It's Wednesday, and as usual I scout around various issues that I have been thinking…

The financial markets should be kept away from the climate crisis solution

It’s Wednesday and today, apart from presenting some great music, I am commenting on the ridiculous notion, that even progressive greenies propagate that we need to harness the financial resources of the markets (Wall street types) to help governments decarbonise their societies. The narrative that has emerged – that the financial CEOs with “trillions in assets” (all at COP26 because they could smell lucre) are a key to solving the climate challenge – is as ridiculous as progressives saying we need to tax them to fund schools and hospitals. Both narratives reflect the dominance of mainstream macroeconomics which has convinced us that currency-issuing governments are like big households and can ‘run out of money’. That is fiction but is part of the reason we have a climate crisis. Read on.

Don’t let the financial markets near this

A few years ago I was on a panel in Scotland with the leader of the Greens there. The topic was a Green Transition and when it was her turn to talk she spoke effusively about the need for ‘green bonds’ and to embrace the capacity of the financial markets to fund the decarbonisation.

That view is shared by many progressives.

Some years ago, they were also touting ‘Robin Hood’ taxes.

I wrote about that in these blog posts:

1. Robin Hood was a thief not a saviour (April 1, 2010).

2. Progressives should move on from a reliance on ‘Robin Hood’ taxes (September 4, 2017).

More recently, they are about ‘taxing the rich’ so we can have good schools and hospitals.

1. Governments do not need the savings of the rich, nor their taxes! (April 15, 2015).

2. The ‘tax the rich’ call bestows unwarranted importance on them (February 21, 2018).

3. Tax the rich to counter carbon emissions not to get their money (January 22, 2020).

Meanwhile, the financial markets – the casino which seeks massive profits irrespective of how it is gained and the short- and long-term fallout that results – are circling with their ambitious plans to save the world through so-called ‘green financing’.

The talk at COP26 was less about identifying and solving the problems of climate change and more about how the financial markets can get their claws into the picture and create even more speculative products upon which they can make profits from, and, basically, whiteant the whole effort.

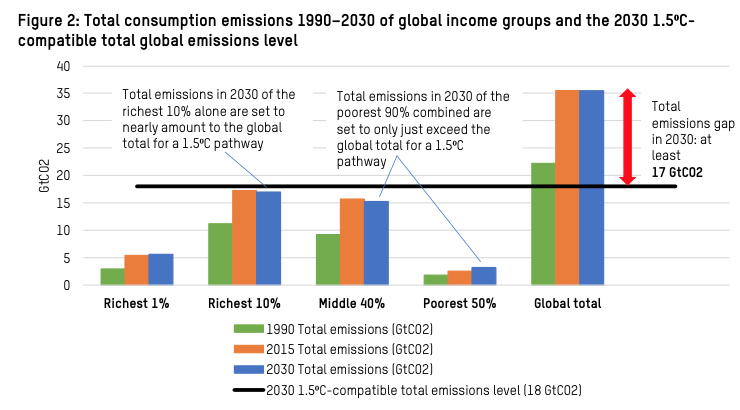

And this is from a demographic (the beneficiaries of the profits) who in 2030 are estimated to have per capita emissions that are:

… 30 times higher than the global per capita level compatible with the 1.5⁰C goal of the Paris Agreement, while the footprints of the poorest half of the world population are set to remain several times below that level.

That conclusion came from a Briefing Note (November 5, 2021) – Carbon inequality in 2030: Per capita consumption emissions and the 1.5⁰C goal – which has been published by Oxfam in liaison with the Institute for European Environmental Policy.

The Report provides the link between income distribution (and inequality) and climate crisis.

The – English version of the Report – concludes that:

1. “between the first Intergovernmental Panel on Climate Change (IPCC) report in 1990 and the 2015 Paris Agreement, the consumption of the world’s richest 1% drove twice the carbon emissions of the poorest half of the global population combined.”

2. “around a third of the global carbon budget for limiting global heating to the Paris Agreement’s 1.50C goal was squandered just to expand the consumption of the richest 10% of the world population.”

