Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

The British Chancellor cannot run short of sterling unless he chooses to do so

It’s Wednesday and my blog-lite day or so it seems. Today I briefly discuss the proposition that the British government can run short of sterling. It cannot unless it chooses to do so. And the basis for choosing to do so would be deeply irrational and irresponsible, when judged from the perspective of advancing the well-being of the citizens. I also reflect on the vested interests in the financial markets and the way they get platforms in the media and policy making circles to advance their sectional interests (profit). And mostly, we just have a 33 minute musical feast to reflect upon.

Institute of Fiscal Studies continues to embarrass itself

The London-based IFS released its – Green Budget 2021 – yesterday (October 12, 2021) – “in association with Citi” – which means the IFS cannot claim to be anything more than a lobby group.

I will analyse the – Full Report – another day as I am still reading it in full.

In its public release, the usual stuff about fiscal risks and the need for fiscal rules is rehearsed.

This stuff is not going to go away any time soon.

Then it came to the section on “The Chancellor faces a dilemma” which talks about the “squeeze” on “unprotected budgets” and the “next two years look especially tricky”.

In the press release – Despite planning biggest tax rises in more than 25 years, and an historic increase in size of the state, the Chancellor is still likely to have little money for hard-pressed public services (October 12, 2021) – the IFS claims that:

1. “Rishi Sunak will have little room for manoeuvre in this month’s Budget and Spending Review.”

2. “he may even have to implement cuts to some budgets over the next two years.”

Why?

Apparently there will be “a legacy of funding pressures” as the British government, which issues its own currency and has a central bank buying up all the public debt that is being issued, needs to spend more on climate change, levelling up, the pandemic (NHS), schools, defence and more.

I have a solution.

Type bigger numbers into the monetary system.

That should do it.

The IFS embarrassment was shared by The Independent newspaper, which chose to run a story (October 12, 2021) – Sunak will be ‘short of money’ despite historic tax rises, IFS warns.

There was no critical scrutiny of the IFS propositions in the story.

Why do journalists go to university and get degrees when they mostly just act as press release summarisers for lobby groups?

The headline tells us all.

“Sunak will be ‘short of money’ despite historic tax rises”.

Solution: get HM Treasury to send a memo to the Bank of England to get the typists typing.

Numbers not letters.

Bigger ones if necessary.

Into bank accounts.

Sunak can never be “short of money”, unless they are referring this his private accounts.

If they are talking about the British government spending capacity, it is abrogation of the truth to write that he can run out of sterling.

He can voluntary restrict his access to sterling by putting in place arbitrary rules to stop the typists typing.

But then he could also introduce rules that say he needs to do 100 pushups every morning before the British government can type any numbers into bank accounts.

But unless he does those things, he can never run “short of money” and the Independent is just making a farce of its ‘title’. It is hardly independent when it rights lies like this which condition the way people think, act and vote.

The creation of a fictional world to distort our behaviour is one of the worst aspects of the mainstream of my profession.

The vested interests of those calling for higher interest rates

In my blog post yesterday – The one-trick New Keynesian ponies are back in town (October 12, 2021) – I noted that an external member of the Bank of England’s Monetary Policy Committee, claimed that the Bank will have to hike interest rates sooner than later.

Michael Saunders also works for Citi Bank.

He also claimed that the:

… markets have priced in over the last few months an earlier rise in Bank rate than previously and I think that’s appropriate … I think it is appropriate that the markets have moved to pricing a significantly earlier path of tightening than they did previously.

The Telegraph journalist that provided the story did not ask Michael Saunders whether the Citi Bank had taken bets on rising interest rates or not.

He should have.

I also noted that private bank economists typically claim interest rates have to rise because their companies make more profits when they do.

The media always seeks voice from these characters without disclosing that they have a vested interest in the result that they are recommending.

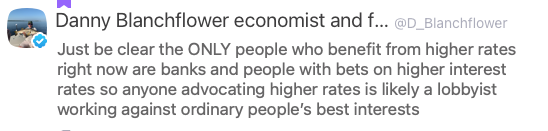

Overnight, there was a good Tweet from former MPC member Danny Blanchflower:

Says it all really.

The media should stop using statements from bank economists unless they also disclose their gambling portfolios.

It has no credibility to have a private interest in interest rates rising and then to come out and recommend they are increased.

And why are characters like this on the MPC anyway?

Saunders or his Bank might not have been betting on rate rises but at least we should know before accepting his recommendations as carrying any weight.

Music – a great discovery

This is what I have been listening to while working this morning.

One of the classic albums in my musical education and for others to was the 1964 album – A Love Supreme – released by the doyen of experimental jazz – John Coltrane = with his quartet.

The other three players were:

1. Elvin Jones – drums (Jimi Hendrix called Mitch Mitchell “my Elvin Jones”)

2. McCoy Tyner piano.

3. Jimmy Garrison – double bass.

I acquired my copy of the album in the early 1970s and wore it out soon after – as one does.

There are only three tracks on the album, although side two was actually two parts “Pursuance” and the shorter “Psalm”.

It was also recorded in the earlier days of – Free Jazz – movement, which – Ornette Coleman – had pioneered.

This style really defied definition but one knows it when they hear it. Certainly it allowed players to break out of the strictness of modal jazz and bebop.

John Coltrane and others in this trend were vilified by critics, traditional players (such as Miles Davis) and so-called purist jazz audiences for breaking out of the traditions and going free – pushing their instruments into new territory and effectively taking control away from the composition.

But, as Miles Davis was to learn, traditions are made to be broken and he did that in 1969 when he went fusion, and still the ‘purists’ screamed in their irrelevance.

An interesting thing about this album was that John Coltrane rarely played the material live in concerts.

As this Atlantic article – You’ve Never Heard John Coltrane Like This Before (October 9, 2021) – reported last week, a “rare live performance of the jazz legend’s masterpiece, A Love Supreme, was throught to be lost to history. But it wasn’t.”

A rare amateur recording made in October 1965 during a concert in Seattle has been uncovered and has been recently released as a new album. The Atlantic story provides the history of this discovery.

While I note the new album is selling for over $US80 for vinyl, I paid $A16.99 for the digital recording.

I wasn’t disappointed.

The live version is much freer than the recorded version. It also includes another pioneer of the free jazz movement – Pharoah Sanders.

In between the original recording and this version, John Coltrane added extra bass players to explore new precussive dimensions. You either like it or you don’t. I do.

You can read a review via the UK Guardian – John Coltrane: A Love Supreme Live in Seattle review – a unique record of a landmark band (October 8, 2021) – which is a fair enough account.

But, here is the original album, which I like better though.

33 minutes of delight.

Part 1 Acknowlegement

Part 2 – Resolution

Part 3 – Pursuance

Part 4 – Psalm

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

As Jack Lang, mentor to Paul Keating, imprinted on his mentee “In the race of life, always back self-interest; at least you know it’s trying.”

Works in the same way as “Follow the money”. Pretty simple really.

What I find most surprising is that they are still churning out this stuff *after what happened last year*.

We have a Contingencies Fund in the UK – a system that has been heavily used over the last year. Sunak doesn’t even need to go to Parliament to ask for the money first. The journalists can even see how it works simply by reading the accounts: https://www.gov.uk/government/publications/contingencies-fund-account-2020-to-2021

There simply is no excuse any more.

Nationalise any bank that acts against the public interest.