Yesterday (April 24, 2024), the Australian Bureau of Statistics (ABS) released the latest - Consumer…

Apparently, MMT says there are no inflationary threats – which planet?

It’s Wednesday and we have the music feature to enjoy following some other news snippets. Here is an argument: Modern Monetary Theory (MMT) tells us that when there are fiscal deficits there is no problem with inflation. At present, inflation has been rising and there are deficits left over from the pandemic. Therefore “Tick off a loss for the modern monetary theorists amid rising inflation” because “Under MMT, the risk of inflation is considered minimal as governments that fully control their fiat currencies are believed to be able to control price levels”. Okay? So I think I better just terminate this blog today, say sorry for being so stupid, and start writing Op Eds demanding interest rates rise and governments cut their fiscal deficits immediately. But I won’t. Why? Because I am not stupid enough to mount that argument in the first place like some, who have the audacity to write financial columns that only demonstrate their ignorance. Good. Let’s have some music.

RBA holds its nerve

Yesterday (April 5, 2022), the Reserve Bank of Australia (RBA) defied all the financial commentators and held the monetary policy rate constant at 10 basis points and the rate on bank reserves (Exchange Settlement balances in the Australian context) at zero.

Often the media wheels out private bank economists to provide commentary, as if they are independent voices.

In the past, the media used academics, which are more independent. But that era is over largely.

One journalist told me once that the bank economists are easier to contact. In the day of mobile phones that claim is ludicrous.

The journalists are all in a cosy groupthink with these commercial economists, who have been claiming the ‘markets have priced in the interest rate rise’ and have been pressuring the RBA to ratify that choice.

I have mentioned on many occasions that ‘pricing in rate rises’ is shorthand (groupthink speak) for the fact that these banks have made speculative bets in forward markets that rates will rise, because they think the RBA board is as locked into the mainstream rhetoric on rates and inflation as they are.

The pressure they bring is because they know if the RBA pushes up rates, their speculative bets are realised and their corporations make profits.

There isn’t anything more about it than that.

Fortunately, the RBA Board resisted falling into that narrative and held rates constant.

In the Governor’s statement – Statement by Philip Lowe, Governor: Monetary Policy Decision – we read:

Inflation has increased sharply in many parts of the world. Ongoing supply-side problems, Russia’s invasion of Ukraine and strong demand as economies recover from the pandemic are all contributing to the upward pressure on prices …

Wages growth has picked up, but, at the aggregate level, is only around the relatively low rates prevailing before the pandemic …

Inflation has increased in Australia, but it remains lower than in many other countries; in underlying terms, inflation is 2.6 per cent and in headline terms it is 3.5 per cent … The main sources of uncertainty relate to the speed of resolution of the various supply-side issues, developments in global energy markets and the evolution of overall labour costs …

The Board’s policies during the pandemic have supported progress towards the objectives of full employment and inflation consistent with the target. The Board has wanted to see actual evidence that inflation is sustainably within the 2 to 3 per cent target range before it increases interest rates. Inflation has picked up and a further increase is expected, but growth in labour costs has been below rates that are likely to be consistent with inflation being sustainably at target. Over coming months, important additional evidence will be available to the Board on both inflation and the evolution of labour costs. The Board will assess this and other incoming information as its sets policy to support full employment in Australia and inflation outcomes consistent with the target.

Full employment.

Wages growth still weak.

Inflationary pressures – supply-side and cartel-driven.

Not a demand-side driven episode.

Interest rates will not make the ships and trucks go faster, keep factories open with Covid still infecting millions of workers, and will not stop the Ukraine War nor bring the OPEC sheiks to heel.

The RBA knows that.

The financial commentariat doesn’t seem to be bright enough to grasp that.

MMT says there are no inflationary threats – excuse me!

It is more a case of where to start when reading articles in the financial media like this one – Yahoo Finance ‘Verdict is in’ on modern monetary theory, strategist says.

In Australia, we have an expression – Kangaroo Court – which seems to have emerged during the Californian gold rush in 1849, as many Australian miners rushed to the US to make their fortune.

It refers to a court:

… that ignores recognized standards of law or justice, carries little or no official standing in the territory within which it resides, and is typically convened ad hoc.

So this ‘verdict’ is coming from a court such as that.

We read:

1 “Under MMT, the risk of inflation is considered minimal as governments that fully control their fiat currencies are believed to be able to control price levels” – not even close.

MMT places inflation at the heart of our analysis. It just refocuses our attention on real resource constraints rather than fictional financial constraints.

2. “But the 82% increase in the monetary base was an experiment to see if we could get away with, effectively, modern monetary theory. And now the verdict is in. You can’t.”

Where does one start.

First, the inflationary pressures at present have little to do with the monetary base expansion.

Take the Australian case. The RBA has increased the monetary base by 372.7 per cent since January 2020 as a result of its operations to support the fiscal stimulus.

It has purchased around 93 per cent of all the Treasury debt issued over that time.

The inflation rate is fairly low.

Why? Because we are less exposed to the supply and energy shocks.

This is not a demand-driven event.

Second, the expansion in the monetary base was not an ‘application’ of MMT. MMT just allows us to understand what the consequences of such an expansion might be.

And without Covid, without OPEC greed, and without the Ukraine War, inflation would be moderate given the spending aggregates I have previously documents from the US national accounts.

3. “… [Increasing the monetary base has created] almost double digit inflation …'”

No Covid, OPEC and the War have generated the inflationary pressures.

A kangaroo court in action.

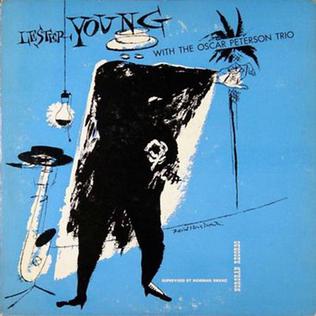

Music – Lester Young

This is what I have been listening to while working this morning.

