The IMF and the World Bank are in Washington this week for their 6 monthly…

Australian wages growth remains flat despite RBA claims that a breakout is about to occur

On May 4, 2022, the RBA increased interest rates claiming they had evidence of accelerating wages growth. For the last few years, the RBA had been signalling that they would not move on interest rates until there was a concerted increase in wages growth, which has been at record low levels for some years now. Well, today, we found out the RBA was poorly informed because the latest wages data shows that wages growth has been flat in each of the last three quarters. The is no acceleration. Wages growth is not driving the inflation trajectory. Workers are enduring massive real wage cuts and the RBA has made that worse by pushing up mortgage rates for those exposed. Today (May 18, 2022), the Australian Bureau of Statistics released the latest – Wage Price Index, Australia – for the March-quarter 2021. The WPI data shows that nominal wages growth was 2.4 over the 12 months. Private sector wages growth has remained at low levels. The last time wages growth was higher was in the December-quarter 2014. While the conservatives are railing about inflation now and looking to target workers’ wages (further cuts), the evidence is that the wages side is not driving any inflationary pressures – the opposite is the case. The business sector, as a whole, thinks it is clever to always oppose wages growth and the banks love that because they can foist more debt onto households to maintain their consumption expenditure. But the reality is clear – there can be no sustained recovery for the economy post Covid without significant increases in the current rate of wages growth.

The Wage Price Index:

… measures changes in the price of labour, unaffected by compositional shifts in the labour force, hours worked or employee characteristics

Thus, it is a cleaner measure of wage movements than say average weekly earnings which can be influenced by compositional shifts.

The summary results (seasonally adjusted) for the March-quarter 2022 were:

| Measure | Quarterly (per cent) | Annual (per cent) |

| Private hourly wages | 0.7 | 2.4 |

| Public hourly wages | 0.6 | 2.2 |

| Total hourly wages | 0.7 | 2.4 |

| Basic CPI measure | 2.0 | 5.2 |

| Weighted median inflation | 1.0 | 3.7 |

| Trimmed mean inflation | 1.4 | 3.2 |

On price inflation measures, please read my blog post – Inflation benign in Australia with plenty of scope for fiscal expansion (April 22, 2015) – for more discussion on the various measures of inflation that the RBA uses – CPI, weighted median and the trimmed mean The latter two aim to strip volatility out of the raw CPI series and give a better measure of underlying inflation.

Real wage trends in Australia

The summary data in the table above confirm that the plight of wage earners continues in Australia.

Real wages fell again in the March-quarter in both the private and public sectors.

It is clear that the public sector wage caps (state and federal) have created an environment where private sector wage rises are being constrained, independently of the state of the private labour market.

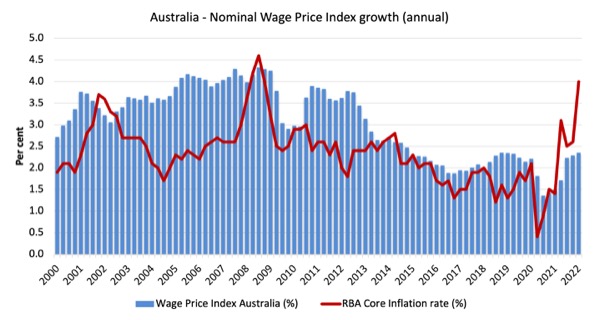

The first graph shows the overall annual growth in the Wage Price Index (public and private) since the March-quarter 2000 (the series was first published in the March-quarter 1997) and the RBA’s core annual inflation rate (red line).

Any blue bar area above the red line indicate real wages growth and below the opposite.

Workers have endured increasing real wage cuts over the last four quarters.

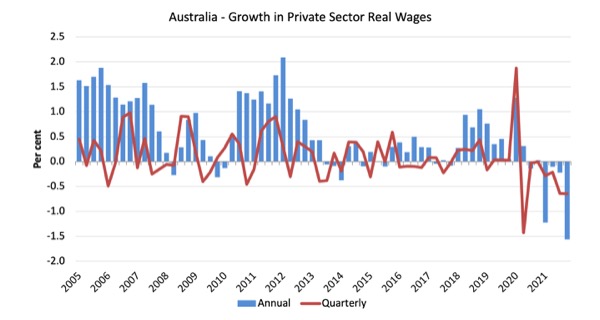

The next graph shows the growth in private sector real wages since the March-quarter 2005 to the March-quarter 2021. The core inflation rate is used to deflate the nominal wages growth.

