It's Wednesday, and as usual I scout around various issues that I have been thinking…

Workers in UK enduring real wage cuts except the unproductive bankers

It is Wednesday and I have three live presentations to make throughout the day. So we will be brief today. The ABS released the latest Wage Price Index today which shows that annual wages growth in Australia was 2.3 per cent, compared to the official inflation rate of 3.5 per cent. I will analyse that data in detail tomorrow, given I am short of time today. But there was also disturbing data coming out of the UK last week on the wages front, which reflects a major imbalance in priorities and also tells me that there is no wage demands driving the current inflationary episode.

Wages data reveals appalling lack of priorities

The situation in Australia is bad enough with workers being forced to take a real wage cut due to lack of nominal wages growth.

The public sector continued to drag wages growth with their enforced wage cap policies at federal and state levels. Workers in the utilities could only gain a annual wage rise of 1.3 per cent.

Further, the Education sector only recorded a rise of 0.3 per cent on a quarterly basis.

So with energy prices soaring due to the combination of uncompetitive cartel behaviour and now the Russian situation, workers will struggle to maintain real living standards over the next 12 months at least.

The situation is worse in the UK.

The Office of National Statistics released their latest wages data on February 15, 2022 – Average weekly earnings in Great Britain: February 2022.

The ONS note that:

Average weekly earnings measures money paid by employers to employees in Great Britain before tax and other deductions from pay. The estimates are not just a measure of pay rises because they also reflect, for example, changes in the overall structure of the workforce. More high-paid jobs in the economy would have an upward effect on the earnings growth rate

Growth in average total pay (including bonuses) was 4.3% and growth in regular pay (excluding bonuses) was 3.7% among employees in October to December 2021.

The ONS also note that:

In real terms (adjusted for inflation), in October to December 2021, total and regular pay fell on the year at negative 0.1% for total pay and negative 0.8% for regular pay.

In terms of the monthly movements, real average weekly earnings “fell on the year in both November 2021 and December 2021, at negative 1.0% and negative 1.2% respectively.”

So the overall pay situation for British workers is not looking good.

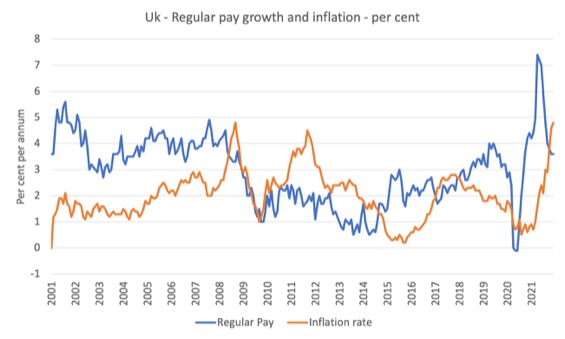

The following graph shows the annual growth in nominal regular pay and the inflation rate. When the inflation rate is above the wage rate growth it means the real wage is falling.

But when one digs a bit deeper, there are some very disturbing aspects of this data release.

First, average pay for the private sector was 4.6 per cent in the 12 months to December 2021, whereas the public sector only recorded 2.6 per cent.

Second, if we examine the industy growth patterns, we find that rather disturbing outcomes lying under the aggregate outcome.

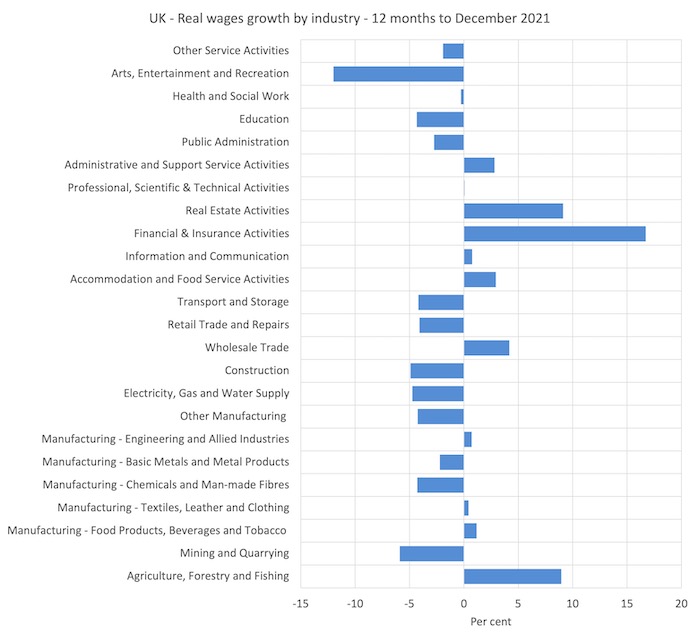

The following graph shows the annual growth in real wages by industry division to December 2021.

