Today (February 21, 2023), the Australian Bureau of Statistics released the latest - Wage Price…

Australia – workers endure on-going real wage cuts as corporate profits soar

Yesterday (February 23, 2022), the ABS released the latest – Wage Price Index, Australia – for the December-quarter 2021. The WPI data shows that nominal wages growth remained modest to say the least. The data shows that the significant cuts to workers’ purchasing power continue, and, in my view, constitute a national emergency. While the conservatives are railing about inflation now and looking to target workers’ wages (further cuts), the evidence is that the wages side is not driving any inflationary pressures – the opposite is the case. The business sector, as a whole, thinks it is clever to always oppose wages growth and the banks love that because they can foist more debt onto households to maintain their consumption expenditure. But the reality is clear – there can be no sustained recovery for the economy post Covid without significant increases in the current rate of wages growth.

The Wage Price Index:

… measures changes in the price of labour, unaffected by compositional shifts in the labour force, hours worked or employee characteristics

Thus, it is a cleaner measure of wage movements than say average weekly earnings which can be influenced by compositional shifts.

The summary results (seasonally adjusted) for the December-quarter 2021 were:

| Measure | Quarterly (per cent) | Annual (per cent) |

| Private hourly wages | 0.7 | 2.3 |

| Public hourly wages | 0.7 | 2.1 |

| Total hourly wages | 0.7 | 2.3 |

| Basic CPI measure | 1.3 | 3.5 |

| Weighted median inflation | 0.9 | 2.7 |

| Trimmed mean inflation | 1.0 | 2.6 |

On price inflation measures, please read my blog post – Inflation benign in Australia with plenty of scope for fiscal expansion (April 22, 2015) – for more discussion on the various measures of inflation that the RBA uses – CPI, weighted median and the trimmed mean The latter two aim to strip volatility out of the raw CPI series and give a better measure of underlying inflation.

Real wage trends in Australia

The summary data in the table above confirm that the plight of wage earners continues in Australia.

Real wages fell again in the December-quarter in both the private and public sectors.

It is clear that the public sector wage caps (state and federal) have created an environment where private sector wage rises are being constrained, independently of the state of the private labour market.

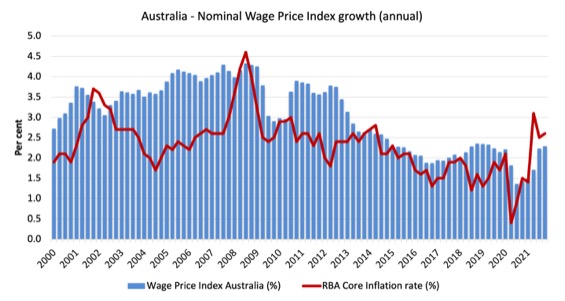

The first graph shows the overall annual growth in the Wage Price Index (public and private) since the December-quarter 2000 (the series was first published in the December-quarter 1997) and the RBA’s core annual inflation rate (red line).

The blue bar area above the red line indicate real wages growth and below the opposite.

In the December-quarter, while nominal wages growth ticked up slightly (2.23 to 2.3 per cent), the inflation rate remained well above the wages growth, which meant that real purchasing power continued to fall (for three successive quarters).

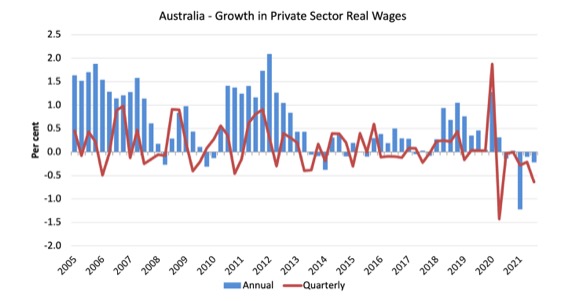

The next graph shows the growth in private sector real wages since the December-quarter 2005 to the December-quarter 2021. The core inflation rate is used to deflate the nominal wages growth.

The blue bars are the annual rate of change, while the red line is the quarterly rate of change.

The fluctuation between the June- and December-quarters 2020 is an outlier created by the temporary government decision to offer free child care for the December-quarter which was rescinded in the December-quarter.

Overall, the record since 2013 has been appalling.

Throughout 2017 and into 2018, real wages growth was negative. But then there were several quarters of modest real wages growth. The trend, however, is towards zero real wages growth.

