasian EUN.

As the EUN is effectively more like the UN than the EU, Russia with its independent defence posture could easily coexist with NATO and hopefully that counterproductive contest would dissipate over time. This avenue would be important with maintaining a geopolitical balance with the more assertive and rapidly growing superpower of China.

Back to Scotland I believe there is merit in each Scottish adult citizen having access to bank accounts denominated in UK pounds, the euro and the Scottish sporran and being able to freely transfer between each account at the prevailing continuously updated market rate with zero fees.

I feel Scotland although having its own national currency for all governmental and major commercial dealings could then continue to exclusively use the UK pound including notes and coins for all consumer level transactions. Consumer goods would continue to be priced in UK pounds. As by far most Scottish cross border trade is with the rest of the UK and most movement of people is within the UK this arrangement although initially a little complex is actually likely to be much more convenient for most Scottish and other UK people.

Most wages including all government sector wages could be paid in sporran but for many in the retail sector or for many sole traders for example it could be more convenient to be paid with UK pounds or even the euro.

This model would also suit smaller European nations currently in the EU such as the Baltic States which could then join the EUN, readopt their national currencies but continue to use the euro at the transactional level.

‘This is me’ but a knowledge of MMT informs us that the UK national debt is not really debt as that term is generally understood. That so called debt is already an asset owned by those commercial banks and financial institutions both local and foreign including foreign central banks. There is nothing for the UK government to repay. Those other entities mentioned already own those assets.

Many of the MMT academics have recommended abandoning the archaic and unnecessary practice of selling government bonds on a one to one basis corresponding to any national deficits, which is a relic of the gold standard era, and simply paying a small interest on excess bank reserves and also providing a convenient safe deposit account for financial institutions to deposit their holdings of the national currency. The cash rate would be allowed to trend to zero and fiscal policy using the Job Guarantee would be used for more optimal inflation control. The awful and ineffective NAIRU method of inflation control would be replaced by NAIBER.

The sale of government bonds does not fund national government deficits when a free floating fiat currency has been adopted. Currently bond sales are instead used to drain excess banking system reserves so as to maintain the target cash rate and are therefore a monetary operation and not a fiscal operation.

Sure Scotland can be assigned a share of the obligation to pay a low rate of interest to those holders of UK pounds who would then have a proportionate holding of Scottish sporrans receiving an equally low rate of interest but why bother. In either case zero cost currency issuance by either the BOE or the BOS would be used to pay that interest.

Andreas: You’d have to convince Westminster to adopt this new mindset. And that will never happen.

Also, regarding your plan to have wages in iScotland paid in the new currency. It is a recipe for disaster for anyone who has debts (mortgage, auto, credit card) denominated in sterling, because the new currency will surely depreciate vs sterling, and the companies who own the debt will not volunteer to redenominate the debt from sterling to the new currency.

‘This is me’ yes ignorance and self interest dominate but one can at least try to define a good policy model I suppose.

If any debts are held with Scottish financial institutions they should be re-denominated in the local currency and clearly the same applies to any new loans. Existing loans to non Scottish financial institutions in foreign currencies could continue as foreign currency loans with the risk/benefit of exchange rate movements. The local Scottish currency could go either way relative to the UK pound and the euro. The current account balance of each nation/economic zone relative to each other would be the main determinant. Even a constantly devaluing currency much like the old lira is not so bad as long as unemployment is low, government services adequate, the economy has rising productivity/innovation/level of enterprise and export capacity can at least match essential imports. Italy now with a relatively stable currency – the euro, is clearly now much worse off than if the Lira was retained and fiscal policy was used to ensure near to full employment.

