The IMF and the World Bank are in Washington this week for their 6 monthly…

US inflation is moderating while a massive fiscal contraction is underway – recession looming

Yesterday (May 11, 2022), the US Bureau of Labor Statistics released the latest – Consumer Price Index Summary – April 2022 – which showed the monthly increase in the CPI to be 0.3 per cent, the lowest monthly increase since August 2021 and, as it happens, just about right on the average monthly growth rate from January 1947 and April 2022. The result suggests a tapering of price pressures. The Energy component fell by 2.7 per cent in April after spiking at 11 per cent in March. Further, the growth in food prices fell for the third consecutive month. All of this has nothing to do with the recent interest rises imposed on the economy by the US Federal Reserve. They were already in train and confirm the transitory nature of this period of price instability. The US Treasury Department also published its most recent fiscal statistics yesterday – Monthly Treasury Statement – for April 2022, which reports a staggering $US533,794 fiscal shift between April 2021 and April 2022 – the fiscal drag embodied in that shift is massive and calls into question the conduct of the US Federal Reserve – why did they think they needed to push the economy towards recession? Fiscal policy is already working in that direction!

The CPI data

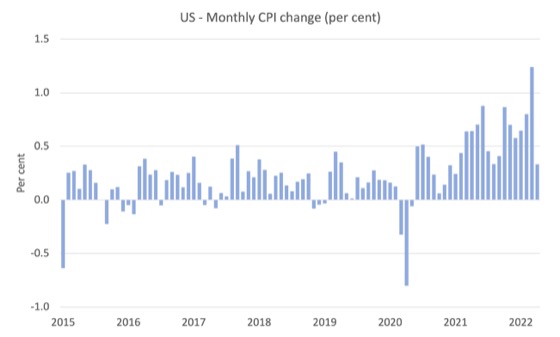

The first graph shows the monthly All-Items US City Average CPI growth since January 2015 to April 2022 (CPI_U).

The graph shows that the CPI growth has risen to elevated levels since 2021 but is certainly not accelerating and is probably now in decline.

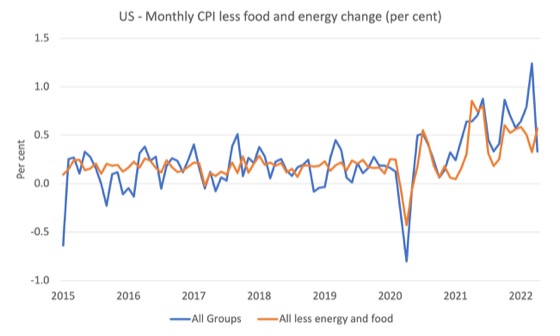

The next graph compares the trajectory of the All-Items series with the same series less the food and energy components.

It is obvious that the underlying inflation rate is much lower once we exclude the volatile items of food and energy.

Those volatile components are obviously linked because the rising oil prices feed into truck and delivery prices and other machinery used to produce food.

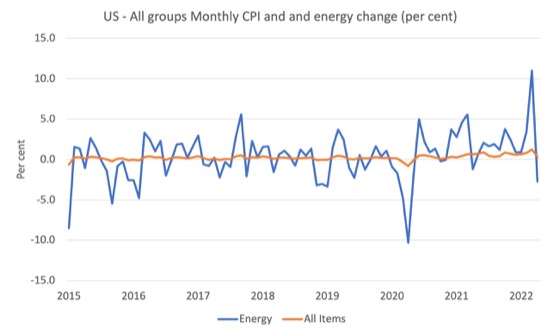

The next graph compares the All-Items series with the energy prices.

Energy prices fell 2.7 per cent in April and it is possible that oil prices have peaked as demand is falling.

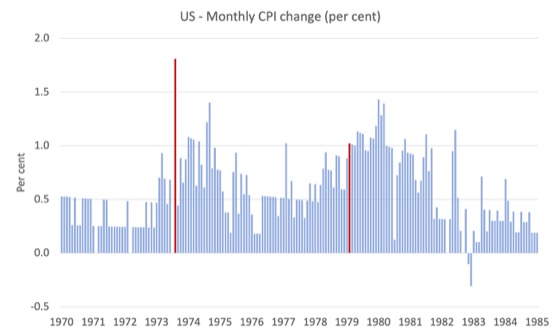

Contrast the current experience with the next graph, which covers the period January 1970 to December 1985, a period in which two major oil price shocks occurred (marked by the red bars).