The sharp spike downwards in the June-quarter 2021 is the result of very moderate nominal wages growth combined with a transitory surge in the CPI inflation rate.

The results for the December-quarter 2021 tell us that for most of 2021, real wages have been falling in Australia.

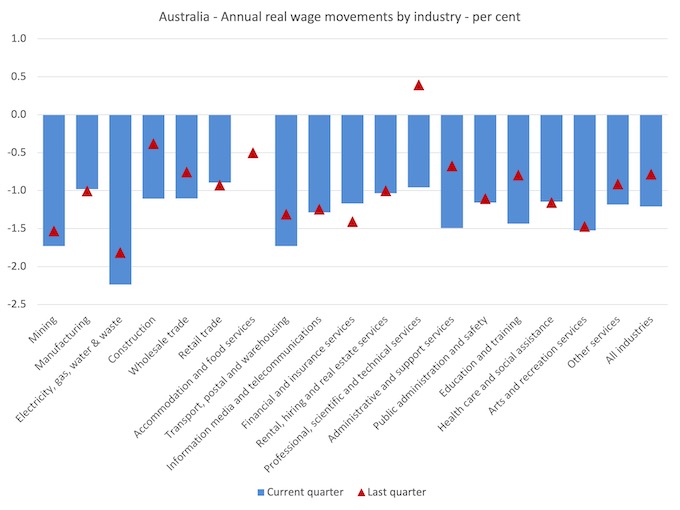

Sectoral Variability

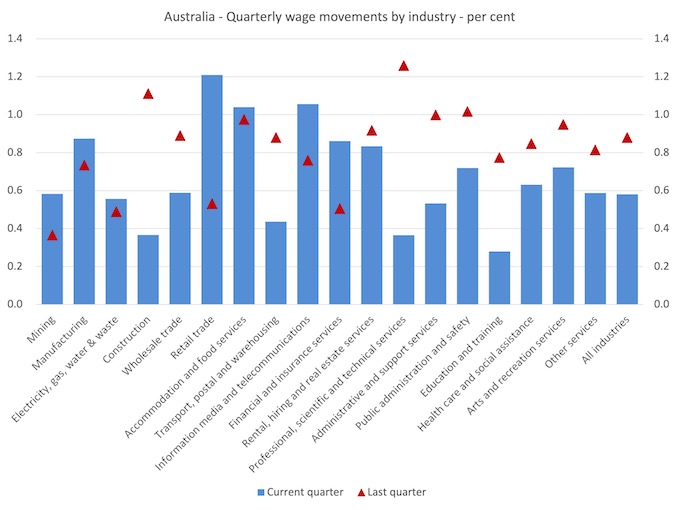

The aggregate data shown above hides quite a significant disparity in quarterly wage movements at the sectoral level, which are depicted in the next graph.

The blue bars are the current quarterly change, while the red triangles are the previous quarterly change.

The ABS also reported that:

- Retail trade recorded the largest quarterly rise of any industry (1.2%), the highest rate for the industry since September quarter 2015.

- Education and training industry recorded the lowest rate of quarterly growth of 0.3% influenced by the expiry of several key enterprise agreements.

- Accommodation and food services industry recorded the highest rate of growth through the year at 3.5%, influenced by the payment of 2020 and 2021 Fair Work Commission annual wage increases in March and December quarters 2021 respectively.

- Electricity, gas, water and waste services industry recorded the lowest through the year wage growth (1.3%) for the second consecutive quarter.

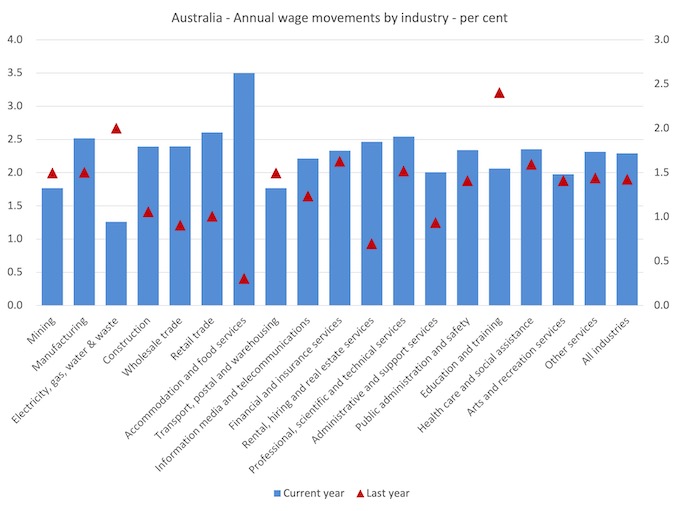

If we consider the situation over the last year, then we can see from the following graph that there is no evidence of a major wages breakout occurring.

