It's Wednesday and we have discussion on a few topics today. The first relates to…

We will soon see just how ‘pragmatic’ Sunak really is

At present, Britain is still in the throes of a global pandemic that has devastated the nation. Last week, at Brighton, the key economic spokespersons for the TLP or the Tory-lite Party (short form, British Labour Party) told the voters of Britain why they should remain in opposition. They were sterling performances by the leader and shadow chancellor. Clarifying for all, the fact that the Party hasn’t learned much at all about their recent history. A history that has seen them lose 4 national elections in a row and in the face of one of the worst British governments in history (and that is really saying something), the TLP’s electoral fortunes continue to wallow in loss-making percentiles. Then we had the Tory version outlined by the actual chancellor on Monday. Taking advantage of the political space the TLP has given them to reinstate all the religious nonsense about the immorality of public debt and the rest of the stuff that cultists (mainstream economists) dish up.

The current chancellor gave his keynote speech to the Tory conference in Manchester on Monday..

Now, I know all about semantics.

The Speech was an exercise in basic denial.

The Chancellor started and finished trying to reinstate the fiscal-sky-is-falling-in narrative which seems to run counter to his claim that:

We will do whatever it takes!

Well whatever it takes will not allow for any of the fiscal changes he foreshadowed.

The Chancellor said that “we need to fix our public finances”:

I’m a pragmatist, I care about what works, not about the purity of any dogma. I believe in fiscal responsibility. Just borrowing more money and stacking up bills that future generations have to pay is not just economically irresponsible – it is immoral.

Because, because, because, it’s not the state’s money, it’s your money.

The semanticist would tell us that the immorality lies in Sunak lying about the capacities of the British government as the monopoly issuer of the sterling.

Lying is immoral.

But, of course, when religion enters the fray, lying is par for the course.

If Sunak is really a pragmatist then he will be sorely disappointed in himself over the next few years because he will have to violate his concept of fiscal responsibility.

There is no way he can honour a later statement he made during the Speech that “I will do whatever I can to protect peoples’ livelihoods” and set about cutting the fiscal deficit in any significant way.

But let’s clear a few things up first.

1. The government’s fiscal balance is not a motor car. The latter sometimes required repair when a component ages and falters.

There is no sense to be made of applying the metaphor to a fiscal balance.

One doesn’t ‘fix’ that balance.

One doesn’t ‘repair’ it.

It is what it is and should never be a target in itself for action.

In a modern monetary economy, the currency-issuing government should be targetting things that matter – like protecting “peoples’ livelihoods” and letting the fiscal balance be whatever is required to achieve that aim, conditional on what the non-government sector is doing with respect to spending and saving decisions.

Currently, that means the fiscal deficit has to be continuously large in Britain.

Not forever, but any notion of a fiscal surplus or balance is nonsensical and the pragmatist would soon see the unemployed bodies piling up and be forced to do something about it.

2. The future generations choose whatever public debt levels and tax structures that they will live with. The baby boomers didn’t impose any particular tax structure on our children.

Once they get to voting age they can express their preferences accordingly.

What we have left them with is massive deteriorating natural environment, the ‘gig’ economy where their future prospects are damaged, a housing market that will preclude all but the ‘rich’ kids from fully participating, run-down educational institutions, health services that are underfunded, public transport systems that continually fail, and all the rest of it.

That is the burden that this “we need to fix our public finances” mentality has wrought for our children, and for us, and for the planet.

3. Sunak claimed the ‘national debt’ at nearly 100 per cent of GDP was problematic.

If he really believed that he could easily authorise the Treasury to stop issuing it and then sending a memo to the Bank of England requiring them to purchase the outstanding debt and writing it down to zero.

Of course, he can get away with all this nonsense because Her Majesty’s Opposition is trying to sound even more hardline on fiscal matters.

The TLP’s constant inferiority complex and irrational paranoia about what the ‘City’ might do to them if they were a government that dared call all this fiscal lying out – this immoral fiscal lying – keeps them firmly under control.

And if the public is kept in the dark by the ‘immoral fiscal lying’ and has been conditioned to value the ‘fiscal fixers’, then why would anyone ever vote for a ‘Lite-version’ of the real thing.

