"Fiscal support can manage the direct economic fallout from extreme weather events." That quote came…

The RBA has no credibility and the governor and board should resign

So, I was wrong. I thought the Reserve Bank of Australia (RBA) would hold the line on interest rates this month after telling all and sundry that they would be waiting until there was evidence of accelerating wages growth. They also lured thousands of first-home buyers into a hot property market on that promise, allowing the commercial banks to push mortgage debt onto these borrowers, sometimes at rates of six times the borrower’s income (massively overindebted in other words). The RBA also watched as household debt reached record levels and know that hundreds of thousands of borrowers are now on the margin of solvency. And all this was going on while the RBA promised the borrowers that they would not push up rates until that wages growth was evident. So far, there is no evidence of accelerating wages growth. There is lower unemployment, but that is mostly due to the fact that our external border has been closed for two or more years and labour supply growth has been static. That has now changed. I also thought the RBA was resisting the greedy push from the banks to increase interest rates and redistribute income from the struggling households with huge mortgages to the shareholders of the banks, who are well heeled, if anything. And I thought the RBA understood finally that the current inflationary surge has nothing much to do with excess spending in the economy. But I was wrong. Stupidity prevails.

Yesterday, the RBA increased the cash rate target from 0.10 per cent to 0.35 per cent and the major banks didn’t hang around before pushing up the longer-term rates and their profits!

The RBA also increased the support rate on excess reserves from zero to 25 basis points – thus providing more opportunities for profit for the banks.

The RBA – Statement by Philip Lowe, Governor: Monetary Policy Decision (May 3, 2022) – said:

The economy has proven to be resilient and inflation has picked up more quickly, and to a higher level, than was expected. There is also evidence that wages growth is picking up. Given this, and the very low level of interest rates, it is appropriate to start the process of normalising monetary conditions.

Unless the RBA gets advance briefings from the Australian Bureau of Statistics, there is no publicly available, robust evidence that “wages growth is picking up”.

Anecdotally, some firms are offering higher wages to attract labour but if one examines the enterprise bargains recently struck there is no trend to accelerating wages.

Real wage cuts across the board are the norm at present.

Further the state governments are persisting with the 1.5 per cent wages caps they imposed a few years back, which has conditioned wage bargains throughout the economy downwards and ensured their workforce is enduring substantial real cuts in their purchasing power, while corporations are recording record profits.

We won’t know until May 18, 2022, when the ABS releases the latest Wage Price Index, what is happening on the broad wages front, which is why I thought the RBA would wait until the June meeting before pushing up rates.

I don’t even expect the WPI data will show any evidence of a wages ‘breakout’.

So the RBA just threw that in to provide cover for themselves because by any standards they have broken their word to the Australian society.

Economists talk about central bank credibility all the time as being the most important thing the central bank can protect (and they apply this to mean the bank is free from political manipulation).

But yesterday’s decision by the RBA challenges its credibility after the statements it has made about waiting for wages growth to occur before they would raise rates.

Tens of thousands of borrowers, who are now likely to enter financial stress, and many who will lose their homes, as a result of the RBA reneging on that public commitment, are entitled to feel betrayed, tricked or whatever word one wants to apply.

The RBA statement also said:

The central forecast is for the unemployment rate to decline to around 3½ per cent by early 2023 and remain around this level thereafter. This would be the lowest rate of unemployment in almost 50 years.

Therein lies the contradiction.

The only logic that tells us that increasing interest rates will work to curb inflationary pressures is through their effect on suppressing total spending.

Basic macroeconomic fact: spending equals income equal output, which, in turn, drives employment growth.

So the RBA believes they have to cut spending in the economy right now, which will drive up unemployment if it is successful.

The RBA is back in a NAIRU-world using unemployment as a policy tool to discipline total spending, and, according to the mainstream logic, move the economy towards recession.

There are many problems with this logic.

First, the housing market, which has been booming, largely because the tax policy favours speculation in housing stock, is now past the peak anyway.