While nominal wages growth was mostly positive, albeit modest, the next graph shows the movements in real wages and you can see that there in all but one sector real wages fell again.

The Accommodation and food services recorded no change in real wages.

This on-going cut in the purchasing power of workers is almost unprecedented in our wages history and marks a massive redistribution of income towards profits.

Further, one can hardly say that wages push is causing the inflation spike.

Workers not sharing in productivity growth

The Non-farm GDP per hour data (productivity) is derived from the quarterly National Accounts and available via the RBA Table H2 Labour Costs and Productivity.

The ABS Information Note: Gross Domestic Product Per Hour Worked – says that:

In Australian National Accounts: National Income, Expenditure and Product (cat. no. 5206.0) and Australian System of National Accounts (cat. no. 5204.0) the term ‘GDP per hour worked’ (and similar terminology for the industry statistics) is generally used in preference to ‘labour productivity’ because:

– the term is more self-explanatory; and

– the measure does not attribute change in GDP to specific factors of production.

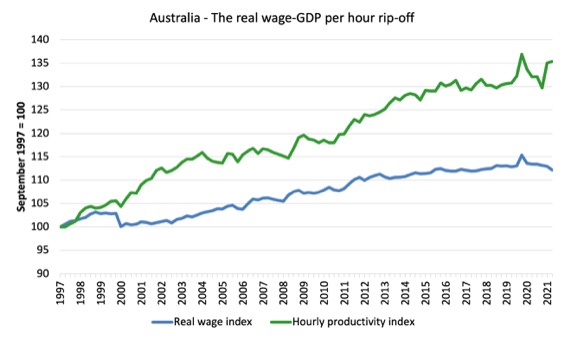

While the decline in real wages means that the rate of growth in nominal wages being outstripped by the inflation rate, another relationship that is important is the relatoionship between movements in real wages and productivity.

Historically (for periods which data is available), rising productivity growth was shared out to workers in the form of improvements in real living standards.

In effect, productivity growth provides the ‘space’ for nominal wages to growth without promoting cost-push inflationary pressures.

There is also an equity construct that is important – if real wages are keeping pace with productivity growth then the share of wages in national income remains constant.

Further, higher rates of spending driven by the real wages growth can underpin new activity and jobs, which absorbs the workers lost to the productivity growth elsewhere in the economy.

Taking a longer view, the following graph shows the total hourly rates of pay in the private sector in real terms (deflated with the CPI) (blue line) from the inception of the Wage Price Index (December-quarter 1997) and the real GDP per hour worked (from the national accounts) (green line) to the December-quarter 2021.

It doesn’t make much difference which deflator is used to adjust the nominal hourly WPI series. Nor does it matter much if we used the national accounts measure of wages.

But, over the time shown, the real hourly wage index has grown by only 12.2 per cent (and falling), while the hourly productivity index has grown by 35.3 per cent (and rising).

So not only has real wages growth turned negative over the last year or so, but the gap between real wages growth and productivity growth continues to widen.

If I started the index in the early 1980s, when the gap between the two really started to open up, the gap would be much greater. Data discontinuities however prevent a concise graph of this type being provided at this stage.

For more analysis of why the gap represents a shift in national income shares and why it matters, please read the blog post – Australia – stagnant wages growth continues (August 17, 2016).

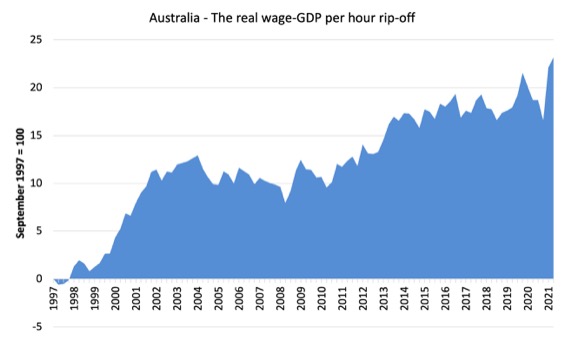

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go?

Answer: Mostly to profits.