Labour had a perfect opportunity when the pandemic hit to shift the narrative and challenge all the precepts of mainstream macroeconomics that will cruel the future in Britain.

They could have set up ‘interest rate watch pages’, ‘bond yield watch pages’, ‘bid-to-cover watch pages’, ‘non-government wealth incrementation watch pages’, ‘government left pocket loaning to the right pocket watch pages’ and more.

They could have put out daily press releases about how the rising deficit was responsible and necessary and pointing out that the sky was not about to fall in as per the mainstream predictions.

But instead they went all ‘fiscal credibility rules’ on the British people and surrendered any credibility for government as a consequence (in my assessment) but ceded any ground to the Tories to give them the space to wheel Sunak out to dish up this rubbish.

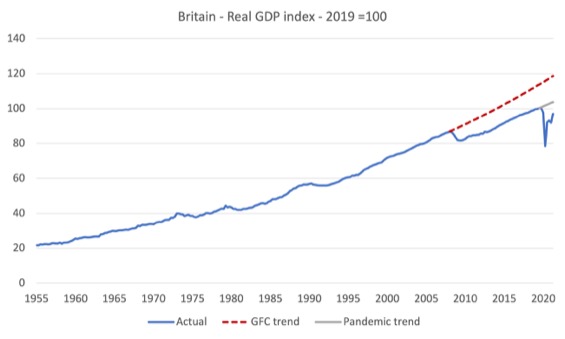

The following graph provides a starting point for the narrative.

The problem with popular narratives from politicians that are designed to massive sentiment rather than, necessarily, advance general well-being, is that they forget things that are important.

So this graph allows us to construct various stories about what might have been and what should be.

It shows actual real GDP as published by the British Office of National Statistics (Source) from the March-quarter 1955 to the June-quarter 2021.

It also shows two projected lines – the first, starting at the March-quarter 2008 and then extrapolating the average real GDP growth rate from the March-quarter 2000 to that point.

The second, extrapolates the average growth rate from the March-quarter 2000 to the December-quarter 2019 out to the June-quarter 2021.

In words, the first line tells us what real GDP would have been if the average trend prior to the GFC was maintained.

The second tells us what real GDP would have been if the average trend from March-quarter 2000 to the onset of the pandemic was maintained.

The difference between these respective lines and the actual GDP line is an indicator of how much output has been lost as a result of the economy straying from its previous trend growth rate.

We call these the output gaps.

In the first case, it shows the consequences of the austerity policies that the Tories inflicted on the nation when they were elected in May 2010.

These policies killed the recovery and it took ages for the economy to start the process of recovery. ONS was still recording negative real GDP quarters in the December-quarter 2012, which was around the time that George Osborne was forced by the evidence before him to start relaxing the mindless austerity that he had imposed.

In the second case, the output gap provides an estimate of the impact of the pandemic in pushing the economy of the previous growth path.

The gaps are just ball-park figures not hard science.

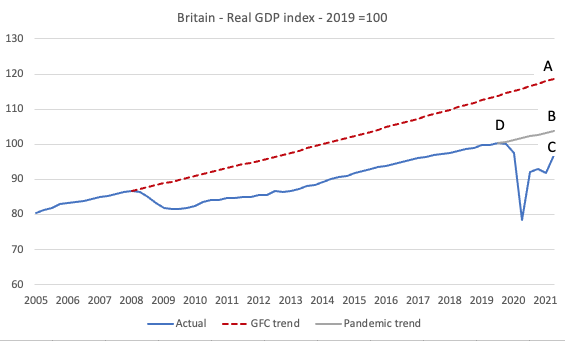

In the second graph, I shortened the sample (starting at March-quarter 2005) to highlight the gaps.

The following gaps can be expressed:

1. A-C which is the difference between where the economy is now (June-quarter 2021) and where it would have been had the pre-GFC trend been maintained. That gap is -18.3 per cent of potential – huge.

2. B-C which is the difference between where the economy is now (June-quarter 2021) and where it would have been had the pre-pandemic trend been maintained. That gap is -6.6 per cent of potential – still large.

3. C-D which is the extent to which the economy is below the pre-pandemic level. That gap is 3.4 per cent – significant.

Whatever construction one wants to make, the spending shortfall is large in Britain at present.

