Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

No inflationary trends evident in Australia – latest data

I have been seeing a lot of crazy predictions that inflation is about to accelerate because of the elevated levels of government spending, record low interest rates and substantial government bond purchases by the Reserve Bank of Australia. It is almost as if the conservative, deficit-haters want that to happen so they can say “We told you so” as they cling on to their flawed macroeconomic theories. Well sorry to disappoint. Today (April 27, 2021), the Australian Bureau of Statistics released the latest – Consumer Price Index, Australia – for the March-quarter 2021, which hoses down the inflation fears. The Consumer Price Index rose by just 0.6 per cent in the quarter (mostly petrol prices) and over the 12-months to March 2021 it rose 1.1 per cent. The less volatile series, Trimmed Mean rose just 0.3 per cent and the Weighted Median rose 0.4 per cent. So nothing to see here. The RBA keeps buying government debt and effectively funding substantial proportions of the fiscal interventions since the pandemic, interest rates remain low and yet inflation is still well below the lower bound of the RBA’s inflation targetting range. The most reliable measure of inflationary expectations are flat and below the RBA’s target policy range.

The summary Consumer Price Index results for the March-quarter 2021 are as follows:

- The All Groups CPI rose by 0.6 per cent.

- The All Groups CPI rose by 1.1 per cent over the 12 months to the March-quarter 2021.

- The Trimmed mean series rose by 0.3 per cent in the March-quarter 2020 and by 1.1 per cent over the previous year (steady).

- The Weighted median series rose by 0.4 per cent in the March-quarter 2020 and by 1.3 per cent over the previous year (steady).

The ABS Press Release notes that:

Higher fuel prices, compared with the low prices seen in 2020, accounted for much of the rise in the March quarter CPI …

The most significant rises in the March quarter were automotive fuel (+8.7 per cent), medical and hospital services (+1.5 per cent), and pharmaceutical products (+5.3 per cent) due to the resetting of the Medicare and Pharmaceutical Benefits Scheme safety nets …

The introduction, continuation and conclusion of a number of government schemes remained a factor in the March quarter, seen in price falls …

So we also see, once again, that movements in the CPI are strongly influenced by administrative decisions (policy) taken by government in the form of excises, indexed adjustments and other more ad hoc policy shifts.

Thus, administrative decision not related to the balance between aggregate spending and the productive capacity of the economy to meet that spending through the provision of goods and services can shift the inflation rate

Which means that all those who argue that Modern Monetary Theory (MMT) is fatally flawed because the only defence against any inflationary effects of fiscal deficits are tax hikes, which might be politically difficult to introduce at certain times, haven’t really understood the full array of tools available to a government that is intent on controlling an inflationary outbreak.

The other point to note is that inflation has not surged in Australia, despite the Reserve Bank of Australia purchasing $A68,250 million worth of federal government bonds in secondary markets and $A11,098 million worth of state/territory government debt since March 2020.

Since January 2018, the RBA has increased its holdings of Australian government securities (debt) from $3,748 million to $181,747 million, a massive increase.

In other words, the central bank has been significantly funding government spending at both federal and state levels.

No inflationary pressures evident.

Which accords with the historical record where central banks in Europe, the UK, Japan, the US have been engaged in large-scale bond purchases and inflation is benign, and, in Japan’s case, has been for 30 years.

What is apparent from yesterday’s inflation figures and the most recent labour market data is that there is plenty of room for further fiscal stimulus to help the economy create more jobs to reduce unemployment and underemployment.

There will be no core inflationary pressures until wages growth starts to outstrip productivity growth and that doesn’t look like happening anytime soon.

Trends in inflation

The headline inflation rate increased by 0.6 per cent in the March-quarter 2021 and 1.1 per cent over the 12 months. There is no upward trend in the inflation rate evident.

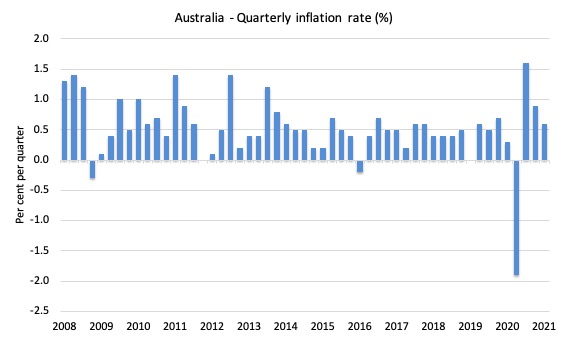

The following graph shows the quarterly inflation rate since the March-quarter 2008.