3. “The share of total global emissions associated with the consumption of the richest 1% is set to continue to grow, from 13% in 1990, to 15% in 2015 and 16% in 2030.”

4. “By 2030, the richest 1% are on course for an even greater share of total global emissions than when the Paris Agreement was signed.”

5. “Carbon inequality is extreme, both globally and within most countries”.

The following graph is a reproduction of Figure 2 in the Report and is stunning in its starkness.

6. Even if the US cuts its per capital emissions by one half between 2015-2030, they will still be “5 times the global 1.5°C per capita level.”

The lesson from this research for the rest of us (not the top-end-of-town) is that:

Maintaining such high carbon footprints among the world’s richest people either requires far deeper emissions cuts by the rest of the world’s population, or it entails global heating in excess of 1.50C above pre-industrial levels. There is no other alternative.

For once I agree with the use of the TINA invocation.

It means that the “world’s richest, highest-emitting countries must finally commit to their fair share” – that includes Australia.

It means that reducing income and wealth inequality has to be a key part of this process.

It is not just about ‘technological’ solutions that the ‘market’ will come up with.

The Report says that:

… it is time for governments to raise major taxes on or to outright ban highly carbon-intensive luxury consumption, from SUVs to mega yachts, private jets and space tourism, that represent a morally unjustified depletion of the world’s scarce remaining carbon budget.

But … the emissions of the world’s richest people linked to their capital investments are likely even greater than those associated with their direct consumption …

… coordinated and substantial taxation of wealth is urgently required to reduce inequality and at the same time curb the emissions of the richest. It is time to use regulation and taxation to end extreme wealth altogether, to protect people and the planet.

So this sounds like a ‘tax the rich’ argument.

Which it is.

But it is not the same construction that the progressives usually think is appropriate.

In proposing these taxes, the government doesn’t want their funds.

The objective is to deprive them of funds – to reduce their command on goods and services.

And, it is clear that the ‘market’ will not deliver what we need, so there is a role for ‘rules-based’ policy – outright bans on things – like, for example, Amazon boss having an enlightenment above the Earth in his ridiculous rocket trip.

But this feeds into the point about allowing the financial markets to be the main drivers of our response through their ‘funding’ vehicles.

The last thing the World needs is more financial products. There are more than enough gambling vehicles out there already and the challenge, as part of the process which will involve taxes and regulations, is to reduce those vehicles through legislative bans.

Eliminating most of the speculative products that feed the wealth accumulation in the financial markets has to be the goal.

Those transactions do nothing to advance the well-being of the majority of us.

They should be banned.

And the first place to start is to ban all derivative products associated with food and energy.

It is beyond criminal to buy up staple agricultural products like maize, to store them while the market is manipulated to create artificial shortages and price rises (and profits upon sale), while there is food poverty around the world.

Ban the lot of it.

But the embrace of the ‘green bonds’ narrative also reflects the ignorance about the capacities of our governments, which goes to the heart of the core Modern Monetary Theory (MMT) agenda.

And this ignorance is deliberately promoted by those in the top echelons of economic policy making in government because they know it will favour solutions that generate work and profits for the financial markets.

Why would they do that?

Well, because they gain benefits themselves from the financial markets.

Consider, for example, Janet Yellen, the current Secretary of the Treasury under the Biden Administration and formerly the Chair of the Federal Reserve (2014-2018).

As Federal Reserve boss she was paid around $US200,000 (2019 the amount was $US203,500).

As of January 2021, the Treasury boss gets $US221,400.

On top of that, her financial disclosures indicate that she made $US7.2 million in ‘corporate speeches’ in the last two years alone.

Citigroup paid her around $US1 million for nine speeches.

A hedge fund (Citadel) paid her $US800,000 for a speech.

And so on.

Her disclosed list is staggering.

You can see it HERE

Speeches to various groups that are lining up and tripping over each other to get their claws into the Green Transition along with lucrative government payouts.