Housing prices are starting to fall in the major cities and this will persist.

What that means for those low-income families who overstretched themselves to get into the market as it approached the peak, not only will their monthly payments be higher because of the interest rate rise, but also they are so indebted relative to their income, that they now run the danger of hitting negative equity before long, depending on how far the market declines.

In some segments, the price decline will be significant.

Second, real income has already been significantly squeezed by the rising inflation, given that wages are not growing anywhere near as fast, so households are already making decisions to cut back on other expenditures.

That process is already reducing total spending on goods and services (as national income is redirected to the shareholders of the banks) and will slow the economy anyway.

Third, the business community spokespersons were on national radio and TV today claiming business costs are killing margins etc but in the same breath praising the RBA for ‘normalising’ monetary policy.

Their narrative is so idiotic – the rising interest rates will add to the rising cost burden on business and they will use their market power to pass them on as higher prices – that is, fuel higher inflation rates.

Fourth, and most telling, is the fact that the rising interest rates will do nothing to dent inflation in the short run given that the pressures are not demand driven.

The RBA statement said:

This rise in inflation largely reflects global factors. But domestic capacity constraints are increasingly playing a role and inflation pressures have broadened, with firms more prepared to pass through cost increases to consumer prices. A further rise in inflation is expected in the near term, but as supply-side disruptions are resolved, inflation is expected to decline back towards the target range of 2 to 3 per cent.

More strange contradictions.

The RBA thinks the inflationary pressures are transitory – which has been my narrative all along.

They think that because the pressures are coming from obvious factors that are of an extraordinary nature – War in Ukraine, bushfires and floods down the East Coast, a global pandemic choking factory production, shipping, trucking, etc., the OPEC cartel gouging for all its worth.

Everybody can see that.

So how will increasing interest rates influence the trajectory of these extraordinary factors?

They won’t – not one scintilla.

Then, within that statement, we see the RBA also wants to curb the capacity of firms “to pass through cost increases to consumer prices”.

The only way that will happen is if the RBA can create higher unemployment and plunge the firms into a sales crisis, so they repress their desire to maintain real profit margins.

Tell me whether you think it is responsible for a macroeconomic policy maker that is largely unaccountable to the Australian people to be plotting a strategy to force: (a) cuts in purchasing power for low-paid workers; (b) increasing the likelihood of low-paid workers becoming insolvent through mortgage stress (after they promised these borrowers no rate rises until 2024), and (c) creating high unemployment and all that goes with that, WHEN, they acknowledge the inflationary pressures will abate in the medium term.

I don’t think it is responsible – one bit.

I think the RBA is regressing back to form – back to neoliberal, unaccountable form – and the government should step in and sack the governor and the board.

The happy ones out of all this are the shareholders of the big banks that have a disgusting record of conduct in terms of cheating, lying and profiteering (see Royal Commission evidence).

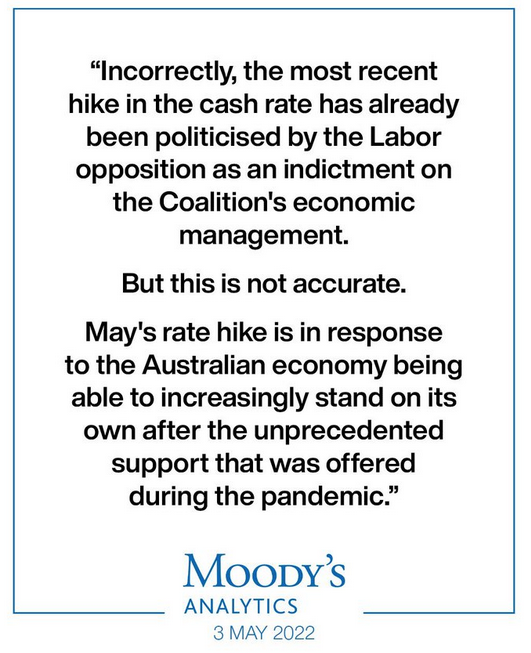

Moody’s gets political

And then you get the repugnant political intervention from Moody’s the credit rating agency that the US Congress revealed had gouged out dubious profits in the lead up to the GFC through its “triple-A ratings” bonanza.