The big negative spike in the June-quarter was mostly due to the free child care, which was reversed in the March-quarter.

Since that adjustment, the inflation rate has fallen steadily each quarter.

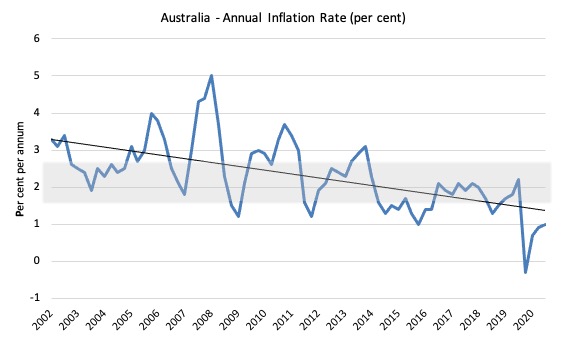

The next graph shows the annual headline inflation rate since the first-quarter 2002. The black line is a simple regression trend line depicting the general tendency. The shaded area is the RBA’s so-called targetting range (but read below for an interpretation).

The trend inflation rate is quite steeply downwards.

Once we take out the so-called ‘volatile’ items (such as, food and fuel), the annual inflation rate is only 1 per cent. Well below the RBA’s target range.

What is driving inflation in Australia?

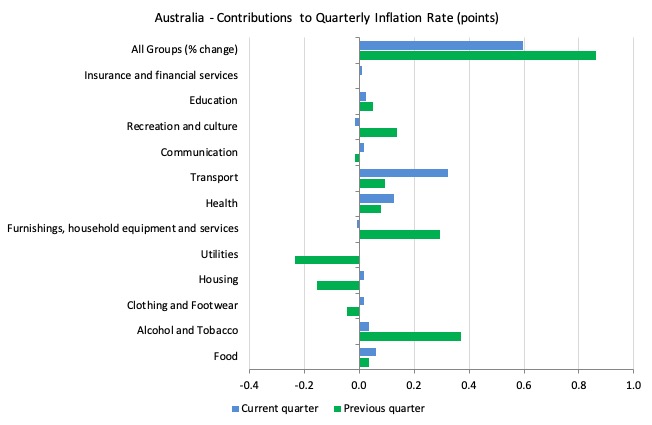

The following bar chart compares the contributions to the quarterly change in the CPI for the March-quarter 2021 (blue bars) compared to the December-quarter 2020 (green bars).

Note that Utilities is a sub-group of Housing.

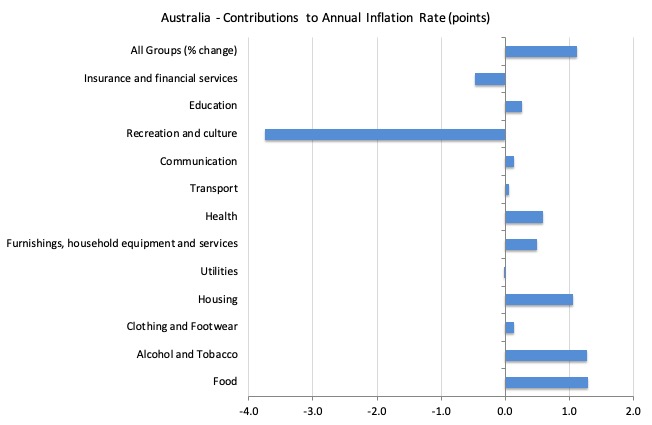

The next graph provides shows the contributions in points to the annual inflation rate by the various components.

Inflation and Expected Inflation

I mentioned at the outset, the on-going inflation obsession among market players.

If you examine the market trends in speculative trades then it is clear that the traders were betting on a major shift in the RBA policy upwards after 2016 because they have been punting on a substantial rise in inflation.

They have been systematically wrong on that front.

More recently, it is clear their expectations have been falling as the RBA holds to its low interest rate regime.

Significantly, it is this misplaced fear of inflation, that, in place, drives the misplaced preference by New Keynesians for counter-stabilising monetary policy instead of fiscal policy.

If we went back to 2009 and examined all of the commentary from the so-called experts we would find an overwhelming emphasis on the so-called inflation risk arising from the fiscal stimulus. The predictions of rising inflation and interest rates dominated the policy discussions.

The fact is that there was no basis for those predictions in 2009 and 12 years later no major inflation outbreak is forthcoming.