At COP26, she made a speech – Keynote Remarks by Secretary of the Treasury Janet L. Yellen at COP26 in Glasgow, Scotland at the Finance Day Opening Event (November 3, 2021) – and said among other things:

… the United States also intends to fully support the Climate Investment Funds Capital Markets Mechanism. Through an innovative leveraging structure, this initiative will help attract significant new private climate finance and provide $500 million per year for the Clean Technology Funds’ programming, including the new Accelerating Coal Transition investment program.

And:

The gap between what governments have and what the world needs is large, and the private sector needs to play a bigger role … The private sector is ready to supply the financing to set us on a course to avoid the worst effects of climate change. CEOs representing trillions in assets are here to show their commitment.

At which time, you know the World is in trouble.

The point is that:

1. The aspirations of the financial markets are to make profits from speculative ventures and only coincidentally will that ever be consistent with advancing the well-being of the rest of us.

2. History tells us that they are short of ethics and long on chicanery and incompetence.

3. The growth of such speculative activity has worsened income and wealth inequality – as per the Oxfam Report.

4. The US government has all the financial resources it needs to make the transition away from carbon.

5. It also has the legislative clout to regulate anything that moves.

6. As to most governments.

The narrative that has emerged – that the financial CEOs with “trillions in assets” (all at COP26 because they could smell lucre) are a key to solving the climate challenge – is as ridiculous as progressives saying we need to tax them to fund schools and hospitals.

Both narratives reflect the dominance of mainstream macroeconomics which has convinced us that currency-issuing governments are like big households and can ‘run out of money’.

It is time we learned.

Music – Bobby Hutcherson

This is what I have been listening to while working this morning.

It comes off one of the best albums around – Components – by – Bobby Hutcherson – on vibes and marimba.

It was issued by Blue Note in 1966 and I purchased it in 1970.

It is an album of two styles where side A is hard bop (all Hutcherson compositions) and melodic. It is conventional swing with lots of complex rhythm changes. Side B goes experimental and avante-garde.

All the great players are on this album:

1. James Spaulding – Alto Saxophone and FLute.

2. Herbie Hancock – Piano and Organ.

3. Ron Carter – Double bass.

4. Freddie Hubbard – Trumpet.

5. Joe Chambers – Drums.

The track chosen is called – Tranquility – a ballad which features trumpet of Freddie Hubbard, then Hutcherson, then a great solo from Herbie Hancock on piano.

This is a very thoughtful composition – gentle but very melodic.

My favourite from the album.

And great to have playing in the background while one thinks out things.

Bobby Hutcherson evolved into post bop later in his career but didn’t get better than this.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

Thankyou Bill for that. If makes a nice change from reading Richard Murphy’s twaddle on Green Bonds and it also reinforces what George Monbiot writes in the Guardian today. Meanwhile, in Glasgow the World continues in its death throes…

I have been listening to William Basinski’s The Disintegration Loops:

https://www.youtube.com/watch?v=mjnAE5go9dI

Good music to watch UK scenery go by on the train.

I feel great after reading this post by bill. The reason is because I came to similar conclusions and understandings earlier – on this issue of climate change and finances, as well. But then again, most of the things I know about macroeconomics and MMT, I learned from Billy’s blog. So, thank you again to Bill et al. for the confidence and forever kind and untiring knowledge sharing.

Morning,

Oh, it is a lot worse than that Bill. Her total knowledge of the monetary system is zero. The Scottish Greens just rinse and repeat what Craig Dalzell from the common weal says. Richard Murphy has hitched a ride on the bandwagon that allows him to massage his ego.

Lorna and Patrick who lead the Greens are fully signed up members of the EU is a work in progress crowd. That once Scotland are members they will be listened too and convince all the other countries to move to the left and starting implementing progressive policies.

At least they said recently that under the Scottish growth commission framework fighting climate change would be impossible. Years after we told them it would destroy the Scottish economy.

Of course that’s what they promise but as soon as they get a little bit of power they fall right into the framing and narrative that is expected of them. As explained in this article.