The blue bars are the annual rate of change, while the red line is the quarterly rate of change.

The fluctuation in mid-2020 is an outlier created by the temporary government decision to offer free child care for the March-quarter which was rescinded in the June-quarter.

Overall, the record since 2013 has been appalling.

Throughout most of the period since 2015, real wages growth has been negative with the exceltion of some partial catchup in 2018 and 2019.

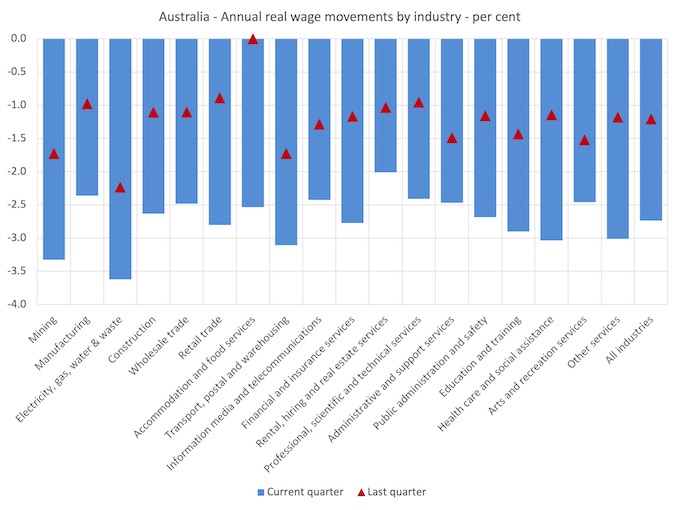

Industry Variability

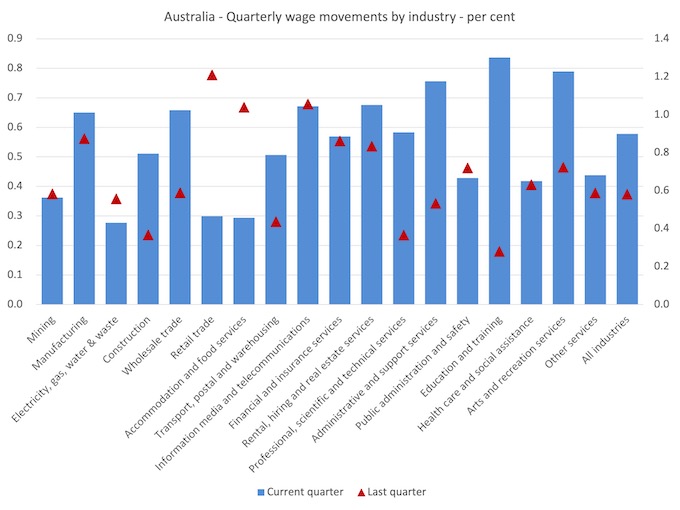

The aggregate data shown above hides quite a significant disparity in quarterly wage movements at the sectoral level, which are depicted in the next graph.

The blue bars are the current quarterly change, while the red triangles are the previous quarterly change.

Some sectors have experienced rising nominal wages growth in the last quarter but many other sectors are static or going backwards.

The ABS also reported that:

- Administrative and support services, Education and training and Arts and recreational services industries all recorded the highest quarterly rate of growth (0.8%).

- Electricity, gas, water and waste services, Retail trade and Accommodation and food services industries recorded the lowest quarterly rate of growth (0.3%).

