As part of a another current project, which I will have more to say about…

The Ministry for the Future has some MMT lessons on fiscal policy

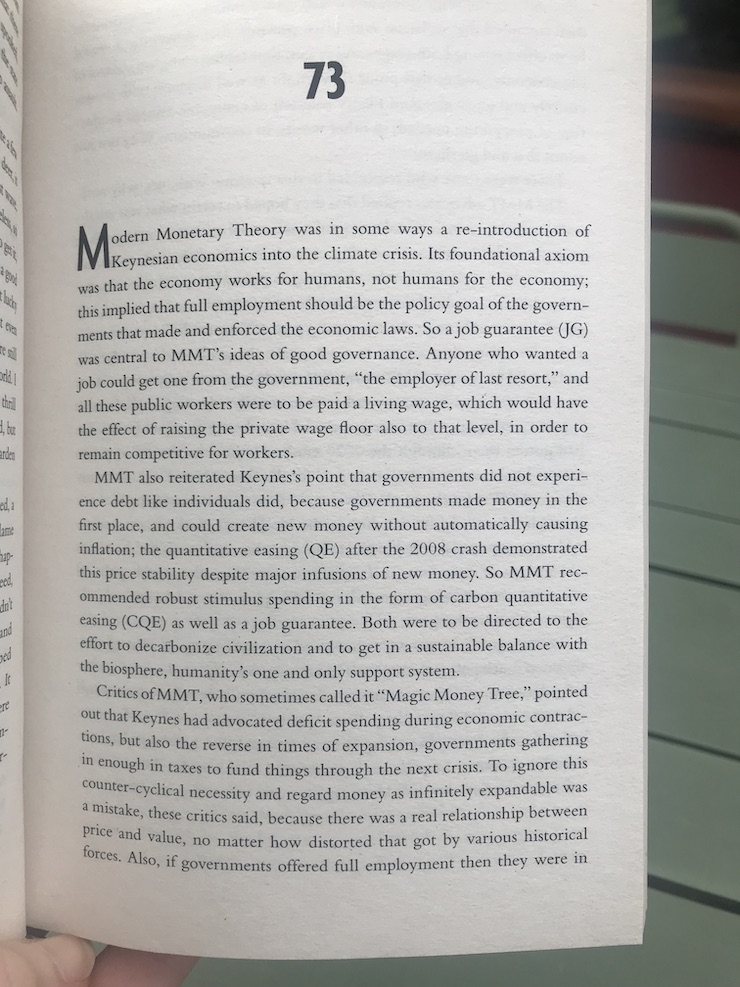

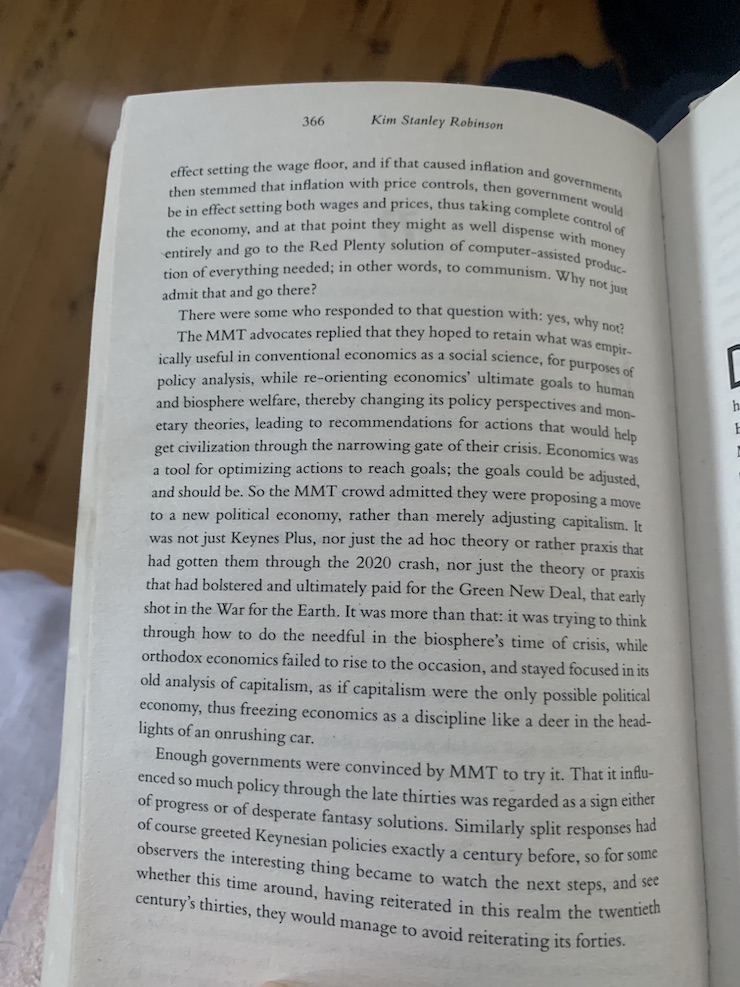

A close friend send me some pages from a book she is reading – Ministry for the Future – by author Kim Stanley Robinson, which was published in 2020. It is about an organisation that is chartered with defending the rights of future generations and they pursue various projects accordingly. Its major challenge is climate change, after a “deadly heat wave in India” and the narrative allows the author to entertain very interesting discussions about economics, ecology and society. It is classified as “hard science fiction” because while the work reflects the imagination of the author, he bases the narrative on “scientific accuracy and non-fiction descriptions of history and social science” to bring home the challenges we face with climate etc. The pages I received came from Chapter 73 (pages 365-366), which has a two-page discussion about Modern Monetary Theory (MMT). The author writes in his future scenario that “Enough governments were convinced by MMT to try it. That it influenced so much policy through the late thirties was regarded as a sign either of progress or of desperate fantasy solutions.” While the discussion is interesting, I want to focus on one of the ideas the author presents because they illustrate an important distinction between ‘Keynesian’ and ‘Post Keynesian’ thought on fiscal policy and MMT analysis.

I found the reference to MMT in the book very interesting because it reveals that our academic work is now entering popular fictional narratives and that means the ambit of our ideas is widening and the ideas are now being applied to different agendas.

That signifies progress.

I hope to do a podcast with the author in the coming period.

The following images capture the two-page Chapter 73 on MMT (you can enlarge the files if you are interested).

Lessons that can be drawn

The author writes:

Modern Monetary Theory was in some ways a re-introduction of Keynesian economics into the climate crisis. Its foundational axion was that economy works for humans, not humans for the economy; this implied that full employment should be the policy goal of the government that made and enforced the economic laws …

MMT also reiterated Keynes’s point that governments did not experience debt like individuals did, because governments made money in the first place and could create new money without automatically causing inflation …

MMT recommended robust stimulus spending … to be directed to the effort to decarbonize civilisation and to get in a sustainable balance with the biosphere, humanity’s one and only support system.