MMT is somewhat idealistic, in my opinion. It assumes that ‘people’ will agree to ‘do the right thing’. Yet, clearly, beauty is in the eye of the beholder. Yes, policies advocated by proponents of MMT are beneficial to the society as a whole. Indeed, in the long run everyone will prosper. Yet, as Keynes himself points out, ‘In the long run we are all dead’. Moreover, there are some who will lose a bit and a few who who will lose everything. Those few will fight to the death. Also, there will be external powerful entities opposed to the change. In the modern society one can’t prosper in isolation. North Korea comes to mind. With powerful enemies one may not live long enough to see the product of one’s labor.

“Whether the Scottish people will vote to go back into the EU is an unknown right now.”

Don’t be daft. The Nats want to join the EU because they want to be important people in the EU, not running a backwater on the edge of empire.

It’s utterly naive to believe that wouldn’t be the first order of business.

Scottish independence has always been about that. Which is why what is best for Scotland is to support a UK wide implementation of MMT ideas – primarily a Job Guarantee. Which is wildly popular in Scotland, and the rest of the UK regions.

@Lavrik ‘MMT is somewhat idealistic, in my opinion. It assumes that ‘people’ will agree to ‘do the right thing’… Yes, policies advocated by proponents of MMT are beneficial to the society as a whole’. I can’t understand how people can read this blog and still not understand that MMT provides a lens and coherent body of thought to enable the understanding of what we have. It isn’t ideology. And most progressives worth that name fully recognise the battle to make progress even as more people are reliant on food parcels, die due to political failure and catastrophic climate change gets ever closer.

Andreas Bimba: An independence vote would compel the entire Finance Industry to leave Scotland, b/c it has to have the BoE as its lender of last resort in order to keep its clients. It takes 10% of GDP & the largest single chunk of Scotland’s “Exports” to the rUK with it when it goes. And there will be massive capital flight as people flee the new, unknown currency. Therefore, we know the current account balance picture, therefore we know what will happen to the S£. Bill states it in his piece: “Scottish economists are scared of a new Scottish currency collapsing.”

The holders of the debt sterling-denominated owed by Scots have no reason to agree to rednominate it to the new currency at a fixed exchange rate chosen by the ISG if they think it is going to be “constantly devaluing”. And the ISG has no power to compel the change without compensation, any more than it could seize all the farmland and collectivise it.

to

This is Me

“I can smell shite”

@dan macaulay: most people can do the same, it is hardly something to brag about.

Can you make a logical, cogent argument, based on facts and reason?

‘This is me’, but surely the transition to a new currency by Scotland would be much the same as the transition to the euro for most European nations and the transition to national currencies that the Baltic States underwent after regaining independence from the Soviet Union? A few hiccups but all manageable.

The Bank of Scotland would become the Scottish central bank and becomes the issuer and guarantor of the Scottish currency. The ruling Scottish government would set the policy agenda and the Scottish parliament writes the laws and can compel financial institutions operating in the country to use the local currency for most loans to the Scottish general public and indeed exclude foreign financial institutions from that market if it so chose or apply the appropriate legislation for their local operations. The financial services sector could continue much the same as before. There is little practical difference between running a relatively small country or a large one – Iceland manages quite well.

Scottish economists may indeed be scared of a new Scottish currency collapsing but there is no doubt that Bill considers those concerns groundless provided the transition is managed competently by people who understand how modern economies function. The technicalities could be handled by most MMT trained economists with ease. Yes it is possible the new Scottish government and parliament will be even more incompetent than the current British one, but it could also be better. That is the nature of self governance and perhaps over time any errors would self correct.

Replying to This is me

These are tired old arguements of no substance. Warren Mosler has debated them away over many years. In a debate on Twitter which was watched by many with a poster called Scottish pensions an expert in the pension industry Warren destroyed this debate.

Let me try and explain. The logical facts and reason are you are making the mistake they all make and that is assume nothing changes after independence. That the mainstream logic is followed. In this case with the SNP being so clueless you are probably correct. However, using the MMT lens your point does not make any sense.