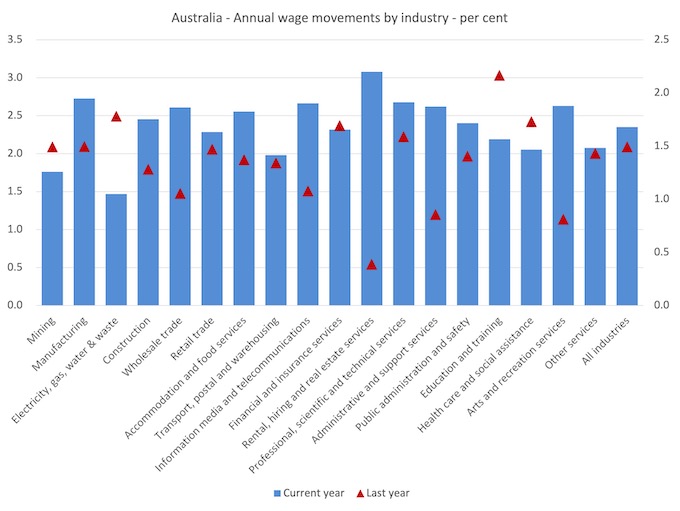

- The highest through the year growth was recorded in the Rental, hiring and real estate services industry at 3.1%. This is the highest annual rate of growth for the industry since June quarter 2013.

- Electricity, gas, water and waste services industry recorded the lowest annual rate of wage growth (1.5%) for the third consecutive quarter.

If we consider the situation over the last year, then we can see from the following graph that there is no evidence of a major wages breakout occurring.

While nominal wages growth was positive, albeit modest, the next graph shows the movements in real wages and you can see that real wages fell in all sectors.

This is now a chronic situation.

This on-going cut in the purchasing power of workers is almost unprecedented in our wages history and marks a massive redistribution of income towards profits.

Further, one can hardly say that wages push is causing the inflation spike.

Workers not sharing in productivity growth

The Non-farm GDP per hour data (productivity) is derived from the quarterly National Accounts and available via the RBA Table H2 Labour Costs and Productivity.

The ABS Information Note: Gross Domestic Product Per Hour Worked – says that:

In Australian National Accounts: National Income, Expenditure and Product (cat. no. 5206.0) and Australian System of National Accounts (cat. no. 5204.0) the term ‘GDP per hour worked’ (and similar terminology for the industry statistics) is generally used in preference to ‘labour productivity’ because:

– the term is more self-explanatory; and

– the measure does not attribute change in GDP to specific factors of production.

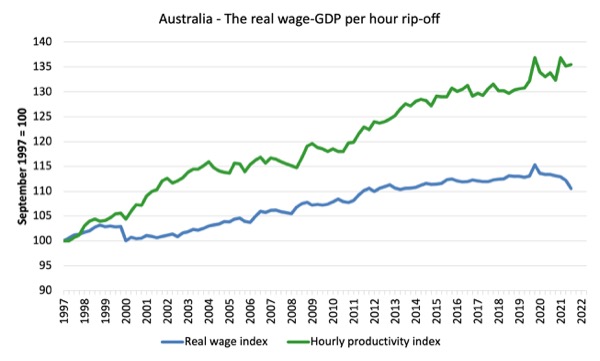

While the decline in real wages means that the rate of growth in nominal wages being outstripped by the inflation rate, another relationship that is important is the relationship between movements in real wages and productivity.

Historically (up until the 1980s), rising productivity growth was shared out to workers in the form of improvements in real living standards.

In effect, productivity growth provides the ‘space’ for nominal wages to growth without promoting cost-push inflationary pressures.

There is also an equity construct that is important – if real wages are keeping pace with productivity growth then the share of wages in national income remains constant.

Further, higher rates of spending driven by the real wages growth can underpin new activity and jobs, which absorbs the workers lost to the productivity growth elsewhere in the economy.

Taking a longer view, the following graph shows the total hourly rates of pay in the private sector in real terms (deflated with the CPI) (blue line) from the inception of the Wage Price Index (March-quarter 1997) and the real GDP per hour worked (from the national accounts) (green line) to the March-quarter 2021.

It doesn’t make much difference which deflator is used to adjust the nominal hourly WPI series. Nor does it matter much if we used the national accounts measure of wages.

But, over the time shown, the real hourly wage index has grown by only 10.5 per cent (and falling), while the hourly productivity index has grown by 35.5 per cent (and rising).