The first shock came in October 1973 as a result of the Arab OPEC members decision to increase the oil price by around 4 times. There were also some export bans to nations (for example, US, Japan, Western Europe) who were considered conspiring with Israel.

The inflation that followed started to recede in the latter part of that decade only to be hit by the second OPEC shock came with the – 1979 oil crisis – which was caused by a reduction in oil production associated with the Iranian Revolution.

A further shock to the oil price came soon after that as a result of the Iran-Iraqi War (beginning 1980).

It took the rest of the 1980s and the 1991 recession to fully expunge those inflationary pressures from the global economy.

The current situation has not become entrenched into a wage-price struggle nor in the long-term expectations as yet.

In the 1970s, both institutional forces pressured inflation upwards after the initial oil price shocks.

In the current period, real wages are falling as nominal wages growth lags well behind the temporary rise in the CPI. There is no sense that wages growth is pushing the inflation rate further ahead.

We know what the push factors are:

1. Supply disruptions in manufacturing and distribution – shipping, truck transport etc.

2. Workers continuing to become sick from Covid and being unable to work.

3. War in Ukraine.

4. OPEC anti-competitive profits push.

None of those push factors are very sensitive to interest rate changes.

And we keep hearing that business profitability is undermined by cost pressures emanating from wage rises.

Well, if that logic is valid, then surely the same impact will be felt from cost pressures emanating from interest rate rises.

And just as business uses its market power to pass the wage costs onto consumers, they will also pass on interest rate rises.

Thereby exacerbating the inflationary pressures.

The only way the interest rate rises will reduce inflation is if they are pushed to such high levels that the economy tanks into a deep recession and that stifles the capacity of the firms to push margins out.

But by then mass unemployment rises to high levels and we have a human tragedy on our hands.

Fiscal policy shifts

As noted in the Introduction, fiscal policy is contracting massively at the moment in the US.

On May 9, 2022, the US Congressional Budget Office released their – Monthly Budget Review: April 2022 – which showed that:

The federal budget deficit was $360 billion in the first seven months of fiscal year 2022 … That amount is about one-fifth of the $1.9 trillion shortfall recorded during the same period in 2021. Revenues were $843 billion (or 39 percent) higher and outlays were $729 billion (or 18 percent) lower than during the same period a year ago.

You might then be lured into thinking along these lines – there is still a fiscal deficit so the fiscal position of the government is still supporting the overall economy.

In one sense that is true.

There is still a net injection of government spending into the economy – the deficit.

But that doesn’t help us understand the situation very much.

We need context.

And context requires us to know what else is going on – with the private domestic sector and the external sector.

And it requires us to appreciate that it is the change in the fiscal position from period to period that is important in conditioning our view of what fiscal policy is up to.

On March 24, 2022, the US Bureau of Economic Analysis, which published National Accounts data and the Balance of Payments data, released the most recent Current Account data.

The release – U.S. Current-Account Deficit Widens in 2021 – told us that:

The U.S. current-account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, widened by $205.5 billion, or 33.4 percent, to $821.6 billion in 2021. The widening mostly reflected an expanded deficit on goods. The 2021 deficit was 3.6 percent of current-dollar gross domestic product, up from 2.9 percent in 2020.

So, in terms of expenditure flows, the external sector is draining an increasing amount of net spending from the domestic economy – thus undermining GDP growth increasingly.

The question then is with the fiscal balance fast heading towards balance at least, and the external sector draining 3.6 per cent worth of GDP out of the expenditure stream, what does that mean for the private domestic income and spending balance.

Well to fill that gap, the private domestic sector will have to increase its deficit and accumulate substantially more debt.

That is a particularly precarious prospect with current private debt at unsustainable levels.

And the rapidity of the fiscal shift is placing massive negative pressure on the spending system.

Next stop ?

Recession.

And it would be completely self-inflicted by a failure to maintain responsible policy settings.

