It's Wednesday, and as usual I scout around various issues that I have been thinking…

Who would be so stupid to advocate deliberately putting 2.3 million workers out of work? Guess who?

It’s Wednesday and I am pushed for time today. My local community is in the last stages of trying to stop a massive overdevelopment in our midst, which will damage the social cohesion and environmental amenity in our neighbourhood, while delivering massive profits to a greedy property developer. I have to appear before a tribunal today to document the impacts of the development on these things. Property developers are the scourge. So are mainstream economists like Larry Summers who is proposing that unemployment be deliberately increased by more than 2.3 million and held at that level or higher for years in order to reduce the current (transitory) inflation. Who would be so stupid? And after getting really mad about that and Keir Starmer’s abandonment of working class representation, we can soothe our souls with some Roy Elridge.

Who would be so stupid to advocate increasing unemployment by more than 2.3 million for years just to bring the CPI down a bit?

In May 2022, the US unemployment rate was 3.6 per cent, which meant that 5,950 thousand workers remained without work but wanted and were available to work.

The broader measure of labour underutilisation – U6 – stood at 7.1 per cent, but rises and falls with the official unemployment rate.

If the US unemployment rate rose to 5 per cent, say, then some 8,218.8 thousand workers would be without work.

I just did a simple regression analysis which suggests that the U6 rate would rise to just over 10 per cent.

So a shift from the current labour market position to a state where the unemployment rate was 5 per cent would put an additional 2,268 thousand workers onto the jobless pile and around 16.4 million workers would be considered to be broadly underutilised (underemployment, marginal attachment, unemployed).

Conclusion:

1. Highly destructive of human potential.

2. Massive daily loss of national income.

So who would be stupid enough to suggest that the US government adopt a strategy whereby this scenario would play out as a solution to transitory supply side shocks and the cartel behaviour of oil producers?

Well, mainstream economists would suggest that.

Stupid.

And in the past day, none other than Larry Summers, who was reported in the Bloomberg article (June 21, 2022) – Larry Summers Says US Needs 5% Jobless Rate for Five Years to Ease Inflation

Here is some analysis of his past judgement:

1. The dying embers of New Keynesian reasoning (August 31, 2021).

2. Being shamed and disgraced is not enough (December 18, 2009).

Summers said that:

We need five years of unemployment above 5% to contain inflation — in other words, we need two years of 7.5% unemployment or five years of 6% unemployment or one year of 10% unemployment … The US may need as severe monetary tightening as Paul Volcker pushed through in the late 1970s early 1980s.

First, in this blog post – US Federal Reserve Bank economists going Marxist on us (May 30, 2022) – I analysed new research from economists at the US Federal Reserve Bank, who categorically rejected the ‘Volcker ended inflation’ narrative.

They showed that it was a significant diminution in the bargaining capacity of workers that allowed the inflation to subside after a period of distributional conflict between labour and capital.

They concluded that the monetary policy gyrations engineered by Paul Volcker did not work in the way that Summers is suggesting.

I gave a talk at the Levy Summer Seminar last week where I recalled a quote from Milton Friedman who was talking about how a deflationary monetary policy episode would eventually expunge inflationary pressures where workers and bosses were fighting over who would take the real income loss from an imported raw material supply shock.

He said that the period of elevated unemployment (over what he claimed was the natural rate) would have to be of the order of 15 or so years – nearly a generation of workers denied work.

Summers is pitching in the same league really.

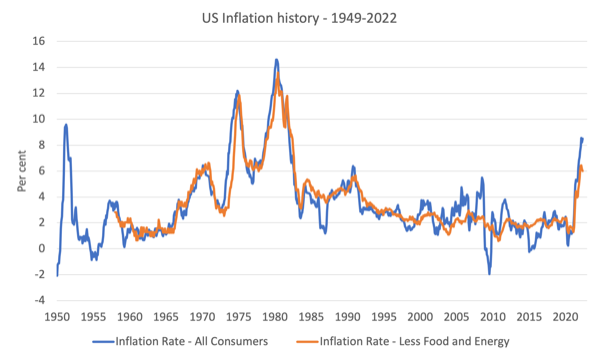

The first graph shows the evolution of the CPI inflation in the US from 1949 to May 2022 – with the core measure currently on 6 per cent while the All Items measure is 8.5 per cent.

There is little prospect of the either measure rising to the levels experienced in the 1970s because there simply isn’t the on-going propagation from a wages war with capital.

It is not clear yet when the pandemic effects will dissipate, and when Putin will stop his War, and when OPEC will end its current profit gouging round.

But when those things end, inflation will drop almost immediately to low levels.

Yes, a rapid and extended recession with more than 5 per cent unemployed (and the extra underemployment) would eventually reduce demand for petrol, which would eventually force OPEC to reduce oil prices.

