It's Wednesday, and as usual I scout around various issues that I have been thinking…

New Keynesian inflation model is unfit for purpose

It’s Wednesday – a day for a few short comments and then relaxing to music. Today I consider some statements from the Bank of International Settlements, which suggest that the mainstream inflation approach, based on the New Keynesian Phillips curve is subjected to “serious practical shortcomings”. In other words, it is unfit for purpose, which means you should not be surprised that central banks are hiking rates to stifle a transient supply-side inflation burst. Quackery leads to quackery. I also consider some recent evidence that supply disruptions are easing. And, then, we learn that that the British Labour Party no longer things workers should strike. And if that has driven you mad, then we restore calm with some great music from Jiro Inagaki.

New Keynesian inflation approach is subject to ‘serious flaws’

The Bank of International Settlements released its – Annual Economic Report 2022 – on June 26, 2022.

I have been wading through the 138-page document and will write something more about it when I have had a chance to fully understand all the detail.

But a central banker friend of mine sent me an excerpt from it today (which is Box B The Phillips Curve and inflation under the hood – section on Pages 50-51) – which contains some very interesting statements.

Statements that a typical mainstream economists in this field would not write but words that I would write and have written often.

My PhD dissertation was about these matters.

I won’t go into detail here (later) but the BIS admit that the usual New Keynesian representation of the Phillips curve (and hence their inflation model) “misses some important elements”.

Which are?

1. “a single measure of economic slack” (typically aggregate unemployment or some aggregate output gap measure) “cannot capture sectoral developments and differences in the the sensitivity of prices to sectoral slack.”

2. “wage- and price-setting mechanisms and their interactions … are at the very heart of the inflation process but are necessarily glossed over in the Phillips curve representation.”

The capacity of workers “to recoup losses in purchasing power”, or firms “to compensate for squeezes in profit margins” is typically absent in the mainstream Phillips curve.

So the power play between workers and capital is hidden.

3. “a weakening in workers’ bargaining power), will result in a “flattening” of the Phillips curve, a well documented stylised fact.”

4. The “New Keynesian Phillips curves” approach, “suffers from serious practical shortcomings”.

Most importantly:

So, even starting from the microfounded version of the Phillips curve, a researcher typically ends up estimating a reduced-form relationship between inflation and a measure of slack that looks a lot like the prototypical version described above. Moreover, the standard version only features a bundled consumer good, and hence does not allow a role for relative price changes. And even in versions with multiple sectors, relative price changes only reflect different adjustment speeds in prices, so that longer-run trends play no role.

So, all the claims for theoretical purity of the ‘microfounded’ model, gives way to a complete ad hoc statistical model that tells us nothing about the theoretical veracity.

This means that ultimately there is no possible authority that New Keynesians can claim.

Their theory is untestable in a statistical sense so they fudge it and then make stuff up.

In short, there is no New Keynesian macroeconomics.

I wrote about that in this blog post – Mainstream macroeconomic fads – just a waste of time (September 18, 2009).

My 2008 book with Joan Muysken – Full Employment abandoned – considered all this from a technical perspective.

And I have an upcoming research paper coming out soon on the topic – I will make it available when I can.

What it means is that the mainstream inflation model which drives monetary policy is erroneous – not fit for purpose.

Which is no wonder the central bankers have gone off the rails with the current burst of inflation.

Supply chain disruption easing a little

I keep seeing signs that cost pressures are in decline.

For example, on March 7, 2022, nickel was trading at $US48,256 per metric Ton. Today it is selling at $US23,876 per Ton.

There are many other commodities coming off quickly.