You are correct when you say would have to agree to accept responsibility for a share of the UK’s national debt. They would do this by issuing new debt instruments, payable to WM, and denominated in sterling. You are correct when you say who own the debt will not volunteer to redenominate the debt from sterling to the new currency.

I say so what ? What are the real issues with that ?

You will use mainstream logic “sound finance” the status quo. I will say not so fast let’s look at this issue from another prespective.

1. The last thing the ISG should do is convert the sterling debt into the new currency. You don’t want to force conversion. There’s a right way and a wrong way to do it. You are proposing the wrong way. The right way. You don’t actually leave sterling the ISG simply starts spending and taxing in the new currency. The conversion is on a 1:1 basis. Whatever you taxes and spent in sterling you tax and spend the same amount in the new currency. Now you have independent fiscal policy and independent monetary policy.

2. Don’t force conversion on bank deposits from Sterling to the new currency if people want to hold sterling you let them gold sterling. Let’s say half want to keep sterling and half need the new currency to pay their taxes and run their businesses. If you convert everybody to the new currency those people who need sterling will sell the new currency to get sterling the want and it can drop 60%. So you don’t do that. So the sell the new currency to get sterling the central bank doesn’t know what to do so they raise interest rates. Import prices go through the roof with job losses everywhere.

3. Leave it alone everybody is happy those that want sterling have sterling those that want the new currency have the new currency. Those that now need the new currency now have to sell sterling and buy the new currency. That pushes the new currency up not down. Where are these people going to get the new currency when it is scare at this moment time ?

4. From the only place that has it the ISG. The ISG will sell the new currency to these people at a slight premium in exchange for these people’s sterling. The currency is wanting to get stronger at this point but the ISG will sell enough to keep it stable. Now the ISG is hoarding sterling what are they going to use that sterling for ?

5. To service that sterling debt that you say is going to be a nightmare of course. They will service it over time and manage it and reduce it over time without a collapse in the currency. The simple fact is said debt need be no worse with your own currency, and less of an issue if you have your own currency and sustain higher levels of real domestic output. The sterling debt is a drag on the Scottish economy now but with your own fiscal policy a job guarentee and monetary policy setting the interest rate to zero it can be less of a drag using your own currency.

6. Mortgage debts etc in sterling is complete nonsense. The banking sector looking to earn profits for their shareholders. Will step in like they have everywhere in the world when countries have become independent like the Baltic states, Czech republic, Australia, Cananda, New Zealand the list is endless and provide a service to their customers to convert these debts into the local currency for them. It is absurd to think otherwise.

7. You are right of course that gamblers in the FX markets will gamble heavily and start shorting the new currency. Even though the ISG has launched in the correct way above that the SNP are not capable of understanding. So there is a danger that the SNP who are clueless will do it the wrong way and the gamblers will run riot in top of that I fully accept that reality. It doesn’t make your arguement correct though. As I’ve shown above.

8. If people who are in charge do launch it in the correct way above using the MMT lens then more fool the gamblers. They are going to get burned. Speculators playing silly games laying on shorts in the new currency. They will do so until there is nobody is prepared to take the other side, no soft holders to panic out of their savings and no more flash crashes allowing dealers to close open long positions. In other words until the liquidity drains away until all that is left is that required for the underlying trade flows.

Then you will get the mother of all bear squeezes.currency

The game, of course, is to tempt the patsy of last resort - the central bank - into the speculation market to throw fresh salmon to the bears. A wise central bank will avoid doing this. Instead it will offer to clear needed trade flows with its reserves on a strict national policy basis - food and power: yes, Learjets: no. It will offer refinancing to firms who have foreign currency loans, as long as they go through administration first so that the foreign currency loan is wiped out and the foreign bank is force to take the loss. A wise central bank would do everything it can to ensure the squeeze stays on track. It would make its intentions known - there will be no liquidity for speculation outside the ‘natural’ supply. And that means, in an over-the-counter market of foreign exchange, liquidity may run out.