The next graph shows the gap between the real wage index and the labour productivity index in points.

It provides an estimate of the cumulative redistribution of income to profits as a result of real wage suppression.

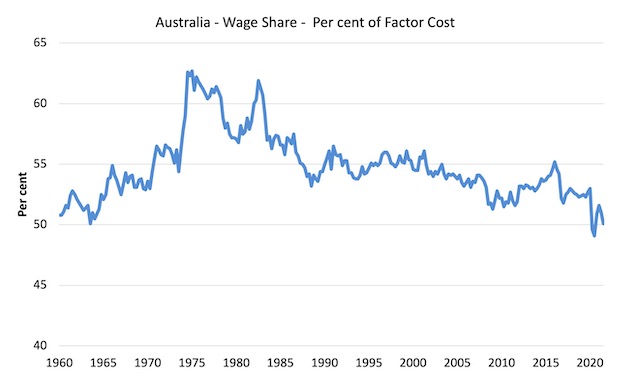

Now, if you think the analysis is skewed because I used GDP per hour worked (a very clean measure from the national accounts), which is not exactly the same measure as labour productivity, then consider the next graph.

It shows the movements in the wage share in GDP (at factor cost) since the December-quarter 1960 to the September-quarter 2021 (latest data).

While the series moves around from quarter to quarter, the trend is obvious.

The only way that the wage share can fall like this, systematically, over time, is if there has been a redistribution of national income away from labour.

I considered these questions in a more detailed way in this blog post series:

1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 1 (November 20, 2019).

2. 1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 2 (November 21, 2019).

And the only way that can occur is if the growth in real wages is lower than the growth in labour productivity.

That has clearly been the case since the late 1980s. In the December-quarter 1991, the wage share was 56.6 per cent and the profit share was 22.2 per cent.

By the December-quarter 2021, the wage share had fallen to 50.1 per cent and the profit share risen to 30.3 per cent.

There has been a massive redistribution of income towards profits has occurred over the last 40 years.

The relationship between real wages and productivity growth also has bearing on the balance sheets of households.

One of the salient features of the neo-liberal era has been the on-going redistribution of national income to profits away from wages. This feature is present in many nations.

The suppression of real wages growth has been a deliberate strategy of business firms, exploiting the entrenched unemployment and rising underemployment over the last two or three decades.

The aspirations of capital have been aided and abetted by a sequence of ‘pro-business’ governments who have introduced harsh industrial relations legislation to reduce the trade unions’ ability to achieve wage gains for their members. The casualisation of the labour market has also contributed to the suppression.

The so-called ‘free trade’ agreements have also contributed to this trend.

I consider the implications of that dynamic in this blog post – The origins of the economic crisis (February 16, 2009).

As you will see, I argue that without fundamental change in the way governments approach wage determination, the world economies will remain prone to crises.

In summary, the substantial redistribution of national income towards capital over the last 30 years has undermined the capacity of households to maintain consumption growth without recourse to debt.

One of the reasons that household debt levels are now at record levels is that real wages have lagged behind productivity growth and households have resorted to increased credit to maintain their consumption levels, a trend exacerbated by the financial deregulation and lax oversight of the financial sector.

Real wages growth and employment

The standard mainstream argument is that unemployment is a result of excessive real wages and moderating real wages should drive stronger employment growth.

As Keynes and many others have shown – wages have two aspects:

First, they add to unit costs, although by how much is moot, given that there is strong evidence that higher wages motivate higher productivity, which offsets the impact of the wage rises on unit costs.

Second, they add to income and consumption expenditure is directly related to the income that workers receive.

So it is not obvious that higher real wages undermine total spending in the economy. Employment growth is a direct function of spending and cutting real wages will only increase employment if you can argue (and show) that it increases spending and reduces the desire to save.

There is no evidence to suggest that would be the case.

I usually publish a cross-plot that consistently shows no relationship between annual growth in real wages and the quarterly change in total employment over a long period.

The graph has issues at present due to Covid-19 outliers, although the conclusion doesn’t change.

There is also strong evidence that both employment growth and real wages growth respond positively to total spending growth and increasing economic activity. That evidence supports the positive relationship between real wages growth and employment growth.

Conclusion

In the December-quarter 2021, Australia’s wage growth remained modest to say the least.

There can be no sustained recovery for the economy post Covid without a significant shift in the way we think about wages growth.

The data shows that the significant cuts to workers’ purchasing power continue, and, in my view, constitute a national emergency.