I could quibble marginally with this but to no end.

The author continued then:

Critics of MMT … pointed out that Keynes had advocated deficit spending during economic contractions, but also the reverse in times of expansion, governments gathering in enough in taxes to fund things through the next crisis. To ignore this counter-cyclical necessity and regard money as infinitely expandable was a mistake, these critics said, because there was a real relationship between price and value …

It is this notion I want to focus on.

Kim Stanley Robinson’s depiction of this strand of criticism of MMT is sound.

This is exactly what traditional Keynesians, most Post Keynesians, and some of the less extreme New Keynesians (Stiglitz, Krugman, etc) claim.

As background reading to the analysis that follows, this blog post is relevant – The full employment fiscal deficit condition (April 13, 2011).

The idea that fiscal policy has to be balanced over some economic cycle typifies their position and has been labelled a ‘deficit dove’ stance, to separate them from the hard-core ‘hawks’ who never see a role for fiscal deficits.

However, the difference between hard-core ‘sound finance’ and the softer ‘deficit dove’ narrative is not all that clear.

They both essentially believe that government spending is financially constrained and that ultimately governments have to ensure an excess of tax revenue over spending is required to ‘pay back’ the debt built up in past periods, when that condition was not satisfied for one reason or another.

Progressive Keynesians invoke simple narratives that what is good for the homebuyer or a corporation is good for the government – which means that at some times increasing debt through deficits is fine.

So ‘deficit doves’ think deficits are fine as long as you wind them back over the cycle (and offset them with surpluses to average out to zero) and keep the debt ratio in line with the ratio of the real interest rate to output growth.

They took this seemingly ‘reasonable’ position to differentiate themselves from Monetarists and others who eschew all fiscal deficits.

Students were taught torturous formulas (debt dynamics, etc) under the presumption that the government faces a financing constraint and told that as long as government adopts fiscal caution things will be fine.

So just as a household or corporation can benefit by increasing their debt levels to expand their wealth or business as long as a sensible return is made that permits the servicing and payback the debt, the government can also increase debt at certain times (during recessions), as long as they keep it under strict control when economic activity improves.