A wise central bank understands that is the responsibility of the other central bank with the high currency value and an excess export policy to decide what they want to do. A wise central bank will keeps it head while all around are losing theirs.

This is me part 2.

Now that you have independent fiscal policy and monetary policy you can hoard even more sterling that keeps reducing the sterling debt over time until eventually it is dealt with. Without any of the issues you are so worried about becoming a problem.

1. You can sustain full employment by introducing a job guarentee and output, and a permanent 0 rate policy, but real terms of (external) trade can be problematic in any case. With or without your own currency. But by introducing full employment at home The higher levels of domestic output from having your own currency works in your favour in support of your real wealth. It attracts both foreign direct investment which again keeps the new currency strong. Attracts imports.

2. Since you’ve created full employment at home exporters will be standing in line begging to sell you their goods and services. Even discount their own currency to do it. This allows you to use your skills and real resources and more productive projects within your own borders. Ideally your exports should be fully automated if you can and the strategic ones should be state owned.

3. By setting the interest rate at zero. This allows you to see where the inflation is coming from that can be managed with a fiscal adjustment either via more taxes or less spending. Government can command any resources available for sale in its currency and can use its sovereign power to force those resources to be freed up so it can purchase them for the public good. The only constraint is what skills and real resources are available.

This is in sharp contrast to the neo-liberal viewpoint which is that government is just another organisation in the system that has to compete for resources by price. Business and banks always get first choice of resources and government has to make do with the scraps. They believe the bankers and businesses should be in charge and that the population are just factors of production to be shifted around, like ingots of steel, as business requires.

4. Banks can only lend directly to borrowers for capital development purposes (i.e. business credit lines and household loans), and the banks keep those loans on their books until cleared.

Banks must operate on a single balance sheet. No hiving things off into ‘off balance sheet’ subsidiaries to try and hide them.

Banks cannot accept collateral. Collateral is a fixed charge over an asset as an insurance policy and aligns the incentives of banks with those possessing assets, not ideas. It stops banks being capital developers and turns them into pawn shops. That is the wrong alignment of incentives. We want loan officers with skin in the game. Their success should depend upon the success of the borrower. Banks should line up in insolvency with the other unsecured creditors (and importantly behind the remaining preferential creditors - employees).

Depositors are protected 100% at all amounts. A depositor in a commercial bank is holding nothing more than an outsourced central bank account. They are not investors in the bank and should never be treated as such.

Regulation is provided by the bank resolution agency, which is a public body funded entirely by government. There is no charge or levy to the banks for the operation.

The job of the bank resolution agency is to ensure the banks are properly capitalised given their loan book and declare them solvent. If they are not, they take the bank over and resolve it with any excess losses absorbed by government. This aligns the incentives of the regulator. If they get the solvency calculation wrong and the capital buffers exhaust, the regulator stands the cost.

The Central Bank provides unlimited, unsecured lending to regulated banks at zero interest rates. Collateral serves no purpose since the bank has been declared solvent (and therefore there is no reason for it to be illiquid), and collateralised Central Bank lending just shifts the losses to depositors who are protected 100% anyway.

Once you get rid of interbank collateral and funding requirements, you get rid of one of the final excuses for keeping Government Bonds. National Savings annuities for pensions (allowing retiring individuals to receive a secure lifetime income) would get rid of the final one. Transferable instruments that confer government welfare on the owners do not serve the public purpose. Government welfare receipt is a social decision, not a market driven one.

As the asset side is heavily regulated, you want the liability side to be as cheap as possible. Unlimited central bank access ensures liquidity for depositors and allows lending-only banks to arise. It gets rid of the Interbank overnight market and replaces it with central bank overnight accounts. It puts the Central Bank ‘in the bank’ as a major investor - with open access to the commercial bank’s loan book via the work of the solvency regulator.