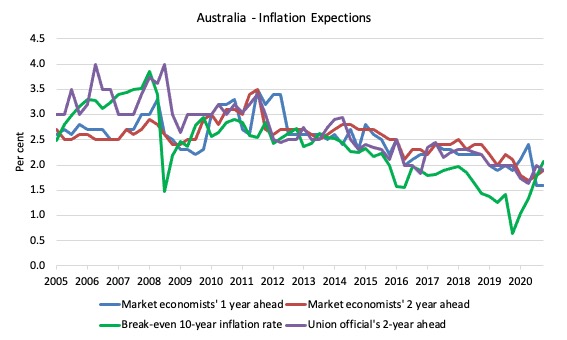

The following graph shows four measures of expected inflation expectations produced by the RBA – Inflation Expectations – G3 – from the June-quarter 2005 to the March-quarter 2021.

The four measures are:

1. Market economists’ inflation expectations – 1-year ahead.

2. Market economists’ inflation expectations – 2-year ahead – so what they think inflation will be in 2 years time.

3. Break-even 10-year inflation rate – The average annual inflation rate implied by the difference between 10-year nominal bond yield and 10-year inflation indexed bond yield. This is a measure of the market sentiment to inflation risk.

4. Union officials’ inflation expectations – 2-year ahead.

Notwithstanding the systematic errors in the forecasts, the price expectations (as measured by these series) are trending down in Australia, which will influence a host of other nominal aggregates such as wage demands and price margins.

The market economists’ one-year and two-year ahead expectations are well above the Break-even 10-year inflation rate. Even Union officials have fallen for the accelerating inflation outlook.

It is well known that the ‘market economists’ systematically get movements in the economy wrong and one wonders if their organisations actually bet money on their analysis!

The most reliable measure – the Break-even 10-year inflation rate – is now at 2.1 per cent, around the lower bound of the RBA targetting range

It has been at or below the lower bound of the RBA’s policy target range since March 2016 and has adjusted upwards to match the other expectations.

The other expectations are still lagging behind the actual inflation rate, which means that forecasters progressively catch up to their previous forecast errors rather than instantaneously adjust, a further piece of evidence that refutes the mainstream economics hypothesis that decision makers use ‘rational expectations’ (that is, on average get it right).

Implications for monetary policy

What does this all mean for monetary policy?

Clearly, the market economists were punting on a rise in the interest rate and have only started to realise in the last few quarters that this is unlikely to happen any time soon (as disclosed by their inflationary expectations above).

The inflation trends provide no basis for any expectation that the RBA will hike interest rates anytime soon.

The Consumer Price Index (CPI) is designed to reflect a broad basket of goods and services (the ‘regimen’) which are representative of the cost of living. You can learn more about the CPI regimen HERE.

Please read my blog – Australian inflation trending down – lower oil prices and subdued economy – for a detailed discussion about the use of the headline rate of inflation and other analytical inflation measures.

The RBA’s formal inflation targeting rule aims to keep annual inflation rate (measured by the consumer price index) between 2 and 3 per cent over the medium term. Their so-called ‘forward-looking’ agenda is not clear – what time period etc – so it is difficult to be precise in relating the ABS data to the RBA thinking.

What we do know is that they do not rely on the ‘headline’ inflation rate. Instead, they use two measures of underlying inflation which attempt to net out the most volatile price movements.

To understand the difference between the headline rate and other non-volatile measures of inflation, you might like to read the March 2010 RBA Bulletin which contains an interesting article – Measures of Underlying Inflation. That article explains the different inflation measures the RBA considers and the logic behind them.

The concept of underlying inflation is an attempt to separate the trend (“the persistent component of inflation) from the short-term fluctuations in prices. The main source of short-term ‘noise’ comes from “fluctuations in commodity markets and agricultural conditions, policy changes, or seasonal or infrequent price resetting”.

The RBA uses several different measures of underlying inflation which are generally categorised as ‘exclusion-based measures’ and ‘trimmed-mean measures’.

So, you can exclude “a particular set of volatile items – namely fruit, vegetables and automotive fuel” to get a better picture of the “persistent inflation pressures in the economy”. The main weaknesses with this method is that there can be “large temporary movements in components of the CPI that are not excluded” and volatile components can still be trending up (as in energy prices) or down.

The alternative trimmed-mean measures are popular among central bankers.

The authors say:

The trimmed-mean rate of inflation is defined as the average rate of inflation after “trimming” away a certain percentage of the distribution of price changes at both ends of that distribution. These measures are calculated by ordering the seasonally adjusted price changes for all CPI components in any period from lowest to highest, trimming away those that lie at the two outer edges of the distribution of price changes for that period, and then calculating an average inflation rate from the remaining set of price changes.