That is the argument. You can see the problem immediately. It presumes an analogy between an entity (household or corporation) which uses the fiat currency and is thus financially constrained in its spending – and an entity (the sovereign government) which is the monopoly issuer of the fiat currency that clearly has no financial constraint.

It presumes that the debt in some way ‘funded’ the government spending and was not used to defend the central bank’s interest rate targets.

It presumes that the sovereign government needs to generate a monetary return (how?) to repay the debt without problems.

First, that is a fictional depiction of how a fiat monetary system works.

Second, it reflects a basic misunderstanding of the purpose of fiscal policy, which the first passage from the Ministry of the Future (above) alludes to – the functionality of government spending and taxes rather than the ‘sound finance’ aspects.

Abba Lerner developed his notion of functional finance as a counter to what he called ‘sound finance'” (which is the precursor of modern mainstream (neo-liberal) thinking).

See the blog post – Functional finance and modern monetary theory (November 1, 2009).

Abba Lerner juxtaposed his “economics of control” policy thinking with the dominant laissez-faire approach that prevailed during the Great Depression.

Sound finance was all about fiscal rules that aimed to balance the fiscal outcome over the course of the economic cycle and only increase the money supply in line with the real rate of output growth; etc.

Lerner thought that these rules were based more in conservative morality than being well founded ways to achieve the goals of economic behaviour – full employment and price stability.

He said that once you understood the monetary system you would always employ functional finance – that is, fiscal and monetary policy decisions should be functional – advance public purpose and eschew the moralising concepts that public deficits were profligate and dangerous.

MMT also argues that the idea that you offset past deficits by storing up surpluses (for a ‘rainy day’) is inapplicable in a fiat monetary system.

The currency-issuing government can always spending today irrespective of its fiscal position yesterday.

There is no sensible notion of ‘saving’ that can be applied to a government.

Households save to expand future consumption possibilities because they are financially constrained.

A government that issues its own currency is never constrained in that way and can always purchase whatever is for sale in that currency whenever it likes.

Further, the problem with deficit dove thinking is that it ignores context and thinks fiscal policy is about satisfying certain financial goals rather than functional goals.

Here are some scenarios to illustrate this point.

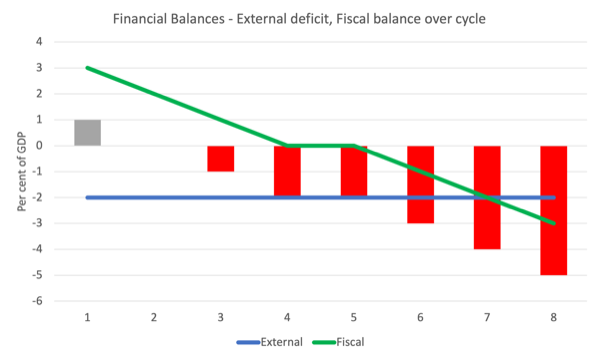

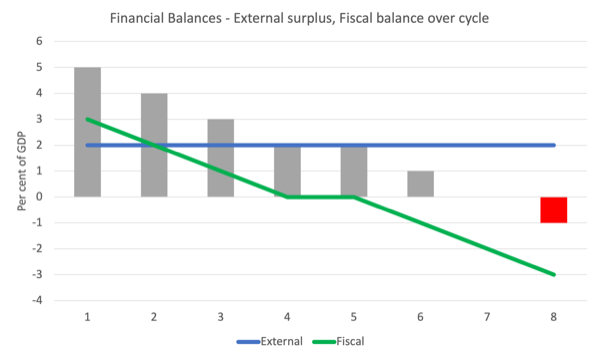

Scenario 1 – External deficit, Balanced fiscal position over the cycle

The following graph summarises this scenario.

Note the fiscal position is (G – T) and so a positive number is a deficit and a negative number is a surplus.

- External deficit constant at 2 per cent of GDP – which means that much income is being drained from the economy each period and stimulating foreign economies.

- Fiscal position starts off in deficit (perhaps a recession) and then the government imposes austerity and eventually achieves surplus (periods 6 to 8).

- Over the 8-period economic cycle – the fiscal position is balanced at zero – the earlier deficits (periods 1 to 3) are exactly offset by surpluses (periods 6 to 8)

- The private domestic sector moves from a surplus (period 1), to deficit in periods 3 to 8.

Changes in national income over this economic cycle ensure these financial balance relationships are maintained in each period.

The application of the ‘balanced-over-the-cycle’ rule ensures under these conditions that the private domestic sector increasingly spends more than its income (the growing red bars – which are deficits).