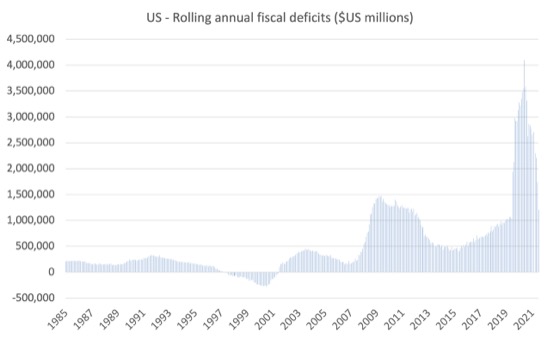

The next graph shows annual fiscal deficits ($US millions) calculated on a rolling monthly basis since 1985.

You can see that the rate of consolidation (contracting) in the current period is very rapid relative to say the GFC period.

The US government supported the economy for much longer during the GFC than during the current pandemic.

I fear the pace of consolidation is too fast at present.

The Monthly Treasury Statement (linked to above) for April 2022 shows a massive increase in revenue to the US federal government and only a modest rise in outlays (mostly due to price increases).

The fiscal shift in April was of the order of $US533,794 million, which in relative terms represents a very substantial withdrawal of expenditure from the system.

The lunacy of all this is that as the US government increases support for Ukraine, they are diverting spending from other areas such as education, chile care, health care and climate remediation.

Those areas were the basis of the president’s domestic agenda but they have fallen into the trap of thinking there is only so many US dollars available, which introduces the whole diversion mania.

The results will be fairly clear – a reduction in well-being for the US citizens, particularly low income recipients.

Conclusion

I had hoped when Jerome Powell made the August 2020 statement that suggested they were breaking out of the NAIRU mindset that things might change.

I wrote about that in this blog post – US Federal Reserve statement signals a new phase in the paradigm shift in macroeconomics (August 31, 2020).

However, I was wrong and policy makers in the US seem hell bent on bringing on a recession as part of a futile fight against inflationary pressures which are already moderating.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

The neoliberal New Keynesians can’t cope with bottleneck inflation. Any price changes at all must be attacked by interest rate rises immediately.

Even the neo-Monetarists want to get away from ‘inflation targeting’ and allow bottleneck inflation to sort itself out. Only the neoliberals want to stick with no price changes ever.

You can tell they serve the interests of debt owners.

The morbid symptons that Gramsci talked about are upon us.

The mainstreamers don’t even pretend that they are doing something remotely related to macroeconomics.

What do they do, when the economy is in dire straits?

They apply pro-cyclic fiscal measures.

We’ve seen it happening back in the “good” old GFC days, but we thought it was some kind of misjudgment, blunder and/or plain stupidity.

Now, we know it was on purpose.

Warren Moslet had made the point that all else euqal the deifict must be larger to keep the economy out of recession if inflation is high. That point seem to valid with the plausible assumption that the public targets real savings. I think this point is largely overlooked.

Mosler points to the low growth in the 70’s when the nominal deficit was supposedly relatively large.

This blog post is excellent! It painted a clear picture with evidences of what is going on with the US economy and what is to come next.

The policy makers and the Fed should read this and learn from it.

When I compared their analysis and bill’s, it shows clearly that they don’t have the ability to put the two and two together nor all the factors and processes involved in one scene.

They can only do a piecemeal or simple comparative/correlational analysis of variables when it comes complex situations involving the oil price, the interest rates, the real wage growth, the CPI, the sectoral balances, the current global situation etc.

But I also understand that they don’t have the tool or the lens that bill has.

Any way, a very powerful analysis by bill. It is like a Picasso of the current macroeconomic situation.

“The policy makers and the Fed should read this and learn from it.”

They know how it works have done for hundreds of years ever since clay tablets and tally sticks. Long before the United States of America was even a thing.

Do you think they could set up the EU the way they did without knowing how It works. Do you think they could set up the French African currency without understanding how It works. Do you think the founding fathers of the US could set up the monetary system the way they did without understanding how It works. Do you think the Romans used coinage the way they did without understanding how It works. Do you think the economies of ancient civilizations and the Clean Slate debt cancellations (the Jubilee Year), used in Babylonia and the introduction of interest-bearing loans in agrarian 3rd Millennium BC Mesopotamia. Without understanding how It works ?

History shows time and time and time It is a story of those with real power v’s those who have none.

Those with the real power set up the monetary systems to serve themselves.