I recently purchased a – Roland AE-30 – digital wind controller, which is easier to cart around on planes – than my old tenor sax.

The AE-30 is a very beautiful instrument and great to play. I plan to use it in live settings instead of my acoustic sax.

The progress that these – Wind controller – instruments have made over the last several decades is stunning and the sounds that you can get from them are getting closer to the real thing (if you want to emulate an acoustic instrument), not to mention the fantastic array of synthesised sounds one can get and model.

But, even the best digital instruments cannot fully get the tone that a master musician gets from the old brass.

Here is one of my favourite tracks – Stardust – which was composed by – Hoagy Carmicheal – in 1927.

Lyrics were written by – Mitchell Parish.

One of my best friends named his son – Hoagy!

It is played by one of the greatest tenor players – Lester Young – with – The Oscar Peterson Trio – and appeared on the 1954 album (rleeased by Norgran Records) – Lester Young with the Oscar Peterson Trio (recorded in 1952).

Lester Young died 9 years after this album was recorded at the age of 49.

This album was recorded as his health was in decline through excessive alcohol consumption.

If you can listen to some of this recordings in the 1950s as he was approaching death, you can almost sense the days he felt better relative to the other days.

His playing changed in the 1950s and while it was spotty, at times, it reached heights of tone that was unsurpassed. I love listen to those albums.

He was not a screaming soloist. Rather he played ‘softer’ tones emphasising very complicated harmonies interspersed with pretty syncopated riffs.

If he was still alive in the 1970s, we might have called him a funky player.

Sadly he wasn’t.

But all tenor players listen to the way he played because there is a plethora of possibilities that he teaches us.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

A fiat currency is a pledge by the government who issues the currency that it won’t go bankrupted.

If the economy is strong, the currency is strong and vice-versa.

So, if your economy is growing, so has to grow the “quantity” of money.

Unless you want to stifle the economy, you have to create credit, and credit creates dollars or euros.

Some of it is recycled back to the issuer as taxes, some is used to buy stuff, that spurs some other economy elsewhere, some is saved.

But the issuer has 3 options: he can keep things as they are; he can be inflationary, issuing more currency than what the economy needs (devaluating the currency); he can be deflationary, destroying already issued currency, appreciating it, making imports cheaper and exports more dificult.

Usually, nobody wants to twarth exports, so the option will be inflationary.

What varies is the degree of the inflationary drive of the currency issuer.

Markets will add deflationary pressures, as businesses compete to outsell each other (impaired by the growing monopoly share on markets).

The FIRE sector usually adds inflationary pressure, as speculators try to extract more and more profits out of every invested dollar.

And there are many other pressures whether inflationary or inflationary.

It’s the balance of all this pressures that computes the inflation value.

@Paulo, there’s a simple solution to the ‘RE’ of FIRE: land value tax.

Based on the quoted statement from RBA governor Lowe yesterday, the geniuses at the ASX produced a graph of expected cash rate future yields,

https://www.asx.com.au/data/trt/ib_expectation_curve_graph.pdf

I’m an innocent bystander in the economics of the nation and I’m completely baffled. The ASX is a market leading institution, the “data” it produces is widely reported on and is the basis for investment decisions and financial advice in the market.

This graph, appears to me, to bear no relationship to the information provided in the statement from the RBA governor, and so called “data” such as this drives the very expectations it claims to predict. it’s insane and surely misleading.

The very idea that an increase in the cash rate to levels above 3% by September next year could be beneficial to either the economy or the housing market is unfathomable.

Who would benefit from such an outcome?

Bill said:

“MMT places inflation at the heart of our analysis. It just refocuses our attention on real resource constraints rather than fictional financial constraints.”

May be so. But does not MMT say, by and large, that the Phillips Curve is dead?

Oh be kind. The reporter “is an undergraduate student at Stetson University (’22) majoring in finance and economics with a minor in political science”.

The kid is receiving a thoroughly mainstream indoctrination, probably getting good marks, and is demonstrating all the requisite initiative and entrepreneurialism in scoring himself a gig at Yahoo Finance. We should expect nothing less from a privatised education sector that competes to produce the most “job-ready” graduates, whose salaries are their sales pitch.

On the other hand, a middle-aged postgraduate Political Economy student such as myself will sit around discussing an issue through 4 different economic lenses to see how that might inform a policy response. Through a neo-liberal lens this is, of course, self-evidently indulgent and wasteful.

That’s enough procrastination from me, I have an essay to write on Keynes.

Hello prof mitchell will you be writing about sri lanka’s current dire economic situation and how an understanding of mmt can help improve it?

Henry R.,

In so far as the Phillips Curve just uses financial info to predict things, it then follows that because it ignores the real world resources availability in the economy, that therefore MMT would assert that it is dead and/or useless.

.

Steve A,

The Phillips Curve says nothing about resource availability.

It is an empirical relationship, a problematic one at that, given that the relationship between unemployment and inflation is complicated and multifaceted.

Henry R.

MMTers say that inflation only starts when all the available labor and resources are already being used. Now, the shortages make the resources and also finished products be available in short supply or not enough supply; so there is inflation.

BTW — the invisible hand of the market is supposed to raise prices when there is a shortage, because it is intended to see that the poor are the 1st to not bet to buy things in short supply and the rich will get some unless there is zero supply. Why is everyone blaming inflation on the large deficits?

Have you seen historical data for inflation as a function of the money supply?

Or of inflation vs recent Gov. deficit?

Or of inflation vs total national debt?

IIRC, Bill had a graph a while back and it showed little correlation.

.