But at what cost?

Massive.

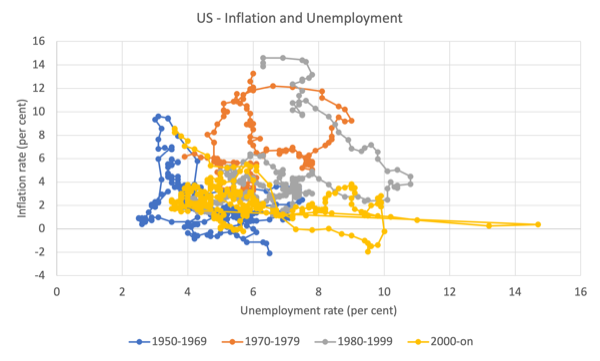

The second graph shows the relationship between the US unemployment rate and the inflation rate, split into historical time periods.

The 1970s loop and the slow improvement shown bu the 1980-1990s loop is what Summers is thinking should be forced.

But the flatness of the relationship since 2000 with a current spike excepted tells us a lot about the internal labour market dynamics in the US, particularly in relation to wage pressure and the shift in unemployment that would be required to scorch the earth so badly that inflation fell.

Because the inflation is heavily driven by supply-side factors, a demand-side policy action would be incredible costly in lost income etc.

Yes, there are excess demand issues.

But they are not the typical ‘inflation gap’ type excesses, where the supply side is fully utilised and nominal demand continues to grow faster than capacity.

All the factories in China, and ships not delivering and workers sick with Covid means there is considerable supply side slack.

In that case, even a normal level of spending will create ‘excess demand’ pressures.

But the answer is not to cut spending as much as it is to expand supply so that the existing capacity is more fully utilised.

And that won’t happen until Covid disappears and the Ukraine situation is resolved.

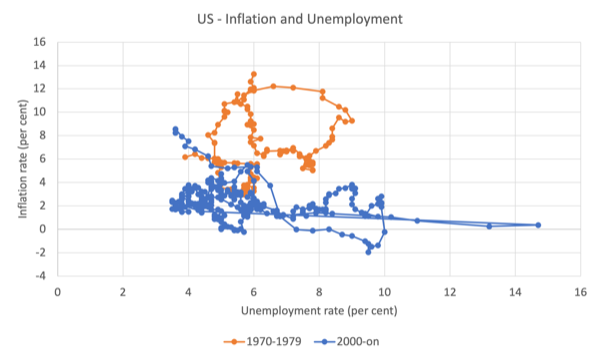

The next graph highlights the 1970s with the period since 2000 – for better clarity of the differences between the two episodes.

The two decades are not comparable.

The current rise in slope of the Phillips Curve here is temporary.

The existing fundamentals are better described by the flatter sections.

They are very different to the 1970s, when trade unions were stronger and workers could more successfully defend their real wage.

It would be crazy to deliberately engineer a major rise in unemployment and the attendant misery because policy makers were not patient enough to see this transitory period off.

Max Planck’s wisdom was summarised by the quote – paradigms shift one funeral at a time.

Never intending to wish harm on anyone, but ….

British Labour Party – Leader scared to support legitimate industrial action

The increasingly unpopular Keir Starmer has apparently told his front bench MPS not to provide visible support to the rail workers who are seeking better pay and conditions at present.

Apparently, Starmer things that by avoiding any association with the workers on picket lines, his team are showing ‘leadership’.

The UK Guardian story – Keir Starmer tells Labour frontbench they should not join rail strike pickets (June 20, 2022) – thinks the travelling public should be prioritised over workers’ interests.

If that idea had have been dominant over the long struggle by workers for better pay and conditions since the start of the industrial revolution, then all workers would not be still living in poverty.

The last general election saw the Labour Party lose connection with its traditional support base.

Presumably, they are banking on the Tories being so bad, that that base will return.

I wouldn’t bet on that at all.

Labour has to be in harmony with the trade unions and the struggles of workers.

Not everyone are highly-paid lawyers!

This article – Keir Starmer’s stance on rail strikes raises questions over strategy (June 21, 2022) – suggests that Starmer is more interested in continuing his purge of Leftist elements in the Labour Party than he is in representing the working class interests.

He should look over the Channel and see how Left unity has benefited the progressive political forces in France.

Music – Roy Elridge

This is what I have been listening to while working this morning.

This is a classic from American trumpet player – Roy Elridge – who built a new style after the dominance of – Louis Armstrong – which was later to define the virtuosity of – Dizzy Gillespie.

Roy Elridge played with sax player – Coleman Hawkins – and they both elevated the so-called – Tritone substitution – to a new level in jazz.

For musicians, that might mean substituting a Db7 chord for a G7 chord to enhance the improvisation.

For non-musicians, it just means that it sounds good – producing more contrast in the harmonic content.

