Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

ECB realises it has to keep funding Member State deficits for the foreseeable future

Well, the Melbourne virus outbreak has scuttled lots of plans and events. We wouldn’t be in this situation if the Federal government had have invested in dedicated quarantine facilities last year when they were told to and taken advice to ensure their vaccination purchases were sufficient. Anyway, that is for another day. Today, I have been examining European data and matching them against a recent interview (May 26, 2021) – Interview with Fabio Panetta, Member of the Executive Board of the ECB, conducted by Jun Ishikawa – that Nikkei published yesterday. Things have changed a bit in Europe since the GFC although the fundamental problem of the Eurozone remains – there is a disjuncture between fiscal responsibility and fiscal capacity and the only way that that mismatch is being addressed is the via the on-going ECB funding of fiscal deficits, despite the denial that that is what is happening. It is plainly obvious to all.

Saving ratios in Europe are high and rising

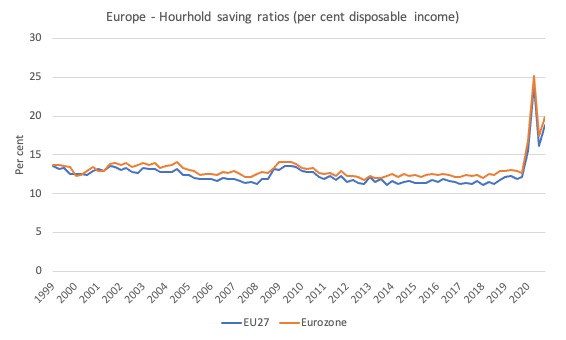

The first thing to appreciate is that household saving ratios (as a proportion of disposable income) are very high and have been rising sharply since the pandemic.

That is, with one exception.

The first graph shows the household saving ratios for the EU27 and the 19 Member States of the Eurozone since 1999. The Eurostat data goes up to the December-quarter 2020.

By Australian standards these are the sort of ratios we saw in the 1960s before the neoliberal credit frenzy pushed them into negative territory.

It is also important to note that the rising fiscal deficits have helped ‘fund’ the rising saving ratios although the fact that overall growth is still negative means that the deficits have not been large enough to satisfy the desire for rising saving and offset the declining household consumption expenditure.

The point is that with high household saving ratios diverting income generation away from expenditure, other sources of expenditure are necessary to ensure employment growth is strong.

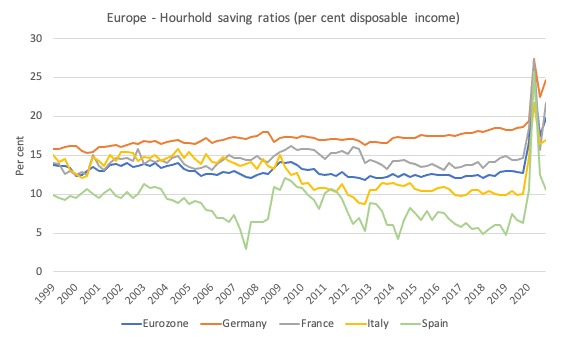

The next graph shows the same data for selected Eurozone nations – compared to the currency union average.

German households are now saving around 25 per cent of their disposable income and French households around 20 per cent.

Think about what else is going on in each of these nations.

Germany is running a huge external surplus, while France is running a large external deficit.

Germany runs an investment ratio of around 20 per cent of GDP, while France is higher at around 25 per cent.

So for Germany, the two sectors that make up the non-government sector overall are in surplus, while in France they are in deficit.

The implications for the fiscal positions are different with France likely to require higher deficits to sustain growth given the leakage via the external sector.

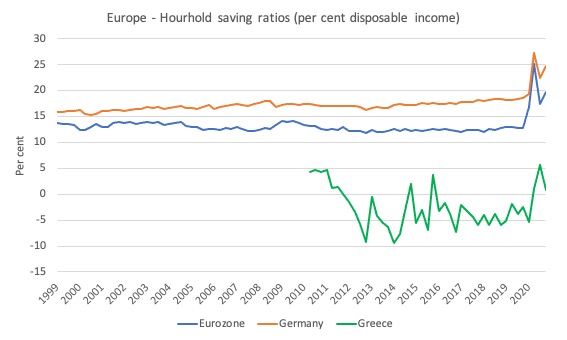

And the last graph contrasts the situation in German (high household saving and personal risk management) to that of Greece which has seen austerity severely squeeze household income and forced people to dis-save to maintain a semblance of life.

The consequences of that will devastate that nation for years to come.

Those graphs are background to my response to the Panetta Interview with Nikkei.

Interview with ECB Board Member, Fabio Panetta

Panetta summarised the economic situation in the Eurozone:

1. “recovery is incomplete: euro area GDP is still 5.5% below its pre-pandemic level and even further beneath its pre-crisis growth trend.”