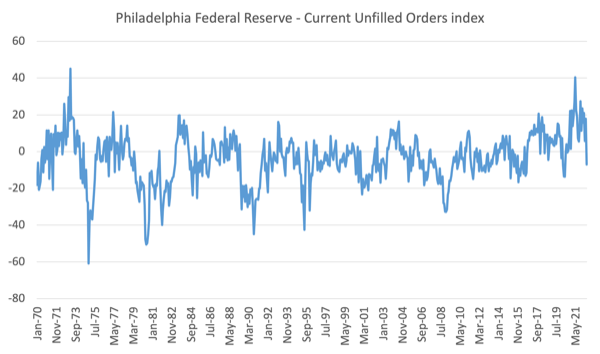

The latest diffusion indexes from the Philadelphia Federal Reserve Bank are also interesting.

The Philadelphia Federal Reserve published a monthly survey of business, the latest being – June 2022 Manufacturing Business Outlook Survey.

The complete dataset for their indexes is available – HERE.

The diffusion index is calculated by taking the percent reporting increases and subtracting the percentage reporting decreases.

The first graph shows the ‘Current Unfilled Orders’ diffusion index which shifted from 17.9 in May 2022 to -7.0 in June 2022, one of the largest monthly shifts in the history of the series, which began in May 1968.

The forward expectation (6 months from now) is shifting from -24.5 to -32.0.

So US manufacturing firms are experiencing (overall) less delays in satisfying orders, which is a sign that supply chains are easing.

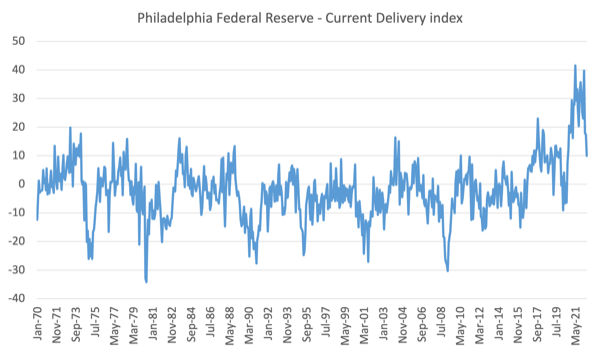

The next graph shows the ‘Current Delivery Times’ which reports the change in delivery time compared to the previous month for reporting manufacturing firms.

This index fell from 17.5 in May 2022 to 9.9 in June.

The forward expectation (6 months from now) is shifting from -29.1 to -36.3.

So on both the immediate situation and the expected future (6 months from now), US manufacturing firms are thinking delivery times will fall as they are able to meet demand from current production more easily.

The survey results were generally poor – indicating a drop in demand pressure as a result of the fiscal and monetary squeeze in the US.

But these particular indicators are about the supply chain.

My expectation is that as the supply disruption eases, the price pressures will dissipate rather quickly.

The only issue is whether the economies can avoid recession – despite the best efforts of misguided policy makers to create that sort of crisis.

British Labour Party leadership forgetting where it came from

The British Labour Party – was founded in 1900 by a coalition of the socialist parties and the trade unions.

Prior to that, there were a number of organisations representing working class interests in the political process.

These groups were unified in 1900 under the banner of the modern British Labour Party to allow the trade union movement to achieve political representation in the national government.

They were social democratic in leaning favouring nationalisation, welfare state support, and redistribution of national income to achieve equity.

As the neoliberal era dawned (Callaghan, 1976), the British Labour Party started to abandon its roots.

That accelerated under Blair – and the current leadership is a product of that era.

Now they don’t even support strike action by the trade unions.

In a recent train wreck of an interview, the Shadow foreign secretary – David Lammy – made news this week by claiming that workers should not strike for better pay and conditions.

One would think that the Labour Party should just shut up and let the Tories implode. But that wouldn’t do either because the Labour Party is singularly unfit to lead a modern Britain given its inability to purge the Blairites from its ranks.

After the leader (Starmer) told MPs they were not to join trade union pickets supporting striking workers, Lammy drove the ice-cream cone further into the Party’s face by claiming that a “serious party of government does not join picket lines” despite being photographed in 2018 on a picket line.

In one interview, he was asked whether he supported the BA check-in staff who were forced to take a 10 per cent pay cut during the pandemic and were now seeking to have that pay restored.