The FIRE sector activities have experienced very strong real wages growth despite a lot of that work being unproductive.

The Financial and Insurance Service workers gain nominal wage rises of 21.5 per cent over the 12 months to December 2021, of which around 30 per cent was in the form of bonuses to the City of London bankers.

The contrast is – especially during a pandemic – is that workers in health and social work – saw their real pay cut.

A similar story for those working in Education, Arts, Entertainment and Recreation, among other industries where real wage cuts were realised.

Regular readers know that I advocated massive wage increases for cleaners, health professionals (excluding doctors), and other workers that actually make our lives safer and more rewarding.

I would cut wages in banking and the other FIRE occupations – quite significantly.

The data tells me a few things:

1. The priorities are all wrong.

2. The call for wage moderation by the Bank of England governor was obviously only targetted to his own sector (joke), I wrote about that matter in this blog post – Bank of England Governor just didn’t go far enough (February 8, 2022).

3. There are no wage pressures mounting that might turn this transitory inflation episode into something more structural and more difficult to deal with.

Our edX MOOC – Modern Monetary Theory: Economics for the 21st Century continues

Week 3 starts today in our 4-week MMTed/University of Newcastle edX MOOC.

The course is free and will run for 4-weeks with new material each Wednesday for the duration.

It is not to late to enrol and became part of the already large class. You need to devote around 2 hours a week so you can still catch up if you wish.

Learn about MMT properly with lots of videos, discussion, and more.

Today, we have the first of two live events as part of the course, which is an additional feature for this year.

There will be two one-hour sessions today for students.

So even if you completed the course last year, these live events might be a reason for enrolling again.

Further Details:

https://edx.org/course/modern-monetary-theory-economics-for-the-21st-century

If you want to do the course, get in early as then you avoid having to catch up.

All are welcome.

Music – Human Condition

This is what I have been listening to while working this morning.

I dug this out this morning after having the bass line come into my head while I was out running early before work.

I couldn’t shake it, so I thought it must be a sign.

This is from the great – Canned Heat – from their ‘The Very Best of Canned Heat’ album, which was released in 2005.

The song – Human Condition – was recorded July 30, 1970 and was originally released on the 1994 Uncanned collection (EMI).

It was written by – Alan “Blind Owl” Wilson – who sadly was a mentally tortured genius who died from an accidental drug dose on September 3, 1970 at the age of 27.

Within the space of a few weeks we lost Alan Wilson, Jimi Hendrix and then Janis Joplin – the musical giants of their time.

This song sees Alan Wilson reflecting on his interaction with a psychiatrist after one of his suicide attempts.

The line-up at that time was:

1. Bob ‘The Bear’ Hite – vocals/harmonica.

2. Al ‘Bline Owl’ Wilson – vocals, guitar, harmonica.

3. Henry ‘Sunflower’ Vestine – guitar.

4. Antonio de la Barreda – bass.

5. Adolfo ‘Fito’ De La Parra – drums.

It gets stuck in your head if you listen to it.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

In the first graph is the blue line the inflation rate?

Blue line looks like pay

Hi Bill

Thanks for another introduction to a musician. I recommend Suzanne Santo, she is a great listen.

When you get time I would love to read a piece on your thoughts about Russian sanctions. Some pundits have suggested that Putin could price oil in Roubles, making some of the sanctions redundant.

Listened to Joni Mitchell’s “Hejira” in a trip to Margate. Incredible album.

British Gas got in touch via email reassuring me that they will not be raising energy prices up to the new Ofgem cap, but they will still raise them by about £600 annually or 50 per cent higher than they were before.

Might jump onto the course again for a refresher and complete the four weeks in two.

Sounds about right… but it’s okay our great English Government knows how to fix the problem. Anyone who gets less than a Grade 5 at GCSE won’t be eligible for a student loan… so instead of going off to University, they will instead have to do all those poorly paid jobs in health and social care.

(Shall we stop pretending that the Westminster Government cares about Scotland or Wales)

No, I think it is the brown line.

This is because in 2020 the blue line falls when prices of oil were falling and it ends with the brown line (inflation?) above the blue line (nominal wage growth) at a time when Bill said workers are losing real wages.

@Bill. Please label the lines on the graph.