It was only a matter of time I suppose but the IMF is now focusing…

Corporate welfare booming in Europe despite the deep crisis being endured by the citizens

The European Union officials seem to be ‘playing violins while the nations burn’, given Covid-19 is running out of control still (another wave coming) and new variants are outpacing the vaccine rollout (which wouldn’t be hard given how slow it has been). New extended lockdowns are coming, mass insolvencies are coming (once the relaxation of rules occurs), unemployment remains at obscene levels, and the whole show is lurching into stagnation, of the type only the EU elites can create. But what isn’t going wrong is the welfare system for the financial elites. They are rushing to purchase government bonds as if there is no tomorrow despite the deep crisis that the Member States are mired in. The bond investors are warmed by the knowledge that the ECB will do whatever it takes to keep bond yields low for fear that one or more Eurozone nations will become insolvent. The dysfunctional architecture of the common currency has ensured that the ECB has to keep buying government debt in large volumes to fund the growing fiscal deficits (despite their denial). The consequential outcome of this is that bond investors make tidy capital gains and the whole risk structure of investment in the EMU is corrupted.

This graph comes from the ECB’s statistical warehouse and is the yield curve for – Euro area 10-year government bond – from September 6, 2004 to March 23, 2021.

The time series is a synthetic measure derived from euro area Member State bond issues.

It gives a pretty good guide to what is going on throughout the currency union, especially given the role the ECB has played in suppressing bond spreads among the Member States.

Many people cannot quite get their heads around the sustained negative yields that investors are prepared to take on long-term bond purchases.

First, it is all relative. Relative means that when a crisis occurs, government debt is the lowest risk asset on offer.

Second, the investors are betting on the price of the bonds rather than the yield. They are hoping that the face value rises in the secondary markets.

Some people use the term ‘bagholder’ to describe a sort of ‘pass the parcel’ effect, where sentiment in the market keeps pushing the price of the bonds up and the last holder is the one who is holding the ‘bag’.

But in the European context, the situation is much easier to understand.

The ‘bagholder’ is the ECB and the investors know that the central bank is purchasing government debt in large volumes and will eventually end up holding the negative yield debt, while the investors walk away with tidy capital gains as a result of the increased demand coming courtesy of the various ECB asset purchasing programs.

The corporate welfare element of government debt emerges one way or another.

Third, while the yields in euros are negative, cross-currency transactions of those assets can yield positive outcomes for other currency holders.

Bonds are bought for two broad reasons: (a) as an investment; and (b) as a trading instrument.

To understand the next point one needs to know what – Interest-rate parity – is all about.

Interest rate parity attempts to explain the relationship between interest rates across nations and the exchange rates.

The idea is that if you we have two countries and financial capital flows are mobile between each, which means financial assets denominated in the currency of one nation can be exchanged readily for financial assets denominated in the other nation’s currency, and the assets are substitutable, which means that they have similar risk and liquidity characteristics, then an investor will expect to earn equivalent returns no matter which asset they hold.

That is the return on holding assets in country A will equal the return on country B’s assets once exchange rates are taken into account.

There are two exchange rate concepts in play: (a) the spot rate, which is the rate you get at the airport when you swap currencies; and (b) the forward rate, which is the rate that you can get in a contract to buy or sell currency at some future date.

Which means that an investor who borrows in the nation with the lowest interest rates, converts the funds into the other nation’s currency and invests the funds in that nation which has higher interest rates, will not gain.

No-one would consider a negative yielding bond to be a good investment. It would be almost certain that at the end of the maturity period, the bond would result in a loss.

But in trading terms, with interest rate differentials across the world, investors from currencies with higher interest rates can make profits by buying foreign assets with negative yields.

For example, an investor with US dollars can actually generate better returns by buying negative yield euro bonds than they can from purchasing US government bonds that provide positive yields.

It all comes down to the hedging strategy, which means insuring the trading purchase against exchange rate shifts between the US dollar and the euro.

Suppose a US investment bank purchases a negative yielding bond from Germany which requires it to exchange US dollars for euros in order to make the purchase.