With the external sector draining spending from the economy, as the fiscal balance moves into surplus and adds to that spending drain, the only way this economy could keep recording GDP (income) growth would be for the private domestic sector to fill the spending gap by increasing its deficit and indebtedness.

This is an unsustainable dynamic because eventually the balance sheets in the private domestic sector would become so precarious (and be increasingly sensitive to small changes in employment and interest rates, etc) that the households and firms would start to make a spending correction.

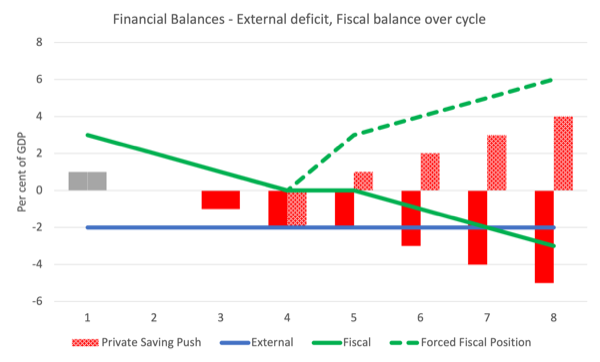

The next graph shows what might transpire if the private domestic sector, fearing increasing indebtedness started a ‘saving push’ and were successful over this cycle.

I am assuming the external position is unchanged (just to keep things simple) although in practice imports would probably fall under this scenario.

The dotted bars reflect a successful increase in overall private domestic saving and paying down of debt.

The withdrawal of consumption and investment spending from the economy as a result of this push would push the economy towards, if not into, recession.

And, because the fiscal balance is not exclusively determined by discretionary government policy settings – the reductions in private domestic sector, combined with the on-going external spending drain, would reduce economic activity, which, in turn, would reduce tax revenue and increase government welfare spending (as unemployment rose).

As a result, the dotted green line tells us what the fiscal outcome would be – an outcome that would be forced on government by the private domestic spending and saving decisions and the resulting impacts on economic activity.

Despite the ‘dove’ intention to balance the fiscal position over the cycle, the austerity imposed in periods 2 to 4, would soon be swamped by the automatic stabiliser effect and push the fiscal balance into increase deficit, but with rising unemployment and declining income growth.

A ‘bad’ deficit, in other words.

So context matters.

A broad ‘dove’ stipulation that the fiscal position has to be balanced over the cycle defies context.

A more reasonable (MMT) position is that the fiscal position should float in the face of fluctuations in external and private domestic sector spending and saving realities to ensure desired functional outcomes are achieved.

The general outcome is that with an external deficit and a balanced fiscal position over the cycle, the private domestic sector will end up with a deficit equal to the average external deficit over the same cycle.

There are times where that might be sustainable.

But in general, it won’t be.

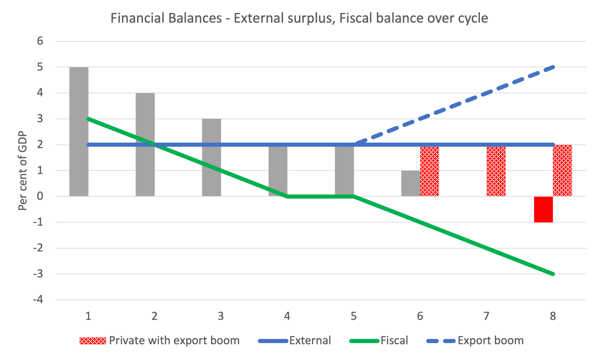

Scenario 2 – External surplus, Balanced fiscal position over the cycle

The next graph depicts a very different economy to the previous one shown above.

This economy is recording export surpluses – meaning there is a net injection of spending into the domestic economy from abroad.

Again, we assume the fiscal position is balanced over the cycle – so deficits (periods 1 to 3) as private domestic overall saving is high (and perhaps the economy is in recession or sluggish) and then fiscal surpluses (periods 6 to 8), which reinforce the spending drain coming from the external sector.

As a consequence the private domestic surplus shrinks until the final period, the increasing fiscal drag exceeds the external spending injection, and the private domestic sector income squeeze results in a deficit.

But over the entire cycle – the private domestic sector records a 2 per cent of GDP surplus (and could pay down debt over the cycle) equal to the 2 per cent average external surplus, with the average fiscal balance of zero.

So in this scenario, there is more scope for the government to run fiscal surpluses without undermining total economic activity because there is an external spending injection.

Finally, the next graph shows what might happen if the economy started to experience an export boom in periods 6 to 8, where the external surplus rises from 2 per cent of GDP to 5 per cent over that part of the cycle.