All levies, liquidity ratios, reserve requirements and the like are eliminated. The cost of maintaining the collateral system is eliminated. The result is loans at a low price with the quantity restricted solely by credit quality. As an economy heats up, credit quality declines and loans become restricted - systemically preventing the Ponzi stages of finance that lead to a Minsky Moment.

You get a natural and steady withdrawal of funding that is far more surgically targeted and responsive to local conditions, than the carpet bombing approach of interest rate adjustment.

This leaves the payment system, which should be as costless as cash and clear just as instantly to eliminate transaction frictions. Whether that should be publicly provided, or remain outsourced to the banks is an open question. Depositors are a cost to the bank and would effectively be a tax, but leaving them with the banks would give them an incentive to get the cost of clearing provision down. It may boil down to a political question that depends upon your view of the effectiveness of public and private provision. I’d lean towards an Open clearing system created by the state (or even states) and available to all on an open licence. We want one good clearing system.

Which of course is What Turkey and Argentina should do. Not the ” sound finance” approach they follow that of course causes all of the things that you suggest will happen to an independent Scotland.

There is another way the MMT way that can manage these issues much more effectively than the “sound finance” way ever could.

This is me part 3 rep!y.

The Canadian dollar has made very large movements versus the USD over the past decades. Nothing bad has really happened ?

Same with the Aussie dollar – it has gyrated between US$0.50 and US$1.10 since floating in the mid 1980s. Can you point to anything bad happening ?

Floating rates adjust that is their job.

You can call it a “collapse” and write op-eds about how terrible it is, but you cannot point to anything that’s particularly negative. Very different from the Great Depression, where policymakers had an insane desire to defend the gold parity at any cost. Or Compared to defending foreign FX reserves associated with fixed FX it has been a breeze in comparison. Floating rates have been a breathe of fresh air.

Most of the scare stories about what would happen if Scotland became independent are just that. Scare stories to scare the children. Stories that happens under different monetary trimester no longer apply to floating FX.

Firstly, floating currencies do not fall forever; at some valuation becomes attractive and the market reaches a new flow equilibrium Secondly, currency volatility prevents the buildup of positions by investors who are concerned about currency risk in the first place.

An exchange rate is a relative price: one currency unit for another. If we look at the post-1990 period, inflation rates in the developed countries have been quiescent, bouncing around 2% for most countries. As such, each currency has relatively stable purchasing power for domestic goods and services, including the cost of wages.

The stability of wages has one side effect: if a currency falls rapidly versus its developed peers, the cost of wages falls relative to other countries. This drops input costs for production relative to other countries. And even if imported inputs rise in price in domestic terms due to the drop in the exchange rate, those input costs are unaffected when expressed in terms of the foreign currency unit.

The result is that domestic exporters suddenly have greater prospective profit margins versus their international peers. This will have two effects: buoy the attractiveness of the local equity market and attract investment inflows (either reallocations of capital by multinationals, or foreign direct investment).

These capital flows (and the prospect of future flows) help put a floor under the domestic currency. This helps explain why there have been no cases of developed currencies going to zero in the foreign exchange marketplace.

You can talk about Argentina, Turkey, Venezuela all The usual suspects and their ” sound finance” obsessions regarding foreign debt. We will highlight the mistakes they’ve made in following false beliefs and the errors they made when using fiscal and monetary policy and The economic choices they made that made things worse not better. MMT’rs would have ran all these countries differently.

The risks that you have highlighted are purely political. Fully linked to the belief of the mainstream economic profession and ” sound finance. The MMT lens manages those risks and exposed the rest as myths. Which just leaves the political risks.

That is something we can agree on the SNP are clueless don’t have a clue what they are doing. That is the political risk that will probably make your arguments come true. That I am 100% sure of but as shown in my replies to you it doesn’t have to be that way.

MMT economists would run Scotland differently compared to the madness of the SNP.