2. “This means that millions of jobs lost during the pandemic have not been recovered.”

3. “job retention schemes continue to play a major role: in the euro area, the share of workers who are unemployed, discouraged or enrolled in such schemes is around 17%, double the headline unemployment rate.”

4. “the economy still relies on the oxygen provided by both monetary and fiscal policy: we are far from the point where we can see self-sustained growth.”

The obvious point is that the “oxygen” has been in short or restricted supply – revert to point 1.

Why are nations outside the Eurozone (like the UK and Australia) experiencing positive growth while the Eurozone is still wallowing in recession?

The Eurozone is being choked by a lack of “oxygen”.

Why?

Because fiscal policy is in the hands of the Member States who do not have the currency capacity to expand sufficiently.

Yes, the Stability and Growth Pact rules have been suspended temporarily, the culture that the rules have created have created a lack of adventure among political leaders who fear, rightly, that Brussels will force them into harsh austerity at some point in the future.

Further, the Next GenerationEU funds have not been deployed yet after 18 months or so of (typical) disagreement among the Member States.

These disagreements make it virtually impossible for the EU to meet emergencies such as the pandemic in any functional way.

A given crisis will always be worse in the EU than elsewhere.

The relevant point to this blog post is that the ECB, which is the currency issuer in the EMU, is ensuring that any deficits that are being incurred by Member States are being funded via their bond buying program, without forcing the Member States to be at the behest of private bond markets.

The question that has been raised continually over the last year or so as the scale of the asset purchase programs has been ramped up is when the ECB will reduce their purchases.

That was a question that Fabio Panetta was keen to address and put paid to the rising calls from conservatives for the ECB to start retrenching its support to the Member States.

He said:

In such an environment, a premature withdrawal of policy support would risk suffocating the recovery before it becomes self-sustained. And it would exacerbate uncertainty, further weighing on demand.

We didn’t hear that during the GFC when despite the ECB conducting asset buying programs the conditionality for such purchases was that the Member States had to implement austerity, years before fiscal withdrawal was indicated by the circumstances.

Fabio Panetta also shifted the focus from financial variables to real variables, which is appropriate:

… we must continue to closely monitor the incoming data and ensure that the exit from the crisis is supported by a robust and lasting recovery. The output gap, the employment gap and the inflation gap are the key variables to determine when we have truly gone beyond the pandemic phase.

The shift in rhetoric is clear.

The talk is not about fiscal rule thresholds being breached but about employment and output.

I did some calculations.

Total Member State (consolidated) public debt rose by 1,080,285 million euros over the course of 2020.

The ECB’s holdings of government debt rose by 1,055,452 million euros, which is 97.7 per cent of the debt issued (in net terms) over 2020.

In the first 20 weeks of 2021, ECB holdings of government debt have risen a further 406,523 million euros.

We don’t yet know by how much government debt has risen in the first 20 weeks of 2021.

The point is that ECB has essentially purchased all the debt issued since the beginning of the pandemic and then some (probably).

That is far more than is necessary to satisfy “securities held for monetary policy purposes”, which is how they classify their purchases.

They are funding government deficits and everyone knows it.

Fabia Panetta was then asked (inevitably and boringly) to respond to the statement that “It looks like inflation is coming back, doesn’t it?”.

He said:

… this will be a temporary hump: it is not expected to last beyond this year, as it’s not self-sustained and it’s not domestically driven. In any case, underlying inflation, which is mainly driven by domestic services, remains very low, at 0.7% in April.

We are getting increased hysteria about small price changes from a very low base.

But again, note the link to the real economy “not domestically driven” rather than just equating the large-scale QE program with an expanding money supply and – inflation.

In fact, he considered the risk wa that “inflation is going to remain well below our objective of 2%” and that this ” may affect our credibility after so many years of inflation ‘misses’.”

What it demonstrates is that the central bank cannot just arbitrarily push up the inflation rate by adding reserves to the banking system, which is a major repudiation of mainstream macroeconomic theory.

Of course, in the interview he denied that and said instead that “the level of inflation in the medium term is still decided by the central bank” and the interviewer didn’t push him to explain how!

The interview then shifted to the Pandemic Emergency Purchase Program (PEPP), which is just an additional government bond buying program added to the existing programs.

All the interest has been on whether the ECB would continue this program after June 2021.

The answer is clear from Fabio Panetta:

… only a sustained increase in inflationary pressures, reflected in an upward trend in underlying inflation and bringing inflation and inflation expectations in line with our aim, could justify a reduction in our purchases.

So while the ECB might abandon the PEPP, the additional purchases will just be tacked onto the existing APP if his view prevails at the board level.

He went further and noted that:

… we are now seeing a further undesirable increase in yields …

Which reinforces the ECB’s motivation to keep controlling yields at low levels by ramping up the bond-buying program.

The interview then diverted into discussions of digital currency, which I will not comment on.