So not only has real wages growth turned negative over the last year or so, but the gap between real wages growth and productivity growth continues to widen.

If I started the index in the early 1980s, when the gap between the two really started to open up, the gap would be much greater. Data discontinuities however prevent a concise graph of this type being provided at this stage.

For more analysis of why the gap represents a shift in national income shares and why it matters, please read the blog post – Australia – stagnant wages growth continues (August 17, 2016).

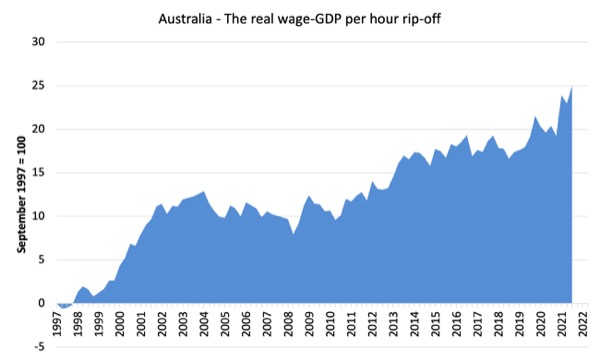

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go?

Answer: Mostly to profits.

The next graph shows the gap between the real wage index and the labour productivity index in points.

It provides an estimate of the cumulative redistribution of income to profits as a result of real wage suppression.

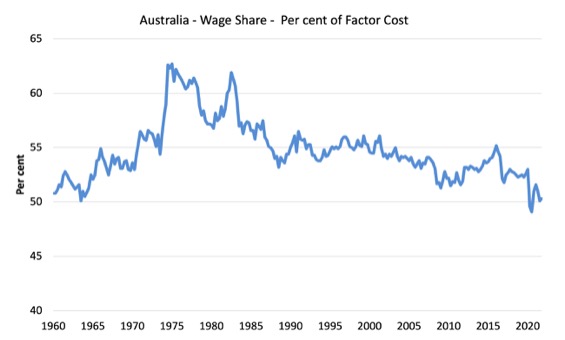

Now, if you think the analysis is skewed because I used GDP per hour worked (a very clean measure from the national accounts), which is not exactly the same measure as labour productivity, then consider the next graph.

It shows the movements in the wage share in GDP (at factor cost) since the March-quarter 1960 to the December-quarter 2021 (latest data).

While the series moves around from quarter to quarter, the trend is obvious.

The only way that the wage share can fall like this, systematically, over time, is if there has been a redistribution of national income away from labour.

I considered these questions in a more detailed way in this blog post series:

1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 1 (November 20, 2019).

2. 1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 2 (November 21, 2019).

And the only way that can occur is if the growth in real wages is lower than the growth in labour productivity.

That has clearly been the case since the late 1980s. In the March-quarter 1991, the wage share was 56.6 per cent and the profit share was 22.2 per cent.

By the March-quarter 2021, the wage share had fallen to 50.1 per cent and the profit share risen to 30.3 per cent.

There has been a massive redistribution of income towards profits has occurred over the last 40 years.

The relationship between real wages and productivity growth also has bearing on the balance sheets of households.

One of the salient features of the neo-liberal era has been the on-going redistribution of national income to profits away from wages. This feature is present in many nations.

The suppression of real wages growth has been a deliberate strategy of business firms, exploiting the entrenched unemployment and rising underemployment over the last two or three decades.

The aspirations of capital have been aided and abetted by a sequence of ‘pro-business’ governments who have introduced harsh industrial relations legislation to reduce the trade unions’ ability to achieve wage gains for their members. The casualisation of the labour market has also contributed to the suppression.

The so-called ‘free trade’ agreements have also contributed to this trend.

I consider the implications of that dynamic in this blog post – The origins of the economic crisis (February 16, 2009).

As you will see, I argue that without fundamental change in the way governments approach wage determination, the world economies will remain prone to crises.

In summary, the substantial redistribution of national income towards capital over the last 30 years has undermined the capacity of households to maintain consumption growth without recourse to debt.

One of the reasons that household debt levels are now at record levels is that real wages have lagged behind productivity growth and households have resorted to increased credit to maintain their consumption levels, a trend exacerbated by the financial deregulation and lax oversight of the financial sector.