“

@ Andreas Bimba: Surely not. B/c in those cases (a) the exchange rate was fixed for all time and then (b) the old currency disappeared. Obviously, neither pertain here.

The Baltic States were economic backwaters with no consumer debt and no capital that could flee.

@ Derek Henry

“What are the real issues with that ?”

The need to come up with the sterling. Which will cost more and more every month as the S£ declines.

‘This is me’, let the scared holders of capital flee. As Derek mentioned siting Canada and Australia, a devaluing or volatile national currency is not that significant. Any capital flight is unlikely to irreparably damage much of the productive economy and should in any case be short term I would guess.

A government that has fiscal, monetary and regulatory control has all the levers needed to steer the ship of state and to ensure all are fed, have medical care, a job and so on. The scared holders of capital will return when they see a stable enough and profitable market opportunity.

Scotland could be a jewel in the EUN crown much like Switzerland in time or better if the MMT academics can set the main policy settings – or it could all go badly, its their democratic choice.

I don’t see why Scotland’s share of the UK’s ‘debt’ should not be re-denominated in the new Scottish currency? I suspect servicing that ‘debt’ if it was to remain in UK pounds could be a potentially hazardous challenge much like when Argentina took on too much US dollar denominated debt? Did not those countries entering the eurozone re-denominate their prior central bank ‘debt’ into euro denominated ‘debt’??

Derek you made many good suggestions regarding banking for Scotland, are these based on Warren Mosler’s recommendations?

Re: Derek Henry. Yes, MMT is a lens, EU is dysfunctional and Scotland needs its own central bank to be truly independent. All that is true. Yet, since when ‘truth’ was a necessity attribute in a political or economic debate? Truth doesn’t decide the outcome. The argument must resonate and make sense to either a lot of ‘small’ people or a few ‘big’ ones. Neither seems likely at this time. The former demographic needs years of ‘re-education’ to restore proper intuition. The latter one has much to lose and therefor will prefer to lie. Passionate speeches in front of the crowd who is already on board will get you nowhere. Neither do I think you will ‘convince’ the opponents who choose to pretend to not understand. I think one must start from the very beginning. Early education, then universities… Bill’s book on macroeconomy and a course is a step in the right direction. Your heart is in the right place. That’s not enough though.

The medical experts on the pandemic were listened to by governments of both sides of the duopoly at least in Australia yet the climate scientists have been ignored by the conservative side and to a lesser extent also by the right of the ALP. Some of the crazy right try to deny the medical science regarding Covid-19 and spread disinformation but they so far have not had the numbers to change policy direction. The policy advice of the MMT academics has also generally been ignored especially by the conservatives but also by the right of the ALP.

The difference is money and power. Powerful groups of oligarchs want to keep using fossil fuels and the same applies to the neoliberal economic agenda. The pandemic response is not a point of contention by any powerful oligarchs apart from Murdoch’s gutter media that likes to spread distrust of experts and of government.

The will of the people has become largely irrelevant when those with money and power have a different view.

The political class especially the conservatives have been bought or are just the agents of segments of the oligarchy. Educating the public so they make better electoral choices is a long slow process and the other side has bigger megaphones. Both sides of the duopoly political system that exists in the Anglosphere have been bought on the big issues but an electorate that seeks out third parties may make progress but even here the same oligarchs have helped create populist diversionary parties of the right that generally also block progress on the main issues of importance.

Charismatic populist leaders with integrity of the progressive side can build large followings quite rapidly and Bernie Sanders and also Jeremy Corbyn are examples. Jacinda Adern is very popular but she is politically more towards the centre but may swing behind something like a Green New Deal for New Zealand. Sanders and Corbyn both got close and more of that strategy is likely to be the quickest way to break through. Certainly large segments of the electorates in most countries generally hate neoliberal policies and the old establishment political elites that betray them so a breakthrough cannot be too far away. The global warming crisis is also time critical and will add pressure for change.

