I have received several E-mails over the last few weeks that suggest that the economics…

The gloom gets gloomier – national accounts!

The long-awaited National Account data was released today by the ABS and shows that the Australian economy is now sliding along the zero line. The headline result was that the measure of overall economic activity, Gross Domestic Product (GDP) decreased by 0.5 per cent in the December quarter. This is the first negative result since December 2000. So one more negative quarter and we will all cry recession. For the 12 months December 2008, the economy grew by the very modest 0.3 per cent but this was driven by agriculture. Non-farm GDP did not grow at all over that same period. What are the signs for employment and what is the government doing? Here are some of my thoughts …

Of interest to me was the sharp rise in the household saving ratio which measures how much households are saving out of net disposable income. It shot up to 8.5 per cent in the December quarter 2008 which was the highest it has been since September 1990. Be warned: just after September 1990 the economy fell apart.

This return to saving was always going to happen as households have finally realised they cannot keep increasing their already bulging debt levels indefinitely. The binge years, where we permitted the Federal government to bail out of generating jobs (and economic activity) and turned a blind eye to their debilitating budget surpluses because we were consuming like there was no tomorrow, are now well and truly over.

You can also see that households have started to make some hard decisions. First, household final consumption expenditure crawled up by 0.1 per cent in seasonally adjusted terms in the final quarter of 2008 (see the accompanying table below). The two main increases in consumption were outlays on rents and dwellings (up 0.6 per cent) and food (up 0.6 per cent).

Clearly, discretionary choices were being made with spending on hotels, cafes and restaurants down 1 per cent; clothing and footwear down 1.3 per cent, grog down 2.4 per cent and vehicle purchases down 1.2 per cent. The buckles are tightening which signals a large role for public spending if we are to prevent further gloom in our economic outcomes.

Firms are also making adjustments. There was a major decline in inventories which I am interpreting as firms seeking to meet orders with existing stocks rather than maintaining production levels (they clearly are cutting production).

The labour market signals in today’s data are poor. Hours worked increased by a miserly 0.4 per cent in the last quarter of 2008 which means that any employment (actual jobs) generated have merely been sharing the hours around. In the so-called market sector (nearly the private sector) there was no growth in hours worked despite a continued decline in the real unit cost of labour. So the increased profit share has not been conducive to increased employment. So much for the argument we need lower labour costs to solve the unemployment problem.

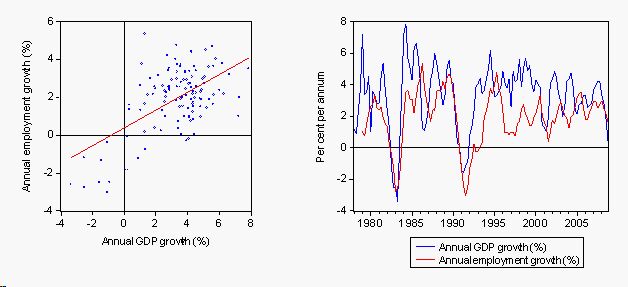

The destiny of employment growth despite what the neo-liberal economists tell you about excessive wage levels is firmly driven by GDP growth. I created the following graph to emphasise this.

The left hand scatter plot is simply annual employment growth against annual GDP growth (the red line is a simple OLS regression). The correspondence between the two is very close. The time series plot in the RHS panel shows that the turning points and dynamics are very similar. You can see the two major cyclical events in the last thirty years: (a) the 1982 recession; and (b) the 1991 recession. When GDP growth plummets, so does employment growth. Cutting wages in this situation will only worsen the situation because wages comprise a significant component of household incomes which drive consumption spending.

So how much has the public sector contributed to growth in the period since December 2007 (the time that the current Federal government has held the fiscal responsibility)? The national accounts data breaks down the total expenditure into components. I computed some summary measures of the growth in consumption and investment spending from today’s data. In the investment (that is, gross fixed capital formation) data I have excluded public corporations which have a modest upward trend over the last 12 months. This exclusion doesn’t alter the basic result.

So who is lifting the (spending) weight?

| Expenditure component | Sep 08-Dec 08 | Dec 07-Dec 08 |

| Household Final consumption expenditure | 0.09 | 0.57 |

| Federal government final consumption expenditure | -0.84 | 0.33 |

| State and local government final consumption expenditure | 0.58 | 3.67 |

| Total government final consumption expenditure | 0.02 | 2.34 |

| Total final consumption expenditure | 0.07 | 0.99 |

| Private Investment | 0.35 | 6.70 |

| Federal government investment | -18.82 | -4.78 |

| State and local government investment | 1.00 | 4.44 |

| Total government investment | -3.58 | 2.50 |

| Total investment | 0.05 | 6.71 |

In terms of consumption outlays, as noted above the private households have cut back significantly over the last three months of 2008. But the public sector was even more moderate in their spending growth (0.02 per cent overall) although for the 12 months to December 2008, the growth was 2.34 per cent. The timing profile doesn’t seem right to me. The urgency has become stronger in more recent months and this is a time for accelerating public consumption spending. In terms of the split between the federal and state/local governments, the stunning fact is that the Federal government has cut back on consumption spending in the last three months of 2008. The 2.34 per cent over the 12 month period is largely due to the strong growth in State/Local government spending.

Its gets worse when we look at growth in investment spending. This is the area where big public infrastructure projects are pursued and long-lasting benefits bestowed on the community. Total investment growth was very flat over the last three months of 2008 (0.05 per cent). But any positive growth was due to private sector and State/Local government investment. Overall the public sector investment contracted by 3.6 per cent over the last three months in 2008 with the Federal government seemingly bailing completely with an 18.8 per cent contraction. Over the period of tenure held by the current Federal government, federal investment has declined by 4.8 per cent.

What gives? At a time when we have urgently needed major projects to start redressing the massive degeneration of our public goods that the previous regime left us with, the new Federal government reduced its investment spending. Where is the commitment to creating major job creation sites in the public sector? Don’t answer that!

If Australia is to avoid a protracted recession then the Federal government will have to start spending much larger amounts than they have been spending or have promised to spend. Given we have known about the global economic meltdown since 2007, why have they taken so long to push the budget into deficit and create job opportunities for those that are losing them or who were deprived of them by the previous government?

World stimulus patterns:

On a related matter, I read a very interesting survey today done by academics at Boston University (see Gallagher, Kevin P., et al, Survey of Stimulus and IMF Rescue Plans During the Global Financial Crisis: I, February, 2009) which provides the following insights. The survey is an on-going piece of work as the authors accumulate more data from different countries. Gallagher writes that despite the call from the G-20 in November 2008

… for a coordinated set of national responses to the global financial crisis and … [a pledge] … that such responses would not be pro-cyclical in nature

the reality is something different, particularly in regard to IMF rescue plans. The survey found that (paraphrasing or quoting their own summary):

- The sum of the known stimulus packages represents a tiny percent of global GDP;

- These packages have mostly occurred in the developed world or in larger developing countries.

- Every stimulus package identified is clearly expansionary, yet IMF packages are starkly contractionary and have a high degree of conditionality.

The IMF stepping up to the plate as usual! In the global restructuring that will be required to solve the disaster that is before us, major reforms within the IMF will be required. Totally scrapping it is not such a stupid idea. I will write more about the IMF and its rescue plans in due course. I am doing some work in a developing country at present and when I am permitted to talk about it – I will!

This Post Has 0 Comments