Oh dear Scottish Greens, so soon?

http://robinmcalpine.org/oh-dear-scottish-greens-so-soon/

Just a little taste of what is to come at The heart of Europe.

The SNP think bonds not just green bonds are needed for revenue – to find the funds. John Swinney announced this to the nation along with his ignorance on what QE is. As the SNP embrace the corporation’s on every issue on a daily basis.

I can see why they want to hand the keys over to Brussels. They are useless Bill with one policy failure after the other for years now. Just think what they could have achieved the length of time They have been in power in Scotland. If they knew what they were doing and actually planned for independence properly.

Voters are sleepwalking into a bear trap cheered on by Richard Murphy. Because of our PR voting system a trap they will never escape from. Here’s the results.

They have increased the number of Conservative seats in Scotland from 1 to 31 which is 21.9% of the Constituency votes.

Roughly 35% voted leave in the EU referendum. Some Tories voted to remain.

So you can see what’s going to happen when Scotland sleep walks into the bear trap. When the Tories are the only party who said we told you so. What that 21.9% increases to is not clear but was is certain is it is going to increase in a big way. The only party that will represent the 35% who voted to leave the EU will be the Tories.

Nobody even talks about it. Never mind the dangers MMT’rs point out regarding EU membership but the other danger that the Tories will win a Scottish election.

From 1 Tory seat in Scotland to winning an election. That’s what happens when you are stupid enough to listen to Richard Murphy and his merry band of liberals. Who talk like the left when they want your vote but act like the right when in power.

” structural reforms” two words Scottish voters have never had to bother with before. Just wait until they find out exactly what they mean. When the order is passed down from Brussels. Will Richard be there front and centre explaining it to them ?

You can make up your own mind on that one.

How is it possible that the Scottish Greens can say that under the Scottish growth commission framework fighting climate change would be impossible.

Yet, still put their full weight behind being at the Heart of Europe in normal times.

Why is it they can’t connect the dots like the rest of us ? See the growth commission was a copy and paste job of an EU convergence program?

It’s because they believe they can bend the will of the other members of Europe. After 30 years of trying. They will suddenly convince them to change more than the sum total of banning smoking in pubs.

It is delusional !

1.They don’t understand the geopolitical and foreign policy framework within the heart of Europe. Left wing politics will not be tolerated.

2. They can’t even change Scotland after trying to do so for decades. Never mind getting all the countries in Europe to bend to their will.

That’s something they’ll never change. If they try they will be Corbynised. Hung drawn and quartered in the town square in full view of the public who will throw rotten fruit and vegetables at them.

The German Greens will teach them how to pretend to fight neoliberalism and globalism and how to make plenty of money out of it at the same time. Fill their pockets via ” fake resistance” .

The owners and Doners of both the Democrats and Republicans have said clearly they want infrastructure privatised in a way that will generate profits for the new owners, along with interest for the bondholders and the banks that fund it; and also, management fees. Most of all, the privatised enterprises should generate capital gains for the stockholders as they jack up prices for these public services.

The Democratic Party, like the Republican, answers to the owners and donors. It is doing exactly what it’s been told to do, abandoning all its progressive promises (it never had any principles) in the false name of compromise and bipartisanship.

And this is exactly why Donald Trump could be reelected in 2024.

Not that the corporate-owned Democrats care, mind you. Things are actually easier for them with Trump in office. They can raise more money off their fake “resistance” to Trump, and they can wash their hands of tax cuts for the rich and more and more corporate-friendly deals, blaming them on Trump when of course the Democrat donors too support all these things….

Government spending is the devil – please walk this way into my office while I offer you a loan instead.