@Andreas Bimba

“Any capital flight is unlikely to irreparably damage much of the productive economy”

When the modern productive industries that are not tied to the land leave for the rUK, they have no reason to ever go through the expense of returning.

“A government that has fiscal, monetary and regulatory control has all the levers needed to steer the ship of state and to ensure all are fed, have medical care, a job and so on.”

How’s that working out for Venezuela?

“I don’t see why Scotland’s share of the UK’s ‘debt’ should not be re-denominated in the new Scottish currency?”

Because Westminster doesn’t want to be paid in S£s.

“The need to come up with the sterling. Which will cost more and more every month as the S£ declines.”

I’ve explained in great detail how they come up with the sterling in several ways. In my 3 replies.

I’ve also shown that if done right it doesn’t decline it becomes stronger. A strong currency can cause problems also. Weak doesn’t mean bad and strong doesn’t mean good also explained in my replies.

Floating rates adjust to their environment.

Derek, I’ll be honest: I didn’t read it, b/c it was obviously an all-purpose cut-and-paste job, not a response.

Neil:

All parts of Britain have high employment levels (at low wages) if not full employment.

Introducing a Job guarantee won’t really have a huge affect on the country (whichever one,Britain as a whole,Scotland, or England and Wales etc).

What really needs addressing is this long term low productivity problem.we need a set of policies targeting that issue.increasing productivity will allow wages to rise (and hours to reduce).

I’m not entirely sure what these policies should be.Quality infrastructure investments,Industrial strategy(?),credit policy to SME’s

England in particular is far behind European competitors like Germany, France and even Italy.

This problem, which afflicted the country prior to joining the EU,was what convinced the political class that it was necessary to join the EU in the first place.

In my mind this is the number 1 problem as it limits are ability to create wealth,improve living standards.

Re: Jake. Official unemployment rate in UK is %4.9. With population 66.65 million (2019) it makes ~3.26 million unemployed. Far from ‘full employment as it is. Taking into account somewhat distorted way this figure is arrived at we can safely assume that the real number of unemployed and underemployed is significantly higher. As far as I know less than %2 can be attributed to frictions and transitions. This means that almost 2 million people even according to official data want to work yet can’t.

This is me,

There’s nothing economically special about Scottish, Venezuelan, or Portuguese economies, just the political empowering of idiots. If you make stuff, people will want your currency.

Jake,

Does everyone who wants a full-time job has a full-time job, or anywhere near it? Heavens, no. Stop using politically biased metrics.

“Introducing a Job guarantee won’t really have a huge affect on the country ”

It would boost GDP by 3% instantly.

“What really needs addressing is this long term low productivity problem.”

Lack of demand in the regions due to lack of work, and substituting capital for labour due to excessively easy immigration policies which suppresses wage growth. And the fad for relying on ‘foreign investment’ which is fixed exchange rate thinking.

The UK should be doing foreign outward investment. If we want Poles to work for UK firms, build the factory in Poland and own it. We no longer need it here, because we have a Job Guarantee…

The problem is that the entire belief system is backwards. Because of the “But what about the jobs” argument. Get rid of that and all of a sudden the correct policies can be put in place.

Which is why the first order of business is guaranteed jobs for all.

“Taking into account somewhat distorted way this figure is arrived at we can safely assume that the real number of unemployed and underemployed is significantly higher. ”

In the UK, there are currently 3.65 million without work that want it (LFM2 and MGSC series at the ONS) and 0.946 million short of work. (YCCX series at the ONS).

@Paulo

“If you make stuff, people will want your currency.”

And what will iScotland make? There is no long term future in oil, and its very large Financial Services industry will have to leave, b/c it can’t keep its clients without a credible LOLR.

The hype around its renewables industry is just that. There is nothing special about its wind or waves that can’t be replicated in the North of England by a Westminster interested in energy security. There are no interconnectors to the continent b/c the engineering is too difficult for them to be cost-effective.