It then enters a forward exchange contract, which means it will sell euros for dollars at an agreed price some time in the future (say one year).

It now has an asset (the bond) denominated in euros and a contract to sell euros for dollars at a fixed price in 12 months time.

To profit from the transaction, the forward contract the investor agrees has to ensure that when the forward contract comes due (in a year) the euros that the investor is holding will generate more dollars than they outlaid for the bond purchase.

If the difference in the spot exchange rate (which they used to buy the euros now) and the future rate (when they realise the contract) is sufficiently large enough then they can earn a return on the investment which overrides the negative yield on the euro government bond.

Why would that occur?

Well if interest rates are higher in the US relative to the Eurozone then global financial flows will be moving into the US assets to get a better return.

The forward currency markets will then be reflecting this increased demand for US dollars, which means that US investors can be seen as earning a premium to supply the US dollars into the spot market now in order to buy non-US dollar assets.

As long as US interest rates are higher than those in the Eurozone, then US investment banks can make profits from buying Eurozone bonds with negative yields.

And that all hinges on whether the US Federal Reserve maintains an interest rate differential against the ECB.

There are other ways in which profits can be made from negative yielding bond investments but that would take me too far from where I want to be today (hint: riding the maturity curve!).

Current situation

I wrote about bid-to-cover ratios in these blogs among others:

1. Bid-to-cover ratios and MMT (March 27, 2019).

2. D for debt bomb; D for drivel (July 13, 2009).

The bid-to-cover ratio is just the the $ volume of the bids received to the total $ volumes desired. So if the government wanted to place $20 million of debt and there were bids of $40 million in the markets then the bid-to-cover ratio would be 2.

In bond markets where the government is a currency issuer, the value of the ratio doesn’t matter at all. Whether the private bond markets buy the debt on issue or not is moot, even though the government would try to tell us otherwise.

If there was a serious shortfall (bid-to-cover below 1) then the central bank would cover the rest without doubt.

Such governments choose the way in which the debt instruments are issued. The organisation of debt issuance is not dictated by the ‘market’ but a matter of government prerogative.

But for a Eurozone Member State, the bid-to-cover ratio has meaning because the governments have to issue debt to cover spending commitments above tax revenue.

So what has been going on lately?

The current situation in European bond markets is quite staggering.

The bond auctions are attracting massive patronage from investors.

Spanish and Italian government bond markets are at record levels for bids relative to issue.

Even Greek government debt is in high demand.

Last week (March 17, 2021), the Association for Financial Markets in Europe (AFME) released its – AFME Government Bond Data Report Q4 2020

It provides background information on the trends in European bond markets if you are interested.

They note that “European trading volumes … represented the most active fourth-quarter in terms of trading since 2016.”

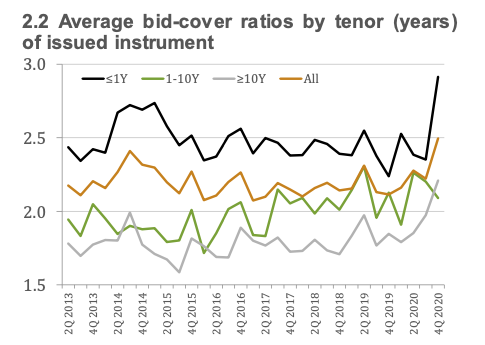

This graph shows the bid-to-cover ratios (average) by the maturity of the bonds up for auction.

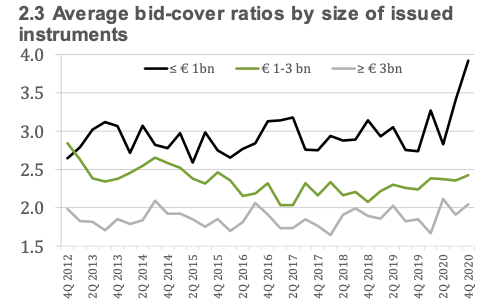

This one shows the bid-to-cover ratios by the size of the auction.