Lammy first showed he didn’t understand the situation: “Many of us might want a rise of ten per cent – in truth, most people understand it’s unlikely that you’re gonna get that, it’s a negotiation, and it absolutely would not be right, it would not be responsible opposition, if I suggested yes to every strike, you should get your …”

Then he said in response to whether he supported the industrial action:

No, I don’t, no I don’t it is a no, is a categorical no.

The workers were just trying to get the previous pay cut restored rather than a 10 per cent increase. Lammy didn’t even get that (Source).

Unelectable.

Music – Jiro Inagaki and His Soul Media

This is what I have been listening to while working this morning.

One of the unheralded geniuses in Jazz music is tenor player – Jiro Inagaki – who was a pathfinder in Jazz fusion in the 1960s and 1970s.

I first heard him while I was haunting Keith Glass’s Import Shop in Bourke Street, Melbourne in the early 1970s.

This 1973 album – In the Groove – is now a collector’s piece in its original vinyl release (commanding a very high sale price).

But you can get the digital version for $A14.99 if you weren’t lucky enough to have bought the original when it came out.

This has always been one of my favourite albums.

The track is – That’s How I Feel – and features some great bass playing as well as the star attraction.

The song was written by – Wilton Felder – and recorded by his band – The Crusaders – in 1973, the same year Jiro Inagaki released his album.

The Soul Media interpretation is a much better version.

The band on this track is:

1. Jiro Inagaki – Alto and Tenor.

2. Tsunehide Matsuki – Guitar.

3. Akira Okazawa – Bass.

4. Hajime Ishimatsu – Drums.

5. Takeshi Kamachi – Keyboards.

6. Takashi Imai – Trombone.

There is lots more information about Jiro Inagaki and his band on his – blog (in Japanese).

Jiro Inagaki is one of the great players that very few people outside jazz know about.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Thank you. Nice music.

All the wealth going away from the 99% of the population of the world is going to pay for the rearmament of the nato countries.

Money for the guns manufacturers is already flowing big time.

Soaring prices have an effect on profits, but also has an effect on taxes collected by governments.

If we pay more for food, tax collection goes up.

Nato is preparing to go to war and we – the 99% – are beeing called to pay for it – while filling more the pockets of the 1%.

This is the US dollar system working – nothing new.

Our governments emptied the stockpiles of obsolete weapons and sold them to the Ukrainians on credit.

But, excise tax is not enough to pay for the most brutal war of human history.

It seems that there are no more constraints on spending, as long as it goes to buy guns.

But, in the eurozone, I wonder how will they manage to keep the 3% limit on the deficit and buy tanks, missiles and fighter jets.

Lowering wages, said the Lagarde woman yesterday.

I don’t see how NATO is going to re-arm with the EU shutting down industries for lack of energy.

@Mel

Yes – surely the Russians have concluded that in the bigger scheme of things, their most powerful weapon is not troops or tanks or artillery or hypersonic missiles………it’s having control over a large chunk of their opponents energy supply.

Professor,

you should listen to Ryo Fukui, If you haven’t already of course.

I think the US is already in recession (pretty sure that its economy shrank in Q1) but by definition (two successive quarters of shrinking) you don’t find out until it’s already happened. We can hardly be surprised since the central banks don’t have the tools to deal with supply side inflation problems, and, having to “be seen to be doing something” they hiked rates anyway. Muppets.

As for UK Labour, Piketty describes this abandonment of the original blue collar constituency in favour of urban elites across the western world (US Democrats, European Social Democratic parties, UK Labour), though he’s too polite to use my preferred term – betrayal.

The spam filter is preventing me from appending the link, but Piketty’s May 2021 paper (with Amory Gethin and Clara Martinez-Toledano) is titled “Brahmin Left vs Merchant Right: Changing Political Cleavages in 21 Western Democracies 1948-2020”