What’s left? Whisky, agriculture, and fishing. That’s it.

I’m late with my thoughts, but …

How could the rUK demand that iScotlnd take part of its national debt without *also giving* it an equal part of its gold holdings?

So, I think that they can’t do one and not the other.

Also, iScotland could demand that it 1st try to get all UK bond holders to accept its new bonds at some fixed exchange rate, maybe even 2 for 1. All who accept this deal would count their Br. Pound Sterling amount against the amount that iScotland would need to let the BoE keep as UK bonds that iScotand must pay with Br. Pounds Sterling.

If Scotland got its hands on that share of the UK’s gold then it could back its bonds being held by the BoE or rUK with gold. Not 100%, but a big chunk of the total.

Combine this conversion (of UK bonds into iScotish bonds) with the gold holdings of Scotland and it may make the burden be much smaller. [We MMTers know that, for example, the US national debt is not *any* sort of burden for the common people or rich people of the US.]

Jake the JG allows the national economy to run at the fiscal limit of the full employment condition. I suspect that would be over a 6% boost in GDP for the UK because of the high levels of unemployment, underemployment, those that have given up looking for work that would return to the workforce and misemployment where people have no choice but to take on work that does not suit them or their skills. The bottom end of the job market would shrink as the JG would set a live-able floor level wage with benefits and conversely the number of better jobs would increase even more so and the opportunities for further education would greatly improve which also has an impact on productivity.

Most of the fiscal gap can be utilised for well targeted government spending, improving existing government services, more funding support for regional and local governments and possibly some tax cuts. The JG just needs to be big enough to perform the labour price anchor role and in other words to not shrink to zero during any economic boom periods in any region preferably with regulatory restraints on speculation also being in place. If the JG provides useful ongoing services then some of these services could become full wage government services.

I think the UK has a future in advanced manufacturing, capital intensive heavy industry and providing the hardware and design/construction services for a carbon neutral and environmentally sustainable world. All those economic areas covered now such as agriculture, aerospace, the defence sector, arts and entertainment, financial services, construction, government services and so on still have a future. The UK abandoned a lot of manufacturing to Germany, Japan, South Korea, China, the rest of Europe and should in my view try to become a big league player again.

The Japanese approach to industry development and continual improvements in productivity/innovation/technological advancement using their Ministry of Economy, Trade and Industry – METI which works closely with industry is a good fit for Britain and indeed most advanced nations.

Trade protection especially during the vulnerable start up phase is one of the tools used as well as low interest stable finance, industry clustering, developing consortiums, export assistance, long term planning for example the net zero by 2050 is a big project now under way.

Japan after the war had a mostly destroyed economy, no capital and few resources and faced competition from a technologically advanced, productive, huge and wealthy United States and Japan’s strategy then was stack the economic game in favour of local industries by all means available. Britain is now in a similar situation.

More state funding of R&D and a closer relationship between academia and industry will help improve productivity and develop new business opportunities. A knowledge of MMT means more funds can be applied for advanced education and state aid of industry and Brexit removes the EU’s restrictions that were designed to favour Germany’s already advanced industries.

Professor Goran Roos a Swedish expert on economic development has presented many worthy industry development strategies for Australia, Britain and Europe and his plans should be implemented not just shelved with the thousands of other reports for government.

“How could the rUK demand that iScotlnd take part of its national debt without *also giving* it an equal part of its gold holdings?”

The Gold holdings of the UK are worth £9.9bn according to the Whole of Government Accounts.

The net liabilities of the UK – including public sector pensions which is the biggest liability is £2,455.8bn.

The net reserves into the banking system is £1,407bn

Of course Scotland would be mad to join EU, but would they need some trade agreement with EU and UK at least? Would the Norway deal be OK for them? Brexit was never about free trade for me – and ‘Norway’ would have been fine – even the free movement of labour thing doesn’t look quite so attractive now. I’m willing to be put right.