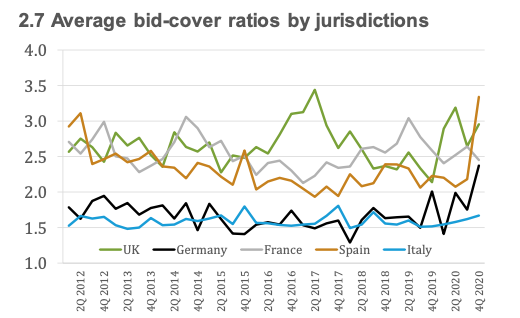

And this one shows the ratios for different countries.

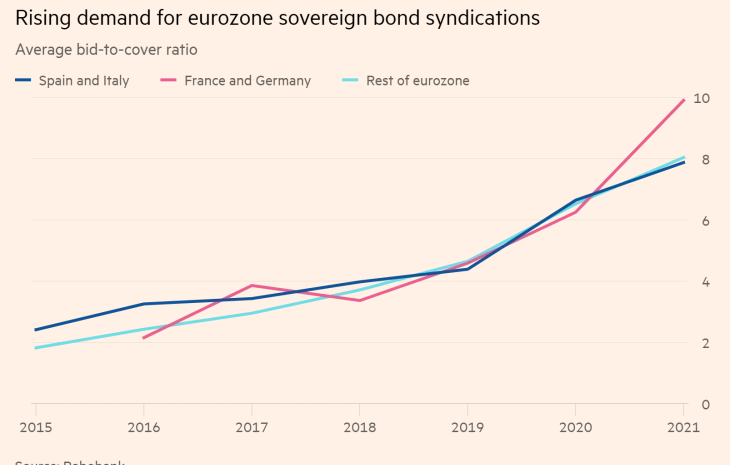

More recently, the increased demand for government bonds has seen the bid-to-cover ratios in some nations (Spain, France and Germany) go through the roof.

The Financial Times article – European bond sale order books grow to ‘ridiculous’ levels (March 18, 2021) – provided this graph which tells the story.

Syndications refer to the bankers’ club method of issuing debt. Instead of an open auction among the primary dealers (and note that the number of primary dealers in the Eurozone has fallen recently) the debt is placed via a deal with a selection of dealers under certain (cosy) conditions.

When – MMTed – launches its advanced topics, we will cover how bond markets work in great detail.

But you can see that for the Eurozone government debt on average there are 8 times more bids than debt available.

And this is at a time of deep crisis.

So what is going on? How come the bond investors are falling over themselves to get risky Member State debt, when these nations are in deep crisis?

Cue: ECB and its massive asset purchasing program, including its most recent iteration the Pandemic Emergency Purchasing Program (PEPP).

The ECB is dominating the secondary bond market, which is where the debt is traded openly, after being issued in the primary market to a select few market-making dealers.

And various financial institutions require holdings of government debt to satisfy prudential regulations (Basel etc).

They are now being squeezed in the secondary market by the sheer volume of ECB purchases, which pushes up demand in the primary market.

Moreover, the debt being issued is generating capital gains as a result of the massive volume of ECB purchases.

So the risk of acquiring the debt is minimal even though the nations in question are in deep crisis, because the investors know the ECB is ready to purchase.

Conclusion

Which tells us that corporate welfare is alive and well in the Eurozone and even, booming.

Meanwhile, the citizens are wallowing in the virus and the economic fall out that is accompanying it.

Meanwhile, Brussels fails yet again.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

“When – MMTed – launches its advanced topics, we will cover how bond markets work in great detail.”

Todays blog feels like we are moving into a higher gear! Interesting then:

David Ricardo (a name I often come across in this blog) is the subject of Melvyn Bragg’s ‘In Our Time’ today: https://www.bbc.co.uk/programmes/m000tfjk

Scott-Ferguson joined Bill in one of the excellent discussions (by video link) in Bill’s recent EdX (MOOC). In this link he introduces Rob Hawkes, a scholar of literature from Teeside University (Middlesbrough is my home town…there was no university there then): https://moneyontheleft.org/2021/03/22/money-literature-trust-with-rob-hawkes-guest-lecture/.

Posting in case anyone has not come across either of these.