We assume the fiscal strategy and outcome is unaltered. There would have to be adjustments to individual spending and tax parameters to achieve this given the booming export sector and the increasing spending injection that would create.

But with the fiscal authority still successfully maintaining its ‘balanced-over-the-cycle’ fiscal rule, then the impact on the private domestic sector’s financial balances is quite stark.

Even with the fiscal drag in periods 6 to 8, the booming export revenue would create the conditions where private domestic saving could continue to outstrip investment spending and thus the sector could maintain surpluses throughout.

Conclusion

These are simple and stylised examples and there are parts of the story I have left silent to ensure the essential aspects are highlighted.

The purpose of these simple examples is to reinforce the notion that context matters when we are judging the fiscal stance of government.

A blind ‘balanced-over-the-cycle’ fiscal rule is unlikely to be productive in terms of the actual targets that should dominate fiscal policy settings.

In some cases, a fiscal surplus will be fine.

In most cases, a balanced-over-the-cycle approach to fiscal policy is likely to fail (given it is private domestic spending and saving and the external position that significantly influence the final fiscal outcome).

Moreover, the attempts to achieve that fiscal rule are likely to undermine prosperity.

The rejection of that fiscal approach is a major point of departure of MMT from traditional Keynesian and more recent Post Keynesian macro thinking.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

I’d love to see something similar done with bank lending instead of fiscal.

Breaking down bank lending into productive and non productive lending. That backs up The hypothesis of financial instability which was developed by Minksy. The results showing that for bank lending to be effective, loans have to be at a low price with the quantity restricted solely by credit quality. As an economy heats up, credit quality declines and loans become restricted - systemically preventing the Ponzi stages of finance.

MMT critics always attack fiscal as they prefer bank lending instead. See nothing wrong with destroying the savings of the private sector and loading them up with private sector debt. In order to grow an economy.

MMT spends most of the time defending the critics attacks on fiscal and end up in a defensive position going over old history books.

When MMT could actually go on the attack and say okay you replaced fiscal with bank lending how did that work out. It is very clear it was a complete failure and this is why it failed. This is what was wrong with your replace fiscal with bank lending theory.

A book could be written on the subject building upon Steve Keen’s ,Michael Hudson ‘s and Minsky’s work. Get the MMT critics to defend bank lending. Push them on the back foot because quite simply bank lending is all they have. Take bank lending away from them and they have nowhere else to go.

We tend to talk about bank lending and private sector debt in a sectoral balances framework. Which are always a quarter behind and based on aggregates. My own view is we should have a much more robust and historical driven analysis on bank lending. There’s enough historical evidence to provide one.

If Stephanie is writing a new book. A chapter called why replacing fiscal with bank lending failed would be a welcome start at getting the MMT critics onto the back foot. Start to put immense pressure on that theory and ideology.

Nail bank lending once and for all. Instead of talking to 6 different MMT economists and ending up with several different opinions. Bank lending should be like the JG so that when you talk with 6 different MMT economists you get mainly one definitive answer regarding bank lending.

MMT is a lens but that is an open goal for our critics. If 6 different MMT economists view bank lending differently viewing it through that lens. Government bonds are the same 6 different MMT economists will give several different versions of what should be done with bonds after using the MMT lens. In my view why MMT activists struggle to stay on message.

Here’s MMT Economists on Taxation.

https://new-wayland.com/blog/mmt-economists-on-taxation/

Is it any wonder why MMT activists find it difficult to stay on message ? MMT economists don’t make it easy for us but open doors for our critics.

It is time MMT economists found one voice on bank lending, tax, bonds etc, like they kinda do with the JG. Or our critics will continue to have an open field to play with. Find it incredibly easy to blame this current inflationary episode on government running large deficits. As we have already lost the social media debate on that topic today. Social media users already Believe the inflation was caused by excessive government spending. That failure has nothing to do with the activists.

Keynes was not a MMT proponent, not only because there wasn’t any notion of MMT back then, but because Keynes’s had to comply with the powers that be.

And the powers that be wanted to keep power, so Keynes did only what was necessary and suficient, to avoid the end of the capitalism in 1930.

So, capitalism recovered and Keynesianism was slowly distorted to what we call today new keynesianism.

But, we find ourselves again in 1929 and Keynes is dead.

MMT is the algebra (the lens) of all fiat currencies, but there can’t be no more compliance with the powers that be, because capitalism is mired in a multi-crisis, from where no “Keynes” can save it.

All capitalist’s “solutions” to climate change will only make it worse.

On top of that, history just got back, promising absolute carnage, as nuclear war is at our doorstep.

Zoonoses keep coming (still wondering what’s the use of so many bio labs?).