So you get some measure of central tendency not by exclusion but by giving lower weighting to volatile elements. Two trimmed measures are used by the RBA: (a) “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”; and (b) “the weighted median (which is the price change at the 50th percentile by weight of the distribution of price changes)”.

Please read my blog – Australian inflation trending down – lower oil prices and subdued economy – for a more detailed discussion.

So what has been happening with these different measures?

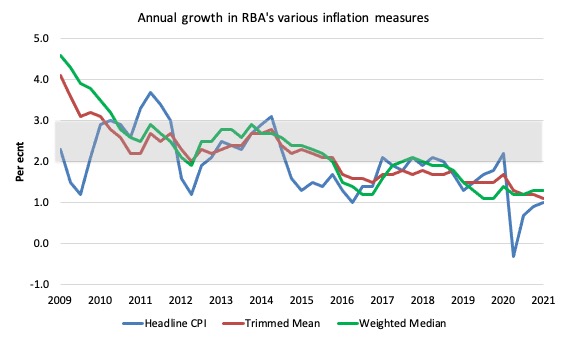

The following graph shows the three main inflation series published by the ABS since the March-quarter 2009 – the annual percentage change in the All items CPI (blue line); the annual changes in the weighted median (green line) and the trimmed mean (red line).

The RBAs inflation targetting band is 2 to 3 per cent (shaded area). The data is seasonally-adjusted.

The three measures are all currently below the RBA’s targetting range:

1. CPI measure of inflation – 1.1 per cent and below the RBAs target band for the last two years (apart from the blip associated with the child care policy decision noted above).

2. The RBAs preferred measures – the Trimmed Mean (1.1 per cent and stable) and the Weighted Median (1.3 per cent and stable) – are also well below the lower bound of the RBAs targetting range of 2 to 3 per cent.

How to we assess these results?

First, there is clearly a downward trend in all of the measures – even before the pandemic. The “core” measures used by the RBA have been benign for many quarters even with an on-going significant fiscal deficit, record low interest rates, and the newly introduced QE program.

Second, inflationary expectations are benign, although the ‘market’ sector seems to think there will be a rise in inflation. I would discount that expectation.

Third, in terms of their legislative obligations to maintain full employment and price stability, one would think the RBA would have to change its monetary policy tack.

It clearly cannot cut interest rates much and will avoid negative rates.

I think it is time they dropped their prima donna position and announced they would fund all deficits – federal and state – for the foreseeable future to allow governments to deal with the pandemic without the unknowing claims in the media that public debt is out of control.

We don’t need those diversions any longer.

Conclusion

Just before the pandemic hit all the macroeconomic policy talk in Australia was about getting the fiscal position into surplus to reduce public debt and ensure that inflation didn’t accelerate.

The problem is that the effort to cut public net spending created the circumstances such that the economy was already in trouble even before the pandemic hit.

Now we have larger deficits, record low interest rates and a central bank engaging in QE.

Inflation will not be an issue.

Wages growth will have to accelerate rather sharply before we get any core inflationary pressures.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

In the US, there’s a lot of handwringing over inflation in the housing markets. In addition, by ‘normal’ measures stock and bond prices are being propped up unnecessarily. If you have the time, you might visit Wolfstreet, a blogsite that does a pretty good job of monitoring various markets and industries. I read him. He does a good job with the statistics. Doesn’t understand MMT though.

Debt fear has an almost endless set of underwriters.

Education, Politics, Media, Think Tanks all feed the immense choir of mourners of the “piles of debt”, the GREAT SIN of modern times.

They all fail to explain why humankind as come this far, from the treetops where our simian ancestores dwelt to our modern cities, our modern houses, our cars, our rockets and drones on Mars.

They all say we have to appease the owners of money, so they will lend to our lame governments, who also live in fear of a hike in interest rates.

But money is not gold.

Since 1975. It’s a huge pile of worthless pieces of paper.

Money is worth as much as what the economy of the issuer state is worth.

If it’s a strong economy, it’s good money.

If it’s a weak economy, it’s bad money.

So they live in a paradox: they say the state is weak, but money is worthless in a weak state.

We all have to drop out those neoliberal storytellers, if we don’t want to climb the trees again.

Paulo makes a lot of sense to me. So here’s a few additional questions related to his observations. Why is INFLATION, rather than the alleviation and elimination of human and environmental degradation, THE apparent obsession of the entire field economics, apart from Marx and other socialist thinkers? Why are mainstream economists feverishly worried about inflation rather than homelessness or hunger or species extinction or global warming? Is there something fundamentally wrong with the entire discipline of non-Marxist or non-socialist economics, something inherently inhumane and ecocidal? And does MMT avoid this fundamental problem, as I suspect it does, by claiming to be only a lens to guide the economic application of non-economic values?

