It's Wednesday, and as usual I scout around various issues that I have been thinking…

New German finance minister thinks (27 per cent slump in GDP) Greece is Germany’s new role model for reform

It’s Wednesday so not much today. I offer some comments on the latest data release from Germany (not good) and the probability that the new German finance minister will be anything other than a dangerous dud. An announcement about the edX MMTed course (coming back). And then Blind Willie Johnson serving up Great Depression angst.

German economy is tanking

On Monday (December 6, 2021), the German statistical office (deStatis) released the latest industrial outcomes data – Manufacturing in October 2021: new orders down 6.9% on the previous month – where the headline tells the story.

Foreign orders declined by 13.1 per cent.

I suppose the Remainers in Britain will blame that on Brexit too!

Internal Eurozone orders declined and non-Eurozone orders fell by a staggering 18.1 per cent in the one month.

This will challenge the new coalition government as the nation descends further into the pandemic.

Will the new government be up to it?

Things are looking pretty grim already – as the new ministers start to make statements outlining their approach.

Particularly worrying is the Finance minister.

I saw a news story (December 7, 2021) – Incoming German finance minister sees model in Greek reform measures – which should disabuse anyone of the idea that the European Union is about to become all deficit friendly and continue to relax the Stability and Growth Pact (SGP) and related rules for much longer.

Apparently, the new German finance minister who is the leader of the liberal Free Democrats (FDP) one of the coalition members that makes the new German government look rather farcical (power for power’s sake rather than ideological consistency) has declared that his role model is the experience of Greece post GFC.

He claimed that:

Germany must aspire to become as ambitious as Greece’s domestic policy … The future federal government will stick to the (path) of the last few years and will therefore stand for stability …

In the last few years, [the Greek government] has succeeded in putting the Greek economy on a new course for success with very impressive reform measures

End of story really.

Let me remind you.

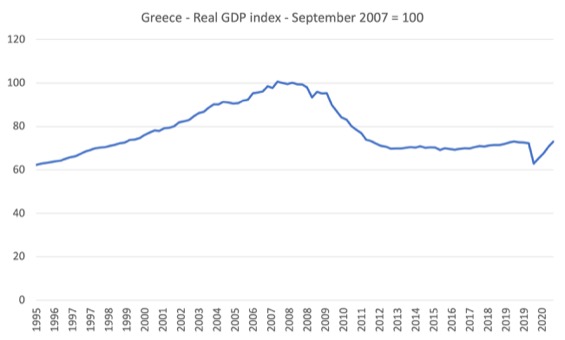

The next graph is real GDP indexed to 100 in the September-quarter 2007 (the peak before the GFC).

14 years later, the index sits at 73 points.

That means the Greek economy is 27 percent smaller than it was just before the GFC.

No other country has endured that much decline and hardship.

All of it was deliberately engineered by malevolent officials on high pay in Brussels, Washington and Frankfurt.

None of the policies that were introduced (forced on the people) by the Troika is worthy of being part of any civilised blueprint for reform for any country.

Greek unemployment is still above 13 per cent and youth unemployment is at 33.2 per cent.

It is a failed state.

Doesn’t bode well for Germany or the rest of Europe really.

Twitter madness

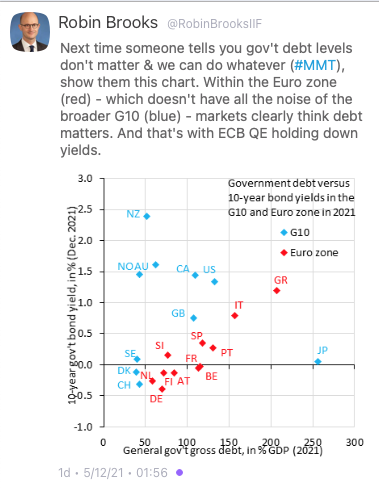

Talking about Europe, I saw this Tweet the other day from the Chief Economist for the IFF (based in Washington) who used to work for Goldman Sachs and the IMF.

He seems to think he is an expert or something.

He thought the “MMT crowd” would be snookered by this graph.

Basic MMT – the 19 Member States do not have their own currency and are always subject to credit risk when they issue debt.

Markets can only influence bond yields if the government (via their central bank) allows them to.

Stupid graph.

Stupid campaign to discredit our work.

MMTed and edX MMT course to return early February 2022

We are now able to offer the edX course – Modern Monetary Theory: Economics for the 21st Century – again in early 2022.

A tentative date for the course commencement will be February 9, 2022.

Many people have asked for the course to return who didn’t get to finish it or even start it last time.

I will post more details of enrolments etc in due course, once we have finalised the schedule.

On other – MMTed news, we are nearly finished with the production of a short course on Monetary Sovereignty which we had hoped to offer before the end of the year but it will now come out early 2022.

It will be a week-long course only (compared to the 4-week edX course) and we might be able to offer it in March to follow up on the edX course.

More details when I know them.

We continue to thank very much those who have provided financial support for MMTed. Your contributions are really appreciated.

If anyone else wants to help out so that we can get material out more quickly please send me an E-mail.

Pressure Drop returns

After months of lockdowns and closed venues, the Melbourne music scene is limping back into action at present.

For how long? Who can tell with omicron entering the picture.

But while the sun is shining, my band – Pressure Drop – is playing live this Saturday night (December 11, 2021) for the first time in months.

We will be returning to one of our usual haunts – Bar Next Door, 211A High St, Northcote VIC 3070.

The music will start around 20:00.

If you like reggae and dub with a revolutionary air then we will be happy to see you.

Entry to the bar is free.

I can talk MMT during the breaks although through my mask!

It will also be the first gig after the death of our usual drummer Matt Berg and we will be paying respect to his memory.

Music – Blind Willie Johnson

This is what I have been listening to while working this morning.

The song – The Soul of a Man – was recorded by – Blind Willie Johnson – on April 20, 1930 in Atlanta, Georgia and was released on a single by Columbia records.

I have it on an album – Texas Country Music Vol. 2 1927-1937 – which was released in 1968 and I picked it up secondhand at the famous – Batman Records – in Melbourne sometime in the 1970s.

Batman Records closed in 2003 to much sadness.

The album has a classic assortment of folk blues with lots of great tracks.

This song was recorded as the Great Depression was wrecking lives in the US – certainly among the black folk in rural areas.

It was the penultimate single Blind Willie Johnson recorded before his early death.

The backing vocals is supplied by his then partner (wife) – Willie B. Harris.

Here is an interesting contemporary bio about Blind Willie Johnson – The Soul of a Man (December 2010).

Life was definitely not easy for him but he produced some of the best folk blues to date.

His slide guitar playing ranks among the best.

You can hear a good compilation of all his works – which at the time were more popular than the releases Bessie Smith put out – on this album – The Complete Blind Willie Johnson.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

Well a slow down is inevitable when the money dries up. The wealthy have hoards saved and are not investing or spending in proportion to their wealth and pay very low tax rates. Instead of spending to increase demand on that curve there is a push from Reserve banks to continue it’s deference to the supply curve. This would have worked when the gap between the wealth in developed countries and the lower, working, and middle classes were not as pronounced. But given that the stimulus was vacuumed up by the .01% and effectively destroyed through savings, and given that governments have refused to tax this wealth in essence it creates a income destruction loop requiring ever more amounts of cash into the system.

It may be time for update to the Breton woods Agreements!

And what about the new germany stimulus package?