The so-called champions of democracy bankroll terrorists to undermine governments of the states that don’t follow the neoliberal doctrine.

And global south populations are on the brink of a major famine.

It’s not a question of right or wrong: it’s a question of who rules.

Michael Hudson’s criticism of bank lending is that, The Way Things Have Been Going, bank loans have been used overwhelmingly in the modern West to bid up the prices of existing assets, e.g. through mortgage lending. This in contrast with, say, 19th century Germany, where credit was used for industrial development.

I keep thinking of MMT-directed fiscal policy as spending on useful or productive things. However, if a government used its money-creating powers to move asset prices instead (sound like Quantitative Easing?), we’d get the same results as Prof. Hudson sees from present bank lending.

The line in the text that leapt out at me was “Enough governments were convinced by MMT to try it.” Such misunderstands that currency issuing governments with an unpegged currency already function via the tenets of MMT whether or not they know or, if they do, purposely do not admit same to their citizens as they roll on with their neoliberal ways under the propagandised message of TINA. While ever the many continue with their ingrained misunderstandings of what is possible because they believe that currency is or should be limited, and that all is a political choice, we will remain in the mire. The race toward neofeudalism via expanding financialised rentier economics in place of industrial economics in our first world will doom existence on this planet.

Is it too difficult for the many to get their heads around the fact that our monopoly currency issuing government doesn’t need to make a financial return for its survival? As a consequence, it has this unique ability to spend for the public good and not for the private interests of its funders, as is so often the way today. By contrast, all of us on the non-government side of things face the prospect of insolvency. In the end, what is government (and the economy) for?

Derek Henry is on the money as he advocates loans for productive and not for financial purposes. Public debt = not a problem; private debt for financial and not productive purposes = a problem, as broad generalities. Pushing private financialisation debt just plays into the hands of the rentiers. The criticality of the banks and controls that should be imposed on them need much more dissemination.

I appreciated this discussion but for me it didn’t quite hit the nail on the head vis a vis the book’s statement:

“To ignore this counter-cyclical necessity and regard money as infinitely expandable was a mistake, these critics said, because there was a real relationship between price and value, no matter how distorted that got by various historical forces.”

Is the author alluding to monetarism? What is the “real relationship between price and value,” anyway? MMT doesn’t talk of “expanding money” and as far as I’ve seen, it has little to say about the money supply (stock), except to debunk the relevance of the Quantity Theory of Money.

MMT talks of public spending for goods and services, not for the purpose of “expanding money,” but to run fiscal policy for the public good.

So what is meant by the “real relationship between price and value?”

It feels like the novel is offering up a muddled version of the Quantity Theory of Money as a foil for MMT.

@Bill, great post. I’ll be linking to it today on Politics Forum. I post there as my way to talk to the world.

@Derek Henry, yes, MMTers should attack bank lending as always eventually causing recessions, i.e. the GFC/2008.

I also bookmarked the link to MMTers on taxation.

I wonder what MMTers would think about a steep exponential progressive corp tax on total revenues minus payroll expenses. That is, above a certain point revenues collected in the US (nation) minus payroll paid to people in that nation would have the tax rate increase rapidly. My intent is to tax to oblivion corps like Amazon and Microsoft. This makes anti-trust laws unnecessary.

@Paulo Rodrigues,

Keynes was writing when the gold standard was still the norm. In the war gold payments were suspended, but the intent was to return to gold ASAP.

Yes, all market solutions to climate change have and will always make it worst. This is why I call for rationing in the West and G20 nations, etc. I would allow the rich to buy a 2nd or 3rd ration card, but the costs would be high and increase.

@Richard Genz, yes I agree that “the novel is offering up a muddled version of the Quantity Theory of Money as a foil for MMT.” The author may not grok MMTers’ view on the Quantity Theory of Money.

My thoughts on the Quantity Theory of Money is that, MMT sees 2 leakages of money out of the economy; savings and the trade deficit. So, when the Gov. sells a bond it is making sure that all those dollars will be saved by someone, somewhere, until the bond comes due. OTOH, when the Fed buys a bond from the holder or the Gov. this does result in the money returning to or staying in the economy. Therefore, it isn’t the size of the national debt that counts toward the inflationary pressure (if there is any validity to the Quantity Theory of Money) it is the amount of the debt that is held by the Fed. Paulo, do you agree with this? Or, maybe, do you believe that the Quantity Theory of Money is just totally wrong.

People, I want to discuss my views on MMT with believers of MMT. I have not found such a group, yet. I still hope that this site can be that place. Bill, is this a bad idea in your view?