Conclusion

The point is that the ECB knows well that it is the only thing holding the monetary union together.

Without this massive funding of Member State deficits (which are too low to be sure), many Member States would become insolvent fairly quickly – Italy would be first in the queue.

And with the high household saving ratios across the zone bar the destroyed Greece, there is a lot of expenditure leakage that has to be filled by government net spending.

The Europeans have got themselves into a real bind as a result of the dysfunctional monetary architecture they pushed onto their citizens.

The system is austerity biased and the democratically deficient.

And for its continuity, it relies on the central bank essentially acting outside the legal framework established in the treaties, although it denies that.

And that continuity cannot deliver a desirable standard of living for its citizens in general.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

The Euro is kept alive, fuelled on lies.

First lie (and fundamental lie): this is a monetary union. The American dollar is a monetary union; the Australian dollar is a monetary union. The euro is a half backed monetary union, that keeps wealth flowing from the poor to the rich.

Second lie: We are in this together. No we are not. The Germans don’t care for Italians, Greeks, Spanniards or the Portuguese. If their exports are artificially cheaper, because of the effect of the slower economies in southern europe, so be it. They are happy.

Third lie: the ECB is not supporting the euro through massive “money printing” (or hitting the zero keystroke on Laggarde’s computer). Money printing is what’s keeping the euro from failing.

Fourth lie: This monstrous contraption will be a super power. No it won’t. Without the UK, this is but a joke. Rembember: the Brits said: we don’t need any of that. That’s a message to everybody else “maybe we don’t need any of that too”.

Fifth lie: the far right will be no different from the Macrons and Merkels of today. Oh yes, they will. Just imagine Le Pen with the nuclear trigger on her desk. We have liars today, but the far-right will take lying to the next level, since lying is their modus-operandi. They have an ultra-neoliberal agenda, but don’t even mention any of that on they speak.

There are many other lies, so many that we could write a large book on them…

The death of what I call ‘flunkenomcs?’ This mess is the result of a political ideology, identified as neo-liberal (whatever that means), being pushed as a math based economic ‘science.’ It is nonsense. Verging on useless. Mitchell and company have constructed a macroeconomic framework based on common sense. There will be no real recovery as long as we churn out ‘flunkenomics’ degrees.

‘the culture that the rules have created have created a lack of adventure among political leaders who fear, rightly, that Brussels will force them into harsh austerity at some point in the future.’ Sounds like not leaving it to citizens to test out the Ricardian Equivalence theory.

@Chris Herbert – I don’t know why you are joining in with the ‘whatever that means/meaningless term’ belittling of ‘neo-liberal’. Seems to be it’s a very good concise term for the current predominant arrangements that those who support those arrangements wish to keep murky and ill-defined.

@Chris Herbert:

The IMF has described neo-liberalism as follows: “The neoliberal agenda-a label used more by critics than by the architects of the policies-rests on two main planks. The first is increased competition-achieved through deregulation and the opening up of domestic markets, including financial markets, to foreign competition. The second is a smaller role for the state, achieved through privatization and limits on the ability of governments to run fiscal deficits and accumulate debt.” Later in the article: “Curbing the size of the state is another aspect of the neoliberal agenda. Privatization of some government functions is one way to achieve this. Another is to constrain government spending through limits on the size of fiscal deficits and on the ability of governments to accumulate debt.”

C.f. Neo-liberalism Oversold? June 2016, vol 3, no.2. It’s on the IMF website under Finance & Development. I think Bill did a piece on this.

It is worth reading the whole IMF article.

And yet major research institutions are touting European stocks as the next big upward move. I happened to accompany a friend to visit a wealth management advisor at a local Chase office today and listened while he extolled how his firm believed European stocks were a great opportunity right now because growth there would surely catch up with the U.S. Of course I was wearing a face mask, so luckily the mask hid my cynical smile. But he was so sure of himself and his firm’s view. I didn’t have the time (or the heart) to try to explain to him the real situation with the EU. If I thought he would read it (or if he did read it, if he could understand it), I would send him a link to this excellent post by Bill.

William,

The Chase analyst might have a point. Afterall, the EU is there to promote the interests of the large corporations.

I would imagine those companies with substantial international business such as the finance companies, vehicle manufacturers, capital goods manufacturers could do well if the rest of the world is doing well.

Their businesses would be soundly supported by the weak Euro.

Here’s the IMF article Keith Newman above refers to:-

https://www.imf.org/external/pubs/ft/fandd/2016/06/ostry.htm

“”securities held for monetary policy purposes”,

Ha brilliant lmao what an interesting way of saying fund the deficits.

By the way ? What effective fiscal deficit does each country have,are any countries pushing the boat out conscious that for the time being ECB will provide support.

Although it’s a hypocrite lying system; perhaps this is how it will sustain itself,no country will disengage now ,especially with ECB supporting government deficits.