The current Australian treasurer, who I hope is in his last 17 days of tenure (election May 21, 2022) – circulated a Moody’s Analytics statement today which attacked the Opposition Labor Party, who are in a winning position at the upcoming federal election.

Here is the Moody’s message. They clearly favour the conservatives which is a telling disclosure and deserves more forensic investigation.

The US House of Representatives Committee on Oversight and Government Reform report (October 22, 2008) – Credit Rating Agencies and the Financial Crisis – had some choice things to say about Moody’s and the other credit rating agencies, including:

At Moody’s, profits quadrupled between 2000 and 2007. In fact, Moody’s had the highest profit margin of any company in the S&P 500 for 5 years in a row. Unfortunately for investors, the triple-A ratings that proved so lucrative for the rating agencies soon evaporated … Moody’s had to downgrade over 5,000 mortgage-backed securities.

In their testimony today the CEOs of Standard & Poor’s, Moody’s and Fitch will tell us that, “virtually no one anticipated what is occurring.” But the documents that the committee obtained tell a different story.

After noting that the Moody’s CEO had claimed the GFC was unimaginable, the hearings revealed the contents of a “confidential presentation” he gave to the Moody’s board in October 2007, where he acknowledges the trouble Moody’s was in.

The US Congress also was given evidence from a Moody’s management team member who admitted that people from the agencies were lying and said that the evidence showed that the credit rating agencies were “either incompetent at credit analysis or … sold our soul to the devil for revenue”.

Leopards don’t change their spots.

It is unconscionable conduct.

Music – Charlie Rouse on Tenor

This is what I have been listening to while working this morning.

One of the all-time, underrated tenor players is – Charlie Rouse – who played with the – Thelonius Monk – quartet from 1959 to 1970. Before that he was with Billy Eckstine, Dizzie Gillespie and Duke Ellington orchestras.

He was in the bebop then hardbop tradition but still managed to sound really smooth at times in the low register.

Here he is from his 1961 album – Yeah – playing the classic – You Don’t Know What Love Is.

I first heard this song in the early 1970s on a Miles Davis album from 1954, and then I purchased the Charlie Rouse album soon after and have worn it out a hundred times or more since!

He is accompanied on this album by:

1. Peck Morrison – bass (prominent in Lou Donaldson’s recordings from the late 1950s).

2. Dave Bailey – drums (many years with Gerry Mulligan).

3. Billy Gardner – piano.

Beautiful playing.

Here is an obituary (December 2, 1988) – https://www.nytimes.com/1988/12/02/obituaries/charlie-rouse-64-a-saxophonist-known-for-work-in-monk-quartet.html.

This reminiscence (January 16, 2021)- Charlie Rouse – A Creative Force on Tenor Saxophone – is also interesting.

I loved the line “If Charlie Rouse hadn’t existed, Thelonious Monk would have had to invent him.”

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

The line I read was that the rate change is required to ‘protect the currency’, in that Australia would become the source for the carry trade if they stepped out of line with other central banks.

It’s groupthink, but it fits with the New Keynesian mentality.

– Any price change is abhorrent and must be crushed by demand destruction instantly, and in this we are really just Monetarists with shiner suits.

– It’s all about the international exchange rate because we really believe there should be one world currency to rule them all, and in this we are really just Sauron with uglier orks.

It’s a political belief that the price of things must never change, and external trade is far more important than internal trade.

That’s what we are fighting against. Few people really care about the exchange rate against the US dollar, and even real international trade doesn’t worry about it that much because they know how future contracts work.

Why do we care if speculators lose money?