And, of course, whether any of these benchmarks or starting points in the construction of a narrative are meaningful is debatable.

They definitely represent a minimum envelope.

So, then one starts asking questions about the state of the British economy pre-GFC or pre-pandemic – and estimating the shortfalls in spending implied at those points, the narrative starts to broaden and the quantum for the spending gaps start to rise.

For example, in the Autumn of 2018, the British government announced it would spend an additional £20 billion on the National Health System up to 2023.

At the time, that sum seemed to me to be a wild underestimate of what was required.

Then a pandemic intervenes and the wild underestimate becomes even wilder.

There were some additional spending promises by the government for the NHS, some of which fudged old money into alleged new.

But if we go back to pre-GFC as a starting point and then see what the impact of austerity has been on the NHS system, the decade leading up to 2019 saw allocations cut severely in growth terms (around 1.4 per cent per annum over that decade compared to a long-term average of around 3.7 per cent).

Last month, the British government announced a ‘Spending Review’ which promised extra funding for the NHS in an environment where the costs of providing front-line health care services are rising by around £4 to £5 billion a year.

The estimates are that the shortfall for next year alone will be at least £10 billion (Source)

Then add on the necessity for a government response to climate change, doing ‘levelling up’ properly rather than talking about it, and, most significantly, ensuring that Brexit doesn’t become a nightmare that it easily will if under-funded, and the narrative is anything but that coming from Labour or the Tories.

These expenditure demands are in addition to the injections required to deal with the spending gaps identified above.

Conclusion

Trying to pursue the austerity narrative now will be much harder than, say, in May 2010.

A lot of evidence has been revealed that predicates against the mainstream interpretation of events.

But, moreover, and probably more important, is the fact that the challenges ahead for the globe (climate and pandemic), and, particularly Britain (with Brexit) will render any austerity attempts highly damaging – and visibly so.

Our youth are already rising up to protect their futures.

And that is not an uprising against public debt – but against existential threats from climate change.

Sunak will have his hand forced for sure and we will see how pragmatic he really is.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

The first episode of a 5 part series of the Blair and Brown years was on the BBC last night. The Full series can be watched on BBC I player.

Shows what is playing out in both the Labour party today and the Cinder in front of our very eyes. There is also a series called the David Cameron years to get the full picture.

Not very often I agree with Robin McAlpine but I think he describes what us going on very well in his recent article – When politics and politicians diverge.

http://robinmcalpine.org/when-politics-and-politicians-diverge/

With both left wing voters and right wing voters not getting what they want populism will continue to rise. The UK could easily become like the US and divided more than ever. Not because of brexit but because So many just refuse to accept the result of a democratic referendum.

Agree austerity has been dealt a killer blow by Covid. Its been the best thing for MMT. Silver linings and all that.

But these graphs can used in many ways as you point out “And, of course, whether any of these benchmarks or starting points in the construction of a narrative are meaningful is debatable”

Smoothing out the curve from 1955 to now would suggest the real outlier is the faster than expected growth 1995-2008 – the period of the dreaded Blairites! Perhaps part of the problem was not the response to the crisis but the unbridled growth preceding it.

@Derek, I turned on the Blair/Brown show briefly and heard how they plotted to turn the Party blue while John Smith was leading, on the basis that they would never get elected otherwise. The truth is that the tories were bound to lose and it mattered not what state the Labour Party was in by 97. Tragic. I couldn’t watch any further.

Meanwhile, we again watch as the US repeatedly bashes itself over the head with a “debt ceiling”. And they will raise it a bit more, and bash their heads into it again in a year, or less. The definition of insanity!

Couldn’t agree more,Carol.

in 1997 the tories were a highwire act with a bottle in their hands and the electoral genius of that horrific troika of blair,brown and mandelson (which had failed so recently before) has been rather overplayed; mainly by themselves.

The wretched, tribute band performance of blair starmer shows their malign spirit lives on.

That said, the sleaze evident then has long since been eclipsed by the following governments, most markedly the current one.

They view public spending as a personal and party slush fund, nothing more.

Hi MMTers.

Does anybody know what is happening with Australian state government bonds that are being bought by the RBA? Are they being forgiven/retired or are the states expected to pay interest to the RBA?

Any info or links much appreciated.

Cheers