“But the embrace of the ‘green bonds’ narrative also reflects the ignorance about the capacities of our governments, which goes to the heart of the core Modern Monetary Theory (MMT) agenda.” YES! And that heart or core is the concept and reality of fiat money. Period. Once we get that point across, the rest of MMT, at least in broad outline, follows as a matter of course. This is where I have learned to start in explaining MMT to friends and acquaintances, with the nature of modern money, inexhaustible like points on a scoreboard, inflation-constrained only by available resources. If I can get that point across, I’ve made a convert. Being a liberal Protestant clergyman, I’m reminded of the similar heart or core of Christian conversion–not some dogma about who Jesus was or how he sacrificed himself for us, but rather the resplendent vision of the Kingdom of God, embodied in a society or community structured according to the Golden Rule shared by all the great religions of the world. Edward Bellamy nailed this in the late 1800’s, writing two books (“Looking Backward” and “Equality,” both free on the net) with stunningly intertwined economic and religious impact. What a loss for all of us, especially MMTers, that he has been neglected or forgotten.

The best of it is Bill…..

The strategy of using Brexit like a bottle of poison and swear allegiance to the Heart Of Europe. To try and move the polls further in the favour of independence failed. It was always going to fail and should never have been welded onto the back of Independence in the first place. ” Heart of Europe” was always going to be the biggest mistake since ” keep the pound”. I tried to warn them but they wouldn’t listen.

Even having Boris in number 10 the polls haven’t moved. All they did was ramp up the number of Tory seats in Scotland. When they sleep walk into the single market and customs union and the four prisons. They have to get a majority under a PR system if they change their minds to get out. Good luck with that the prison door is locked and the keys will have been thrown away.

When that’s what is on offer. The wise choice is to stay within the UK and try to get MMT lens and the Job guarentee implemented in London. Rather than try and convince a bunch of other countries who have their own geopolitical and foreign policy agendas. That are completely different to Scotland’s.

Last year around Christmas Larry Summers did his best effort to become the Grinch by opposing additional government assistance on the grounds it was bound to be inflationary. And today, 11 months later, the lead headline in the New York Times (online version) is that we got a lot of inflation going on. Gas prices are up. Somewhat mysterious ‘supply chain’ issues abound. People don’t seem to want to work in really crummy jobs for really crappy wages anymore. Someone screwed up about demand for computer chips and stopped making them or something. And Americans just can’t seem to make new cars let alone used cars anymore. Never understood how you make used cars- but whatever.

So Bill- am I going to have to apologize to the grinchy Larry Summers for saying he was wrong in a very insulting way? I really do not want to do that.

Yes, we do have to keep financial markets away from climate crisis solutions. I agree with that.

But the next part is where I disagree with Bill. We have to tax the rich harshly to reduce their wealth and thus their power. Their financial capital gives them power. They buy politicians and governments, capture legislation and regulation and use resources to do things which damage the climate, environments and people. The political economy picture is bigger than just how to fund governments;which governments can do themselves of course by printing fiat currency.

If the entire system is permitted to continue whereby the money floods up to rich people and they hide it in tax havens and control everything with it, then we will never solve our problems. The rich have to be taxed and wealth-taxed right out of existence (as rich). Letting the rich persist lets the current power system persist. Such an approach will fail. They have to be de-wealthed as that is the only way they will be de-powered.

Update on my last comment. Bill has highlighted reducing the wealth of the rich, in some of his posts he links to, for the purposes of reducing wealth and power inequalities. Yes, indeed! That is important, equally important. Without both planks, giving to the poor/working poor and reducing the insanely wealthy, the necessary changes to generate equality and sustainability cannot be achieved.

Thanks Bill – great post.

What are your (and other readers’) views on cap and trade type systems? I can see how those would be a useful way of setting an upper limit of carbon emissions which firms can then trade among themselves in order to pollute more than they are allowed, while still keeping emissions within a regulated maximum. That seems like an efficient way for ‘markets’ to use their allotted greenhouse emissions in a sustainable way. Governments can then buy the credits and ‘retire’ them from the scheme to reduce the available credits in circulation when emissions need to be further reduced.

Derek Henry – 100%

Unlike some, who felt really good after reading Bill’s post, I felt awful. This was because Bill put in black and white what i knew to be true — I had even watched some of it in real time, which didn’t make me feel very well either. Some of the activists outside, who claim that Cop26 is nothing other than greenwashing are largely right, though, as Bill says, it is even worse than that. The whole thing has been sickening.