This was a remarkable backflip from the RBA – though not a trained economist, it is easy for me to read the sudden hawkishness in the RBA Governor’s statement yesterday (almost coming out of nowhere) – at this point in time, they intend yesterday’s rise to be merely the first in a run of rate rises.

I have some difficulty accepting that Lowe and the board members do not understand that the Australian economy cannot sustain such a regime without serious economic and social harm.

I think Lowe and the entire board should be removed for dereliction of duty.

typo alert…but if one “examinations” the enterprise bargains recently…

Not sure if the RBA is taking its cue from the BofE or the other way around, but it seems to me one can predict the latest idiocy by looking at the other’s recent action rather than any mealy-mouthed words. Shared political belief as Neil Wilson points out.

Moody’s is just part of the geopolitical, foreign policy package. That play the same role as the IMF, World Bank and NATO.

Moody’s involve themselves in democracies to make sure the ” other lot ” don’t get in and ramp it up when they want regime change. To make sure the names on the ballot box are the names that reflect US geopolitical foreign policy.

All you have to do is data mine Twitter and the group with all the flags and symbols that represent a flock of sheep, are the people who don’t get it. Who Support the very same Groupthink that asset stripped their own countries and cheer them on when they asset strip abroad.

When you stumble across somebody who has the ” full house” hand on twitter you can just about guarentee 4 things……

a) They donate to the Guardian, the sermon on the mount of Groupthink.

b) They have 33 direct debits set up and donate to every charity on the planet and have a cupboard full of different coloured wrist bands. All based on the false belief the government has run out of money.

c) They are going to explain to you that you live in a gold standard, fixed exchange rate world.

d) If you disagree they will shout at you calling you either a communist or a Putin Puppet.

The whole experience is very similar to being sober and walking into a pub at half eleven at night.

Since the 1980s onwards, a whole new generation of politicians was “washed ashore” on the “beaches” of western democracies.

Once, from 1945 to 1980, democracies were ruled by “statesmen”, not all alike, of course, but with a common backbone of service to the community.

But they got old and died, and so they had to be replaced.

And then, corporate money got in the way and the rulling parties got “colonized” with olygarchs’ clerks.

And it’s getting worse by the hour, as old parties loose electoral hedge and are beeing replaced by new parties, some of them entirely at the service of corporations (because they are beeing bankrolled by those same corporations).

And so, with public interest lost forever, the tax payer money (I’m talking from the eurozone, where there can’t be no MMT) is beeing drained to feed unsastainable private companies, who, otherwise, would be closed by bankrupcy a long time ago.

I even know a “profligate” european country, whose largest private bank failed in 2014.

A few days before the crash, the country’s top chairman said on TV that the bank’s finantial health was solid.

Nobody deemed the situation odd, because the mingling of private business with public service had been going on for many years.

Thousands of (wealthy) savers rushed to the bank, and bought the bank’s commercial paper, all to be lost in a matter of days.

What happened next?

Some lost money, others earned money. That’s it.

Nobody even got arrested, to this day.

As someone who negotiates enterprise agreements for a living, the line the RBA used of evidence of wage increases is laughable. Employers laugh at you when you suggest wage increases at 2per cent let alone meeting inflation rates.

The RBA board are ideologues. Driven by a desire to impoverish the working class and drive ever greater income to the ruling classes. On the election; Sadly, if the LNP are tossed out I have little faith the ALP will be any better!

Hi Bill,

I wonder if your could post, at some point, something on Lula’s proposals to found a South-American currency — the “Sur”. Different options seem to be proposed by Lula and his advisors; it is not clear if he wants a South American Euro, or an arrangement like the EC “snake in the tunnel” (to seek to accommodate the different S-A currencies), or something like a South American Bancor. But if the latter, why not just take part in the resource-backed Russian-Chinese Bancor type arrangement? I guess, so as not to be seen to be siding EITHER with the US/NATO/EU or the Eurasian reserve currency. Is there a role for a supranational currency in South America?