Just to report: search engine Bing lists “an interesting article” alongside its results for ‘Bill Mitchell blog’; turns out to be by one Anandi Sharan.

“Anandi Sharan was born in Switzerland and educated at the University of Cambridge. Anandi co-founded the Global Commons Institute along with Aubrey Meyer, Jim Berreen and Tony Cooper. She was active at the UNFCCC from 1991 to 2012 and got several CDM methodologies and projects projects approved and registered including for improved cookstoves, biogas, and forestry.”

Apparently she came across an article by Bill on the GND, and concluded MMT will result in “genocide”, because building the required infrastructure will itself burn the planet!

But her main objection to MMT it seems is the idea of a “sovereign state” – she thinks individuals are sovereign……

In the meantime, on Q&A tonight, Gigi Foster was repeating her usual nonsense of a trade-off between the economy and the virus, because the “the government rescue-debt resulting from enforced lock-downs is massive and and will have to be paid back”. And the entire panel including Stan Grant seemed to agree with that mainstream view, though Bruce Pascoe of course said we should all revert to the hunter-gatherer society. Well that’s what he was virtually saying. Obviously hasn’t communicated with Noel Pearson re a JG, to end aboriginal disadvantage. And Picketty is still pushing for a global tax on wealth. Confusion all around! (Grant, like Sharan, turns out to be pushing the “sovereignty of the individual”/classical-liberal line. Marxist China is the bogeyman…despite the fact it is the “democratic” world which is currently in chaos…

The EU is a postponed corpse.

The EMU will go first, leaving 19 countries in chaos.

The alternative to a failed euro will be crytocurrencies, as has been happening in Nigeria (the nightmare of ponzi schemes will breath new life into maffiosi business).

Adding to a failled euro, we will see the end of the remaining of europe’s industry.

They are allready closing factories, because the supply chains of globalization are failing big.

There is shortage of electronic chips, because the EU dependes on imports from Asia by 100%.

There is shortage of sales, because Chinese products (take smartphones as an example) are better than the european equivalents (made in China, but at lower standards, because of lower costs).

There is even shortage of raw materials for manufacturing things as basic a shoes.

And nobody can escape to descarbonization, that is demanding a whole new economic model, not compatible with the sole purpose of defending banks and pension funds in Germany/France.

Why is it surprising that investors are buying up Greek debt? The ECB will end up buying them anyways. And with yields still in the positive (although lower than the US, I believe) the margin of safety should be even better, no?

I think the negative yields in bonds is one of the reasons why asset prices have shot up in the US. There’s certainly data that EU banks have increasingly been investing in the US stock market and bonds.

Looking forward to the advanced MTTed course.

It would be good to get an equally clear account of what is happening in Turkey at present.

Thanks Neil, it is good to stay abreast of the insanity.

Anandi Sharan is one of those fraudsters propagating climate change mythology. As if “MMT” has any claim on how to green the economy!

Fact is: the COVID lock-downs have shown we are capable of drastically reducing emissions by 40% to 50% just by conservation measures and eliminating bullsh*t jobs. So an “MMT informed” green transition in the first instance does not need to “build” any infrastructure. Legal provisions alone can support low impact public sector work and eliminate a lot of wasteful energy use. Such jobs do not require making more concrete.

But another start might be simply banning allocations of CPU cycles in high performance computer server farms used for useless ponzi schemes like Bitcoin, and parasitic HFT bots. Bitcoin is now consuming power at the rate of an entire nation the size of Argentina. So…. what the f**k are governments doing allowing Bitcoin to operate in their borders? Those CPU cycles would be much better spent building climate models or forecasting real inflation, or using evolutionary algorithms to design more efficient public transportation, or boosting internet virtual meeting bandwidth.

@ Bijou Smith,

I knew bitcoin was sucking energy for nothing.

I didn’t realize how much. Wow, that is a sh*tload.

Your’re right, it is a shame it isn’t blocked somehow.

Thank you, Michael Galvin – I’m listening to Melvyn Bragg’s programme on David Ricardo with great interest… this is stuff I never knew about, even after 63 years on the planet.

What did I do with my life?