One message that one could take away from all this is contained in Sinclair Lewis’s It Can’t Happen Here published in 1935. Under propitious circumstances, of course, deep down, some know it can. Naturally, it needn’t. But what would stop it? Johnson? I hardly think so.

Right on. The sooner we can ditch this ridiculous notion that money grows on rich people, the better.

I get your post but the top 1% of businesses and people have created the majority of the climate impact. If the bottom 99% went completely austere the climate would have zero impact because the top 1% controls the capital and spending. So I understand your concerns, money can’t solve everything. But in the case of the 1% maybe not spending as much or using private inefficient modes of transportation and expensive housing might be in order.

Cap-and-Trade looks good in simple theory, and could be effective if everything worked exactly right. It has this vulnerability: someone well-connected financially could borrow a huge amount of money, buy a huge proportion of the cap, and waste it. That would leave the rest of the economy with a vital need to use some of the carbon cap to do necessary things — but none of the cap available. Our villains could even put a cherry on top by defaulting on their debt.

Money is available on credit, but survivable carbon use is absolute. You can’t treat the two as equivalent.

I’m still staggered that after the GFC when the financiers were helped out of their gambling bankruptcy by limitless government largesse, the ‘government needs to borrow from private financiers’ narrative has still been able to be pushed, not only by the mainstream, but by the likes of Marxist Prof Woolf, and received without blinking. Now we’ve gone through a similar bailout of the private sector through covid, and still no blinking. These people are serious, and dangerous gamblers.

Re: Protecting the Earth – not the wealth of financial tycoons – at the heart of world’s unprecedented climate commitments, David Olive, Nov. 11, 2021

https://www.thestar.com/business/opinion/2021/11/11/protecting-the-earth-not-the-wealth-of-financial-tycoons-at-the-heart-of-worlds-unprecedented-climate-commitments.html?rf

While our schools, hospitals and roads are usually built by contract with private enterprise, we generally want such infrastructure to be owned and controlled by government to serve public purpose rather than to maximize benefits for private monopolies.

The same can be said for the new energy and transportation systems required to fight climate change. If left to its own devices, the global financial alliance will prioritize profit and speculation as it always has, regardless of destructive environmental and social consequences .

The claim that government is “cash-strapped” and must step aside is the revealing narrative lie. When private sector excess leads to great crashes, to whom do capitalist titans go begging for bailouts? They know that ultimate money comes from monetarily sovereign governments that control central banks.

Footnotes:

1. Michael Hudson is Professor of Economics at the University of Missouri, Kansas City and author The Bubble and Beyond (2012)

counterpunch.org

“The objective of the classical economists was to bring prices in line with value to prevent a free ride, to prevent monopolies, to prevent an absentee landlord class so as to free society from the legacy of feudalism …..

***

To prevent such price gouging…., Europeans kept the most important natural monopolies in the public domain: the post office, the BBC and other state broadcasting companies, roads and basic transportation, as well as early national airlines. European governments prevented monopoly rent by providing basic infrastructure services at cost, or even at subsidized prices or freely in the case of roads. The guiding idea is for public infrastructure – which you should think of as a factor of production along with labor and capital – was to lower the cost of living and doing business.

***

If you look at the Forbes 100 or 500 lists of each nation’s richest people, most made their fortunes through insider dealing to obtain land, mineral rights or monopolies.”

2. The financial markets should be kept away from the climate crisis solution

“The narrative that has emerged – that the financial CEOs with “trillions in assets” (all at COP26 because they could smell lucre) are a key to solving the climate challenge – is as ridiculous as progressives saying we need to tax them to fund schools and hospitals.

Both narratives reflect the dominance of mainstream macroeconomics which has convinced us that currency-issuing governments are like big households and can ‘run out of money’.

It is time we learned.”

3. Alan Greenspan, former U.S. Federal Reserve Chairman

federalreserve

“…… monetary authorities-the central bank and the finance ministry-can issue unlimited claims denominated in their own currencies …….a government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims without limit.”