Real wages growth and employment

The standard mainstream argument is that unemployment is a result of excessive real wages and moderating real wages should drive stronger employment growth.

As Keynes and many others have shown – wages have two aspects:

First, they add to unit costs, although by how much is moot, given that there is strong evidence that higher wages motivate higher productivity, which offsets the impact of the wage rises on unit costs.

Second, they add to income and consumption expenditure is directly related to the income that workers receive.

So it is not obvious that higher real wages undermine total spending in the economy. Employment growth is a direct function of spending and cutting real wages will only increase employment if you can argue (and show) that it increases spending and reduces the desire to save.

There is no evidence to suggest that would be the case.

I usually publish a cross-plot that consistently shows no relationship between annual growth in real wages and the quarterly change in total employment over a long period.

The graph has issues at present due to Covid-19 outliers, although the conclusion doesn’t change.

There is also strong evidence that both employment growth and real wages growth respond positively to total spending growth and increasing economic activity. That evidence supports the positive relationship between real wages growth and employment growth.

Conclusion

In the March-quarter 2022, Australia’s wage growth remained modest to say the least.

There can be no sustained recovery for the economy post Covid without a significant shift in the way we think about wages growth.

The data shows that the significant cuts to workers’ purchasing power continue, and, in my view, constitute a national emergency.

There can be no sustained acceleration in the inflation rate while wages growth is at these levels.

The business sector, as a whole, thinks it is clever to always oppose wages growth and the banks love that because they can foist more debt onto households to maintain their consumption expenditure.

The problem is that the federal government supports wage suppression because that attracts funding for the conservatives from the corporate lobbies which help them stay in power.

None of this offers workers a better future.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

If price rises are structurally greater than wage increases then you don’t have inflation, you have deflation.

If you want to stop price rises due to war and Covid19, then you will have to stop the war and stop Covid19.

If instead you increase interest rates, you will make the deflation worse.

Is it possible or not ?

I would imagine any solution has to include the rationalisation of the public sector. Destroy the monopoly rent seeking that is taking place. Otherwise they will club together in the public sector and find away around government policy that tries to stop them. Wastes skills and real resources in the process that could be used for something else.

The private sector is there to produce.

When you have a choice of what you can buy with your disposable income you would think that you could shop around without much hassle to try and avoid the price gouging that is taken place. However, when the price gouging is taking place on essentials that everybody needs like what used to be called the public sector it is very difficult to do so.

Once the public sector is renationalised and the government doesn’t really need the income from them to top up the Treasury. What you are charged for the public service is essentially just another tax.

So public services could be made to be as cheap as possible and in some cases free to use. Yes, I mean all of them including energy and water.The challenge I would think would be if the charge for using the public service is essentially just a tax. How do you replace that tax with another tax elsewhere in the economy , in order to keep inflation and real resources usage under control.

With your disposable income now protected when you use the public sector. It leaves you to shop around when you buy things from the private sector. To try and get a better price for what you want to buy. Which is easier as there is more competition.

Once the public sector has been sorted out. It is imperative that the monopolies and mergers and competition commission does its job in the private sector. That producers are treated like cattle and not pets. Stop just one company owning 30 restaurants on the high street and 14 clothing outlets. Which was shown to be the case throughout the pandemic as companies asked for money from the government to survive.

Smash them up and create real competition online and on the high street.

Then deal with the banks.

With your disposable income now protected when you use both the public sector and private sector you can now save more of your income. Instead of it being gouged out of existence by the rent seekers who love to do nothing more than form monopolies.

No longer would they be able to threaten investment strikes to hold governments to ransom or scare governments with job losses in the public sector. Or go running to Nanny to ask for cheap labour from abroad as soon as local workers get a bit of pricing power as their wages increase.

The private sector is left to compete. Compete or die, cattle not pets. If they can’t produce they fail and somebody who can produce will take their place.

Now that the public services are as cheap as possible or free it makes the country a cheap place to do business that will naturally help to keep prices down for everybody.

So is it possible to make every public service very cheap or free ? Where would you move the tax to in the economy , now that it has been removed in the form of charges ?