The RBA is serving its masters by crushing labour under its heel, raising interest rates with the same logic which brought us, “in order for the village to be saved it was necessary that it be destroyed.”

Same goes for the Bank of England, the Bank of Canada and the US Fed. A pox on all their houses …

I note in the commentary on the interest rates, one of the “experts” was out praising the RBA board for this great decision claiming that house prices had risen 30% in most cities. He then went on to claim that wages had risen 8%, therefore we are all better off.

8% wage rise indeed, and he obviously believes you can dine on the supposed increased equity in your home after you’ve been retrenched.

Kookie is an apt description.

Bill

I have little sympathy for the plight of anyone who was irresponsible enough to borrow more than six times household income to get into an already incredibly expensive housing market and serve to push prices even higher.

While I generally agree with your analysis, my view is that interest rates have been held at emergency levels for way too long, encouraging a massive overallocation of resources to housing. Better that the RBA had made some modest moves much earlier, rather than the overreaction they now appear to have in store.

But Lowe had painted himself into a corner by attempting to predict the course of interest rates out to 2024. To say the least, this was foolhardy, unnecessary and, almost certainly, lulled many into a false sense of security. He should resign.

The problem with the RBA is that it only has a hammer in it’s tool box and consequently every problem looks like a nail.

This is an exercise in futility!

JohnL, what do you mean by “interest rates have been held at emergency levels”? The natural rate of interest for a fiat currency is zero – anything higher requires the central bank to “defend” the non-zero rate in open market operations or by paying interest on reserves.

JohnL – ” I have little sympathy for the plight of anyone who was irresponsible enough to borrow more than six times household income to get into an already incredibly expensive housing market …”

Have you seen the rental availability and affordability rates for Australia? They were in crisis pre-COVID and it’s much, much worse now. Lots of work from home tree changers carried the crisis to the regions. Bushfires and floods reduced the rental stock even more. Have you looked at how much people are paying in rent? Couple that with the insecurity of renting- the sheer bloody minded greed of investors who kick lease holders out just to increase the rent, the inability to even hang a wedding or baby photo on the wall or own a pet. Renting’s horrible. I know, because I do it. I’m one of those single 50-something women on a low income who’d be looking down the barrel at poverty and homelessness when I can’t work anymore if it wasn’t for my children.

You’d have to be ignorant, heartless or financially comfortable in your own home not to understand why people bit the bullet and bought their first home before the prices went up yet again beyond the deposit they’d sacrificed to save. Bear in mind banks have a responsibility to ensure borrowers can handle interest rate rises, too.

The self righteous attitude some of my generation (Xer’s) and Boomers have to current housing prices incenses me. You’re the ones who spent decades voting to make housing wealth creating assets. You did it again in grand style as recently as 2019, then you blame the victims for your greed.

In my view, if you believe in the fixed, or relatively fixed quantity of money (fixed exchange rate), then, I think this is where PhilipR’s conjecture is valid.

But, if we believe in the money as a fiscal and market based construct (floating exchange rate), then, the natural rate of interest is zero as pointed out by many MMTers and eg.

Otherwise, there is no work for the central banks or the monetary policy committees, just accountants sitting at the desks counting beans (tax) and expenditures using a spread sheet to see if they are balance in each period (with or without credit creation option).

For assets price inflation, I perceive this has to do with the demand and supply, just like any other commodities. Interest rate is an operating cost, or margins, if you are financial institutions, which has already factored all these in at the time of purchase from every side for future survival.

But in reality, we cannot really do risk management for everyone and everything, as it involves not just time, but demand and supply or consumer behaviors/their perception in that particular moment in time.

And might I throw in the demand/supply manipulation, as well?

But still, I cannot see the logic or linkage how the RBA or any CBs could link this to a housing bubble, as we have been living with the pandemic/slow growth during the past 3 years.

Unless we/society want to and can afford double spacing to observe social distancing at all time.