There can be no sustained acceleration in the inflation rate while wages growth is at these levels.

The business sector, as a whole, thinks it is clever to always oppose wages growth and the banks love that because they can foist more debt onto households to maintain their consumption expenditure.

The problem is that the federal government supports wage suppression because that attracts funding for the conservatives from the corporate lobbies which help them stay in power.

None of this offers workers a better future.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

Interesting that retail trade recorded the largest rises of any industry and the largest rises that sector has experienced for over 6 years – it doesn’t mention if the same factor that raised them in accommodation and food services was a factor.

Retail workers don’t typically have a great deal of bargaining power to demand higher wages. I was thinking that perhaps it might have something to do with large numbers of retail workers being knocked out with Covid and having to be replaced with temporary workers on casual rates but working full-time hours – but if this measure accounts for compositional changes then that would probably be accounted for.

No relationship to the more than half-a-billion worth of underpayments to retail staff by Woolworths that have to be rectified?

https://thenewdaily.com.au/finance/finance-news/2022/02/23/woolworths-underpayments/

I keep hearing that capital keeping the fruits of productivity growth for itself is justified because apparently it now largely derives from automation and AI invested in by the owner.

Too bad robots and computer programmes don’t consume the plethora of goods and services that human workers do, the consumption of which is necessary to keep capitalism going – looks like an ever-increasing problem here. Obviously why some notable captains of industry call for a UBI – so government can subsidise underpayed labour to keep consuming while capital keeps awarding itself the spoils.

“I keep hearing that capital keeping the fruits of productivity growth for itself is justified because apparently it now largely derives from automation and AI invested in by the owner.”

Who created the automation and the AI?

It’s becoming increasingly clear that the problem with business is a lack of real competition. They are not concerned about quantity adjusters stealing their market share. What they are concerned about is when people aren’t borrowing enough money from banks.

In terms of soundbites what we should be saying is : “price rises are always everywhere a lack of effective market competition”.

Business seeks to obtain monopoly and as well as slicing markets and using psychological trickery in their marketing department they use regulatory capture to stop government imposing competition upon them.

In the UK the broadband regulator, Ofcom, allows broadband providers to put up their prices by inflation + 3.5% per year within fixed term contracts. That’s inflation caused by government action – lobbied for by big business.

Off Topic Bill,

This morning you see the real reason the EU was created the way it was.

Leaders of sovereign nation states are gagged and Ursa Von Der Leyen talks for them.

Next step by the neoliberal globalists is to finally get the EU army started.

Any country that respects itself has to get out of this Orwellian nightmare. Leave the EU as quick as it can or be used as cannon fodder for the West who put none of their own at risk as they try and fulfill their geopolitical, foreign policy agenda.

Lord Palpatine and the Syth are evil Bill. Becoming more authoritarian within their own borders every day. Just ask the Canadian truckers how authoritarian these psychopaths have become. Whilst trying to swallow up anybody they can On the world stage.

“The greed that colonialism brought is like an animal who could never quench its own thirst.”

~ Dakota Indians.

The Western media this morning in its full glory. You can now no longer believe a word it says. Absolutely nobody holding these war mongers to account and what they have created. They had the complete and utter audacity to call Trump the war monger. Mentally torture Julian Assange for telling the truth.

The liberal left are destroying the left each and every day with their actions.

Of course that’s the whole point of it. The triangulation of a slow death.

Conservatives and republicans will win by a landslide and then China will be the focus.

If ever there was a time to get a new political party started the UK and the US it is now.

Derek,

“Lord Palpatine and the Syth….”

It seems that these fictions and fantasies are not the only ones swirling in your head.

Derek Henry

The Portuguese so-called socialists (that should be called liberals and some of them even neoliberals) do traingulation all the time.

Although the marxist left never had any chance to rule anything, they are accused of everything that goes wrong and even of what the right-wingers dream that went wrong.

They do this by passing legislation that pleases the marxist left, the identity causes of the left, like abortion laws and the like.

This is given big echo on the media, while, at the same time, and without any media coverage, the same liberals are making economic legislation with the right-wingers.

When people find out about how they got any rights, about how their salaries went down, about how their taxes went up (and the 1% taxes went down), they have a obvious culprit: the marxist left, because the liberals were legislating with them, and the “poor liberal souls” had to satisfy their profligate demands.

What that legislation was about, nobody cares.