@ Chris Herbert It’s absolutely right for economic policy to be concerned at house price inflation in an economy of significant homeowners/mortgagors, but also recognise that (in the UK and I assume elsewhere) house price inflation is not included in general price inflation and only indirectly affects it. This is reasonable on grounds of houses being a long-lasting asset that isn’t consumed, one that is paid for over 25 years (and longer with expanding lengths of mortgage), is directly felt by only the property owning sector of the population (which although substantial is, in the UK, shrinking as ownership is consolidated) and varies from country to country (UK has more mortgagors than Germany for instance). Yes to an extent house price inflation feeds through to domestic rents, but these are more subject to wage levels. In fact, house price inflation is more likely to have a deflating effect on the rest of the economy by sucking money out of it. But then we have general price inflation propogated as an evil, as also wage inflation (can’t have workers gaining a bigger share) while house price (and stocks) inflation is presented as a side issue and a positive, although actually wrecking the economy.

@Paulo Rodriguez re:’Since 1975. It’s (money) a huge pile of worthless pieces of paper.’ I don’t understand why you use this language. We should get away with money as ‘printed’ paper, it’s (almost entirely now, digitally) recorded financial asset and liability (debt).

@Newton E. Finn re: ‘And does MMT avoid this fundamental problem (being divorced from environmental and human degradation) as I suspect it does.’ I guess your suspicion makes a change from MMT being attacked as not being concerned enough about inflation (which is clearly untrue), but you seem to want MMT to be an all encompassing theory and policy for modern society. It isn’t. It isn’t a replacement or alternative to Marx’s critique of capitalist societies, nor does it preclude us seeking to be informed by other social sciences. But it does help us to understand the macroeconomic possibilities and restrictions in arranging society for human (and environment) benefit.

Agreed, Patrick. I’m not criticizing MMT for lacking non- or meta-economic values, but I AM criticizing mainstream economics for HAVING such values (precisely the wrong kinds from human and environmental standpoints), while keeping them hidden, inter alia, by its preoccupation (to the point of obsession) with inflation.

Bytes in a computer memory card are worthless as pieces of paper.

When the christmas season comes and the need for printed money surges, the central bank prints bills in paper and people cash it on the bank desk or in the ATM.

Days later, that money is, in turn, deposited in banks accounts by the sellers, ressellers, importers, manufacturers, etc.

And it ends up again in the central bank, that destroys the old bills, keeping the bytes on the computer memory board, adding many accounts, subtracting many others.

So when the need for money comes from the education/health/military/etc departments of the government, the treasury department has to check if it has money (lets say in bytes) available in the budget to pay for it.

If it doesn’t (which is, normally, the case) we have two possibilities:

1) the government tells the central bank to change the bytes in the treasury’s accounts (lets forget the printers for now) in the central bank (or on the government’s accounts on commercial banks);

2) the government sells bonds and issues debt to get the money it needs.

So it’s here that the things get complicated.

As money (whether printed or digital) is worthless, having too many money in circulation turns it even more worthless.

So, this excess money in circulation brings to the fore fears of inflation and hyperinflation, and here comes Weimar Republic and Zimbabwe.

And then came the myth of independent central banks, to keep them from the pressure of governments.

This is the neoliberal mantra and yes, it’s ecocidal, it’s genocidal.

It’s capitalism in the limits of capitalism.

MMT isn’t about capitalism, Patrick B said, but capitalists made monetary policy their business.

That’s why it is so hard to overturn the status quo.

Hi Paulo. Re: ‘MMT isn’t about capitalism, Patrick B said’. I really didn’t you know. MMT shows how the government really acts and is integral to keeping our capitalist societies going. Of course it can also help with understanding a society that dispensed with private banks and hasn’t replaced a full employment goal with some inflation/unemployment tradeoff (I have China in mind – of which other criticisms can be made).

Is there a surge in the demand for printed notes at Christmas? Certainly there is in China at New Year, when children are given note filled red envelopes, when at other time, it’s even more of a cash-less society than here in the UK. But I’m not alone in the cashless habit, even at Christmas, when back in the UK, where cash exchange is primarily maintained because of VAT at 20%. I would have thought that the move to a cashless society would make more people think, especially post GFC and more so with the covid crisis, of the tenuous link between their well-being and the banks’ computers and then to the government’s (central bank) computer, but the language of printed money and budgets is resistant to change. That’s the cleverest part of capitalists making government a part of their business.