.

@Richard Genz,

Mainstream market economists/neo-Keynesnians claim “there is real relationship between price and value”, because they consider prices can only be determined in “invisible hand” markets.

But governments can hire and pay people out-side private sector invisible hand markets, and pay, eg, age-care workers a decent wage, regardless of market-determined, eg, CEO ‘values’.

eg, IMO) an age-care worker is more ‘valuable’ than the CEO of Coca-Cola , because the latter is complicit in the obesity/ diabetes epidemic affecting large sections of the population.

“The results showing that for bank lending to be effective, loans have to be at a low price with the quantity restricted solely by credit quality.”

The best approach with bank lending is just to let the private sector sort it out by itself. Which is essentially Warren’s approach.

Messing around with trying to control the quantity of bank lending has become the Philosopher’s Stone of economics. Far better just to admit that a control theory doesn’t exist – any more than it does for the quantity of apples produced or Pig Iron.

So you stop paying interest in the vertical circuit, leave the horizontal circuit to itself, and make banks just ordinary businesses. Then going bust controls banks as it controls steel mills and event organisers.

Incidentally zero interest in the vertical circuit makes implementing Central Bank Digital Currency very easy. No gnashing of teeth about maintaining the ‘power’ of short term interest rate setting.

What’s particularly amusing is that the UK’s Government Banking Service – with a control account at the Bank of England and memoranda accounts at the commercial banks *is* a Central Bank Digital Currency. It’s also what Positive Money has been banging on about for years.

Give everybody a GBS account and we’re done.

If commercial bank accounts become memoranda accounts rather than control accounts, then which bank you decide to use to undertake a transaction can, at least in theory, be chosen on a transaction by transaction basis.

At which point if your bank goes bust, you just go to another one, identify yourself, and all your transaction details will be there automatically – by referencing the control account at the BoE with your particular account number.

Making it easy for banks to go bust is how you control private lending. Investors in banks need to be clear they will lose their shirt if the bank fails to control the quality of its lending.

Neil wrote; “Making it easy for banks to go bust is how you control private lending. Investors in banks need to be clear they will lose their shirt if the bank fails to control the quality of its lending.”

In the US this is not true, because the bank often sells loans to investors. This is what gave them the opportunity to cause the GFC/2008.

Traditional more progressive Public Finance economists were ‘deficit doves’. Many believed that public debt was sustainable as long as the growth in public debt didn’t exceed the growth in GDP.

Steve American,

” wonder what MMTers would think about a steep exponential progressive corp tax on total revenues minus payroll expenses. That is, above a certain point revenues collected in the US (nation) minus payroll paid to people in that nation would have the tax rate increase rapidly. My intent is to tax to oblivion corps like Amazon and Microsoft. This makes anti-trust laws unnecessary. ”

Or just move all the taxes from the employee onto the employer ?

If your wage is £20K a year that is what you take home £20k a year the employer, pays the workers income was and all the other tax the employee has to pay including national insurance.

But you will need a monopoly and competition authority with some teeth put in place first. To ensure competition, so that it just doesn’t get passed on via higher prices. Those that can keep their prices lower whilst absorbing the extra cost benefits.

Taxes will be hidden and the ” right” can no longer use taxes as a stick to beat the heads of voters with. As far as voters are now concerned they don’t pay any taxes. The employer pays them all.

If the employer says sorry I have to pay X people off as I am now paying all the tax for my workers and my workers now don’t pay any taxes. As I can’t raise my prices to absorb the extra cost of all the tax I know need to pay, because my competition can absorb The extra cost without putting their prices up.

The job guarentee will catch them.

Those on the JG will be put to work doing public purpose or Find work with somebody who knows how to run a business and can take them on and absorb the extra cost.

It will push productivity forward also, as business look to invest to get rid of the extra cost of their tax bill.

@ Derek Henry Here’s the book you’re looking for:-

https://www.amazon.co.uk/s?k=A+Brief+History+of+Doom%3A+Two+Hundred+Years+of+Financial+Crises&crid=1Q1FZA4JR0UFJ&sprefix=a+brief+history+of+doom+two+hundred+years+of+financial+crises%2Caps%2C161&ref=nb_sb_noss

https://smile.amazon.com/gp/product/0812251776/ref=ppx_yo_dt_b_asin_title_o04_s00?ie=UTF8&psc=1

@Steve_American

Quantity Theory of Money permeates journalistic econ and it seems to be mainstream bedrock, the heart of Milton Friedman’s view I guess. It’s also got a lot of moving parts and I find it hard to understand myself. It does have a common-sense ring to it.