Franz Schubert used this substitution to great effect in his classical pieces.

Here he is playing – Echoes of Harlem – the classic 1936 composition written by – Duke Ellington.

Roy Elridge recorded this in 1951 (see below) in Stockholm, but it was not released until 1955 on the – Roy’s Got Rhythm.

It is a very complex piece with multiple parts, shifting keys and moving from minor to major, overlaid by a beautiful trumpet melody.

Which just means – yes – it sounds good.

Roy Elridge recorded this composition with:

1. Charlie Norman – piano.

2. Carl-Henrik Norin – tenor.

3. Leppe Sundevall – bass trumpet.

4. Anders Burman – drums.

5. Thore Jederby – double bass.

Almost perfect.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Scotland is the same the SNP the So called saviour of the left in the UK have been attacking the unions since before COP 26.

They are now nothing but liberals who have abandoned the working class for the middle class.

Now a price will be paid

http://robinmcalpine.org/now-a-price-will-be-paid/

The same price every left wing party that moved to the centre right has paid. Lost votes to the populists, starting with the low paid and rural areas that have become nothing but low paid summer holiday camps.

The progressives in Scotland thinks the massive U turns of their 20 year economic policies promises are because of this.

Who signed up to the squeeze?

http://robinmcalpine.org/who-signed-up-to-the-squeeze/

It isn’t.

It started with the growth commission – the EU convergence program. Every U turn committed by both the Scottish Greens and the SNP can be traced back to that document. As they both simply adore the EU and can’t wait to be at the heart of it.

Labour have already said their priority is to reverse the Brexit result.

The neoliberal, globalist, rules based order is all the matters and moving away from it will not be tolerated. You have to comply or you will receive a very stiff letter from the Borg in Washington. Resistance is futile.

Foreign policy and the geopolitical map demands it.

The western world is like a silly game of “monkey see, monkey do”.

If the US is raising interest rates to increase unemployment, there we have the EU raising interest rates. Swiss clockwork.

They might even tell us that’s not their fault,

It’s Biden’s fault. No, it’s Powell’s fault, No, it’s Summer’s fault.

Don’t bother with names. Ask the simple question “who rules?”.

The emperor is wall street.

And the emperor is parading with its cerimonial gown.

Or, maybe he thinks so. He might be naked and we might all be starting laughing soon (or crying…).

In Portugal, the 4th country in the world with the oldest population, imigrants are offsetting the shortage of labor.

If unemployment rises, those people will go home or elsewhere, to were they can find work.

Depending on the scale of the exodus, the unemployment rate could be offset by the waning labor force.

So, what will the emperor do?

He will double down on the austerity dose, accelerating the wealth transfer from the 99% to the 1%.

We’re racing to the bottom.

@Derek, interesting, I thought, that Scottish Labour leader, who succeeded in pushing out JC- supporting Richard Leonard, is defying Starmer by supporting joining RMT picket line. Wonder who’s going to succeed Starmer – plotting against him going on – of course, nothing like that against Corbyn. I believe it’s important for lefties to join/rejoin LP before the next leadership contest – you need 6 months membership to vote. I can’t see Streeting being elected but I’d at least like the chance to vote her against most of the likely contenders, including Nandy.

Unfortunately Australia doesn’t escape the very serious recommendation to inflict misery.

From the Kouk on twitter.

‘For Australia, in an ideal economy:

Inflation 2-3%

Wages growth 4-4.5%

GDP growth 2.5 – 3.25%

Unemployment rate 3.5 – 4.25%

Balanced budget’

The 1970-79/2000-on inflation/unemployment curve shows the difference globalization since the 1980s has made to the Phillips Curve relationship.

The waning of globalization and recently imposed tariffs should add more verticality to the curve.

It’s no surprise Keir Starmer is unwilling to support striking rail workers. I can’t imagine he’ll ever forgive the RMT for opposing membership of his beloved EU.

It’s Roy Eldridge, not Elridge. My browser says the video could not be embedded, but here’s a link to the album on YouTube: https://www.youtube.com/watch?v=lhP2vUGMl2s

I was fortunate to hear Roy play once near the end of his life. His doctor had told him he could no longer play trumpet due to his heart condition. So he switched to his original instrument: drums!

On January 30, set your internet dial to wkcr.org for their annual 24-hour Roy Eldridge birthday broadcast.

@Carol Wilcox Anas Sarwar, Scottish Labour Leader has indeed shown his support for the rail strike. As a very few other Labour MPs who Starmer will no doubt bear a grudge against.

@GH yes that sums him up nicely

@Paulo Rodrigues interesting, Portugal behind Japan, Italy and Finland, with Greece, Germany and France not far behind and the UK not far off. It’s strange that the elderly populations are the most resistant to incomers who might keep production going at a level to support their demand.