I’d love to be able to read a paper on it to find out if it is possible or not.

@korual not sure I follow the deflation bit…and neither do you.

I’m still convinced it you were to sort out both the public sector and private sector in the way described above and Introduced a job guarentee. To help protect our disposable incomes.

The whole infrastructure of your country would have to be upgraded dramatically to state of the art infrastructure in both rural areas , the cities, road and rail and the ports. Otherwise it would not cope with the increased demand produced by these changes.

Just by making rail travel very cheap or free the current infrastructure would not cope and fall apart. Never mind other public services.

The pandemic has shown after 30 years of very low growth caused by neoliberalism and globalism. What our infrastructure is used to handling on a day to day basis below.

https://d3fy651gv2fhd3.cloudfront.net/charts/united-kingdom-gdp-growth@2x.png?s=ukgrybzq&v=202205120639V20220312&d1=19970524

Any increase in demand over and above what we have been used to. Will cause some serious issues.

China puts the infrastructure in place first to cope with any new economic policy. Any changes that are made to the infrastructure that copes with the increases in demand are dealt with by government spending and not bank lending.

Isn’t it about time we started to do the same ?

Instead of the carrot and the stick approach of bank lending and leaving it to the private sector to sort out ?

What comes first the chicken or the egg. Infrastructure then policy of policy then infrastructure.

“Economic planning” the 2 words that makes Conservative voters teeth fall out and grow a hump in the middle of their backs.

Is the only way.

Instead of basing everything you do on the destructive myth. That there is always some producer with a cheque book open ready to hire the unemployed. Ready to invest to produce and the free market tooth fairy will solve our problems via bank lending.

Hi Bill, would it be reasonable for the Commonwealth Parliament to legislate a one-off increase in the minimum wage from $20.30 per hour to $25 per hour, and to legislate that future increases will happen automatically in line with national productivity growth?

Free (verb to free) markets of monopolies and you’ll have a healthy economy.

Privatize public services and privates will conglomerate (verb to conglomerate) until there remains just a big monopolist.

Then, he will be the government.

Paulo,

And of course, the ultimate monopolist is the socialist state.

Well it’s clear – and there were always strong grounds to suspect – that the RBA f****d up monumentally this month.

Unless they have knowledge that wages have skyrocketed in the past 6 or so weeks – something I would be highly sceptical of.

Surely, rather than simply surveying business and asking them if they expect to start being forced to start shelling out great big wage increases, vastly more informative and factual data could be derived by surveying workers representatives regarding what sort of increases are contained in agreements that are actually being negotiated and concluded?

That the RBA appear to either not do this or if they do, place a lower weighting on the real, officially lodged agreement data than on what some CEO’s tell them they are worried might happen………just beggars belief.

Dear Henry Rech (at 2022/05/19 at 4:43 am)

The problem with your analogy between a monopolist and the state is clear – you are committing a type error (apples and oranges)

The monopolist pursues private profit for private gain and manipulates their market power accordingly.

The state is meant to pursue public purpose and does not pursue private profits. It is also our agent whether it owns the means of production on our behalf or not.

best wishes

bill

Bill,

You can characterize it any way you wish, the fact is, a socialist state has monopoly economic and political power.

And moving away from your theoretical description about what a state should do, history clearly demonstrates that totalitarian states (monopolies) behave in ways very much inimical to the interests of individuals at in the small and the large and even the public purpose and they themselves more than likely display brutal, corrupt and unconscionable behaviour.

If you want a socialist state, you are welcome to it.

We should be so lucky to have an actual socialist state, Henry. As it stands we have mixed economies, but the current “mixture” is hostile to the well-being of the citizenry in general and labour in particular.

Hi Bill,

Good to see this analysis, I guess the RBA really did jump the gun and make mighty fools of themselves. We can only hope they reflect on the data and realise their mistake.

So the much touted ‘wage growth’ is not happening or is only confined to a few sectors? I keep reading that wages are on the rise due to supposed ‘skills shortages’ and know several people who have experienced big pay increases this year. Perhaps they are not the norm. I think the increases are for people changing jobs rather than those remaining in the same jobss.