Because Bill Mitchell and the other MMT economists think it’s invalid — it’s in the textbook — I haven’t tried to second-guess and learn what’s probably a fallacy. But it’s always coming up in op-eds and such. Keynes wrote about how he finally shook it off after a lot of wrestling with the theory. The US Fed says it now pays less attention to the monetary aggregates that literally comprise “the quantity of money.” And I think I’m understating how the theory has really been disowned by central banks in general.

@Neil Halliday

Thanks for explaining the concept of “real relationship between price and value.”

I’m trying to figure out what Robinson was driving at by including it in the MMT chapter. I guess is proposition is that invisible-hand pricing is not compatible with MMT.

Perhaps in such a pure-market world, government budgets always balance and maybe banks don’t create new money, either. Private transactions set prices, “undisturbed” by actors who aren’t profit-seeking.

That wouldn’t be an MMT world, would it? Maybe that’s what Robinson was getting at.

“In the US this is not true, because the bank often sells loans to investors. This is what gave them the opportunity to cause the GFC/2008.”

And? Those ‘investors’ just need to go bust too. Then they’ll stop buying MBS from crappy originators.

You’d have the same agency problem if a bank outsourced its creditworthy evaluation operation.

The GFC was caused by banks being systemically important. If they weren’t then they would have just collapsed like the dot.com bubble, gone bust and we’d start again with the sensible banks that remained.

@’Richard Genz’ I do not think you have “got it” yet. A zero government budget balance with a free market would not be prescribed MMT, but would still be an MMT system if tax liabilities still drive demand for the fiat currency.

Even when governments run zero deficit they still are the price setter. The free market cannot set the price level, it can only settle relative prices. The monopolist is always price setter, whether they know it or not, this is the critical point of MMT, the government (outside the eurozone) is the currency monopolist.

Neil Halliday wrote: “Mainstream market economists/neo-Keynesians claim “there is real relationship between price and value”, because they consider prices can only be determined in “invisible hand” markets.”

Bijou wrote: “The free market cannot set the price level, it can only settle relative prices. The monopolist is always price setter, whether they know it or not, this is the critical point of MMT, the government (outside the eurozone) is the currency monopolist.”

Thanks for responding, Bijou.

I’m thinking of two prices MMT economists have talked about: price of labor, and price of money (int. rate).

Because gov’t is currency issuer/monopolist, it can set the minimum price of labor by following a “price rule,” buying all the labor available for sale at a government-declared price.

Using the same currency-issuer power, government can set interest rates, for example hold the long-term rate to 2.5 percent as in WWII by buying and selling whatever quantities of debt are required to set the desired price (rate) for debt.

So it’s the sovereign currency issuer that has the unique power to set absolute prices (in these two cases anyway).

Is that about right Bijou?

Coming back to author Robinson, now it seems to me that the position of the anti-MMT people he cites is:

*Temporary countercyclical measures aside, it’s important for government not to run perpetual fiscal deficits. Unbounded spending by the monopoly issuer of a sovereign, free-floating currency would displace the ability of “invisible hand” private markets to set all prices in the manner such markets inherently do, i.e., in line with real value.*

@Richard Genz: There is a price which government can fix whether it has currency-issuing power or not: the price of land (the forgotten factor or production). If all of the return to land (rent) is expropriated by government the price falls to zero. That is what LVT at its extreme implementation would do.

Richard Genz, you wrote, “*Temporary countercyclical measures aside, it’s important for government not to run perpetual fiscal deficits. Unbounded spending by the monopoly issuer of a sovereign, free-floating currency would displace the ability of “invisible hand” private markets to set all prices in the manner such markets inherently do, i.e., in line with real value.*”

IMO, one main goal of the Neo-liberal project to creating a logical basis for their theory was to prove that the market price is the true current value of the thing or service. So, they set out to prove it logically. To do this they had to start with self-evident assumptions or premises. In logic none of the premises can be false. Obviously, they found that they needed some false premises to make the proof work. An example I remember is that, every player in the market knows everything about the thing being sold, or at least everyone knows the exact same things. This is obviously false.

. . . So, the proof that markets set the true price is not valid, so the conclusion is unproven.

And yet, you are right that is what anti-MMTers say. They keep saying it. and now 50 years later most people believe it.

@Steve American. Yes I see what you’re saying.

What I wrote there is my paraphrase of Robinson.

@Carol Wilcox Your comment about Land Value Tax is a great opening for new thinking about housing affordability – which I know you’re already pursuing. Especially since LVT could be considered outside of fiat currency regimes, at regional and local government levels.