It is the those with real power v’s those who have none. Those with real power serve the interests of the debt owners. Who have hijacked the political process and the state to feed their own greed and ambitions.

They are not stupid. They are evil.

The useful idiots they use to spread their propaganda are the “stupid” in this reality. Some of which are also evil as they get paid well for doing so who know the stories they tell are fairy tales.

If a postman from Peterborough, A baker from Birmingham, A grocer from Glasgow and a nurse from Nottingham can understand it. Why can’t Paul Krugman or Wren Lewis ?

You choose who you serve.

If you have run treasuries and central banks for the number of years these governments have.

It is impossible not to understand how it works.

Why it was so easy to set it up to serve themselves.

The years between after World war 2 and the 1980’s was a very abnormal time and one of the very few times over hundreds of years those with the real power decided to share some of their profits.

If you analyse hundreds of years of history, 99% of the time the monetary system was used to serve those who held the real power over everyone else. With very few exceptions all the way back to ancient times and when monetary systems were created.

Did they understand it when they put The white paper forward in 1945 ?

https://billmitchell.org/blog/?p=45069

Of course they did. They know how it works. It is written in that paper in black and white. A complete understanding of how things really work.

Everything changed when they put The Berlin Wall on wheels and pushed it forever Eastwards. Because foreign policy and geopolitics and now the one party nation states demands that neoliberalism and globalism rules the rule based order and serves the American empire. Why the EU was set up the way it was.

We all have a front row seat of the evil that built it to serve themselves.

When you look at the key points that came out of Glasgow climate pact of COP 26.

https://www.theguardian.com/environment/2021/nov/14/what-are-the-key-points-of-the-glasgow-climate-pact-cop26

The figures they said would be delivered. Would struggle to find. $ 75 billion for poorer countries.

Then think how much has been given to Ukraine created from thin air by a vote, and they are not finished yet.

You very quickly realise we are dealing with a bunch of gangsters masquerading as democracy.

Derek H., thank you for the response, I like it. But in there, few assumptions may or may not be the case.

One, I agree historians discovered artefacts that showed double entry booking keeping was used in ancient times, and so they understand how it works all along, as you mentioned. However, the assumption that the system was set up for the people with real power to serve themselves against people who have none is not a strong thesis.

One reason that comes to mind is that it is an accounting system, it serves everyone, but whether one abuses it, or uses it for the benefit of the majority is another question, which needs to be examined separately.

You are mixing the two together. How these double entry/balance sheets play out for different classes of society is one matter, how the system is taken care of is another, like you mentioned the clean slate, or debt jubilee.

Second, you are talking as if there is a ‘firm’ behind all that is happening. Everyone understands it, but they choose who to serve like Paul or Wren, the Fed, the EU, the French in Africa etc., – the strong exploit the weak and they are evil.

In the implementation of the system, I doubt this is the main purpose, it is just a way the fiscal and monetary system should be set up. What happens after that depends on education, natural resources, political processes and the will of the people (not any particular one), and which needn’t always be evil.

Many countries around the world and their citizens have prospered because of this double entry system. Many are not, so I don’t think it is the system for exploitation, as it is not universally abused.

In sum, things may look that way but it might not be the case. Maybe, it is just the balance sheets that have to be balanced better.

Hi Bill

Thanks again for the efforts you put into this blog.

I’m having a chat with others on a forum I frequent on how the government could address supply constraint issues without causing inflationary pressure. I’ve read about your suggestion say for reducing fuel consumption by making public transport free. Are there any strategies you’ve come up with that increase supply rather than reduce demand? For example, there are frequent shortages of frozen vegetables in our industry, Our business operates in a remote location and mostly relies on renewable energy to run refrigeration etc so we make use of products that have long shelf lives eg frozen veggies, powdered milk etc to feed our clients. What can the government do to ensure say that supplies of frozen veggies are not interrupted?

Cheers

Tony

Fascinating post Bill!

Do you see another, larger, stock market crash coming(in addition to the damage inflicted just over the last few months)? Or simply – less extreme, but still damaging, negative growth over the coming quarters?

Cheers,

David

Vora pot, I think you miss Derek’s point; for me he is saying that the problem is the people who lust for wealth and power, the same problem that has dogged humankind since the dawn of civilization.